Professional Documents

Culture Documents

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Uploaded by

sudCopyright:

Available Formats

You might also like

- AD50VT1Document8 pagesAD50VT1Pablo RodriguezNo ratings yet

- A Contribution To The Empirics of Economic GrowthDocument39 pagesA Contribution To The Empirics of Economic GrowthJamesNo ratings yet

- US BN: Key Findings: Pe DealsDocument1 pageUS BN: Key Findings: Pe DealsethernalxNo ratings yet

- JK Cement: Key Financial Highlights (2018-19)Document1 pageJK Cement: Key Financial Highlights (2018-19)KpNo ratings yet

- Sheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Document32 pagesSheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Mansi Raut PatilNo ratings yet

- Name of Project:: 2 X 4.4Mw Rudi Khola HepDocument2 pagesName of Project:: 2 X 4.4Mw Rudi Khola HepapsNo ratings yet

- Vox - AD100VTH SMDocument7 pagesVox - AD100VTH SMADAMO PATRICIO O'BYRNE RIVERANo ratings yet

- Parts and Assemblies Model of Diesel Hydraulic Shunter of The Bulgarian Narrow Gauge Railways (BDZ)Document1 pageParts and Assemblies Model of Diesel Hydraulic Shunter of The Bulgarian Narrow Gauge Railways (BDZ)M Ardan Budi PrasetyaNo ratings yet

- AD100VT Service ManualDocument7 pagesAD100VT Service ManualKyleRBNo ratings yet

- Oktnp 2018 08 23 A 001 PDFDocument1 pageOktnp 2018 08 23 A 001 PDFNewcastle NewsNo ratings yet

- Stock Performance of Obour Land For Food Industries (OLFI - EGY)Document1 pageStock Performance of Obour Land For Food Industries (OLFI - EGY)body.helal2001No ratings yet

- Bangladesh Economic Growth FDIs - Lightcastle Partners PresentationDocument10 pagesBangladesh Economic Growth FDIs - Lightcastle Partners PresentationMizanur RahmanNo ratings yet

- PRINT IMO Sulphur Limit 2020 Guidance 2019 07Document4 pagesPRINT IMO Sulphur Limit 2020 Guidance 2019 07faridNo ratings yet

- Nilai B. Indo 8iDocument1 pageNilai B. Indo 8iIlpa ListiantoNo ratings yet

- N Fall2012 PDFDocument6 pagesN Fall2012 PDFManuel ChNo ratings yet

- CCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Document29 pagesCCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Amit PatelNo ratings yet

- 32 Avanza (Cont. Next Page) : Headlight (From Aug. 2015 Production)Document9 pages32 Avanza (Cont. Next Page) : Headlight (From Aug. 2015 Production)aritw541214No ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Return RollersDocument1 pageReturn RollersHO Minh TuanNo ratings yet

- BrandZ Indonesia 2019 ReportDocument79 pagesBrandZ Indonesia 2019 Reportmdf.fadilahNo ratings yet

- Country Profile: BahrainDocument10 pagesCountry Profile: BahrainOMERNo ratings yet

- BUY BUY BUY BUY: Intel CorpDocument5 pagesBUY BUY BUY BUY: Intel Corpderek_2010No ratings yet

- Embassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Document30 pagesEmbassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Yash ChhabraNo ratings yet

- GB00B1JQBT10GBGBXSSMMDocument4 pagesGB00B1JQBT10GBGBXSSMMAhmad Ibn MosharrafNo ratings yet

- Harga Termurah F1a1 RevisedDocument4 pagesHarga Termurah F1a1 RevisedCyntia AgustinaNo ratings yet

- BP9763 A3 Sheet 02Document1 pageBP9763 A3 Sheet 02shanthoshraaj25No ratings yet

- Dkn-Leger Semster GenapDocument4 pagesDkn-Leger Semster GenapMuhammad Syaiful ArifNo ratings yet

- A3 General Arrangement, Isometric View, Bill of Material, Parts and Assemblies Experimental Model Steam Engine Using A Bourdon TubeDocument1 pageA3 General Arrangement, Isometric View, Bill of Material, Parts and Assemblies Experimental Model Steam Engine Using A Bourdon TubeLe TruongNo ratings yet

- Jakarta Retail 2q17Document2 pagesJakarta Retail 2q17ainia putriNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Soulace Type ADocument15 pagesSoulace Type AgopisaiNo ratings yet

- Rekap Nilai Siswa Kosong 2021Document16 pagesRekap Nilai Siswa Kosong 2021nenek hafidzNo ratings yet

- Pid Dme PlantDocument1 pagePid Dme PlantSyamsul Rizal Abd ShukorNo ratings yet

- Trenton Technology 4U Rackmount Chassis With 20 Slot Backplane Options 26.4in DeepDocument1 pageTrenton Technology 4U Rackmount Chassis With 20 Slot Backplane Options 26.4in DeepTracy CossonNo ratings yet

- 1ST FloorDocument4 pages1ST FloorAdnany JanuzajNo ratings yet

- 3x2x13 944Document1 page3x2x13 944gman_g2000No ratings yet

- Nokia Factsheet 2023 q4Document1 pageNokia Factsheet 2023 q4Freedo MatijevicNo ratings yet

- Trenton Technology 4U Rackmount Chassis With 14 Slot Backplane Options 24.6in DeepDocument1 pageTrenton Technology 4U Rackmount Chassis With 14 Slot Backplane Options 24.6in DeepTracy CossonNo ratings yet

- 2017 JobStreet - Com Salary ReportDocument6 pages2017 JobStreet - Com Salary ReportHelbert Agluba PaatNo ratings yet

- Sept 09 BagstufferDocument2 pagesSept 09 BagstuffershowmelocalNo ratings yet

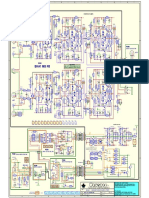

- Schematic - AudioDocument1 pageSchematic - AudioBhaskaranand LNo ratings yet

- Schematic - AudioDocument1 pageSchematic - AudioBhaskaranand LNo ratings yet

- 315c Excavator Hydraulic System - Attachment Two-Way With OnDocument2 pages315c Excavator Hydraulic System - Attachment Two-Way With OnAlessandro GomesNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- 7464 01 Sales Manager Powerpoint Dashboard 16x9Document4 pages7464 01 Sales Manager Powerpoint Dashboard 16x9nataliaNo ratings yet

- 2 Fly Me To The Moon Marcin TABDocument8 pages2 Fly Me To The Moon Marcin TABtuoihja iodajsNo ratings yet

- Bha1 MB R8: Input Buffers Power Op AmpsDocument1 pageBha1 MB R8: Input Buffers Power Op AmpsQuique BonzonNo ratings yet

- File ComponentsDocument1 pageFile ComponentsRaju D PuthusserryNo ratings yet

- Andono Kusuma Jati Sampel (Dengan Pemisahan Azeotrop) Prarancangan Pabrik Etilendiamin Dari Bahan Baku Monoetanolamin Dan Amonia Dengan Proses Amonolisis Katalitik Kapasitas 55.000 TonDocument118 pagesAndono Kusuma Jati Sampel (Dengan Pemisahan Azeotrop) Prarancangan Pabrik Etilendiamin Dari Bahan Baku Monoetanolamin Dan Amonia Dengan Proses Amonolisis Katalitik Kapasitas 55.000 Tonandono kusuma jatiNo ratings yet

- Drawing RadiatorDocument1 pageDrawing RadiatorindayuristNo ratings yet

- RadioDocument5 pagesRadioElberTyan Chura ANo ratings yet

- Engine Control PDFDocument1 pageEngine Control PDFZibrain ElcomNo ratings yet

- Engine Control Wiring Diagram Xenia 2 CoilDocument1 pageEngine Control Wiring Diagram Xenia 2 CoilSuwito Hariyono100% (1)

- Engine Control PDFDocument1 pageEngine Control PDFAnonymous Totb7QgNo ratings yet

- Engine Control Xenia Vvti PDFDocument1 pageEngine Control Xenia Vvti PDFtutorial otomotifNo ratings yet

- Engine Control AvanzaDocument1 pageEngine Control Avanzagunawan naibahoNo ratings yet

- Engine ControlDocument1 pageEngine ControlSuwito HariyonoNo ratings yet

- Engine Control PDFDocument1 pageEngine Control PDFYazied AndreazNo ratings yet

- Engine ControlDocument1 pageEngine ControlE SuhermanNo ratings yet

- The Rough Guide to Beijing (Travel Guide eBook)From EverandThe Rough Guide to Beijing (Travel Guide eBook)Rating: 2 out of 5 stars2/5 (1)

- New Doc 2020-03-15 20.05.46Document1 pageNew Doc 2020-03-15 20.05.46sudNo ratings yet

- New Doc 2019-07-15 19.17.03Document6 pagesNew Doc 2019-07-15 19.17.03sudNo ratings yet

- New Doc 2019-07-16 15.52.28Document1 pageNew Doc 2019-07-16 15.52.28sudNo ratings yet

- Stocks Stocks: Fairchem Specialty HDFC BankDocument1 pageStocks Stocks: Fairchem Specialty HDFC BanksudNo ratings yet

- New Doc 2019-06-01 10.58.18 - 1Document1 pageNew Doc 2019-06-01 10.58.18 - 1sudNo ratings yet

- New Doc 2019-06-01 10.33.21 - 1Document1 pageNew Doc 2019-06-01 10.33.21 - 1sudNo ratings yet

- All Goals Within Easy Reach: Family Fi NanceDocument1 pageAll Goals Within Easy Reach: Family Fi NancesudNo ratings yet

- Now, Pay Health Premium Monthly: Preview PreviewDocument1 pageNow, Pay Health Premium Monthly: Preview PreviewsudNo ratings yet

- ETM 2019 09 23 Page 38Document1 pageETM 2019 09 23 Page 38sudNo ratings yet

- The Stocks To Consider For This Year's Mahurat TradingDocument1 pageThe Stocks To Consider For This Year's Mahurat TradingsudNo ratings yet

- These Capital Goods Stocks Could Create WealthDocument1 pageThese Capital Goods Stocks Could Create WealthsudNo ratings yet

- Why We All Must Save A Little: Planning PlanningDocument1 pageWhy We All Must Save A Little: Planning PlanningsudNo ratings yet

- Best True Wireless Earbuds On A Budget: Check CheckDocument1 pageBest True Wireless Earbuds On A Budget: Check ChecksudNo ratings yet

- Lu Bba SyllabusDocument10 pagesLu Bba SyllabusTalha SiddiquiNo ratings yet

- 9th MOM CSMCDocument40 pages9th MOM CSMCSandeep ZakneNo ratings yet

- Mivi InvoiceDocument1 pageMivi InvoiceMohit RajNo ratings yet

- Economic History: The Second Industrial RevolutionDocument34 pagesEconomic History: The Second Industrial RevolutionMark GoslingNo ratings yet

- Grade 7 Fact and Opinion PDFDocument4 pagesGrade 7 Fact and Opinion PDFCristine Mae E. ArevaloNo ratings yet

- The Isri Scrap Yearbook 2012 FinalDocument49 pagesThe Isri Scrap Yearbook 2012 FinalYanka IlarionovaNo ratings yet

- Internship FinalDocument20 pagesInternship FinalKrish JaiswalNo ratings yet

- Prashan Mantri Jeevan Jyoti Bima YojanaDocument2 pagesPrashan Mantri Jeevan Jyoti Bima YojanaRatsihNo ratings yet

- Quiz - IntangiblesDocument1 pageQuiz - IntangiblesAna Mae HernandezNo ratings yet

- Q. No.1 # Explain The Law of Diminishing Marginal Utility With The Help of Schedule and Diagram. Also Describe Its Assumptions and LimitationsDocument5 pagesQ. No.1 # Explain The Law of Diminishing Marginal Utility With The Help of Schedule and Diagram. Also Describe Its Assumptions and LimitationsAdnan KanwalNo ratings yet

- WWW Abasynisb Edu PK PDFDocument1 pageWWW Abasynisb Edu PK PDFowaisyaqoob29No ratings yet

- Financing Mozal ProjectDocument19 pagesFinancing Mozal ProjectSimran MalhotraNo ratings yet

- RRL For The GoooDocument4 pagesRRL For The GoooCarl MedinaNo ratings yet

- ECB Flow of Funds AnalysisDocument46 pagesECB Flow of Funds AnalysisJayraj ChokshiNo ratings yet

- Project Report: "Transfer Pricing"Document34 pagesProject Report: "Transfer Pricing"Dev RaiNo ratings yet

- Chap 6 Regional PlanningDocument15 pagesChap 6 Regional PlanningShamsavina Sukumaran Shamsavina SukumaranNo ratings yet

- Managerial Economics in A Global Economy: Cost Theory and EstimationDocument23 pagesManagerial Economics in A Global Economy: Cost Theory and EstimationArif DarmawanNo ratings yet

- US Internal Revenue Service: f2210 - 1994Document3 pagesUS Internal Revenue Service: f2210 - 1994IRSNo ratings yet

- Abellana v. Sps. PonceDocument3 pagesAbellana v. Sps. PoncejenizacallejaNo ratings yet

- FypDocument12 pagesFypddalielaNo ratings yet

- "Varsovie Radieuse. Return of Le Corbusier To Za Żelazną Bramą" Exhibition BrochureDocument28 pages"Varsovie Radieuse. Return of Le Corbusier To Za Żelazną Bramą" Exhibition BrochureCentrum Architektury100% (1)

- Bank of The South An Alternative To The IMF World BankDocument45 pagesBank of The South An Alternative To The IMF World BankCADTMNo ratings yet

- Percentage and Its ApplicationsDocument6 pagesPercentage and Its ApplicationsSahil KalaNo ratings yet

- Narrative ReportDocument30 pagesNarrative ReportClevin CabuyaoNo ratings yet

- S17.s1 - Final Project - Inglés 4 XDDocument2 pagesS17.s1 - Final Project - Inglés 4 XDPIERR ALEX CAMPANO ROCHANo ratings yet

- Partnership Accounting IntroductionDocument5 pagesPartnership Accounting IntroductionAbigail MendozaNo ratings yet

- Department of Labor: Cepr102105Document2 pagesDepartment of Labor: Cepr102105USA_DepartmentOfLaborNo ratings yet

- Company Profile - Quebral Diaz & Co.Document6 pagesCompany Profile - Quebral Diaz & Co.Achie DennaNo ratings yet

- Royal Mail Door To Door Rate Card July 2022Document8 pagesRoyal Mail Door To Door Rate Card July 2022self disciplineNo ratings yet

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Uploaded by

sudOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Stocks: Larsen & Toubro Bharat Electronics Finolex Cables

Uploaded by

sudCopyright:

Available Formats

stocks

The Economic Times Wealth September 23-29, 2019 11

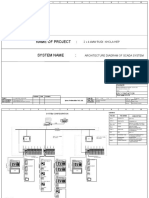

LARSEN & TOUBRO FINOLEX CABLES POTENTIAL

BHARAT ELECTRONICS

UPSIDE

10-year Current 10-year Current 1-yr target 10-year

Current PE

average PE POTENTIAL

UPSIDE

PE

12.2

average PE

17.7

price (`)

368

price (`)

488

32.5% Current PE

average PE

POTENTIAL

UPSIDE

17.5 28.3

26.4% ANALYSTS’ FINOLEX CABLES BSE CAPITAL GOODS

15.5

Current

19.8

1-yr target

16.6%

Current 1-yr target RECOMMENDATIONS 97

100 BSE SENSEX price (`) price (`)

price (`) price (`) 18 Sept 2018

BUY 8 HOLD 2 108 126

1,314 1,661

ANALYSTS’ RECOMMENDATIONS

ANALYSTS’ RECOMMENDATIONS 92

BUY 35 HOLD 2 SELL 2 BUY 22 HOLD 1 SELL 2

SELL 0

67

17 Sept 2019

A MANUFACTURER OF electrical and telecommunication cables, BHARAT ELECTRONICS BSE CAPITAL GOODS

LARSEN & TOUBRO BSE CAPITAL GOODS lighting products, electrical accessories, switchgear, fans and water

BSE SENSEX 124

BSE SENSEX heaters, Finolex Cables is in a sweet spot. A report by Firstcall

Research says its electrical cables segment is likely to get a boost

from the government’s rural and infrastructure push. On the other 100

97 18 Sept 2018

100 hand, government’s focus on Digital India and its ambitious Bharat

18 Sept 2018 Net initiative will improve the prospects of the communication

cables segment. 97

98 KEI INDUSTRIES POTENTIAL 92

UPSIDE

Current 10-year Current 1-yr target

92

17 Sept 2019

PE

15.8

average PE

43.3

price (`)

467

price (`)

552

18.2% 17 Sept 2019

A NAVRATNA PSU, it is engaged in the design,

A CONGLOMERATE WITH a presence in over ANALYSTS’ KEI INDUSTRIES BSE CAPITAL GOODS manufacture and supply of electronics products

RECOMMENDATIONS & systems for the defense requirements.

30 countries, it addresses critical needs BSE SENSEX 119

of key sectors, including infrastructure, Operational excellence, superior R&D, improved

construction, defence, hydrocarbons, heavy BUY 12 HOLD 0 100 order execution, higher cash flows, and better

18 Sept 2018

engineering, power and shipbuilding among 97 working capital management are the key

others. JP Morgan is bullish on the stock due positives for the company. In addition, the focus

to the company’s strong earnings growth on technological innovation which involves

track record, efficient and profitable execution 92 upgradation of machinery and infrastructure

SELL 1 provides the much needed competitive

capabilities, improvement in working capital

management and RoE enhancement. The advantage. It reported good numbers in the June

17 Sept 2019 2019 quarter, with 16.9% year-on-year growth in

research house feels that guidance for 2019-20

appears achievable in terms of revenue growth A WIRES AND cables manufacturer, Kei Industries offers a wide operating profit and 13.9% growth in net profit.

and EBITDA margins. The profitability is likely range of cabling solutions. AnandRathi is bullish on the company Analysts say the company will be the main

to improve due to the sale proceeds from real due to its leading position in institutional cables, strong earnings beneficiary of the government’s reforms in the

estate monetisation (e.g. Hyderabad metro real growth and improved balance sheet. Strong order book of Rs 4,530 defence sector and its healthy order book provide

estate). Even in a tough macro environment, crore offers robust revenue assurance in 2019-20. The brokerage strong revenue visibility going forward.

L&T has won a larger share in the limited big house expects that the cables segment mix of EHV cables, retail and

order opportunities. Sebi’s nod to the share exports will aid margin expansion in the future and its ability to Current PE is based on future 12-month blended forward earnings.

Stock prices as on 17 September 2019.

buyback proposal could be a near term catalyst. generate free cash flows will help in the stock’s re-rating.

Source: ACE Equity & Bloomberg.

BEML POTENTIAL

KALPATARU POWER TRANSMISSION POTENTIAL

UPSIDE UPSIDE

10-year Current 1-yr target 10-year Current 1-yr target

Current PE

22.7

average PE

54.5

price (`)

814

price (`)

1,107

35.9%

Current PE

13.6

average PE

29.2

price (`)

453

price (`)

548

21.1%

THIS MINIRATNA CATEGORY-1 PSU has ANALYSTS’ RECOMMENDATIONS A DIVERSIFIED CONGLOMERATE, ANALYSTS’ RECOMMENDATIONS

three major business verticals: mining & Kalpataru is engaged in the

BUY 4 HOLD 0 SELL 0 BUY 17 HOLD 1 SELL 1

construction, defence and rail and metro. global power transmission and

According to a report by Antique Stock infrastructure EPC space. ICICI

Broking, the metro rail projects will con- Direct believes that the strong order

tinue to provide large scale opportunities BEML BSE CAPITAL GOODS BSE SENSEX book with good traction in non- KALPATARU POWER TRANSMISSION

to the company as both the Centre and T&D business (railways, pipeline),

BSE CAPITAL GOODS BSE SENSEX

the states have stepped up their efforts improved subsidiary performance 139

towards increasing the metro network 100 and operating leverage gains

18 Sept 2018 106

not just in big cities but also in tier II and are likely to support consistent 100

tier III cities. In addition, BEML’s mining growth. Moreover, diversification 18 Sept 2018

and construction business is expected to in international T&D markets

remain steady given robust Coal India would provide good opportunities. 97

capex outlook for 2019-20. The company The returns ratios are expected to

expects to drive margin expansion 92 improve because of the company’s

through operating leverage, cost cutting strategy to monetise non-core

97 92

measures and other operational excel- assets and sales proceeds from the

lence initiatives. 17 Sept 2019 transmission assets. 17 Sept 2019

You might also like

- AD50VT1Document8 pagesAD50VT1Pablo RodriguezNo ratings yet

- A Contribution To The Empirics of Economic GrowthDocument39 pagesA Contribution To The Empirics of Economic GrowthJamesNo ratings yet

- US BN: Key Findings: Pe DealsDocument1 pageUS BN: Key Findings: Pe DealsethernalxNo ratings yet

- JK Cement: Key Financial Highlights (2018-19)Document1 pageJK Cement: Key Financial Highlights (2018-19)KpNo ratings yet

- Sheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Document32 pagesSheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Mansi Raut PatilNo ratings yet

- Name of Project:: 2 X 4.4Mw Rudi Khola HepDocument2 pagesName of Project:: 2 X 4.4Mw Rudi Khola HepapsNo ratings yet

- Vox - AD100VTH SMDocument7 pagesVox - AD100VTH SMADAMO PATRICIO O'BYRNE RIVERANo ratings yet

- Parts and Assemblies Model of Diesel Hydraulic Shunter of The Bulgarian Narrow Gauge Railways (BDZ)Document1 pageParts and Assemblies Model of Diesel Hydraulic Shunter of The Bulgarian Narrow Gauge Railways (BDZ)M Ardan Budi PrasetyaNo ratings yet

- AD100VT Service ManualDocument7 pagesAD100VT Service ManualKyleRBNo ratings yet

- Oktnp 2018 08 23 A 001 PDFDocument1 pageOktnp 2018 08 23 A 001 PDFNewcastle NewsNo ratings yet

- Stock Performance of Obour Land For Food Industries (OLFI - EGY)Document1 pageStock Performance of Obour Land For Food Industries (OLFI - EGY)body.helal2001No ratings yet

- Bangladesh Economic Growth FDIs - Lightcastle Partners PresentationDocument10 pagesBangladesh Economic Growth FDIs - Lightcastle Partners PresentationMizanur RahmanNo ratings yet

- PRINT IMO Sulphur Limit 2020 Guidance 2019 07Document4 pagesPRINT IMO Sulphur Limit 2020 Guidance 2019 07faridNo ratings yet

- Nilai B. Indo 8iDocument1 pageNilai B. Indo 8iIlpa ListiantoNo ratings yet

- N Fall2012 PDFDocument6 pagesN Fall2012 PDFManuel ChNo ratings yet

- CCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Document29 pagesCCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Amit PatelNo ratings yet

- 32 Avanza (Cont. Next Page) : Headlight (From Aug. 2015 Production)Document9 pages32 Avanza (Cont. Next Page) : Headlight (From Aug. 2015 Production)aritw541214No ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Return RollersDocument1 pageReturn RollersHO Minh TuanNo ratings yet

- BrandZ Indonesia 2019 ReportDocument79 pagesBrandZ Indonesia 2019 Reportmdf.fadilahNo ratings yet

- Country Profile: BahrainDocument10 pagesCountry Profile: BahrainOMERNo ratings yet

- BUY BUY BUY BUY: Intel CorpDocument5 pagesBUY BUY BUY BUY: Intel Corpderek_2010No ratings yet

- Embassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Document30 pagesEmbassy Office Parks REIT - Initiating Coverage - Axis Direct - 23!12!2019 - 14Yash ChhabraNo ratings yet

- GB00B1JQBT10GBGBXSSMMDocument4 pagesGB00B1JQBT10GBGBXSSMMAhmad Ibn MosharrafNo ratings yet

- Harga Termurah F1a1 RevisedDocument4 pagesHarga Termurah F1a1 RevisedCyntia AgustinaNo ratings yet

- BP9763 A3 Sheet 02Document1 pageBP9763 A3 Sheet 02shanthoshraaj25No ratings yet

- Dkn-Leger Semster GenapDocument4 pagesDkn-Leger Semster GenapMuhammad Syaiful ArifNo ratings yet

- A3 General Arrangement, Isometric View, Bill of Material, Parts and Assemblies Experimental Model Steam Engine Using A Bourdon TubeDocument1 pageA3 General Arrangement, Isometric View, Bill of Material, Parts and Assemblies Experimental Model Steam Engine Using A Bourdon TubeLe TruongNo ratings yet

- Jakarta Retail 2q17Document2 pagesJakarta Retail 2q17ainia putriNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Soulace Type ADocument15 pagesSoulace Type AgopisaiNo ratings yet

- Rekap Nilai Siswa Kosong 2021Document16 pagesRekap Nilai Siswa Kosong 2021nenek hafidzNo ratings yet

- Pid Dme PlantDocument1 pagePid Dme PlantSyamsul Rizal Abd ShukorNo ratings yet

- Trenton Technology 4U Rackmount Chassis With 20 Slot Backplane Options 26.4in DeepDocument1 pageTrenton Technology 4U Rackmount Chassis With 20 Slot Backplane Options 26.4in DeepTracy CossonNo ratings yet

- 1ST FloorDocument4 pages1ST FloorAdnany JanuzajNo ratings yet

- 3x2x13 944Document1 page3x2x13 944gman_g2000No ratings yet

- Nokia Factsheet 2023 q4Document1 pageNokia Factsheet 2023 q4Freedo MatijevicNo ratings yet

- Trenton Technology 4U Rackmount Chassis With 14 Slot Backplane Options 24.6in DeepDocument1 pageTrenton Technology 4U Rackmount Chassis With 14 Slot Backplane Options 24.6in DeepTracy CossonNo ratings yet

- 2017 JobStreet - Com Salary ReportDocument6 pages2017 JobStreet - Com Salary ReportHelbert Agluba PaatNo ratings yet

- Sept 09 BagstufferDocument2 pagesSept 09 BagstuffershowmelocalNo ratings yet

- Schematic - AudioDocument1 pageSchematic - AudioBhaskaranand LNo ratings yet

- Schematic - AudioDocument1 pageSchematic - AudioBhaskaranand LNo ratings yet

- 315c Excavator Hydraulic System - Attachment Two-Way With OnDocument2 pages315c Excavator Hydraulic System - Attachment Two-Way With OnAlessandro GomesNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- 7464 01 Sales Manager Powerpoint Dashboard 16x9Document4 pages7464 01 Sales Manager Powerpoint Dashboard 16x9nataliaNo ratings yet

- 2 Fly Me To The Moon Marcin TABDocument8 pages2 Fly Me To The Moon Marcin TABtuoihja iodajsNo ratings yet

- Bha1 MB R8: Input Buffers Power Op AmpsDocument1 pageBha1 MB R8: Input Buffers Power Op AmpsQuique BonzonNo ratings yet

- File ComponentsDocument1 pageFile ComponentsRaju D PuthusserryNo ratings yet

- Andono Kusuma Jati Sampel (Dengan Pemisahan Azeotrop) Prarancangan Pabrik Etilendiamin Dari Bahan Baku Monoetanolamin Dan Amonia Dengan Proses Amonolisis Katalitik Kapasitas 55.000 TonDocument118 pagesAndono Kusuma Jati Sampel (Dengan Pemisahan Azeotrop) Prarancangan Pabrik Etilendiamin Dari Bahan Baku Monoetanolamin Dan Amonia Dengan Proses Amonolisis Katalitik Kapasitas 55.000 Tonandono kusuma jatiNo ratings yet

- Drawing RadiatorDocument1 pageDrawing RadiatorindayuristNo ratings yet

- RadioDocument5 pagesRadioElberTyan Chura ANo ratings yet

- Engine Control PDFDocument1 pageEngine Control PDFZibrain ElcomNo ratings yet

- Engine Control Wiring Diagram Xenia 2 CoilDocument1 pageEngine Control Wiring Diagram Xenia 2 CoilSuwito Hariyono100% (1)

- Engine Control PDFDocument1 pageEngine Control PDFAnonymous Totb7QgNo ratings yet

- Engine Control Xenia Vvti PDFDocument1 pageEngine Control Xenia Vvti PDFtutorial otomotifNo ratings yet

- Engine Control AvanzaDocument1 pageEngine Control Avanzagunawan naibahoNo ratings yet

- Engine ControlDocument1 pageEngine ControlSuwito HariyonoNo ratings yet

- Engine Control PDFDocument1 pageEngine Control PDFYazied AndreazNo ratings yet

- Engine ControlDocument1 pageEngine ControlE SuhermanNo ratings yet

- The Rough Guide to Beijing (Travel Guide eBook)From EverandThe Rough Guide to Beijing (Travel Guide eBook)Rating: 2 out of 5 stars2/5 (1)

- New Doc 2020-03-15 20.05.46Document1 pageNew Doc 2020-03-15 20.05.46sudNo ratings yet

- New Doc 2019-07-15 19.17.03Document6 pagesNew Doc 2019-07-15 19.17.03sudNo ratings yet

- New Doc 2019-07-16 15.52.28Document1 pageNew Doc 2019-07-16 15.52.28sudNo ratings yet

- Stocks Stocks: Fairchem Specialty HDFC BankDocument1 pageStocks Stocks: Fairchem Specialty HDFC BanksudNo ratings yet

- New Doc 2019-06-01 10.58.18 - 1Document1 pageNew Doc 2019-06-01 10.58.18 - 1sudNo ratings yet

- New Doc 2019-06-01 10.33.21 - 1Document1 pageNew Doc 2019-06-01 10.33.21 - 1sudNo ratings yet

- All Goals Within Easy Reach: Family Fi NanceDocument1 pageAll Goals Within Easy Reach: Family Fi NancesudNo ratings yet

- Now, Pay Health Premium Monthly: Preview PreviewDocument1 pageNow, Pay Health Premium Monthly: Preview PreviewsudNo ratings yet

- ETM 2019 09 23 Page 38Document1 pageETM 2019 09 23 Page 38sudNo ratings yet

- The Stocks To Consider For This Year's Mahurat TradingDocument1 pageThe Stocks To Consider For This Year's Mahurat TradingsudNo ratings yet

- These Capital Goods Stocks Could Create WealthDocument1 pageThese Capital Goods Stocks Could Create WealthsudNo ratings yet

- Why We All Must Save A Little: Planning PlanningDocument1 pageWhy We All Must Save A Little: Planning PlanningsudNo ratings yet

- Best True Wireless Earbuds On A Budget: Check CheckDocument1 pageBest True Wireless Earbuds On A Budget: Check ChecksudNo ratings yet

- Lu Bba SyllabusDocument10 pagesLu Bba SyllabusTalha SiddiquiNo ratings yet

- 9th MOM CSMCDocument40 pages9th MOM CSMCSandeep ZakneNo ratings yet

- Mivi InvoiceDocument1 pageMivi InvoiceMohit RajNo ratings yet

- Economic History: The Second Industrial RevolutionDocument34 pagesEconomic History: The Second Industrial RevolutionMark GoslingNo ratings yet

- Grade 7 Fact and Opinion PDFDocument4 pagesGrade 7 Fact and Opinion PDFCristine Mae E. ArevaloNo ratings yet

- The Isri Scrap Yearbook 2012 FinalDocument49 pagesThe Isri Scrap Yearbook 2012 FinalYanka IlarionovaNo ratings yet

- Internship FinalDocument20 pagesInternship FinalKrish JaiswalNo ratings yet

- Prashan Mantri Jeevan Jyoti Bima YojanaDocument2 pagesPrashan Mantri Jeevan Jyoti Bima YojanaRatsihNo ratings yet

- Quiz - IntangiblesDocument1 pageQuiz - IntangiblesAna Mae HernandezNo ratings yet

- Q. No.1 # Explain The Law of Diminishing Marginal Utility With The Help of Schedule and Diagram. Also Describe Its Assumptions and LimitationsDocument5 pagesQ. No.1 # Explain The Law of Diminishing Marginal Utility With The Help of Schedule and Diagram. Also Describe Its Assumptions and LimitationsAdnan KanwalNo ratings yet

- WWW Abasynisb Edu PK PDFDocument1 pageWWW Abasynisb Edu PK PDFowaisyaqoob29No ratings yet

- Financing Mozal ProjectDocument19 pagesFinancing Mozal ProjectSimran MalhotraNo ratings yet

- RRL For The GoooDocument4 pagesRRL For The GoooCarl MedinaNo ratings yet

- ECB Flow of Funds AnalysisDocument46 pagesECB Flow of Funds AnalysisJayraj ChokshiNo ratings yet

- Project Report: "Transfer Pricing"Document34 pagesProject Report: "Transfer Pricing"Dev RaiNo ratings yet

- Chap 6 Regional PlanningDocument15 pagesChap 6 Regional PlanningShamsavina Sukumaran Shamsavina SukumaranNo ratings yet

- Managerial Economics in A Global Economy: Cost Theory and EstimationDocument23 pagesManagerial Economics in A Global Economy: Cost Theory and EstimationArif DarmawanNo ratings yet

- US Internal Revenue Service: f2210 - 1994Document3 pagesUS Internal Revenue Service: f2210 - 1994IRSNo ratings yet

- Abellana v. Sps. PonceDocument3 pagesAbellana v. Sps. PoncejenizacallejaNo ratings yet

- FypDocument12 pagesFypddalielaNo ratings yet

- "Varsovie Radieuse. Return of Le Corbusier To Za Żelazną Bramą" Exhibition BrochureDocument28 pages"Varsovie Radieuse. Return of Le Corbusier To Za Żelazną Bramą" Exhibition BrochureCentrum Architektury100% (1)

- Bank of The South An Alternative To The IMF World BankDocument45 pagesBank of The South An Alternative To The IMF World BankCADTMNo ratings yet

- Percentage and Its ApplicationsDocument6 pagesPercentage and Its ApplicationsSahil KalaNo ratings yet

- Narrative ReportDocument30 pagesNarrative ReportClevin CabuyaoNo ratings yet

- S17.s1 - Final Project - Inglés 4 XDDocument2 pagesS17.s1 - Final Project - Inglés 4 XDPIERR ALEX CAMPANO ROCHANo ratings yet

- Partnership Accounting IntroductionDocument5 pagesPartnership Accounting IntroductionAbigail MendozaNo ratings yet

- Department of Labor: Cepr102105Document2 pagesDepartment of Labor: Cepr102105USA_DepartmentOfLaborNo ratings yet

- Company Profile - Quebral Diaz & Co.Document6 pagesCompany Profile - Quebral Diaz & Co.Achie DennaNo ratings yet

- Royal Mail Door To Door Rate Card July 2022Document8 pagesRoyal Mail Door To Door Rate Card July 2022self disciplineNo ratings yet