Professional Documents

Culture Documents

DK Top Buys List

DK Top Buys List

Uploaded by

Murali Narayanan0 ratings0% found this document useful (0 votes)

10 views3 pagesThe document provides details on current company tickers, their conviction levels, yields, prices, historical fair values, discount levels, and dividend rates. It rates many companies as strong buy opportunities given their current discount to the estimated historical fair value prices.

Original Description:

Top Buys List

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides details on current company tickers, their conviction levels, yields, prices, historical fair values, discount levels, and dividend rates. It rates many companies as strong buy opportunities given their current discount to the estimated historical fair value prices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views3 pagesDK Top Buys List

DK Top Buys List

Uploaded by

Murali NarayananThe document provides details on current company tickers, their conviction levels, yields, prices, historical fair values, discount levels, and dividend rates. It rates many companies as strong buy opportunities given their current discount to the estimated historical fair value prices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

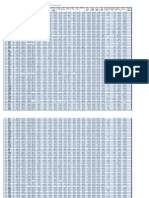

Current

Company Ticker Conviction Yield Price

Energy Transfer LP (uses K1 tax form) ET Strong Buy 8.89% $13.72

Tanger Outlet Centers SKT Strong Buy 9.04% $15.71

Lazard (uses K-1) LAZ Strong Buy 5.32% $35.31

Halliburton HAL Strong Buy 3.52% $20.44

AbbVie ABBV Strong Buy 5.91% $72.39

CVS Health CVS Strong Buy 3.11% $64.30

MPLX (uses K-1) MPLX Strong Buy 8.88% $30.06

Walgreens WBA Strong Buy 3.33% $55.00

Altria MO Strong Buy 8.23% $40.81

Carnival CCL Strong Buy 4.15% $48.22

Enbridge ENB Strong Buy 6.03% $35.34

Marathon Petroleum MPC Strong Buy 3.85% $55.10

Albermarle ALB Strong Buy 2.13% $68.86

Cummins CMI Strong Buy 3.24% $161.57

British American Tobacco BTI Strong Buy 7.16% $36.29

Bristol Myers BMY Strong Buy 3.24% $50.57

Caterpillar CAT Strong Buy 3.21% $128.16

Skyworks Solutions SWKS Buy 1.91% $79.75

Simon Property Group SPG Strong Buy 5.42% $155.04

Brookfield Renewable Partners (uses K BEP Strong Buy 5.47% $37.64

CoreCivic CXW Buy 10.14% $17.36

Broadcom AVGO Buy 3.73% $284.26

Philip Morris International PM Buy 6.40% $71.20

Cullen/Frost Bankers CFR Buy 3.21% $88.51

Principal Financial PFG Buy 3.82% $56.56

QTS Realty Trust QTS Buy 3.46% $50.93

Citigroup C Buy 2.94% $69.35

Ameriprise Financial AMP Buy 2.66% $145.78

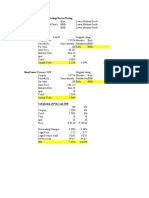

Medical Properties Trust MPW Brad Thomas Strong Buy 5.25% $19.04

Discount 5-Year CAGR

Historical To Total Return

Fair Value Strong Historical Estimate (F.A.S.T

Price Buy Near Good Buy Near Fair Value Graphs)

$30 $23 $26 54% 24% to 28%

$34 $26 $29 54% 23% to 29%

$71 $53 $60 50% 15% to 24%

$38 $30 $34 46% 21% to 27%

$121 $97 $103 40% 16% to 27%

$107 $80 $91 40% 17% to 26%

$50 $38 $43 40% 15% to 19%

$88 $70 $79 38% 18% to 25%

$63 $50 $57 35% 15% to 23%

$74 $59 $67 35% 15% to 25%

$53 $45 $50 33% 15% to 20%

$82 $62 $70 33% 14% to 22%

$98 $83 $93 30% 13% to 24%

$226 $181 $203 29% 13% to 20%

$50 $38 $43 27% 21% to 26%

$69 $55 $62 27% 12% to 25%

$172 $155 $163 25% 16% to 30%

$106 $80 $90 25% 20% to 27%

$206 $185 $206 25% 11% to 18%

$50 $40 $45 25% 13% to 24%

$23 $16 $18 25% 13% to 18%

$366 $311 $348 22% 13% to 20%

$89 $67 $85 20% 12% to 19%

$105 $84 $105 16% 13% to 20%

$67 $50 $57 16% 9% to 17%

$58 $44 $49 12% 9% to 16%

$78 $62 $70 11% 12% to 22%

$160 $128 $144 9% 15% to 23%

$15 $12 NA -27% 8% to 18%

Current

Dividend

1.22

1.42

1.88

0.72

4.28

2

2.67

1.83

3.36

2

2.13

2.12

1.47

5.24

2.6

1.64

4.12

1.52

8.4

2.06

1.76

10.6

4.56

2.84

2.16

1.76

2.04

3.88

1

You might also like

- Fortune 500 US List 2022 Someka Excel Template V2 Free VersionDocument8 pagesFortune 500 US List 2022 Someka Excel Template V2 Free Versionweekend politicsNo ratings yet

- Fortune 500 US List 2021 Someka V2Document7 pagesFortune 500 US List 2021 Someka V2Vicky DaswaniNo ratings yet

- Fortune 1000 US List 2019 - Someka V1Document8 pagesFortune 1000 US List 2019 - Someka V1Brajesh Kumar SinghNo ratings yet

- 4186 Metabical SpreadsheetDocument7 pages4186 Metabical SpreadsheetTomas KellyNo ratings yet

- Brugge 5-19Document13 pagesBrugge 5-19Alma PustaNo ratings yet

- Dividend AristocratsDocument6 pagesDividend AristocratsSujitKGoudarNo ratings yet

- P/E 2.96 EPS (TTM) 41.36 Market Cap 63.85B PEG 0.07Document4 pagesP/E 2.96 EPS (TTM) 41.36 Market Cap 63.85B PEG 0.07metalswedenNo ratings yet

- Fortune 1000 US List 2018 - Someka V1Document8 pagesFortune 1000 US List 2018 - Someka V1Bilesh PrasadNo ratings yet

- Fortune 500 US List 2019Document8 pagesFortune 500 US List 2019Amit Kumar GuptaNo ratings yet

- Data Analyst TestDocument5 pagesData Analyst TestMorgan MarkulNo ratings yet

- Solucion MetabicalDocument16 pagesSolucion MetabicalMiguel A. Fano MartelNo ratings yet

- Fortune 1000 US List 2021 Someka V1FDocument14 pagesFortune 1000 US List 2021 Someka V1FDeep SahuNo ratings yet

- Investment Plan Using Valuation Vs Trendline Log RegressionDocument12 pagesInvestment Plan Using Valuation Vs Trendline Log RegressionfoxNo ratings yet

- Symbol Name Current Price 1 Month % CHG 3 Month % CHG 6 Month % CHG 1 Year % CHGDocument12 pagesSymbol Name Current Price 1 Month % CHG 3 Month % CHG 6 Month % CHG 1 Year % CHGAmit AwalNo ratings yet

- 2009 Forbes 200 Small CompaniesDocument3 pages2009 Forbes 200 Small CompaniesOld School ValueNo ratings yet

- Valentine's Day 1-18-16 PressDocument5 pagesValentine's Day 1-18-16 PressAnonymous EnJd6RheYNo ratings yet

- Converting Nominal Yield Into Effective YieldDocument48 pagesConverting Nominal Yield Into Effective YieldOUSSAMA NASRNo ratings yet

- Fortune 500: FiltersDocument10 pagesFortune 500: Filterssivagnana selvakumarNo ratings yet

- Stock Working FileDocument56 pagesStock Working FileSokhomNo ratings yet

- MM 20 - Per Day ProjectDocument21 pagesMM 20 - Per Day Projectferdy molNo ratings yet

- Blue Chip Shares Instrument: Us Stock PerformanceDocument1 pageBlue Chip Shares Instrument: Us Stock PerformanceGustiayu OkaindrayaniNo ratings yet

- Companies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)Document1 pageCompanies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)fcsamscribdNo ratings yet

- Ticker Name Price: Data Provided For Free by IEXDocument4 pagesTicker Name Price: Data Provided For Free by IEXManuel HijarNo ratings yet

- Dividend KingsDocument6 pagesDividend KingsVelmurugan JeyavelNo ratings yet

- Courier Round 7 (2028)Document15 pagesCourier Round 7 (2028)G H O S TNo ratings yet

- Fund Report DraftDocument4 pagesFund Report DraftRenjie XuNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Instapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Document79 pagesInstapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Darlene BlayaNo ratings yet

- Analisis Suturas 2020Document6 pagesAnalisis Suturas 2020David SantoandreNo ratings yet

- State of The Market - Nov. 3 - 9, 2022Document14 pagesState of The Market - Nov. 3 - 9, 2022Cleverton Lehmkuhl LourençoNo ratings yet

- Sucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronDocument9 pagesSucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronjoseNo ratings yet

- TabelasDocument3 pagesTabelasKállison StolzeNo ratings yet

- Stock Case Price Tracker Fin 350Document13 pagesStock Case Price Tracker Fin 350api-578941689No ratings yet

- Group 6 - CalculationDocument5 pagesGroup 6 - CalculationDINKAR JAISWALNo ratings yet

- Duration and ConvexityDocument12 pagesDuration and ConvexityAditya BanerjeeNo ratings yet

- CreditmetricsDocument2 pagesCreditmetricsnikhil1684No ratings yet

- Maryam M. Al Ali - SolutionDocument2 pagesMaryam M. Al Ali - Solutionaminlaiba2000No ratings yet

- DIA Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes LunesDocument8 pagesDIA Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes LunesJuan Martin OropezaNo ratings yet

- Variación Del Punto de Equilibrio Ante Variación Del Costo FijoDocument18 pagesVariación Del Punto de Equilibrio Ante Variación Del Costo FijoHector MacavilcaNo ratings yet

- Mis Inversiones V26Document106 pagesMis Inversiones V26angelNo ratings yet

- Currency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%Document29 pagesCurrency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%raman nandhNo ratings yet

- January '23 - 1st Half - Research Dashboard Research Dashboard Model: Coverage UniverseDocument3 pagesJanuary '23 - 1st Half - Research Dashboard Research Dashboard Model: Coverage UniverseadeladeftaNo ratings yet

- Hotel Performance 2022Document1 pageHotel Performance 2022srcesrbije.onlineNo ratings yet

- Monmouth CaseDocument6 pagesMonmouth CaseMohammed Akhtab Ul HudaNo ratings yet

- Jumpstart BSchool Data 3Document25 pagesJumpstart BSchool Data 3Saeed T. AyedhNo ratings yet

- Jumpstart BSchool Data 4Document27 pagesJumpstart BSchool Data 4Saeed T. AyedhNo ratings yet

- ROI CallsDocument3 pagesROI CallsramojiraNo ratings yet

- Company Name Year Price Controller Speed Battery Life Camera Brand Equity USADocument5 pagesCompany Name Year Price Controller Speed Battery Life Camera Brand Equity USABala SudhakarNo ratings yet

- Growing Market ModelDocument12 pagesGrowing Market ModeljanuarNo ratings yet

- Kitov China DealDocument1 pageKitov China DealAnonymous ipErpL6No ratings yet

- Phase in FinalDocument2 pagesPhase in FinalRuss LatinoNo ratings yet

- Assign N5Document2 pagesAssign N5cc20379No ratings yet

- Pràctica 5 19e50069 Mario AlbertoDocument21 pagesPràctica 5 19e50069 Mario AlbertoMario Alberto Cruz MoralesNo ratings yet

- Compare Jet Aircraft - JetBrokers Worldwide Corporate Aircraft SalesDocument9 pagesCompare Jet Aircraft - JetBrokers Worldwide Corporate Aircraft Salesborko manevNo ratings yet

- Cuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADocument4 pagesCuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADiana Camargo MurciaNo ratings yet

- How To Analyze A Category Value, Size, Share, Growth of Category, Segments & CompetitorsDocument4 pagesHow To Analyze A Category Value, Size, Share, Growth of Category, Segments & CompetitorsSara KarenNo ratings yet

- Bai Giang Equity R2Document6 pagesBai Giang Equity R2yến đỗNo ratings yet

- Asian Paint FMVRDocument20 pagesAsian Paint FMVRdeepaksg787No ratings yet

- ITF Sample Open Position SpreadsheetDocument5 pagesITF Sample Open Position SpreadsheetSilat KaliNo ratings yet

- Monthly Profile of State and National Mortgage Activity: Mba Org ResearchDocument4 pagesMonthly Profile of State and National Mortgage Activity: Mba Org ResearchdudeNo ratings yet

- Multiple Choice Questions for Haematology and Core Medical TraineesFrom EverandMultiple Choice Questions for Haematology and Core Medical TraineesNo ratings yet

- Current List of HART Manufacturer ID Codes - FieldComm Group Support PortalDocument15 pagesCurrent List of HART Manufacturer ID Codes - FieldComm Group Support PortalHooman KaabiNo ratings yet

- Business Combination-Date of AcquisitionDocument13 pagesBusiness Combination-Date of Acquisitionmax pNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingSamsung AccountNo ratings yet

- BUILDER - DATA NCRDocument367 pagesBUILDER - DATA NCRDecember RealtyNo ratings yet

- BibliographyDocument2 pagesBibliographyShashankSinghNo ratings yet

- Business Case AnalysisDocument6 pagesBusiness Case Analysispatricia pillarNo ratings yet

- Close Corporation (Q & A)Document6 pagesClose Corporation (Q & A)Eunice Reyala TabinasNo ratings yet

- Advantages of Joint Stock Company: 5 Online ClassDocument2 pagesAdvantages of Joint Stock Company: 5 Online Classrahmatullah HamidiNo ratings yet

- Paint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacDocument8 pagesPaint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacKhushboo RajNo ratings yet

- Mumbai DatabaseDocument41 pagesMumbai DatabaseSumitNo ratings yet

- EmpasmontookmlDocument4 pagesEmpasmontookmlthe kriboeeNo ratings yet

- SP 500 SlogansDocument21 pagesSP 500 SlogansGoufran AlnoufiNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- Corporation Final ReviewerDocument48 pagesCorporation Final ReviewerAssecmaNo ratings yet

- CFAP 2 CLS Summer 2017 PDFDocument4 pagesCFAP 2 CLS Summer 2017 PDFJawad TariqNo ratings yet

- Case Studies On Ethics and Corporate Governance - Vol. IDocument8 pagesCase Studies On Ethics and Corporate Governance - Vol. IibscdcNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document6 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Schreibman Contributions 2011-2012Document8 pagesSchreibman Contributions 2011-2012David LombardoNo ratings yet

- Chapter 6 Cost of CapitalDocument18 pagesChapter 6 Cost of CapitalmedrekNo ratings yet

- BCG Always On Strategy Apr 2017Document6 pagesBCG Always On Strategy Apr 2017Hoanabc123No ratings yet

- Audit of The Capital Acquisition and Repayment Cycle Accounts in The CycleDocument3 pagesAudit of The Capital Acquisition and Repayment Cycle Accounts in The CycleGeorgia VasanthaNo ratings yet

- Private Equity GlossaryDocument4 pagesPrivate Equity GlossarySmruti Ranjan NayakNo ratings yet

- Mutual Fund in IndiaDocument19 pagesMutual Fund in IndiaRahul JaiswalNo ratings yet

- Table B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Document2 pagesTable B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Rekha BaiNo ratings yet

- Test To Determine Applicability of Piercing The Veil: CorporationDocument9 pagesTest To Determine Applicability of Piercing The Veil: CorporationVanessa dela TorreNo ratings yet

- Examiners' Reports 2019: LA3021 Company Law - Zone ADocument17 pagesExaminers' Reports 2019: LA3021 Company Law - Zone AdaneelNo ratings yet

- Advantages and Disadvantages of Incorporation of A CompanyDocument5 pagesAdvantages and Disadvantages of Incorporation of A CompanyAmrutha PrakashNo ratings yet

- SOP DiscDocument6,931 pagesSOP DiscGD SinghNo ratings yet

- PNBHousing - Grant of Options Under ESOP SchemeDocument2 pagesPNBHousing - Grant of Options Under ESOP SchemeRoshan. l I dggBishtNo ratings yet