Professional Documents

Culture Documents

Henrico Retail Inc.

Henrico Retail Inc.

Uploaded by

Lê KhoaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Henrico Retail Inc.

Henrico Retail Inc.

Uploaded by

Lê KhoaCopyright:

Available Formats

CASE 9.

2

Henrico Retail, Inc.

Understanding the IT Accounting System and

Identifying Audit Evidence for Retail Sales

MARK s. BEASLEY • FRANK A. BUCKLESS ■ STEVEN M. GLOVER • DOUGLAS F. PRAWXTT

LEARNING OBJECTIVES

After completing and discussing this case you should be able to

[1] Outline the audit trail for processing retail sales [3] Develop audit plans for gathering evidence to test

transactions the occurrence and accuracy assertions for retail

[2] Recognize when audit evidence must be gathered sales transactions

electronically if a traditional paper trail is absent

INTRODUCTION

Henrico Retail, Inc. is a first year audit client. The audit partner obtained the following description of the

sales system after recently meeting with client personnel at the corporate office.

DESCRIPTION OF THE SALES SYSTEM

Henrico’s sales system is IT-based with computerized cash registers on the floors of all of its stores. At the

point of sale, Henrico’s sales clerks scan the bar code on the price tag of the product being sold to read the

product number. If the quantity of a product being sold exceeds one, sales clerks can either enter the quantity

being sold for that particular product code or scan the bar code for each individual item being purchased. At

that point, the computerized cash register performs the following:

■ Identifies correct unit price for that product number from the online price master file stored on the

store server

■ Notifies the clerk if product number is invalid

■ Calculates total price of purchase (price X quantity)

■ Extends totals, calculates sales taxes, and determines final transaction amount.

Before the sale can be completed, sales clerks must indicate whether this is a cash, debit, or credit

sale. For credit sales, Henrico only accepts VISA or MasterCard credit cards. Customers swipe their credit

card through a card reader directly linked to VISA and MasterCard to initiate the online credit card approval

process, when the credit card agency’s electronic approval is transmitted back to the cash register system,

the credit approval code is electronically recorded on the cash register hard drive before the charge slip is

generated for customer signature, when credit is denied, customers must either pay by cash or the sales clerk

voids the sale. The original signed copy of the credit charge slip is maintained in the cash drawer. Debit card

transactions work virtually in the same manner as credit sales except that the online system seeks

authorization from the customer's bank.

The case was prepared by Mark s. Beasley, Ph.D. and Frank A. Duckless, Ph.D. of North Carolina State University and Steven M. Glover, Ph.D. and

Douglas F. Prawitt, Ph.D. of Brigham Young University, as a basis for class discussion. Henrico is a fictitious company. All characters and names

represented are fictitious; any similarity to existing companies or persons is purely coincidental.

Section 9: Auditing Cash, Fair Value, and Revenues

For all types of sales, the cash register generates a customer paper-based receipt while a duplicate record of

© 2015 Pearson Education, Inc. 265

the transaction is stored on the cash register’s hard drive in an online file that is backed up hourly to the

store’s computer server. This electronic transaction information documents on the register’s hard drive the

product number, unit price, quantity sold, the extended transaction totals, and credit card agency or bank

approval information.

Sales clerks have no access to the transaction electronic file. In addition, sales clerks can only read

unit price information and have no access to change unit prices in the online price master file. Only the store

manager’s staff has access to the price master file. Each week, the store manager’s staff approves price

changes and new product listings to be added to the price list master files. And, only the store’s human

resources manager is authorized to input changes to the employee master file of valid employee

identification numbers.

Store clerks are allowed to operate any machine on the floor as long as the clerk has a valid employee

identification number. If a cash register is not currently being used, all the sales clerk has to do is enter his

or her employee identification number before scanning any product being sold. The system will not proceed

without a valid employee identification number. Generally, operation of the cash register is self-explanatory

although some problems have occurred previously. New sales clerks receive two hours of training on the

operation of the cash register before serving customers on the sales floor. Henrico management believes “on

the job experience” is most effective.

At the end of each day, sales clerks select the “register closing” option on the cash register. That

process automatically updates both the transaction online file stored on the cash register’s hard drive and the

backup file stored on the store’s server. The closing process generates a receipt printout at the register that

summarizes the total amount of cash sales, debit and credit sales, sales returns, and any other miscellaneous

transactions for the day. The sales clerks count the cash in the drawer and list the total cash count on a Daily

Deposit sheet (a preprinted blank form). In addition, sales clerks summarize total debit and credit sales on

the Daily Deposit Sheet by listing total amounts from the debit and credit sales slips in the register. The sales

clerks also record on the Daily Deposit Sheet the cash, debit, credit, and other transaction totals indicated on

the cash register receipt generated by the register closing process. The sales clerks reconcile their cash, debit,

and credit slip counts to these transaction totals and indicate any differences in amount. At that point, the

sales clerks take the cash drawer, which includes debit and credit slips, to the store cashier who is located in

the store cashier’s office. The store cashier verifies the Daily Deposit Sheet and initials the total cash and

debit and credit sales columns listed on the Daily Deposit Sheet for each register closed indicating that the

amounts in the drawer reconcile to the amounts on the Daily Deposit Sheet.

The cashier leaves $200 in each cash drawer to begin the following day. Cash drawers are stored

overnight in the store’s vault. Each night, a local Brinks security service picks up the cash , debit transaction

receipts, and credit charge slips collected during the day for delivery to the overnight depository at the store’s

local bank. The next day, the hank immediately gives the store cash credits for all charge slips presented

based on the bank’s arrangement with VISA and MasterCard and funds from debit transactions are

electronically transmitted to Henrico's bank account from the customers' banks. And, the bank automatically

credits the store’s bank account for all cash received. The store cashier can download confirmation of the

deposit processed each day by logging into the bank's online customer account access webpage.

An independent person in accounting for each store verifies that the sum of the cash, debit

transactions, and credit card slip totals on all Daily Deposit Sheets for the prior day reconcile to the

confirmation received from the bank of the deposit processed. After the reconciliation is performed, the

bank’s email confirmation is printed and attached to the Daily Deposit Sheets, which are filed together by

date.

Overnight, the store computer server processes all transactions downloaded from each cash register

through the register closing process and summarizes that information in a Daily Sales Report, which is an

electronic file stored on the store’s server. Each night, an electronic copy of the Daily Sales Report file from

each store is transmitted automatically at midnight to the corporate office

Case 9.2: Henrico Retail, Inc.

main server. The store server also automatically generates a paper copy of the Daily Sales Report for each

store nightly. It summarizes total store sales, as well as subtotals of cash transactions, debit transactions, and

credit sales, by store cash register. These reports are filed by date at each store.

Each night, the store computer server automatically updates perpetual inventory records, which are

stored on the store’s computer server. Once the perpetual inventory records are updated, an electronic copy

of the perpetual inventory record is transmitted to the corporate office main server. No paper reports of daily

266 © 2015 Pearson Education, Inc.

updates to the perpetual inventory record are generated by the computer.

At month end, the store computer server generates an Inventory Report from the perpetual inventory

file. The Inventory Report provides inventory quantity information by product number. Also, the store

computer server uses each day’s Daily Sales Report file to generate a Monthly Sales Report file for each

store. This file contains daily sales totals for the store for each day of the month. This Monthly Sales Report

information is electronically transmitted to the corporate office. Each store’s server generates a printout of

the Monthly Sales Report at month end. The corporate office computer server uses this information to

prepare and print a consolidated General Ledger, which summarizes the postings of monthly sales totals

from each store to the consolidated sales account.

REQUIRED

You are the audit senior assigned to the audit of Henrico Retail Inc. The audit partner recently asked you to

assist in planning the audit of the sales system based on your review of the client-prepared sales system

narrative. The partner has asked you to address the following issues:

[1] Describe the sales transaction audit trail from the point of sale to the general ledger posting to the

consolidated sales accounts at the corporate office. Be sure to emphasize which aspects of the audit trail

are in paper or electronic form.

[2] Describe the difference between a preventative control and a detective control and give an example of

each that are present in the sales system at Henrico.

[3] Develop a proposed strategy for auditing the occurrence assertion for sales transactions. Describe

whether there is a sufficient paper-based audit trail to audit that assertion without relying on IT audit

specialists to test electronic only processes.

[4] What evidence source would you use to select a sample of sales transactions to test the occurrence of

sales transactions at one store? why would you use this source? what evidence would you examine for

each transaction selected?

[5] Develop a proposed strategy for auditing the accuracy assertion for sales transactions. Describe whether

there is a sufficient paper-based audit trail to audit that assertion without relying on IT audit specialists

to test electronic only processes.

[6] Describe whether you can use the same sample of transactions selected to test the occurrence assertion

to also test the accuracy assertion.

[7] How would you select a sample to test the completeness assertion for sales? Explain whether the sample

used to test the occurrence assertion would be effective for testing the completeness assertion.

[8] How do risks related to manual controls differ from risks related to automated controls? Give an example

of each from the sales system at Henrico.

[9] What portion, if any, of the accounting system will likely require the assistance of an IT systems auditor,

who evaluates evidence existing only in electronic form?

[10] What control deficiencies can you identify in the existing sales system?

© 2015 Pearson Education, Inc. 267

You might also like

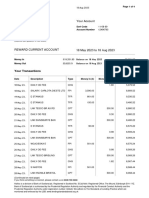

- Halifax Statement 2023 08 18Document4 pagesHalifax Statement 2023 08 18VALENTIN SHABLIKANo ratings yet

- Solution Manual Auditing and Assurance Services 13e by Arens Chapter 14Document29 pagesSolution Manual Auditing and Assurance Services 13e by Arens Chapter 14Tyasa Putri100% (1)

- Lecturing C Meeting 01 - Paper F3 PDFDocument34 pagesLecturing C Meeting 01 - Paper F3 PDFchrislinNo ratings yet

- Material Flow Cost Accounting (MFCA) : Pertemuan 6-7 Akuntansi KeberlanjutanDocument44 pagesMaterial Flow Cost Accounting (MFCA) : Pertemuan 6-7 Akuntansi KeberlanjutanErlia AgastyaNo ratings yet

- Tugas 1 - Problem 1-12Document2 pagesTugas 1 - Problem 1-12cemkudaNo ratings yet

- Jawaban CH 14Document28 pagesJawaban CH 14Heltiana NufriyantiNo ratings yet

- Jawaban Chapter 19Document21 pagesJawaban Chapter 19Stephanie Felicia TiffanyNo ratings yet

- Tugas Auditing 1 Pertanyaan Dan Soal Diskusi No 14-30 Sampai 14-32 14-30 (Objective 14-5) You Have Been Asked by The Board of Trustees of A Local ChurchDocument4 pagesTugas Auditing 1 Pertanyaan Dan Soal Diskusi No 14-30 Sampai 14-32 14-30 (Objective 14-5) You Have Been Asked by The Board of Trustees of A Local ChurchHusnul KhatimahNo ratings yet

- Bai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Document3 pagesBai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Ngọc MinhNo ratings yet

- Tugas 17-1 Sampai 17-10Document2 pagesTugas 17-1 Sampai 17-102111070296 AFRATIWI HANDAYANINo ratings yet

- Control and Accounting Information Systems Suggested Answers To Discussion QuestionsDocument58 pagesControl and Accounting Information Systems Suggested Answers To Discussion QuestionsTrisha Gabriel100% (2)

- Solution Manual14Document90 pagesSolution Manual14Sarah FauziaNo ratings yet

- Tugas GSLC 1Document5 pagesTugas GSLC 1JSKyung100% (1)

- AUDITDocument1 pageAUDITNur Liena AmieraNo ratings yet

- CH 2 - Internal Audit's CBOK - MindmapDocument1 pageCH 2 - Internal Audit's CBOK - MindmapWenderlin KoswaraNo ratings yet

- Data Modeling and Database Design: Accounting Information SystemsDocument23 pagesData Modeling and Database Design: Accounting Information SystemsNatasha GraciaNo ratings yet

- CASE 4.5docxDocument5 pagesCASE 4.5docxNhiNo ratings yet

- Contoh Eliminasi Lap - Keu KonsolidasiDocument44 pagesContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniNo ratings yet

- Daftar Isi Capital Market Research in AccountingDocument23 pagesDaftar Isi Capital Market Research in AccountingAgung Gde AgungNo ratings yet

- 12.1. Match The Term in The Left Column With Its Definition in The Right ColumnDocument1 page12.1. Match The Term in The Left Column With Its Definition in The Right ColumnNguyễn HồngNo ratings yet

- Aeb SM CH21 1Document26 pagesAeb SM CH21 1jg2128100% (2)

- John Sloan President of Sloan Toy Company Inc in OregonDocument1 pageJohn Sloan President of Sloan Toy Company Inc in OregonAmit PandeyNo ratings yet

- Managerial Accounting Chapter 1Document21 pagesManagerial Accounting Chapter 1Ikhlas WauNo ratings yet

- Assessing and Responding To Fraud RisksDocument7 pagesAssessing and Responding To Fraud RisksRisal EfendiNo ratings yet

- Tugas 5 (Kelompok 5)Document9 pagesTugas 5 (Kelompok 5)Silviana Ika Susanti67% (3)

- AIS Group 8 Report Chapter 17 Hand-OutDocument8 pagesAIS Group 8 Report Chapter 17 Hand-OutPoy GuintoNo ratings yet

- Assessing and Responding To Fraud Risks: Concept Checks P. 281Document30 pagesAssessing and Responding To Fraud Risks: Concept Checks P. 281Eileen HUANGNo ratings yet

- Rangkuman Audit Risk Based AprroachDocument5 pagesRangkuman Audit Risk Based AprroachNico Hadi GelianNo ratings yet

- Fraud Audit - Kelompok 10 - Consumen Fraud - FinalDocument56 pagesFraud Audit - Kelompok 10 - Consumen Fraud - Finalmeilisa nugrahaNo ratings yet

- Kunci Jawaban Bab 5 Manajemen Biaya CompressDocument10 pagesKunci Jawaban Bab 5 Manajemen Biaya Compressrilakkuma6No ratings yet

- Materi Persentasi SIA (Semester 4)Document3 pagesMateri Persentasi SIA (Semester 4)Rahmad Bari BarrudiNo ratings yet

- Mayora Indah TBK PDFDocument84 pagesMayora Indah TBK PDFsherlijulianiNo ratings yet

- Chapter 6 - Internal ControlDocument36 pagesChapter 6 - Internal Controlsiti fatimatuzzahraNo ratings yet

- Auditing - Hook Chapter 9 SolutionsDocument12 pagesAuditing - Hook Chapter 9 SolutionsZenni T XinNo ratings yet

- CASE: IS Auditng: RequiredDocument1 pageCASE: IS Auditng: Requiredevel streetNo ratings yet

- Variance Analysis Problem MCSDocument2 pagesVariance Analysis Problem MCSKunjan ChaudharyNo ratings yet

- Auditing Plant, Property, and Equipment - The Why and How Guide - CPA Hall TalkDocument8 pagesAuditing Plant, Property, and Equipment - The Why and How Guide - CPA Hall TalkFriedeagle OilNo ratings yet

- Accounting Measurement SystemDocument7 pagesAccounting Measurement SystemDionysius Ivan Hertanto100% (1)

- B1B121009 Linda Solusi Bab 8Document7 pagesB1B121009 Linda Solusi Bab 8Aslinda MutmainahNo ratings yet

- Answer Quiz 1-Ol2Document15 pagesAnswer Quiz 1-Ol2Kristina KittyNo ratings yet

- RMK Audit 18Document14 pagesRMK Audit 18Amin MuhammadNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument19 pagesAudit of The Capital Acquisition and Repayment CyclenisasuriantoNo ratings yet

- Boynton SM Ch.15Document28 pagesBoynton SM Ch.15Eza R100% (2)

- Kunci Jawaban Module 1-4Document10 pagesKunci Jawaban Module 1-4meyyNo ratings yet

- Chapter 3 Appendix ADocument16 pagesChapter 3 Appendix AOxana NeckagyNo ratings yet

- Accounting and Finance-Based Measures of RiskDocument18 pagesAccounting and Finance-Based Measures of RiskshldhyNo ratings yet

- Audit of Cash BalancesDocument17 pagesAudit of Cash BalancesHoàng VũNo ratings yet

- Chapter 22 ArensDocument12 pagesChapter 22 Arensrahmatika yaniNo ratings yet

- Audit 2 Week 6 AssignmentDocument11 pagesAudit 2 Week 6 AssignmentDewi RenitasariNo ratings yet

- Solution CH 5 Audit Evidence and DocumentationDocument28 pagesSolution CH 5 Audit Evidence and DocumentationAkramElKomeyNo ratings yet

- RMK Audit 1 TM 6Document11 pagesRMK Audit 1 TM 6lailatulNo ratings yet

- Prak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093Document2 pagesPrak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093nanaNo ratings yet

- Audit CH 19 Completing The AuditDocument19 pagesAudit CH 19 Completing The AuditAnji GoyNo ratings yet

- Audit Risk Model Application ProblemsDocument2 pagesAudit Risk Model Application ProblemsZoe MoranNo ratings yet

- Pengauditan TiluDocument3 pagesPengauditan Tiluariena alifia sNo ratings yet

- Henrico Retail, Inc.-Đã Chuyển ĐổiDocument4 pagesHenrico Retail, Inc.-Đã Chuyển ĐổiKim NguyenNo ratings yet

- Henrico Retail, Inc.Document5 pagesHenrico Retail, Inc.Nguyễn Thị DiễmNo ratings yet

- Henri Case StudyDocument2 pagesHenri Case StudyMaria100% (1)

- Point-Of-Sale (POS) SystemDocument17 pagesPoint-Of-Sale (POS) SystemBalestramon100% (2)

- Sales Order EntryDocument3 pagesSales Order EntryfaudNo ratings yet

- Chapter 4 The Revenue Cycle PDFDocument2 pagesChapter 4 The Revenue Cycle PDFKent Braña Tan100% (1)

- MetaBank Deposit Account AgreementDocument31 pagesMetaBank Deposit Account AgreementNarcara HarvilleNo ratings yet

- Statement Usman GhaniDocument13 pagesStatement Usman Ghanihammad016No ratings yet

- BUPA Handbook 04 12Document47 pagesBUPA Handbook 04 12Δώρα ΠέτταNo ratings yet

- What Is My Minimum Payment? When Do I Need To Pay?Document4 pagesWhat Is My Minimum Payment? When Do I Need To Pay?Scott CollinsNo ratings yet

- Mohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Document9 pagesMohsen Saadi Mohsen Saadi 4 Burnham Avenue Glenwood NSW 2768Cincin TiaNo ratings yet

- Buy Now, Pay Later, Jurnal Acuan 2Document7 pagesBuy Now, Pay Later, Jurnal Acuan 2FDKMDDinaPutri AnaNo ratings yet

- Electronic BankingDocument29 pagesElectronic BankingnedqNo ratings yet

- Welcome To HDFC Bank NetBankingDocument1 pageWelcome To HDFC Bank NetBankingrajeshNo ratings yet

- Disney 170Document14 pagesDisney 170andesramos29No ratings yet

- 93c3 Document 3Document14 pages93c3 Document 3NONON NICOLASNo ratings yet

- AZN35OFF - Amazon: FREE70 - PaytmDocument5 pagesAZN35OFF - Amazon: FREE70 - PaytmJagamohan JenaNo ratings yet

- Free 18 Guage Stainless Steel Sink : Free Door-To-Door Delivery in Central VermontDocument33 pagesFree 18 Guage Stainless Steel Sink : Free Door-To-Door Delivery in Central VermontCoolerAdsNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- F 1864 - Credit - Debit Card Dispute Form - V2Document2 pagesF 1864 - Credit - Debit Card Dispute Form - V2shane rungen0% (1)

- Coway-Sales-Order-Form - 2020-05-01 02-38-02 - ROFAIZAL-BIN-RAHMAT PDFDocument2 pagesCoway-Sales-Order-Form - 2020-05-01 02-38-02 - ROFAIZAL-BIN-RAHMAT PDFNoor Shahirah Ayub100% (1)

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- June 4Document17 pagesJune 4Abdul HadiNo ratings yet

- Account Opening and Servicing Part 1.odtDocument159 pagesAccount Opening and Servicing Part 1.odtpriyankaNo ratings yet

- NYC DOB Now Safety Owner User ManualDocument70 pagesNYC DOB Now Safety Owner User ManualArchitectural Preservation Studio, DPCNo ratings yet

- SRS - Transport Service Automation SystemDocument7 pagesSRS - Transport Service Automation SystemAnirbanNo ratings yet

- Credit Card HSBCDocument74 pagesCredit Card HSBClove_3080160% (5)

- MCPDF0022Document2 pagesMCPDF0022NataliiaNo ratings yet

- Account History Report2Document2 pagesAccount History Report2PrintMASS BestNo ratings yet

- Wa0015.Document9 pagesWa0015.Santosh Kumar GuptaNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherVIkashNo ratings yet

- AirtelDocument4 pagesAirtelHari Ram KumarNo ratings yet

- Full Chapter ATM QUESTIONNAIREDocument25 pagesFull Chapter ATM QUESTIONNAIREPurnima kumariNo ratings yet

- Cascade 56 Strategy ExamplesDocument43 pagesCascade 56 Strategy ExamplesAnthony RezaNo ratings yet

- Online Giro Form PDFDocument3 pagesOnline Giro Form PDFDing Zheng YangNo ratings yet