Professional Documents

Culture Documents

Fertecon Ammonia Report: 4 September 2008

Fertecon Ammonia Report: 4 September 2008

Uploaded by

Mike MureyaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fertecon Ammonia Report: 4 September 2008

Fertecon Ammonia Report: 4 September 2008

Uploaded by

Mike MureyaniCopyright:

Available Formats

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.

com FERTECON

FERTECON AMMONIA REPORT

4 September 2008

© 2008 FERTECON Limited. Unauthorised transmission or reproduction prohibited

HEADLINES

New business out of Black Sea at $900 fob.

Sale of Middle East ammonia to a trader for the Far East at $920 cfr.

New sale into US Gulf at $955 cfr.

KEY PRICES

Yuzhnyy fob – $850-900.

Tampa/US Gulf cfr – $931-955.

OUTLOOK

Firm for near-term but some feelings that prices are approaching a peak.

INTERNATIONAL PRICES US DOMESTIC PRICES

US$/t US$/short ton

1000 1000

800 800

600 600

fob Caribbean

400 400

200 200

fob M. East fob NOLA barge

0 0

JFMAMJJASONDJFMAMJ JASONDJFMAMJJASONDJFMAMJJAS JFMAMJJASONDJFMAMJJASONDJFMAMJJASONDJFMAMJJAS

2005 2006 2007 2008 2005 2006 2007 2008

FERTECON AMMONIA REPORT – 4 September 2008 Page 1 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

FERTECON PRICE SERVICE

AMMONIA PRICE INDICATIONS

All prices in US$

4 September 28 August 21 August

Fob prices

Caribbean 885-886 885-886 700-875

Middle East * revised 775-842* 734-842 734-842

Of which:

- Netbacks on contract/formula-priced sales 775-785* 734-735 734-735

*revised

- Spot fob 820-842 800-842 800-842

Yuzhnyy/FSU 850-900 845-860 840-850

Ventspils/FSU 860-910 855-870 850-860

Southeast Asia * nominal 750-850* 700-850* 700-840*

Of which:

- Netbacks on contract/formula-priced sales 750-800* 700-750* 700-720*

* nominal

- Spot fob * nominal 830-850* 830-850* 800-840*

Delivered prices

NW Europe (duty paid/duty free) *nominal 945-995* 940-950* 940-950*

NW Europe (duty unpaid) * nominal 900-955 895-905 895-905

Far East 800-920 800-900 800-900

India 815-828 712-774 712-774

US Gulf/Tampa 931-955 931-936 745-925

- Tampa 931 931 745

- US Gulf (MS, LA, TX) * nominal 955 936 925

- US east coast n/a n/a n/a

US domestic

US barge (s.t. fob NOLA) n/a n/a n/a

FREIGHT INDICATIONS

US $/tonne

(Rates basis 1-1 unless stated)

Route Cargo size (t) Rates Notes

Caribbean –Tampa/USG 20-23,000 45-50

Baltic (Ventspils) – NW Europe 23,000 35-40

Black Sea–NW Europe (excl Scandinavia) 8-12,000 75-95 basis t-c

Black Sea – Antwerp/Belgium 23-25,000 65-70 Low end t-c, high spot

Black Sea – US (1-1 Tampa) 35-37,000 85-90

Black Sea – US (1-2 USG) 35-37,000 90-100

Black Sea – Far East 35-37,000 125-135 Low end t-c, high spot

Middle East – India (W. Coast) 15-20,000 30-43 basis t-c, 1-1/3 ports

Middle East- Far East (Taiwan) 23,500 70-80 Low end t-c, high spot

Middle East - Far East (South Korea) 23,500 80-90 Low end t-c, high spot

Indonesia – Far East (Taiwan) 15-20,000 40-45 40-45

FERTECON PRICE DEFINITION

Prices, rounded to the nearest US$, represent the last known spot business and current indications, for 4-35,000

t cargoes, net of credit. The interest rate used to deduct credit is the $ LIBOR rate plus 1% - i.e. currently

4.3%/year.

FERTECON AMMONIA REPORT – 4 September 2008 Page 2 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

ANALYSIS

Ammonia prices have continued to climb with new business reported this week out of Yuzhnyy at

$900 fob for late September. A new spot sale into the US Gulf has been done at $955 cfr. A trader

has bought Middle Eats ammonia for the Far East at $920 cfr.

However, already traders are hesitating over making further commitments at such high prices in the

Black Sea. The recent soaring ammonia prices have largely been the result of severe supply

constraints due to both planned and unexpected plant closures over the summer months. However,

ammonia export supply is set to improve as plants come back on-stream after turnaround. Although

there is no further news over the possible timing of a restart of the Burrup ammonia plant in Western

Australia, plants in North Africa, Russia and Ukraine are coming back on-stream after turnarounds.

There are still some turnarounds due in September but supply should be improving as we go through

September and October. In some cases, there appears to be some suggestion of a shift towards

higher ammonia exports – in the case of CIS exporters because of a lacklustre nitrogen fertilizer

market, and in the case of Libya because of continued problems with urea capacity. Oil prices are

also coming off.

Demand for ammonia has so far remained fairly buoyant and certainly the eastern hemisphere

remains tight. However, there have been some concerns over reductions in demand for ammonia for

non-fertilizer end-uses in the US, Europe and Far East due to high input costs of ammonia and other

chemicals.

Although Indian ammonia imports (largely for DAP production) are picking up as phosphoric acid

supplies improve, there are concerns elsewhere about future DAP production rates due to some

downturn in demand, which could impact on ammonia import requirements. (Downward momentum

continues in the international phosphate market. There has been some business in India but

elsewhere import demand remains very subdued. Sentiment in the current market, even on the part of

traders, is becoming increasingly bearish. Last week, DAP sold into India at prices of $1,200-1,240

cfr. Earlier this week, fresh tonnes were sold at $1,170 and now two additional cargoes have been

sold at $1,095 and $1,100 cfr. Firm offers have been made ex-US at $1,100 cfr this week. Indian

buyers’ price ideas are adjusting downwards accordingly and are now well below $1,100 cfr. DAP

buyers in Latin America, Europe and Pakistan are showing little sign of returning to the market to

book significant volumes any time soon and the same is true for most other global markets. Given

uncertainties as to how prices will develop in the short term, most buyers are choosing to wait on the

sidelines in anticipation of lower prices.)

On the input cost side for DAP, sulphur prices are sliding rapidly in the international market. For

example, new business has been done in India at $500 cfr, down from sales in the $670s cfr done a

few weeks ago. Similar trends are being seen in other regions. For the time being, however, some US

DAP producers who have to rely imported rock and given ammonia costs of $931-936 delivered for

September, are looking at production costs of well over $1,200 per metric tonne of DAP. Depending

on how international DAP prices develop, DAP production closures are a real possibility, whuch could

affect ammonia demand.

SUPPLIERS

FSU: Yuzhnyy: Gorlovka has sold 20,000 t for 20-30 September lifting at $900 fob. New indications

are higher but traders are now becoming hesitant about committing to new purchases at this stage, as

they sense that prices may now be peaking.

Ammonia capacity is beginning to come back on-stream after summer turnarounds although there are

still some turnarounds to take place which will restrict supply to some extent. The Rossosh plant in

Russia will be down for turnaround this month. There are unconfirmed reports that, in Ukraine,

Severodonetsk will go down for turnaround in September. DnieprAzot has postponed its turnaround

until 6-8 October.

However, OPZ will take down one urea line on 7-10 September for 15-21 days and the second line for

just 5-7 days. This will release additional ammonia for export – around 5-7,000 t – during this period.

Cherkassy is due to bring the second line up from maintenance in mid September.

FERTECON AMMONIA REPORT – 4 September 2008 Page 3 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

Furthermore, some producers are also intimating that they may make a shift towards higher ammonia

exports as nitrogen fertilizers prices come under pressure product backs up. In particular there are

some indications that producers will cut back AN output to favour ammonia, particularly if AN prices

slip below $450 fob. Indeed, ammonium nitrate prices have come under considerable pressure this

week with offers reported as low as $420-440 fob Black Sea but upon investigation these are proving

more likely to be buyers’ bids. Even if prices came to $450 it is not evident that there could be too

much interest but equally sellers do not seem ready to commit at this level as yet.

The KIP (the Ukrainian minimum export price system) has been abolished to be replaced by a

recommended price.

August ammonia shipments out of Yuzhnyy totalled 281,000 t. The last vessel to load was the

Herdis, which completed for Yara on 31 August.

So far around 310,000 t has been committed for September shipment. The September line-up is as

follows;

- Brussels – 23,500 t, Transammonia to US, 3 September.

- Al Majedah – 15,000 t Yara, 4 September.

- Hemina – 35,000 t, Nitrochem to US, 5 September.

- Havlur – 12,000 t, Yara/Israel, 7 September.

- Brugge Venture - 23,500 t, Transammonia to US, 9-10 September.

- Hesiod – 40,000 t, Yara, 12-15 September.

- Clipper Posh – 35,000 t, Nitrochem, 17-20 September.

- Kent– 23,000 t, Nitrochem, 20 September.

- Herakles – 20,000 t, Keytrade to Morocco, 25-20 September.

- tbn – 35,000 t, Nitrochem, end September.

Ventspils – There are some signs that availability could start to improve as we go through

September although there are still some shortfalls due to turnarounds. The Berezniki plant goes

down for turnaround 20 September. Kemerovo was due to restart last week but has encountered

some problems and is now expected back on stream next week. The Salavat plant is scheduled to go

down for a 21 day turnaround in September. However, Perm restarted mid-August.

UNITED STATES: CF Industries Holdings, Inc. reported yesterday that its Donaldsonville,

Louisiana nitrogen complex, which had completed an orderly shutdown last weekend in advance of

Hurricane Gustav striking the US Gulf Coast, is currently assessing the effects of the storm on the

operation and their implications for start-up timing. Initial indications are that the complex suffered no

significant physical damage during the storm. The Donaldsonville facility is located on the Mississippi

River between New Orleans and Baton Rouge. CF stated that it has begun removing storm debris at

the complex's ammonia, urea, and UAN solution plants. However, as of Wednesday morning,

electrical power had not been restored in the Donaldsonville region. Damage to area electrical

transmission lines must be repaired before the complex can restart production.

ALGERIA: The Annaba plant continues to run well. One line at Arzew has been running and the

other is now understood to be starting to run again. The Pertusola is loading 11,800 t in Annaba to

day for Europe.

LIBYA: The urea line that has been down for turnaround for two months has a major problem and it

could be some time before NOC can restart production. In the meantime, the ammonia unit will be

restarted about 10-15 September. NOC can now load 23,000 t lots following recent work at the

loading facilities and is expected to offer a cargo of this size later on for 1st half October lifting.

MIDDLE EAST: Spot fob prices are stable in the $820-842 fob range. Netbacks achieved on

contract sales are increasing, with latest direct contract business in west coast India at $883.75 cfr

with 60 days’ credit, giving a return of around the mid $780s fob.

Mitsui has sold 23,500 t of Middle East ammonia to Koch at $955 cfr US Gulf, for early October

arrival.

Mitsubishi has bought 23,500 t of Saudi ammonia at $920 cfr Far East.

Iran – Transammonia’s cargo of 14,982 t, which loaded in BIK on the Nijinsky, will arrive in

Kandla/WC India tomorrow for KIT/Iffco.

FERTECON AMMONIA REPORT – 4 September 2008 Page 4 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

Transammonia is sending both the Tobolsk and the Sanko Independence, which loaded in Iran in late

August, to South Korea, covering spot sales to SFC.

Transammonia will load a cargo in the Middle East on the Sylvie around 15-20 September for delivery

to PPL/Paradeep, EC India under contract for end September arrival.

Oman – Iffco/India has received 20,006 t of Omani ammonia into Paradeep on the east coast on the

Nordic River.

Qatar – The price of Qafco’s 14,000 t cargo on the Al Marona destined for west coast India for

Hindalco (5,000 t eta 1-3 September), MCFL (4,000 t eta 5-6 September) and Zuari (5,000 t eta 8

September) (as reported last week) is $833.75 cfr with 60 days’ credit.

Mitsui’s vessel, the Gas Oriental, sailed today from Qatar with 23,300 t on board for delivery to east

coast India as follows – 11,300 t to CFL and 1,000 t for STL at Kakinada, plus 4,000 t to CFL at Vizag

and 7,000 t to CFL at Ennore.

It is understood that the Gas Colombia is loading in Qatar covering Mitsui’s sale of 23,500 t of Middle

East ammonia to Koch at $955 cfr US Gulf, for early October arrival.

Saudi Arabia - Sabic has sold 23,500 t to Mitsubishi at a price close to $920 cfr Far East for

shipment in 1st week September for 2nd half September arrival. It is believed that the tonnes will load

on the Rose Gas. It is understood that Mitsubishi will take most of the tonnes to FPG at

Mailiao/Taiwan, plus possibly a small lot elsewhere in the Far East.

The price of Mitsui’s cargo on the Al Jabirah, which loaded 14,935 t last week in Al Jubail/S. Arabia

for delivery to east coast India for CFL at Kakinada (5,935 t) and Vizag (9,000 t) is $815 cfr cash.

The Damman ammonia/urea plant has now been permanently shut down.

Middle East export shipments for August/September 2008 are as follows:

Price $/t cfr

Vessel Supplier/Origin ‘000 t Destination/Buyer unless stated Load date

AUGUST 222.71

n/a Mitsui/Qafco 15 Far East 650 fob August

n/a Mitsui/PIC 8 n/a 800 fob August

TA/Iran & Abu

Nijinsky Dhabi 15 Igsas/Turkey n/a 4 August

Oman (8.19) & 654-655 w 15

Tobolsk 22.19 KIT/Iffco, WC India 10 August

Qatar (14) d

Gas Major Qafco/Qatar 10 JPMC/Jordan l-t contract 6 August

S. Arabia (18) &

Rose Gas 23.19 WC India - KIT/Iffco l-t contract 11 Aug

Oman (5.19)

EC India – CFL 10 to

Gas Oriental Mitsui/Iran 23.39 Vizag & 12.89 Kanada 712.75 2nd wk Aug

+ 0.5 STL

MCFL & Zuari, WC

Al Marona Qafco/Qatar 10 India 779.63 w 60 d 18 August

Tobolsk TA/Iran 23.5 South Korea/SFC n/a 18-22 Aug

Sanko

Independence TA/Iran 23.5 South Korea/SFC n/a 25 August

Nordic River KIT/Oman 20 KIT/Iffco – EC India n/a Late August

Al Jabirah Mtsui/S.Arabia 14.94 EC India/CFL 815 cash 27 August

Hindalco (5), MCFL

Al Marona Qafco/Qatar 14 833.75 w 60 d Late August

(4), Zuari (5), WCIndia

SEPTEMBER 116.78

Nijinsky TA/Iran 14.98 India/KIT-Iffco n/a 1 Sept

FERTECON AMMONIA REPORT – 4 September 2008 Page 5 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

CFL (22.3), STL (1),

Gas Oriental Mitsui/Qatar 23.3 n/a 4 Sept

EC India

Gas Colombia Mitsui/Qatar 23.5 Koch/US 955 cfr Early Sept

Antwerpen Mitsui/Iran 8 ? Early Sept

MSK/Far East – prob 1st week

Rose Gas Sabic/S.A. 23.5 incl Taiwan 920 cfr Sept

Sylvie TA/Iran 23.5 PPL/EC India n/a 15-20 Sept

Tbn Nitrochem/Iran n/a n/a n/a End Sept

INDONESIA: Kaltim announced plans this week to build another urea plant at a cost of $740

million. Construction would start in mid-2009 and be completed in 2011 according to local press

reports.

MALAYSIA: The Nanga Parbat is on its way back to Kerteh and due to arrive 5 September to load

another cargo for east coast India. Based on current numbers, Mitco estimates this will give a fob

netback of around $660.

MARKETS

NORTHWEST EUROPE: DSM’s Geleen plant in the Netherlands is now back up to full capacity

following ammonia production problems. The plant came back up to full operation last weekend.

In France, as reported previously, GPN is taking maintenance turnarounds at its two units in

succession (Rouen and Grandpuits) from 1 September for 5-6 weeks.

European gas prices have strengthened this week and are currently quoted at around $12/mmBtu for

spot gas, which is still considerably less than the reported contract price of $14.50 mm/Btu. The gas

Interconnector from the UK to mainland Europe is down for maintenance so the usual gas flows that

happen at this time of the year from the UK to the continent currently do not exist. UK gas has

increased to over 73p/therm ($13/mmBtu) due to North Sea supply problems.

INDIA: The price of contract deliveries from Middle East suppliers has risen further this week, with

latest pricing at $833.75 cfr with 60 days credit for three port discharge.

Ammonia import requirements are recovering now that acid supplies have improved. It is understood

that GCT/Tunisia has yet to finalise third quarter phosphoric acid contracts with GSFC and CFL at the

supplier’s target price of $2,310 cfr. However, OCP/Morocco earlier settled at $2,310 cfr with GSFC,

Zuari, PPL, MCFL, and TCL and has started supplying these volumes.

West coast: Iffco will receive 14,982 t into Kandla tomorrow on the Nijinsky, which loaded in

BIK/Iran under Transammonia’s account with KIT.

The price of Qafco’s 14,000 t cargo on the Al Marona destined for west coast India for Hindalco

(5,000 t eta 1-3 September), MCFL (4,000 t eta 5-6 September) and Zuari (5,000 t eta 8 September)

(as reported last week) is $833.75 cfr with 60 days’ credit.

East coast: The price of Mitsui’s cargo on the Al Jabirah, which loaded 14,935 t last week in Al

Jubail/S. Arabia for delivery to CFL at Kakinada (5,935 t) and Vizag (9,000 t) on east coast India is

$815 cfr cash.

Mitsui’s vessel, the Gas Oriental, sailed today from Qatar with 23,300 t on board for delivery to east

coast India as follows – 11,300 t to CFL and 1,000 t for STL at Kakinada, plus 4,000 t to CFL at Vizag

and 7,000 t to CFL at Ennore.

Iffco has received 20,006 t of Omani ammonia into Paradeep on the Nordic River.

Transammonia will load a cargo in the Middle East on the Sylvie around 15-20 September for delivery

to PPL under contract for end September arrival.

Indian ammonia imports for September 2008 delivery are tabulated below:

FERTECON AMMONIA REPORT – 4 September 2008 Page 6 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

Buyer/ $/t cfr unless

Location Supplier ’000 t stated Arrival Vessel

SEPTEMBER 110.72

West coast 28.98

KIT/Iffco/Kandla TA/Iran 14.98 n/a 5 Sept Nijinsky

Hindalco/Dahej Qafco/Qatar 5 833.75 w 60 d 1-3 Sept Al Marona

MCFL/Mangalore Qafco/Qatar 4 833.75 w 60 d 5-6 Sept Al Marona

Zuari/Goa Qafco/Qatar 5 833.75 w 60 d 8 Sept Al Marona

East Coast 81.74

CFL/Ennore Mitsui/Qatar 7 l-t contract Mid Sept Gas Oriental

CFL/Kakinada Mitsui/S. A. 5.94 815 cash 5-7 Sept Al Jabirah

CFL/Kakinada Mitsui/Qatar 11.3 l-t contract Mid Sept Gas Oriental

STL/Kakinada Mitsui/Qatar 1 l-t contract Mid Sept Gas Oriental

CFL/Vizag Mitsui/S.A. 9 815 cash 7-8 Sept Al Jabirah

CFL/Vizag Mitsui/Qatar 4 l-t contract Mid Sept Gas Oriental

Iffco/Paradeep KIT/Oman 20 n/a 2 September Nordic River

PPL/Paradeep TA/Iran 23.5 n/a End Sept Sylvie

FAR EAST: Prices have risen with the latest spot purchase of Saudi product by Mitsubishi at close

to $920 cfr.

CHINA: China has increased the special export duty on urea to 150%, making the total duty 185%

currently. The export duty also now also applies to exports of ammonia. However, China currently

does not export ammonia but does import into Caojing and Zhanjiang and there is a small terminal at

Fangcheng port in the south of China near the Vietnamese border.

PHILIPPINES: Philphos is in the market to buy ammonia but will probably pass on offers in the

current, very tight market in Asia.

SOUTH KOREA: Namhae is due to receive two cargoes of ammonia in September - one each

from Nitrochem and Mitsubishi, and another one from Mitsubishi in October.

SFC will receive two cargoes of ammonia from Mitsui and one from Yara in September, one each

from Mitsui, Mitsubishi and Yara in October and one each from Mitsubishi and Yara in November.

Transammonia is sending both the Tobolsk and the Sanko Independence, which loaded in Iran in late

August, to South Korea, covering spot sales to SFC.

TAIWAN: Formosa Plastics (FPG) received one cargo of ammonia from Mitsubishi at the very end

of August and is due to receive a another cargo from Mitsubishi at the end of September which will be

shipped from the Middle East – i.e. the Sabic cargo recently purchased by Mitsubishi at $920 per t cfr.

Demand for imported ammonia for the balance of the year may be adversely affected by current high

ammonia prices as FPG has cut back on acrylonitrile production, claiming this is due to high costs.

UNITED STATES: As reported last week, the Tampa contract price has now risen to $931 cfr, a

massive $186 increase on the August contract price of $745 cfr.

Last week, new ammonia business was concluded into the US Gulf at $936 cfr, but this week there

has been a sale of 23,500 t of Middle East ammonia by Mitsui to Koch at $955 cfr for arrival in early

October.

DAP is a major end use for imported ammonia into the US and there are some concerns over the

outlook for production rates given a downturn in demand for DAP in domestic and international

markets.

There has been little impact on import demand for ammonia because of the impact of Hurricane

Gustav, however – although Mosaic’s Faustina phosphate plant is currently down due to power loss

following Hurricane Gustav, this plant is not based on imported ammonia. MissPhos, which imports

ammonia into Pascagoula, announced earlier this week that Hurricane Gustav caused only minimal

physical wind damage to its Pascagoula phosphate production facility. The facility experienced an

electrical interruption during the storm which resulted in a temporary plant shutdown. The facility was

in the process of resuming full operations. The company’s customers and suppliers should see no

impact.

FERTECON AMMONIA REPORT – 4 September 2008 Page 7 of 8

FAX +44 1892 701711 PHONE +44 1892 701710 • EMAIL info@fertecon.com FERTECON

CROP PRICES / AGRICULTURE

UKRAINE: According to the agriculture ministry, Ukraine harvested 43.2 million t grain on 12.56

million hectares by 1 September 2008, with an average yield of 3.44 t/hectare. The amount of grain

harvested to date is around double the amount harvested a year ago, when the average yield was

reported at 2.05 t/hectare. The ministry said wheat harvested to date was 26.842 million t on just over

7 million hectares, 99.9% of the total area to be harvested and the average yield was 3.8 t/hectare.

Barley harvest to date was 13.42 million t on 4.179 million hectares. Rye harvest was 1.051 million t

on 459,000 hectares. The ministry expects grain harvest this year at 48.7 million t compared with 29.3

million t in 2007.

CHICAGO BOARD OF TRADE (CBOT) CROP PRICES

cents/bushel

Weekly

Price Price Price

Product Change

Sept 2008 Sept 2007 Sept 2009

(Cents)

Corn 546.4 -31 322 600.2

Wheat 752.2 -50.4 770 841.0

Soybean 1,251.0 -97 870 1,263.6

Rough Rice 1,844.0 +10 1,003 1,800

FERTILIZER DERIVATIVES

Bids and offers for FIS ammonia cash settled derivatives are as follows.

Contact: Ron Foxon & Alexey Paliy - FIS Ltd

Office : + 44 207 090 1122 Mobile: + 44 7738726557

ferts@freightinvestor.com www.freightinvestorservices.com

Yuzhnyy:

Ammonia fob Yuzhnyy

($/tonne)

Month Bid Offer

September 850 925

October 850 900

Regards

Vivien Bright

FERTECON AMMONIA REPORT – 4 September 2008 Page 8 of 8

You might also like

- Scheme DocumentDocument94 pagesScheme Documenttommy prastomo100% (1)

- Farmc: Levels of DevelopmentDocument17 pagesFarmc: Levels of DevelopmentArthur MericoNo ratings yet

- Urea Weekly Market Report 6 Sept17Document18 pagesUrea Weekly Market Report 6 Sept17Victor VazquezNo ratings yet

- Argus Sulphur (2018-08-02)Document14 pagesArgus Sulphur (2018-08-02)saeidNo ratings yet

- GRN 0022Document74 pagesGRN 0022Tran Minh NhutNo ratings yet

- TOEFL ExamDocument8 pagesTOEFL ExamAnkit100% (2)

- Somebody That I Used To Know Ukulele TabsDocument5 pagesSomebody That I Used To Know Ukulele Tabsafcabanas100% (2)

- Argus FMB Ammonia Precios Amoniaco PDFDocument7 pagesArgus FMB Ammonia Precios Amoniaco PDFCarlos Manuel Castillo SalasNo ratings yet

- Argus Phosphates Report-Jan 19, 2023Document13 pagesArgus Phosphates Report-Jan 19, 2023Abdullah UmerNo ratings yet

- Seabrooke Report On PDIDocument19 pagesSeabrooke Report On PDIPeterborough ExaminerNo ratings yet

- LV Motors: IE2 Safe Area: Reliable - Long Las NGDocument16 pagesLV Motors: IE2 Safe Area: Reliable - Long Las NGAvish ShahNo ratings yet

- Preços Cloro - Soda CáusticaDocument27 pagesPreços Cloro - Soda CáusticaLuiz Guilherme Carvalho PaivaNo ratings yet

- Composites Market Report 2015Document44 pagesComposites Market Report 2015Jeffery NguNo ratings yet

- DT Stock and ETF Report 1-9-2015Document20 pagesDT Stock and ETF Report 1-9-2015chr_maxmannNo ratings yet

- Conduct Hearing of Dr. Morgan OsborneDocument10 pagesConduct Hearing of Dr. Morgan OsborneCTV CalgaryNo ratings yet

- Economic Integration in South Asia (2005)Document121 pagesEconomic Integration in South Asia (2005)caportNo ratings yet

- 162-CompSat JRC JLR-21-31 MED-B Certificate GPS 5-3-2021Document4 pages162-CompSat JRC JLR-21-31 MED-B Certificate GPS 5-3-2021MarcoNo ratings yet

- Raw Materials in The Chemical Industry - Regional Trends in A Globalized IndustryDocument38 pagesRaw Materials in The Chemical Industry - Regional Trends in A Globalized IndustryunitedmanticoreNo ratings yet

- MENA Mining Report - Q1 2023Document60 pagesMENA Mining Report - Q1 2023saim siam100% (1)

- Primary, Secondary, and Other Credit Extensions by Remaining Term Outstanding OnDocument52 pagesPrimary, Secondary, and Other Credit Extensions by Remaining Term Outstanding OnvpkqbbbsziwtxNo ratings yet

- 2 Paivi Rousu PDFDocument34 pages2 Paivi Rousu PDFMahendra Pratap SinghNo ratings yet

- Platts Coal Trader International: Volume 22 / Issue 142 / July 27, 2022Document22 pagesPlatts Coal Trader International: Volume 22 / Issue 142 / July 27, 2022Fabian TorresNo ratings yet

- ZHF XPXN 0DC01 Omi 001-2Document145 pagesZHF XPXN 0DC01 Omi 001-2Online 4-lifeNo ratings yet

- MI 116 Affidavit of Lost or Destroyed CertificateDocument1 pageMI 116 Affidavit of Lost or Destroyed CertificateAKOSU ORBEM JethroNo ratings yet

- Commercial Fidelity Guarantee Claim FormDocument3 pagesCommercial Fidelity Guarantee Claim FormHihiNo ratings yet

- Trove Carbon Credit Investment Report 13 Sept 2023Document23 pagesTrove Carbon Credit Investment Report 13 Sept 2023Nyasimi GeoffreyNo ratings yet

- Brandon Fisher CVDocument6 pagesBrandon Fisher CVapi-281831309No ratings yet

- Phosphate Weekly Market Report 6 Sept17Document20 pagesPhosphate Weekly Market Report 6 Sept17Victor VazquezNo ratings yet

- Fastmarkets MB Lithium MethodologyDocument10 pagesFastmarkets MB Lithium MethodologyNavin JhaNo ratings yet

- 1Document68 pages1priya suresh100% (1)

- Volume Shockers (Stocks With Rising Volumes), Technical Analysis ScannerDocument2 pagesVolume Shockers (Stocks With Rising Volumes), Technical Analysis ScannerfixemiNo ratings yet

- QA Monthly Report 2022-09 SeptemberDocument32 pagesQA Monthly Report 2022-09 SeptemberMark Mirosevic-SorgoNo ratings yet

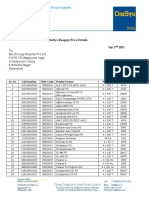

- Diasys Price Details For Bhrungi Hospital HyderabadDocument4 pagesDiasys Price Details For Bhrungi Hospital HyderabadSandeep BellapuNo ratings yet

- Global50 2022Document8 pagesGlobal50 2022ALEX CID JIMENEZNo ratings yet

- SML AR 2017 (Final) Low ResDocument178 pagesSML AR 2017 (Final) Low ResRatih Q AnjilniNo ratings yet

- News Reading: Class Xii - Sma Al Irsyad Kota TegalDocument11 pagesNews Reading: Class Xii - Sma Al Irsyad Kota TegalZahra AdzaniaNo ratings yet

- PHÂN TÍCH KẾT QUẢ KHẢO SÁTDocument11 pagesPHÂN TÍCH KẾT QUẢ KHẢO SÁTHải Âu HồNo ratings yet

- IOCL Call Letter Appln No 6010412004694 PDFDocument3 pagesIOCL Call Letter Appln No 6010412004694 PDFsagarNo ratings yet

- Coatings Word December 2012Document52 pagesCoatings Word December 2012sami_sakrNo ratings yet

- Pollution Board ZoningDocument9 pagesPollution Board ZoningHem Prakash SanchetiNo ratings yet

- Evaluation of Tanap and Tap Projects EfficiencyDocument9 pagesEvaluation of Tanap and Tap Projects EfficiencyKamranNo ratings yet

- Badhkummed Indane Gramin Vitark-21-22Document9 pagesBadhkummed Indane Gramin Vitark-21-22gera 0734No ratings yet

- Prevalence, Comorbidities, Diagnosis, and Treatment of Nonallergic RhinitisDocument11 pagesPrevalence, Comorbidities, Diagnosis, and Treatment of Nonallergic RhinitisputriNo ratings yet

- NikeadidasDocument2 pagesNikeadidasNgọc Huyền NguyễnNo ratings yet

- Finding A Home For Global LNG in Europe NG 157Document79 pagesFinding A Home For Global LNG in Europe NG 157HERNAN CORTEZ FARFANNo ratings yet

- LME Monthly Overview November 2020 PDFDocument21 pagesLME Monthly Overview November 2020 PDFMochammad Yaza Azhari BritainNo ratings yet

- GLICO LIFE ANNUAL REPORT - WebDocument57 pagesGLICO LIFE ANNUAL REPORT - WebAlexander FrimpongNo ratings yet

- Gas Ban Measure Ballot Title Appeal MemoDocument25 pagesGas Ban Measure Ballot Title Appeal MemoMegan BantaNo ratings yet

- Maruti SuzukiDocument5 pagesMaruti SuzukiSiddharth SatamNo ratings yet

- Argus FMB Ammonia Precios AmoniacoDocument7 pagesArgus FMB Ammonia Precios AmoniacoCarlos Manuel Castillo SalasNo ratings yet

- Why Standardization of Festival Marketing Might Be A Cheesy AffairDocument17 pagesWhy Standardization of Festival Marketing Might Be A Cheesy AffairPeter SpiveyNo ratings yet

- Ship Radio Licence: Guidance NotesDocument24 pagesShip Radio Licence: Guidance NotesNguyen Phuoc HoNo ratings yet

- 2 746 CorrDocument10 pages2 746 CorrSri Susilawati IslamNo ratings yet

- HDPE PE300 Safety Data SheetDocument4 pagesHDPE PE300 Safety Data SheetmalikNo ratings yet

- Insights Reg PlantationsDocument69 pagesInsights Reg PlantationsNasya YenitaNo ratings yet

- FijiTimes - Aug 32012 PDFDocument48 pagesFijiTimes - Aug 32012 PDFfijitimescanadaNo ratings yet

- AU9560-GBS-GR: Technical Reference ManualDocument20 pagesAU9560-GBS-GR: Technical Reference ManualjobegodNo ratings yet

- Marketable Surplus and Market-Arrivals in APMC YardsDocument71 pagesMarketable Surplus and Market-Arrivals in APMC YardssrikanthuasNo ratings yet

- Channel Demarcation and Regulation Buoy Signals 2022Document79 pagesChannel Demarcation and Regulation Buoy Signals 2022YUSRA SHUAIB100% (1)

- Gold Bull S Sandman Project Scoping Study PointsDocument11 pagesGold Bull S Sandman Project Scoping Study PointsBabacar Latgrand DioufNo ratings yet

- Lpgas: Northwest Europe Daily Assessments $/MTDocument5 pagesLpgas: Northwest Europe Daily Assessments $/MTMilkiss SweetNo ratings yet

- History of SteelDocument16 pagesHistory of SteelRajNo ratings yet

- Wildlife ManagementDocument29 pagesWildlife ManagementJisan JoniNo ratings yet

- Axis Bank - 123456763542 - Sample Statement - cc319740Document5 pagesAxis Bank - 123456763542 - Sample Statement - cc319740Seemab LatifNo ratings yet

- 2022 10 30qrDocument177 pages2022 10 30qrB8Inggit KartikaDiniNo ratings yet

- Director Human Resources in Denver CO Resume Janice ClewellDocument2 pagesDirector Human Resources in Denver CO Resume Janice ClewellJaniceClewellNo ratings yet

- MMN 02 2021 07 01 2021 Gulf of GuineaDocument3 pagesMMN 02 2021 07 01 2021 Gulf of GuineaDelfin RegisNo ratings yet

- ATF Form 4 Application For Tax Paid Transfer and Registration of FirearmDocument12 pagesATF Form 4 Application For Tax Paid Transfer and Registration of FirearmAmmoLand Shooting Sports NewsNo ratings yet

- Writing Task 1 Explanation AcademicDocument12 pagesWriting Task 1 Explanation AcademicMuza StewartNo ratings yet

- Victory Kitchen & Restaurant Breakfast MenuDocument2 pagesVictory Kitchen & Restaurant Breakfast MenuChris VictoryNo ratings yet

- FibreC PDFDocument38 pagesFibreC PDFseljak_veseljakNo ratings yet

- Home Security Evaluation ChecklistDocument10 pagesHome Security Evaluation ChecklistEarl DavisNo ratings yet

- Health 10 Q2 M1Document30 pagesHealth 10 Q2 M1Carol NavarroNo ratings yet

- Purposive Communication: Module 1: Communication Process, Principles and EthicsDocument11 pagesPurposive Communication: Module 1: Communication Process, Principles and EthicsJan Jerwin PobleteNo ratings yet

- CA Pragya Singh Rajpurohit: Documents List - BasicDocument30 pagesCA Pragya Singh Rajpurohit: Documents List - BasicsankNo ratings yet

- Labor Standards (Azucena, JR., 2013) 165Document1 pageLabor Standards (Azucena, JR., 2013) 165Marlo Caluya ManuelNo ratings yet

- NASC SG7 19 Risk Assessments Method Statements RAMSDocument16 pagesNASC SG7 19 Risk Assessments Method Statements RAMSDoru-Mihai VlasNo ratings yet

- Universal Greens: Grand - Green - GraciousDocument12 pagesUniversal Greens: Grand - Green - GraciousinfosurenNo ratings yet

- Criminology TermsDocument4 pagesCriminology TermsTon RJ IdoNo ratings yet

- Case 4 Precise Software SolutionsDocument3 pagesCase 4 Precise Software Solutionssaikat sarkarNo ratings yet

- 2.1 A Global Warming LessonDocument2 pages2.1 A Global Warming LessonZulfiqar AhmadNo ratings yet

- The Ichorous Peninsula - Twilight ProwlersDocument5 pagesThe Ichorous Peninsula - Twilight Prowlersmoniquefailace325No ratings yet

- Can't Help Falling in Love (Tenor Sax)Document1 pageCan't Help Falling in Love (Tenor Sax)AnardinoNo ratings yet

- Design Methods in Engineering and Product DesignDocument1 pageDesign Methods in Engineering and Product DesignjcetmechanicalNo ratings yet

- Ielts Practice Listening Test (Pretest)Document7 pagesIelts Practice Listening Test (Pretest)adpNo ratings yet

- 1ghadjzftewifvsmn PDFDocument282 pages1ghadjzftewifvsmn PDFAlex MingNo ratings yet

- Cash ReceiptDocument6 pagesCash ReceiptYed777andiNo ratings yet

- Application Form / Checklist : Department of Fire & Rescue Services, Government of KeralaDocument37 pagesApplication Form / Checklist : Department of Fire & Rescue Services, Government of KeralaStew884No ratings yet

- Contempor Ary Philippine Arts From The Regions: Rose-Anne B. Magsino, LPTDocument21 pagesContempor Ary Philippine Arts From The Regions: Rose-Anne B. Magsino, LPTLara NicoleNo ratings yet

- CVC EED StudentEssay HouseSenate PDFDocument4 pagesCVC EED StudentEssay HouseSenate PDFSpencerNo ratings yet