Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

38 viewsAudit

Audit

Uploaded by

Lal Dhwojreport

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Job Safety Analysis Sheet: Electrical IsolationDocument1 pageJob Safety Analysis Sheet: Electrical IsolationLal Dhwoj67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Peace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fDocument2 pagesPeace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fLal DhwojNo ratings yet

- Accident Investigation - 5 PDFDocument10 pagesAccident Investigation - 5 PDFLal DhwojNo ratings yet

- Ljifo M - Jflif (S FWF/) F Ef / N) VF K/Lif) F K - LTJ) BG DagwdfDocument4 pagesLjifo M - Jflif (S FWF/) F Ef / N) VF K/Lif) F K - LTJ) BG DagwdfLal DhwojNo ratings yet

- Peace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fDocument2 pagesPeace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fLal DhwojNo ratings yet

- GC2-Element 6 Fire Hazard EACDocument41 pagesGC2-Element 6 Fire Hazard EACLal DhwojNo ratings yet

- GC 2Document108 pagesGC 2Lal DhwojNo ratings yet

- All About OSHADocument21 pagesAll About OSHALal DhwojNo ratings yet

- Nepal Marriage Bill 2011 B SDocument6 pagesNepal Marriage Bill 2011 B SLal DhwojNo ratings yet

- Electoral Rolls Rule 2052 1996Document56 pagesElectoral Rolls Rule 2052 1996Lal DhwojNo ratings yet

- Profile 1 District LevelDocument1 pageProfile 1 District LevelLal DhwojNo ratings yet

- Profile 3 Districts LevelDocument2 pagesProfile 3 Districts LevelLal DhwojNo ratings yet

- FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) %Document8 pagesFJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) %Lal DhwojNo ratings yet

- Profile National Level DevDocument2 pagesProfile National Level DevLal DhwojNo ratings yet

- Ladf SDKGLSF) Laqlo Laj/0Fm +lifkt HFGSF/L: LGHL (JG Aldf Joj Fo Ug) (Aldssf) Ljqlo Ljj/0F Dagwl LGB) (ZGDocument16 pagesLadf SDKGLSF) Laqlo Laj/0Fm +lifkt HFGSF/L: LGHL (JG Aldf Joj Fo Ug) (Aldssf) Ljqlo Ljj/0F Dagwl LGB) (ZGLal DhwojNo ratings yet

- मालपोत मिनाहा एन २०१९Document5 pagesमालपोत मिनाहा एन २०१९Lal DhwojNo ratings yet

- Ndex Contract Specification: ExpgolDocument1 pageNdex Contract Specification: ExpgolLal DhwojNo ratings yet

- Iosh Risk Assement InstructionDocument1 pageIosh Risk Assement InstructionLal DhwojNo ratings yet

- पुलिस यन PDFDocument24 pagesपुलिस यन PDFLal DhwojNo ratings yet

- Dwo:Ytf P) G, @) %%: NFNDF) X/ / K - SFZG LDLTDocument20 pagesDwo:Ytf P) G, @) %%: NFNDF) X/ / K - SFZG LDLTLal DhwojNo ratings yet

- LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @Document5 pagesLJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @Lal DhwojNo ratings yet

- S) XL G) KFN P) Gnfo ( +ZF) WG Ug) (P) G, @) $ @) $.%. (Document14 pagesS) XL G) KFN P) Gnfo ( +ZF) WG Ug) (P) G, @) $ @) $.%. (Lal DhwojNo ratings yet

- 6 ) 8 O"lgog P) G, @) $ (: NFNDF) X/ / K - SFZG LDLTDocument14 pages6 ) 8 O"lgog P) G, @) $ (: NFNDF) X/ / K - SFZG LDLTLal DhwojNo ratings yet

Audit

Audit

Uploaded by

Lal Dhwoj0 ratings0% found this document useful (0 votes)

38 views7 pagesreport

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentreport

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

38 views7 pagesAudit

Audit

Uploaded by

Lal Dhwojreport

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 7

Registered Auditors & Ta Siitanlé (Proprietorship Firin No ~- 2594.)

Kathmandu, Nepal. Tel: 015110187.

To, PAN - 500087804

‘The share Holders : Date: 2075) 06/14

Peace Nepal Treks (P.) Ltd

Thamel Pkanajol -16, Kathmandu, Nepal

Ref: Audit Report for the Fiscal Year 2074/75B 8.

We have audited the attached balance sheet and Income & Expenditure account with annexed of the

Peace Nepal Treks (P) Lid Thamel Pkanjol -16 Kathmandu, Nepal, for the year ended 32nd

"Ashadh 2075 (Fiseal Year 2074/75). These financial statements ate the main responsibility of the

Company's management Our esponsibility is to express an opinion on these financial statements

‘based on our aut.

We conducted our audit in accordance with generally accepted auditing standards, Those standards

Tequire that we plan and perform the audit to obtain reasonable assurance about whether the

‘Hnonetal statements are free of materials misstatement, An audit includes examining, ona test bass,

tvidence supporting the amounts and disclosure inthe financial statements. An audit also includes

SSeessng the accountng principle used and significant estimates made by the Management, as well

fs evaluating the overall financial statemént presentation. We believe that our audit provides

reasonable basis for our opinion.

We have obtained all informetion and explanations, which to the best of our knowledge and

belief where necessary during the course of auditing process ofthe Company.

In so far as appears ftom our examination of such books of account, the company has kept

proper books of account to the financial transsctions according 10 government rule and

‘regulation and company act 2063,

Balance sheet and Income & Expenditure AJC referred to the reports are in agreement with

books of account meintained by the company.

4. Inout opinion and to the best our information and according to the explanations given to us, the

Balance-sheet, trading and Profit & Loss account are true and fair view of the company for the

year ended at that date

5. During the course of audit, we have not found any misconduct fom any responsible persons

staff and board members ofthe company,

Finally we wish the progress and prosperity ofthe Company, business organization, and would like

to thanks to members end staff ofthe company for thei assistance. Thanking you all again,

Reference to: =

| Office ofthe Company Registration, Katmandu, Nepal

2 Internal Revenue Office, Bala, Katmandu, Nepal

SHERPA SALAKA & COMPANY

Registered Auditors & Ta Consultants (Proprietorship Firm No :- 2594.)

Kathmandu, Nepal. Tel: 01-5110187

PAN :- 500087804

Date: 2075108/14

Notes and Explanations to Annual Accounts

General Information

“The Peace Nepal Treks (P) Ltd. was incorporated as a profit making Business

Organization under the Company Registration Office for trekking services to

foreiners in the Himalayan resions with taking service charge

Significant Accounting Policies:

‘The Financial Statement “like balance sheet, Income statement and cash flow

statement has been prepared as per Historieal Cost Concept.

1, Recognition of revenue and costs are under basis of historical cost accounting

system,

Incomes have been recognized on cash basis and the expenditures are

recorded on accrual basis.

2, Fixed assets are valued as the time of acquisition and depreciation are charged

on the basis of diminishing balance method.

Indra Sherpa ‘Salaka

Reg. AUDITOR

PEACE NEPA!

TREKS (P) LTD.

P.O.Box 2518, Traine Kathmandu Nepal.

Balance Sheet’AS at 32/03/2075 BS.

Prev.Year Capital & Liabilities [Sch] Details | Current Year

‘Amount Rs. ‘Amount RS_| Amount Rs.

7,000,000.0 [Authorized Capital @ Rs. 100 4,000,000.00

4,000,000.6 issued Capital @Rs.100 4,000,000.00

4,000,000.0 [Paid up Capital @Rs100 1,000,000.0 | ,000,000.00|

46,000.00 |Sundry Creditors 15,000.00, 45,000.00,

66,921.19 |Profitfor This year |p| 9675288.

(268,178.8)|PreviousYear Profit | 191,258,65)| (104,505.83)

|

10,180.0 {TDS : Salary 2,860.0

|Auditing 1,500.0

House Rent 6,000.0 10,360.00

823,921.35 Grand Total 920,854.18 | 920,854.18

Prevvear ‘Assets [Sch] Details [Current Year

‘Amount Rs. ‘Amount Rs._| Amount Rs.

299,945.96 |Fixed Assets, 3.0| 267,993.41] 257,993.41

Deposite =~

200,000.00 |}, Bank Guarantes 200,000.00

{80,000.00 |!! Bank Guarantee NRB 0,000.00,

418,750.00 |1, Telphone & P.0.Box 1375000] 263,750.00

14,000.00 | Tax Paid in Advance 15,750.00 18,750.00

82,751.94 ||, Cash in hand 75,360.00

163,473.45 |li, Cash at Bank 19619581} 261,545.81

[Sundry Debtors 12181496 | 121,814.96

823,921.95 Grand Total saoes4t8| 920,988.18

SLX

(Nir Bdr.Lama)

Managing Director

y

Lat Dhoj Tamang

Account Manager

PEACE NEPAL. TREKS (P) LTD.

P.O.Box 25181 3Thaiiel Kathmandu Nepal.

Statement of comprehensive Income

For the Year Ended 32Asadh 2075

caret Yr —[Frevois¥7

fe Fanaa sen] Amoant | Amount Rs

7 [By Non Vatabe Seles a} 102,680.00] 1,01565000

2 [by Vatable Sales a] s.s01s2s.00| 74522428

A Total income 3,387,618.00| 1760.90.24

70 fo Purchase Gost 3] 1.881 207-00

2.0[Te Hott Accomodation 4807870

3.0|To Porter Cherge ser.s0000| 520,600.00

40)To Tins and NP. Cheige 174860.00| 114000.00

50[To Traveling Reting Ex esrsio00| 12056000

3 | Total Trading Expenses 7810.457.00 | 1185,998.70

[AB Jfo Gross income ed 577,11800[ 57504254

1 Te Seley and Allowances 796,000.00] 288,000 00

2| To House Rent for Ofoe e0.00000| 60,000.00

3| To Pintng & Siatenery «800.00

«| To Communication 4000.00] 80000

5|ToTea& Refreshment 450000| 11,900.00

6| To Membership & Renewal 1000.00) 22.4120

7| To insurance Prema 10,996.00] 1099500

3 To Depreciation Charge ai9sos7| 4560729

| To Aucting Expenses tooco.00| 10.0000

10| To Newspaper & Magazine 470000) 3.50000

14| To Water lecity 550000/ 8.50000

45| To Misotaneous 400.00| 11,9000

c Grand Toa aenaa7s7| 05.1420

[TREO Net income Beers Tax se70.a4] 9922026

Provision fornoome Ta aasiret| 22.0706

Net core aftr Tax 3675285| 6021.19

Ay, for U

NA GZ

DL 7a

“ir Bo. Lama) Lal Dhoj Tamang

Managing Director AIC Manager

a,

Cash Flow Statement Fiscal Year 2074/75.BS.

SN Particulars

[Detail Amt.

[amount Rs.

'A_ [casi FLOW FROM OPERATING ACTIMTIES

5,320.43,

|, Net teome before Tax ( Loss )

i. Depreciation Charges for the year

i, increase (Decrease }n sundry Creditors

lv, Increase (Decrease ) in Short-term-Loan

lit, Decrease (Increase ) in Sundry Debtors

iv, Decrease (Increase ) in Inventory stock

lv, Decrease' Increase) in paid of Income Tax

96,752.83

41,952.57

(121,814.98)

(1,570.00)

[east FLOW ROW INVESTING ACTIVTIES

|, Purchase of Fixed Asseis for the year

li, Decrease (increase) in Investment at others

i, Decrease (increase } in Bank Guarantee

[CASH FLOW FRON FINANCING ACTIVITIES

T Medium-term loan increase (Decrease)

i, Long-term Loan Increase (Decrease )

ji, Share ane Dedentures Increasa(Decrease)

Net Cash increase (Decrease ) from Arc

5,320.43

1 [Beginning balance of Cash and Bank

256,225.39

|, Opening Cash Balance

li, Opening Bank Balance

92,751.94

163,473.45,

[a5 AND BANK BALANCE END OF THE YEAR

261,548.81

|, Cash in Hand balance atthe end

Cash at Bank balance atthe end

75.351.00

186,195.81

‘Kir Ba Lama) Lal Dhoj Tamang

Managing Director. ‘Account Manager

PEACE NEPAL REKS (P) LTD.

P.0.Box 25181, Thame! Kethinandu Nepal

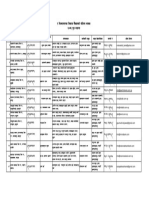

Shedule No:01

Salary and Allowances Statement for the year ended 32/03/2075

SN Employees" Name | Post Scale Yrly Rs. Paid Rs. Balance

+ lente Bahadur Lamau rector | 16,000 114500| | t14so0|___-

2 teal DhojTamang|Accourtant| 10500] 73.500 73500;

a | snambutame [rouroprat| 7.500 | 62.500 sso]

3 Iacerem Bérlame |@uide/Sida| 6,500] 45.500 4550|

[1 erana Tota wosoo| 286,000] | 206,000

‘Shedule No:-02

Fixed Assets as at 32/03/2075

Sep

Boonen] Amount

Sa] Foncaas PEREE*Taacoon] Taaron [rae] AOE | Pos

1 [rumiture aronre | 524205 s24zes| ton] s2ez0|_<7.teaee

2 lovice Equipment _| 7.4877 erasr7| roe] 12e747| 240220

.3 [kichen Eauioment | 206088 soeses | 20%| sa7e| _2astis

1 [trekking Equpment|_ 9.4714 coaria| ssi] 149207| e4ssoee

slcomputer Printer | _s9911s sastis| 15%| 29007] 1992478

Gran Tor [2eosasor| | aeooaae| | a1gsz6| as7sos.t|

bac A

xt Blir Lama) LA Dhoj Tamang

Managing Director Account Manager

PEASE NEPAL TREKS “°) LTD.

P.0.Box 25181, Thamel Kathmandu Nepal.

Schedual No. 03

Sales Revenue & Purchase gst with W Year ended 32nd Asadh 2075B.S

BIUN, Sales [VAT [ovat

(Non Vatabil(Purchase [VAT Non Vatabe [Total [Net VAT

‘Month [Amount Sates “Jamount urchase [Purchase

4495500] 5841.20| _50,77429| 476610] _25,008.00| 2,991.04] 476.61000| 26,099.04

Mangsir| 7006460] 103,0540| 03.6000] 77a2000| ev00r60| s07.9020| 7732000 |" 997.9170

Poush S 7

Magh zi eta an z

Falgun_| 10502460 [ 796.5480 | 7.106,001.0 | 256,8600| i026.te40 | reae6a0| 296.e800| 11618479

Tae seo] sas saOS| 2,141,2655| 1ae2 90 | ToeT ZOO] —Paassew | TAeZ6800| 21267659 | 1765S

7.0 [inten 006 558.3

2.0 308,505 3

30, *150,889.7

4.0 Dhulkhel Mountain Resort

5.0 Other Hotel Expenses

Total

Tal Dhoj Tamang

Accountant Reg. Auditor

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Job Safety Analysis Sheet: Electrical IsolationDocument1 pageJob Safety Analysis Sheet: Electrical IsolationLal Dhwoj67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Peace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fDocument2 pagesPeace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fLal DhwojNo ratings yet

- Accident Investigation - 5 PDFDocument10 pagesAccident Investigation - 5 PDFLal DhwojNo ratings yet

- Ljifo M - Jflif (S FWF/) F Ef / N) VF K/Lif) F K - LTJ) BG DagwdfDocument4 pagesLjifo M - Jflif (S FWF/) F Ef / N) VF K/Lif) F K - LTJ) BG DagwdfLal DhwojNo ratings yet

- Peace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fDocument2 pagesPeace Nepal Treks (P) LTD: Ljifo:-A) B) Lzs D'B - FSF) DFL S SF/F) JF/ ljj/0fLal DhwojNo ratings yet

- GC2-Element 6 Fire Hazard EACDocument41 pagesGC2-Element 6 Fire Hazard EACLal DhwojNo ratings yet

- GC 2Document108 pagesGC 2Lal DhwojNo ratings yet

- All About OSHADocument21 pagesAll About OSHALal DhwojNo ratings yet

- Nepal Marriage Bill 2011 B SDocument6 pagesNepal Marriage Bill 2011 B SLal DhwojNo ratings yet

- Electoral Rolls Rule 2052 1996Document56 pagesElectoral Rolls Rule 2052 1996Lal DhwojNo ratings yet

- Profile 1 District LevelDocument1 pageProfile 1 District LevelLal DhwojNo ratings yet

- Profile 3 Districts LevelDocument2 pagesProfile 3 Districts LevelLal DhwojNo ratings yet

- FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) %Document8 pagesFJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) % FJ (Hlgs '/iff Lgodfjnl, @) %Lal DhwojNo ratings yet

- Profile National Level DevDocument2 pagesProfile National Level DevLal DhwojNo ratings yet

- Ladf SDKGLSF) Laqlo Laj/0Fm +lifkt HFGSF/L: LGHL (JG Aldf Joj Fo Ug) (Aldssf) Ljqlo Ljj/0F Dagwl LGB) (ZGDocument16 pagesLadf SDKGLSF) Laqlo Laj/0Fm +lifkt HFGSF/L: LGHL (JG Aldf Joj Fo Ug) (Aldssf) Ljqlo Ljj/0F Dagwl LGB) (ZGLal DhwojNo ratings yet

- मालपोत मिनाहा एन २०१९Document5 pagesमालपोत मिनाहा एन २०१९Lal DhwojNo ratings yet

- Ndex Contract Specification: ExpgolDocument1 pageNdex Contract Specification: ExpgolLal DhwojNo ratings yet

- Iosh Risk Assement InstructionDocument1 pageIosh Risk Assement InstructionLal DhwojNo ratings yet

- पुलिस यन PDFDocument24 pagesपुलिस यन PDFLal DhwojNo ratings yet

- Dwo:Ytf P) G, @) %%: NFNDF) X/ / K - SFZG LDLTDocument20 pagesDwo:Ytf P) G, @) %%: NFNDF) X/ / K - SFZG LDLTLal DhwojNo ratings yet

- LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @Document5 pagesLJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @ LJJFX BTF (P) G, @) @Lal DhwojNo ratings yet

- S) XL G) KFN P) Gnfo ( +ZF) WG Ug) (P) G, @) $ @) $.%. (Document14 pagesS) XL G) KFN P) Gnfo ( +ZF) WG Ug) (P) G, @) $ @) $.%. (Lal DhwojNo ratings yet

- 6 ) 8 O"lgog P) G, @) $ (: NFNDF) X/ / K - SFZG LDLTDocument14 pages6 ) 8 O"lgog P) G, @) $ (: NFNDF) X/ / K - SFZG LDLTLal DhwojNo ratings yet