Professional Documents

Culture Documents

DLP Compound Interest

DLP Compound Interest

Uploaded by

Jennifer MagangoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLP Compound Interest

DLP Compound Interest

Uploaded by

Jennifer MagangoCopyright:

Available Formats

Republic of the Philippines

Department of Education

MIMAROPA Region

SCHOOLS DIVISION OF ORIENTAL MINDORO

PUERTO GALERA NATIONAL HIGH SCHOOL

Poblacion, Puerto Galera, Oriental Mindoro

Email: my_pgnhs@yahoo.com

School PUERTO GALERA NATIONAL HS Grade Level 11

Learning General

Teacher Mrs. Jennifer B. Magango

DAILY Area Mathematics

LESSON LOG September 18, 2019

Teaching Date 7:00-8:00 11-Bourdain

Quarter First

and Time 9:00-10:00 11-Smith 1:30-2:30 11-Einstein

11:30-12:30 11-Keller 2:30-3:30 11-Newton

I. OBJECTIVES

A. Content Standard The learner demonstrates understanding of...

1. key concepts of simple and compound interests, and simple and general annuities.

B. Performance Standards The learner is able to...

1. investigate, analyze and solve problems involving simple and compound interests and

simple and general annuities using appropriate business and financial instruments.

C. Learning Competencies & Code 1. Illustrate compound interests. M11GM-IIa-1

2. Compute interest, maturity value/future value, and present value in compound

interest environment.M11GM-IIa-b-1

II. CONTENT BASIC BUSINESS MATHEMATICS

COMPOUND INTEREST

III. LEARNING RESOURCES

A. References

1. Teaching Guide pp. 159-198

2. Leaners’ Material/ Textbook pp. 126-152

3. Additional Materials from LR portal

B. Other Learning Resources

IV. PROCEDURES

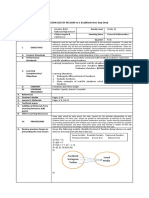

A. Reviewing previous lesson or FIND MY PARTNER

presenting the new lesson Match the terms in Column A with the correct definitions in Column B.

Column A Column B

Principal A. time money is borrowed

Term B. amount paid or earned for the use of money

Interest C. percentage of increase of investment

Maturity Value D. amount of money borrowed or invested

Interest rate E. amount added by the lender, to be received on

repayment date

F. amount received on repayment date

In computing interest, how can we describe simple interest and how can it be

computed?

How do we solve for the final amount or maturity value in simple interest?

B. Establishing a purpose for the lesson Before presenting the lesson objectives, tell the students the following ideas.

“In any business establishments, it is fundamental principle to pay an interest when it is

due so that the interest will be used to earn more money. But very few banks

today pay interest based on the simple interest formula. Instead, they

pay interest by using a principle called compounding.”

C. Presenting examples/ instances of the WHO’S RICHER?

new lesson Pose the situation to the students

Sam and Charles each save Php 100, but under different interest schemes.

Sam earns 10% of his Php 100 savings multiplied to the number of years the money is

invested. While, Charles earns 10% of his Php 100 for the first year, then on the second

year 10% of his Php 100 and the interest it earned on the previous year.

Help the two to complete the table of interest earned using Microsoft Excel

Sam’s Savings after t years Charles’ Savings after t years

Time Principal Interest Amount in t Time Principal Interest Amount in

(years) I=Prt years (years) I=Prt t years

(r=10%) (Maturity (r=10%) (Maturity

Value) Value)

F = P(1+rt) F = P(1+rt)

1 100 1 100

2 2

3 3

4 4

5 5

6 6

7 7

8 8

9 9

10 10

How much interest was earned by Sam and Charles?

Which of the two earned more money at the end of 10 years?

What do you think is the kind of interest applied to Sam’s savings? How about on

Charles’ savings?

Therefore, what is compound interest?

D. Discussing new concepts and LET’s INVESTIGATE!

practicing new skills #1 Investigate how the Maturity Value and Compound Interest can be expressed as an

E. Discussing new concepts and equation and computed.

practicing new skills #2 Let students make their investigation from the table that showed Charles’ earnings.

Raise questions to help and guide students in conceptualizing the method of

computing for the maturity value and compound interest.

Charles’ Savings after t years

Time Principal Interest Amount in t years Can be expressed as

(years) (r=10%) (Maturity Value)

I=Prt F = P(1+rt)

1 100 10 110 𝐹1 = 𝑃(1 + 𝑟𝑡)

2 110 11 121 𝐹2 =

3 121 12.1 133.1

4 133.1 13.31 146.41

5 146.41 14.641 161.051

6 161.05 16.105 177.156

7 177.156 17.716 194.871

8 194.871 19.487 214.358

9 214.358 21.436 235.795

10 235.795 23.579 259.374

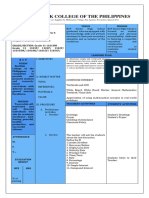

(Expected response: Compound interest is the interest earned from the principal and the

interest earned from the previous period. The final amount or the compound amount is the

accumulated value at the end of the term or period. It can be computed using 𝐹 = 𝑃(1 + 𝑟)𝑛 ,

Where n represents the no. of conversion periods. To identify the compound interest earned,

it can be computed using 𝐼𝑐 = 𝐹 − 𝑃.)

F. Developing mastery (leads to LET’s SEE!

Formative Assessment) Demonstration of computing for the maturity value and compound interest.

Allow learners to acquire the skill of solving for the maturity value and compound

interest through board work activities.

ILLUSTRATIONS:

1. Lina invested Php 15, 000 in Cardbank with 12% interest compounded annually.

How much will she have in her account at the end of two years?

2. Mr. Bunquin borrowed Php 27, 000 for 3 years at a bank charging 8 % annual

compound interest. How much interest would the bank earn from his loan?

G. Finding practical applications of LET’s DO IT TOGETHER!

concepts and skills in daily living Solve the given problems with your group. Present a clear and complete solution.

1. Harlene deposited Php 5, 000 in a bank paying 12% compounded annually. After 4

years, Harlene decided to close her account. How much money would she be able

to get from the bank?

2. Baby borrowed Php 12, 000 from Caloy which he charged 9% compound interest

annually. She promised to return the money after 2 years. How much interest would

Caloy earn from lending money to Baby?

3. The Sangguniang Bayan members of your municipality passed an order allowing

an increase of tricycle fare at 5% compounded annually. If the present fare is Php

10, what will be the fare after 10 years?

4. Your school require all incoming Grade 7 to open an account in its partner bank

paying 8% compound interest annually which will be withdrawn after graduation.

How much should a student save to receive Php 1, 000 on his graduation

H. Making generalizations and SUM IT UP!

abstractions about the lesson Lead the students in summarizing the lesson through asking the following questions.

1. How can you describe compound interest?

2. How is the maturity value and compound interest computed?

I. Evaluating learning EVALUATE:

Solve the problems below by applying what you have learned on compound interest.

1. A person borrowed Php 24, 000 in a bank charging 12% interest compounded

annually. How much would he pay at the end of 5 years?

2. You are deciding on how much money to invest in bank paying 7.5% interest

compounded annually so that after 3 years you will have Php 30, 000 in your

account. How much would it be?

J. Additional activities for application or

remediation

V. REMARKS

VI. REFLECTION

A. No. of learners who earned 80% in the evaluation

B. No. of learners who require additional activities for remediation

C. Did the remedial lessons work? No. of learners who have caught up with the

lesson.

D. No. of learners who continue to require remediation.

E. Which of my teaching strategies worked well? Why did these work?

F. What difficulties did I encounter which my principal or supervisor can help me

solve?

G. What innovation or localized materials did I use/discover which I wish to share

with other teachers?

Prepared by:

JENNIFER B. MAGANGO

SST – III

Checked by: Noted by:

BERNARD C. BUNQUIN, Ph. D. VICTORINO B. AGELLON

Assistant Principal II Principal I

You might also like

- Elc590 - Persuasive SpeechDocument21 pagesElc590 - Persuasive SpeechNasrin AazizNo ratings yet

- Department of Education: Republic of The PhilippinesDocument6 pagesDepartment of Education: Republic of The PhilippinesAngel Guillermo Jr.100% (1)

- BSBOPS505 - Project Portfolio Section 2 Template v21.1Document10 pagesBSBOPS505 - Project Portfolio Section 2 Template v21.1Shravani Pulgam50% (2)

- DLL Stat and Prob Pop ProportionsDocument3 pagesDLL Stat and Prob Pop ProportionsGladys Joy Santos MallariNo ratings yet

- Lesson Plan in General Mathematics Grade 11Document3 pagesLesson Plan in General Mathematics Grade 11EdwardJohnG.CalubII100% (1)

- SHS Demo Operations On FunctionsDocument11 pagesSHS Demo Operations On FunctionsRaffy Jay Jamin100% (1)

- Daily Lesson Plan School Grade Level Teacher Learning Area Teaching Date and Time QuarterDocument2 pagesDaily Lesson Plan School Grade Level Teacher Learning Area Teaching Date and Time QuarterJennifer Magango100% (2)

- GGR107 - Textbook NotesDocument148 pagesGGR107 - Textbook NotesSaeed BahatheqNo ratings yet

- History of Special EducationDocument5 pagesHistory of Special EducationCyra MandigmaNo ratings yet

- Entreprenuership Notes (Full)Document230 pagesEntreprenuership Notes (Full)Izo Serem78% (9)

- DLL - Genmath - Finding Interest Rate and Time in Compound InterestDocument7 pagesDLL - Genmath - Finding Interest Rate and Time in Compound InterestGerson Tampolino AcostaNo ratings yet

- DLL Compound InterestDocument4 pagesDLL Compound InterestYvonne Alonzo De BelenNo ratings yet

- LED TV, Laptop, Powerpoint Presentation, Manila Paper, Colored Papers andDocument3 pagesLED TV, Laptop, Powerpoint Presentation, Manila Paper, Colored Papers andRachael OrtizNo ratings yet

- LP Random VariablesDocument8 pagesLP Random VariablesGary Omar PacanaNo ratings yet

- Lesson Plan in General Mathematics Grade 11 Grade 11 - Humss/Gas/ Tvl-H.E./Tvl-SmawDocument8 pagesLesson Plan in General Mathematics Grade 11 Grade 11 - Humss/Gas/ Tvl-H.E./Tvl-SmawRolly Dominguez BaloNo ratings yet

- WHLP General Mathematics Week 1 - 4Document8 pagesWHLP General Mathematics Week 1 - 4Christine YnotNo ratings yet

- Gen Math - Lesson1&2Document5 pagesGen Math - Lesson1&2Gladzangel LoricabvNo ratings yet

- DLL Observation 1Document7 pagesDLL Observation 1Nald Tropel100% (1)

- Daily Lesson Plan General Mathematics Lesson 1 Functions As ModelsDocument33 pagesDaily Lesson Plan General Mathematics Lesson 1 Functions As ModelsAnne Marie100% (1)

- Statistics and Probability Daily Lesson LogDocument3 pagesStatistics and Probability Daily Lesson LogMa. Wilma Q. SevilloNo ratings yet

- Lesson Plan in General Mathematics Grade 11Document3 pagesLesson Plan in General Mathematics Grade 11Rosemarie Sumao-i Bugaoan100% (1)

- DLL - Genmath - Compounding Once A YearDocument8 pagesDLL - Genmath - Compounding Once A YearGerson Tampolino AcostaNo ratings yet

- DLL - Gen - Math - 12-5-2022Document2 pagesDLL - Gen - Math - 12-5-2022Rodrigo Balais100% (1)

- Week 5Document2 pagesWeek 5Myra Dacquil Alingod100% (2)

- Piecewise Activity DLLDocument2 pagesPiecewise Activity DLLbonnavie.buenoNo ratings yet

- Asymptotes and InterceptsDocument4 pagesAsymptotes and InterceptsPearl Arianne MontealegreNo ratings yet

- Daily Lesson LOG School Grade Level 11 - Love Teacher Chris Evans Learning Area Statistics & Probability Teaching Date and Time Quarter FirstDocument2 pagesDaily Lesson LOG School Grade Level 11 - Love Teacher Chris Evans Learning Area Statistics & Probability Teaching Date and Time Quarter FirstLeonardo BasingNo ratings yet

- Simple Interest ActivityDocument2 pagesSimple Interest ActivityDhet Pas-Men100% (1)

- The Learner Demonstrates Understanding Of... : GRADES 1 To 12 Daily Lesson LogDocument5 pagesThe Learner Demonstrates Understanding Of... : GRADES 1 To 12 Daily Lesson Logric manalastas100% (1)

- DLL - Gen Math Week 17Document4 pagesDLL - Gen Math Week 17Ron Robert M. PecanaNo ratings yet

- Gen Math STEM B Daily Lesson LogDocument6 pagesGen Math STEM B Daily Lesson LogAnonymous XY2gPzqZNo ratings yet

- Lesson Plan MATH2Document4 pagesLesson Plan MATH2Jomar AbreuNo ratings yet

- DLL q1 w7 GenmathDocument3 pagesDLL q1 w7 GenmathNimrod LadianaNo ratings yet

- GM Ii 2 DLPDocument3 pagesGM Ii 2 DLPMA. CHRISTINA ANDALESNo ratings yet

- A Lesson Plan On Exponential Functions in RealityDocument3 pagesA Lesson Plan On Exponential Functions in RealityMarnellie Bautista-Valdez100% (1)

- General Mathematics 11.2.1Document4 pagesGeneral Mathematics 11.2.1Dindin Oromedlav Lorica0% (1)

- Rational Function RepresentationDocument3 pagesRational Function RepresentationJM Panganiban IINo ratings yet

- Simple Interest Lesson EDTECH 541Document2 pagesSimple Interest Lesson EDTECH 541Jennifer Marrott80% (5)

- DLL Gen Math Ems AnnuitiesDocument13 pagesDLL Gen Math Ems AnnuitiesFreyy Agad Maligot0% (1)

- COT-1 - DLP - COMPOUND INTEREST (Final)Document9 pagesCOT-1 - DLP - COMPOUND INTEREST (Final)maritchel cadion100% (1)

- DLL Gen Math Week 1Document8 pagesDLL Gen Math Week 1Jerry G. GabacNo ratings yet

- Lesson Plan in Statistics and Probability October 29, 2019Document3 pagesLesson Plan in Statistics and Probability October 29, 2019Elmer PiadNo ratings yet

- DLP FinalDocument3 pagesDLP FinalMarlaFirmalinoNo ratings yet

- M1112sp-Ivb - 1,2Document4 pagesM1112sp-Ivb - 1,2chingferdie_111100% (1)

- Dlp-General Math (1st Meeting)Document3 pagesDlp-General Math (1st Meeting)Jennifer Balais PausalNo ratings yet

- Detailed Lesson Plan in Mathematics 10Document15 pagesDetailed Lesson Plan in Mathematics 10Zachary Aaron0% (1)

- Lesson Plan FormatDocument47 pagesLesson Plan FormatGena Clarish Carreon100% (5)

- Lesson Plan Observation - Random VariablesDocument4 pagesLesson Plan Observation - Random VariablesJEMUEL MARC NIKKO URCIADANo ratings yet

- Stat and Prob Lesson PlanDocument77 pagesStat and Prob Lesson PlanRamoj Reveche Palma100% (3)

- Performance Task in Statistics and ProbabilityDocument3 pagesPerformance Task in Statistics and Probabilityrhea diadulaNo ratings yet

- Grade 11 General Mathematics - CIDAMDocument9 pagesGrade 11 General Mathematics - CIDAMRESTY SABEROLA100% (1)

- Thess-DLP-COT Q4-Testing HypothesisDocument14 pagesThess-DLP-COT Q4-Testing HypothesisThess ValerosoNo ratings yet

- Region-4A - Business and Consumer Loans - Hernandez NDocument6 pagesRegion-4A - Business and Consumer Loans - Hernandez NLynn hernandezNo ratings yet

- Week 1. Day 2 (Lesson 2)Document6 pagesWeek 1. Day 2 (Lesson 2)Gladzangel LoricabvNo ratings yet

- Detailed Lesson Plan (DLP) Format: Instructional PlanningDocument2 pagesDetailed Lesson Plan (DLP) Format: Instructional PlanningLily Anne Ramos MendozaNo ratings yet

- A Detailed Lesson PlanDocument6 pagesA Detailed Lesson PlanRaquel NavarezNo ratings yet

- DAILY LESSON LOG - Stat Week 2Document3 pagesDAILY LESSON LOG - Stat Week 2Kyun Yanyan100% (2)

- Hypothesis CotDocument40 pagesHypothesis CotAldrin Dela CruzNo ratings yet

- Statistics and Probability FinalDocument3 pagesStatistics and Probability FinalGerby Godinez100% (2)

- Thess-DLP-COT 1-Q4-Rejection RegionDocument15 pagesThess-DLP-COT 1-Q4-Rejection RegionThess ValerosoNo ratings yet

- Math 11Document22 pagesMath 11HONEY JEAN SUPITERNo ratings yet

- DLL Q2 Mod1 3Document2 pagesDLL Q2 Mod1 3Judy Ann BalcitaNo ratings yet

- DLL Compound InterestDocument4 pagesDLL Compound InterestJose BenaventeNo ratings yet

- Totoo Na To Promise Lesson PlanDocument12 pagesTotoo Na To Promise Lesson PlanLydia AlbanNo ratings yet

- Week 12 Gen Math LPDocument5 pagesWeek 12 Gen Math LPBSED 4101 M- Troyo, Mark N.No ratings yet

- Businessfinance12 - q3 - Mod6.1 - Basic-Long-Term-Financial-Concepts - Simple-and-Compound-InterestDocument27 pagesBusinessfinance12 - q3 - Mod6.1 - Basic-Long-Term-Financial-Concepts - Simple-and-Compound-InterestMarilyn Tamayo0% (1)

- CAPACITORS in PARALLELDocument18 pagesCAPACITORS in PARALLELJennifer MagangoNo ratings yet

- Department of Education: Teacher'S Weekly PlanDocument1 pageDepartment of Education: Teacher'S Weekly PlanJennifer MagangoNo ratings yet

- Stored Energy in CapacitorsDocument25 pagesStored Energy in CapacitorsJennifer MagangoNo ratings yet

- Chapter Test - Electric Potential PDFDocument1 pageChapter Test - Electric Potential PDFJennifer MagangoNo ratings yet

- Puerto Galera National High School: Daily Lesson LogDocument2 pagesPuerto Galera National High School: Daily Lesson LogJennifer MagangoNo ratings yet

- DLP - Central Limit Theorem V2Document5 pagesDLP - Central Limit Theorem V2Jennifer Magango75% (4)

- Chapter 3 - Long TestDocument3 pagesChapter 3 - Long TestJennifer MagangoNo ratings yet

- Compound Interest More Than ONCEDocument24 pagesCompound Interest More Than ONCEJennifer MagangoNo ratings yet

- Electric Forces and Electric FieldsDocument37 pagesElectric Forces and Electric FieldsJennifer Magango100% (1)

- Electric Charges: Third QuarterDocument25 pagesElectric Charges: Third QuarterJennifer MagangoNo ratings yet

- Coulomb's LawDocument24 pagesCoulomb's LawJennifer Magango50% (2)

- Basic Business Mathematics: Simple NterestDocument12 pagesBasic Business Mathematics: Simple NterestJennifer MagangoNo ratings yet

- Science 10: Department of Education Division of Oriental Mindoro Puerto Galera Nhs Dulangan ExtensionDocument3 pagesScience 10: Department of Education Division of Oriental Mindoro Puerto Galera Nhs Dulangan ExtensionJennifer MagangoNo ratings yet

- Simple and Compound InterestDocument1 pageSimple and Compound InterestJennifer MagangoNo ratings yet

- Template MAPEHDocument4 pagesTemplate MAPEHJennifer MagangoNo ratings yet

- DLP PlanetsDocument2 pagesDLP PlanetsJennifer MagangoNo ratings yet

- DLP Lesson 1Document1 pageDLP Lesson 1Jennifer MagangoNo ratings yet

- DLP - Intro (Communication)Document1 pageDLP - Intro (Communication)Jennifer MagangoNo ratings yet

- Puerto Galera National High School Dulangan ExtensionDocument2 pagesPuerto Galera National High School Dulangan ExtensionJennifer MagangoNo ratings yet

- DLP - Origin of The Solar SystemDocument1 pageDLP - Origin of The Solar SystemJennifer MagangoNo ratings yet

- DLP - Interior of The EarthDocument1 pageDLP - Interior of The EarthJennifer MagangoNo ratings yet

- DLP - Intro (Performance Task)Document1 pageDLP - Intro (Performance Task)Jennifer MagangoNo ratings yet

- Minerals: Chapter 2: Lesson 1Document49 pagesMinerals: Chapter 2: Lesson 1Jennifer MagangoNo ratings yet

- Particle Theory of MatterDocument23 pagesParticle Theory of MatterJennifer MagangoNo ratings yet

- DLP - Asexual and SexualDocument2 pagesDLP - Asexual and SexualJennifer Magango100% (3)

- Universe and Solar SystemDocument10 pagesUniverse and Solar SystemJennifer MagangoNo ratings yet

- EcosystemDocument34 pagesEcosystemJennifer MagangoNo ratings yet

- Philosophy I. Complete The Table Below. Write Your Answer in Your NotebookDocument1 pagePhilosophy I. Complete The Table Below. Write Your Answer in Your NotebookJennifer MagangoNo ratings yet

- SIP My PartsDocument20 pagesSIP My PartsJennifer MagangoNo ratings yet

- NOVATHERABBITPATTERNDocument10 pagesNOVATHERABBITPATTERNTejidos Castillo Amigurumis con Amor100% (3)

- 1 Wages Boards OrdinanceDocument37 pages1 Wages Boards Ordinancesandhwani3893No ratings yet

- English Test-SMA-Kelas-XII-Semester-IDocument4 pagesEnglish Test-SMA-Kelas-XII-Semester-IAru HernalantoNo ratings yet

- 8th November, 2016 Daily Global, Regional and Local Rice E-Newsletter by Riceplus MagazineDocument74 pages8th November, 2016 Daily Global, Regional and Local Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- Pava 8191255 40Document2 pagesPava 8191255 40Ximena Gabriela Sotomayor-VelasquezNo ratings yet

- Service, SRS Config. in SOM 5 5.5 VB30 38 39 40 41 36 CSTD CT02-023.805.02 CT00-000.843.08Document57 pagesService, SRS Config. in SOM 5 5.5 VB30 38 39 40 41 36 CSTD CT02-023.805.02 CT00-000.843.08Klaus BöhmdorferNo ratings yet

- Arts 8 - Q4 - M4Document29 pagesArts 8 - Q4 - M4Rod Ivan Dela Cruz0% (1)

- The Effect of Social Verbal Physical and Cyberbullying Victimization On Academic PerformanceDocument22 pagesThe Effect of Social Verbal Physical and Cyberbullying Victimization On Academic PerformanceMark Dave Aborita MorcoNo ratings yet

- Experiential Metafunction PracticalDocument67 pagesExperiential Metafunction PracticalFatin KamaruddinNo ratings yet

- 1234 FBM203Document16 pages1234 FBM203andresg417No ratings yet

- Bagi 'LKPD 2 Teks News ItemDocument8 pagesBagi 'LKPD 2 Teks News ItemMuhammad IhsanNo ratings yet

- Cambodia of The Land Management and Administration Project (LMAP)Document19 pagesCambodia of The Land Management and Administration Project (LMAP)SaravornNo ratings yet

- SE Book by BrainHeatersDocument364 pagesSE Book by BrainHeatersmercy patelNo ratings yet

- 4th QuarterDocument3 pages4th QuarterGina YanNo ratings yet

- Bishop James D. Conley - Sursum Corda 10 Suggestions For Rekindling The Literary ImaginationDocument4 pagesBishop James D. Conley - Sursum Corda 10 Suggestions For Rekindling The Literary ImaginationjczamboniNo ratings yet

- Industrial Report On Saras DairyDocument88 pagesIndustrial Report On Saras DairyDeepak ChelaniNo ratings yet

- Playful Business ResumeDocument1 pagePlayful Business ResumeOlivia LinNo ratings yet

- LMS October VLDocument4 pagesLMS October VLSean CuberoNo ratings yet

- GA22 API464139 Parts ManualDocument100 pagesGA22 API464139 Parts ManualAlisha Lynn Lacoursiere100% (1)

- Detailed Lesson Plan in Grade 7 ScienceDocument11 pagesDetailed Lesson Plan in Grade 7 ScienceMariel Biason100% (3)

- Starting Up Notes (1-2-3-4) .Document2 pagesStarting Up Notes (1-2-3-4) .JHIMY PAREDESNo ratings yet

- Bless The Broken Road Chords (F)Document2 pagesBless The Broken Road Chords (F)Anonymous 8tw7R6No ratings yet

- 28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Document38 pages28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Ananthesh RaoNo ratings yet

- Nilai Raport & Praktik 6A 2023-2024Document6 pagesNilai Raport & Praktik 6A 2023-2024Muhammad AminullahNo ratings yet

- 000 SRS Software Feasibility Study TemplateDocument19 pages000 SRS Software Feasibility Study TemplateWeyNo ratings yet