Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsInvestment Management Project

Investment Management Project

Uploaded by

Archana ChapatwalaThis document contains data on the monthly stock returns of three companies - Reliance, TCS, and ITC - from April 2018 to March 2019. It also contains calculations of average returns, variances, covariances, and correlations for the three stocks. Various portfolios were created with different weightages for the three stocks, and their returns, variances, standard deviations, and Sharp ratios were calculated. An efficient frontier graph was plotted. A portfolio was created on Moneycontrol with a total net worth of Rs. 4,66,280 and its daily gain was calculated. The Sharp ratios for portfolios with different weightages of the original portfolio and risk-free asset were also calculated.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Smart Money Entry TypesDocument15 pagesSmart Money Entry TypesEyad Qarqash96% (46)

- Valuation HandbookDocument2 pagesValuation HandbookPedro DiasNo ratings yet

- Investors Perception Towards Stock MarketDocument67 pagesInvestors Perception Towards Stock MarketHappy Singh36% (22)

- Mandiri KusnoDocument10 pagesMandiri KusnoANGGUNNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- 2022 バナナMonthly Update SepDocument1 page2022 バナナMonthly Update SepThuan DuongNo ratings yet

- Taller de PortafolioDocument18 pagesTaller de PortafolioEdi CostaNo ratings yet

- Analisis InvestasiDocument5 pagesAnalisis InvestasihynoNo ratings yet

- GridExport December 8 2022 19 20 38Document4 pagesGridExport December 8 2022 19 20 38FBusinessNo ratings yet

- Taller Riesgo FroDocument41 pagesTaller Riesgo FroSHARON ARANGONo ratings yet

- Potfolio ManagementDocument3 pagesPotfolio Managementsomya guptaNo ratings yet

- How To Pricing LoansDocument2 pagesHow To Pricing LoansMatNo ratings yet

- Dataset 1 - Class ExerciseDocument3 pagesDataset 1 - Class ExerciseRitesh SahaNo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- Inputs Bank PG 2020 2019 2018 2017 2016 2020Document15 pagesInputs Bank PG 2020 2019 2018 2017 2016 2020CKNo ratings yet

- IV PortDocument19 pagesIV PortAchilles AkhilNo ratings yet

- Real Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPDocument3 pagesReal Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPGabriel WaitikoskiNo ratings yet

- Alex Sharpe - S PortfolioDocument7 pagesAlex Sharpe - S PortfolioPedro José ZapataNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- Mendoza Vargas Danna JikelDocument4 pagesMendoza Vargas Danna Jikelfabian herreraNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Latihan CAPM CALDocument6 pagesLatihan CAPM CALanwarchoiNo ratings yet

- Bank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetDocument2 pagesBank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetMartha Gracia ManurungNo ratings yet

- Item Uni/Año $/UNIDDocument11 pagesItem Uni/Año $/UNIDCatalina TiqueNo ratings yet

- Kinerja Bisnis Mikro Januari 2017: 04459 - Unit Puteran TasikmalayaDocument2 pagesKinerja Bisnis Mikro Januari 2017: 04459 - Unit Puteran Tasikmalayaina kurniasihNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Portfolio Performance PresentationDocument9 pagesPortfolio Performance Presentationharshwardhan.singh202No ratings yet

- Advanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDDocument4 pagesAdvanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDJayesh PurohitNo ratings yet

- Efficient FrontiersDocument10 pagesEfficient FrontiersMuhammad Ahsan MukhtarNo ratings yet

- Ranking CoberturasDocument13 pagesRanking CoberturasRoberto Mtz tiburcioNo ratings yet

- Total Benchmarking Raindo Putra LestariDocument4 pagesTotal Benchmarking Raindo Putra LestariImehNo ratings yet

- Latihan 2 - Pengkategorian Saham - Nurfirda Alifia (11221531)Document2 pagesLatihan 2 - Pengkategorian Saham - Nurfirda Alifia (11221531)Fadya PutriNo ratings yet

- KHS New Daily Progres UpdateDocument3,256 pagesKHS New Daily Progres UpdateRifaldyo TrinandaNo ratings yet

- Amild KLY PG ReportDocument40 pagesAmild KLY PG ReportIvan HartanaNo ratings yet

- Data Neraca Perdagangan - EditDocument8 pagesData Neraca Perdagangan - EditMega SenoputriNo ratings yet

- Book 7Document5 pagesBook 7Bio Audi HanantioNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- JK Agri GeneticsDocument32 pagesJK Agri GeneticsXicaveNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Bitumen Extraction Test: Gradation of Aggregate of BC WT of SampleDocument6 pagesBitumen Extraction Test: Gradation of Aggregate of BC WT of Sampleamit singhNo ratings yet

- BetaDocument7 pagesBetaMutaz AleidehNo ratings yet

- Return Saham Bulan A B C rA-rA RB-RBDocument8 pagesReturn Saham Bulan A B C rA-rA RB-RBCitra ParwatiNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Confiabilidad EjerciciosDocument10 pagesConfiabilidad EjerciciosGely CruzNo ratings yet

- Reporte de Ratios Nasdaq - Mayo 2020Document10 pagesReporte de Ratios Nasdaq - Mayo 2020Pety SuarNo ratings yet

- Lap. Crosseling February 2022Document59 pagesLap. Crosseling February 2022Fatimah RizkiNo ratings yet

- 00 - 49 - Daily - Report JAM 12.00Document52 pages00 - 49 - Daily - Report JAM 12.00maisyaNo ratings yet

- SCM AbcDocument2 pagesSCM Abcjana.nel345No ratings yet

- Preparatory Examination Provincial Results Analysis 2023Document5 pagesPreparatory Examination Provincial Results Analysis 2023Agnes MmathaboNo ratings yet

- Excel Stock and Bond PortfolioDocument7 pagesExcel Stock and Bond Portfolioapi-27174321No ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- CombinepdfDocument2 pagesCombinepdfAizon SusulanNo ratings yet

- Gantt Chart SampleDocument5 pagesGantt Chart SampleZen Marl GaorNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Bài tập tài chính định lượng 2Document23 pagesBài tập tài chính định lượng 2THÀNH NGUYỄN THỊ MINHNo ratings yet

- Ejercicio 1 AnálisisDocument7 pagesEjercicio 1 AnálisisscawdarkoNo ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Dfi 501 Course OutlineDocument3 pagesDfi 501 Course OutlineblackshizoNo ratings yet

- Harnischfeger Corporation ResearchDocument2 pagesHarnischfeger Corporation ResearchMahmood KarimNo ratings yet

- Chapter 5 InvestmentDocument49 pagesChapter 5 InvestmentmeenNo ratings yet

- Cost of CapitalDocument44 pagesCost of CapitalSubia Hasan50% (4)

- HandlDocument8 pagesHandleliyas mohammedNo ratings yet

- Consistent Pricing Model For VolatilityDocument38 pagesConsistent Pricing Model For VolatilitypedroperezNo ratings yet

- Group Project Guidelines PDFDocument3 pagesGroup Project Guidelines PDFRami BadranNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisMasud Khan ShakilNo ratings yet

- Sukuk Market in Saudi ArabiaDocument19 pagesSukuk Market in Saudi ArabiafathalbabNo ratings yet

- CBP Circular No. 783 81 Interest On Loans and Yield On Purchases ofDocument3 pagesCBP Circular No. 783 81 Interest On Loans and Yield On Purchases ofEnarftedNo ratings yet

- Industry Profile: CommodityDocument12 pagesIndustry Profile: CommoditySaidi ReddyNo ratings yet

- CDC UP Quality Management Plan TemplateDocument38 pagesCDC UP Quality Management Plan TemplateMuhammad ImranNo ratings yet

- Common Stocks, Uncommon Profits by Phil Fisher - Review by Henrik AnderssonDocument1 pageCommon Stocks, Uncommon Profits by Phil Fisher - Review by Henrik AnderssonaxiosbibliosNo ratings yet

- Equity MarketDocument3 pagesEquity MarketMihir ThackerNo ratings yet

- Solutions To Chapter 11 Introduction To Risk, Return, and The Opportunity Cost of CapitalDocument10 pagesSolutions To Chapter 11 Introduction To Risk, Return, and The Opportunity Cost of CapitalMelva CynthiaNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Foreign Exchange in PDFDocument62 pagesForeign Exchange in PDFArun Kumar100% (2)

- Tech AnalysisDocument19 pagesTech AnalysisjatingediaNo ratings yet

- Order Block Trading GuideDocument7 pagesOrder Block Trading GuidevikibahlNo ratings yet

- Role of An International Financial ManagerDocument13 pagesRole of An International Financial ManagermanoranjanpatraNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Investment AdviceDocument5 pagesInvestment Adviceniketanpatel86No ratings yet

- Introduction To Mutual FundsDocument17 pagesIntroduction To Mutual FundsSaakshi SinghalNo ratings yet

- FUJIYA-Cover To Page 172Document192 pagesFUJIYA-Cover To Page 172kokueiNo ratings yet

- Internship Report of Js BankDocument67 pagesInternship Report of Js BankSalahaudin67% (3)

- E21 An Open Letter To Chairman Bernanke QE2Document1 pageE21 An Open Letter To Chairman Bernanke QE2richardck61No ratings yet

Investment Management Project

Investment Management Project

Uploaded by

Archana Chapatwala0 ratings0% found this document useful (0 votes)

12 views12 pagesThis document contains data on the monthly stock returns of three companies - Reliance, TCS, and ITC - from April 2018 to March 2019. It also contains calculations of average returns, variances, covariances, and correlations for the three stocks. Various portfolios were created with different weightages for the three stocks, and their returns, variances, standard deviations, and Sharp ratios were calculated. An efficient frontier graph was plotted. A portfolio was created on Moneycontrol with a total net worth of Rs. 4,66,280 and its daily gain was calculated. The Sharp ratios for portfolios with different weightages of the original portfolio and risk-free asset were also calculated.

Original Description:

sharpe model

Original Title

Investment Management Project-converted (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains data on the monthly stock returns of three companies - Reliance, TCS, and ITC - from April 2018 to March 2019. It also contains calculations of average returns, variances, covariances, and correlations for the three stocks. Various portfolios were created with different weightages for the three stocks, and their returns, variances, standard deviations, and Sharp ratios were calculated. An efficient frontier graph was plotted. A portfolio was created on Moneycontrol with a total net worth of Rs. 4,66,280 and its daily gain was calculated. The Sharp ratios for portfolios with different weightages of the original portfolio and risk-free asset were also calculated.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views12 pagesInvestment Management Project

Investment Management Project

Uploaded by

Archana ChapatwalaThis document contains data on the monthly stock returns of three companies - Reliance, TCS, and ITC - from April 2018 to March 2019. It also contains calculations of average returns, variances, covariances, and correlations for the three stocks. Various portfolios were created with different weightages for the three stocks, and their returns, variances, standard deviations, and Sharp ratios were calculated. An efficient frontier graph was plotted. A portfolio was created on Moneycontrol with a total net worth of Rs. 4,66,280 and its daily gain was calculated. The Sharp ratios for portfolios with different weightages of the original portfolio and risk-free asset were also calculated.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

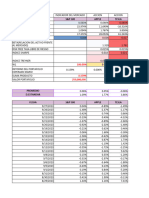

PART A

IT SECTOR FMGC SECTOR

DATE INDUSTRIAL SECTOR

(B) (C)

RELIANCE TATA COMSULTANCY SERVICES LTD. ITC Ltd.

(A) (B) (C)

Apr-18 996.3 1766.05 281.45

May-18 921.35 1741.05 271.65

Jun-18 972.45 1847.75 266.2

Jul-18 1186 1940.2 297.7

Aug-18 1241.65 2078.4 319.85

Sep-18 1257.95 2183.7 297.75

Oct-18 1061.25 1938.15 280.1

Nov-18 1167.55 1968.25 285.8

Dec-18 1121.25 1893.05 281.65

Jan-19 1227.15 2014.1 278.65

Feb-19 1231.05 1983.45 276.05

Mar-19 1363.25 2001.65 297.25

RETURNS OF DIFFERENT STOCK

Return of A Return of B Return of C

-7.52% -1.42% -3.48%

5.55% 6.13% -2.01%

21.96% 5.00% 11.83%

4.69% 7.12% 7.44%

1.31% 5.07% -6.91%

-15.64% -11.24% -5.93%

10.02% 1.55% 2.03%

-3.97% -3.82% -1.45%

9.44% 6.39% -1.07%

0.32% -1.52% -0.93%

10.74% 0.92% 7.68%

1.18% 0.60&

AVERAGE RETURN 3.08%

SD 10.17% 5.57% 5.97%

0.28% 0.32%

VARIANCE 0.94%

Ra & Rb 0.38%

Covariance Ra & Rc 0.43%

Rb & Rc 0.13%

Ra & Rb 0.75

Correlation Ra & Rc 0.77

Rb & Rc 0.41

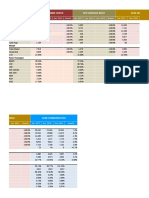

WEIGHTS OF DIFFERENT PORTFOLIOS, PORTFOLIO RETURN, Portfolio Variance, Portfolio SD

Weightage of A Weightage of Weightage Portfolio Portfolio Portfolio Sharp

B of C Return Variance SD ratio

0% 80% 20% 1.07%

10% 50% 40% 1.14% 0.003 5.29% -0.730

20% 40% 40% 1.33% 0.003 5.78% -0.635

30% 50% 20% 1.63% 0.004 6.29% -0.536

40% 40% 20% 1.82% 0.005 6.80% -0.468

50% 40% 10% 2.07% 0.005 7.34% -0.399

60% 30% 10% 2.26% 0.006 7.88% -0.348

70% 20% 10% 2.45% 0.007 8.44% -0.302

80% 10% 10% 2.64% 0.008 9.02% -0.262

90% 10% 0% 2.89% 0.009 9.58% -0.220

100% 0% 0% 3.08% 0.010 10.17% -0.189

EFFICIENT FRONTIER GRAPH:

PART – B

BUILDING A PORTFOLIO ON MONEY CONTROL

INTERPRETATION:

The total net worth of portfolio is 4,66,280. Its daily gain is

295. According to our portfolio ITC shows the positive increase

of 0.7%. Whereas reliance shows the decrease of 0.44% and

TCS shows total decrease of 0.28%. Hence we can say that ITC

has positive gain, while reliance and TCS has negative gain in

total net worth.

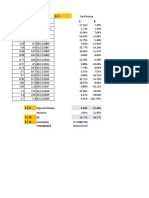

PART – C

CALCULATING SHARPE RATIO:

Portfolio as per CML

Return of Portfolio 2.64%

SD of Portfolio 9.58

Risk Free Return 5%

Sd of Risk free

Weightage of Portfolio Weightage of Risk free

100% 0%

90% 10%

80% 20%

70% 30%

60% 40%

50% 50%

40% 60%

30% 70%

20% 80%

10% 90%

0% 100%

New Portfolio New Sharp

Portfolio variance Portfolio Ratio

Returns SD

2.88% 74.34 7.66 0.002

3.11% 58.74 6.71 0.002

3.35% 44.97 5.75 0.0028

3.58% 33.04 4.79 0.0029

3.82% 22.94 3.83 0.0030

4.06% 14.68 2.87 0.0032

4.29% 8.26 1.92 0.0036

4.53% 3.67 0.96 0.0041

4.76% 0.92 0.00 0

5.00% 0.00 0.00 0

0.00% 0.00 0.00 0

You might also like

- Smart Money Entry TypesDocument15 pagesSmart Money Entry TypesEyad Qarqash96% (46)

- Valuation HandbookDocument2 pagesValuation HandbookPedro DiasNo ratings yet

- Investors Perception Towards Stock MarketDocument67 pagesInvestors Perception Towards Stock MarketHappy Singh36% (22)

- Mandiri KusnoDocument10 pagesMandiri KusnoANGGUNNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- 2022 バナナMonthly Update SepDocument1 page2022 バナナMonthly Update SepThuan DuongNo ratings yet

- Taller de PortafolioDocument18 pagesTaller de PortafolioEdi CostaNo ratings yet

- Analisis InvestasiDocument5 pagesAnalisis InvestasihynoNo ratings yet

- GridExport December 8 2022 19 20 38Document4 pagesGridExport December 8 2022 19 20 38FBusinessNo ratings yet

- Taller Riesgo FroDocument41 pagesTaller Riesgo FroSHARON ARANGONo ratings yet

- Potfolio ManagementDocument3 pagesPotfolio Managementsomya guptaNo ratings yet

- How To Pricing LoansDocument2 pagesHow To Pricing LoansMatNo ratings yet

- Dataset 1 - Class ExerciseDocument3 pagesDataset 1 - Class ExerciseRitesh SahaNo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- Inputs Bank PG 2020 2019 2018 2017 2016 2020Document15 pagesInputs Bank PG 2020 2019 2018 2017 2016 2020CKNo ratings yet

- IV PortDocument19 pagesIV PortAchilles AkhilNo ratings yet

- Real Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPDocument3 pagesReal Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPGabriel WaitikoskiNo ratings yet

- Alex Sharpe - S PortfolioDocument7 pagesAlex Sharpe - S PortfolioPedro José ZapataNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- Mendoza Vargas Danna JikelDocument4 pagesMendoza Vargas Danna Jikelfabian herreraNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Latihan CAPM CALDocument6 pagesLatihan CAPM CALanwarchoiNo ratings yet

- Bank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetDocument2 pagesBank Mandiri Taspen BPD Sumatera Barat Bank Mestika: AssetMartha Gracia ManurungNo ratings yet

- Item Uni/Año $/UNIDDocument11 pagesItem Uni/Año $/UNIDCatalina TiqueNo ratings yet

- Kinerja Bisnis Mikro Januari 2017: 04459 - Unit Puteran TasikmalayaDocument2 pagesKinerja Bisnis Mikro Januari 2017: 04459 - Unit Puteran Tasikmalayaina kurniasihNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Portfolio Performance PresentationDocument9 pagesPortfolio Performance Presentationharshwardhan.singh202No ratings yet

- Advanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDDocument4 pagesAdvanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDJayesh PurohitNo ratings yet

- Efficient FrontiersDocument10 pagesEfficient FrontiersMuhammad Ahsan MukhtarNo ratings yet

- Ranking CoberturasDocument13 pagesRanking CoberturasRoberto Mtz tiburcioNo ratings yet

- Total Benchmarking Raindo Putra LestariDocument4 pagesTotal Benchmarking Raindo Putra LestariImehNo ratings yet

- Latihan 2 - Pengkategorian Saham - Nurfirda Alifia (11221531)Document2 pagesLatihan 2 - Pengkategorian Saham - Nurfirda Alifia (11221531)Fadya PutriNo ratings yet

- KHS New Daily Progres UpdateDocument3,256 pagesKHS New Daily Progres UpdateRifaldyo TrinandaNo ratings yet

- Amild KLY PG ReportDocument40 pagesAmild KLY PG ReportIvan HartanaNo ratings yet

- Data Neraca Perdagangan - EditDocument8 pagesData Neraca Perdagangan - EditMega SenoputriNo ratings yet

- Book 7Document5 pagesBook 7Bio Audi HanantioNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- JK Agri GeneticsDocument32 pagesJK Agri GeneticsXicaveNo ratings yet

- Shivangi Rastogi BM 019161Document9 pagesShivangi Rastogi BM 019161Berkshire Hathway coldNo ratings yet

- Bitumen Extraction Test: Gradation of Aggregate of BC WT of SampleDocument6 pagesBitumen Extraction Test: Gradation of Aggregate of BC WT of Sampleamit singhNo ratings yet

- BetaDocument7 pagesBetaMutaz AleidehNo ratings yet

- Return Saham Bulan A B C rA-rA RB-RBDocument8 pagesReturn Saham Bulan A B C rA-rA RB-RBCitra ParwatiNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Confiabilidad EjerciciosDocument10 pagesConfiabilidad EjerciciosGely CruzNo ratings yet

- Reporte de Ratios Nasdaq - Mayo 2020Document10 pagesReporte de Ratios Nasdaq - Mayo 2020Pety SuarNo ratings yet

- Lap. Crosseling February 2022Document59 pagesLap. Crosseling February 2022Fatimah RizkiNo ratings yet

- 00 - 49 - Daily - Report JAM 12.00Document52 pages00 - 49 - Daily - Report JAM 12.00maisyaNo ratings yet

- SCM AbcDocument2 pagesSCM Abcjana.nel345No ratings yet

- Preparatory Examination Provincial Results Analysis 2023Document5 pagesPreparatory Examination Provincial Results Analysis 2023Agnes MmathaboNo ratings yet

- Excel Stock and Bond PortfolioDocument7 pagesExcel Stock and Bond Portfolioapi-27174321No ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- CombinepdfDocument2 pagesCombinepdfAizon SusulanNo ratings yet

- Gantt Chart SampleDocument5 pagesGantt Chart SampleZen Marl GaorNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Bài tập tài chính định lượng 2Document23 pagesBài tập tài chính định lượng 2THÀNH NGUYỄN THỊ MINHNo ratings yet

- Ejercicio 1 AnálisisDocument7 pagesEjercicio 1 AnálisisscawdarkoNo ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Dfi 501 Course OutlineDocument3 pagesDfi 501 Course OutlineblackshizoNo ratings yet

- Harnischfeger Corporation ResearchDocument2 pagesHarnischfeger Corporation ResearchMahmood KarimNo ratings yet

- Chapter 5 InvestmentDocument49 pagesChapter 5 InvestmentmeenNo ratings yet

- Cost of CapitalDocument44 pagesCost of CapitalSubia Hasan50% (4)

- HandlDocument8 pagesHandleliyas mohammedNo ratings yet

- Consistent Pricing Model For VolatilityDocument38 pagesConsistent Pricing Model For VolatilitypedroperezNo ratings yet

- Group Project Guidelines PDFDocument3 pagesGroup Project Guidelines PDFRami BadranNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisMasud Khan ShakilNo ratings yet

- Sukuk Market in Saudi ArabiaDocument19 pagesSukuk Market in Saudi ArabiafathalbabNo ratings yet

- CBP Circular No. 783 81 Interest On Loans and Yield On Purchases ofDocument3 pagesCBP Circular No. 783 81 Interest On Loans and Yield On Purchases ofEnarftedNo ratings yet

- Industry Profile: CommodityDocument12 pagesIndustry Profile: CommoditySaidi ReddyNo ratings yet

- CDC UP Quality Management Plan TemplateDocument38 pagesCDC UP Quality Management Plan TemplateMuhammad ImranNo ratings yet

- Common Stocks, Uncommon Profits by Phil Fisher - Review by Henrik AnderssonDocument1 pageCommon Stocks, Uncommon Profits by Phil Fisher - Review by Henrik AnderssonaxiosbibliosNo ratings yet

- Equity MarketDocument3 pagesEquity MarketMihir ThackerNo ratings yet

- Solutions To Chapter 11 Introduction To Risk, Return, and The Opportunity Cost of CapitalDocument10 pagesSolutions To Chapter 11 Introduction To Risk, Return, and The Opportunity Cost of CapitalMelva CynthiaNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Foreign Exchange in PDFDocument62 pagesForeign Exchange in PDFArun Kumar100% (2)

- Tech AnalysisDocument19 pagesTech AnalysisjatingediaNo ratings yet

- Order Block Trading GuideDocument7 pagesOrder Block Trading GuidevikibahlNo ratings yet

- Role of An International Financial ManagerDocument13 pagesRole of An International Financial ManagermanoranjanpatraNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Investment AdviceDocument5 pagesInvestment Adviceniketanpatel86No ratings yet

- Introduction To Mutual FundsDocument17 pagesIntroduction To Mutual FundsSaakshi SinghalNo ratings yet

- FUJIYA-Cover To Page 172Document192 pagesFUJIYA-Cover To Page 172kokueiNo ratings yet

- Internship Report of Js BankDocument67 pagesInternship Report of Js BankSalahaudin67% (3)

- E21 An Open Letter To Chairman Bernanke QE2Document1 pageE21 An Open Letter To Chairman Bernanke QE2richardck61No ratings yet