Professional Documents

Culture Documents

Accounts Receivable

Accounts Receivable

Uploaded by

Mikaela Samonte0 ratings0% found this document useful (0 votes)

2K views11 pagesnotes

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2K views11 pagesAccounts Receivable

Accounts Receivable

Uploaded by

Mikaela Samontenotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 11

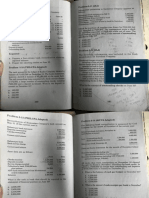

PROBLEMS

Problem 6-1 Multiple choice (AA)

sLiTende receivabloe are classiSe a9 GuEreHeiaagat ey

Thre rearnably expected to be collected

a. Within one year.

Within the normal operating em

oie fhe year or within the operating eee Whichever

is shorter.

sa Mnhone year or within the opernling IS MBs

is longer.

2. Nontrade rcsivables are casifed as cureat Sts By

Nontrad reasonably expected to be realized in eat

‘Within one yar or within the operating eve, whichever

is shorter

1b whiners year or within the operating fee, whichever

is Jonge.

ce. Within the normal operating ee

& Witnin one year, the Length of the operat see

notwithstanding

4 Which of the flowing statement is trie exces

Which ion of recsvabes inthe atatament sf inane)

position?

ivables are show?

separately

tb. Nontrade receivables

ensure of short-term receivables in the

Ba teeich totaen i in Socrenet vaio

ged nh ate, Faure ol

2M pedove ot make the statement of fname

tileading bocause en

hor-term receivables are not interest bearing.

er dobttul accounts inclios assent

ment. of the discount isnot material

soa Sen can be 01d toa bank or factor.

lances in acoounts receivable shall be classified a

abilities

feof accounts payable

erm liabilities

from accounts receivable

following statements is incorrect regarding

are fancilassets |

SS fecal nares

sdurtics are may be reported as separate

‘statement of financial position. P

Meccelvabl ae written promises of the

uy fbr goods or service

fing should be recorded in accounts

shall be classified as,

current depending on the

m within on yon oF over

9. Where the operating cyle extends beyond 986 aa Beste

of normal credit terms asin te cas of i ales

household appliances

“Its proper to classify the entire ceaBleaiaaasene

assets with disclosure of the amount i“

sithin one year, if material

The entire racivables ae shown 8 a

©. ‘The portion due in one year is shows 88

balance ae noncurrent

4. The receivables are not repented:

10. In the case of long-term installment

fatate inetallment sales) where a Moe

fecelvables would be collected beyon

operating ele

a. The entire receivables are shown a8 GUIS

‘Thaseure of the amount not currently des

b, ‘The entire receivablos are shown

© Only the portion curently due is shown a3:

fand the balance as noneurrent.

4. Tho entire receivables are shown 83

‘Trelosure of the amount not eurrently due

Problem 6-2 Multiple choice (AICPA Adapted)

1. Which method of recording bad debt loss is epnsistent with

bpecrual accounting?

Allowance method

Direct weiteoff method

Percent of sales method

Peroent of accounts receivable

shod of estimating doubtful necunts that crmphasizes

he fiom rather than ¥aceme measurement i= the

‘method based on

‘he accounts receivable

returns and allowances

munge of relating an entity's bad debt experience

Me josivable is that this approach

reasonably correct measurement of accounts

Se ie in the suntement of financial position

tad debt loss to the period of sale

ely generally accepted method for measuring

ints receivable

Mtimaten of tncolletible accounts necessary

yrance method of recognizing doubtful accounts

Tent to record the weiteotT ofa specific account

fance method for recognizing

Aury to record the writeoft of a

unt

fe nor working capital

Thor accounts ©

nd working capital

and accounts reccivable

wable

sognizing bad den ‘an accounts receivable aging schedule is prepared, a

‘of eallaetion of 4), oP enputations ia made to determine the estimated

oie gosounts, The resulting amount from this ging

7.When the allowance method of ree

expense is used, the entries a the tm

account previously written off would

allowance for doubtful ace

2) Have moet ont ms added tothe total acounts written off during the

©. Have noclfect on the allowance se ee nanan

XL Have no effet on net sncome r ot eet alan

nt of doubMul accounts expense forthe yene

8, Anentity uses the allowance method arama that should be added to the beginning

scouts expense, What isthe impacto sao fn a ee a

recount previously wntten of? nace fr doubt eee

Jesited credit balance ofthe allowance

to be reported at yearend

a. Decrease the

for d

a. No eflect on both allowance for doubt

b. Noveffect on allowance for dowbtful ssa

JQeovnse in doubtful accounts expense

‘a, Increase in allowance for doubtful the following methods of determining bad debt

es not mateh expense and revenue?

clfect on doubtful accounts expense

4, Increare in allowance for doulbstull #ee0

sae come

8 inate

9, When a epecifie customer's account receivable is wit Dad debts with a percentage of accounts

‘effect on net income? Tunder the allowance method

ff as uncollectibe, what wil be the

wy didebis with an amount derived from aging

No effect under both allowance method and direct {5 receivable under the allowance method

debts as accounts are written off as

writeoff method Ri

Decrease under both allowance: and direst

‘writeoff method

[No effect under allowance m

direct writeoff method

|. Decrease under allowance

for doubtful accounts as a

wable.

for doubtful accounts by

8 When the allowance method of recognizing bad debt

expense is used, the allowance for doubtful aesounts

‘would decrease when

Specific account receivable is collested

Account previously writen offi elected,

Account previously written off becomes eallestible

“A, Specific tncollecuible account is writen

4. Why is the allowance method preferred over the direct

‘writeoff method of acwunting for bad debts?

‘4. Allowance method is used for tx purpose)

b, Estimates are used.

©. Determining worthless nceounts under d

method is difioult to do,

{4 Improved matching of bad debt expense with

sachioved,

5. Which of the fallowing je not acceptable in

tuncollectible aoounts receivable?

a The estimate of uncollecible accounts is

percentage of sales forthe period

bb The estimate of uncollectible aceounta

pereentage of the noeounts receivable

period.

e. The estimate of unclletible

‘aging schedule

ad. No estimate of uncollectible

Net income

insllaable value of accounts receivable

rking capital

iry debiting accounts roccivable and crediting

a ae peul accounts would be mde when

1 pays its account balance

er defaults on its account.

mialy defaulted customer pays its outstanding

ce

lanigied uncollectible receivables are too low

Dpalance in the allowance for doubtful accounts

the result of management not providing large

fallowanee in order to manage earnings

eur before the end-of-period adjustment for

etible accounts

leven after the end-of-period adjustment for

eetible accounts.

swriteoff method of recognizing bad debt

the entry to write off a specific customer

net income

‘receivable balance and increase

unis receivable balance and

Problem 6-24 (PHILCPA Adapted) 1m 6-26 (AICPA Adapted)

On December 31, 2012, the accounts rect e ea.

s receivable showed the following: ;

1, 2012 statement of financial postion of

{he current receivables consisted of the

2000000

Accouteknowntobe worthless 100000 ag

nce payments tocreditorson purchase orders 40,000

Advances to alia 0000 I

rom ale eturne (e00,000 : rntat 150% of cot

Interest ecnvablson bonds ‘gjooo eet betes!

Trade scents esiable ‘3s0q000 mame

incription reser dunn 30 days 2200000

“Trade ineallmenteroceerbe due 118 months <=

‘rcluding uneered aan charge of P0000 ‘000

‘Trajesoannterecereable rom for duo curently 190000, Jal amount should be reported as current trade and

Tae acsuntson whieh potted checks areal abies?

(oo entree were made on eet of chad) onao0

What isthe correct balance of trade accounts reeaivable®

a. 4,650,000 bo

wb 4:700,000

4150.00 (CPA Adapted)

44. 41050,000 on relates to accounts receivable of

Problem 6-25 (IAA)

1,300,000

‘Vagabond Company bad net sales in 2012 of 5.300,000

‘December 31, 2012, before adjusting entries a.

selected accounts were accounts receivable P a

‘nd allowance for dof account PD December 0.000

[Gatimated that 5% ofits accounts ater i

° What is the cash Miapersgingstyearcad 250,000

3

not realizable value of

3, 20127

Problem 6-2

blem 6-28 (AICPA Adapted) mn 6-80 (AICPA Adapted)

ry 12012, Malice Company's allowance for doubtful

Rapture Comy

{pture Company had the follwing information ft 3012 MPa a credit balance of P00.000, During 2012, the

Ber esti acesn pee wee

Jeu eit may simone Fee ee

corm 0 00 ot et pies et me fn

ingrecevery 70.000

Scounts writen fin priya

(customer creditwas not estaba)

Examen PA

What i the balance of accounts receivable, before

{or doubtfal azounts, on Decomber 81, 20122

a. 1,825,000 4 Pp

%. 11850,000 s1 (AICPA Adapted)

©, 1,950,000.

$, oe 4 ny prepared an aging ofits accounts receivable

it 2012 and determined that the not realizable

- Dunte receivable was P2,500,000. Additional

Problem 6-29 (IAA) BB i

[At the end of its fist year of operations, Doss

je accounts on January 1 280,000

‘Majeade Company had accounts receivable of

Ur the related allowence for doubtful accounts 250,000

{he entity recorded charges to bad debt pt De 2,700,000,

fd wrote off P200,000 of uncollectible re i 30,000

December 2, what is the

(On December 31, 2012, what amount 22 2012 whee

‘Accounts receivable before the al

ro ICPA Adapted)

Problem 6-32 (AICPA Adapted) en y

Mon: any sells to wholesalers on terms 2/15, net 30.

Monsoon Company's allowance for doubt accounts ws sortna no eash sales but 50% of the customers take

200,000 at the end of 2012 and P180,000 atthe end of 2011.

B Mf the discount. An analysis of the accounts

‘or the year ended December 31, 2012, Monsoon. Company ousidered collectible on Decomber 31, 2012

reported doubtful accounts expense of P50,000. following:

500,000 100%

What amount did the entity debit tothe appropriate aesount 3,000,000 28

12 to write off actual bad debts? "250,000 0%

a. 30,000,

50,000

4. 70,000

Problem 6-88 (AICPA Adapted)

‘The following information pertains to Tantrum COmpaBY’

rnocounts receivable on December 31, 2012,

Daye Batimated , 2012, Ludicrous Company reported before

outstanding Amount ‘adjustments accounta receivable of P6,000,000

o = 1.200.000 . ubtful accounts of P300,000,

& > Bo ‘0 000 wg

Ome 120 so.000 Proba

ts ofcollection

6

so

using 2012, the enity wrote off P70,000 es

Pcie and resovered P2000 that ad f %

FeeerSjenrs. The December 31, 2031 al ; &

Mcolcctble acsunta wae P0,000

appropriate balance for the

‘on December 31, 2012?

Problem 6-36 (AICPA Adapted)

The following accounts were abstracted from Namesake

Company's unadjusted trial balance on December 81, 2012

Debit Cree 308

Accountacsvab 31000060 190.000

Allowance for doubt acount 10000 sano)

Netcreditelee ‘005,000 00

‘The entity estimated that 3% of the gross account receivable

will become uncollectible,

What amount should be reported as doubtful aesounta

‘expense for 2012?

corded doubtful accounts expense at the rate of

lies, What amount should be reported as

Ge doubtful accounts on December 21°

Problem 6-87 (AICPA Adapted) (AICPA Adapted)

Bestial Company's trial belance om December Hite year ended December 31, 2012, Fateful

Included the flowing accounts: new aesounting method for estimating

é ubtful accounts at the amount indicated

ff accounts receivable. The following

Allowance for doubtful accounts

eae 250,000,

‘The entity estimated its un 200,000

: 205,000

sper aging,December31 220,000

What is the doubtful accounts

Problem 6-40 (AA)

The foll

The following information is available for Gruesome

Company lable Oa

Allowance fr doubifl acnuntson December 3120115350608

Credit alos during 2012 ‘000,000,

Scouts receivable deemed worthless and

‘wnitton off during 2012 00,000

As a result of a review and aging of acsounts receivable i

arly January 2013 it has been detormined that an allowanes

for doubefal accounts of P400,000 is needed. on Decembae SIy

12, What amount thould be rooorded as doubt “2

expense for 20127

2 400000

% son. i

& Sea. :

§, $e.

Problem 6-41 (IAA)

Bizarre Company reported accounts receivable oa Dems

51, 2012 as follows: a

‘Aye Company

Bee Company

(Cee Company

Day Company

‘Rother sceounts receivable

‘Tho entity.

jem 6-42 (PHILCPA Adapted)

ray Company started its business on January 1, 2012

Goring the collection experience of other entities

der ye entity eatablished an allowance for bad

sty oe of credit sales. Outstanding accounts

mate {ed on Decombor 31, 2012 totaled P115,000,

Haswange for bad debis account had a credit balance

ewan Grording estimated doubtful accounts

OD ateember and after writing off P2,500 of

jibe accounts.

Manlysis of the entity's accounts showed that

gai oF iy 2012 amounted to PAS0,000 and

y Minventory was P75,000. Goods were sold

‘amounted to 80% of total sales, Total

sinew on the other hand, excluding cash

tions on accounts receivable

for bad debts?

ccivable Allowance for bad debts

6,000 understated

18500 understated

10,000 understated

12,600 understated

tthe allowance method of accounting

ounts. During 2012, the entity had

didebt expense, and wrote off accounts

‘uncollectbie,

i capital as a result of the

receivable?

a jing transactions eee Sscoventa rece a

adjusts pany reported the following balances after uo pe

oni gn ret hem

atin sam Salen aetna

ag gm Ames peer 3.2/0 ie

P16) 000 snd soloed Past onan onc 200

Previous years. aven to cash customers for sales

aso

What amount should be reported as doubtful accounts (not included in

panes for tho ear ended Dreenbee a]: 01 a aac sooo

198000 BN fe pens on te Deceer 21,

& ao ireendl estos

&. 150000 “3000

Problem 5igae” a for its net uncollectible account losses

ing b jad debts for 2% of net credit

Oasis Company followed the procedure of d for bad dobts for 2%

‘ipense fr 26 ofall ow ales. Slee for r oo

years andi gegr-end allowance soy nce of accounts receivable on December

follows: q

Uallowance for bad debts after

‘1, 20127

Problem

Hblem 6-47 (AICPA Adapted)

ception of operatio,

Omnipotent Company" pr

to December 31, 2012,

ovided for wneolletible aecounts

nse under the allowance method and provisions were

ade monthly at 3% of eredit sales, No yearend adjustments

to the allowance account were made,

‘The balance in the allowance for doubtful ecounts was

£330,000 on January 1, 2012, During 2013, credit al totaled is E

P20,000.000, interim provisions for doubtful accounte were E

‘made at 3% of eredit sales, P100,000 of bad debts Were writen eo ECEIVABL

off, and recoveries of accounts previously written off

amounted to P20,000.

An aging of accounts receivable was made for the first time

‘on December 81, 2012 as follows:

Agog Balance nolo

o- © s2n000 a

oe 1a 1 “promissory note is an. unconditional promise in

181 = 360 1,000,000, 2896 err roms

ont ‘one person to another, signed by the maker,

= oo a on demand or at a fixed determinable future

Based on the review of collectibility of the in in money to order or to bearer.

in the "over 360 days" aging category, a

‘totaling P50,000 are to be written offon D ry note is a written contract in which

‘as the maker, promises to pay another

Effective with the year ended December 3 ‘payee, a definite sum of mone’

adopted a new accounting method for est

allowance for doubtful accounts at

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSA SubjectsDocument4 pagesBSA SubjectsMikaela SamonteNo ratings yet

- Specific Format 1. Tables and Figures Must Fit Within MarginDocument3 pagesSpecific Format 1. Tables and Figures Must Fit Within MarginMikaela SamonteNo ratings yet

- Section 3 Obligations of The Partners With Regard To Third Persons PDFDocument16 pagesSection 3 Obligations of The Partners With Regard To Third Persons PDFMikaela SamonteNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument20 pagesChapter 3 Dissolution and Winding UpMikaela SamonteNo ratings yet

- Correlational Research - Definition With Examples - QuestionProDocument5 pagesCorrelational Research - Definition With Examples - QuestionProMikaela SamonteNo ratings yet

- BSMAC 2019 FlowchartDocument1 pageBSMAC 2019 FlowchartMikaela SamonteNo ratings yet

- NDNDJDDocument15 pagesNDNDJDMikaela SamonteNo ratings yet

- Proof of CashDocument4 pagesProof of CashMikaela Samonte100% (1)

- 1st Quiz Intacc5Document37 pages1st Quiz Intacc5Mikaela SamonteNo ratings yet

- Cash and Cash Equivalents PDFDocument10 pagesCash and Cash Equivalents PDFMikaela SamonteNo ratings yet

- BSA 2019 FlowchartDocument1 pageBSA 2019 FlowchartMikaela SamonteNo ratings yet

- Chap03 Time Value of MoneyDocument9 pagesChap03 Time Value of MoneyMikaela SamonteNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationMikaela Samonte100% (3)

- There Were Real Heroes in The Philippine American WarDocument3 pagesThere Were Real Heroes in The Philippine American WarMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:13 AMDocument1 pageSafari - Aug 9, 2019 at 7:13 AMMikaela SamonteNo ratings yet

- Reviewer in Buslaw FinalsDocument9 pagesReviewer in Buslaw FinalsMikaela SamonteNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Former Cfo of Autonomy Guilty of Accounting FraudDocument3 pagesFormer Cfo of Autonomy Guilty of Accounting FraudMikaela SamonteNo ratings yet

- GHHDocument1 pageGHHMikaela SamonteNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet