Professional Documents

Culture Documents

ACC 401 Advanced Financial Accounting I 3 Credits

ACC 401 Advanced Financial Accounting I 3 Credits

Uploaded by

Toluwalope BamideleCopyright:

Available Formats

You might also like

- J. Swot AnalysisDocument3 pagesJ. Swot AnalysisTaskeen Zafar100% (1)

- Shapiro CHAPTER 5 SolutionsDocument11 pagesShapiro CHAPTER 5 Solutionsjimmy_chou13140% (1)

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- MODULE 2 - Accounting 1Document3 pagesMODULE 2 - Accounting 1JAY ROME CASTILLANONo ratings yet

- Module 1 - Development of Financial Reporting Framework and Standard-Setting BodiesDocument8 pagesModule 1 - Development of Financial Reporting Framework and Standard-Setting BodiesAndrealyn DitanNo ratings yet

- Bus 5110 Written Assignment Unit 7Document7 pagesBus 5110 Written Assignment Unit 7KonanRogerKouakouNo ratings yet

- DAC 501 Financial Accounting IDocument11 pagesDAC 501 Financial Accounting IdmugalloyNo ratings yet

- Accounting 12 Module 1Document12 pagesAccounting 12 Module 1Kristy Veyna BautistaNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Module 1 Financial Reporting LMSDocument15 pagesModule 1 Financial Reporting LMSGAZA MARY ANGELINENo ratings yet

- Ac 1&2 Module 1Document11 pagesAc 1&2 Module 1ABM-5 Lance Angelo SuganobNo ratings yet

- Mohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineDocument2 pagesMohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineAttyNo ratings yet

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaNo ratings yet

- Accounting and FinanceDocument301 pagesAccounting and FinanceLuvnica Verma100% (2)

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- Accounting and Business - Part IDocument38 pagesAccounting and Business - Part IJaymark LigcubanNo ratings yet

- Basic - Accounting by Mehtha SirDocument85 pagesBasic - Accounting by Mehtha Sirsamsonawane09100% (1)

- BUS 1.3 - Financial Awareness - Level 4 AssignmentDocument9 pagesBUS 1.3 - Financial Awareness - Level 4 AssignmentDave PulpulaanNo ratings yet

- Dmi - St. Eugene University (Dmiseu) : Module Code: 552 AC 35/ Module Name: Fundamentals of AccountingDocument182 pagesDmi - St. Eugene University (Dmiseu) : Module Code: 552 AC 35/ Module Name: Fundamentals of AccountingKaoma Joseph100% (1)

- Accounting I ModuleDocument92 pagesAccounting I ModuleJay Githuku100% (1)

- Accountancy Is The Process of Communicating Financial: Einstein College of EngineeringDocument21 pagesAccountancy Is The Process of Communicating Financial: Einstein College of EngineeringJackson JeevarajNo ratings yet

- FA Iof 1Document15 pagesFA Iof 1weyessagetuNo ratings yet

- Class 11 Accounts Syllabus Session 2015-16Document7 pagesClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument13 pagesACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341No ratings yet

- The Nature and Scope of Financial AccountingDocument6 pagesThe Nature and Scope of Financial AccountingShannoyia D'Neila ClarkeNo ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Chapter 1 FARDocument10 pagesChapter 1 FARHehe Hehe50No ratings yet

- FINANCIAL AND MANAGEMENT ACCOUNTING NOTES at MBA BKDocument383 pagesFINANCIAL AND MANAGEMENT ACCOUNTING NOTES at MBA BKJayesh Goswami100% (3)

- Accounting Information For Managers - Chapter OneDocument2 pagesAccounting Information For Managers - Chapter Onegumtree472No ratings yet

- Elizade Acc 101 Revision Lecture NotesDocument18 pagesElizade Acc 101 Revision Lecture NotesTijani OladipupoNo ratings yet

- Financial and Management AccountingDocument443 pagesFinancial and Management AccountingAyyappa Kattamuri100% (1)

- Shahjalal University of Science &technologyDocument12 pagesShahjalal University of Science &technologyপ্রজ্ঞা লাবনীNo ratings yet

- Conceptual FrameworksDocument169 pagesConceptual FrameworksAllana MierNo ratings yet

- (Paper) Commerce and Accountancy: Optional Subject of Main ExaminationDocument4 pages(Paper) Commerce and Accountancy: Optional Subject of Main ExaminationBhupendra JaiswalNo ratings yet

- Chapter 15Document4 pagesChapter 15helennguyen242004No ratings yet

- Financial Accounting FrameworkDocument45 pagesFinancial Accounting Frameworkajit_satapathy1988No ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- Chapter 1Document132 pagesChapter 1Joyce Ann Santos100% (1)

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisVivek SuranaNo ratings yet

- IM - Conceptual Framework and Accounting Standards PDFDocument88 pagesIM - Conceptual Framework and Accounting Standards PDFJocel VictoriaNo ratings yet

- IM - Conceptual Framework and Accounting Standards 2Document88 pagesIM - Conceptual Framework and Accounting Standards 2Shekainah BNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- Process Financial TNXN TTLM Nigussie BDocument40 pagesProcess Financial TNXN TTLM Nigussie Bnigus50% (2)

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Modul: Accounting For Manager (MAN 653)Document29 pagesModul: Accounting For Manager (MAN 653)kiki dutaNo ratings yet

- Finance For Non-Finance Executives: The Concept of Responsibility CentresDocument31 pagesFinance For Non-Finance Executives: The Concept of Responsibility Centressuresh.srinivasnNo ratings yet

- Finance Leverage Capital Markets Money Management: Importance-And-Limitations/61727Document7 pagesFinance Leverage Capital Markets Money Management: Importance-And-Limitations/61727GUDDUNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementAemro TadeleNo ratings yet

- ED Unit 3Document28 pagesED Unit 3sg.2312002No ratings yet

- FUNACC MIDTERM WPS Office 2Document9 pagesFUNACC MIDTERM WPS Office 2Althea Anne AcaboNo ratings yet

- Module 3 Conceptual Frameworks and Accounting StandardsDocument10 pagesModule 3 Conceptual Frameworks and Accounting StandardsJonabelle DalesNo ratings yet

- Principles of AccountingDocument74 pagesPrinciples of AccountingAwang NoviariNo ratings yet

- Fa Msu PDFDocument254 pagesFa Msu PDFSelvakumar Thangaraj100% (1)

- Introduction To AccountingDocument19 pagesIntroduction To AccountingKitea ChhakchhuakNo ratings yet

- Accounts and Audit Project Legal Provision Regarding Annual Accounts of A CompanyDocument24 pagesAccounts and Audit Project Legal Provision Regarding Annual Accounts of A CompanyAmit KumarNo ratings yet

- AccountingDocument339 pagesAccountingShaik Basha100% (3)

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Accounting TheoryDocument5 pagesAccounting TheoryToluwalope BamideleNo ratings yet

- Name: Bamidele Toluwalope CelestinaDocument8 pagesName: Bamidele Toluwalope CelestinaToluwalope BamideleNo ratings yet

- Ats2 Fa - Ias2&8Document10 pagesAts2 Fa - Ias2&8Toluwalope BamideleNo ratings yet

- Business PolicyDocument4 pagesBusiness PolicyToluwalope BamideleNo ratings yet

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALNo ratings yet

- Diagnositic SurveyReport Women SMEsDocument141 pagesDiagnositic SurveyReport Women SMEsAyza FatimaNo ratings yet

- IA2 03 - Handout - 1 PDFDocument6 pagesIA2 03 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Mgt101-15 - Accounting For InventoriesDocument69 pagesMgt101-15 - Accounting For InventoriesHaris AliNo ratings yet

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDocument7 pagesEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeNo ratings yet

- Audit Report On Financial StatementsDocument37 pagesAudit Report On Financial StatementsPeter BanjaoNo ratings yet

- Analysis and Use of Financial StatementsDocument227 pagesAnalysis and Use of Financial StatementsPik PokNo ratings yet

- Cost of Capital DoneDocument19 pagesCost of Capital DoneAjmal Salam100% (1)

- Lendify - Investor Presentation - 16 Jan 2018 PDFDocument58 pagesLendify - Investor Presentation - 16 Jan 2018 PDFDeepakNo ratings yet

- Krakatau BebebDocument14 pagesKrakatau BebebFebrian Rahmana PutraNo ratings yet

- Question Bank Answer: UNIT 4: Company FormationDocument5 pagesQuestion Bank Answer: UNIT 4: Company Formationameyk89No ratings yet

- Investments Analysis and Management 13th Edition Jones Test Bank 1Document20 pagesInvestments Analysis and Management 13th Edition Jones Test Bank 1theresa100% (44)

- Definition of Money MarketDocument17 pagesDefinition of Money MarketSmurti Rekha JamesNo ratings yet

- Additional Lecture - Chapter 10 Exchange Rate and Foreign Exchange MarketDocument6 pagesAdditional Lecture - Chapter 10 Exchange Rate and Foreign Exchange MarketTrần Hoàn Hạnh NgânNo ratings yet

- Bloomberg User Manual 2nd Edition 2018 Chapter 4 PDFDocument36 pagesBloomberg User Manual 2nd Edition 2018 Chapter 4 PDFRolandNo ratings yet

- Quiz Franchise and ConsignmentDocument2 pagesQuiz Franchise and ConsignmentMergierose DalgoNo ratings yet

- 1.2 General Partnership Vs Limited PartnershipDocument2 pages1.2 General Partnership Vs Limited PartnershipXyril MañagoNo ratings yet

- Post Covid-19 Best Practices For Public Listed Companies On Uganda's Securities Exchange.Document2 pagesPost Covid-19 Best Practices For Public Listed Companies On Uganda's Securities Exchange.Allan WaholiNo ratings yet

- Warren Buffett's Investment ChecklistDocument3 pagesWarren Buffett's Investment ChecklistrahkritiNo ratings yet

- Dupont Analysis of Asian PaintsDocument4 pagesDupont Analysis of Asian Paintsdeepaksg787No ratings yet

- Haberberg and Rieple: Strategic ManagementDocument20 pagesHaberberg and Rieple: Strategic ManagementMilan MisraNo ratings yet

- Client Wise Detail Report: As On 31 Oct 2023Document2 pagesClient Wise Detail Report: As On 31 Oct 2023smitaghike23No ratings yet

- VoVo NAAIM20101st Place Tony Cooper AgyDocument34 pagesVoVo NAAIM20101st Place Tony Cooper AgyMichael BarfußNo ratings yet

- Chapter 1 Fair FinancersDocument71 pagesChapter 1 Fair FinancersArfan AhmedNo ratings yet

- Chapter 1Document4 pagesChapter 1Micaela BakerNo ratings yet

- TRX Inc Finance CaseDocument4 pagesTRX Inc Finance CaseAnirban MondalNo ratings yet

ACC 401 Advanced Financial Accounting I 3 Credits

ACC 401 Advanced Financial Accounting I 3 Credits

Uploaded by

Toluwalope BamideleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 401 Advanced Financial Accounting I 3 Credits

ACC 401 Advanced Financial Accounting I 3 Credits

Uploaded by

Toluwalope BamideleCopyright:

Available Formats

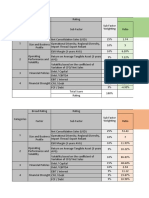

ACC 401 ADVANCED FINANCIAL ACCOUNTING I 3 CREDITS

Review of Company Accounts. Group Accounts – preparation of consolidated accounts,

elimination of intra-group balances and profit on intra-group transactions. Treatment of minority

interest, and cost of control. Accounting problems of group companies including multinationals

takeovers, mergers, reconstructions, re-organisations, associate companies. Accounting for

acquisitions and mergers. Accounting for foreign operations – Foreign branches/affiliates, means

of conversion etc. valuation of share and business – going concern and break-up basis.

Bankruptcy and Insolvency – requirements of the statute and accounting for bankruptcy and

insolvency. Accounting for specialised transactions; Joint venture, Hire-purchases, Goods on

sales or return, Royalties, Containers, Consignments, Investments and Securities, Bills of

Exchange and Pension Fund. Accounting for Banks and Insurance Industries, with special

reference to relevant legislation. Interpretation of financial statements – ratio analysis of working

capital and statements of the sources and application of funds and cash flows; and objectives of

disclosure.

ACC 421 Financial Management I 3 CREDITS

Nature, and Purpose of Financial Management. Capital Budgeting; Working Capital. Analysis

and interpretation of Basic Financial Statements; Evaluating Trade Credit, Advantages and

Disadvantages of Trading on Credit. Capital Structure and Economic Order Quantity (E.O.Q).

Business Mergers and Takeovers. Capital Market and Portfolio Theory Analysis. Capital Market

Efficiency (CME), Portfolio Analysis, Selection, and Revision Techniques.

ACC 441 PUBLIC SECTOR ACCOUNTING 3 CREDITS

Definition, Principles and Concepts of Public Sector Accounting Differences Between Private

and Public Sector Accounting, Legal Basis of Public Sector Accounting, Structure of Public

Sector Accounting Basis of Accounting, Accounting for Not-For-Profit Making Organizations,

Fund Accounting – Consolidated Revenue Fund, Federation Account Auditing in the Public

Sector, Accounting for Local Governments, Budget and Budgetary Control. Accounting for

Tertiary Institutions and Health Institutions, Nigeria’s Involvement in ECOWAS – Implications

to the Nation’s Economy Reforms in the Nigerian Public Enterprises.

ACC 461 FINANCIAL REPORTING AND ACCOUNTING ETHICS 3 CREDITS

The Nature and Role of Accounting Theory, Types of Methodology of Accounting Theory, The

Regulatory Framework of Government, Impact on the Development Accounting for

Measurement of income, Revenue, and Capital Maintenance. Valuation of Assets and Liabilities,

Deferred Expenditures, Extra-Ordinary, Exceptional and Abnormal Items, Detailed Treatment of

International Accounting Standards and Local Board Regulatory Body, Valuation of Shares and

Business ongoing Concern and Break-Up Basis, Accounting for Reconstruction and Re-

Organisation, inflation Accounting, Ethical Issues in Accounting Profession, Report Writing,

Treatment of Some Item in Published Accounts E.G. Cash Flow, Statement/Statement of Source

and Application of Funds, Value, Added Statement.

ACC 431 ACCOUNTING THEORY 3 CREDITS

This course is designed to introduce the students to theories of financial accounting. At the end of the

course, the students should have learned the theories surrounding most accounting practices. Areas of to

cover include a review of basic accounting procedures, including the rationale of financial accounting and

the economic foundations of accounting generally, elements of the history of accounting, working papers

and interpretations of financial statements, including the analysis of working capital and statements of

the cash flows, generally accepted accounting principles and net income concepts, including the valuation

of stock and work-in-progress.

.

BUS 401 BUSINESS POLICY AND STRATEGY 3 CREDITS

Nature, dynamics, and significance of corporate strategy and policy. The Nigerian business

environment, corporate social strategy and organisation structure, case studies in general

management, any other topical issues.

You might also like

- J. Swot AnalysisDocument3 pagesJ. Swot AnalysisTaskeen Zafar100% (1)

- Shapiro CHAPTER 5 SolutionsDocument11 pagesShapiro CHAPTER 5 Solutionsjimmy_chou13140% (1)

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- MODULE 2 - Accounting 1Document3 pagesMODULE 2 - Accounting 1JAY ROME CASTILLANONo ratings yet

- Module 1 - Development of Financial Reporting Framework and Standard-Setting BodiesDocument8 pagesModule 1 - Development of Financial Reporting Framework and Standard-Setting BodiesAndrealyn DitanNo ratings yet

- Bus 5110 Written Assignment Unit 7Document7 pagesBus 5110 Written Assignment Unit 7KonanRogerKouakouNo ratings yet

- DAC 501 Financial Accounting IDocument11 pagesDAC 501 Financial Accounting IdmugalloyNo ratings yet

- Accounting 12 Module 1Document12 pagesAccounting 12 Module 1Kristy Veyna BautistaNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Module 1 Financial Reporting LMSDocument15 pagesModule 1 Financial Reporting LMSGAZA MARY ANGELINENo ratings yet

- Ac 1&2 Module 1Document11 pagesAc 1&2 Module 1ABM-5 Lance Angelo SuganobNo ratings yet

- Mohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineDocument2 pagesMohawk Valley Community College Utica and Rome, New York School of Business and Hospitality Course OutlineAttyNo ratings yet

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaNo ratings yet

- Accounting and FinanceDocument301 pagesAccounting and FinanceLuvnica Verma100% (2)

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- Accounting and Business - Part IDocument38 pagesAccounting and Business - Part IJaymark LigcubanNo ratings yet

- Basic - Accounting by Mehtha SirDocument85 pagesBasic - Accounting by Mehtha Sirsamsonawane09100% (1)

- BUS 1.3 - Financial Awareness - Level 4 AssignmentDocument9 pagesBUS 1.3 - Financial Awareness - Level 4 AssignmentDave PulpulaanNo ratings yet

- Dmi - St. Eugene University (Dmiseu) : Module Code: 552 AC 35/ Module Name: Fundamentals of AccountingDocument182 pagesDmi - St. Eugene University (Dmiseu) : Module Code: 552 AC 35/ Module Name: Fundamentals of AccountingKaoma Joseph100% (1)

- Accounting I ModuleDocument92 pagesAccounting I ModuleJay Githuku100% (1)

- Accountancy Is The Process of Communicating Financial: Einstein College of EngineeringDocument21 pagesAccountancy Is The Process of Communicating Financial: Einstein College of EngineeringJackson JeevarajNo ratings yet

- FA Iof 1Document15 pagesFA Iof 1weyessagetuNo ratings yet

- Class 11 Accounts Syllabus Session 2015-16Document7 pagesClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument13 pagesACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341No ratings yet

- The Nature and Scope of Financial AccountingDocument6 pagesThe Nature and Scope of Financial AccountingShannoyia D'Neila ClarkeNo ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Module 1Document11 pagesModule 1ysa tolosaNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Chapter 1 FARDocument10 pagesChapter 1 FARHehe Hehe50No ratings yet

- FINANCIAL AND MANAGEMENT ACCOUNTING NOTES at MBA BKDocument383 pagesFINANCIAL AND MANAGEMENT ACCOUNTING NOTES at MBA BKJayesh Goswami100% (3)

- Accounting Information For Managers - Chapter OneDocument2 pagesAccounting Information For Managers - Chapter Onegumtree472No ratings yet

- Elizade Acc 101 Revision Lecture NotesDocument18 pagesElizade Acc 101 Revision Lecture NotesTijani OladipupoNo ratings yet

- Financial and Management AccountingDocument443 pagesFinancial and Management AccountingAyyappa Kattamuri100% (1)

- Shahjalal University of Science &technologyDocument12 pagesShahjalal University of Science &technologyপ্রজ্ঞা লাবনীNo ratings yet

- Conceptual FrameworksDocument169 pagesConceptual FrameworksAllana MierNo ratings yet

- (Paper) Commerce and Accountancy: Optional Subject of Main ExaminationDocument4 pages(Paper) Commerce and Accountancy: Optional Subject of Main ExaminationBhupendra JaiswalNo ratings yet

- Chapter 15Document4 pagesChapter 15helennguyen242004No ratings yet

- Financial Accounting FrameworkDocument45 pagesFinancial Accounting Frameworkajit_satapathy1988No ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- Chapter 1Document132 pagesChapter 1Joyce Ann Santos100% (1)

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisVivek SuranaNo ratings yet

- IM - Conceptual Framework and Accounting Standards PDFDocument88 pagesIM - Conceptual Framework and Accounting Standards PDFJocel VictoriaNo ratings yet

- IM - Conceptual Framework and Accounting Standards 2Document88 pagesIM - Conceptual Framework and Accounting Standards 2Shekainah BNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- Process Financial TNXN TTLM Nigussie BDocument40 pagesProcess Financial TNXN TTLM Nigussie Bnigus50% (2)

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Modul: Accounting For Manager (MAN 653)Document29 pagesModul: Accounting For Manager (MAN 653)kiki dutaNo ratings yet

- Finance For Non-Finance Executives: The Concept of Responsibility CentresDocument31 pagesFinance For Non-Finance Executives: The Concept of Responsibility Centressuresh.srinivasnNo ratings yet

- Finance Leverage Capital Markets Money Management: Importance-And-Limitations/61727Document7 pagesFinance Leverage Capital Markets Money Management: Importance-And-Limitations/61727GUDDUNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementAemro TadeleNo ratings yet

- ED Unit 3Document28 pagesED Unit 3sg.2312002No ratings yet

- FUNACC MIDTERM WPS Office 2Document9 pagesFUNACC MIDTERM WPS Office 2Althea Anne AcaboNo ratings yet

- Module 3 Conceptual Frameworks and Accounting StandardsDocument10 pagesModule 3 Conceptual Frameworks and Accounting StandardsJonabelle DalesNo ratings yet

- Principles of AccountingDocument74 pagesPrinciples of AccountingAwang NoviariNo ratings yet

- Fa Msu PDFDocument254 pagesFa Msu PDFSelvakumar Thangaraj100% (1)

- Introduction To AccountingDocument19 pagesIntroduction To AccountingKitea ChhakchhuakNo ratings yet

- Accounts and Audit Project Legal Provision Regarding Annual Accounts of A CompanyDocument24 pagesAccounts and Audit Project Legal Provision Regarding Annual Accounts of A CompanyAmit KumarNo ratings yet

- AccountingDocument339 pagesAccountingShaik Basha100% (3)

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Accounting TheoryDocument5 pagesAccounting TheoryToluwalope BamideleNo ratings yet

- Name: Bamidele Toluwalope CelestinaDocument8 pagesName: Bamidele Toluwalope CelestinaToluwalope BamideleNo ratings yet

- Ats2 Fa - Ias2&8Document10 pagesAts2 Fa - Ias2&8Toluwalope BamideleNo ratings yet

- Business PolicyDocument4 pagesBusiness PolicyToluwalope BamideleNo ratings yet

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALNo ratings yet

- Diagnositic SurveyReport Women SMEsDocument141 pagesDiagnositic SurveyReport Women SMEsAyza FatimaNo ratings yet

- IA2 03 - Handout - 1 PDFDocument6 pagesIA2 03 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Mgt101-15 - Accounting For InventoriesDocument69 pagesMgt101-15 - Accounting For InventoriesHaris AliNo ratings yet

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDocument7 pagesEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeNo ratings yet

- Audit Report On Financial StatementsDocument37 pagesAudit Report On Financial StatementsPeter BanjaoNo ratings yet

- Analysis and Use of Financial StatementsDocument227 pagesAnalysis and Use of Financial StatementsPik PokNo ratings yet

- Cost of Capital DoneDocument19 pagesCost of Capital DoneAjmal Salam100% (1)

- Lendify - Investor Presentation - 16 Jan 2018 PDFDocument58 pagesLendify - Investor Presentation - 16 Jan 2018 PDFDeepakNo ratings yet

- Krakatau BebebDocument14 pagesKrakatau BebebFebrian Rahmana PutraNo ratings yet

- Question Bank Answer: UNIT 4: Company FormationDocument5 pagesQuestion Bank Answer: UNIT 4: Company Formationameyk89No ratings yet

- Investments Analysis and Management 13th Edition Jones Test Bank 1Document20 pagesInvestments Analysis and Management 13th Edition Jones Test Bank 1theresa100% (44)

- Definition of Money MarketDocument17 pagesDefinition of Money MarketSmurti Rekha JamesNo ratings yet

- Additional Lecture - Chapter 10 Exchange Rate and Foreign Exchange MarketDocument6 pagesAdditional Lecture - Chapter 10 Exchange Rate and Foreign Exchange MarketTrần Hoàn Hạnh NgânNo ratings yet

- Bloomberg User Manual 2nd Edition 2018 Chapter 4 PDFDocument36 pagesBloomberg User Manual 2nd Edition 2018 Chapter 4 PDFRolandNo ratings yet

- Quiz Franchise and ConsignmentDocument2 pagesQuiz Franchise and ConsignmentMergierose DalgoNo ratings yet

- 1.2 General Partnership Vs Limited PartnershipDocument2 pages1.2 General Partnership Vs Limited PartnershipXyril MañagoNo ratings yet

- Post Covid-19 Best Practices For Public Listed Companies On Uganda's Securities Exchange.Document2 pagesPost Covid-19 Best Practices For Public Listed Companies On Uganda's Securities Exchange.Allan WaholiNo ratings yet

- Warren Buffett's Investment ChecklistDocument3 pagesWarren Buffett's Investment ChecklistrahkritiNo ratings yet

- Dupont Analysis of Asian PaintsDocument4 pagesDupont Analysis of Asian Paintsdeepaksg787No ratings yet

- Haberberg and Rieple: Strategic ManagementDocument20 pagesHaberberg and Rieple: Strategic ManagementMilan MisraNo ratings yet

- Client Wise Detail Report: As On 31 Oct 2023Document2 pagesClient Wise Detail Report: As On 31 Oct 2023smitaghike23No ratings yet

- VoVo NAAIM20101st Place Tony Cooper AgyDocument34 pagesVoVo NAAIM20101st Place Tony Cooper AgyMichael BarfußNo ratings yet

- Chapter 1 Fair FinancersDocument71 pagesChapter 1 Fair FinancersArfan AhmedNo ratings yet

- Chapter 1Document4 pagesChapter 1Micaela BakerNo ratings yet

- TRX Inc Finance CaseDocument4 pagesTRX Inc Finance CaseAnirban MondalNo ratings yet