Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

54 viewsAccountancy (Code No. 055) : Class-XII (2019-20)

Accountancy (Code No. 055) : Class-XII (2019-20)

Uploaded by

naveenaThe document outlines the syllabus for Accountancy (Code No. 055) for Class XII (2019-20). It covers three parts:

1) Accounting for Not-for-Profit Organizations, Partnership Firms and Companies with three units covering financial statements of NPOs, accounting for partnership firms, and accounting for companies.

2) Financial Statement Analysis with two units on analysis of financial statements and cash flow statements.

3) Project work or Computerized Accounting. The project work includes a project file, written test, and viva voce. Computerized Accounting covers computerized accounting systems.

The units provide learning outcomes related to the topics including preparation of

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- ACCT6174-Tugas Kelompok 3-W8-S12-R1Document3 pagesACCT6174-Tugas Kelompok 3-W8-S12-R1Iden PratamaNo ratings yet

- Rational Producer BehaviorDocument4 pagesRational Producer Behaviorleaha17No ratings yet

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Accountancy XII Syllabus 1234Document5 pagesAccountancy XII Syllabus 1234Moheet KumarNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- 2022 23 Accountancy 12-MinDocument8 pages2022 23 Accountancy 12-MinShajila AnvarNo ratings yet

- Accountancy (Code No. 055) Class-XII (2018-19)Document7 pagesAccountancy (Code No. 055) Class-XII (2018-19)saurabhNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2022 23Document8 pagesCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- Kvs Student Support Materical Class Xii AccountancyDocument200 pagesKvs Student Support Materical Class Xii Accountancyahujakrishna242No ratings yet

- Account SyllabusDocument5 pagesAccount Syllabusadityasinghania.gtsNo ratings yet

- Accountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Document9 pagesAccountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Parthiv PattaNo ratings yet

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Cbse Class 12 Syllabus 2019 20 AccountancyDocument10 pagesCbse Class 12 Syllabus 2019 20 AccountancyDhanbad TalksNo ratings yet

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Document5 pagesTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNo ratings yet

- Reduced SyllabusDocument333 pagesReduced SyllabusRaj Rajeshwer Gupta100% (1)

- Cbse Accountancy - SrSec - 2022-23Document8 pagesCbse Accountancy - SrSec - 2022-23Sneha DubeNo ratings yet

- SM 12 Accountancy Eng 201617 PDFDocument424 pagesSM 12 Accountancy Eng 201617 PDFUdit100% (1)

- Cbse Class 12 Accountancy SyllabusDocument8 pagesCbse Class 12 Accountancy SyllabusKunj PatelNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- CBSE Class 12 Accountancy SyllabusDocument6 pagesCBSE Class 12 Accountancy Syllabusrkmobile58627No ratings yet

- 12 Accountancy Eng 2023 24Document5 pages12 Accountancy Eng 2023 24Gaurav KumarNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument11 pagesACCOUNTANCY (Code No. 055) : RationaleIshan MittalNo ratings yet

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocument240 pagesAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY75% (8)

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- CBSE Class 12 Term Wise Accountancy Syllabus 2021 22Document9 pagesCBSE Class 12 Term Wise Accountancy Syllabus 2021 22ILMA UROOJNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : RationaleAditya GawdeNo ratings yet

- Accountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Document7 pagesAccountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Sarthak PithoriyaNo ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Accountancy SrSec 2023-24Document16 pagesAccountancy SrSec 2023-24sarathsivadamNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : Rationaledadan vishwakarmaNo ratings yet

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- ACCOUNTANCY (Code No. 055)Document16 pagesACCOUNTANCY (Code No. 055)Jayanth KumarNo ratings yet

- AccountancyDocument16 pagesAccountancyKatyani SinghNo ratings yet

- Bba Amity AccountsDocument1 pageBba Amity AccountsDeepak BatraNo ratings yet

- Accountancy SrSec 2022-23Document16 pagesAccountancy SrSec 2022-23Commerce VIVEKNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership FirmsDocument5 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firmsbhumilimbadiya09_216No ratings yet

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocument2 pagesH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNo ratings yet

- 15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionDocument1 page15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionKhushiNo ratings yet

- CBSE Class 11 Accountancy Syllabus 2023 24Document7 pagesCBSE Class 11 Accountancy Syllabus 2023 24vaibhavmenon6No ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Document3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNo ratings yet

- ACCOUNTANCY (Code No. 055) (2020-21)Document18 pagesACCOUNTANCY (Code No. 055) (2020-21)Bharti JindalNo ratings yet

- Corporate-Accounting-bk GoelDocument3 pagesCorporate-Accounting-bk Goeltanisha kochharNo ratings yet

- Xi Accountancy Syllabus 23-24Document8 pagesXi Accountancy Syllabus 23-24GauriNo ratings yet

- Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)Document2 pagesAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)singhankit257No ratings yet

- Prachi CUET-UG AccountancyDocument22 pagesPrachi CUET-UG AccountancySmriti Saxena100% (1)

- Faa PDFDocument17 pagesFaa PDFshubham kumarNo ratings yet

- Unit 19 - Partnership AccountsDocument2 pagesUnit 19 - Partnership AccountsMuhammad Umar SalmanNo ratings yet

- Research SupportDocument28 pagesResearch SupportVikãsh MishrâNo ratings yet

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Document5 pagesAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084No ratings yet

- 7.-ISC-Accounts 040424 2025Document20 pages7.-ISC-Accounts 040424 2025jiyadugar037No ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Accounting..... All Questions & Answer.Document13 pagesAccounting..... All Questions & Answer.MehediNo ratings yet

- Cbse Class 12 Business Studies Syllabus 2019 20Document23 pagesCbse Class 12 Business Studies Syllabus 2019 20naveenaNo ratings yet

- CHAPTER 12 Consumer Protection Short NotesDocument3 pagesCHAPTER 12 Consumer Protection Short NotesnaveenaNo ratings yet

- Samle (Paper 0404 Sample PaperDocument5 pagesSamle (Paper 0404 Sample PapernaveenaNo ratings yet

- Voc SR Secondary Curriculum Xii 18 19Document134 pagesVoc SR Secondary Curriculum Xii 18 19naveenaNo ratings yet

- Chapter TwoDocument33 pagesChapter TwoTerefe DubeNo ratings yet

- PSPC - 17-Q - Q3 2018Document43 pagesPSPC - 17-Q - Q3 2018Michael Francis Uy CastiloNo ratings yet

- Chapter 2 ExercisesDocument13 pagesChapter 2 ExercisesKiều PhươngNo ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- 3 - The Reformulation of Financial Statements - UnlockedDocument33 pages3 - The Reformulation of Financial Statements - Unlockedchirag0% (3)

- International School of Asia and The Pacific Management Advisory Services Institutional ReviewDocument27 pagesInternational School of Asia and The Pacific Management Advisory Services Institutional ReviewCharles BarcelaNo ratings yet

- Analisis Risiko AlkDocument21 pagesAnalisis Risiko AlkAnanda LukmanNo ratings yet

- Cheatsheet AF UASDocument2 pagesCheatsheet AF UASIndera HadiNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- T1 Mock TestDocument6 pagesT1 Mock TestAbdul Gaffar0% (1)

- Cash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsDocument5 pagesCash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsMenodiado FamNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- 3RD Year Diagnostic ExamDocument30 pages3RD Year Diagnostic ExamRoisu De KuriNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Case Study ChemaliteDocument5 pagesCase Study Chemalitesubburam007No ratings yet

- Unit V Inventory Theory: Improve Customer ServiceDocument20 pagesUnit V Inventory Theory: Improve Customer ServiceyvigkNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Final Exam 3Document4 pagesFinal Exam 3HealthyYOU50% (2)

- The Figures in The Margin On The Right Side Indicate Full MarksDocument8 pagesThe Figures in The Margin On The Right Side Indicate Full MarksManas Kumar SahooNo ratings yet

- Capital Structure TheoriesDocument25 pagesCapital Structure TheoriesLalit ShahNo ratings yet

- UGCNET Paper2 ManagementDocument25 pagesUGCNET Paper2 ManagementRomiNo ratings yet

- Capital Budgetting Multiple ChoiceDocument24 pagesCapital Budgetting Multiple ChoiceMaryane Angela67% (3)

- Chapter 20 Questions & AnswersDocument54 pagesChapter 20 Questions & AnswersAbayomiNo ratings yet

- Grace Corp Audited FSDocument17 pagesGrace Corp Audited FSArchie Guevarra90% (10)

- ACCA AFM S22 NotesDocument66 pagesACCA AFM S22 NotesdakshinNo ratings yet

- Chapter 3 - Financial AnalysisDocument39 pagesChapter 3 - Financial AnalysisHeatstroke0% (1)

- Property BRRR Model v1Document9 pagesProperty BRRR Model v1Trịnh Minh TâmNo ratings yet

Accountancy (Code No. 055) : Class-XII (2019-20)

Accountancy (Code No. 055) : Class-XII (2019-20)

Uploaded by

naveena0 ratings0% found this document useful (0 votes)

54 views6 pagesThe document outlines the syllabus for Accountancy (Code No. 055) for Class XII (2019-20). It covers three parts:

1) Accounting for Not-for-Profit Organizations, Partnership Firms and Companies with three units covering financial statements of NPOs, accounting for partnership firms, and accounting for companies.

2) Financial Statement Analysis with two units on analysis of financial statements and cash flow statements.

3) Project work or Computerized Accounting. The project work includes a project file, written test, and viva voce. Computerized Accounting covers computerized accounting systems.

The units provide learning outcomes related to the topics including preparation of

Original Description:

Original Title

cbse-class-12-accountancy-syllabus-2019-20 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the syllabus for Accountancy (Code No. 055) for Class XII (2019-20). It covers three parts:

1) Accounting for Not-for-Profit Organizations, Partnership Firms and Companies with three units covering financial statements of NPOs, accounting for partnership firms, and accounting for companies.

2) Financial Statement Analysis with two units on analysis of financial statements and cash flow statements.

3) Project work or Computerized Accounting. The project work includes a project file, written test, and viva voce. Computerized Accounting covers computerized accounting systems.

The units provide learning outcomes related to the topics including preparation of

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

54 views6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)

Accountancy (Code No. 055) : Class-XII (2019-20)

Uploaded by

naveenaThe document outlines the syllabus for Accountancy (Code No. 055) for Class XII (2019-20). It covers three parts:

1) Accounting for Not-for-Profit Organizations, Partnership Firms and Companies with three units covering financial statements of NPOs, accounting for partnership firms, and accounting for companies.

2) Financial Statement Analysis with two units on analysis of financial statements and cash flow statements.

3) Project work or Computerized Accounting. The project work includes a project file, written test, and viva voce. Computerized Accounting covers computerized accounting systems.

The units provide learning outcomes related to the topics including preparation of

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

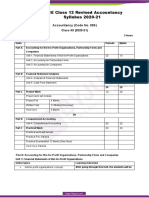

Accountancy (Code No.

055)

Class-XII (2019-20)

Theory: 80 Marks 3 Hours

Project: 20 Marks

Units Periods Marks

Part A Accounting for Not-for-Profit Organizations, Partnership Firms and

Companies

Unit 1. Financial Statements of Not-for-Profit Organizations 25 10

Unit 2. Accounting for Partnership Firms 90 30

Unit 3. Accounting for Companies 35 20

150 60

Part B Financial Statement Analysis

Unit 4. Analysis of Financial Statements 30 12

Unit 5. Cash Flow Statement 20 8

50 20

Part C Project Work 20 20

Project work will include:

Project File 4 Marks

Written Test 12 Marks (One Hour)

Viva Voce 4 Marks

Or

Part B Computerized Accounting

Unit 4. Computerized Accounting 50 20

Part C Practical Work 20 20

Practical work will include:

Practical File 4 Marks

Practical Examination 12 Marks (One Hour)

Viva Voce 4 Marks

Part A: Accounting for Not-for-Profit Organizations, Partnership Firms and Companies

Unit 1: Financial Statements of Not-for-Profit Organizations

Units/Topics Learning Outcomes

Not-for-profit organizations: concept. After going through this Unit, the students will be

Receipts and Payments Account: features able to:

and preparation. state the meaning of a Not-for-profit

Income and Expenditure Account: features, organisation and its distinction from a profit

preparation of income and expenditure making entity.

account and balance sheet from the given state the meaning of receipts and payments

receipts and payments account with account, and understanding its features.

additional information. develop the understanding and skill of

Scope: preparing receipts and payments account.

(i) Adjustments in a question should not exceed 3 or 4 state the meaning of income and expenditure

in number and restricted to subscriptions, account and understand its features.

consumption of consumables and sale of assets/ old develop the understanding and skill of

material. preparing income and expenditure account

(ii) Entrance/admission fees and general donations and balance sheet of a not-for-profit

are to be treated as revenue receipts. organisation with the help of given receipts

(iii) Trading Account of incidental activities is not to be and payments account and additional

prepared. information.

Unit 2: Accounting for Partnership Firms

Units/Topics Learning Outcomes

Partnership: features, Partnership Deed. After going through this Unit, the students will be

Provisions of the Indian Partnership Act 1932 able to:

in the absence of partnership deed. state the meaning of partnership, partnership

Fixed v/s fluctuating capital accounts. firm and partnership deed.

Preparation of Profit and Loss Appropriation describe the characteristic features of

account- division of profit among partners, partnership and the contents of partnership

guarantee of profits. deed.

Past adjustments (relating to interest on discuss the significance of provision of

capital, interest on drawing, salary and profit Partnership Act in the absence of partnership

sharing ratio). deed.

Goodwill: nature, factors affecting and differentiate between fixed and fluctuating

methods of valuation - average profit, super capital, outline the process and develop the

profit and capitalization. understanding and skill of preparation of

Profit and Loss Appropriation Account.

Note: Interest on partner's loan is to be treated as a develop the understanding and skill of

charge against profits. preparation profit and loss appropriation

Goodwill to be adjusted through partners capital/ account involving guarantee of profits.

current account or by raising and writing off goodwill develop the understanding and skill of

(AS 26) making past adjustments.

state the meaning, nature and factors affectin

Accounting for Partnership firms - Reconstitution goodwill

and Dissolution. develop the understanding and skill of

Change in the Profit Sharing Ratio among valuation of goodwill using different methods.

the existing partners - sacrificing ratio, state the meaning of sacrificing ratio, gaining

gaining ratio, accounting for revaluation of ratio and the change in profit sharing ratio

assets and reassessment of liabilities and among existing partners.

treatment of reserves and accumulated develop the understanding of accounting

profits. Preparation of revaluation account treatment of revaluation assets and

and balance sheet. reassessment of liabilities and treatment of

Admission of a partner - effect of admission reserves and accumulated profits by

of a partner on change in the profit sharing preparing revaluation account and balance

ratio, treatment of goodwill (as per AS 26), sheet.

treatment for revaluation of assets and re- explain the effect of change in profit sharing

assessment of liabilities, treatment of ratio on admission of a new partner.

reserves and accumulated profits, adjustment develop the understanding and skill of

of capital accounts and preparation of treatment of goodwill as per AS-26, treatment

balance sheet. of revaluation of assets and re-assessment of

Retirement and death of a partner: effect of liabilities, treatment of reserves and

retirement / death of a partner on change in accumulated profits, adjustment of capital

profit sharing ratio, treatment of goodwill (as accounts and preparation of balance sheet of

per AS 26), treatment for revaluation of the new firm.

assets and reassessment of liabilities, explain the effect of retirement / death of a

adjustment of accumulated profits and partner on change in profit sharing ratio.

reserves, adjustment of capital accounts and develop the understanding of accounting

preparation of balance sheet. Preparation of treatment of goodwill, revaluation of assets

loan account of the retiring partner. and re-assessment of liabilities and

Calculation of deceased partner’s share of adjustment of accumulated profits and

profit till the date of death. Preparation of reserves on retirement / death of a partner

deceased partner’s capital account and his and capital adjustment.

executor’s account. develop the skill of calculation of deceased

Dissolution of a partnership firm: meaning partner's share till the time of his death and

of dissolution of partnership and partnership prepare deceased partner's executor's

firm, types of dissolution of a firm. Settlement account.

of accounts - preparation of realization discuss the preparation of the capital

account, and other related accounts: capital accounts of the remaining partners and the

accounts of partners and cash/bank a/c balance sheet of the firm after retirement /

(excluding piecemeal distribution, sale to a death of a partner.

company and insolvency of partner(s)). understand the situations under which a

Note: partnership firm can be dissolved.

(i) The realized value of each asset must be given at develop the understanding of preparation of

the time of dissolution. realisation account and other related

(ii) In case, the realization expenses are borne by a accounts.

partner, clear indication should be given regarding the

payment thereof.

Unit-3 Accounting for Companies

Units/Topics Learning Outcomes

Accounting for Share Capital After going through this Unit, the students will be

Share and share capital: nature and types. able to:

Accounting for share capital: issue and state the meaning of share and share capital

allotment of equity and preferences shares. and differentiate between equity shares and

Public subscription of shares - over preference shares and different types of

subscription and under subscription of share capital.

shares; issue at par and at premium, calls in understand the meaning of private placement

advance and arrears (excluding interest), of shares and Employee Stock Option Plan.

issue of shares for consideration other than explain the accounting treatment of share

cash. capital transactions regarding issue of

Concept of Private Placement and Employee shares.

Stock Option Plan (ESOP). develop the understanding of accounting

Accounting treatment of forfeiture and re- treatment of forfeiture and re-issue of

issue of shares. forfeited shares.

Disclosure of share capital in the Balance describe the presentation of share capital in

Sheet of a company. the balance sheet of the company as per

schedule III part I of the Companies Act

Accounting for Debentures 2013.

Debentures: Issue of debentures at par, at a explain the accounting treatment of different

premium and at a discount. Issue of categories of transactions related to issue of

debentures for consideration other than cash; debentures.

Issue of debentures with terms of develop the understanding and skill of writing

redemption; debentures as collateral security- of discount / loss on issue of debentures.

concept, interest on debentures. Writing off understand the concept of collateral security

discount / loss on issue of debentures. and its presentation in balance sheet.

develop the skill of calculating interest on

Note: Discount or loss on issue of debentures to be debentures and its accounting treatment.

written off in the year debentures are allotted from state the meaning of redemption of

Security Premium Reserve (if it exists) and then from debentures.

Statement of Profit and Loss as Financial Cost (AS develop the understanding of accounting

16). treatment of transactions related to

Redemption of debentures-Methods: Lump redemption of debentures by lump sum, draw

sum, draw of lots. of lots and Creation of Debenture

Creation of Debenture Redemption Reserve. Redemption Reserve.

Note: Related sections of the Companies Act, 2013

will apply.

Part B: Financial Statement Analysis

Unit 4: Analysis of Financial Statements

Units/Topics Learning Outcomes

Financial statements of a Company: After going through this Unit, the students will be

Statement of Profit and Loss and Balance Sheet in able to:

prescribed form with major headings and sub develop the understanding of major headings

headings (as per Schedule III to the Companies Act, and sub-headings (as per Schedule III to the

2013) Companies Act, 2013) of balance sheet as

per the prescribed norms / formats.

Note: Exceptional items, extraordinary items and state the meaning, objectives and limitations

profit (loss) from discontinued operations are of financial statement analysis.

excluded. discuss the meaning of different tools of

Financial Statement Analysis: Objectives, 'financial statements analysis'.

importance and limitations. develop the understanding and skill of

Tools for Financial Statement Analysis: preparation of comparative and common size

Comparative statements, common size financial statements.

statements, cash flow analysis, ratio analysis. state the meaning, objectives and

Accounting Ratios: Meaning, Objectives, significance of different types of ratios.

classification and computation. develop the understanding of computation of

Liquidity Ratios: Current ratio and Quick current ratio and quick ratio.

ratio. develop the skill of computation of debt equity

Solvency Ratios: Debt to Equity Ratio, Total ratio, total asset to debt ratio, proprietary ratio

Asset to Debt Ratio, Proprietary Ratio and and interest coverage ratio.

Interest Coverage Ratio. develop the skill of computation of inventory

Activity Ratios: Inventory Turnover Ratio, turnover ratio, trade receivables and trade

Trade Receivables Turnover Ratio, Trade payables ratio and working capital turnover

Payables Turnover Ratio and Working ratio.

Capital Turnover Ratio. develop the skill of computation of gross

Profitability Ratios: Gross Profit Ratio, profit ratio, operating ratio, operating profit

Operating Ratio, Operating Profit Ratio, Net ratio, net profit ratio and return on investment.

Profit Ratio and Return on Investment.

Note: Net Profit Ratio is to be calculated on the basis of profit before and after tax.

Unit 5: Cash Flow Statement

Units/Topics Learning Outcomes

Meaning, objectives and preparation (as per After going through this Unit, the students will

AS 3 (Revised) (Indirect Method only) be able to:

state the meaning and objectives of cash flow

Note: statement.

(i) Adjustments relating to depreciation and develop the understanding of preparation of

amortization, profit or loss on sale of assets including Cash Flow Statement using indirect method

investments, dividend (both final and interim) and tax. as per AS 3 with given adjustments.

(ii) Bank overdraft and cash credit to be treated as

short term borrowings.

(iii) Current Investments to be taken as Marketable

securities unless otherwise specified.

Note: Previous years’ Proposed Dividend to be given effect, as prescribed in AS-4, Events occurring after the

Balance Sheet date. Current years’ Proposed Dividend will be accounted for in the next year after it is declared

by the shareholders.

You might also like

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- ACCT6174-Tugas Kelompok 3-W8-S12-R1Document3 pagesACCT6174-Tugas Kelompok 3-W8-S12-R1Iden PratamaNo ratings yet

- Rational Producer BehaviorDocument4 pagesRational Producer Behaviorleaha17No ratings yet

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Accountancy XII Syllabus 1234Document5 pagesAccountancy XII Syllabus 1234Moheet KumarNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- 2022 23 Accountancy 12-MinDocument8 pages2022 23 Accountancy 12-MinShajila AnvarNo ratings yet

- Accountancy (Code No. 055) Class-XII (2018-19)Document7 pagesAccountancy (Code No. 055) Class-XII (2018-19)saurabhNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2022 23Document8 pagesCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- Kvs Student Support Materical Class Xii AccountancyDocument200 pagesKvs Student Support Materical Class Xii Accountancyahujakrishna242No ratings yet

- Account SyllabusDocument5 pagesAccount Syllabusadityasinghania.gtsNo ratings yet

- Accountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Document9 pagesAccountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Parthiv PattaNo ratings yet

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Cbse Class 12 Syllabus 2019 20 AccountancyDocument10 pagesCbse Class 12 Syllabus 2019 20 AccountancyDhanbad TalksNo ratings yet

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Document5 pagesTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNo ratings yet

- Reduced SyllabusDocument333 pagesReduced SyllabusRaj Rajeshwer Gupta100% (1)

- Cbse Accountancy - SrSec - 2022-23Document8 pagesCbse Accountancy - SrSec - 2022-23Sneha DubeNo ratings yet

- SM 12 Accountancy Eng 201617 PDFDocument424 pagesSM 12 Accountancy Eng 201617 PDFUdit100% (1)

- Cbse Class 12 Accountancy SyllabusDocument8 pagesCbse Class 12 Accountancy SyllabusKunj PatelNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- CBSE Class 12 Accountancy SyllabusDocument6 pagesCBSE Class 12 Accountancy Syllabusrkmobile58627No ratings yet

- 12 Accountancy Eng 2023 24Document5 pages12 Accountancy Eng 2023 24Gaurav KumarNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument11 pagesACCOUNTANCY (Code No. 055) : RationaleIshan MittalNo ratings yet

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocument240 pagesAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY75% (8)

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- CBSE Class 12 Term Wise Accountancy Syllabus 2021 22Document9 pagesCBSE Class 12 Term Wise Accountancy Syllabus 2021 22ILMA UROOJNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : RationaleAditya GawdeNo ratings yet

- Accountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Document7 pagesAccountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Sarthak PithoriyaNo ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Accountancy SrSec 2023-24Document16 pagesAccountancy SrSec 2023-24sarathsivadamNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : Rationaledadan vishwakarmaNo ratings yet

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- ACCOUNTANCY (Code No. 055)Document16 pagesACCOUNTANCY (Code No. 055)Jayanth KumarNo ratings yet

- AccountancyDocument16 pagesAccountancyKatyani SinghNo ratings yet

- Bba Amity AccountsDocument1 pageBba Amity AccountsDeepak BatraNo ratings yet

- Accountancy SrSec 2022-23Document16 pagesAccountancy SrSec 2022-23Commerce VIVEKNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership FirmsDocument5 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firmsbhumilimbadiya09_216No ratings yet

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocument2 pagesH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNo ratings yet

- 15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionDocument1 page15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionKhushiNo ratings yet

- CBSE Class 11 Accountancy Syllabus 2023 24Document7 pagesCBSE Class 11 Accountancy Syllabus 2023 24vaibhavmenon6No ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Document3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNo ratings yet

- ACCOUNTANCY (Code No. 055) (2020-21)Document18 pagesACCOUNTANCY (Code No. 055) (2020-21)Bharti JindalNo ratings yet

- Corporate-Accounting-bk GoelDocument3 pagesCorporate-Accounting-bk Goeltanisha kochharNo ratings yet

- Xi Accountancy Syllabus 23-24Document8 pagesXi Accountancy Syllabus 23-24GauriNo ratings yet

- Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)Document2 pagesAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)singhankit257No ratings yet

- Prachi CUET-UG AccountancyDocument22 pagesPrachi CUET-UG AccountancySmriti Saxena100% (1)

- Faa PDFDocument17 pagesFaa PDFshubham kumarNo ratings yet

- Unit 19 - Partnership AccountsDocument2 pagesUnit 19 - Partnership AccountsMuhammad Umar SalmanNo ratings yet

- Research SupportDocument28 pagesResearch SupportVikãsh MishrâNo ratings yet

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Document5 pagesAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084No ratings yet

- 7.-ISC-Accounts 040424 2025Document20 pages7.-ISC-Accounts 040424 2025jiyadugar037No ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Accounting..... All Questions & Answer.Document13 pagesAccounting..... All Questions & Answer.MehediNo ratings yet

- Cbse Class 12 Business Studies Syllabus 2019 20Document23 pagesCbse Class 12 Business Studies Syllabus 2019 20naveenaNo ratings yet

- CHAPTER 12 Consumer Protection Short NotesDocument3 pagesCHAPTER 12 Consumer Protection Short NotesnaveenaNo ratings yet

- Samle (Paper 0404 Sample PaperDocument5 pagesSamle (Paper 0404 Sample PapernaveenaNo ratings yet

- Voc SR Secondary Curriculum Xii 18 19Document134 pagesVoc SR Secondary Curriculum Xii 18 19naveenaNo ratings yet

- Chapter TwoDocument33 pagesChapter TwoTerefe DubeNo ratings yet

- PSPC - 17-Q - Q3 2018Document43 pagesPSPC - 17-Q - Q3 2018Michael Francis Uy CastiloNo ratings yet

- Chapter 2 ExercisesDocument13 pagesChapter 2 ExercisesKiều PhươngNo ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- 3 - The Reformulation of Financial Statements - UnlockedDocument33 pages3 - The Reformulation of Financial Statements - Unlockedchirag0% (3)

- International School of Asia and The Pacific Management Advisory Services Institutional ReviewDocument27 pagesInternational School of Asia and The Pacific Management Advisory Services Institutional ReviewCharles BarcelaNo ratings yet

- Analisis Risiko AlkDocument21 pagesAnalisis Risiko AlkAnanda LukmanNo ratings yet

- Cheatsheet AF UASDocument2 pagesCheatsheet AF UASIndera HadiNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- T1 Mock TestDocument6 pagesT1 Mock TestAbdul Gaffar0% (1)

- Cash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsDocument5 pagesCash Budget: Month: April May June Cash Receipts Total Receipts 161,200 166,400 173,200 Cash OutflowsMenodiado FamNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- 3RD Year Diagnostic ExamDocument30 pages3RD Year Diagnostic ExamRoisu De KuriNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Case Study ChemaliteDocument5 pagesCase Study Chemalitesubburam007No ratings yet

- Unit V Inventory Theory: Improve Customer ServiceDocument20 pagesUnit V Inventory Theory: Improve Customer ServiceyvigkNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Final Exam 3Document4 pagesFinal Exam 3HealthyYOU50% (2)

- The Figures in The Margin On The Right Side Indicate Full MarksDocument8 pagesThe Figures in The Margin On The Right Side Indicate Full MarksManas Kumar SahooNo ratings yet

- Capital Structure TheoriesDocument25 pagesCapital Structure TheoriesLalit ShahNo ratings yet

- UGCNET Paper2 ManagementDocument25 pagesUGCNET Paper2 ManagementRomiNo ratings yet

- Capital Budgetting Multiple ChoiceDocument24 pagesCapital Budgetting Multiple ChoiceMaryane Angela67% (3)

- Chapter 20 Questions & AnswersDocument54 pagesChapter 20 Questions & AnswersAbayomiNo ratings yet

- Grace Corp Audited FSDocument17 pagesGrace Corp Audited FSArchie Guevarra90% (10)

- ACCA AFM S22 NotesDocument66 pagesACCA AFM S22 NotesdakshinNo ratings yet

- Chapter 3 - Financial AnalysisDocument39 pagesChapter 3 - Financial AnalysisHeatstroke0% (1)

- Property BRRR Model v1Document9 pagesProperty BRRR Model v1Trịnh Minh TâmNo ratings yet