Professional Documents

Culture Documents

Fifi

Fifi

Uploaded by

Mi-cha Park0 ratings0% found this document useful (0 votes)

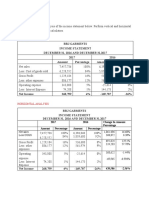

16 views1 pageThe document shows sales, costs, expenses, taxes, and other financial metrics for a company over multiple years. Sales increased each year from 2014 to 2017 at rates between 14.73% to 15.87%. In 2017, the company had $129,815 in sales and $63,447 in net income after paying costs, expenses, interest, and taxes. Projections show the company needing $42,652 in additional funds to cover increasing assets based on the prior year's 15% growth rate.

Original Description:

Financial Management, sales projection

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows sales, costs, expenses, taxes, and other financial metrics for a company over multiple years. Sales increased each year from 2014 to 2017 at rates between 14.73% to 15.87%. In 2017, the company had $129,815 in sales and $63,447 in net income after paying costs, expenses, interest, and taxes. Projections show the company needing $42,652 in additional funds to cover increasing assets based on the prior year's 15% growth rate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageFifi

Fifi

Uploaded by

Mi-cha ParkThe document shows sales, costs, expenses, taxes, and other financial metrics for a company over multiple years. Sales increased each year from 2014 to 2017 at rates between 14.73% to 15.87%. In 2017, the company had $129,815 in sales and $63,447 in net income after paying costs, expenses, interest, and taxes. Projections show the company needing $42,652 in additional funds to cover increasing assets based on the prior year's 15% growth rate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Year Sales Rate of Increase

2014 84697

2015 97172 14.73%

2016 112589 15.87%

2017 129 815.117 15.3%

Sales 129,815.117

Less : Cost of sales x.30 38944.5351

Gross Profit 90870.5819

Less: Operating Expenses (12%) 1557.81404

Income before Interest and taxes 89312.76786

Less: Interest Expense 101.469303

Income before taxes 89211.29856

Less: Income Tax .30 26763.38957

Net Income after tax 63447.90899

Sales 112 589

Current Assets 27801.589624

Non Current A 37581.124132

Current Liabilities 16062.347298

Non Current Liabiities 6147.358587

Ordinary Shares 2765.381406

Retained Earnings 19551.431915

1. Projected increase in assets = (112 589 x 15%) 27801.589624/112 589 =4 170.238444

2. Spontaneous Increase in Asset = (112 589 x 15%) 16062.347298 / 112 589 = 2409.352095

3. Increase in Retained Earnings

63447.90899 x .30 = 19034.3727

63447.90899-19034.3727 =44413.53629

4. Additional Funds = 4 170.238444 - 2409.352095 - 44413.53629 = -42652.64994

You might also like

- Vertical and Horizontal AnalysisDocument19 pagesVertical and Horizontal Analysissanamehar89% (9)

- Coffee Shop - Industry ReportsDocument17 pagesCoffee Shop - Industry ReportsCristina Garza0% (1)

- Comparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDDocument23 pagesComparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDManan Suchak100% (1)

- IndusDocument5 pagesIndusFateen HabibNo ratings yet

- San Miguel Food Corporation - Income StatementDocument4 pagesSan Miguel Food Corporation - Income StatementCarl Anne CaradoNo ratings yet

- Financial Statements Analysis of Apollo and FortisDocument9 pagesFinancial Statements Analysis of Apollo and FortisAnurag DoshiNo ratings yet

- Balance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015Document4 pagesBalance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015sanameharNo ratings yet

- Hamza ZarishDocument31 pagesHamza ZarishTehreem FatimaNo ratings yet

- AFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberDocument25 pagesAFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberwawanNo ratings yet

- Cafe - Industry ReportsDocument17 pagesCafe - Industry ReportsCristina GarzaNo ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- TermpaperDocument6 pagesTermpaperHasib HasanNo ratings yet

- TÀI CHÍNH DOANH NGHIỆPDocument61 pagesTÀI CHÍNH DOANH NGHIỆPGia Uyên NguyễnNo ratings yet

- B9ZqHTBpXtizFKLec1t3exemplos Modelagem Receita PreenchidoDocument10 pagesB9ZqHTBpXtizFKLec1t3exemplos Modelagem Receita PreenchidoCaio Palmieri TaniguchiNo ratings yet

- DCF NHLDocument5 pagesDCF NHLMittal Kirti MukeshNo ratings yet

- Finance ProjectDocument9 pagesFinance ProjectMujtaba HassanNo ratings yet

- Past Papers2Document46 pagesPast Papers2leylaNo ratings yet

- FIX Presentation AnkeuDocument14 pagesFIX Presentation AnkeuSafa Aulia RahmanNo ratings yet

- Vetical Analysis: V. ProcessDocument1 pageVetical Analysis: V. ProcessJestine AlcantaraNo ratings yet

- Income Statement (Inr Millions) Common Size IS Trend AnalysisDocument17 pagesIncome Statement (Inr Millions) Common Size IS Trend AnalysisParth Hemant PurandareNo ratings yet

- Vertical Analysis: AssetsDocument10 pagesVertical Analysis: AssetstayyabasdNo ratings yet

- Book 1Document7 pagesBook 1RUPIKA R GNo ratings yet

- Sales ForcastingDocument3 pagesSales Forcastingb.amankumar.ak75No ratings yet

- Keerthika Case StudiesDocument9 pagesKeerthika Case StudiesAarti SaxenaNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetManan SuchakNo ratings yet

- Financial Statement AnalysisDocument13 pagesFinancial Statement AnalysisAfzalNo ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- Contribution Margin & Fixed Cost: SchedulesDocument2 pagesContribution Margin & Fixed Cost: SchedulesJayson LeybaNo ratings yet

- Year Current RatioDocument13 pagesYear Current Ratiopsana99gmailcomNo ratings yet

- Gross Profit: Forecasted Income StatementDocument2 pagesGross Profit: Forecasted Income StatementMalihaHaqueNo ratings yet

- Drreddy - Ratio AnalysisDocument8 pagesDrreddy - Ratio AnalysisNavneet SharmaNo ratings yet

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- Common Size Analisis & Arus Kas 2015Document6 pagesCommon Size Analisis & Arus Kas 2015Muhammad Najibulloh ImadaNo ratings yet

- Project Appraisal CIA 3Document10 pagesProject Appraisal CIA 3Kush BafnaNo ratings yet

- The Warehouse GroupDocument2 pagesThe Warehouse GroupNawshin DastagirNo ratings yet

- Hira Textile Mill Horizontal Analysis 2015-13 2Document1 pageHira Textile Mill Horizontal Analysis 2015-13 2sumeer shafiqNo ratings yet

- DCF Calculation of Dabur India Ltd.Document6 pagesDCF Calculation of Dabur India Ltd.Radhika ChaudhryNo ratings yet

- Eidul Hussain 12Document103 pagesEidul Hussain 12Rizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- 1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionDocument3 pages1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionHana AlisaNo ratings yet

- PREformaDocument6 pagesPREformajaiNo ratings yet

- Britannia Industries Horizontal AnalysisDocument4 pagesBritannia Industries Horizontal AnalysisSneha BhartiNo ratings yet

- ST ND RD TH THDocument4 pagesST ND RD TH THSanam ShresthaNo ratings yet

- Analysis of Havells 2020 - Writik Saha (20192260)Document32 pagesAnalysis of Havells 2020 - Writik Saha (20192260)writik sahaNo ratings yet

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaNo ratings yet

- Industry AvaragesDocument81 pagesIndustry Avaragessandeep kumarNo ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- KPR MillsDocument32 pagesKPR MillsSatyam1771No ratings yet

- Accounts ProjectDocument5 pagesAccounts ProjectMuhammad AwaisNo ratings yet

- Cost AssignmentDocument16 pagesCost Assignmentmuhammad salmanNo ratings yet

- Financial YearDocument1 pageFinancial Yearshashikumarnaik124No ratings yet

- Finance TermpaperDocument12 pagesFinance TermpaperSabiha IslamNo ratings yet

- Finance Project: Sir Usman AkmalDocument51 pagesFinance Project: Sir Usman AkmalRehan AbdullahNo ratings yet

- Xyz Company: Profit and Loss Account For The Year EndedDocument19 pagesXyz Company: Profit and Loss Account For The Year EndedYaswanth MaripiNo ratings yet

- Fa Analysis - Group 1Document18 pagesFa Analysis - Group 1ananthNo ratings yet

- Finance Profit & Loss HDFC Bank LTD: Year 2021 2020 2019 2018 IncomeDocument12 pagesFinance Profit & Loss HDFC Bank LTD: Year 2021 2020 2019 2018 IncomeYash SinghalNo ratings yet

- Fine Foods Limited: FU Wang Food LimitedDocument8 pagesFine Foods Limited: FU Wang Food LimitedS. M. Zamirul IslamNo ratings yet

- 2019 2018 Particulars: IncomeDocument8 pages2019 2018 Particulars: IncomeSruthi ChandrasekharanNo ratings yet

- How Resistors Work: CapacitorDocument6 pagesHow Resistors Work: CapacitorMi-cha ParkNo ratings yet

- Research Red HorseDocument54 pagesResearch Red HorseMi-cha ParkNo ratings yet

- ReadingsDocument4 pagesReadingsMi-cha ParkNo ratings yet

- Readings in Philippine: Primary SourcesDocument3 pagesReadings in Philippine: Primary SourcesMi-cha ParkNo ratings yet

- Finmar SolmanDocument7 pagesFinmar SolmanMi-cha ParkNo ratings yet

- Communication Privacy Management TheoryDocument7 pagesCommunication Privacy Management TheoryMi-cha ParkNo ratings yet

- BOBBY6Document83 pagesBOBBY6Mi-cha ParkNo ratings yet

- Yung Maximum Seconds Kung Hindi Kaya Okay Lang Naman Ako Mag Adjust Sa Vid. Thank Youuu. Ang Mahalaga Ma Deliver Mo Nang MaayosDocument1 pageYung Maximum Seconds Kung Hindi Kaya Okay Lang Naman Ako Mag Adjust Sa Vid. Thank Youuu. Ang Mahalaga Ma Deliver Mo Nang MaayosMi-cha ParkNo ratings yet

- Philippine Literature During American PeriodDocument5 pagesPhilippine Literature During American PeriodMi-cha ParkNo ratings yet

- Due Date: Print Color: Quantity: Size/s: XS S M L XL XXL Others: TotalDocument3 pagesDue Date: Print Color: Quantity: Size/s: XS S M L XL XXL Others: TotalMi-cha ParkNo ratings yet