Professional Documents

Culture Documents

Case Bab 6,,maria Hardina Wea

Case Bab 6,,maria Hardina Wea

Uploaded by

miraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Bab 6,,maria Hardina Wea

Case Bab 6,,maria Hardina Wea

Uploaded by

miraCopyright:

Available Formats

CASE STUDY – BAB 6

Nama : Maria Hardina Wea

NPM : 1606950560

1. Plot a graph of the newly estimated maintenance costs and repair savings projections,

assuming the protectors last for 7 more years.

Answer :

PowerUp Lloyd's Lloyd's new

tahun Investment and salvage Annnual maintenanceRepair savings Investment and salvage Annnual maintenance Repair savings maint. Cost- repair savings

0 -26000 0 0 -36000 0 0

1 0 -800 25000 0 -300 35000 34700

2 0 -800 25000 0 -300 32000 31700

3 0 -800 25000 0 -300 28000 27700

4 0 -800 25000 0 -1200 26000 24800

5 0 -800 25000 0 -1320 24000 22680

6 2000 -800 25000 0 -1452 22000 20548

7 0 -1597 20000 18403

8 0 -1757 18000 16243

9 0 -1933 16000 14067

10 0 -2126 14000 11874

AW element -6642 -800 25000 -7173 -977 26055

Total AW $17,558 $17,904

2. With these new estimates, what is the recalculated AW for the Lloyd’s protectors? Use the old

fi rst cost and maintenance cost estimates for the fi rst 3 years. If these estimates had been

made 3 years ago, would Lloyd’s still have been the economic choice?

Answer :

Nilai annua worth baru = $17904, nilai ini lebih sedikit lebih besar dari PW = $17558

Pilihan lloynds’s tetap dipilih tapi dengan margin yang kecil.

3. How has the capital recovery amount changed for the Lloyd’s protectors with these new

estimates?

Answer : Jumlah capital recovery = $7173 dan mengalami peningkatan dari $-7025

You might also like

- Literary Analysis - The NecklaceDocument5 pagesLiterary Analysis - The NecklaceDanny Hoi33% (3)

- SAft Purchase AgreementDocument22 pagesSAft Purchase AgreementSong BAONo ratings yet

- AMREEN of Assignment 6Document2 pagesAMREEN of Assignment 6Loshith KumarNo ratings yet

- International Trade FinanceDocument297 pagesInternational Trade Financesai kiran100% (1)

- FI Processes SCCDocument16 pagesFI Processes SCCGAANo ratings yet

- Director Financial Planning Analysis in New York NY Resume Howard SchierDocument2 pagesDirector Financial Planning Analysis in New York NY Resume Howard SchierHowardSchierNo ratings yet

- Cash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RentDocument4 pagesCash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RenttanimaNo ratings yet

- Regression StatisticsDocument10 pagesRegression StatisticsNovia SukmawatiNo ratings yet

- Deviation AnalysisDocument2 pagesDeviation AnalysisChona FontanillaNo ratings yet

- Problem 2.12 - SolutionDocument8 pagesProblem 2.12 - SolutiontanimaNo ratings yet

- Balance Sheet Assets Cash Non-Current Assets Current Asset EquipmentDocument3 pagesBalance Sheet Assets Cash Non-Current Assets Current Asset EquipmentAritra NaNo ratings yet

- Coton production of BRMDocument9 pagesCoton production of BRMAbdullah IlyasNo ratings yet

- Obj FN 60 50 Soln Obj STC Ass 4 10 100 Insp 2 1 22 STRG 3 3 39Document3 pagesObj FN 60 50 Soln Obj STC Ass 4 10 100 Insp 2 1 22 STRG 3 3 39vikas upadhyayNo ratings yet

- RentDocument3 pagesRentSneha KumariNo ratings yet

- Macro Assignment 2Document4 pagesMacro Assignment 2Wasi ChoudharyNo ratings yet

- Homework 2Document11 pagesHomework 2ayethNo ratings yet

- Método Costo Inicial, Valor de Salvingreso AnualDocument8 pagesMétodo Costo Inicial, Valor de Salvingreso AnualJose Elias Ojeda HerreraNo ratings yet

- Pipe Pressure RatingDocument2 pagesPipe Pressure RatingApoorv Singh100% (1)

- ConuDocument4 pagesConuPrabhat MishraNo ratings yet

- PreferenceShares - June 26 2017Document1 pagePreferenceShares - June 26 2017Tiso Blackstar GroupNo ratings yet

- Prachi Vahalkar FCD Assignment - Rajeshwari VeerDocument15 pagesPrachi Vahalkar FCD Assignment - Rajeshwari VeerVarun AgrawalNo ratings yet

- Iso 898-1Document1 pageIso 898-1abhineet.gargNo ratings yet

- Practica Calificada 3era Unidad NocheDocument24 pagesPractica Calificada 3era Unidad NocheNayelie RojasNo ratings yet

- Problema en ClaseDocument3 pagesProblema en ClaseNay BautistaNo ratings yet

- Preference Shares - November 6 2019Document1 pagePreference Shares - November 6 2019Tiso Blackstar GroupNo ratings yet

- PreferenceShares - June 23 2017Document1 pagePreferenceShares - June 23 2017Tiso Blackstar GroupNo ratings yet

- It FormatDocument1 pageIt Formatvaishak viswanathNo ratings yet

- Preference Shares - November 18 2019Document1 pagePreference Shares - November 18 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Homework - Supply Chain Design Chapter 6: Supply Contracts: P C $ 125 $ 55 $ 70 C S $ 55 $ 20 $ 35Document3 pagesHomework - Supply Chain Design Chapter 6: Supply Contracts: P C $ 125 $ 55 $ 70 C S $ 55 $ 20 $ 35Anh Cao Thị MinhNo ratings yet

- W&B Manual A320 IndexDocument1 pageW&B Manual A320 IndexAlan GomezNo ratings yet

- Bài tập phương pháp phần tử hữu hạn: Sinh viên thực hiện: Trần Tiến Trung. MSSV: 1713722Document3 pagesBài tập phương pháp phần tử hữu hạn: Sinh viên thực hiện: Trần Tiến Trung. MSSV: 1713722Huy Lê PhướcNo ratings yet

- Sales 4000000 4000000 Costs (%) 0.733333 0.75 Op Proft 1066667 1000000Document5 pagesSales 4000000 4000000 Costs (%) 0.733333 0.75 Op Proft 1066667 1000000shivmsNo ratings yet

- Preference Shares - March 21 2019Document1 pagePreference Shares - March 21 2019Tiso Blackstar GroupNo ratings yet

- Target Jember: Tanggal Listrik Bangunan Wifi Pemasukan PenghasilanDocument2 pagesTarget Jember: Tanggal Listrik Bangunan Wifi Pemasukan PenghasilanBurcot AjaNo ratings yet

- Ewing Far Sliding Scale TableDocument1 pageEwing Far Sliding Scale TableEwing Township, NJNo ratings yet

- Worksheets 2022 FarDocument7 pagesWorksheets 2022 FarMariñas, Romalyn D.No ratings yet

- MGT 115 Removal Exam 1S AY 2017 2018 25 Sept 2018Document6 pagesMGT 115 Removal Exam 1S AY 2017 2018 25 Sept 2018Kadita MageNo ratings yet

- Highlights of 7th CPC RecommendationsDocument7 pagesHighlights of 7th CPC Recommendationsomadvocatevijaykumarsingh369No ratings yet

- Ingreso Anuales de Amzon 2Document2 pagesIngreso Anuales de Amzon 2Leonel ColqueNo ratings yet

- Raouff FDocument6 pagesRaouff FRaouf TitiweNo ratings yet

- Preference Shares - March 24 2019Document1 pagePreference Shares - March 24 2019Anonymous 7A1d7fjj3No ratings yet

- Report and Analysis of Cooling Water QualityDocument4 pagesReport and Analysis of Cooling Water QualityFahmi FuadulNo ratings yet

- Matrix Calculation Task2 - 1Document2 pagesMatrix Calculation Task2 - 1Amanu PramonoNo ratings yet

- Azucena MBCpayrollDocument15 pagesAzucena MBCpayrollacctg2012No ratings yet

- 20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Document4 pages20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Jax TellerNo ratings yet

- Chart TitleDocument6 pagesChart TitleLUIZAGA GOMEZ SOFIA LEONORNo ratings yet

- Tugas TraseDocument13 pagesTugas TraseSyaifuddin MohammadNo ratings yet

- Estructuras 1: Dx Dy θyDocument28 pagesEstructuras 1: Dx Dy θykrenzhitaNo ratings yet

- Ordinaria 1290Document1 pageOrdinaria 1290alfa27No ratings yet

- Given Requirement (PC) : Pc/Sheet Raw Materials No. of Days Delayed Balance Delay 1St Day 2Nd DayDocument14 pagesGiven Requirement (PC) : Pc/Sheet Raw Materials No. of Days Delayed Balance Delay 1St Day 2Nd Daynairam_ellimacNo ratings yet

- Preference Shares - April 14 2019Document1 pagePreference Shares - April 14 2019Lisle Daverin BlythNo ratings yet

- Carga (N) Dist. Entre Puntos (MM)Document7 pagesCarga (N) Dist. Entre Puntos (MM)Enrique GonzálezNo ratings yet

- AwawDocument2 pagesAwawJunedy Sio SianturiNo ratings yet

- Preference Shares - March 26 2019Document1 pagePreference Shares - March 26 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 11 2019Document1 pagePreference Shares - April 11 2019Tiso Blackstar GroupNo ratings yet

- Table 2-3 Rated Lifting Weight of Main Cargo Boom of QY50C Crane (Unit: KG)Document5 pagesTable 2-3 Rated Lifting Weight of Main Cargo Boom of QY50C Crane (Unit: KG)stalin vNo ratings yet

- Mba Sem I Home Assignments - MS-Excel Name - Jay Oswal Fymba Roll NO-142 Section ADocument5 pagesMba Sem I Home Assignments - MS-Excel Name - Jay Oswal Fymba Roll NO-142 Section AJay OswalNo ratings yet

- Bora Skyscraper Limited SandeshDocument17 pagesBora Skyscraper Limited SandeshVISHNU HARINo ratings yet

- Preference Shares - July 14 2019Document1 pagePreference Shares - July 14 2019Anonymous C13oy8No ratings yet

- Tarea para Seguir Pagina 851Document9 pagesTarea para Seguir Pagina 851Fabricio CastilloNo ratings yet

- Lab 1Document7 pagesLab 1cameronrobin495No ratings yet

- AccDocument123 pagesAccNguyen Thi Lan Anh (K17 HCM)No ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Proposal Bantuan Dana: Asia Youth International MunDocument2 pagesProposal Bantuan Dana: Asia Youth International MunmiraNo ratings yet

- Intro Foundation EngineeringDocument4 pagesIntro Foundation EngineeringmiraNo ratings yet

- Stationing Trase 4 Default 000Document30 pagesStationing Trase 4 Default 000miraNo ratings yet

- Soal Latihan Kelas 8 Selasa 9 April 2019Document7 pagesSoal Latihan Kelas 8 Selasa 9 April 2019miraNo ratings yet

- Yale EndowmentDocument40 pagesYale Endowmentpurple_panda_pantsNo ratings yet

- Bert and Ernie Accounts Prep QuestionDocument3 pagesBert and Ernie Accounts Prep Questioncons theNo ratings yet

- Afar Midterms Reviewer - PracticeDocument10 pagesAfar Midterms Reviewer - PracticeAlmira Bulilan TanNo ratings yet

- FINALE Accounts ManagementDocument36 pagesFINALE Accounts ManagementGel GarabilesNo ratings yet

- SSC MOCK TEST Paper - 153 39 PDFDocument22 pagesSSC MOCK TEST Paper - 153 39 PDFRitu narwalNo ratings yet

- TermsDocument3 pagesTermsAmy GarrettNo ratings yet

- Merger of JSW Steel Limited & Ispat Industries LimitedDocument2 pagesMerger of JSW Steel Limited & Ispat Industries Limitedpriteshvadera12345No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Ec 392 PS 2Document1 pageEc 392 PS 2Pablo MercadoNo ratings yet

- Adobe Scan 11-Mar-2024Document1 pageAdobe Scan 11-Mar-2024searchjobs4119No ratings yet

- SAP Financial Supply Chain Management (FSCM) Online TrainingDocument4 pagesSAP Financial Supply Chain Management (FSCM) Online TrainingGloryittechnologiesNo ratings yet

- Share CapitalDocument43 pagesShare CapitalAnalou LopezNo ratings yet

- 63) Tuazon v. Orosco, 5 Phil 596Document4 pages63) Tuazon v. Orosco, 5 Phil 596Micho DiezNo ratings yet

- S&P Agreement - SA708DDocument5 pagesS&P Agreement - SA708DJojo Al-hami Zurairi Y.MNo ratings yet

- Case Study 2Document7 pagesCase Study 2Afifah Abd HalimNo ratings yet

- Reckitt BenckiserDocument55 pagesReckitt BenckiserSiddhant Chandel100% (5)

- Module 6 Irr and Payback PeriodDocument4 pagesModule 6 Irr and Payback PeriodSulaim Al KautsarNo ratings yet

- BFI Sample CommerceDocument24 pagesBFI Sample CommerceMAREESWARAN KNo ratings yet

- Commercial Law Review Cases Batch 2Document42 pagesCommercial Law Review Cases Batch 2KarmaranthNo ratings yet

- Cost Accounting: Sixteenth Edition, Global EditionDocument32 pagesCost Accounting: Sixteenth Edition, Global EditionAhmed El KhateebNo ratings yet

- Arab Sudanese Bank: Sudanese Private Ccompany LTDDocument30 pagesArab Sudanese Bank: Sudanese Private Ccompany LTDShadow PrinceNo ratings yet

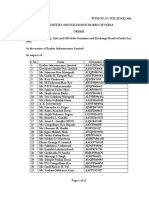

- Order in The Matter of Exelon Infrastructure LimitedDocument22 pagesOrder in The Matter of Exelon Infrastructure LimitedShyam SunderNo ratings yet

- Bay' Al TawarruqDocument1 pageBay' Al TawarruqAriff MustafaNo ratings yet

- Understanding Financial Statements, Taxes, and Cash Flows:, Prentice Hall, IncDocument50 pagesUnderstanding Financial Statements, Taxes, and Cash Flows:, Prentice Hall, IncYuslia Nandha Anasta SariNo ratings yet

- Income and Tax AuthorityDocument21 pagesIncome and Tax AuthorityRatul HaqueNo ratings yet