Professional Documents

Culture Documents

Depreciation: (Part - 1)

Depreciation: (Part - 1)

Uploaded by

VinitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation: (Part - 1)

Depreciation: (Part - 1)

Uploaded by

VinitCopyright:

Available Formats

Accountancy

DEPRECIATION

(Part -1)

1. Offclasses Ltd. purchased on 1st April, 2014 a Machinery costing Rs.60,000. It purchased

further machinery on 1st October, 2014 costing Rs.40,000 and on 1st July, 2015 costing

Rs.30,000.

Show how machinery account would appear in the books for the year 2014, 2015 and

2016. It being given that machinery was depreciated by straight line method at 10%

p.a. The company closes the books of accounts on 31st December every year.

[Balances of machinery on 31st Dec 2016: M1 – Rs. 43,500; M2 – Rs. 31,000; M3 – Rs. 25,500]

2. Premier Educations Ltd. purchased a machinery for Rs.50,000 on 1st July, 2015. Another

machinery costing Rs. 10,000 was purchased on 1st September, 2016. The company

charges depreciation at the rate of 15% p.a. on straight line method. Accounting are

closed on 31st March every year.

Prepare the machinery account for 3 years.

[Balances of machinery on 31st March 2018: M1 – Rs. 29,375; M2 – Rs. 7,625]

EMAIL: OFFCLASSES@GMAIL.COM BY - SHRINIVAS BHATT 1

You might also like

- Depreciation Accounts 1. Answer The Following. (4 Marks Each)Document2 pagesDepreciation Accounts 1. Answer The Following. (4 Marks Each)Yashvi FulwalaNo ratings yet

- Depreciation AssignmentDocument3 pagesDepreciation Assignmentjainmoulding.jainjainNo ratings yet

- Depreciation AssignmentDocument5 pagesDepreciation AssignmentFalak SagarNo ratings yet

- Accounting of DepreciationDocument2 pagesAccounting of DepreciationAkshay KawadeNo ratings yet

- Depreciation Assignment SumsDocument2 pagesDepreciation Assignment SumsshuklaworiorNo ratings yet

- Booklet 13Document12 pagesBooklet 13lakishagupta25No ratings yet

- DepreciationDocument60 pagesDepreciationsafafasfasfasfsafNo ratings yet

- Accounting QuestionsDocument1 pageAccounting QuestionsShona ShonaNo ratings yet

- DDDDDocument1 pageDDDDGeet DharmaniNo ratings yet

- Practice Question For Depreciation & ProvisionDocument2 pagesPractice Question For Depreciation & ProvisionAli QasimNo ratings yet

- Videep Institute Dhanbad 7979800517 Accounts TestDocument2 pagesVideep Institute Dhanbad 7979800517 Accounts TestMysterious RohitNo ratings yet

- HSC Bk1Document48 pagesHSC Bk1avtaran100% (1)

- Chapter 13 - DepreciationDocument30 pagesChapter 13 - DepreciationKumari Kumari100% (1)

- Untitled DocumentDocument3 pagesUntitled Documentnyssapandey9No ratings yet

- Depreciation 11 TH Class 16.12.2024Document1 pageDepreciation 11 TH Class 16.12.2024anchalrktg22No ratings yet

- CBSE Class 11 Accountancy - DepreciationDocument1 pageCBSE Class 11 Accountancy - Depreciationrohan guptaNo ratings yet

- ch15 Depreciation Numerical SheetCDocument2 pagesch15 Depreciation Numerical SheetClicab58347No ratings yet

- Class 11 Question Paper On DepriciationDocument2 pagesClass 11 Question Paper On DepriciationWaheguru 123No ratings yet

- BBA II Chapter 3 Depreciation ProblemsDocument4 pagesBBA II Chapter 3 Depreciation ProblemsSiddharth SalgaonkarNo ratings yet

- AdditionalPracticalProblemPg.14.52 14Document1 pageAdditionalPracticalProblemPg.14.52 14Vijay KumarNo ratings yet

- Depreciation: Illustration 1 (Journal Entries)Document3 pagesDepreciation: Illustration 1 (Journal Entries)Navnidh KaurNo ratings yet

- Additional Practical Problems-15Document5 pagesAdditional Practical Problems-15areet2701No ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationDocument52 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationKishore Kumar Chandra SekarNo ratings yet

- Accounts QuestionsDocument2 pagesAccounts QuestionsYuvnesh Kumar R.JNo ratings yet

- DepreciationDocument1 pageDepreciationSiva SankariNo ratings yet

- Revision Assign - DepreciationDocument2 pagesRevision Assign - DepreciationTribhuwan JoshiNo ratings yet

- Depreciation Basic - Problem1Document2 pagesDepreciation Basic - Problem1Pallavi Ingale0% (1)

- Assignment BHM AccountsDocument2 pagesAssignment BHM AccountsShahbaz AlamNo ratings yet

- Vikas Mahila Campus Accountancy - Xi: ST STDocument1 pageVikas Mahila Campus Accountancy - Xi: ST STAnkit GuptaNo ratings yet

- Long Answer Type QuestionsDocument2 pagesLong Answer Type QuestionssarithaNo ratings yet

- Financial Accounting Practice Questions of DepreciationDocument3 pagesFinancial Accounting Practice Questions of DepreciationRaffayNo ratings yet

- Accounts Revision DepreciationDocument2 pagesAccounts Revision DepreciationAMIN BUHARI ABDUL KHADERNo ratings yet

- Accounting of DepreciationDocument9 pagesAccounting of DepreciationPrasad BhanageNo ratings yet

- Unit III - DepreciationDocument5 pagesUnit III - Depreciationkailasbankar96No ratings yet

- Vijayam JR - College, Chittoor Sub:Commerce Date:13/07/2018 Marks:25Document2 pagesVijayam JR - College, Chittoor Sub:Commerce Date:13/07/2018 Marks:25M JEEVARATHNAM NAIDUNo ratings yet

- AdditionalPracticalProblemPg 14 53-B-14 PDFDocument1 pageAdditionalPracticalProblemPg 14 53-B-14 PDFURBAN AUDIOSNo ratings yet

- Reliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sDocument4 pagesReliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sRohit MathurNo ratings yet

- Depreciation 28-10-23Document8 pagesDepreciation 28-10-23RONAK THE LEGENDNo ratings yet

- Depreciation: For 11 CommerceDocument12 pagesDepreciation: For 11 CommerceAaditya Agrawal100% (1)

- Fa Ass 3Document2 pagesFa Ass 3Shikha SharmaNo ratings yet

- Question Paper - FA (BCA)Document2 pagesQuestion Paper - FA (BCA)gurjeetkaur1991No ratings yet

- Depreciation Questions.Document2 pagesDepreciation Questions.doshifamily.raahilNo ratings yet

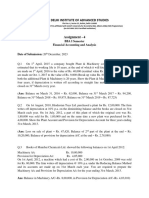

- Assignment - 4Document1 pageAssignment - 4pulkit guptaNo ratings yet

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- Problems On Depreciation AccountingDocument3 pagesProblems On Depreciation Accountingmaheshbendigeri5945No ratings yet

- Caf 3 Far1Document4 pagesCaf 3 Far1askerman0% (1)

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- T Shape Account PreprationDocument5 pagesT Shape Account Preprationrajindere sainiNo ratings yet

- Test 1 DisposalDocument1 pageTest 1 DisposalBasit MehrNo ratings yet

- Depreciation ProblemsDocument1 pageDepreciation ProblemssrisaraswathiganeshaNo ratings yet

- Depreciation Accounting-6Document19 pagesDepreciation Accounting-6rohitsf22 olypmNo ratings yet

- Latihan TM 15 Kelar Tinggal SalinDocument13 pagesLatihan TM 15 Kelar Tinggal SalinDaffaKeirenzNo ratings yet

- SR Bills and DepreciationDocument2 pagesSR Bills and DepreciationM JEEVARATHNAM NAIDUNo ratings yet

- Accounts Final RaoDocument190 pagesAccounts Final RaoSameer Krishna100% (1)

- Depreciation WorksheetDocument1 pageDepreciation WorksheetbnbcafejaipurNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Problems On PPEDocument1 pageProblems On PPEimrul kaishNo ratings yet

- Depreciation Class WorkDocument5 pagesDepreciation Class WorkChaaru VarshiniNo ratings yet

- Practice Problems Testing of HypothesisDocument4 pagesPractice Problems Testing of HypothesisVinitNo ratings yet

- Ier2017 enDocument158 pagesIer2017 enVinitNo ratings yet

- New Product Launch Media Brief - MIMDocument2 pagesNew Product Launch Media Brief - MIMVinitNo ratings yet

- Create An Internal Communication Plan - A Process For Reaching Employees Through Combinations ofDocument5 pagesCreate An Internal Communication Plan - A Process For Reaching Employees Through Combinations ofVinitNo ratings yet

- Electric Car Using Prince2Document29 pagesElectric Car Using Prince2Vinit100% (1)

- Information Security About The Industry and CompanyDocument7 pagesInformation Security About The Industry and CompanyVinitNo ratings yet

- Information Security: - Va I B H Av-0 1 - TARUN-03 - Bhagyashree-06 - VINIT-07 - ARCHANA-08 - SAYLEE-36 - MANALI-38 - KARTIK-42Document7 pagesInformation Security: - Va I B H Av-0 1 - TARUN-03 - Bhagyashree-06 - VINIT-07 - ARCHANA-08 - SAYLEE-36 - MANALI-38 - KARTIK-42VinitNo ratings yet

- Maruti Suzuki ReportDocument20 pagesMaruti Suzuki ReportVinitNo ratings yet

- Name: Priyanka M. Salunkhe Roll No - 24: Accounts AssignmentDocument20 pagesName: Priyanka M. Salunkhe Roll No - 24: Accounts AssignmentVinitNo ratings yet

- Marketing Management-C Case PresentationDocument22 pagesMarketing Management-C Case PresentationVinitNo ratings yet