Professional Documents

Culture Documents

Annual Income Statemen1 Mcdonalds KFC

Annual Income Statemen1 Mcdonalds KFC

Uploaded by

Anwar Ul HaqOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Income Statemen1 Mcdonalds KFC

Annual Income Statemen1 Mcdonalds KFC

Uploaded by

Anwar Ul HaqCopyright:

Available Formats

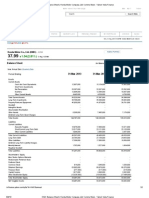

Annual Income Statement (values in 000's)Get Quarterly Data

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Total Revenue $21,025,200 $22,820,400 $24,621,900 $25,413,000

Cost of Revenue $10,239,200 $12,199,600 $14,417,200 $15,623,800

Gross Profit $10,786,000 $10,620,800 $10,204,700 $9,789,200

Operating Expenses

Research and Development $0 $0 $0 $0

Sales, General and Admin. $1,963,400 $1,068,100 $2,460,200 $2,643,700

Non-Recurring Items $0 $0 $0 $0

Other Operating Items $0 $0 $0 $0

Operating Income $8,822,600 $9,552,700 $7,744,500 $7,145,500

Add'l income/expense items ($25,300) ($57,900) $6,300 $48,500

Earnings Before Interest and Tax $7,816,100 $8,573,500 $6,866,000 $6,555,700

Interest Expense $0 $0 $0 $0

Earnings Before Tax $7,816,100 $8,573,500 $6,866,000 $6,555,700

Income Tax $1,891,800 $3,381,200 $2,179,500 $2,026,400

Minority Interest $0 $0 $0 $0

Equity Earnings/Loss Unconsolidated $0 $0 $0 $0

Subsidiary

Net Income-Cont. Operations $5,924,300 $5,192,300 $4,686,500 $4,529,300

Net Income $5,924,300 $5,192,300 $4,686,500 $4,529,300

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Net Income Applicable to Common $5,924,300 $5,192,300 $4,686,500 $4,529

Shareholders

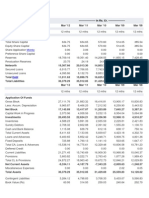

Annual Income Statement (balance Sheet

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Current Assets

Cash and Cash $866,000 $2,463,800 $1,223,400 $7,685,500

Equivalents

Short-Term $0 $0 $0 $0

Investments

Net Receivables $2,441,500 $1,976,200 $1,474,100 $1,298,700

Inventory $51,100 $58,800 $58,900 $100,100

Other Current Assets $694,600 $828,400 $2,092,200 $558,700

Total Current Assets $4,053,200 $5,327,200 $4,848,600 $9,643,000

Long-Term Assets

Long-Term $1,202,800 $1,085,700 $725,900 $792,700

Investments

Fixed Assets $22,842,700 $22,448,300 $21,257,600 $23,117,600

Goodwill $2,331,500 $2,379,700 $2,336,500 $2,516,300

Intangible Assets $0 $0 $0 $0

Other Assets $2,381,000 $2,562,800 $1,855,300 $1,869,100

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Deferred Asset $0 $0 $0 $0

Charges

Total Assets $32,811,200 $33,803,700 $31,023,900 $37,938,700

Current Liabilities

Accounts Payable $2,973,500 $2,890,600 $2,696,300 $2,950,400

Short-Term Debt / $0 $0 $77,200 $0

Current Portion of

Long-Term Debt

Other Current $0 $0 $694,800 $0

Liabilities

Total Current $2,973,500 $2,890,600 $3,468,300 $2,950,400

Liabilities

Long-Term Debt $31,075,300 $29,536,400 $25,878,500 $24,122,100

Other Liabilities $3,177,500 $3,525,300 $2,064,300 $2,074,000

Deferred Liability $1,843,300 $1,119,400 $1,817,100 $1,704,300

Charges

Misc. Stocks $0 $0 $0 $0

Minority Interest $0 $0 $0 $0

Total Liabilities $39,069,600 $37,071,700 $33,228,200 $30,850,800

Stock Holders Equity

Common Stocks $16,600 $16,600 $16,600 $16,600

Capital Surplus $7,376,000 $7,072,400 $6,757,900 $6,533,400

Retained Earnings $50,487,000 $48,325,800 $46,222,700 $44,594,500

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Treasury Stock ($61,528,500) ($56,504,400) ($52,108,600) ($41,176,800)

Other Equity ($2,609,500) ($2,178,400) ($3,092,900) ($2,879,800)

Total Equity ($6,258,400) ($3,268,000) ($2,204,300) $7,087,900

Total Liabilities & $32,811,200 $33,803,700 $31,023,900 $37,938,700

Equity

Annual Income Statement (Cash flows

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Net Income $5,924,300 $5,192,300 $4,686,500 $4,529,300

Cash Flows-Operating Activities

Depreciation $1,482,000 $1,363,400 $1,516,500 $1,555,700

Net Income Adjustments $33,100 ($24,000) ($310,400) $286,200

Changes in Operating Activities

Accounts Receivable ($479,400) ($340,700) ($159,000) ($180,600)

Changes in Inventories ($1,900) ($37,300) $28,100 $44,900

Other Operating Activities $0 $0 $0 $0

Liabilities $8,600 ($602,500) $297,900 $303,600

Net Cash Flow-Operating $6,966,700 $5,551,200 $6,059,600 $6,539,100

Cash Flows-Investing Activities

Capital Expenditures ($2,741,700) ($1,853,700) ($1,821,100) ($1,813,900)

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Investments $0 $0 $0 $0

Other Investing Activities $286,600 $2,415,700 $839,500 $393,900

Net Cash Flows-Investing ($2,455,100) $562,000 ($981,600) ($1,420,000)

Cash Flows-Financing Activities

Sale and Purchase of Stock ($4,804,500) ($4,228,900) ($10,871,600) ($5,782,000)

Net Borrowings $2,130,800 $2,027,800 $2,670,400 $9,755,200

Other Financing Activities ($20,000) ($20,500) ($3,000) ($58,700)

Net Cash Flows-Financing ($5,949,600) ($5,310,800) ($11,262,400) $735,300

Effect of Exchange Rate ($159,800) $264,000 ($103,700) ($246,800)

Net Cash Flow ($1,597,800) $1,066,400 ($6,288,100) $5,607,600

Annual Income Statement (Financial ratios

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Liquidity Ratios

Current Ratio 136% 184% 140% 327%

Quick Ratio 135% 182% 138% 323%

Cash Ratio 29% 85% 35% 260%

Profitability Ratios

Gross Margin 51% 47% 41% 39%

Period Ending: Trend 12/31/2018 12/31/2017 12/31/2016 12/31/2015

Operating Margin 42% 42% 31% 28%

Pre-Tax Margin 37% 38% 28% 26%

Profit Margin 28% 23% 19% 18%

Pre-Tax ROE 125% 262% 311% 92%

After Tax ROE 95% 159% 213% 64%

Revenue / EPS Summary *

2019 2018 2017

Fiscal Quarter (Fiscal Year) (Fiscal Year) (Fiscal Year)

March

Revenue $4,955(m) $5,138(m) $5,675(m)

EPS 1.72 (3/31/2019) 1.72 (3/31/2018) 1.47 (3/31/2017)

Dividends 1.16 1.01 0.94

June

Revenue $5,341(m) $5,353(m) $6,049(m)

EPS 1.97 (6/30/2019) 1.9 (6/30/2018) 1.7 (6/30/2017)

Dividends 1.16 1.01 0.94

September

Revenue $5,369(m) $5,754(m)

EPS 2.1 (9/30/2018) 2.31 (9/30/2017)

Dividends 1.01 0.94

December (FYE)

Revenue $5,163(m) $5,340(m)

EPS 1.82 (12/31/2018) 0.89 (12/31/2017)

Dividends 1.16 1.01

Totals

Revenue $10,296(m) $21,025(m) $22,820(m)

EPS 3.69 7.54 6.37

Dividends 2.32 4.19 3.83

You might also like

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Case Studies Time Value of MoneyDocument3 pagesCase Studies Time Value of MoneySyed Sohail Shah43% (7)

- Estimated 2022-23 and Projected 2023-24 Balance SheetDocument2 pagesEstimated 2022-23 and Projected 2023-24 Balance SheetRB SalesNo ratings yet

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Coca-Cola Common Size Financials - Balance SheetDocument1 pageCoca-Cola Common Size Financials - Balance Sheetapi-584364787No ratings yet

- FM - Assignment Batch 19 - 21 IMS IndoreDocument3 pagesFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- CTM Tutorial 2Document4 pagesCTM Tutorial 2crsNo ratings yet

- Vertical and Horizontal Analysis of OGDCLDocument7 pagesVertical and Horizontal Analysis of OGDCLMuhammad Tayyab JavaidNo ratings yet

- $ / % How To Calculate It Calculation: T Otal Liabilities Interest ExpensesDocument2 pages$ / % How To Calculate It Calculation: T Otal Liabilities Interest ExpensesLuisa Raigozo100% (1)

- Gerson B. GringcoDocument20 pagesGerson B. GringcoKim Sollano50% (2)

- FABM 2 Module 5 FS AnalysisDocument9 pagesFABM 2 Module 5 FS AnalysisJOHN PAUL LAGAO100% (4)

- Suryaa Hotel Bal SheetDocument3 pagesSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Coca Cola (KO) Balance Sheet PDFDocument2 pagesCoca Cola (KO) Balance Sheet PDFKhmao Sros67% (3)

- HMC Balance Sheet - Honda Motor Company, LTD PDFDocument2 pagesHMC Balance Sheet - Honda Motor Company, LTD PDFPoorvi JainNo ratings yet

- CoirDocument27 pagesCoirraj0906No ratings yet

- DHL Express India PVT LTD Industry:CouriersDocument3 pagesDHL Express India PVT LTD Industry:CouriersNitish BawejaNo ratings yet

- Profit and Loss Account: Prajapati Enterprises LTDDocument1 pageProfit and Loss Account: Prajapati Enterprises LTDMukesh PrajapatiNo ratings yet

- Master Fuel 1957Document2 pagesMaster Fuel 1957namrvora072504No ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (2)

- Enterprise Valuation BXPharma Group 5Document57 pagesEnterprise Valuation BXPharma Group 5Arif.hossen 30No ratings yet

- RMCF 10-Q 20110831Document22 pagesRMCF 10-Q 20110831mtn3077No ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Bab 11 Prospective AnalysisDocument57 pagesBab 11 Prospective AnalysisNovilia FriskaNo ratings yet

- Accounting Entries Under GSTDocument6 pagesAccounting Entries Under GSTmadhu100% (1)

- Britannia: Particular Amount %Document3 pagesBritannia: Particular Amount %Art beateNo ratings yet

- Vertical Analysis of Financial Statements - Pepsi V CokeDocument2 pagesVertical Analysis of Financial Statements - Pepsi V CokeCarneades33% (3)

- Consolidated Balance SheetDocument1 pageConsolidated Balance SheetSukhmanNo ratings yet

- Apollo Tyres FSADocument12 pagesApollo Tyres FSAChirag GugnaniNo ratings yet

- Airasia Financial StatementDocument35 pagesAirasia Financial StatementDyna AzmirNo ratings yet

- Balance Sheet of Tata MotorsDocument25 pagesBalance Sheet of Tata MotorsDevendra Dilip BaikarNo ratings yet

- Maruti Suzuki Financial Statment NewDocument4 pagesMaruti Suzuki Financial Statment NewMasoud Afzali100% (1)

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Oldtown QRDocument26 pagesOldtown QRfieya91No ratings yet

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joeNo ratings yet

- Ola Electric Mobility Limited Financials June-23Document61 pagesOla Electric Mobility Limited Financials June-23Abhijeet KumawatNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Financial Analysis On Marico Bangladesh Ltd.Document24 pagesFinancial Analysis On Marico Bangladesh Ltd.7BaratNo ratings yet

- FA-6 Banking Company Final Accounts RevisedDocument20 pagesFA-6 Banking Company Final Accounts RevisedPaulomi LahaNo ratings yet

- Balance Sheet of Bajaj FinanceDocument8 pagesBalance Sheet of Bajaj FinanceAJ SuriNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Aditya 20birla 20-Final 20ppt 1Document25 pagesAditya 20birla 20-Final 20ppt 1Girish ShettyNo ratings yet

- Meerut Adventure Company CV1Document9 pagesMeerut Adventure Company CV1Ayushi GuptaNo ratings yet

- Chapter Internal ReconstructionDocument4 pagesChapter Internal ReconstructionAnonymous mTZsMOjNo ratings yet

- Financial Accounting Ii-2Document5 pagesFinancial Accounting Ii-2gautham rajeevanNo ratings yet

- Income Statement & Balance SheetDocument23 pagesIncome Statement & Balance SheetSAURABH PATELNo ratings yet

- CMA Assignment-1 - Group5Document9 pagesCMA Assignment-1 - Group5Swostik RoutNo ratings yet

- Farm Record & Balance SheetDocument29 pagesFarm Record & Balance SheetHaikal SapurataNo ratings yet

- Balance SheetDocument11 pagesBalance SheetPrachi VermaNo ratings yet

- ShajgojDocument13 pagesShajgojAdrita RoyNo ratings yet

- CashflowDocument3 pagesCashflowadebo_yemiNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Solutions Consolidation-FormattedDocument22 pagesSolutions Consolidation-FormattedShehrozSTNo ratings yet

- Problem 1 2 3Document4 pagesProblem 1 2 3Ma Theresa MaguadNo ratings yet

- Maynard Case 3 1 PDFDocument2 pagesMaynard Case 3 1 PDFTating Bootan Kaayo YangNo ratings yet

- FM - 1 - Accounts of Professional PersonsDocument15 pagesFM - 1 - Accounts of Professional Personsyagnesh trivedi100% (1)

- Market Analysis - Tiffin & Catering Service, Mumbai RegionDocument10 pagesMarket Analysis - Tiffin & Catering Service, Mumbai RegionSupriya PrasadNo ratings yet

- Hul PDFDocument54 pagesHul PDFPinjas Vaghasiya67% (3)

- Financial Analysis: Horizontal Analysis: (As Per Excel)Document7 pagesFinancial Analysis: Horizontal Analysis: (As Per Excel)mehar noorNo ratings yet

- Balance Sheet With ExplanationDocument2 pagesBalance Sheet With ExplanationTrinadh KNo ratings yet

- Farmers ClubDocument25 pagesFarmers Clubbhumika16490No ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Assignment Lump Sum LiquidationDocument2 pagesAssignment Lump Sum Liquidationpatricia marie olmedoNo ratings yet

- Real Estate Investment and Finance Strategies Structures Key Decisions David Hartzell All ChapterDocument67 pagesReal Estate Investment and Finance Strategies Structures Key Decisions David Hartzell All Chapterdonna.chavis420100% (15)

- Economic Analysis of Tesla PDFDocument4 pagesEconomic Analysis of Tesla PDFabbas iqbalNo ratings yet

- FINA 6092 Case QuestionsDocument7 pagesFINA 6092 Case QuestionsKenny HoNo ratings yet

- Security Analysis and Portfolio Management QBDocument13 pagesSecurity Analysis and Portfolio Management QBAnonymous y3E7iaNo ratings yet

- Project Report OF BUSINESS FINANCE (BBA-5B)Document35 pagesProject Report OF BUSINESS FINANCE (BBA-5B)Haider AliNo ratings yet

- Bujji Paper Plates & CupsDocument15 pagesBujji Paper Plates & CupsarunNo ratings yet

- UntitledDocument2 pagesUntitledAli Mubin FitranandaNo ratings yet

- Syeda Samia Ali - Case Study - National Mayonnaise - CBDocument6 pagesSyeda Samia Ali - Case Study - National Mayonnaise - CBSyédà Sámiá AlìNo ratings yet

- Deutsche Bank - Global Banking Trends After The GFCDocument24 pagesDeutsche Bank - Global Banking Trends After The GFClelaissezfaire100% (2)

- Beml Project Print OUTDocument144 pagesBeml Project Print OUTanon_196360629100% (1)

- Ps Bonds SolutionsDocument20 pagesPs Bonds SolutionsnazNo ratings yet

- WalmartDocument2 pagesWalmartKaranam reechaNo ratings yet

- CollateralDocument3 pagesCollateralVeronicaNo ratings yet

- An Exercise On Ratio AnalysisDocument2 pagesAn Exercise On Ratio AnalysisjiteshjacobNo ratings yet

- 20BLU21 - Customer Relationship Management PDFDocument139 pages20BLU21 - Customer Relationship Management PDFThangamani.R ManiNo ratings yet

- List of Accounting Standards (As 1 - 32) of ICAI (Download PDF Copy) - CA ClubDocument7 pagesList of Accounting Standards (As 1 - 32) of ICAI (Download PDF Copy) - CA ClubMahipal GadhaviNo ratings yet

- FRM Part I - Full Length Test 3Document37 pagesFRM Part I - Full Length Test 3pradeep johnNo ratings yet

- ACI DealingDocument210 pagesACI DealingDarshana Shasthri Nakandala0% (1)

- CV Template 0017Document1 pageCV Template 0017sandeepsaini17071988No ratings yet

- Non-Ergodicity and Its Implications For Businesses and Investors PDFDocument72 pagesNon-Ergodicity and Its Implications For Businesses and Investors PDFAtul Divya SodhiNo ratings yet

- Financial Accounting 10th Edition Harrison Test Bank 1Document73 pagesFinancial Accounting 10th Edition Harrison Test Bank 1harry100% (47)

- Excel Assignment 3Document5 pagesExcel Assignment 3Viet Tuan TranNo ratings yet

- Investment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValueDocument5 pagesInvestment Is Defined As The Employment of Funds, With The Aim of Achieving Additional Income or Some Growth in Its ValuePera AnandNo ratings yet

- Applied Economics: Written Test #1 M1-4Document21 pagesApplied Economics: Written Test #1 M1-4MariaAngelaAdanEvangelistaNo ratings yet

- A Study On Personal Loan of IDFC Bank DraftDocument78 pagesA Study On Personal Loan of IDFC Bank Draftsm9823622No ratings yet

- Financial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Document4 pagesFinancial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Diamante GomezNo ratings yet