Professional Documents

Culture Documents

Green Mountain Coffee Roasters Inc Manual Procedures and Stand Alone PCs Expenditure Cycle

Green Mountain Coffee Roasters Inc Manual Procedures and Stand Alone PCs Expenditure Cycle

Uploaded by

Shivam AroraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Green Mountain Coffee Roasters Inc Manual Procedures and Stand Alone PCs Expenditure Cycle

Green Mountain Coffee Roasters Inc Manual Procedures and Stand Alone PCs Expenditure Cycle

Uploaded by

Shivam AroraCopyright:

Available Formats

GREEN MOUNTAIN COFFEE ROASTERS, INC.

(MANUAL PROCEDURES AND STAND-ALONE PCS)

(Prepared by Ronica Sharma, Lehigh University)

Green Mountain Coffee Roasters, Inc., was founded in 1981 and began as a small cafe in Waitsfield,

Vermont, roasting and serving premium coffee on the premises. Green Mountain blends and distributes

coffee to a variety of customers, including cafes, delis, and restaurants, and currently has about 6,700

customer accounts reaching states across the nation. As the company has grown, several beverages

have been added to their product line, including signature blends, light and heavy roasts, decaffeinated

coffee and teas, and herbal teas. Green Mountain Coffee Roasters, Inc., has been publicly traded since

1993.

Green Mountain Coffee has a warehouse and manufacturing plant located in Wilton, Vermont, where it

presently employees 250 full-time and part-time workers. The company receives its beans in bulk from a

select group of distributors located across the world, with their largest supplier being Columbia Beans Co.

Green Mountain Coffee also sells accessories that complement their products, including mugs,

thermoses, and coffee containers that they purchase from their supplier, Coffee Lovers, Inc. In addition,

Green Mountain purchases paper products such as coffee bags, coffee cups, and stirrers, which they

distribute to their customers.

Green Mountain’s accounting system consists of manual procedures supported by stand-alone PCs

located in various departments. Because these computers are not networked they cannot share data

digitally, and all interdepartmental communication is through hard-copy documents.

Green Mountain is a new audit client for your CPA firm and as manager on the assignment you are

examining their internal controls. The expenditure cycle is described in the following paragraphs.

Purchases System

Green Mountain Coffee purchases beans and blends from manufactures and then sells them to customer

stores. Sara is in charge of inventory management in the warehouse. From her PC, she reviews the

inventory ledger to identify inventory needs. When items fall to their pre-established reorder point, she

prepares a purchase requisition. She keeps a copy in her department for use later, files one in the open

purchase requisition file, and sends a copy to accounts payable. At the end of the day, she uses the

purchase requisitions to prepare a four-part purchase order. One copy is filed, two copies are sent to the

supplier, and one copy is sent to Fayth in the accounts payable department. When the goods arrive, Sara

inspects and counts them and sends the packing slip to accounts payable. Using a PC, Sara updates the

inventory subsidiary ledger and, at the end of day, sends an account summary to Vic in the general

ledger department.

After checking that the purchase requisition and purchase order exist to support the packing slip, Fayth

files the documents in the accounts payable pending file. The supplier’s invoice is mailed directly to

Fayth, who checks it against the documents in the pending file. Using a computer system, she updates

the accounts payable subsidiary ledger and records the transaction in the purchases journal. She then

files the purchase requisition, purchase order, packing slip, and invoice in the open accounts payable file.

At the end of the day, she prepares a journal voucher, which is sent to Vic in the general ledger

department. Using a separate computer system, Vic updates the control accounts affected by the

transactions and files the summary and journal vouchers.

Cash Disbursements System Summary

Fayth reviews the open accounts payable file for items due for payment, waiting until the last date to

make a payment and still take advantage of the discount. From her PC, she then updates (closes) the

appropriate accounts payable subsidiary record, prints a two-part check, and records the payment in the

check register file. At the close of day, Fayth mails the check to the supplier, files a copy, and prepares a

journal voucher, which goes to Vic. Vic records the transaction in the affected general ledger accounts

and files the journal voucher.

Required:

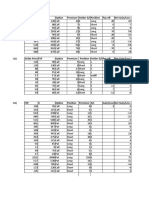

a. Create a data flow diagram of the current system.

b. Create a system flowchart of the existing system.

c. Analyze the system, make comments about it and recommend suggestions to improve the

system. Explain your solutions.

d. Prepare a redesigned system flowchart that adopts the recommendations you suggested.

You might also like

- NISM XV Research Analyst Short NotesDocument62 pagesNISM XV Research Analyst Short Noteskaushal talukderNo ratings yet

- Sun Smarter Life ClassicDocument7 pagesSun Smarter Life Classicpaul jan sarachoNo ratings yet

- Module 9 PAS 32Document5 pagesModule 9 PAS 32Jan JanNo ratings yet

- Practice of Direct Material ConsumedDocument4 pagesPractice of Direct Material Consumedi200051 Muhammad HassaanNo ratings yet

- SteeplechaseDocument3 pagesSteeplechaseArvey Peña DimacaliNo ratings yet

- Accounting Information Systems - Yola-170-171Document2 pagesAccounting Information Systems - Yola-170-171dindaNo ratings yet

- Green Mountain Coffee Roasters - Expenditure Cycle IIDocument2 pagesGreen Mountain Coffee Roasters - Expenditure Cycle IIcompaddictNo ratings yet

- Matt Demko Is The Loading Dock Supervisor For A Dry Cement Packaging CompanyDocument3 pagesMatt Demko Is The Loading Dock Supervisor For A Dry Cement Packaging CompanyShivam Arora100% (1)

- Isc Is An International Manufacturing Company With Over 100 SubsidiariesDocument2 pagesIsc Is An International Manufacturing Company With Over 100 SubsidiariesAmit PandeyNo ratings yet

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNo ratings yet

- ToA Quizzer 1 - Intro To PFRS (3TAY1617)Document6 pagesToA Quizzer 1 - Intro To PFRS (3TAY1617)Kyle ParisNo ratings yet

- 1Document35 pages1Rommel CruzNo ratings yet

- Chapter06 - Answer PDFDocument6 pagesChapter06 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSyuaningtyasnvNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- BOSCOMDocument18 pagesBOSCOMArah Opalec100% (1)

- Acc 310 - M004Document12 pagesAcc 310 - M004Edward Glenn BaguiNo ratings yet

- 9 Chapter6Document2 pages9 Chapter6Keanne ArmstrongNo ratings yet

- Acctg 1Document1 pageAcctg 1Julie Cairo0% (1)

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocument29 pagesModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- Advanced Accounting - Volume 1Document4 pagesAdvanced Accounting - Volume 1Erica CaliuagNo ratings yet

- Tina and KimDocument3 pagesTina and KimAngelli LamiqueNo ratings yet

- 02 Fundamentals of Assurance ServicesDocument5 pages02 Fundamentals of Assurance ServicesKristine TiuNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet

- Sycip Gorres Velayo & Co.: HistoryDocument5 pagesSycip Gorres Velayo & Co.: HistoryYonko ManotaNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- PSA 700, 705, 706, 710, 720 ExercisesDocument11 pagesPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNo ratings yet

- SW - NpoDocument1 pageSW - NpoGwy HipolitoNo ratings yet

- 6 ACCT 2A&B C. OperationDocument10 pages6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- 08 InvestmentquestfinalDocument13 pages08 InvestmentquestfinalAnonymous l13WpzNo ratings yet

- Discussion Questions and Problems Chapter 2 and 3Document3 pagesDiscussion Questions and Problems Chapter 2 and 3Muhammad Ullah0% (1)

- Installment SalesDocument6 pagesInstallment SalesMarivic C. VelascoNo ratings yet

- ACC 211 Review AssignmentDocument5 pagesACC 211 Review Assignmentglrosaaa cNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- 1Document10 pages1Viannice AcostaNo ratings yet

- Ans To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsDocument188 pagesAns To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsLouise GazaNo ratings yet

- Home Office and Branch AccountingDocument1 pageHome Office and Branch AccountingSheena ClataNo ratings yet

- Research 2 FinalDocument15 pagesResearch 2 FinalAngel Venus GuerreroNo ratings yet

- Bustamante, Jilian Kate A. (Activity 3)Document4 pagesBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNo ratings yet

- Auditing Theory - Internal Control ConsiderationDocument11 pagesAuditing Theory - Internal Control ConsiderationNeil BacaniNo ratings yet

- Research 4-P4Document3 pagesResearch 4-P4Jesusa CapuaNo ratings yet

- Chapter 22 - AnswerDocument1 pageChapter 22 - Answerlou-924No ratings yet

- 1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditDocument4 pages1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditXexiannaNo ratings yet

- Questionnaire ActDocument6 pagesQuestionnaire ActLorainne AjocNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- CPALEDocument1 pageCPALERalph Clarence NicodemusNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- Confidential: Section A - 20 Marks Scenario A. (3 Questions)Document4 pagesConfidential: Section A - 20 Marks Scenario A. (3 Questions)Otherr HafizNo ratings yet

- Chapter 11 Activity/Assignment: Ans. 10,000 SolutionDocument1 pageChapter 11 Activity/Assignment: Ans. 10,000 SolutionRandelle James FiestaNo ratings yet

- D. All of ThemDocument6 pagesD. All of ThemRyan CapistranoNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- Accounting InformationDocument3 pagesAccounting Informationnenette cruzNo ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document51 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Dzulija Talipan100% (1)

- Green Mountain Coffee RoastersDocument1 pageGreen Mountain Coffee RoastersTITIS WAHYUNINo ratings yet

- Green Mountain Coffee RoastersDocument2 pagesGreen Mountain Coffee RoastersTITIS WAHYUNINo ratings yet

- Appendix 1 Green Mountain Coffee RoastersDocument5 pagesAppendix 1 Green Mountain Coffee RoastersZale EzekielNo ratings yet

- Green Mountain Coffee Roasters, Inc.: (Prepared by Ronica Sharma, Lehigh University)Document6 pagesGreen Mountain Coffee Roasters, Inc.: (Prepared by Ronica Sharma, Lehigh University)Maria RubieNo ratings yet

- Manesar Case QuestionsDocument3 pagesManesar Case QuestionsShivam AroraNo ratings yet

- Issues in The Teach NG NoteDocument6 pagesIssues in The Teach NG NoteShivam Arora0% (1)

- Module 3-MIND MAPPING: ChallengeDocument2 pagesModule 3-MIND MAPPING: ChallengeShivam AroraNo ratings yet

- Agri OrganicDocument2 pagesAgri OrganicShivam AroraNo ratings yet

- Industry Analysis: Government Policies & Regulatory Framework Investment ApprovalDocument10 pagesIndustry Analysis: Government Policies & Regulatory Framework Investment ApprovalShivam AroraNo ratings yet

- Emerging Issues in Company LawDocument4 pagesEmerging Issues in Company LawShivam Arora0% (1)

- Book Review of ExecutionDocument3 pagesBook Review of ExecutionShivam AroraNo ratings yet

- Chapter - Vi Investment Pattern On Stock MarketsDocument34 pagesChapter - Vi Investment Pattern On Stock MarketsShivam AroraNo ratings yet

- Due To Political Turmoil at The Centre As Well As The Global Economic Changes and Fiscal Imbalances of The Country in Late 80Document4 pagesDue To Political Turmoil at The Centre As Well As The Global Economic Changes and Fiscal Imbalances of The Country in Late 80Shivam AroraNo ratings yet

- Case Sample 1Document3 pagesCase Sample 1Shivam AroraNo ratings yet

- Unit 14 - Liabilities of Auditor PDFDocument14 pagesUnit 14 - Liabilities of Auditor PDFShivam AroraNo ratings yet

- A Research Paper On:: Submitted To: Prof. Gomathy ThyagarajanDocument22 pagesA Research Paper On:: Submitted To: Prof. Gomathy ThyagarajanShivam AroraNo ratings yet

- Strike Price FSP Option Premium Holder E/Lposition Pay of Net Gain/LossDocument42 pagesStrike Price FSP Option Premium Holder E/Lposition Pay of Net Gain/LossShivam AroraNo ratings yet

- Module 2 Part 2Document65 pagesModule 2 Part 2Shivam AroraNo ratings yet

- Module 2 Part 3Document23 pagesModule 2 Part 3Shivam AroraNo ratings yet

- Module 1Document91 pagesModule 1Shivam AroraNo ratings yet

- Module 2 Part 4Document13 pagesModule 2 Part 4Shivam AroraNo ratings yet

- Fifo and LifoDocument4 pagesFifo and LifoShaik. Nazhath SulthanaNo ratings yet

- LLDA Citizens - Charter - 2021Document346 pagesLLDA Citizens - Charter - 2021CatzNo ratings yet

- An Analysis of The Title Insurance Industry: Charles Nyce and M. Martin BoyerDocument46 pagesAn Analysis of The Title Insurance Industry: Charles Nyce and M. Martin BoyerfsahraeiNo ratings yet

- Total Productive MaintenanceDocument25 pagesTotal Productive MaintenanceMuthu BaskaranNo ratings yet

- 4) Customer Related ProcessesDocument7 pages4) Customer Related ProcessesSagar DaundNo ratings yet

- Board Reporting TemplateDocument27 pagesBoard Reporting TemplateYung TanjungNo ratings yet

- Dell 1998 Annual ReportDocument29 pagesDell 1998 Annual Reportarundadwal007100% (1)

- Intro To Accountancy Research PDFDocument50 pagesIntro To Accountancy Research PDFbilly fernandezNo ratings yet

- Data Science Notes and AnswersDocument4 pagesData Science Notes and AnswersandrewarcayNo ratings yet

- Unit IV - (Managerial Economics) Market Structures & Pricing StrategiesDocument37 pagesUnit IV - (Managerial Economics) Market Structures & Pricing StrategiesAbhinav SachdevaNo ratings yet

- BLSDocument21 pagesBLSArvind MehtaNo ratings yet

- JPMorgan High Grade Credit FundamentalsDocument72 pagesJPMorgan High Grade Credit FundamentalsnowakowskidNo ratings yet

- Bayad Center - Group 8Document16 pagesBayad Center - Group 8GENESIS DE GUZMANNo ratings yet

- 13 Month PayDocument12 pages13 Month PayNielle BautistaNo ratings yet

- Evaluating A Firm's Financial PerformanceDocument47 pagesEvaluating A Firm's Financial PerformanceAhmed El KhateebNo ratings yet

- Project Report On::: Insider TradingDocument8 pagesProject Report On::: Insider TradingMadhuri KanadeNo ratings yet

- WMG Opsi 11mso1 Fazil 1159438 PmaDocument36 pagesWMG Opsi 11mso1 Fazil 1159438 PmaogslogoNo ratings yet

- The Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152Document8 pagesThe Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152ghada kotbNo ratings yet

- Multiplos 3 e Commerce DiscrecionalDocument3 pagesMultiplos 3 e Commerce DiscrecionalCesarNo ratings yet

- Case-Application Ch9Document3 pagesCase-Application Ch9Thu Hằng TrầnNo ratings yet

- Emirates - Porter's 5Document3 pagesEmirates - Porter's 5smba0802994% (18)

- Model Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLDocument39 pagesModel Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLTezendra SinghNo ratings yet

- Global Paracetamol MarketDocument3 pagesGlobal Paracetamol MarketZackNo ratings yet

- Ibo 6 em PDFDocument6 pagesIbo 6 em PDFFirdosh Khan100% (7)

- 2 Corporate Liquidation With Partial Answers and SolutionsDocument5 pages2 Corporate Liquidation With Partial Answers and SolutionsnickolocoNo ratings yet

- Customer Relation ManagementDocument25 pagesCustomer Relation ManagementAftabMughalNo ratings yet