Professional Documents

Culture Documents

12 Accountancy Lyp 2008 Set1

12 Accountancy Lyp 2008 Set1

Uploaded by

Yash VagrechaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy Lyp 2008 Set1

12 Accountancy Lyp 2008 Set1

Uploaded by

Yash VagrechaCopyright:

Available Formats

Question

Paper 2008 Delhi set 1

CBSE Class 12 ACCOUNTANCY

General Instructions:

(i) This question paper contains three parts A, B and C.

(ii) Part A is compulsory for all candidates.

(iii) Candidates can attempt only one part of the remaining parts B and C.

(iv) All parts of the questions should be attempted at one place.

Part ‘A’

(Not for profit Organisation, Partnership Firms and Company Accounts)

1. Distinguish between Income and Expenditure Account and Receipt and Payment on the

basis of nature of items recorded therein. (1)

2. Ram and Mohan and partners in a firm without any partnership deed. Their capitals Ram

Rs. 8,00,000 and Mohan Rs. 6,00,000. Ram is an active partner and looks after the business.

Ram wants that profit should be in proportion of capitals. State with reasons whether his

claim is valid or not. (1)

3. Define goodwill. (1)

4. State any two reasons for the preparation of “Revaluation Accounts” on the admission of a

partner. (1)

5. Give the meaning of ‘minimum subscription’. (1)

6. Calculate the amount of sports material to be debited to the Income and Expenditure

Accounts of Capital sports club for the year ended 31.3.2007 on the basis of the following

information: (1)

1.4.2006 Rs. 31.3.2007 Rs.

Stock of the sports material 7,500 6,400

Creditors for sports material 2,000 2,600

Material downloaded from myCBSEguide.com. 1 / 9

7. Samta Ltd. Forfeited 800 equity shares of Rs. 100 each for the non-payment of first call of

Rs. 30 per share. The final call of Rs. 20 per share was not yet made. Out of the forfeited 400

were re-issued at the rate of Rs. 105 per share fully paid up.

Pass necessary journal entries in the books of Samta Ltd. For the above transactions. (3)

8. Deepak Ltd. Purchased furniture Rs. 2,20,000 from M/s Furniture Mart 50% of the amount

was paid to Furniture Mart by accepting a bill of exchange and for the balance the company

issued 9% debentures of Rs. 100 each at a premium of 10% in favour of furniture Mart.

Pass necessary journal entries in the book of Deepak Ltd. For the above transaction. (3)

9. Kumar and Raja were partners in a firm sharing profits in the ratio of 7:3. Their fixed

capitals were: Kumar Rs. 9,00,000 and Raja. Rs. 4,00,000. The partnership deed provided for

the following but the profit for the year was distributed without providing for:

(i) Interest on capital @ 9% per annum.

(ii) Kumar’s salary Rs. 50,000 per year and Raja’s salary Rs. 3,000 per month.

The profit for the year ended 31.3.2007 was Rs. 2,78,000.

Pass the adjustment entry. (4)

10. P, Q and R were partners in a firm sharing profits in 2:2:1 ratio. The firm closes its books

on 31 March every year. P died three months after the last accounts were prepared. On that

date the goodwill of the firm was valued at Rs. 90,000. On the death of a partner his share of

profit of the last four years. The profit of last four years were:

Year ended 31.3.2007 Rs. 2,00,000

Year ended 31.3.2006 Rs. 1,80,000

Year ended 31.3.2005 Rs. 2,10,000

Year ended 31.3.2004 Rs. 1,70,000(loss)

Pass necessary journal entries for the treatment of goodwill and P’s share of profit on his

Material downloaded from myCBSEguide.com. 2 / 9

death. Show clearly the calculate of P’s share of profit. (4)

11. Sagar Ltd. Was registered with an authored capital of Rs, 1,00,000 divided into 1,00,000

equities share of Rs. 100 each. The company offered for public subscription 60,000 equity

share. Applications of 56,000 shares were received and allotment was made to all the

applicant. All the calls were made and were duly receive except the second and final call of

Rs. 20 per share on 700 shares. Prepare the Balance Sheet of the company showing the

different types of share capital. (4)

12. Following is the Receipt and Payment Account of Indian Sport Club for the year ended

31.12.2006:

Receipts Amount Rs. Payments Amount Rs.

10,000 15,000

Balance b/d Salary

52,000 20,000

Subscriptions Billiards Table

5,000 6,000

Entrance Fee Office Expenses

26,000 31,000

Tournament Fund Tournament Expenses

1,000 40,000

ale of old newspapers Sports Equipment

37,000 19,000

Legacy Balance c/d

1,31,000 1,31,000

Other Information:

On 31.12.2006 subscription outstanding was Rs. 2,000 and on 31.12.2005 subscription

outstanding was Rs. 3,000. Salary outstanding on 31.12.2006 was Rs. 1,500.

On 1.1.2206 the club had building Rs. 75,000 furniture Rs. 18,000 12% investment Rs. 30,000

and sports equipment Rs. 30,000. Depreciation charged on these items including purchase

was 10%.

Prepare income and Expenditure Account of the club for the year ended 31.12.2006 and

ascertain the capital Fund on 31.12.2005. (6)

13. K and Y were partners in a firm sharing profits in 3 : 2 ratio. They admitted Z as a new

partner for 1/3rd share in the profits of the firm. Z acquired his share from K and Y in 2 : 3

ratio, Z brought Rs. 80,000 for his capital and Rs. 30,000 for his 1/3rd share as premium.

Material downloaded from myCBSEguide.com. 3 / 9

Calculate the new profit sharing ration of K, Y and Z and pass necessary journal entries for

the above transactions in the books of the firm. (6)

14. Pass necessary journal entries in the books of Varun Ltd. For the following transactions:

(6)

(i) Issued 58,000, 9% debentures of Rs, 1000 each at a premium of 10%/

(ii) Converted 350, 9% debentures of Rs. 100 each into equity shares of Rs. 10 each issued at a

premium of 25%.

(iii) Redeemed 450, 9% debentures of Rs. 100 each by draw of lots.

15. R, S and T were partners in a frim sharing profits in 2 : 2 : 1 ratio. On 1.4.2004 their

Balance Sheet was as follows:

Liabilities Amount Rs. Assets Amount Rs.

12,800 51,300

Bank loan Cash

25,000 10,800

Sundry Creditors Bills Receivable

35,600

Capitals Debtors

44,600

R 80,000 Stock

7,000

S 50,000 Furniture

1,70,000 19,500

T 40,000 Plant and Machinery

9,000 48,000

Profit and Loss A/c Building

2,16,800 2,16,800

S retired from the firm on 1.4.2004 and his share was ascertained in the revaluation of assets

as follow:

Stock Rs. 40,000; Furniture Rs, 6000; Plant and Machinery Rs. 18,000; Building Rs. 40,000; Rs,

1,700 were to be provided for doubtful debts. The goodwill of the firm was valued at Rs.

12,000.

S was to be paid Rs. 18,080 in cash on retirement and the balance in the three equal yearly

instalments.

Material downloaded from myCBSEguide.com. 4 / 9

Prepare Revaluation Accounts, Partner’s Capital Accounts, S’s Loan Account and Balance

Sheet on 1.4.2004. (8)

OR

D are E were partners in a firm sharing profits in 3 : 1 ratio. On 1.4.2007 they admitted F as a

new partner for 1/4th share in the firm which the acquired from D. Their Balance Sheet on

that date was as follow:

Liabilities Amount Rs. Assets Amount Rs.

54,000 50,000

Land and Building

60,000

Creditors Machinery

15,000

Capitals Stock

1,70,000

D 1,00,000 Debtors 40,000

32,000 37,000

E 70,000 Less provision for debts 3,000

50,000

General Reserve Investments

44,000

Cash

2,56,000 2,56,000

F will bring Rs. 40,000 as his capital and the other terms agreed upon were:

(i) Goodwill of the firm was valued at Rs. 24,000

(ii) Land and Building were valued at Rs. 70,000.

(iii) Provision for bad debts was found to be in excess by Rs. 800.

(iv) The capital of the partners be adjusted in sundry creditors was not likely to arise.

(v) The capital of the partners be adjusted on the basis of F’s contribution of capital to the

firm.

(vi) Excess or shortfall, if any, to be transferred to current accounts.

Prepare Revaluation Accounts, Partner’s Capital Accounts and the Balance Sheet of the new

firm.

Material downloaded from myCBSEguide.com. 5 / 9

16. Janated Ltd. Invited applications for issuing 70,000 equity shares of Rs. 10 each at a

premium of Rs. 2 per share. The amount was payable as follows: (8)

On application Rs. 4 per share (including premium)

On allotment Rs. 3 per share

On first and final call-Balance.

Applications for 1,00,000 shares and were received. Applications for 10,000 shares were

rejected. Share were allotted to the remaining applicants on pro-rata basis. Excess money

received with applications were adjusted towards sums due on allotments. All calls were

made and were duly received except first and final call on 700 shares allotted to Kanwar. His

shares were forfeited. The forfeited shares were re-issued for Rs. 77,000 fully paid up.

Pass necessary journal entries in the books of the company for the above transactions. (8)

OR

Shubham Ltd. Invited applications for the allotment of 80,000 equity shares of Rs. 10 each at

a discount of 105. The amount was payable as follows:

On application Rs. 2 per share

On allotment Rs. 3 per share

On first and final call-Balance.

Application for 1,10,000 shares were received. Applications for 10,000 shares were rejected.

Shares were allotted on pro-rata basis to the remaining applications. Excess application

money received on applicant was adjusted towards sums due on allotment. All calls were

made and were duly received. Manoj who had applied for 2000 shares failed to pay the

allotment and first and final call. His shares were forfeited. The forfeited shares share were

re-issued for Rs. 24,000 fully paid up.

Pass necessary journal entries in the books of the company for the above transactions.

Part ‘B’

Material downloaded from myCBSEguide.com. 6 / 9

(Analysis of Financial Statement)

17. The Stock turnover ratio of a company is 3 times. State, giving reasons, whether the ratio

improves, declines or does not change because of increase in the value of closing stock by Rs.

5,000. (1)

18. State whether the payment of cash to creditors will result in inflow, outflow or no flow of

cash. (1)

19. Divided paid by a manufacturing company is classified under which kind of activity

while preparing cash flow statement? (1)

20. Show the major heading on the liabilities side of the Balance sheet of a company as per

schedule VI part I of the Companies Act, 1956.

21. From the following information prepare a Comparative Income Statement of Victor Ltd:

(4)

2006 Rs. 2007 Rs.

Sales 15,00,000 18,00,000

Cost of good sold 11,00,000 14,00,000

Indirect Expenses 20% of Gross Profit 25% of Gross Profit

Income Tax 50% 50%

22. From the following information calculate any two of the following ratios:

(i) Net Profit Ratio

(ii) Debt-Equity Ratio

(iii) Quick Ratio

Information:

Paid up Capital 20,00,000

Capital Reserve 2,00,000

Material downloaded from myCBSEguide.com. 7 / 9

9% Debentures 8,00,000

Net sales 14,00,000

Gross Profit 8,00,000

Indirect Expenses 2,00,000

Indirect Expenses 4,00,000

Current Liabilities 3,00,000

Opening stock 50,000

Closing stock – 20% more than opening stock.

23. From the following Balance Sheet of Som Ltd. As on 31.3.2006 and 31.3.2007 prepare a

Cash Flow Statement: (6)

2006 2006

2007 2007

Liabilities Amount Assets Amount

Amount Rs. Amount Rs.

Rs. Rs,

Equity Share Capital 2,00,000 5,00,000

Profit and Loss 1,25,000 25,000 Fixed Assets 3,00,000 4,50,000

10% Dentures 1,00,000 75,000 Stock 1,00,000 1,50,000

8% Preference 50,000 75,000 Debtors 75,000 1,25,000

share capital Bank 45,000 65,000

General Reserve 45,000 1,15,000

5,20,000 7,90,000 5,20,000 7,90,000

During the year a machine costing Rs. 70,000 was sold for Rs. 15,000. Divided paid Rs. 24,000.

Part C

(Computerised Accountancy)

24. What are the subsystems (types) in the computed Accounting System? (2)

Material downloaded from myCBSEguide.com. 8 / 9

25. Explain the concept of Data Definition Language (DDL). (2)

26. Differentiate between Database and File. (2)

27. What are the Limitation of the computerized accounting system? (3)

28. What are the disadvantages of DBMS? (4)

29. Write the formula for a spreadsheet of compute the depreciation and written down value

of assets. The following are the rates of depreciation: (4+3 =7)

Plant and Machinery: 20%, Computers: 35%, Furniture: 25%, Motor vehicles: 20% Round off

Calculations to the nearest rupee.

Written down

Assets Opening value Depreciation

value

Plant and Machinery 6,25,000

Computers 7,24,000

Furniture and Fitting 99,000

Motor Vehicles 3,89,000

Material downloaded from myCBSEguide.com. 9 / 9

You might also like

- BBA II Chapter 2 Sale of Partnership ProblemsDocument14 pagesBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarNo ratings yet

- Quiz 2 AnswerDocument9 pagesQuiz 2 AnswerFelix Llamera50% (4)

- HW 16433Document2 pagesHW 16433Abdullah Khan100% (1)

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- 12 Accountancy Lyp 2012 Set1Document9 pages12 Accountancy Lyp 2012 Set1SeasonNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- Ac 11 ProjectsDocument8 pagesAc 11 ProjectsJagdish sanjotNo ratings yet

- PQ - Covnersion Partnership To CompanyDocument8 pagesPQ - Covnersion Partnership To CompanyAnshul BiyaniNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Chapter-2: Partnership AccountsDocument6 pagesChapter-2: Partnership Accountsadityatiwari122006No ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Retirement of PartnerDocument6 pagesRetirement of Partneradithyaravikumar2000No ratings yet

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Fundamentals of Accounting-Examples Capital CalculationDocument2 pagesFundamentals of Accounting-Examples Capital CalculationSALENE WHYTENo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Sy Final AccountDocument8 pagesSy Final Accountsmit9993No ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- Chapter 5 Amalgamtion of Companies HandoutsDocument7 pagesChapter 5 Amalgamtion of Companies Handoutsvikax90927No ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

- Illustrations YR4 DocumentDocument3 pagesIllustrations YR4 DocumentmosezkamandezNo ratings yet

- Test DissolutionDocument1 pageTest DissolutionGauri SinglaNo ratings yet

- Sy DissolutionDocument7 pagesSy Dissolutionsmit9993No ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Financial Accounting & AuditingDocument13 pagesFinancial Accounting & Auditingkashish mehtaNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSharu BsNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- B. AOP Test 7 2023Document1 pageB. AOP Test 7 2023Nishtha GargNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Funds and Flow StatementDocument14 pagesFunds and Flow Statement75 SHWETA PATILNo ratings yet

- ACCOUNTANCY+2 B0ardDocument12 pagesACCOUNTANCY+2 B0ardlakshmanan2838No ratings yet

- AccountsDocument5 pagesAccountsvenessaNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- 4120504Document3 pages4120504m_gadhvi6840No ratings yet

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Mergers and Acquisitions DocDocument3 pagesMergers and Acquisitions DocRuchita JanakiramNo ratings yet

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Document8 pagesSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNo ratings yet

- Additional Questions 8Document8 pagesAdditional Questions 8Neel DudhatNo ratings yet

- PDF Living On A Prayer - English VersionDocument17 pagesPDF Living On A Prayer - English VersionmomagagoNo ratings yet

- ARIDO Jewelry Honoring Michelle Falk For Her Contribution in The Art and Film IndustryDocument2 pagesARIDO Jewelry Honoring Michelle Falk For Her Contribution in The Art and Film IndustryPR.comNo ratings yet

- Ebla PDFDocument7 pagesEbla PDFGerardo LucchiniNo ratings yet

- Golden Cucumber Story TellingDocument4 pagesGolden Cucumber Story TellingDIMAS LSNo ratings yet

- Round Shapes and Square Shapes Representation of ShapesDocument8 pagesRound Shapes and Square Shapes Representation of ShapeselmoNo ratings yet

- Flow English Lyrics All .LREDocument21 pagesFlow English Lyrics All .LREGustavo KstNo ratings yet

- A Critical Look at The Critical Period HypothesisDocument6 pagesA Critical Look at The Critical Period Hypothesispaula d´alessandroNo ratings yet

- Module 5 (Lesson 3)Document10 pagesModule 5 (Lesson 3)John M50% (4)

- Partial DifferentiationDocument20 pagesPartial DifferentiationApoorva PrakashNo ratings yet

- Lecture Notes in Computer Science 1767: Edited by G. Goos, J. Hartmanis and J. Van LeeuwenDocument324 pagesLecture Notes in Computer Science 1767: Edited by G. Goos, J. Hartmanis and J. Van LeeuwenbharatmukkalaNo ratings yet

- Otable Ews: Mennonite Children's ChoirDocument14 pagesOtable Ews: Mennonite Children's ChoirMaria BowmanNo ratings yet

- Analysis of Colonialism and Its Impact in Africa Ocheni and Nwankwo CSCanada 2012 PDFDocument9 pagesAnalysis of Colonialism and Its Impact in Africa Ocheni and Nwankwo CSCanada 2012 PDFkelil Gena komichaNo ratings yet

- SentinaDocument10 pagesSentinaakayaNo ratings yet

- I3k2c Bd9usDocument32 pagesI3k2c Bd9usUsman Ahmad TijjaniNo ratings yet

- Peppa Pig HalloweenDocument8 pagesPeppa Pig HalloweentanyaNo ratings yet

- Blom and Another V Brown and Others - 2011 - 3 All SA 223 - SCADocument7 pagesBlom and Another V Brown and Others - 2011 - 3 All SA 223 - SCAtoritNo ratings yet

- Arabic Script in UnicodeDocument22 pagesArabic Script in UnicodeMukhtarNo ratings yet

- Food Biotechnology Sports NutritionDocument14 pagesFood Biotechnology Sports NutritionAngelo PalmeroNo ratings yet

- ZNKR Seitei Iaido PDFDocument46 pagesZNKR Seitei Iaido PDFaldemararaujo100% (2)

- Falling Worlds by Z0RUASDocument19 pagesFalling Worlds by Z0RUASGleneeveeNo ratings yet

- Rodriguez, A. G. & Mckay, S. (2010) - Professional Development For Experienced Teachers Working WithDocument4 pagesRodriguez, A. G. & Mckay, S. (2010) - Professional Development For Experienced Teachers Working WithAaron Jay MondayaNo ratings yet

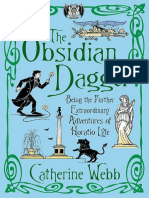

- The Obsidian Dagger Being The Further Extraordinary Adventures of Horatio Lyle Number 2 in Series by Catherine Webb (Webb, Catherine)Document289 pagesThe Obsidian Dagger Being The Further Extraordinary Adventures of Horatio Lyle Number 2 in Series by Catherine Webb (Webb, Catherine)Hitha MathewNo ratings yet

- Raz Lf35 WhereiscubDocument12 pagesRaz Lf35 WhereiscubHà Lê ThuNo ratings yet

- Component 2 JH260721Document11 pagesComponent 2 JH260721Aneeza zafar100% (3)

- Admiralty LawDocument576 pagesAdmiralty LawRihardsNo ratings yet

- Product (RED)Document9 pagesProduct (RED)Madison SheenaNo ratings yet

- DSQC 668 Axis Computer: General InformationDocument2 pagesDSQC 668 Axis Computer: General InformationVenkataramanaaNo ratings yet

- Six-Month Neuropsychological Outcome of Medical Intensive Care Unit PatientsDocument9 pagesSix-Month Neuropsychological Outcome of Medical Intensive Care Unit PatientsYamile Cetina CaheroNo ratings yet