Professional Documents

Culture Documents

Chap03 Time Value of Money

Chap03 Time Value of Money

Uploaded by

Mikaela Samonte0 ratings0% found this document useful (0 votes)

24 views9 pagesnotes

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

24 views9 pagesChap03 Time Value of Money

Chap03 Time Value of Money

Uploaded by

Mikaela Samontenotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 9

10/10/2019

The Time Value

of Money

Learning Outcomes:

Calcutate future values and understand

‘compounding

Calculate present values and understand

discounting.

Calculate implied interest rates and waiting

time from the time value of money equation.

‘Apply the time value of money equation using

formula, calculator, and spreadsheet.

Explain the Rule of 72, a simple estimation of

doubling values.

Future Value and Compounding

Interest

* The value of money at the end of the stated

Period is called the future or compound

value of that cum of money.

“Determine the attractiveness of alternative

investments

Figure out the effect of Inflation on the future

cost of assets, such as a car or a house.

| Business Mathematics

Business Mathematics

10/10/2019

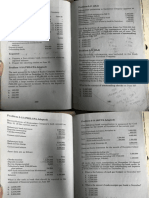

The Multiple-Period Scenario

n

FV = PVx (1+r)

Example 2: If YOU close out your account after 3

years, how much money will you have accumulated?

How” much of that is the Interest-on-interest

component? What about after 10 years?

Fu = #2001106)" #200"2.191016 = 6238.20,

n interest = #238, 20 -P2O0 - 836 = #2.20,

Methods of Solving Future Value

Problems

* Method 1: Formula Method

~Time-consuming, tedious

* Method 2: Financial Calculator Method

= Quick and easy

‘+ Method 3: Spreadsheet Method

= Most versatile

‘= Method 4:Time Value Table Method

= Easy and convenient but most limiting in scope

{| Methods of Solving Future Value

Problems

Example 3: Compounding of Interest

Let’s say you want to know how much money

you will have accumulated in your bank

account after 4 years, if you deposit all

5,000 of your high-school graduation gifts

into an account that pays a fixed interest rate

of 5% per year. You leave the money

untouched for all four of your college years.

Methods of Solving Future Value

Problems

example 3: Answer

FTP 05,000(3.05)= 6,077.59

prev = 6077.59

Fv=6077.59

Time value table method!

FV'= PPMP, 33, 4) = 8000"(1.215508) 6077.59,

where (FIF St.) = Foture value interest factor sted under

thes akin and nthe yea ow of te Future Vaue 66

PV=5,000; Type=o;

Methods of Solving Future Value

Problems.

Example 4: Future Cost due to Inflation

Let’s say that you have seen your dream

house, which is currently listed at 300,000,

but unfortunately, you are not in a position to

buy it right away and will have to wait at least

another 5 years before you will be able to

afford it. If house values are appreciating at

the average annual rate of inflation of 5%,

how much will a similar house cost after 5

years?

‘Methods of Solving Future Value

Problems:

Example 4 (Answer)

Py = current cost of the house = 83000

n= 5 years;

F = average annual inflation rate = 5%,

Solving for FV, using the Formula Method, we have

Fv = #3000061 054 0514.05)0.05)1.08)

= P300,000°(1.276:

= 8382,884.5

So the house will cost B382,884.50 after 5 years

10/10/2019

Methods of Solving Future Value

Problems

Calculator method:

Pv=-300,

Fv=0382,884'5

1/Y=5; PMT=0; CPT

‘Spreadsheet method:

Rate=.05; Nper=5; Pmt=0; PV=-P300,000;

Type =0; FV=8382,884.5

Time value table meth

FV=PV(FVIF,S%,5)=300,000*(1.27628)=6362,884.5;

where (FVIF, 56,5) = Future value interest factor

listed under the 5% column and in the 5-year row of

the future value of Fi table=1.276

Present Value and Discounting

‘Involves discounting the interest that would have

been earned over a given period at a given rate of

interest,

+ It ls therefore the exact opposite or inverse of

calculating the future value of a sum of money.

+ Such calculations are useful for determining today’s

Price or the value today of an asset or cash flow

‘hat will be received in the future.

+ The formula used for determining PV is as follows:

PV=FVx 1/(1+r)?

|g Single-Period Scenario

When calculating the present value or

discounted value of a future lump sum to be

received one period from today, we are

basically deducting the interest that would

have been earned on a sum of money from its

future value at the given rate of interest.

PV = F/(1+r) since n = 1

00; r = 10%; and n =1;

The Multiple-Period Scenario

When multiple periods are involved...

‘The formula used for determining PV Is as

follow:

PV = FVx1/(1+r)?

where the term in brackets is the present

value interest factor for the relevant rate of

interest and number of periods involved, and

is the reciprocal of the future value interest

factor (FVIF)

a Present Value and Discoun

Example 5: Discounting Interest

Let’s say you just won a jackpot of 50,000 at

the casino and would like to save a portion of

it so as to have 40,000 to put down on a

house after 5 years. Your bank pays a 6%.

rate of interest. How much money will you

have to set aside from the jackpot winnings?

Present Value and Discounting

Example 5 (Answer)

FV = amount needed = ®40,000

N = 5 years; Interest rate = 6%;

Using the

°PV=FVx 1/(1+r)°

+ PV = 40,000 x 1/(1.06)5

+ PV = 40,000 x 0.747258

+ PV = 829,890.33 Amount needed

to set aside today

biel dietiel adn

Present Value and Discounting

PMT=0; cpr pv=

3nt=0; Fu=P40,000; Type=0;

Time valye table

PV = FV(PVIF, 6%, 5) = 40,000°(0.7473)=P29,802

where (PVIE, 66,5) = Present value interest factor listed

under the 6% column and in the 5-year row of the Present

Value of Pi tabie=0.7473,

Using Time Lines

+ When solving time value of money

Problems, especially the ones

involving multiple periods and

complex combinations it is always

@ good idea to draw a time line

and label the cash flows, interest

rates and number of periods

involved.

Using Time Lines

‘Time tines of growth rates (top) and discount rotes

{Gottom ilstrave presen va and fare valve

Today Future date

pv Present vale (1+ growth rte" = FY

= fire value ae

PV 11 dicount ate)®

Applications of the Time Value of

Money Equation

* Calculating the amount of savings required

One Equation and Four Variables

Any time value problem involving lump sums-ie., 2

single outflow and a single inflow--requires the use of

single equation consisting of 4 variables:

Fv, PV, ©,

If 3 cout of 4 variables are given, we can solve the

‘unknown one.

FVPV x (14e)" eat

pvaris Tyas

TOES

Saving for retirement

‘Newo0 1 Using the equation

1

mnt x = ag = $2000 X O72 = SIBKAM

ero0 2 Using the TYM keys

Ipt ot 02a

Oe ee)

a =H

Saving for retirement

ik [inna ————

What's the cost of that loan?

Problem joa, acage den elo boow $5,000 soi

fib He apes py ick haan kp spent ie yas rom

‘ower ecto colge The bank ste hat ep sl adobe

'$7,91276 abn bros he $540 fo te ack, what ces ie

iagonbiloa?

‘Solution Aine ie bein hisinsane

Sys &

prasion MemreminestO) pyar

What's the cost of that loan?

10/10/2019

eo 2 Using te TH ays

ee

“J 9 9 9 9

or 30

When will I be rich? When will I be rich?

Problem Yous gl eal Ty ot ics pss smi Using the equation

th S704 Hig ed cpa ce reso

elec hat you can cara 15% eer year on your pri, ou dont plano ‘n($1,90000/$3738.24) (267.8638)

net ital ney hip Wo wba fn oe , eee

‘iho gown on Giver 1 mo orgs be

‘prove: maine Fineness pr ecalh

Solution seetketnetine,

ating pode

pawn ERPBI yam

When will I be rich?

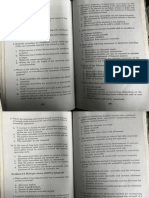

P ‘roblems and Luercises

Joanna's Dad is looking to deposit a sum of

money immediately into an account that pays

an annual interest rate of 9% so that her 1°

year college tuition costs are provided for.

Currently, the average college tuition cost is

P15,000 and is expected to increase by 4%

(the average annual inflation rate). Joanna

just turned 5 years old, and is expected to

start college when she turns 18.

How much money will Joanna’s Dad have to

deposit into the account?

KZA Problem 1 (Solution)

‘Step 1. Calculate the average annual college tuition

cost when Joanna tums 18, i.e, the future

compounded value of the current tuition cost at an

annual increase of 4%.

PV = -15,000; n= 13; 12496; PMI

cpr Fv=P24, 976.10

v= P15,000 x (1.08)!

15,000 x 1.66507

24,976.10

Problem 1 (Solution)

Step 2. Calculate the present value of the annual

tuition cost using an interest rate of 9% per year.

[FV = 24,976.10; n=13; 129%; PMT = 0; CPT PV = P8,146.67

on

Pv = P24,976.10% (1/(1+0.09)

= 24,97610% 0.92618

= 75,146.67

‘50, Joanna's Dad will hve to deposit P8,146.67 into

an account today so that she will have her first-year

{ution coats provided for when she starts college a the

ge off

Problem 2

BPI offers to pay you a lump sum of

P20,000 after 5 years if you deposit

P9,500 with them today. BDO, on the

other hand, says that they will pay you

a lump sum of P22,000 after 5 years if

you deposit P10,700 with them today.

Which offer should you accept, and

why?

Problem 2 (Solution)

‘To answer this question, you have to calculate the rate of

return that wil be earned on each investment and accept the

‘one that has the higher rate of retum.

BPrs Offer

PV = -P9,500; n=5; FV =P20,000; PMT = 0; CPT |= 16,054%

oR

Rate = (FVIPV)""- 1 = (P20,000/P9,500)"* 1

= 1.16054-1

= 16.058%

Problem 2 (Solution)

00's offer

PV=-P10,700

5: FV=P22,000; PMT =o: CPT i215 sa7%

oR

Rate = (FVIPyytin= 4 =

4.18507 —4

15.507%

(P22,000/P10,700)15 +

Decision YOU MUST Make:

‘You ‘should accept BPI's offer, since provides @ higher

‘annual rate of retum ie 18.05%

Problem 3

You have decided that you will sell off

your house, which is currently valued at

P300,000, at a point when it appreciates

in value to P450,000.

If houses are appreciating at an average

annual rate of 4.5% in your:

neighborhood, for approximately how

long will you be staying in the house?

Leg Problem 3 (Solution)

230,000; FV = 450,000; I = 4.5%; PMT =

0; CPT n = 9.21 years or 9 years and 3 months

oR

In(EV/PV)I/fIn(4+i)]

In(450,000/(300,000])/{In(1.045)]

40547 / .04402 = 9.21 years

[EE

Problem 4

Your arch-nemesis, who happens to be

an marketing major, makes the

following remark: “You finance types

think you know it all..well, let's see if

you can tell me, without using a

financial calculator, what rate of return

would an investor have to earn in order

to double P100 in 6 years?” How would

you respond?

ig Problem 4 (Solution)

Use the rule of 72 to silence him once and for

all, and then prove the answer by compounding

2 sum of money at that rate for 6 years to show

him how close your response was to the actual

rate of return....hen ask him politely if he would

like you to be his “lifeline” on "Who Wants to be

2 Millionaire?”

Rate of return required to double a sum of

money = 72/N = 72/6 = 12%

Verification: P100(1.12)* = P197.38...which is

pretty close to double

Problem 4 (Solution)

The accurate answer would be calculated

as follows:

PV = -100; FV = 200; n = 6; PMT = 0;

I= 12.246%

oR

= (FV/PV)#/" - 1 = (200/100)/ 6 - 4

1.12246 -1

12246 or 12.246%

Problem 5

Problem 5 (Solution)

You want to save P25,000 for a down

PeYMeP a CDeBoUse. BPI orrers ve | | aes

Pay 9.35% per year if you deposit 7 PMT = 0; PY = -11,000;

P11,000 with them, while BDO cfien Bee opmmagt

Per year if you invest P10,000

with them.

200

How long will you have to wait to

have the down payment accumulated Corns 11.558 years

under each option?

for Given

Variable Match for Calculator and pana Time in Years

Spreadsheet Int Rates

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSA SubjectsDocument4 pagesBSA SubjectsMikaela SamonteNo ratings yet

- Specific Format 1. Tables and Figures Must Fit Within MarginDocument3 pagesSpecific Format 1. Tables and Figures Must Fit Within MarginMikaela SamonteNo ratings yet

- Section 3 Obligations of The Partners With Regard To Third Persons PDFDocument16 pagesSection 3 Obligations of The Partners With Regard To Third Persons PDFMikaela SamonteNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument20 pagesChapter 3 Dissolution and Winding UpMikaela SamonteNo ratings yet

- BSA 2019 FlowchartDocument1 pageBSA 2019 FlowchartMikaela SamonteNo ratings yet

- BSMAC 2019 FlowchartDocument1 pageBSMAC 2019 FlowchartMikaela SamonteNo ratings yet

- NDNDJDDocument15 pagesNDNDJDMikaela SamonteNo ratings yet

- Cash and Cash Equivalents PDFDocument10 pagesCash and Cash Equivalents PDFMikaela SamonteNo ratings yet

- 1st Quiz Intacc5Document37 pages1st Quiz Intacc5Mikaela SamonteNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationMikaela Samonte100% (3)

- Proof of CashDocument4 pagesProof of CashMikaela Samonte100% (1)

- Correlational Research - Definition With Examples - QuestionProDocument5 pagesCorrelational Research - Definition With Examples - QuestionProMikaela SamonteNo ratings yet

- Accounts ReceivableDocument11 pagesAccounts ReceivableMikaela SamonteNo ratings yet

- There Were Real Heroes in The Philippine American WarDocument3 pagesThere Were Real Heroes in The Philippine American WarMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:13 AMDocument1 pageSafari - Aug 9, 2019 at 7:13 AMMikaela SamonteNo ratings yet

- Reviewer in Buslaw FinalsDocument9 pagesReviewer in Buslaw FinalsMikaela SamonteNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Former Cfo of Autonomy Guilty of Accounting FraudDocument3 pagesFormer Cfo of Autonomy Guilty of Accounting FraudMikaela SamonteNo ratings yet

- GHHDocument1 pageGHHMikaela SamonteNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet