Professional Documents

Culture Documents

Project Assessment at Railways

Project Assessment at Railways

Uploaded by

keyurpatel1993Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Assessment at Railways

Project Assessment at Railways

Uploaded by

keyurpatel1993Copyright:

Available Formats

Project Assessment at Railways

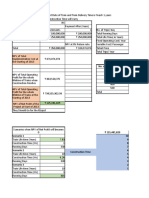

The Railway Minister, Ms Samta Banerjee has mooted the idea of running a Duranto Express Between

Mumbai and Baroda. The railway board has the task of examining the proposal. There will be, in fact two

trains running in the opposite directions, one in the morning and another in the evening every day. The

trains will make two trips, i.e., to and fro each.

The purchase cost of the trains is estimated at Rs. 20 crores, for both the trains put together. Of this, Rs.

10 crore is to be paid upfront and the rest on the delivery of the trains (i.e., engines and carriages) which

is expected one year after the initial payment.

In addition to purchasing the rolling stock, Railways have to make special arrangements for plateforms,

control rooms, installation of signaling systems, track modernization in certain sections and special

training for the staff to handle this new train. This would involve an investment of Rs. 50 crore in total.

However, only 50% of this would be required immediately, the remaining being payable when all

physical facilities get ready (which is expected in a year’s time from now).

The trains will have maximum seating capacity of 1000 passengers per train per trip. The price of the

ticket is tagged at Rs. 250 per passenger. The operating expenses of the train will have a fixed

component of Rs. 10 crore per year. The variable component is estimated at Rs. 25 per passenger.

Railway board traffic analysts estimate the following figures for traffic intensity:

No. of Passenger per Trip Probability

1000 0.1

900 0.2

800 0.3

700 0.2

600 0.1

500 0.1

It is also estimated that every year the trains will run for 330 days.

The economical useful life of the Duranto Express is taken as 10 years from the next year. We are

currently in the year 2013.

The Railways being a Government Department, uses 8% as a required rate of return.

Help the railway board in evaluating the proposal.

Scope of the Railway Assessment Problem

The assignment may address the following issues:

a. What is the expected revenue stream in a year?

b. What is the total expected cost (both Fixed and Variable)?

c. What is the net income per year?

d. How will the net income stream look like given a useful life of 10 years for the two

years?

e. What are the depreciation values in each year assuming straight line method?

f. What are the depreciation values in each year assuming sum of the digits method?

g. What are the depreciation value with constant declining percentage (assume the values

of 10%, 15%, 20%)?

h. What are tax implications yearly for the 10 years of useful life of trains? Incorporate the

concept of depreciation. What is the impact on NPV?

i. What is the impact of inflation on the net income after tax? How the NPV value is

impacted?

j. Perform the sensitivity analysis for the useful life span of train. Currently it is 10 years.

Find at what life span, the NPV tends to become zero?

k. Perform the sensitivity analysis in case there is delay in the construction of

infrastructural facility? At what delay, the NPV becomes zero?

l. Perform the sensitivity analysis in case there is a change in the number of operating

days in a year. Currently, the number of operating days is 330 in a year. What is the

number of operating days at which NPV becomes zero? Is it sensitive measure?

m. What will be the impact on the NPV if there is a salvage value of Rs. 10 Crores for the

trains after its economical life?

You might also like

- Ice Cream Business Plan.Document41 pagesIce Cream Business Plan.Daniel Sanchez76% (25)

- Financial Accounting 10th Edition Harrison Solutions Manual DownloadDocument79 pagesFinancial Accounting 10th Edition Harrison Solutions Manual DownloadSandra Andersen100% (29)

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- Pure Drinks CompanyDocument1 pagePure Drinks CompanyViral BhogaitaNo ratings yet

- Copy of Copy of Gentle Electric Part 2Document3 pagesCopy of Copy of Gentle Electric Part 2inekelechi17% (6)

- Assignment 2Document2 pagesAssignment 2AbhishekKumarNo ratings yet

- INFO 564 Homework Assignment 4 - Solution: Category Frequency/ QuantityDocument3 pagesINFO 564 Homework Assignment 4 - Solution: Category Frequency/ QuantityJesus MuñozNo ratings yet

- SunAir Boat BuildersDocument3 pagesSunAir Boat Buildersram_prabhu00325% (4)

- Atlantic Computers: A Bundle of Pricing OptionsDocument4 pagesAtlantic Computers: A Bundle of Pricing OptionsFree GuyNo ratings yet

- Project Assessment at Railways FinalDocument5 pagesProject Assessment at Railways FinaldebojyotiNo ratings yet

- Chandpur Enterprises LTDDocument8 pagesChandpur Enterprises LTDPritam KarmakarNo ratings yet

- Commuter Cleaning - Group 10Document6 pagesCommuter Cleaning - Group 10AMAL ARAVIND100% (1)

- Case Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationDocument3 pagesCase Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationArnav MittalNo ratings yet

- Managing Inventory at Alko HandoutDocument7 pagesManaging Inventory at Alko Handoutsuhani varshneyNo ratings yet

- Hind Petrochemicals CompanyDocument1 pageHind Petrochemicals CompanyAmmrita SharmaNo ratings yet

- HiltonDocument8 pagesHiltonDamodarSingh100% (1)

- Report Banking RiabkovDocument6 pagesReport Banking RiabkovKostia RiabkovNo ratings yet

- 04 Mrudula Ice Cream ParlourDocument4 pages04 Mrudula Ice Cream ParlourSuchit Singh100% (1)

- Assign 4Document1 pageAssign 4RUHINo ratings yet

- Sap Fico Training: by Rajeev KumarDocument115 pagesSap Fico Training: by Rajeev KumarRajeev Kumar91% (11)

- Brand Ambassador AgreementDocument2 pagesBrand Ambassador AgreementKristel Sales-Medel67% (3)

- Ebook Vince Secrets To Smart TradingDocument18 pagesEbook Vince Secrets To Smart TradingMujitha Manorathna100% (1)

- 0 Asset Protection BasicsDocument43 pages0 Asset Protection Basicspwilkers36100% (1)

- Tata Corus Acquisition and M&ADocument16 pagesTata Corus Acquisition and M&ASaurabh PaliwalNo ratings yet

- Case Study 2 ChandpurDocument11 pagesCase Study 2 ChandpurGaurav VermaNo ratings yet

- PGP2 Nict 2013PGPM039Document5 pagesPGP2 Nict 2013PGPM039Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM010Document3 pagesPGP2 Nict 2013PGPM010Rachit PradhanNo ratings yet

- Case Study PashukhadyaDocument3 pagesCase Study PashukhadyaK ParamNo ratings yet

- Solved The Dijon Company S Total Variable Cost Function Is TVC 50qDocument1 pageSolved The Dijon Company S Total Variable Cost Function Is TVC 50qM Bilal SaleemNo ratings yet

- MacDocument4 pagesMacalwar_shi262068100% (1)

- ATC Case SolutionDocument3 pagesATC Case SolutionAbiNo ratings yet

- 08 Konys IncDocument44 pages08 Konys IncAshish Kumar0% (1)

- JHT Case ExcelDocument4 pagesJHT Case Excelanup akasheNo ratings yet

- Megacard CorporationDocument4 pagesMegacard CorporationSangeeta KumariNo ratings yet

- Daud Engine Parts CompanyDocument3 pagesDaud Engine Parts CompanyJawadNo ratings yet

- Otisline Case StudyDocument2 pagesOtisline Case Studynkumar_324No ratings yet

- Davey & Classic Pen CA - Abhishek - .2022B2PGPMX001docxDocument4 pagesDavey & Classic Pen CA - Abhishek - .2022B2PGPMX001docxabhishek pattanayakNo ratings yet

- Jamcracker Case Study AnalysisDocument2 pagesJamcracker Case Study AnalysisAshutosh Jha100% (1)

- Information Systems For Managers: FINTECH: Choosing A Cloud Services ProviderDocument11 pagesInformation Systems For Managers: FINTECH: Choosing A Cloud Services ProviderAkshay BNo ratings yet

- MAC Davey Brothers - AkshatDocument4 pagesMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNo ratings yet

- Microsign PresentationDocument27 pagesMicrosign PresentationMicrosign ProductsNo ratings yet

- Atlantic Computer: A Bundle of Pricing OptionsDocument36 pagesAtlantic Computer: A Bundle of Pricing OptionsRohit GhoshNo ratings yet

- Kamoki Poultry FeedsDocument2 pagesKamoki Poultry Feedssidra imtiazNo ratings yet

- Decision Sheet Shanghai GDP ApostasyDocument2 pagesDecision Sheet Shanghai GDP ApostasyMEDABOINA SATHVIKANo ratings yet

- Activity Based Costing Test QuestionsDocument5 pagesActivity Based Costing Test QuestionsMehul GuptaNo ratings yet

- 05 Lilac Flour MillsDocument6 pages05 Lilac Flour Millsspaw1108No ratings yet

- MAC - Merrimack Tractors and MowersDocument1 pageMAC - Merrimack Tractors and MowerschansjoyNo ratings yet

- Merton Trucks Case Note: I I M A IIMA/QM-xxxDocument8 pagesMerton Trucks Case Note: I I M A IIMA/QM-xxxAyush GuptaNo ratings yet

- Devyani International LTD - IPO Note-1Document4 pagesDevyani International LTD - IPO Note-1chinna rao100% (1)

- SalesoftDocument32 pagesSalesoftBhuvaneswari HarikrishnanNo ratings yet

- Cost Management - Software Associate CaseDocument7 pagesCost Management - Software Associate CaseVaibhav GuptaNo ratings yet

- Software Associate SolutionDocument6 pagesSoftware Associate SolutionAnupam SinghNo ratings yet

- OTISLINE PresentationDocument5 pagesOTISLINE PresentationAseem SharmaNo ratings yet

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalNo ratings yet

- Grocery GatewayDocument5 pagesGrocery GatewayPiyush SharmaNo ratings yet

- Fashion - Point SolutionDocument4 pagesFashion - Point SolutionMuhammad JunaidNo ratings yet

- Delta AssignmentDocument4 pagesDelta Assignmentbinzidd007No ratings yet

- Operations Management-II Case - Megacard CorporationDocument7 pagesOperations Management-II Case - Megacard CorporationDikshma PaulNo ratings yet

- Siemens ElectricDocument6 pagesSiemens ElectricUtsavNo ratings yet

- 66 India Post Case StudyDocument3 pages66 India Post Case StudySameer GopalNo ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- Memory Manufacturing Company MMC Produces Memory Modules in A Two StepDocument1 pageMemory Manufacturing Company MMC Produces Memory Modules in A Two StepAmit PandeyNo ratings yet

- PIA Hawaii Emirates Easy Jet: Breakeven AnalysisDocument3 pagesPIA Hawaii Emirates Easy Jet: Breakeven AnalysissaadsahilNo ratings yet

- Mohit MBA07214 PM Assignment 1Document2 pagesMohit MBA07214 PM Assignment 1mohit rajputNo ratings yet

- Operations CostingDocument10 pagesOperations CostingAshna BagdiNo ratings yet

- PRM in Sports StadiumsDocument6 pagesPRM in Sports Stadiumskeyurpatel1993No ratings yet

- TheBootcamp IIM Interview PrepbookDocument30 pagesTheBootcamp IIM Interview Prepbookkeyurpatel1993100% (1)

- 5 E/18 Dabouli First Kanpur-208022, Uttar Pradesh 2019 Visa Counsellor, Embassy of Republic of France, MumbaiDocument2 pages5 E/18 Dabouli First Kanpur-208022, Uttar Pradesh 2019 Visa Counsellor, Embassy of Republic of France, Mumbaikeyurpatel1993No ratings yet

- Case Part 7Document1 pageCase Part 7keyurpatel1993No ratings yet

- ..Document18 pages..keyurpatel1993No ratings yet

- Journalise The Following Transactions and Post Them Into Ledger and Prepare Trial BalanceDocument2 pagesJournalise The Following Transactions and Post Them Into Ledger and Prepare Trial Balanceapura desaiNo ratings yet

- MG8091 Ed MCQDocument22 pagesMG8091 Ed MCQSiva Hari100% (1)

- Dissolution Changes in OwnershipDocument29 pagesDissolution Changes in OwnershipKenaniah SanchezNo ratings yet

- Slides Business Level StrategyDocument24 pagesSlides Business Level StrategyThảo PhạmNo ratings yet

- Lucio TanDocument5 pagesLucio TanAce MontenegroNo ratings yet

- Philam v. CIRDocument3 pagesPhilam v. CIRJohn AguirreNo ratings yet

- PECs Important TraitsDocument21 pagesPECs Important TraitsKyle Sean Shei ZeujnaraNo ratings yet

- A Guide To The Preparation of A HACCP-Based Food Safety Management System For HotelsDocument31 pagesA Guide To The Preparation of A HACCP-Based Food Safety Management System For HotelsAna LogNo ratings yet

- Dimitri Iordan Planning For GrowthDocument34 pagesDimitri Iordan Planning For GrowthSoumyadeep BoseNo ratings yet

- BCBG - Fact SheetDocument3 pagesBCBG - Fact SheetjbrooksteinNo ratings yet

- Seminar 2 Information Systems & Knowledge Management: PurposeDocument14 pagesSeminar 2 Information Systems & Knowledge Management: PurposebilalfalconNo ratings yet

- Problems in Calculating National IncomeDocument2 pagesProblems in Calculating National IncomesmilesamNo ratings yet

- Sierralane Architects: Building Dreams Since 1995Document15 pagesSierralane Architects: Building Dreams Since 1995Софья КопыловаNo ratings yet

- A Cheque Is A DocumentDocument15 pagesA Cheque Is A Documentmi06bba030No ratings yet

- Project Synopsis Mba HR Stress Management in Bpo SectorDocument10 pagesProject Synopsis Mba HR Stress Management in Bpo Sectorsarla0% (1)

- 2010 KMT Waterjet PSC Catalog - LDocument39 pages2010 KMT Waterjet PSC Catalog - LaeradriNo ratings yet

- Al Ijarah Vs Hire PurchaseDocument3 pagesAl Ijarah Vs Hire Purchasesimson singawahNo ratings yet

- JLL - Dallas Skyline Review - Spring 2014Document1 pageJLL - Dallas Skyline Review - Spring 2014Walter BialasNo ratings yet

- CV RobahjkDocument1 pageCV Robahjkemiyou100% (1)

- Advertisement Vs Sales PromotionDocument29 pagesAdvertisement Vs Sales PromotionPoorna VenkatNo ratings yet

- Tata Chemicals Case Study - International MKTGDocument5 pagesTata Chemicals Case Study - International MKTGJohn_Fernandes_7150No ratings yet

- Supplier QADocument41 pagesSupplier QAMoraru CiprianNo ratings yet

- Cover Letter DW Indonesia Reporter M Syahrul KhairahDocument1 pageCover Letter DW Indonesia Reporter M Syahrul Khairahmuhammad ArollNo ratings yet

- Sbi Education Loan PolicyDocument3 pagesSbi Education Loan Policyshaik.faridmpNo ratings yet