Professional Documents

Culture Documents

Quiz # 4 Cash & Inventory

Quiz # 4 Cash & Inventory

Uploaded by

Christine Carmona0 ratings0% found this document useful (0 votes)

78 views1 pageBird Company is a manufacturer that provided accounting records for year-end December 31, 2019 including inventory of $1,870,000 and accounts payable of $1,415,000. An audit revealed several discrepancies between the physical inventory count and actual items shipped or received near year-end. After adjusting for these items, Bird's inventory should be increased by $360,000, accounts payable increased by $129,000, and net sales reported as $9,722,400. The statement of financial position as of December 31, 2019 should report accounts payable of $1,544,000 and inventory of $2,230,000.

Original Description:

QUIZ ON INVENTORY

Original Title

QUIZ 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBird Company is a manufacturer that provided accounting records for year-end December 31, 2019 including inventory of $1,870,000 and accounts payable of $1,415,000. An audit revealed several discrepancies between the physical inventory count and actual items shipped or received near year-end. After adjusting for these items, Bird's inventory should be increased by $360,000, accounts payable increased by $129,000, and net sales reported as $9,722,400. The statement of financial position as of December 31, 2019 should report accounts payable of $1,544,000 and inventory of $2,230,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

78 views1 pageQuiz # 4 Cash & Inventory

Quiz # 4 Cash & Inventory

Uploaded by

Christine CarmonaBird Company is a manufacturer that provided accounting records for year-end December 31, 2019 including inventory of $1,870,000 and accounts payable of $1,415,000. An audit revealed several discrepancies between the physical inventory count and actual items shipped or received near year-end. After adjusting for these items, Bird's inventory should be increased by $360,000, accounts payable increased by $129,000, and net sales reported as $9,722,400. The statement of financial position as of December 31, 2019 should report accounts payable of $1,544,000 and inventory of $2,230,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

QUIZ # 4

CASH & INVENTORY

PROBLEM 1

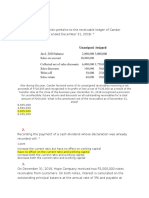

BIRD COMPANY is a manufacturer of small tools. The following information was obtained from the

company’s accounting records for the year ended December 31, 2019:

Inventory at December 31, 2019 (based on physical count in Bird’s

warehouse at cost on December 31, 2019.) P1,870,000

Account payable at December 31, 2019 1,415,000

Net Sales (sales less sales returns) 9,693,400

Your audit reveals the following information:

1. The physical count included tools billed to a customer FOB shipping point on December 31, 2019.

These tools cost P64,000 and were billed at P78,500. They were in the shipping area waiting to be

picked up by the customer.

2. Goods shipped FOB shipping point by a vendor were in transit on December 31, 2019. These goods

with invoice cost of P93,000 were shipped on December 29, 2019.

3. Work in process inventory costing P27,000 was sent to a job contractor for further processing.

4. Not included in the physical count were goods returned by customers on December 31, 2019.

These goods costing P49,000 were inspected and returned to inventory on January 7, 2020. Credit

memos for P67,800 were issued to the customers at that date.

5. In transit to a customer on December 31, 2019, were tools costing P17,000 shipped FOB shipping

point on December 26, 2019. A sales invoice for P29,400 was issued on January 3, 2020, when

Bird Company was notified by the customer that the tools had been received.

6. At exactly 5:00 pm on December 31, 2019, goods costing P31,200 were received from a vendor.

These were recorded on a receiving report dated January 2, 2020. The related invoice was

recorded on December 31, 2019, but the goods were not included in the physical count.

7. Included in the physical count were goods received from a vendor on December 27, 2019.

However, the related invoice for P36,000 was not recorded because the accounting department’s

copy of the receiving report was lost.

8. A monthly freight bill for P32,000 was received on January 3, 2020. It specifically related to

merchandise bought in December 2019, one-half of which was still in the inventory at December

31, 2019. The freight was not included in either the inventory or in accounts payable at December

31, 2019.

1. Bird’s December 31, 2019 inventory should be increased by __________

2. Bird’s accounts payable balance at December 31, 2019 should be increased by _________

3. The amount of net sales to be reported on Bird’s income statement for the year ended December

31, 2019 should be _________

4. Bird’s statement of financial position at December 31, 2019 should report accounts payable of

_________

5. The amount of inventory to be reported on Bird’s December 31, 2019 statement of financial

position should be __________

You might also like

- List of Tax CodesDocument18 pagesList of Tax Codescaxitakochi100% (1)

- Chapter 3 ExercisesDocument3 pagesChapter 3 ExercisesLê Chấn PhongNo ratings yet

- Franchise AgreementDocument21 pagesFranchise Agreementinnovatingwork94% (17)

- Chapter 27 - Inventory Inclusion: Problem 27-1 (AICPA Adapted)Document11 pagesChapter 27 - Inventory Inclusion: Problem 27-1 (AICPA Adapted)Kimberly Claire AtienzaNo ratings yet

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- Logistic and Traffic Departaments Internal OrganizationDocument9 pagesLogistic and Traffic Departaments Internal OrganizationRikardo VergaraNo ratings yet

- Assignment No. 3 Audit of InventoriesDocument6 pagesAssignment No. 3 Audit of InventoriesMa Tiffany Gura Roble100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Whole FoodDocument18 pagesWhole FoodAhad Alim100% (1)

- Documents - MX SCM Excel Based ModelsDocument15 pagesDocuments - MX SCM Excel Based ModelsJovanny2014100% (1)

- Air Canada Booking Confirmation PAA4W5Document6 pagesAir Canada Booking Confirmation PAA4W5Waqar Alam KhanNo ratings yet

- HANSSON CASE Individual AssignmentDocument2 pagesHANSSON CASE Individual AssignmentWawerudasNo ratings yet

- Quiz 4Document3 pagesQuiz 4Christine CarmonaNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- Auditing InventoriesDocument8 pagesAuditing InventoriesSabel FordNo ratings yet

- Auditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Document16 pagesAuditing Problems by Adrianne Paul I. Fajatin, CPA: Problem 1Moira C. Vilog100% (1)

- ExerciseDocument1 pageExerciseDiana Faye CaduadaNo ratings yet

- Quiz Inventories and InvestmentsDocument13 pagesQuiz Inventories and InvestmentsRinconada Benori ReynalynNo ratings yet

- InventoryDocument4 pagesInventoryIzza Mae Rivera KarimNo ratings yet

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- IA 1 and 2 - Midterm Quiz - Student FileDocument21 pagesIA 1 and 2 - Midterm Quiz - Student FileDaniella Mae ElipNo ratings yet

- Unit 4. Audit of Inventories - Handout - T21920 (Final)Document5 pagesUnit 4. Audit of Inventories - Handout - T21920 (Final)Alyna JNo ratings yet

- ACCO 30053 - Audit of Inventories - MARPDocument6 pagesACCO 30053 - Audit of Inventories - MARPBanna SplitNo ratings yet

- Assignment 2Document3 pagesAssignment 2Lei PangilinanNo ratings yet

- AP 9206-1 InventoriesDocument5 pagesAP 9206-1 InventoriesmiobratataNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- CE On Inventories T3 AY1920 PDFDocument9 pagesCE On Inventories T3 AY1920 PDFshiplusNo ratings yet

- Inventories ExercisesDocument11 pagesInventories ExercisesVincrsp BogukNo ratings yet

- Student Name: Subject: Applied Auditing Date: November 28, 2020 Quiz: Inventories Document No.: 11.2020-SF-Q5-INVTY-1Document2 pagesStudent Name: Subject: Applied Auditing Date: November 28, 2020 Quiz: Inventories Document No.: 11.2020-SF-Q5-INVTY-1rowilson reyNo ratings yet

- Process of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesDocument11 pagesProcess of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesRyan Prado AndayaNo ratings yet

- Pamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2Document4 pagesPamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2suruth242No ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- College of Business and Entrepreneurship: Eastern Visayas State UniversityDocument5 pagesCollege of Business and Entrepreneurship: Eastern Visayas State UniversityHelton Jun M. TuralbaNo ratings yet

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- Audit of Prepayments and Intangible AssetsDocument8 pagesAudit of Prepayments and Intangible AssetsVip BigbangNo ratings yet

- Financial LiabilitiesDocument4 pagesFinancial LiabilitiesNicah AcojonNo ratings yet

- Q2FT InventoriesDocument2 pagesQ2FT Inventoriesfrancis dungcaNo ratings yet

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - T21920 (Final)Document7 pagesUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - T21920 (Final)Alyna JNo ratings yet

- Accounting 4 Module 1 3Document3 pagesAccounting 4 Module 1 3Micaela EncinasNo ratings yet

- Chapter-4 Homework ReceivablesDocument3 pagesChapter-4 Homework ReceivablesKenneth Christian WilburNo ratings yet

- Accounting ExercisesDocument6 pagesAccounting ExercisesLiu PNo ratings yet

- Solutiondone 420Document1 pageSolutiondone 420trilocksp SinghNo ratings yet

- 5 6145300324501422418 PDFDocument2 pages5 6145300324501422418 PDFBeverly MindoroNo ratings yet

- Problems - Non-Current Assets Held For SaleDocument1 pageProblems - Non-Current Assets Held For SaleChristine Alysza AnquilanNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNo ratings yet

- Intermediate Accounting 1 - InventoriesDocument9 pagesIntermediate Accounting 1 - InventoriesLien LaurethNo ratings yet

- Cash To InventoryDocument6 pagesCash To InventoryEdmar HalogNo ratings yet

- Inventories Quiz NotesDocument7 pagesInventories Quiz NotesMikaella Nicole PechardoNo ratings yet

- Inventories and Cost FlowDocument5 pagesInventories and Cost Flowalford sery CammayoNo ratings yet

- PROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFODocument4 pagesPROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFOAnn SarmientoNo ratings yet

- Inventories HandoutsDocument7 pagesInventories HandoutsAera GarcesNo ratings yet

- 3 Audit of Inventories and Related AccountsDocument2 pages3 Audit of Inventories and Related AccountsJasmine Marie Ng CheongNo ratings yet

- Quiz#2 Problem Solving InventoryDocument3 pagesQuiz#2 Problem Solving InventoryMyles Ninon LazoNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- Audit of Inventories and Cost of Goods SoldDocument9 pagesAudit of Inventories and Cost of Goods SoldDita Indah0% (1)

- Q CH 3 - 2020 Part 1Document4 pagesQ CH 3 - 2020 Part 1wajdxothmanNo ratings yet

- Correcting Inventory Errors 1Document12 pagesCorrecting Inventory Errors 1Gio PacayraNo ratings yet

- Problem 4Document3 pagesProblem 4novyNo ratings yet

- Audit Accounts PayableDocument3 pagesAudit Accounts Payablenicole bancoroNo ratings yet

- AE-O-A - Quiz QuestionnaireDocument1 pageAE-O-A - Quiz QuestionnaireUSD 654No ratings yet

- The Green Thumb Gardener Is A Retail Store That Sells: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Green Thumb Gardener Is A Retail Store That Sells: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Whatnots Is A Retail Seller of Cards Novelty Items And: Unlock Answers Here Solutiondone - OnlineDocument1 pageWhatnots Is A Retail Seller of Cards Novelty Items And: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- AUD PROB Activity May 18Document2 pagesAUD PROB Activity May 18Kent Judehilee BacalNo ratings yet

- 96Document1 page96Cindy ApriliaNo ratings yet

- Cfas Exam3 ProblemsDocument8 pagesCfas Exam3 ProblemspolxrixNo ratings yet

- 112.inventory ExercisesDocument6 pages112.inventory ExercisesJalanur MarohomNo ratings yet

- Fun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - OnlineDocument1 pageFun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- ACT163 Quiz #1Document2 pagesACT163 Quiz #1Christine CarmonaNo ratings yet

- Partnership OperationsDocument17 pagesPartnership OperationsChristine CarmonaNo ratings yet

- Quiz 4Document3 pagesQuiz 4Christine CarmonaNo ratings yet

- Course Syllabus: Christine Joy D. Carmona Rizalina B. Ong 2019-2020/1 Term OVPAA-034-02Document4 pagesCourse Syllabus: Christine Joy D. Carmona Rizalina B. Ong 2019-2020/1 Term OVPAA-034-02Christine CarmonaNo ratings yet

- ACT142 Quiz #1Document1 pageACT142 Quiz #1Christine CarmonaNo ratings yet

- Jse Module2 Ae25 BTDocument7 pagesJse Module2 Ae25 BTAbeline Martin MestiolaNo ratings yet

- 6ec03 Econ Jan 2010 MsDocument10 pages6ec03 Econ Jan 2010 MsHannah Naomi RoseNo ratings yet

- Goodner Brothers, Inc.: CASE 3.5Document15 pagesGoodner Brothers, Inc.: CASE 3.5moses dickyNo ratings yet

- Chapter 13 - Correlation and Linear RegressionDocument51 pagesChapter 13 - Correlation and Linear RegressionBrenda TandayuNo ratings yet

- AmdeDocument4 pagesAmdeGoogle ComputerNo ratings yet

- Monopoly: Monopoly and The Economic Analysis of Market StructuresDocument15 pagesMonopoly: Monopoly and The Economic Analysis of Market StructuresYvonneNo ratings yet

- UNIVERSITE DU 7 NOVEMBRE A CARTHAGE Faculté Des Sciences Economiques Et de Gestion de Nabeul EXAMEN DE LA SESSION PRINCIPALE MAI 2008Document8 pagesUNIVERSITE DU 7 NOVEMBRE A CARTHAGE Faculté Des Sciences Economiques Et de Gestion de Nabeul EXAMEN DE LA SESSION PRINCIPALE MAI 2008makram74No ratings yet

- 1 Product Management Project Report On Renault DusterDocument3 pages1 Product Management Project Report On Renault DustersinhavisNo ratings yet

- CEO or COO or EVP or Chief or Executive or Operating or OfficerDocument2 pagesCEO or COO or EVP or Chief or Executive or Operating or Officerapi-121452320No ratings yet

- Blade2017 2 PDFDocument84 pagesBlade2017 2 PDFgordonsanweyNo ratings yet

- Globus BrandDocument7 pagesGlobus BrandAayushi PathakNo ratings yet

- Jawaban CH 14Document28 pagesJawaban CH 14Heltiana NufriyantiNo ratings yet

- Mangesh FinalDocument26 pagesMangesh FinalYash LakheraNo ratings yet

- Abap Basics - Open SQLDocument6 pagesAbap Basics - Open SQLeswarscribdNo ratings yet

- 02 Generic CTQ ExamplesDocument4 pages02 Generic CTQ ExamplesAyanNo ratings yet

- Acme Case Study OutcomeDocument7 pagesAcme Case Study OutcomefairousrosmanNo ratings yet

- MarketingDocument110 pagesMarketingriddhi0% (1)

- Customer Relationship Management (CRM) in Retail IndustryDocument24 pagesCustomer Relationship Management (CRM) in Retail IndustryakmohideenNo ratings yet

- Garner Fructis ShampooDocument3 pagesGarner Fructis Shampooyogesh0794No ratings yet

- Kwikspace Guam v. Reaction - ComplaintDocument47 pagesKwikspace Guam v. Reaction - ComplaintSarah BursteinNo ratings yet

- EntrepDocument30 pagesEntrepTrixie Delos Santos100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SHYAM GEORGENo ratings yet