Professional Documents

Culture Documents

Framework For Preparation of Financial Statements

Framework For Preparation of Financial Statements

Uploaded by

Aviral PachoriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Framework For Preparation of Financial Statements

Framework For Preparation of Financial Statements

Uploaded by

Aviral PachoriCopyright:

Available Formats

Framework for Preparation of Financial Statements

Introduction

Whether you watch analysts on CNBC or read articles in the Economic Times, you'll hear experts insisting on

the importance of "doing your homework" before investing in a company. In other words, investors should dig

deep into the company's financial statements and analyze everything from the auditor's report to the footnotes.

But what does this advice really mean, and how does an investor follow it?

A firm's financial statements are the primary source of information used by investors and creditors for making

investment decisions. Firm management is obligated to provide accurate information and motivated to provide

financial results that meet the expectations of BSE participants. Much of the time both results can be obtained

simultaneously. However, there are times where the accurate information will not support the expectations of

the investing community. What is management to do?

The requirement for management is to accurately report the firm's financial position. However, in the late 1990s

and early 2000s there were instances where the desire to meet investors expectations dominated the obligation

to provide accurate information. Therefore, it is necessary to understand financial statements and it’s

component.

What is Financial Statements?

They are summarized statements of accounting data prepared at the end of accounting year. These

statements are prepared to give users outside of the company, like investors and creditors, or users within

company like Board of Directors & employees more information about the company’s financial positions. A

general-purpose set of financial statements usually includes a balance sheet, income statements, statement of

owner’s equity, and statement of cash flows.

The Balance Sheet

BALANCE SHEET A financial statement reflecting the recorded values of all assets, liabilities, and owners’

equity at a point in time. The balance sheet is a summary of the assets, liabilities, and equity of a business at a

particular point in time—usually the end of the firm’s fiscal year. The balance sheet is also known as the

statement of financial condition or the statement of financial position. The values shown for the different

accounts on the balance sheet are not purported to reflect current market values; rather, they reflect historical

costs.

In essence, the balance sheet presents the details of the so-called accounting equation:

ASSETS = LIABILITIES + SHAREHOLDERS’ EQUITY

This equation recognizes that a company has assets and there are claims on the assets by creditors (measured in

terms of the company’s liabilities) and company owners (measured in terms of stockholders’ equity).

ASSET A physical or intangible item of value to a company or an individual. Assets are the resources of the

business enterprise, such as plant and equipment, that are used to generate future benefits. If a company owns

plant and equipment that will be used to produce goods for sale in the future, the company can expect these

assets (the plant and equipment) to generate cash inflows in the future.

There are three major categories of assets: current assets , non current assets and investments. Noncurrent assets

include plant assets, intangibles.

FIXED ASSETS - include machinery and equipment, buildings, and land. Some businesses are more capital-

intensive than others; for example, a manufacturer would typically be more capital-intensive than a wholesale

operation and, therefore, have and more fixed assets.

1 TYBBA - Financial Statement Analysis

ACCUMULATED DEPRECIATION The total of past periodic depreciation charges applicable to

depreciable assets carried on a company’s balance sheet, shown as a deduction from gross fixed assets.

GROSS BLOCK - Gross fixed assets mean the original cost of the fixed assets. Cumulative depreciation in

the books is as per the provisions of The Companies Act, 1956. It is last cumulative depreciation till last year +

depreciation claimed during the current year. Net block = Gross Block – Provision for Depreciation.

INTANGIBLE ASSETS are the current value of nonphysical assets that represent long-term investments of

the company. Such intangible assets include patents, copyrights, and goodwill. The cost of some intangible

assets is amortized (“spread out”) over the life of the asset.

AMORTIZATION is akin to depreciation: The asset’s cost is allocated over the life of the asset; the reported

value is the original cost of the asset, less whatever has been amortized. The number of years over which an

intangible asset is amortized depends on the particular asset and its perceived useful

CAPITAL WORK-IN-PROGRESS – This represents advances, if any, given to building contractors, value of

building yet to be completed, advances, if any, given to equipment suppliers etc. Once the equipment is

received and the building is complete, the fixed assets are capitalised in the books, for claiming depreciation

from that year onwards.Till then, it is reflected in the form of capital work in progress.

INVESTMENTS These are assets that are purchased with the intention of holding them for a long term, but

which do not generate revenue or are not used to manufacture a product. Examples of investments include

equity securities of another company and shares/bonds/units of Unit Trust of India etc for speculative purposes.

This type of investment should be ideally from the profits of the organisation and not from any other funds,

which are required either for working capital or capital expenditure. They are bifurcated in the schedule, into

“quoted and traded” and “unquoted and not traded” depending upon the nature of the investment, as to whether

they can be liquidiated in the secondary market or not.

CURRENT ASSETS (also referred to as circulating capital or working assets or gross working capital)

Current assets are assets that could reasonably be converted into cash within one operating cycle or one year,

whichever takes longer. An operating cycle begins when the firm invests cash in the raw materials used to

produce its goods or services and ends with the collection of cash for the sale of those same goods or services.

For example, if Fictitious manufactures and sells candy products, its operating cycle begins when it purchases

the raw materials for the products (e.g., sugar) and ends when it receives cash for selling the candy to retailers.

Because the operating cycle of most businesses is less than one year, we tend to think of current assets as those

assets that can be converted into cash in one year. E.g. cash, marketable securities, accounts receivable,

inventories, and prepaid expenses.

CASH comprises both currency—bills and coins—and assets that are immediately transformable into cash,

such as

deposits in bank accounts.

Every firm must have cash for current business operations. A reservoir of cash is needed because of the unequal

flow of funds into (cash receipts) and out of (cash expenditures) the business. The amount of the cash balance is

determined not only by the volume of sales, but also by the predictability of cash receipts and cash payments.

MARKETABLE SECURITIES are securities that can be readily sold when cash is needed. Every company

needs to have a certain amount of cash to fulfill immediate needs, and any cash in excess of immediate needs is

usually invested temporarily in marketable securities.

Investments in marketable securities are simply viewed as a short term place to store funds; marketable

securities do not include those investments in other companies’ stock that are intended to be long term. Some

financial reports combine cash and marketable securities into one account referred to as cash and cash

equivalents or cash and marketable securities.

2 TYBBA - Financial Statement Analysis

ACCOUNTS RECEIVABLE are amounts due from customers who have purchased the firm’s goods or

services but haven’t yet paid for them. To encourage sales, many firms allow their customers to “buy now and

pay later,” perhaps at the end of the month or within 30 days of the sale.

Accounts receivable therefore represents money that the firm expects to collect soon. Because not all accounts

are ultimately collected, the gross amount of accounts receivable is adjusted by an estimate of the uncollectible

accounts, the allowance for doubtful accounts, resulting in a net accounts receivable figure.

INVENTORIES represent the total value of the firm’s raw materials, work-in-process, and finished (but as yet

unsold) goods. A manufacturer of toy trucks would likely have plastic and steel on hand as raw materials, work-

in-process consisting of truck parts and partly completed trucks, and finished goods consisting of trucks

packaged and ready for shipping.

PREPAID EXPENSES The portion of any expenses paid during a stated period but applicable to future

periods. A company often needs to prepay some of its expenses. For example, insurance premiums may be due

before coverage begins, or rent may have to be paid in advance. Thus, prepaid expenses are those cash

payments recorded on the balance sheet as current assets and then shown as an expense in the income statement

as they are used.

Format of the Balance Sheet in vertical form

Balance Sheet of ..... as on .....

Particulars

I. Source of Funds:

1. Shareholder’s Funds:

(a) Share capital

Equity

Preference

Less: Calls Unpaid:

Add: Forfeited Shares

(b) Reserves and Surplus

Capital Reserve

Capital Redemption Reserve

Securities Premium

Other Reserves

Profit and Loss Account

Less: Deferred Revenue expenditure to the

extent not written-off.

Preliminary Expenses

Discount on Issue of Shares

Profit and Loss account

(debit balance, if any)

2. Loan Funds:

(a) Secured loans

Debentures

Loans and Advance from Banks

Loans from subsidiary Companies

(b) Unsecured loans

Public Deposits

Total (Capital Employed)

3 TYBBA - Financial Statement Analysis

II. Application of Funds

1. Non Current Assets:

Tangible Assets

Land

Building

Leasehold Premises

Railway Sidings

Plant and Machinery

Furniture

Vehicles

Less: Provision for Depreciation

Intangible Assets

Goodwill

Patents and Trademarks

Less: Amortisation

2. Investments:

Government or Trust Securities, Shares,

Debentures, Bonds

3. Current Assets, Loans and Advances:

Quick

Sundry Debtors

Cash and Bank balances

Bills Receivable

Interest Accrued on investments

Other Current Assets

Short term Loans and Advances

Non Quick

Loose Tools / Stock in Trade, Inventories

Prepaid Expenses

Less: Current Liabilities and Provisions:

Quick liabilities & Provisions

Acceptances

Sundry Creditors

Outstanding Expenses

Provisions for Taxation

Proposed Dividends

Non Quick

Bank Overdraft / Cash Credit

Pre received Income

TOTAL

Note: A footnote to the Balance Sheet may be added to show the contingent liabilities.

LIABILITY is defined as a present obligation of the entity arising from past events, the settlement of which is

expected to result in an outflow from the entity of resources embodying economic benefits.

RESERVES AND SURPLUS represent the profit retained in business since inception of business. “Surplus”

indicates the figure carried forward from the profit and loss appropriation account to the balance sheet, without

allocating the same to any specific reserve. Hence, it is mostly called “unallocated surplus”. The company

4 TYBBA - Financial Statement Analysis

wants to keep a portion of profit in the free form so that it is available during the next year for appropriation

without any problem.

SINKING FUND A separate pool of cash, often held in trust, into which periodic payments are made for the

future redemption of an obligation.

SECURED LOANS represent loans taken from banks, financial institutions, debentures (either from public or

through private placement), bonds etc. for which the company has mortgaged immovable fixed assets (land and

building) and/or hypothecated movable fixed assets (at times even working capital assets with the explicit

permission of the working capital banks)

Usually, debentures, bonds and loans for fixed assets are secured by fixed assets, while loans from banks for

working capital, i.e., current assets are secured by current assets. These loans enjoy priority over unsecured

loans for settlement of claims against the company.

UNSECURED LOANS represent fixed deposits taken from public (if any) as per the provisions of Section 58

(A) of The Companies Act, 1956 and in accordance with the provisions of Acceptance of Deposit Rules, 1975

and loans, if any, from promoters, friends, relatives etc. for which no security has been offered.

Such unsecured loans rank second and subsequent to secured loans for settlement of claims against the

company. There are other unsecured creditors also, forming part of current liabilities, like, creditors for

purchase of materials, provisions etc.

EQUITY, also called shareholders’ equity or net worth or owners fund, reflects ownership. The equity of a

firm represents the part of its value that is not owed to creditors and therefore is left over for the owners. In the

most basic accounting terms, equity is the difference between what the firm owns—its assets—and what it

owes its creditors—its liabilities. Net worth means total of share capital and reserves and surplus.

CURRENT LIABILITIES are obligations that must be paid within one operating cycle or one year,

whichever is longer. It include:

■ Accounts payable, which are obligations to pay suppliers. They arise from goods and services that have been

purchased but not yet paid.

■ Accrued expenses, which are obligations such as wages and salaries payable to the employees of the

business, rent, and insurance.

■ Short-term loans from a bank or notes payable within a year.

INCOME STATEMENT

An income statement is a summary of the revenues and expenses of a business over a period of time, usually

either one month, three months, or one year. This statement is also referred to as the profit and lossstatement. It

shows the results of the firm’s operating and financing decisions during that time.

Income is defined as increases in economic benefits during the accounting period in the form of inflows or

enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to

contributions from equity participants.

Expenses are defined as decreases in economic benefits during the accounting period in the form of outflows or

depletions of assets or incurrence’s of liabilities that result in decreases in equity, other than those relating to

distributions to equity participants.

Cost of goods sold - Whenever a product is manufactured or sold, certain direct costs are incurred. These costs

are designated on the income statement as cost of goods sold, or COGS. For a retail company, direct costs are

simply the cost of materials purchased for resale. For a manufacturing company, direct costs can also include

5 TYBBA - Financial Statement Analysis

labor costs, manufacturing overhead, and depreciation expenses associated with production. Since service

companies incur few direct costs, their income statements usually do not include cost of goods sold.

Operating expenses - Operating expenses are expenses other than cost of goods sold that a company incurs in

the normal course of business. These include items such as management salaries, advertising expenditures,

repairs and maintenance costs, research and development expenditures, lease payments, and general and

administrative expenses.

Interest expense - Interest expense is the cost to the firm of borrowing money. It depends on the overall level

of firm indebtedness and the interest rate associated with this debt. Interest expense is generally a small fraction

of total firm expenses, however, this expense as a percent of revenue can fluctuate dramatically with changes in

the firm’s borrowing requirements or with the general level of interest rates in the economy.

The operating decisions of the company—those that apply to production and marketing—generate sales or

revenues and incur the cost of goods sold (also referred to as the cost of sales or the cost of products sold). The

difference between sales and cost of goods sold is gross profit. Operating decisions also result in administrative

and general

expenses, such as advertising fees and office salaries. Deducting these expenses from gross profit leaves

operating profit, which is also referred to as operating income, or operating earnings.

Non Operating includes income from dividend on share investment made in other companies, interest on fixed

deposits/debentures, sale proceeds of special import licenses, profit on sale of fixed assets and any other sundry

receipts.

Operating and Non Operating decisions take the firm from sales to earnings before interest and taxes (EBIT)

on the income statement. The results of financing decisions are reflected in the remainder of the income

statement. When interest expenses and taxes, which are both influenced by financing decisions, are subtracted

from EBIT, the result is net income. Net income is, in a sense, the amount available to owners of the firm. If the

firm has preferred stock, the preferred stock dividends are deducted from net income to arrive at earnings

available to equity shareholders. If the firm does not have preferred stock, net income is equivalent to earnings

available for equity shareholders.

VERTICAL FORMAT

Financial statements should be rearranged for proper analysis and interpretations of these statements. It enables

to measure the performance of operational efficiency and profitability of a concern during particular period.

The items of operating revenues, non-operating revenues, operating expenses and nonoperating expenses are

rearranged into different heads and sub-heads are given below:

FORMAT OF INCOME STATEMENT

PARTICULARS Amt. (Rs.) Amt. (Rs.) Amt. (Rs.)

Gross Sales X

Less : Returns & Allowances / Sales Tax / Excise Duty X XX

Less: Cost of Goods Sold

Opening stock of goods X

Add: Purchases X

Less: Purchases Returns X X

Add: Freight and Carriage X

Less:Closing Stock of Raw Materials X

Direct wages (Factory) X

Other Factory Exp

Factory Rent and Rates X

Power and Coal X

6 TYBBA - Financial Statement Analysis

Depreciation of Plant and Machinery X

Depreciation of Factory Building X

Work Manager's Salary X

Other Factory Expenses X XX XXX

Gross Profit XXX

Less: Operating Expense

(a) General & Administrative Expense X

(b) Selling Expense X

(c) Finance Expenses X X

Interest on Overdraft / CC

Operating Profit XX

Add: Non Operating Income

Discount Received X

Dividend Received X

Income from Investment X XX

Less: Non Operating Expenses

Loss on Sale of Fixed Assets X

Loss by fire / Earthquake X XX

Net Profit before Interest and Tax XXX

Less: Interest on Long term loan X

Net Profit before Tax X

Less: Provision for Income taxes X

a) Current Tax

b) Deferred tax asset / liability

Net Profit after Tax X

Less: Appropriations X

Closing balance ( to be transferred to balance sheet ) XXX

Income Statement Equations

From the above rearrangement of operating statements, the following accounting equations may be given:

(1) Net sales = Gross sales - (Returns and Allowances)

(2) Gross Profit = Net Sales - Cost of Goods Sold

(3) Operating Expenses = Office and Administrative Expenses + Selling and Distribution Expenses + Finance

Expenses

(4) Net Profit Before Interest and Tax = Operating Profit + Non-Operating Income - Non-Operating Expenses

7 TYBBA - Financial Statement Analysis

You might also like

- Presentation On Pre-Audit of PaymentDocument55 pagesPresentation On Pre-Audit of Paymentsanjay_sbi100% (1)

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- Accounting Terms & DefinitionsDocument6 pagesAccounting Terms & DefinitionsMir Wajid KhanNo ratings yet

- Directives - Unified Directives 2067 EnglishDocument474 pagesDirectives - Unified Directives 2067 EnglishManoj ThapaliaNo ratings yet

- Shares and Debentures: A Comparison ChartDocument2 pagesShares and Debentures: A Comparison ChartJobin JohnNo ratings yet

- What Is A Balance Sheet AuditDocument6 pagesWhat Is A Balance Sheet AuditSOMOSCONo ratings yet

- Financial Manager: Typical Work ActivitiesDocument5 pagesFinancial Manager: Typical Work ActivitiesMansi ChughNo ratings yet

- Methods of Price Level AccountingDocument17 pagesMethods of Price Level AccountingKuladeepa KrNo ratings yet

- CA Inter SM Chapter 7 Nov.21Document37 pagesCA Inter SM Chapter 7 Nov.21vipulNo ratings yet

- 22 Stock Audit Report FormatDocument15 pages22 Stock Audit Report FormatSaptarshi CoomarNo ratings yet

- A. Engagement Letter From Client To CPA - PALACIODocument2 pagesA. Engagement Letter From Client To CPA - PALACIOPinky DaisiesNo ratings yet

- SG Audit Business Advisory Services BrochureDocument16 pagesSG Audit Business Advisory Services BrochureBagus Deddy AndriNo ratings yet

- Duties and Responsibilities of Chief AccountantDocument2 pagesDuties and Responsibilities of Chief AccountantJudy Ann EstradaNo ratings yet

- 1 Auditing Standards, Statements and Guidance Notes - An Overview PDFDocument24 pages1 Auditing Standards, Statements and Guidance Notes - An Overview PDFnavyaNo ratings yet

- 12 Audit ReportsDocument16 pages12 Audit ReportsZindgiKiKhatirNo ratings yet

- Asset Classification and Provisioning Regulations 2017 ENG PDFDocument4 pagesAsset Classification and Provisioning Regulations 2017 ENG PDFNelsonNo ratings yet

- Accounting Postulates, Concepts and PrinciplesDocument4 pagesAccounting Postulates, Concepts and PrinciplesKkaran ShethNo ratings yet

- Introduction and Basic Concept of Income Tax Final 5.12Document53 pagesIntroduction and Basic Concept of Income Tax Final 5.12Sai prasad100% (1)

- QMF Approved and CirculatedDocument78 pagesQMF Approved and CirculatedMuhammad Amir Usman100% (1)

- Financial Management LO3Document6 pagesFinancial Management LO3Hadeel Abdul Salam100% (1)

- Unit 1 Introduction To FDMDocument12 pagesUnit 1 Introduction To FDMZaheer Ahmed SwatiNo ratings yet

- Draft Attached Formats: 1. Resignation Letter by AuditorDocument6 pagesDraft Attached Formats: 1. Resignation Letter by AuditorAlamba Charitable TrustNo ratings yet

- 2011 Revenue and Cash Receipts Cycle Internal ControlDocument11 pages2011 Revenue and Cash Receipts Cycle Internal ControlTheQUICKbrownFOXNo ratings yet

- Substantive Procedures For Sales RevenueDocument5 pagesSubstantive Procedures For Sales RevenuePubg DonNo ratings yet

- Exposure Management Internal TechniquesDocument8 pagesExposure Management Internal TechniquesArockia Shiny SNo ratings yet

- Stock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujaDocument53 pagesStock Broking, Custodial Service, Depository and Service Lending Scheme Submitted By: Kanwarpal Singh Richa PahujanavaggNo ratings yet

- Confidential Information Case Study2Document3 pagesConfidential Information Case Study2SereneNo ratings yet

- Work in ProgressDocument7 pagesWork in ProgressMehakpreet kaurNo ratings yet

- Effect of Stock Market On Indian EconomyDocument28 pagesEffect of Stock Market On Indian Economyanshu009767% (3)

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Accountancy Notes PDFDocument11 pagesAccountancy Notes PDFSantosh ChavanNo ratings yet

- Petty Cash BookDocument13 pagesPetty Cash BookChandran PachapanNo ratings yet

- Limitations of Balance SheetDocument6 pagesLimitations of Balance Sheetshoms_007No ratings yet

- Chapter 7 - TaxationDocument33 pagesChapter 7 - TaxationLOVENo ratings yet

- Holding and Subsidiary CompaniesDocument33 pagesHolding and Subsidiary Companieskhuranaamanpreet7gmailcomNo ratings yet

- Test & InterviewDocument15 pagesTest & InterviewSe SathyaNo ratings yet

- Manual Accounts PayableDocument134 pagesManual Accounts Payablesrinivas0731No ratings yet

- Computerised Information System (CIS)Document41 pagesComputerised Information System (CIS)Arsyad Noraidi100% (1)

- Journal Ledger Trial BalanceDocument22 pagesJournal Ledger Trial BalanceWilliam C JacobNo ratings yet

- Financial Analysis of BDODocument4 pagesFinancial Analysis of BDOPCU COMSELECNo ratings yet

- Investments ProgramfdgfgfDocument30 pagesInvestments Programfdgfgfredearth2929No ratings yet

- Sample Business Plan Outline (Start-Up) : Resources: Trade Associations, FCPL BRC, InternetDocument4 pagesSample Business Plan Outline (Start-Up) : Resources: Trade Associations, FCPL BRC, InternetJobin VargheseNo ratings yet

- Instructor Mr. Shyamasundar Tripathy Management Faculty (HR)Document30 pagesInstructor Mr. Shyamasundar Tripathy Management Faculty (HR)Aindrila BeraNo ratings yet

- Internal Memorandum GuidelinesDocument5 pagesInternal Memorandum Guidelinesrubycorazon_edizaNo ratings yet

- Prakas 068 On Full Implementation of Ifrs MefDocument3 pagesPrakas 068 On Full Implementation of Ifrs MefLona Chee100% (2)

- IAS 16, Property, Plant and Equipment OverviewDocument3 pagesIAS 16, Property, Plant and Equipment OverviewSpencerNo ratings yet

- Asset Disposal PolicyDocument6 pagesAsset Disposal PolicySivasakti MarimuthuNo ratings yet

- Budgetary Control System and Inventory Management - Research Study - 150075041Document3 pagesBudgetary Control System and Inventory Management - Research Study - 150075041aarohi bhattNo ratings yet

- Role and Responsibilities of Independent DirectorsDocument31 pagesRole and Responsibilities of Independent DirectorsLavina ChandwaniNo ratings yet

- Management Control System CH3Document28 pagesManagement Control System CH3Dinaol Teshome100% (1)

- FM 105Document3 pagesFM 105Melzy AgdigosNo ratings yet

- Auditor's Report On Financial StatementsDocument10 pagesAuditor's Report On Financial StatementsNastya SelivanovaNo ratings yet

- Trends in International ManagementDocument5 pagesTrends in International ManagementAleksandra RudchenkoNo ratings yet

- Financial Statements Audit: - Relationship Between Accounting and AuditingDocument6 pagesFinancial Statements Audit: - Relationship Between Accounting and AuditingClydeNo ratings yet

- Audit of Forex TransactionsDocument4 pagesAudit of Forex Transactionsnamcheang100% (2)

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- Balance Sheet SampleDocument1 pageBalance Sheet Samplewaqas akramNo ratings yet

- Bcom Sem-6 (2016) April-2023 Auditing and Corporate Governance-2Document3 pagesBcom Sem-6 (2016) April-2023 Auditing and Corporate Governance-2Hariom ShingalaNo ratings yet

- Final Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Document28 pagesFinal Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Payal Motwani100% (1)

- EY SPA Brochure English 2013Document12 pagesEY SPA Brochure English 2013Никола ЛазићNo ratings yet

- Accounting Concepts and PrinciplesDocument2 pagesAccounting Concepts and PrinciplesAnne AlagNo ratings yet

- 1.3 ActivityDocument9 pages1.3 ActivityRonald MalicdemNo ratings yet

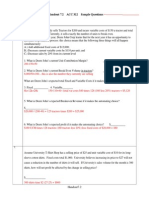

- Handout 7.2 ACC 312 Sample QuestionsDocument3 pagesHandout 7.2 ACC 312 Sample QuestionsShivam GuptaNo ratings yet

- SOLGEO S.R.L. - 2176786 - Entry ReportDocument16 pagesSOLGEO S.R.L. - 2176786 - Entry ReportriccardoNo ratings yet

- Mva & Eva - MKDocument9 pagesMva & Eva - MKIfa FaizahNo ratings yet

- Leases Income Taxes Employee Benefits: Rsoriano/JmaglinaoDocument3 pagesLeases Income Taxes Employee Benefits: Rsoriano/JmaglinaoMerliza JusayanNo ratings yet

- Bài Tập Buổi 1 FA1 (F3)Document4 pagesBài Tập Buổi 1 FA1 (F3)nhtrangclcNo ratings yet

- Arid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDocument3 pagesArid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDeadPool Pool100% (1)

- Fabm 2 Q2-M1Document23 pagesFabm 2 Q2-M1Randy Magbudhi86% (29)

- Statement of Changes in Equity SAT Notes - Removed 2Document6 pagesStatement of Changes in Equity SAT Notes - Removed 2mariaeahjiselle.quebengco.commNo ratings yet

- Valuation of ContributionDocument2 pagesValuation of ContributionsunshineNo ratings yet

- Prelim Set ADocument13 pagesPrelim Set AJanine LerumNo ratings yet

- Corporation Hand Out - RevisedDocument21 pagesCorporation Hand Out - RevisedAnnie RapanutNo ratings yet

- Accounting MCQ PART 3Document10 pagesAccounting MCQ PART 3samuelkishNo ratings yet

- UntitledDocument4 pagesUntitledRima WahyuNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- Fabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Document2 pagesFabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Cameron VelascoNo ratings yet

- Cash Flow - Mojo Jojo CFsDocument2 pagesCash Flow - Mojo Jojo CFsmuhd amyrul haqimNo ratings yet

- Infanta National High School Entrepreneurship: Quarter Challenge 2Document5 pagesInfanta National High School Entrepreneurship: Quarter Challenge 2Callie tena100% (1)

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirNo ratings yet

- CFAS Quiz Questions AddedDocument2 pagesCFAS Quiz Questions AddedSaeym SegoviaNo ratings yet

- Nepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Document24 pagesNepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Gemini_0804No ratings yet

- H04. Statement of Comprehensive IncomeDocument9 pagesH04. Statement of Comprehensive IncomeMaryrose SumulongNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Accounting Mm2Document13 pagesAccounting Mm2For EthicsNo ratings yet