Professional Documents

Culture Documents

Class Test Partnership

Class Test Partnership

Uploaded by

palashndcOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Test Partnership

Class Test Partnership

Uploaded by

palashndcCopyright:

Available Formats

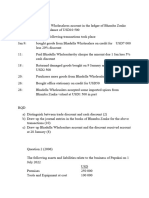

CLASS TEST 4

NAME: ________________________________________

1 Aston, Brutus and Cesar have been in partnership for many years sharing profits and losses in

the ratio 2:2:1. They provided the following information.

Aston, Brutus and Cesar

Statement of financial position at 30 September 2014

$ $

Assets

Non-current assets

Land and buildings 210 000

Plant and machinery 27 950

Motor vehicles 11 352

249 302

Current assets

Inventory 17 632

Trade receivables 9 340

Cash and cash equivalents 2 546

29 518

Total assets 278 820

Capital and liabilities

Capital accounts Aston 80 000

Brutus 60 000

Cesar 20 000 160 000

Current accounts Aston 12 735

Brutus 10 873

Cesar (2 628) 20 980

Non-current liabilities

Loan from Aston 75 000

Current liabilities

Trade payables 22 840

Total capital and liabilities 278 820

On 30 September 2014 they decided to dissolve the partnership. The terms of the dissolution

were:

1. Land and buildings were sold for $217 000.

2. Plant and machinery was sold for $25 000.

3. Motor vehicles were disposed of as follows: one to Aston and one to Brutus at an agreed

value of $4000 each, with the remaining motor vehicles being sold for $5000.

4. The inventory was sold for $18 478.

5. Two customers who owed the partnership $590 and $450 were unable to settle their debts.

The remaining credit customers paid in full after receiving a 2% discount.

6. All of the trade payables were paid after they allowed a 5% discount.

7. The total costs of dissolution amounted to $2250.

REQUIRED

(a) Prepare the partnership realisation account. [13]

(b) Prepare the partners’ capital accounts. [10]

(c) Prepare the partnership bank account. [7]

You might also like

- Sole Traders QuestionsDocument5 pagesSole Traders QuestionsJawad Hasan0% (1)

- Incomplete RecordsDocument27 pagesIncomplete RecordsSteven Raintung0% (1)

- Ch10 ProblemDocument2 pagesCh10 ProblempalashndcNo ratings yet

- JNTUA MBA Draft Syllabus 2014-15Document67 pagesJNTUA MBA Draft Syllabus 2014-15Kota Mani KantaNo ratings yet

- Statement of Cash FlowsDocument11 pagesStatement of Cash FlowsanjuNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- Discussion Questions - Balance SheetDocument2 pagesDiscussion Questions - Balance SheetjakelakerNo ratings yet

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Company Accounting-IgcseDocument2 pagesCompany Accounting-IgcseGodfreyFrankMwakalingaNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Zimbabwe School Examinations Council: Accounting 9197/3Document8 pagesZimbabwe School Examinations Council: Accounting 9197/3nyashamagutsa93No ratings yet

- Istaimy PLC: Chapter 26 Business PurchaseDocument3 pagesIstaimy PLC: Chapter 26 Business PurchaseSir YusufiNo ratings yet

- CAC1101201008 Financial Accounting 1ADocument6 pagesCAC1101201008 Financial Accounting 1AGift MoyoNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- SFP ACT 2021 Answer SheetDocument1 pageSFP ACT 2021 Answer SheetmoreNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Bs 320 Test One TutorialDocument12 pagesBs 320 Test One TutorialPrince Daniels TutorNo ratings yet

- .Archivetemp8 - Financial Accounting (Old Syllabus)Document2 pages.Archivetemp8 - Financial Accounting (Old Syllabus)aneebaNo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Partnership ChangesDocument31 pagesPartnership ChangesNelly LamNo ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- AFM-CFS ProblemsDocument10 pagesAFM-CFS ProblemskanikaNo ratings yet

- Exercises Lesson 6 Statement of Changes in Equity: Financial AccountingDocument31 pagesExercises Lesson 6 Statement of Changes in Equity: Financial Accounting稽古No ratings yet

- HorsefieldDocument2 pagesHorsefieldMarie Xavier - FelixNo ratings yet

- Problems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActDocument7 pagesProblems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActNithyananda PatelNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Bank AccountingDocument8 pagesBank Accountinggordonomond2022No ratings yet

- B02 Final Exam Review QuestionsDocument8 pagesB02 Final Exam Review QuestionsnigaroNo ratings yet

- FS Withadj QuesDocument7 pagesFS Withadj QuesHimank SaklechaNo ratings yet

- Of Financial PositionDocument3 pagesOf Financial PositionIrah LouiseNo ratings yet

- Solved StatamentsDocument16 pagesSolved StatamentsHaris AhnedNo ratings yet

- Repaso T.6 SolucionDocument5 pagesRepaso T.6 Solucionjorge grau lopezNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- CHAPTER 14 - CFS Advance IAS7Document15 pagesCHAPTER 14 - CFS Advance IAS7Hạnh Nguyễn HồngNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- CPA 1 - Financial Acconting Sep 2022Document10 pagesCPA 1 - Financial Acconting Sep 2022Asaba GloriaNo ratings yet

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- SBR Consolidation Mock QueDocument7 pagesSBR Consolidation Mock QuePratham BarotNo ratings yet

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDocument5 pages6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6No ratings yet

- 0cashflow Problem1Document1 page0cashflow Problem1nuvvenuvvenuvveNo ratings yet

- CFS 2Document2 pagesCFS 2RositaNo ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- Osa Jan24 s1 Adbm Business Finance FinalDocument13 pagesOsa Jan24 s1 Adbm Business Finance FinalpzrgftctbxNo ratings yet

- Frankwood 358-358Document1 pageFrankwood 358-358saiimbutt525No ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSharu BsNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- BUS207Document2 pagesBUS207palashndcNo ratings yet

- Principles of AccountingDocument3 pagesPrinciples of AccountingpalashndcNo ratings yet

- Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019Document4 pagesConsolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019palashndcNo ratings yet

- Accounting Accn1: General Certificate of Education June 2015Document16 pagesAccounting Accn1: General Certificate of Education June 2015palashndcNo ratings yet

- Accounting Accn4: General Certificate of Education Advanced Level Examination June 2015Document24 pagesAccounting Accn4: General Certificate of Education Advanced Level Examination June 2015palashndcNo ratings yet

- Internal Auditor As Fraud BusterDocument12 pagesInternal Auditor As Fraud BusterpalashndcNo ratings yet

- Ch11 Ques ParkinDocument1 pageCh11 Ques ParkinpalashndcNo ratings yet

- List of Cambridge Attached Centres in BangladeshDocument12 pagesList of Cambridge Attached Centres in BangladeshpalashndcNo ratings yet

- 1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftDocument2 pages1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftpalashndcNo ratings yet

- American Economic Journal: Macroeconomics 2010, 2:1, 207-223Document17 pagesAmerican Economic Journal: Macroeconomics 2010, 2:1, 207-223palashndcNo ratings yet

- Class Work NAME: - SECTIONDocument1 pageClass Work NAME: - SECTIONpalashndcNo ratings yet

- Cambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeachersDocument26 pagesCambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeacherspalashndcNo ratings yet

- 1 Business OrganisationsDocument2 pages1 Business OrganisationspalashndcNo ratings yet

- 4 Public SectorDocument5 pages4 Public SectorpalashndcNo ratings yet

- Mock Unit04 OligopolyDocument3 pagesMock Unit04 Oligopolypalashndc0% (1)

- Kaizen Institute Consulting Group (KICG) : Global Corporate OverviewDocument19 pagesKaizen Institute Consulting Group (KICG) : Global Corporate OverviewCREATION.DESIGN.JEANSNo ratings yet

- Mini Project PucccaDocument50 pagesMini Project PucccaabdullarkNo ratings yet

- Contract of LeaseDocument2 pagesContract of LeaseesormikNo ratings yet

- Rail E-Ticket - NR251188915465 - PNR 2430501281 - KLL-BDTSDocument2 pagesRail E-Ticket - NR251188915465 - PNR 2430501281 - KLL-BDTSVarsha SamtaniNo ratings yet

- Some Notes For The Energy Risk Professional Exam (GARP)Document49 pagesSome Notes For The Energy Risk Professional Exam (GARP)Dwynne Igau100% (2)

- HDFC Life Sanchay Par Advantage Retail Brochure PDFDocument18 pagesHDFC Life Sanchay Par Advantage Retail Brochure PDFSajidNo ratings yet

- CWTSDocument19 pagesCWTSjoshNo ratings yet

- Final Acc Wid Adjustment PracticalDocument20 pagesFinal Acc Wid Adjustment PracticalMuskan LohariwalNo ratings yet

- Philips Industrial DevelopmentDocument2 pagesPhilips Industrial DevelopmentBroy D BriumNo ratings yet

- Int. J. Production Economics: Jyri P.P. Vilko, Jukka M. HallikasDocument10 pagesInt. J. Production Economics: Jyri P.P. Vilko, Jukka M. HallikasiksanwanNo ratings yet

- Proposal Eta Theke BanaisiDocument109 pagesProposal Eta Theke BanaisiMaruf Hasibul IslamNo ratings yet

- Financial Accounting Information For Decisions Wild 7th Edition Solutions ManualDocument36 pagesFinancial Accounting Information For Decisions Wild 7th Edition Solutions Manualwalerfluster9egfh3100% (39)

- L03 PDFDocument21 pagesL03 PDFUmer ImranNo ratings yet

- ECC1000 - Unit GuideDocument10 pagesECC1000 - Unit GuideThomasMannNo ratings yet

- Natural Law TrustDocument6 pagesNatural Law TrustDEV91% (11)

- Joint Cost Allocation-Illustrative ProblemsDocument4 pagesJoint Cost Allocation-Illustrative ProblemspamssyNo ratings yet

- (WK 1) RM - Basic Concepts of RiskDocument8 pages(WK 1) RM - Basic Concepts of RisksiuyinxddNo ratings yet

- Unit 4-Intro To Services MKTG - Price - Place - Jessy Nair - PESU - JN-MinorsDocument109 pagesUnit 4-Intro To Services MKTG - Price - Place - Jessy Nair - PESU - JN-MinorsJaya HarshitNo ratings yet

- Vicarious Liability in Tort LawDocument17 pagesVicarious Liability in Tort LawRaj Vardhan TiwariNo ratings yet

- Signetics V CA Signetics V CA: Corporate Law Case Write-Up VOL 5 SCRADocument2 pagesSignetics V CA Signetics V CA: Corporate Law Case Write-Up VOL 5 SCRAChino VilloncoNo ratings yet

- How To License A New Product in Oracle ApplicationsDocument5 pagesHow To License A New Product in Oracle ApplicationsNaresh BabuNo ratings yet

- Government of Tamil Nadu: Department of Employment and Training (Training Wing)Document75 pagesGovernment of Tamil Nadu: Department of Employment and Training (Training Wing)SanjaiNo ratings yet

- Cap BudDocument1 pageCap BudGileah ZuasolaNo ratings yet

- Book 39Document6 pagesBook 39Edwin ChristianNo ratings yet

- Brandywine Health Foundation 2014 Community ReportDocument14 pagesBrandywine Health Foundation 2014 Community ReportKen KnickerbockerNo ratings yet

- User Acceptance Sign-Off To C360 Dashboard1010Document36 pagesUser Acceptance Sign-Off To C360 Dashboard1010Anonymous ZbwR1daf4No ratings yet

- Topic: StarbucksDocument24 pagesTopic: StarbucksNga NguyễnNo ratings yet

- Chartering and Shipping TermsDocument76 pagesChartering and Shipping TermsOlivin100% (1)

- BFL Case StudyDocument20 pagesBFL Case StudyRajesh K Pillania88% (8)