Professional Documents

Culture Documents

Assignment 1

Assignment 1

Uploaded by

Lex AñaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Assignment 1

Uploaded by

Lex AñaCopyright:

Available Formats

_______________________________

Title

Several tax incentives granted to a number of sectors were “unnecessary,” and the benefits gained from

supporting these investments were mostly less than the cost shouldered by the government, the Department

of Finance said yesterday.

Citing a cost-benefit analysis of fiscal incentives done by the DOF using 2015 data generated through the

Tax Incentives Management and Transparency Act or Timta Law, Finance Undersecretary Karl Kendrick T.

Chua told the House committee on ways and means that for every P1 in tax perk given away by the

government, between P0.60 and P1.15 come back in benefits to the economy.

The House ways and means committee chaired by Quirino Rep. Dakila Carlo Cua yesterday tackled the

proposed second tax reform package which was aimed at reducing corporate income tax rate which is now

at 30 percent, the highest in Asia, while rationalizing the fiscal perks granted to investors.

By sector, every P1 in tax incentive given to manufacturing projects gives a return of P0.81-P1.34;

agriculture, P0.73-P1.20; services, P0.45-P0.94, and nonmanufacturing activities, between zero and P0.74.

Chua said there were many investment projects that were “very long-term recipients” of tax incentives.

“Many firms are profitable but are still enjoying incentives,” he added.

For Chua, incentives were not necessary if the projects serve the domestic market, as there was a ready

market for their goods and services.

As for investments tapping resources—for instance, natural resources such as minerals as well as human

resources, Chua said perks were also not necessary because investors would already be making use of these

resources.

But in the case of exporters, tax incentives are necessary because the Philippines is competing with

neighboring countries in hosting these investors, Chua said.

Based on the DOF’s analysis, 70 to 100 percent of incentives to the following sectors were unnecessary:

housing; mining and quarrying; energy (refining, storage, marketing and distribution of petroleum); coal and

diesel, and renewable energy.

Among the perks extended to voice-based business process outsourcing (BPO) firms, 59-85 percent were

unnecessary; 52-76 percent among manufacturers of wood, glass, paper, plastic, ceramic and rubber

products; 52-75 percent among electronics manufacturers; 43-62 percent among metals and steel

manufacturers, and 40-57 percent among personal care and medical products manufacturers.

Those with the least number of unnecessary incentives relative to total were garments (23-32 percent);

chemicals (16-23 percent); nonvoice BPO (11-15 percent), and food manufacturing (4-6 percent).

Finance Secretary Carlos G. Dominguez III said foregone revenue due to these tax incentives hit P376

billion from 2015 to 2016.

You might also like

- Columbia Teacher ContractDocument56 pagesColumbia Teacher ContractLancasterOnline100% (1)

- Team CharterDocument2 pagesTeam CharterLex AñaNo ratings yet

- Government Service Insurance System (GSIS)Document11 pagesGovernment Service Insurance System (GSIS)BethylGo0% (1)

- Economic Considerations For Industrial Coating Projects: Scope and ObjectivesDocument40 pagesEconomic Considerations For Industrial Coating Projects: Scope and ObjectivesSUBODH100% (2)

- 2009IPPDocument4 pages2009IPPAtty Rester John NonatoNo ratings yet

- 4478 Fact Sheet 061010Document4 pages4478 Fact Sheet 061010Steve CouncilNo ratings yet

- Castell - PEZADocument108 pagesCastell - PEZARichard AlboroNo ratings yet

- July18.2015 Bcreation of An Agency To Facilitate Entry of Foreign Direct Investments UrgedDocument2 pagesJuly18.2015 Bcreation of An Agency To Facilitate Entry of Foreign Direct Investments Urgedpribhor2No ratings yet

- Case Study FinDocument3 pagesCase Study FinArjcahutayNo ratings yet

- Economic GlobalizationDocument2 pagesEconomic GlobalizationargelenNo ratings yet

- India - Waiting For Economic ReformsDocument3 pagesIndia - Waiting For Economic ReformsBhaskar BalaNo ratings yet

- DevNews 2009 November 24Document5 pagesDevNews 2009 November 24apbauzonNo ratings yet

- 20140710a 012103 PDFDocument1 page20140710a 012103 PDFIntezar NabiNo ratings yet

- Making Canada A Global Leader in InnovationDocument4 pagesMaking Canada A Global Leader in InnovationPeggyNashNo ratings yet

- Position Paper DraftDocument4 pagesPosition Paper DraftsephNo ratings yet

- Nigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillDocument3 pagesNigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillMark allenNo ratings yet

- Assignment Eco211 MacroeconomicDocument15 pagesAssignment Eco211 MacroeconomicNur Ika0% (2)

- Throwing Away Taxpayer Dollars: A Look at The Wasteful Industrial and Commercial Abatement ProgramDocument4 pagesThrowing Away Taxpayer Dollars: A Look at The Wasteful Industrial and Commercial Abatement ProgramBill de BlasioNo ratings yet

- Make in India 12BEI0044Document27 pagesMake in India 12BEI0044Kunal KaushikNo ratings yet

- Assessment Eco211Document15 pagesAssessment Eco211Nur IkaNo ratings yet

- Fc-Sem 2-Unit 1 - Globalisation of Indian SocietyDocument14 pagesFc-Sem 2-Unit 1 - Globalisation of Indian SocietyFahaad AzamNo ratings yet

- Manish ProjectDocument45 pagesManish ProjectManishKumarNabhaitesNo ratings yet

- Presentation On PIB 2020Document27 pagesPresentation On PIB 2020Adegbola OluwaseunNo ratings yet

- Kemi Pla. ResultDocument73 pagesKemi Pla. Resultabidemi kolawoleNo ratings yet

- Opinion On TRAIN LawDocument9 pagesOpinion On TRAIN LawVia Maria MalapoteNo ratings yet

- National Manufacturing PolicyDocument23 pagesNational Manufacturing PolicyAnugrah Narain SaxenaNo ratings yet

- Fuel SubsidyADDocument1 pageFuel SubsidyADSimeon 'Seun AbólárìnwáNo ratings yet

- Creating A Framework For Ghanaians To Benefit From Oil Rich GhanaDocument8 pagesCreating A Framework For Ghanaians To Benefit From Oil Rich Ghanatsar_philip2010No ratings yet

- Government Policies For Small and Tiny EnterprisesDocument41 pagesGovernment Policies For Small and Tiny EnterprisesmaheshewarinavneetNo ratings yet

- Foriegn Direct InvestmentDocument24 pagesForiegn Direct InvestmentiamfromajmerNo ratings yet

- Tax On Venture CapitalistsDocument2 pagesTax On Venture Capitalistsvaru bhandariNo ratings yet

- Economist/Banker: Industrialization in Pakistan by Shan SaeedDocument4 pagesEconomist/Banker: Industrialization in Pakistan by Shan SaeedZambalbanNo ratings yet

- Why The Reform Is Needed: Problem 1Document3 pagesWhy The Reform Is Needed: Problem 1Eldren CelloNo ratings yet

- ExportDevFin FinalprojectRepoDocument117 pagesExportDevFin FinalprojectRepoSaikiran CheguriNo ratings yet

- Ontario New Democrat Fiscal FrameworkDocument16 pagesOntario New Democrat Fiscal FrameworkontarionewdemocratNo ratings yet

- TABULODocument15 pagesTABULOHeidi DeanNo ratings yet

- Industrial Policy of Nigeria PDFDocument5 pagesIndustrial Policy of Nigeria PDFJide OrimoladeNo ratings yet

- Government Policies For Small and Tiny EnterprisesDocument4 pagesGovernment Policies For Small and Tiny EnterprisesPrajakta MahadikNo ratings yet

- 2013 Country Commercial Guide For #HaitiDocument76 pages2013 Country Commercial Guide For #HaitiLaurette M. BackerNo ratings yet

- 2020 Investment Climate StatementsDocument25 pages2020 Investment Climate StatementsCEDDFREY JOHN ENERIO AKUTNo ratings yet

- Bolivia Nationalizes The Oil and Gas SectorDocument6 pagesBolivia Nationalizes The Oil and Gas SectorAnonymous kayEII5NNo ratings yet

- Bofaml 2011 Brazil Conference: March 2011Document38 pagesBofaml 2011 Brazil Conference: March 2011MillsRINo ratings yet

- Adding Muscle To The Core: Impact On InfrastructureDocument1 pageAdding Muscle To The Core: Impact On Infrastructuresmdali05No ratings yet

- Etd 2011 2 7 29Document1 pageEtd 2011 2 7 29143mahimaNo ratings yet

- Food Safety Law Reform Bill New Zealand 2015Document39 pagesFood Safety Law Reform Bill New Zealand 2015KarloAdrianoNo ratings yet

- Comp 2Document41 pagesComp 2kritiNo ratings yet

- Manila Cost of ProductionDocument9 pagesManila Cost of ProductionsalNo ratings yet

- $180 Billion: Duterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyDocument3 pages$180 Billion: Duterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyMayrose Cacal ListaNo ratings yet

- 10 Point Socioeconomic Agenda of Duterte AdministrationDocument5 pages10 Point Socioeconomic Agenda of Duterte AdministrationGlaiza Cabahug ImbuidoNo ratings yet

- 'Miners Should Pay More Taxes' - NGODocument7 pages'Miners Should Pay More Taxes' - NGOAriane Mae LopezNo ratings yet

- Postion Paper - Resource MobilizationDocument3 pagesPostion Paper - Resource MobilizationShadman KhaliliNo ratings yet

- Kathmandu University School of Management (KUSOM) Balkumari, LalitpurDocument17 pagesKathmandu University School of Management (KUSOM) Balkumari, LalitpurYash AgrawalNo ratings yet

- FM Fires Up Make in India Engine: Impact On ManufacturingDocument1 pageFM Fires Up Make in India Engine: Impact On Manufacturingsmdali05No ratings yet

- Proponents: Statements/Positions Re Comprehensive Tax Reform PackageDocument4 pagesProponents: Statements/Positions Re Comprehensive Tax Reform PackageKim PajinagNo ratings yet

- Build Build Build DraftDocument1 pageBuild Build Build DraftCloudKielGuiangNo ratings yet

- Stability With Growth: October 23, 2013Document2 pagesStability With Growth: October 23, 2013NiDa JaVedNo ratings yet

- 04 Teaching Material2Document5 pages04 Teaching Material2rlcasinilloNo ratings yet

- The Budget 2014 For Corporate LawyersDocument2 pagesThe Budget 2014 For Corporate LawyersLexisNexis Current AwarenessNo ratings yet

- Ministerial Speech - Launch of PDPSDocument7 pagesMinisterial Speech - Launch of PDPSOudano MomveNo ratings yet

- Gov't Agencies Urged: Spend, Spend, Spend: Illusory' Infra ProgramDocument4 pagesGov't Agencies Urged: Spend, Spend, Spend: Illusory' Infra ProgramAmbin Fortes FuraqueNo ratings yet

- Description:: Train LawDocument3 pagesDescription:: Train Lawpatricia.aniyaNo ratings yet

- Ibm - Nptel 20Document322 pagesIbm - Nptel 20Diwya Bharathi V I MBANo ratings yet

- Investment PromotionDocument7 pagesInvestment PromotionJordan ReynoldsNo ratings yet

- Checklist On Checking of FormsDocument1 pageChecklist On Checking of FormsLex AñaNo ratings yet

- 7 Major Elements of Communication ProcessDocument2 pages7 Major Elements of Communication ProcessLex Aña0% (1)

- The Death of A Salesman InfoDocument4 pagesThe Death of A Salesman InfoLex AñaNo ratings yet

- Philippine Aluminum Wheels Vs FASGI EnterprisesDocument2 pagesPhilippine Aluminum Wheels Vs FASGI EnterprisesLex AñaNo ratings yet

- Uson V Del Rosario SuccessionDocument1 pageUson V Del Rosario SuccessionLex AñaNo ratings yet

- Like SignDocument2 pagesLike SignLex AñaNo ratings yet

- Banc Case No. 622 : Chanrob Lesvirtua Llawlibra RyDocument37 pagesBanc Case No. 622 : Chanrob Lesvirtua Llawlibra RyLex AñaNo ratings yet

- 7 BAGTAS - OnwardsDocument13 pages7 BAGTAS - OnwardsLex AñaNo ratings yet

- Ago Timber Corp vs. RuizDocument3 pagesAgo Timber Corp vs. RuizLex AñaNo ratings yet

- Batangas V RomuloDocument15 pagesBatangas V RomuloLex AñaNo ratings yet

- 5-5 G.R. No. 178626 June 13, 2012 CECILIA U. LEGRAMA, Petitioner, Sandiganbayan and People of The Philippines, Respondents. Peralta, J.Document6 pages5-5 G.R. No. 178626 June 13, 2012 CECILIA U. LEGRAMA, Petitioner, Sandiganbayan and People of The Philippines, Respondents. Peralta, J.Lex AñaNo ratings yet

- Succession: San Beda College of LawDocument27 pagesSuccession: San Beda College of LawLex AñaNo ratings yet

- 1 FulltextDocument10 pages1 FulltextLex AñaNo ratings yet

- Zalamea V CADocument1 pageZalamea V CALex AñaNo ratings yet

- Transportation Laws Notes Atty Zarah Villanueva CastroDocument15 pagesTransportation Laws Notes Atty Zarah Villanueva CastroLex AñaNo ratings yet

- Child Benefit Claim Form - Getting It Right: Use These Notes To Help YouDocument8 pagesChild Benefit Claim Form - Getting It Right: Use These Notes To Help YouApolloNo ratings yet

- Chapter 10 Pad369Document12 pagesChapter 10 Pad369izatul294No ratings yet

- Orca Share Media1523026232654Document11 pagesOrca Share Media1523026232654Twinie MendozaNo ratings yet

- Variable Pay and Executive Variable Pay and Executive Compensation CompensationDocument28 pagesVariable Pay and Executive Variable Pay and Executive Compensation CompensationAkanksha SonkerNo ratings yet

- Report HRMDocument54 pagesReport HRMsh10821No ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- Employment Income UdomDocument13 pagesEmployment Income UdomMaster KihimbwaNo ratings yet

- Individual Income Tax Outline - JRCDocument30 pagesIndividual Income Tax Outline - JRCChad Hallberg100% (4)

- Chapter V Compensation and BenefitsDocument44 pagesChapter V Compensation and BenefitsJeoven Izekiel RedeliciaNo ratings yet

- Circular - Rewards 2022Document5 pagesCircular - Rewards 2022Sager JathwaniNo ratings yet

- Incentives and BenefitsDocument58 pagesIncentives and Benefitskamaljit kaushik100% (1)

- CompensationDocument20 pagesCompensationKashif AnwerNo ratings yet

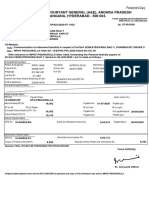

- Office of The Accountant General (A&E), Andhra Pradesh & Telangana, Hyderabad - 500 004Document1 pageOffice of The Accountant General (A&E), Andhra Pradesh & Telangana, Hyderabad - 500 004venkat yeluriNo ratings yet

- Compensation Refers To All Forms of Financial Returns & Tangible Services & Benefits Employees Receive As Part of An Employment RelationshipDocument18 pagesCompensation Refers To All Forms of Financial Returns & Tangible Services & Benefits Employees Receive As Part of An Employment RelationshipGargi KarnatakNo ratings yet

- Ashwini Chavan HR ProjectDocument67 pagesAshwini Chavan HR ProjectDivyeshNo ratings yet

- Income Tax IndividualDocument22 pagesIncome Tax IndividualJohn Oicemen RocaNo ratings yet

- Term Paper On "Performance Linked Incentive Schemes of Schedule Banks"Document23 pagesTerm Paper On "Performance Linked Incentive Schemes of Schedule Banks"10805997No ratings yet

- Benefits and ServicesDocument3 pagesBenefits and ServicesMuhammad SaqibNo ratings yet

- Fringe Benefit Tax Train LawDocument27 pagesFringe Benefit Tax Train LawJoyce Leeann Manansala75% (4)

- Great Attrition' or Great Attraction' The Choice Is YoursDocument6 pagesGreat Attrition' or Great Attraction' The Choice Is YoursAakaara 3DNo ratings yet

- Section C Compensation Strategy For ZenithDocument12 pagesSection C Compensation Strategy For Zenithadeol5012No ratings yet

- Medical 2009Document175 pagesMedical 2009w5bvbNo ratings yet

- CP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at SourceDocument108 pagesCP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at Sourcesaravana pandianNo ratings yet

- Metro Schools Mike Looney ContractDocument7 pagesMetro Schools Mike Looney ContractAnonymous GF8PPILW5No ratings yet

- Pay Standards & Practices: Business Process OutsourcingDocument3 pagesPay Standards & Practices: Business Process OutsourcingsamNo ratings yet

- BIR Revenue Memorandum Order 23 Full TextDocument9 pagesBIR Revenue Memorandum Order 23 Full TextImperator FuriosaNo ratings yet