Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

2K viewsKelompok 3 - Tugas 3 - Bab 'Persediaan'

Kelompok 3 - Tugas 3 - Bab 'Persediaan'

Uploaded by

Elsi NonnyThe document contains the details of two accounting problems from an intermediate accounting textbook.

The first problem asks to calculate cost of goods sold using different inventory costing methods - periodic FIFO, perpetual FIFO, periodic weighted average, and perpetual moving average.

The second problem provides financial information for a company that had a fire and asks to calculate the fire loss on inventory using the gross profit method. The response shows the calculations in a formal labeled schedule.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Sunrise Medical Inc. CaseDocument7 pagesSunrise Medical Inc. Casejuanpaulo33350% (2)

- Hilton Marketing Plan (Final)Document17 pagesHilton Marketing Plan (Final)Tahseef RezaNo ratings yet

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- Tugas Intangible AssetDocument31 pagesTugas Intangible AssetMonica0% (1)

- Case 4 Artistic JawabanDocument3 pagesCase 4 Artistic Jawabanargo satria100% (2)

- Food and Beverage ManualDocument147 pagesFood and Beverage ManualMichael LimNo ratings yet

- OWWA BP - CarenderiaDocument5 pagesOWWA BP - Carenderiabojik2100% (1)

- E21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnDocument3 pagesE21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnWarmthx0% (1)

- E21 16Document2 pagesE21 16Warmthx0% (1)

- Week1 SolutionsDocument14 pagesWeek1 SolutionsM Mustafa100% (1)

- Exercise CH 16-1 ch16-2 ch16-3Document8 pagesExercise CH 16-1 ch16-2 ch16-3Chelsea WulanNo ratings yet

- TR 2 IndahDocument3 pagesTR 2 IndahIndahyuliaputriNo ratings yet

- Lafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Document12 pagesLafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Lafidan Rizata Febiola100% (4)

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Document3 pagesMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiNo ratings yet

- Kisi2 UAS AKM TerjawabDocument8 pagesKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaNo ratings yet

- E7 24Document3 pagesE7 24Muhammad Syafiq Ramadhan100% (1)

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- CASE01 AlibabaDocument8 pagesCASE01 AlibabaJb99No ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- Presentasi Ak. Keu. KLMPK 3Document14 pagesPresentasi Ak. Keu. KLMPK 3Menaz Sadaka100% (1)

- p5 6Document10 pagesp5 6/// MASTER DOGENo ratings yet

- Tugas Kas PiutangDocument14 pagesTugas Kas PiutangDeby Nailatun FitriyahNo ratings yet

- Tugas 6 AKM1 Muhammad Alfarizi 142200278 EA-IDocument9 pagesTugas 6 AKM1 Muhammad Alfarizi 142200278 EA-Imuhammad alfariziNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- A311Chapter 10 ProblemsDocument43 pagesA311Chapter 10 ProblemsVibria Rezki Ananda50% (2)

- Ch9 ExercisesDocument15 pagesCh9 ExercisesMarshanda Berlianti100% (1)

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Document6 pagesTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanNo ratings yet

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- E14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsDocument3 pagesE14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsAsuna SanNo ratings yet

- Tugas PiutangDocument6 pagesTugas Piutangmelvina siregarNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Chapter 21 Solution Manual Kieso IFRS byDocument91 pagesChapter 21 Solution Manual Kieso IFRS byAquarius PlanetNo ratings yet

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Tugas Persediaan 2Document6 pagesTugas Persediaan 2Bertha Liona0% (2)

- Kieso IA 16e SET Ch08Document22 pagesKieso IA 16e SET Ch08Christy0926No ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- Presented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019Document2 pagesPresented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019SalsabiilaNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- 5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12Document14 pages5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12SEPTINA GUMELAR R100% (1)

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Practice For Chapter 7 and 8 Standard CostingDocument12 pagesPractice For Chapter 7 and 8 Standard CostingNCT33% (3)

- PUTU ARI KAMMANI (Individual Assignment)Document4 pagesPUTU ARI KAMMANI (Individual Assignment)Wakil Ketua IIPutu Ari KammaniNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Jawaban Tugas Inventory 2Document8 pagesJawaban Tugas Inventory 2wijayaNo ratings yet

- Chapter 13 Akun Keuangan TugasDocument2 pagesChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Aset TetapDocument9 pagesAset TetapMAYONA MEGAHTANo ratings yet

- PA2 - X - IESP - HW11 - G4 - Yustina Putri DewiDocument7 pagesPA2 - X - IESP - HW11 - G4 - Yustina Putri Dewimellany echa putriNo ratings yet

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Tugas CH 8 Dan 9Document13 pagesTugas CH 8 Dan 9muhammad alfariziNo ratings yet

- CH 07 SMDocument33 pagesCH 07 SMNafisah Mambuay83% (6)

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Latihan AKM 1 TM 4Document5 pagesLatihan AKM 1 TM 4chyntia susantoNo ratings yet

- Latihan AKM 1 CH 08Document5 pagesLatihan AKM 1 CH 08chyntia susantoNo ratings yet

- 4277187Document4 pages4277187mohitgaba19No ratings yet

- Product Project Report On Machinary ChainDocument62 pagesProduct Project Report On Machinary ChainaezkhattaniNo ratings yet

- Final Brief Trawler v. Fishing by Chhorn Songmeng and San KiriDocument7 pagesFinal Brief Trawler v. Fishing by Chhorn Songmeng and San KiriSan KiriNo ratings yet

- CSP-M MountDocument3 pagesCSP-M MountEong Huat Corporation Sdn BhdNo ratings yet

- PharmaDocument4 pagesPharmaharishgnrNo ratings yet

- An Assignment On: ComputersDocument29 pagesAn Assignment On: ComputersTanmoy AntuNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysisiram100% (1)

- Marketing of Technology Products and InnovationsDocument38 pagesMarketing of Technology Products and InnovationsRajesh LakhanotraNo ratings yet

- A. Monday, February 27th, 2012Document4 pagesA. Monday, February 27th, 2012kmkmkmkmlohjsNo ratings yet

- Sales Force MotivationDocument12 pagesSales Force MotivationKumar AbhishekNo ratings yet

- Maruti Suzuki Brand AuditDocument8 pagesMaruti Suzuki Brand Auditshiwani jhaNo ratings yet

- Numericals Cost Volume Profit AnalysisDocument21 pagesNumericals Cost Volume Profit AnalysisDhiren AgrawalNo ratings yet

- Major Components of A Typical Startup-Airline Business Plan: Executive SummaryDocument8 pagesMajor Components of A Typical Startup-Airline Business Plan: Executive Summarysubrat kumarNo ratings yet

- VP Sales Business Development Aerospace in Los Angeles CA Resume Robert HolmquistDocument3 pagesVP Sales Business Development Aerospace in Los Angeles CA Resume Robert HolmquistRobertHolmquistNo ratings yet

- Amit Khan ResumeDocument3 pagesAmit Khan ResumeAmit KhanNo ratings yet

- Chapter 14 - PEDocument43 pagesChapter 14 - PEsharifNo ratings yet

- Microeconomic Analysis: Review OfDocument8 pagesMicroeconomic Analysis: Review OfNaman AgarwalNo ratings yet

- PAN African E-Network Project D B M: Iploma in Usiness AnagementDocument99 pagesPAN African E-Network Project D B M: Iploma in Usiness AnagementOttilieNo ratings yet

- Consumer Rights Important Questions and Answers PDFDocument9 pagesConsumer Rights Important Questions and Answers PDFsimranNo ratings yet

- AJ ResumeDocument3 pagesAJ ResumeCristin StefenNo ratings yet

- Pipe Fitters HandbookDocument316 pagesPipe Fitters HandbookKevin BlackwellNo ratings yet

- Castillo Vs ReyesDocument3 pagesCastillo Vs ReyesJay-ar TeodoroNo ratings yet

- Inflation Causes in PakistanDocument71 pagesInflation Causes in PakistanShahid Mehmood100% (1)

- Invoice PDFDocument1 pageInvoice PDFSapna VermaNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Price and Quantity: Inventory Cost Flow Purchase CommitmentsDocument10 pagesPrice and Quantity: Inventory Cost Flow Purchase CommitmentsShane CalderonNo ratings yet

Kelompok 3 - Tugas 3 - Bab 'Persediaan'

Kelompok 3 - Tugas 3 - Bab 'Persediaan'

Uploaded by

Elsi Nonny100%(1)100% found this document useful (1 vote)

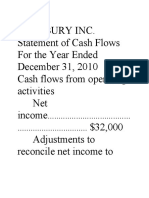

2K views3 pagesThe document contains the details of two accounting problems from an intermediate accounting textbook.

The first problem asks to calculate cost of goods sold using different inventory costing methods - periodic FIFO, perpetual FIFO, periodic weighted average, and perpetual moving average.

The second problem provides financial information for a company that had a fire and asks to calculate the fire loss on inventory using the gross profit method. The response shows the calculations in a formal labeled schedule.

Original Description:

Akm

Original Title

-Kelompok 3- Tugas 3 - Bab 'Persediaan'

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains the details of two accounting problems from an intermediate accounting textbook.

The first problem asks to calculate cost of goods sold using different inventory costing methods - periodic FIFO, perpetual FIFO, periodic weighted average, and perpetual moving average.

The second problem provides financial information for a company that had a fire and asks to calculate the fire loss on inventory using the gross profit method. The response shows the calculations in a formal labeled schedule.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

2K views3 pagesKelompok 3 - Tugas 3 - Bab 'Persediaan'

Kelompok 3 - Tugas 3 - Bab 'Persediaan'

Uploaded by

Elsi NonnyThe document contains the details of two accounting problems from an intermediate accounting textbook.

The first problem asks to calculate cost of goods sold using different inventory costing methods - periodic FIFO, perpetual FIFO, periodic weighted average, and perpetual moving average.

The second problem provides financial information for a company that had a fire and asks to calculate the fire loss on inventory using the gross profit method. The response shows the calculations in a formal labeled schedule.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

TUGAS 3 KELOMPOK 3 AKM 1

Anggota Kelompok: 1. Audi Syahputra (170503003)

2. Afrilliana (170503012)

3. Adinda Andaresta Sihombing (170503022)

4. Yuni Elvira (170503031)

SOAL 1 (Buku Intermediate Accounting IFRS Edition-Kieso, Weygant, Warfield)

*P8-6 (Compute FIFO, Average Cost—Periodic and Perpetual) Ehlo Company is a multiproduct firm. Presented

below is information concerning one of its products, the Hawkeye.

Date Transaction Quantity Price/Cost

1/1 Beginning inventory 1,000 €12

2/4 Purchase 2,000 18

2/20 Sale 2,500 30

4/2 Purchase 3,000 23

11/4 Sale 2,200 33

Instructions

Compute cost of goods sold, assuming Ehlo uses:

(a) Periodic system, FIFO cost flow. (c) Periodic system, weighted-average cost flow.

(b) Perpetual system, FIFO cost flow. (d) Perpetual system, moving-average cost flow.

JAWAB:

(a) Beginning inventory.......................... 1,000

Purchases (2,000 + 3,000)...................... 5,000

Units available for sale .......................... 6,000

Sales (2,500 + 2,200).............................. 4,700

Goods on hand....................................... 1,300

Periodic FIFO

1,000 X €12 = €12,000

2,000 X €18 = 36,000

1,700 X €23 = 39,100

4,700 €87,100

(b) Perpetual FIFO

Purchased Cost of Goods Sold Inventory

Date Quantity Unit Total Quantity Unit Total Quantity Unit Total

Cost Cost Cost Cost Cost Cost

1/1 1,000 €12 €12,000

2/4 2,000 €18 €36,000 1,000 €12 €12,000

2,000 €18 €36,000

2/20 1,000 $12 €12,000 500 €18 €9,000

1,500 $18 €27,000

4/2 3,000 €23 €69,000 500 €18 €9,000

3,000 €23 €69,000

11/4 500 $18 €9,000 1,300 €23 €29,900

1,700 $23 €39,100

Total €87,100

(c) Periodic weighted-average

1,000 X €12 = € 12,000

2,000 X €18 = 36,000

3,000 X €23 = 69,000 4,700

€117,000 ÷ 6,000 = €19.50 X € 19.50

€91,650

(d) Perpetual moving average

Purchased Cost of Goods Sold Inventory

Date Quantity Unit Total Quantity Unit Total Quantity Unit Total

Cost Cost Cost Cost Cost Cost

1/1 1,000 €12 €12,000

2/4 2,000 €18 €36,000 3,000 €16 €48,000

2/20 2,500 €16 €40,000 500 €16 €8,000

4/2 3,000 €23 €69,000 3,500 €22 €77,000

11/4 2,200 €22 €48,400 1,300 €22 €28,600

Total €88,400

SOAL 2 (Buku Intermediate Accounting IFRS Edition-Kieso, Weygant, Warfield)

*P9-5 (Gross Profit Method) Yu Company lost most of its inventory in a fire in December just before the year-end

physical inventory was taken. Corporate records disclose the following.

Inventory (beginning) ¥ 80,000

Sales ¥ 415,000

Purchases 290,000

Sales returns 21,000

Purchase returns 28,000

Gross profit % based on

net selling price 35%

Merchandise with a selling price of ¥30,000 remained undamaged after the fire, and damaged merchandise has a

salvage value of ¥8,150. The company does not carry fire insurance on its inventory.

Instructions

Prepare a formal labeled schedule computing the fire loss incurred.

JAWAB:

Beginning inventory ......................................................................................................................................... ¥ 80,000

Purchases .......................................................................................................................................................... 290,000

370,000

Purchase returns .............................................................................................................................................. (28,000)

Total goods available......................................................................................................................................... 342,000

Sales ......................................................................................................................................... ¥415,000

Sales returns............................................................................................................................... (21,000)

394,000

Less: Gross profit (35% of ¥394,000)......................................................................................... 137,900 (256,100)

Ending inventory (unadjusted for damage)......................................................................................................... 85,900

Less: Goods on hand—undamaged

(¥30,000 X [1 – 35%]) .......................................................................................................................................... 19,500

Inventory damaged ............................................................................................................................................. 66,400

Less: Salvage value of damaged inventory ........................................................................................................... 8,150

Fire loss on inventory ....................................................................................................................................... ¥ 58,250

You might also like

- Sunrise Medical Inc. CaseDocument7 pagesSunrise Medical Inc. Casejuanpaulo33350% (2)

- Hilton Marketing Plan (Final)Document17 pagesHilton Marketing Plan (Final)Tahseef RezaNo ratings yet

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- Tugas Intangible AssetDocument31 pagesTugas Intangible AssetMonica0% (1)

- Case 4 Artistic JawabanDocument3 pagesCase 4 Artistic Jawabanargo satria100% (2)

- Food and Beverage ManualDocument147 pagesFood and Beverage ManualMichael LimNo ratings yet

- OWWA BP - CarenderiaDocument5 pagesOWWA BP - Carenderiabojik2100% (1)

- E21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnDocument3 pagesE21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnWarmthx0% (1)

- E21 16Document2 pagesE21 16Warmthx0% (1)

- Week1 SolutionsDocument14 pagesWeek1 SolutionsM Mustafa100% (1)

- Exercise CH 16-1 ch16-2 ch16-3Document8 pagesExercise CH 16-1 ch16-2 ch16-3Chelsea WulanNo ratings yet

- TR 2 IndahDocument3 pagesTR 2 IndahIndahyuliaputriNo ratings yet

- Lafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Document12 pagesLafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Lafidan Rizata Febiola100% (4)

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Document3 pagesMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiNo ratings yet

- Kisi2 UAS AKM TerjawabDocument8 pagesKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaNo ratings yet

- E7 24Document3 pagesE7 24Muhammad Syafiq Ramadhan100% (1)

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- CASE01 AlibabaDocument8 pagesCASE01 AlibabaJb99No ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- Presentasi Ak. Keu. KLMPK 3Document14 pagesPresentasi Ak. Keu. KLMPK 3Menaz Sadaka100% (1)

- p5 6Document10 pagesp5 6/// MASTER DOGENo ratings yet

- Tugas Kas PiutangDocument14 pagesTugas Kas PiutangDeby Nailatun FitriyahNo ratings yet

- Tugas 6 AKM1 Muhammad Alfarizi 142200278 EA-IDocument9 pagesTugas 6 AKM1 Muhammad Alfarizi 142200278 EA-Imuhammad alfariziNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- A311Chapter 10 ProblemsDocument43 pagesA311Chapter 10 ProblemsVibria Rezki Ananda50% (2)

- Ch9 ExercisesDocument15 pagesCh9 ExercisesMarshanda Berlianti100% (1)

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Document6 pagesTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanNo ratings yet

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- E14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsDocument3 pagesE14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsAsuna SanNo ratings yet

- Tugas PiutangDocument6 pagesTugas Piutangmelvina siregarNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Chapter 21 Solution Manual Kieso IFRS byDocument91 pagesChapter 21 Solution Manual Kieso IFRS byAquarius PlanetNo ratings yet

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Tugas Persediaan 2Document6 pagesTugas Persediaan 2Bertha Liona0% (2)

- Kieso IA 16e SET Ch08Document22 pagesKieso IA 16e SET Ch08Christy0926No ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- Presented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019Document2 pagesPresented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019SalsabiilaNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- 5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12Document14 pages5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12SEPTINA GUMELAR R100% (1)

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Practice For Chapter 7 and 8 Standard CostingDocument12 pagesPractice For Chapter 7 and 8 Standard CostingNCT33% (3)

- PUTU ARI KAMMANI (Individual Assignment)Document4 pagesPUTU ARI KAMMANI (Individual Assignment)Wakil Ketua IIPutu Ari KammaniNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Jawaban Tugas Inventory 2Document8 pagesJawaban Tugas Inventory 2wijayaNo ratings yet

- Chapter 13 Akun Keuangan TugasDocument2 pagesChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Aset TetapDocument9 pagesAset TetapMAYONA MEGAHTANo ratings yet

- PA2 - X - IESP - HW11 - G4 - Yustina Putri DewiDocument7 pagesPA2 - X - IESP - HW11 - G4 - Yustina Putri Dewimellany echa putriNo ratings yet

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Tugas CH 8 Dan 9Document13 pagesTugas CH 8 Dan 9muhammad alfariziNo ratings yet

- CH 07 SMDocument33 pagesCH 07 SMNafisah Mambuay83% (6)

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Latihan AKM 1 TM 4Document5 pagesLatihan AKM 1 TM 4chyntia susantoNo ratings yet

- Latihan AKM 1 CH 08Document5 pagesLatihan AKM 1 CH 08chyntia susantoNo ratings yet

- 4277187Document4 pages4277187mohitgaba19No ratings yet

- Product Project Report On Machinary ChainDocument62 pagesProduct Project Report On Machinary ChainaezkhattaniNo ratings yet

- Final Brief Trawler v. Fishing by Chhorn Songmeng and San KiriDocument7 pagesFinal Brief Trawler v. Fishing by Chhorn Songmeng and San KiriSan KiriNo ratings yet

- CSP-M MountDocument3 pagesCSP-M MountEong Huat Corporation Sdn BhdNo ratings yet

- PharmaDocument4 pagesPharmaharishgnrNo ratings yet

- An Assignment On: ComputersDocument29 pagesAn Assignment On: ComputersTanmoy AntuNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysisiram100% (1)

- Marketing of Technology Products and InnovationsDocument38 pagesMarketing of Technology Products and InnovationsRajesh LakhanotraNo ratings yet

- A. Monday, February 27th, 2012Document4 pagesA. Monday, February 27th, 2012kmkmkmkmlohjsNo ratings yet

- Sales Force MotivationDocument12 pagesSales Force MotivationKumar AbhishekNo ratings yet

- Maruti Suzuki Brand AuditDocument8 pagesMaruti Suzuki Brand Auditshiwani jhaNo ratings yet

- Numericals Cost Volume Profit AnalysisDocument21 pagesNumericals Cost Volume Profit AnalysisDhiren AgrawalNo ratings yet

- Major Components of A Typical Startup-Airline Business Plan: Executive SummaryDocument8 pagesMajor Components of A Typical Startup-Airline Business Plan: Executive Summarysubrat kumarNo ratings yet

- VP Sales Business Development Aerospace in Los Angeles CA Resume Robert HolmquistDocument3 pagesVP Sales Business Development Aerospace in Los Angeles CA Resume Robert HolmquistRobertHolmquistNo ratings yet

- Amit Khan ResumeDocument3 pagesAmit Khan ResumeAmit KhanNo ratings yet

- Chapter 14 - PEDocument43 pagesChapter 14 - PEsharifNo ratings yet

- Microeconomic Analysis: Review OfDocument8 pagesMicroeconomic Analysis: Review OfNaman AgarwalNo ratings yet

- PAN African E-Network Project D B M: Iploma in Usiness AnagementDocument99 pagesPAN African E-Network Project D B M: Iploma in Usiness AnagementOttilieNo ratings yet

- Consumer Rights Important Questions and Answers PDFDocument9 pagesConsumer Rights Important Questions and Answers PDFsimranNo ratings yet

- AJ ResumeDocument3 pagesAJ ResumeCristin StefenNo ratings yet

- Pipe Fitters HandbookDocument316 pagesPipe Fitters HandbookKevin BlackwellNo ratings yet

- Castillo Vs ReyesDocument3 pagesCastillo Vs ReyesJay-ar TeodoroNo ratings yet

- Inflation Causes in PakistanDocument71 pagesInflation Causes in PakistanShahid Mehmood100% (1)

- Invoice PDFDocument1 pageInvoice PDFSapna VermaNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Price and Quantity: Inventory Cost Flow Purchase CommitmentsDocument10 pagesPrice and Quantity: Inventory Cost Flow Purchase CommitmentsShane CalderonNo ratings yet