Professional Documents

Culture Documents

PART B (Annexure)

PART B (Annexure)

Uploaded by

AnbarasanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PART B (Annexure)

PART B (Annexure)

Uploaded by

AnbarasanCopyright:

Available Formats

10000837/CMTPK4864R LOKANATH KALASI

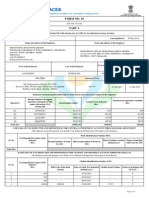

PART B (Annexure)

Details of Salary paid and any other income and tax deducted INR INR INR

1. Gross salary

(a) Salary as per provisions contained in sec.17(1)

376568.28

(b) Value of perquisites u/s 17(2) ( as per Form No.12BA,

wherever applicable ) 0.00

(c) Profits in lieu of salary under section 17(3) ( as per

Form No.12BA, wherever applicable ) 0.00

(d) Total 376568.28

2. Less: Allowance to the extent exempt u/s 10 0.00

Allowance

3. Balance (1-2) 376568.00

4. Deductions:

(a) Entertainment allowance 0.00

(b) Tax on Employment 1250.00

5. Aggregate of 4(a) and (b) 41250.00

6. Income chargeable under the head 'salaries' (3-5) 335318.00

7. Add: Any other income reported by the employee 0.00

Income

8. Gross total income (6+7) 335318.00

9. Deductions under Chapter VI-A Gross Amount Deductible Amount

A) sections 80C, 80CCC and 80CCD

a) section 80C

i) Employee Provident Fund 27573.00 27573.00

(b) section 80CCC 0.00 0.00

(c) section 80CCD 0.00 0.00

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed one lakh and fifty thousand rupees.

B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under chapter VI-A Gross amount Qualifying amount Deductible amount

10. Aggregate of deductible amount under Chapter VI-A 27573.00

11. Total Income (8-10) 307750.00

12. Tax on total income 387.50

13. Education Cess @ 3% (on tax computed at S.No. 12) 0.00

14. Tax payable (12+13) 403.00

15. Less: Relief under section 89 (attach details) 0.00

16. Tax Payable (14-15) 403.00

10000837/CMTPK4864R LOKANATH KALASI

Verification

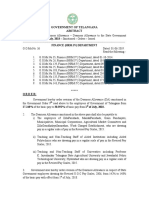

I, GOUTAM DASH, son/daughter of HARA PRASAD DASH working in the capacity of SR. GENERAL MANAGER (designation) do hereby certify

that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, and other available

records.

Place KEONJHAR-DIST

Date 20.06.2019

(Signature of person responsible for deduction of tax)

Designation: SR. GENERAL MANAGER Full Name: GOUTAM DASH

10000837/CMTPK4864R LOKANATH KALASI

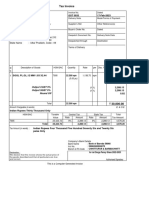

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

Thriveni EarthMovers Pvt Ltd, 22/110 Greenways Road, FairlandsSalem-636016, Tamil Nadu

2) TAN: BBNT00811G

3) TDS Assessment Range of the employer :

Thriveni EarthMovers Pvt Ltd, Plot No-C/280, Azad Basti, Odisha, Laxmi Padia, Joda, Keonjhar, 758034, Odisha

4) Name, designation and PAN of employee :

Mr/Ms: LOKANATH KALASI, Desig.:Tyre Fitter K3, Emp #:10000837, PAN:CMTPK4864R

5) Is the employee a director or a person with substantial interest in

the company (where the employer is a company) :

6) Income under the head "Salaries" of the employee : 375318.28

(other than from perquisites)

7) Financial year : 2018-2019

8) Valuation of Perquisites

S.No Nature of perquisites Value of perquisite Amount, if any, recovered Amount of perquisite

(see rule 3) as per rules(INR) from the employee(INR) chargeable to tax(INR)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

Sweeper , gardener , watchman or

3 0.00 0.00 0.00

personal attendant

4 Gas , electricity , water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional Travel 0.00 0.00 0.00

8 Free meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts,vouchers etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit

0.00 0.00 0.00

/amenity/service/privilege

16 Stock options ( non-qualified options ) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of Profits in lieu of salary

0.00 0.00 0.00

as per section 17 (3)

9. Details of tax, -

(a) Tax deducted from salary of the employee under section 192(1) 403.00

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0.00

(c) Total tax paid 403.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, GOUTAM DASH Son/daughter of HARA PRASAD DASH working as SR. GENERAL MANAGER (designation ) do hereby declare on behalf

of Thriveni EarthMovers Pvt Ltd ( name of the employer ) that the information given above is based on the books of account , documents and

other relevant records or information available with us and the details of value of each such perquisite are in accordance with section 17 and

rules framed thereunder and that such information is true and correct.

Signature of person responsible

Place : KEONJHAR-DIST Full Name:GOUTAM DASH for deduction of tax

Date : 20.06.2019 Designation:SR. GENERAL MANAGER

10000837/CMTPK4864R LOKANATH KALASI

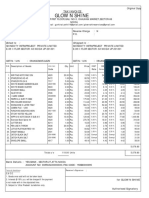

Annexure to Form No.16

Name: LOKANATH KALASI Emp No.: 10000837

Particulars Amount(INR)

Emoluments paid

Basic Salary 107266.65

Conveyance Allowance 17032.26

House Rent Allowance 36881.45

Medical Allowance 2129.03

Bonus 32926.00

Other Allowances 180332.89

Perquisites

Gross emoluments 376568.28

Income from other sources

Income

Total income from other sources 0.00

Exemptions u/s 10

Allowance

Total Exemption 0.00

Date: 20.06.2019 Full Name: GOUTAM DASH

Place:KEONJHAR-DIST Designation: SR. GENERAL MANAGER

You might also like

- CUMMINS 6BT5.9 Manuals: CUMMINS 6BT5.9 Shop Manual (462 Pages) (/manual/1201997/Cummins-5-9.html#product-6BT5.9)Document4 pagesCUMMINS 6BT5.9 Manuals: CUMMINS 6BT5.9 Shop Manual (462 Pages) (/manual/1201997/Cummins-5-9.html#product-6BT5.9)Anbarasan63% (8)

- A Human Resource ManagementDocument85 pagesA Human Resource ManagementAngelie Lopez91% (11)

- Volvo L220G Wheel Loaders Service Manual - A++ Repair Manual StoreDocument22 pagesVolvo L220G Wheel Loaders Service Manual - A++ Repair Manual StoreAnbarasan100% (1)

- Workshop, Repair and Service Manuals, Wiring Diagrams, Fault Codes PDF - More Than 1000+ Truck Manuals Are Available For Free Download!Document12 pagesWorkshop, Repair and Service Manuals, Wiring Diagrams, Fault Codes PDF - More Than 1000+ Truck Manuals Are Available For Free Download!Anbarasan0% (1)

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- MR Harpreet Singh Punjab India 9592923392Document1 pageMR Harpreet Singh Punjab India 9592923392Neno MiqavaNo ratings yet

- Trips Flight DownloadETicketDocument2 pagesTrips Flight DownloadETicketSohaib DurraniNo ratings yet

- 40 Income From Salary PDFDocument12 pages40 Income From Salary PDFkiranshingoteNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediDocument5 pagesCertificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar DwivediprabhatNo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- InvoiceDocument1 pageInvoiceMohan KumarNo ratings yet

- Microsoft Word - 2019FIN - MS36Document6 pagesMicrosoft Word - 2019FIN - MS36nagalaxmi manchalaNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Arul PDFDocument1 pageArul PDFraman73No ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- Flight ResearchDocument3 pagesFlight ResearchSamridh MehtaNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Tax Invoice/Bill of Supply: Shreyash Retail Private LimitedDocument1 pageTax Invoice/Bill of Supply: Shreyash Retail Private LimitedRealme 2 proNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Od 116705815912325000Document1 pageOd 116705815912325000SunnyNo ratings yet

- Proforma Invoice: No. Particular Check in Check Out Nts Base Amount CGST at 9% SGST at 9% TotalDocument1 pageProforma Invoice: No. Particular Check in Check Out Nts Base Amount CGST at 9% SGST at 9% TotalAnkitNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Annexure ADocument1 pageAnnexure Apanduram tiyuNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- EfewaraweDocument1 pageEfewarawesunil kumarNo ratings yet

- Shipping & Billing Address: Giraj: Date: 29/03/2023Document2 pagesShipping & Billing Address: Giraj: Date: 29/03/2023Giraj Prasad goyalNo ratings yet

- Invoice of Realme U1Document1 pageInvoice of Realme U1Shruti SharmaNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Fee ReceiptDocument1 pageFee ReceiptMansi PatelNo ratings yet

- Slaley Offer LetterDocument1 pageSlaley Offer Letterudaya moorthyNo ratings yet

- Earnings Deductions: Empl ID Month SEP YearDocument1 pageEarnings Deductions: Empl ID Month SEP Yearharshwardhan prajapatiNo ratings yet

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDocument3 pagesTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNo ratings yet

- FormDocument1 pageFormSB Branch GandhinagarNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- COMPANY REGISTRATION - CompressedDocument2 pagesCOMPANY REGISTRATION - CompressedPunjab SinghNo ratings yet

- Flight TicketDocument3 pagesFlight Ticketdamilolasamuel.111No ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- Stationary Invoice-5080 PaidDocument2 pagesStationary Invoice-5080 PaidAnkur Agarwal100% (1)

- Received With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromRavi Kiran HrNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Appointment LetterDocument3 pagesAppointment Letterpoonam shuklaNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Grader 3Document5 pagesGrader 3AnbarasanNo ratings yet

- Grader 4Document10 pagesGrader 4AnbarasanNo ratings yet

- Grader 2Document2 pagesGrader 2AnbarasanNo ratings yet

- Grader 1Document6 pagesGrader 1AnbarasanNo ratings yet

- Wheel Loaders Specs and ChartsDocument3 pagesWheel Loaders Specs and ChartsAnbarasanNo ratings yet

- KleemannDocument1 pageKleemannAnbarasanNo ratings yet

- Thermostats: What Is A Thermostat?Document7 pagesThermostats: What Is A Thermostat?AnbarasanNo ratings yet

- Fhewoighwr 2Document6 pagesFhewoighwr 2AnbarasanNo ratings yet

- Tata LPT 1613 SpecificationsDocument4 pagesTata LPT 1613 SpecificationsAnbarasanNo ratings yet

- Specifications: TATA SK 1613Document3 pagesSpecifications: TATA SK 1613AnbarasanNo ratings yet

- DGMS7Document3 pagesDGMS7AnbarasanNo ratings yet

- Part No Details of FMPLDocument117 pagesPart No Details of FMPLAnbarasanNo ratings yet

- Volvo L220G Wheel Loader Service Repair Manual - Service Manual DownloadDocument3 pagesVolvo L220G Wheel Loader Service Repair Manual - Service Manual DownloadAnbarasan25% (4)

- DGMS5Document2 pagesDGMS5AnbarasanNo ratings yet

- Failure Analysis and Learning ReportDocument4 pagesFailure Analysis and Learning ReportAnbarasanNo ratings yet

- Owner's Manual Owner's Manual: All AllDocument6 pagesOwner's Manual Owner's Manual: All AllAnbarasanNo ratings yet

- AL3Document5 pagesAL3AnbarasanNo ratings yet

- DGMS1Document11 pagesDGMS1AnbarasanNo ratings yet

- Lem1 4Document2 pagesLem1 4AnbarasanNo ratings yet

- D1105 BG2 1500RPMDocument2 pagesD1105 BG2 1500RPMAnbarasanNo ratings yet

- SyllabusDocument4 pagesSyllabusAnbarasanNo ratings yet

- OBD2 Scanner, Car Code Reader, TOPDON AL400 Check Engine Light Scan Tool, Car Scanner With O2 Sensor/Freeze Frame/I/M Readiness/Smog Check/DTC Lookup, CAN Diagnostic Scanner For All OBDII CarsDocument3 pagesOBD2 Scanner, Car Code Reader, TOPDON AL400 Check Engine Light Scan Tool, Car Scanner With O2 Sensor/Freeze Frame/I/M Readiness/Smog Check/DTC Lookup, CAN Diagnostic Scanner For All OBDII CarsAnbarasanNo ratings yet

- Truck Manuals PDFDocument4 pagesTruck Manuals PDFAnbarasanNo ratings yet

- 6BTA 5.9 G2-1 Cummins Engine Performance and Emission Tests Using Methyl Ester Mahua (Madhuca Indica) Oil - Diesel Blends - ScienceDirectDocument3 pages6BTA 5.9 G2-1 Cummins Engine Performance and Emission Tests Using Methyl Ester Mahua (Madhuca Indica) Oil - Diesel Blends - ScienceDirectAnbarasanNo ratings yet

- Tata Truck Service Manual PDF - : PinterestDocument2 pagesTata Truck Service Manual PDF - : PinterestAnbarasan100% (1)

- Shanghai Client Diesel Engine Co., LTD.: CategoriesDocument11 pagesShanghai Client Diesel Engine Co., LTD.: CategoriesAnbarasanNo ratings yet

- Blank General Employment Application Form 1Document2 pagesBlank General Employment Application Form 1api-4534342750% (1)

- New Employee Orientation Program Checklist 1Document3 pagesNew Employee Orientation Program Checklist 1Ai LeenNo ratings yet

- International Human Resource ManagementDocument20 pagesInternational Human Resource ManagementAziz UllahNo ratings yet

- Expates GuideDocument36 pagesExpates GuideDaniela Luncan CalinescuNo ratings yet

- Withholding Tax On Compensation in The PhilippinesDocument3 pagesWithholding Tax On Compensation in The Philippinesrobin pilarNo ratings yet

- PPM - SyllabusDocument13 pagesPPM - SyllabusJoseph Kanyi King'ori - HonNo ratings yet

- BDI3C Business Case StudiesDocument3 pagesBDI3C Business Case StudiesMurugesh Chandran100% (1)

- Advert For HR Admin ManagerDocument2 pagesAdvert For HR Admin ManagerPHRINo ratings yet

- Some of The Importance and Role of Supervision in An Organization Are As FollowsDocument6 pagesSome of The Importance and Role of Supervision in An Organization Are As FollowsSumit SharmaNo ratings yet

- Angelina Francisco, G.R. No. 170087: Ynares-Santiago, J.Document4 pagesAngelina Francisco, G.R. No. 170087: Ynares-Santiago, J.Mark Joseph TimpleNo ratings yet

- Colgate HR Case StudyDocument2 pagesColgate HR Case StudySubhro MukherjeeNo ratings yet

- Human Resource Management 3 Semester Ishita Kheria 01916503519 BBA LLB 2019-24Document1 pageHuman Resource Management 3 Semester Ishita Kheria 01916503519 BBA LLB 2019-24Ishita KheriaNo ratings yet

- NST080315CDocument1 pageNST080315CDevavignes LoganathanNo ratings yet

- Kra Kpa Kai SheetDocument4 pagesKra Kpa Kai SheetVikram Khatri100% (1)

- EPlanet HCM FeaturesDocument4 pagesEPlanet HCM FeaturesirfanNo ratings yet

- Final ProjectDocument79 pagesFinal ProjectpppunamNo ratings yet

- Saudi Arabia Labour LawDocument2 pagesSaudi Arabia Labour Lawa_mohid17No ratings yet

- Report of The National Commission On LabourDocument169 pagesReport of The National Commission On LabourshailendrachimadeNo ratings yet

- Director Manager Payroll CPP in Seattle WA Resume Michael HoernerDocument1 pageDirector Manager Payroll CPP in Seattle WA Resume Michael HoernerMichaelHoerner2No ratings yet

- Case StudyDocument3 pagesCase Studybillyyy2401No ratings yet

- Official Business FormDocument1 pageOfficial Business FormDiane Pearl PerezNo ratings yet

- PSM Safety2Document4 pagesPSM Safety2Shaira TangpuzNo ratings yet

- Case 1 PattersonDocument2 pagesCase 1 PattersonRuthy BalotNo ratings yet

- SMC vs. Laguesma (1997)Document2 pagesSMC vs. Laguesma (1997)Kimberly SendinNo ratings yet

- Ce B High Potential Talent ReportDocument23 pagesCe B High Potential Talent ReportYantoNo ratings yet

- Leadership Theories: Andrea RegerDocument20 pagesLeadership Theories: Andrea RegerAlangAki HanafiahNo ratings yet

- Compensation and Benefits Package of BTDDocument29 pagesCompensation and Benefits Package of BTDhaven_boy0078786No ratings yet

- Karnataka Minimum Wages English and Kannada PDFDocument13 pagesKarnataka Minimum Wages English and Kannada PDFkhalilNo ratings yet