Professional Documents

Culture Documents

Top 100 RE Management

Top 100 RE Management

Uploaded by

CosimoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top 100 RE Management

Top 100 RE Management

Uploaded by

CosimoCopyright:

Available Formats

32 INVESTMENT

IPE Real Estate Top 100 Investment Management Survey

The Top 100 Investment Management Survey provides a snapshot of an evolving global

industry. The table below shows the largest 100 real estate managers by assets under

management. See opposite and overleaf for a series of top-10 rankings by geography, sector,

strategy and rankings of multi-managers and listed property specialists. For a full AUM

breakdown of each company, see the data section from page 66.

Company Total RE AUM 30/06/16 (€m) Company Total RE AUM 30/06/16 (€m)

1 Brookfield 134,138 51 Lendlease Investment Management 14,673 (5)

2 PGIM 103,613 (1)

52 Schroder Real Estate Investment Management 14,495

3 The Blackstone Group 93,104 53 Amundi Real Estate 13,912

4 TH Real Estate 87,080 54 La Française 13,841

5 Hines 83,221 55 Fidelity International 13,618

6 CBRE Global Investors 79,800 56 Greystar Real Estate Partners 13,093

7 UBS Asset Management 67,974 (2) 57 The GPT Group 12,750

8 AXA IM - Real Assets 65,872 58 Charter Hall 12,509

9 Invesco Real Estate 64,219 59 Patron Capital Advisors 11,854 (2)

10 Principal Real Estate Investors 62,971 60 Gaw Capital Partners 10,843 (2)

11 Swiss Life Asset Managers 62,948 61 Columbia Threadneedle Investments 10,717

12 JP Morgan Asset Management 62,361 62 Jamestown 10,645

13 MetLife Investments 61,079 63 TA Realty 10,341 (2)

14 LaSalle Investment Management 52,108 (2)

64 TRIUVA 10,025

15 CapitaLand 51,116 65 Apollo Global Management 9,924

16 Deutsche Asset Management 47,357 (2) 66 DTZ Investors 9,676

17 Morgan Stanley Investment Management 46,667 67 Hermes Investment Management 9,657

18 Barings Real Estate Advisers 45,914 68 KBS 9,509

19 Credit Suisse 45,525 69 MEAG Munich Ergo Asset Management 9,405

20 Allianz Real Estate 45,425 70 DRA Advisors 8,718

21 Aviva Investors 44,051 71 CenterSquare Investment Management 8,675

22 Starwood Capital Group 42,548 72 Angelo, Gordon & Co. 8,343 (2)

23 AEW Global 42,168 73 BMO Real Estate Partners 8,263

24 APG Asset Management 39,581 74 Rockspring Property Investment Managers 8,234

25 Tishman Speyer 38,447 75 ISPT 8,230

26 Clarion Partners 36,454 (2) 76 Walton Street Capital 8,216

27 Cohen & Steers Capital Management 36,194 (3) 77 Partners Group 8,088

28 Prologis 35,574 78 Oaktree Capital Management 8,087 (5)

29 M&G 34,497 79 Bouwinvest Real Estate Investment Management 7,920

30 DekaBank Deutsche Girozentrale/Deka Immobilien 34,470 80 MN 7,369

31 Bentall Kennedy Group 30,229 81 KGAL Investment Management 7,269

32 Heitman 29,454 82 Tristan Capital Partners 7,236 (2)

33 Union Investment 27,207 83 Royal London Asset Management 6,947

34 Generali Real Estate 26,413 84 American Realty Advisors 6,614

35 Aberdeen Asset Management 24,464 85 Quadrant Real Estate Advisors 6,408

36 Legal & General Investment Management 23,463 86 GLL Real Estate Partners 6,163

37= BNP Paribas Real Estate Investment Management 23,000 87 Aerium 6,100

37= Goodman 23,000 88 Cromwell Property Group 5,900

39 Mapletree Investments 22,717 (2) 89 Orchard Street Investment Management 5,591

40 GLP 22,491 90 Investa Property Group 5,587

41 Standard Life Investments 22,286 (2)

91 Warburg-HIH Invest Real Estate 5,563

42 PGGM 21,027 (4) 92 Real IS 5,540

43 BlackRock 19,979 93 Sorgente Group 5,483 (5)

44 AMP Capital 18,031 94 Bouwfonds Investment Management 5,347

45 Patrizia 17,200 95 Sentinel Real Estate Corp. 4,902

46 Syntrus Achmea Real Estate & Finance 16,726 96 Meyer Bergman 4,239

47 Colony Capital 16,400 97 Vesteda 4,129

© IPE Research

48 Savills Investment Management 16,384 98 ASR Vastgoed Vermogensbeheer 4,019

49 USAA Real Estate Company 15,419 (3)

99 Torchlight Investors 4,014

50 DEXUS Property Group 14,857 100 Grosvenor Europe 3,910

Footnotes: (1) Represents the combined assets of PGIM Real Estate and PGIM Real Estate Finance, two business units within PGIM, Inc. that provide real estate investment management and commercial mortgage loan services respectively,

through PGIM, Inc. and some of its global subsidiaries. (2) As at 31/03/16 (3) As at 30/09/16 (4) As at 30/06/15 (5) As at 31/12/15

IPE REAL ESTATE november/december 2016

INVESTMENT 33

Top 10 by geography and sector

Real Estate AUM – Global Real Estate AUM – Europe Real Estate AUM – Americas

Company €m Company €m Company €m

1 Brookfield 134,138 1 AXA IM - Real Assets 63,622 1 Brookfield 105,776

2 PGIM 103,613 2 Aviva Investors 42,780 2 PGIM 83,994

3 The Blackstone Group 93,104 3 Credit Suisse 42,201 3 Hines 66,053

4 TH Real Estate 87,080 4 CBRE Global Investors 40,300 4 The Blackstone Group 63,987

5 Hines 83,221 5 DekaBank 31,512 5 TH Real Estate 60,883

6 CBRE Global Investors 79,800 6 Allianz Real Estate 31,363 6 Principal Real Estate Investors 56,566

7 UBS Asset Management 67,974 7 M&G 30,384 7 JP Morgan Asset Management 45,518

8 AXA IM - Real Assets 65,872 8 Generali Real Estate 25,525 8 Barings Real Estate Advisers 42,041

9 Invesco Real Estate 64,219 9 UBS Asset Management 25,410 9 Clarion Partners 36,454

10 Principal Real Estate Investors 62,971 10 TH Real Estate 24,554 10 Invesco Real Estate 34,451

Real Estate AUM – Asia Pacific Office – Global Office – Europe

Company €m Company €m Company €m

1 CapitaLand 49,558 1 Hines 61,467 1 AXA IM - Real Assets 24,022

2 Mapletree Investments 20,979 2 Brookfield 55,462 2 DekaBank 20,387

3 Lendlease Investment Mngt. 13,531 3 Tishman Speyer 32,805 3 Aviva Investors 17,968

4 AMP Capital 13,171 4 TH Real Estate 29,642 4 Generali Real Estate 16,051

5 The GPT Group 12,750 5 PGIM 27,906 5 Brookfield 14,806

6 UBS Asset Management 12,581 6 AXA IM - Real Assets 24,947 6 Deutsche Asset Management 13,024

7 Charter Hall 12,509 7 DekaBank 22,433 7 BNP Paribas Real Estate IM 13,000

8 GLP 8,744 8 Deutsche Asset Management 22,002 8 Union Investment 10,662

9 Brookfield 7,982 9 JP Morgan Asset Management 18,786 9 Amundi Real Estate 9,734

10 CBRE Global Investors 7,300 10 Aviva Investors 18,501 10 AEW Global 9,656

Office – Americas Office – Asia Pacific Retail – Global

Company €m Company €m Company €m

1 Hines 51,758 1 Mapletree Investments 7,740 1 Brookfield 46,674

2 Brookfield 34,080 2 Brookfield 6,576 2 TH Real Estate 28,168

3 PGIM 23,794 3 The GPT Group 6,107 3 PGIM 21,554

4 TH Real Estate 22,109 4 CapitaLand 5,830 4 CapitaLand 19,524

5 JP Morgan Asset Management 16,631 5 Investa Property Group 5,587 5 UBS Asset Management 18,648

6 Principal Real Estate Investors 13,218 6 Charter Hall 5,192 6 Aviva Investors 17,180

7 Bentall Kennedy Group 11,027 7 AMP Capital 5,104 7 CBRE Global Investors 15,600

8 Clarion Partners 10,791 8 Lendlease Investment Mngt. 4,999 8 M&G 13,973

9 CBRE Global Investors 9,300 9 Invesco Real Estate 4,134 9 AEW Global 11,405

10 Invesco Real Estate 8,645 10 BlackRock 4,047 10 LaSalle Investment Management 11,254

Retail – Europe Retail – Americas Retail – Asia Pacific

Company €m Company €m Company €m

1 Aviva Investors 16,684 1 Brookfield 46,172 1 CapitaLand 19,524

2 CBRE Global Investors 14,400 2 PGIM 14,433 2 Lendlease Investment Mngt. 7,999

3 TH Real Estate 13,377 3 TH Real Estate 13,517 3 UBS Asset Management 7,014

4 AXA IM - Real Assets 8,972 4 Principal Real Estate Investors 9,169 4 AMP Capital 6,950

5 Standard Life Investments 8,485 5 JP Morgan Asset Management 8,293 5 The GPT Group 5,435

6 Union Investment 8,156 6 Heitman 7,804 6 Mapletree Investments 5,254

7 Aberdeen Asset Management 8,108 7 Clarion Partners 7,231 7 PGIM 4,560

8 LaSalle Investment Management 7,262 8 Bentall Kennedy Group 6,778 8 Charter Hall 3,625

9 AEW Global 6,630 9 UBS Asset Management 5,118 9 LaSalle Investment Management 1,717

10 UBS Asset Management 6,516 10 Starwood Capital Group 5,054 10 Gaw Capital Partners 1,419

Industrial/logistics – Global Industrial/logistics – Europe Industrial/logistics – Americas

Company €m Company €m Company €m

1 Prologis 35,574 1 Prologis 12,077 1 Prologis 16,224

2 GLP 22,491 2 Aviva Investors 6,417 2 PGIM 14,408

3 PGIM 15,399 3 Legal & General Investment Mngt. 5,386 3 GLP 13,747

4 Principal Real Estate Investors 11,716 4 CBRE Global Investors 5,000 4 Principal Real Estate Investors 11,176

5 Clarion Partners 8,683 5 Standard Life Investments 3,732 5 Clarion Partners 8,683

6 TH Real Estate 8,366 6 Aberdeen Asset Management 2,756 6 TH Real Estate 6,231

7 Mapletree Investments 7,113 7 LaSalle Investment Management 2,606 7 Bentall Kennedy Group 4,907

8 CBRE Global Investors 6,700 8 Columbia Threadneedle Inv. 2,605 8 Brookfield 4,289

9 Aviva Investors 6,608 9 TH Real Estate 2,135 9 Deutsche Asset Management 3,666

10 LaSalle Investment Management 6,085 10 AXA IM - Real Assets 2,045 10 Heitman 3,221

2016 november/december IPE REAL ESTATE

34 INVESTMENT

IPE Real Estate Top 100 Investment Management Survey

Industrial/logistics – Asia Pacific Residential – Global Residential – Europe

Company €m Company €m Company €m

1 GLP 8,744 1 PGIM 22,636 1 Syntrus Achmea RE & Finance 10,754

2 Prologis 7,273 2 UBS Asset Management 16,624 2 AXA IM - Real Assets 8,294

3 Mapletree Investments 7,113 3 Brookfield 14,969 3 UBS Asset Management 7,192

4 Charter Hall 2,917 4 Greystar Real Estate Partners 13,056 4 Patrizia 6,450

5 UBS Asset Management 1,864 5 Credit Suisse 10,850 5 Greystar Real Estate Partners 3,904

6 LaSalle Investment Management 1,692 6 Starwood Capital Group 10,807 6 Bouwinvest Real Estate IM 3,667

7 The GPT Group 1,208 7 Syntrus Achmea RE & Finance 10,754 7 Generali Real Estate 3,136

8 AMP Capital 622 8 TH Real Estate 10,749 8 Amvest 2,904

9 Lendlease Investment Mngt. 533 9 Invesco Real Estate 8,922 9 Patron Capital Advisors 2,733

10 PGIM 203 10 AXA IM - Real Assets 8,447 10 Aberdeen Asset Management 2,490

Residential – Americas Residential – Asia Pacific Hotels – Global

Company €m Company €m Company €m

1 PGIM 21,043 1 CapitaLand 6,063 1 CapitaLand 12,051

2 Brookfield 14,844 2 Gaw Capital Partners 1,009 2 Starwood Capital Group 10,410

3 TH Real Estate 10,669 3 Mapletree Investments 495 3 Brookfield 6,595

4 Starwood Capital Group 10,581 4 Savills Investment Management 410 4 AXA IM - Real Assets 3,259

5 UBS Asset Management 9,345 5 LaSalle Investment Management 378 5 Union Investment 2,993

6 Greystar Real Estate Partners 9,152 6 Angelo, Gordon & Co. 371 6 PGIM 2,921

7 Invesco Real Estate 8,249 7 PGIM 366 7 Patron Capital Advisors 2,912

8 JP Morgan Asset Management 8,031 8 Invesco Real Estate 365 8 DekaBank 2,633

9 Principal Real Estate Investors 7,624 9 Hines 257 9 Credit Suisse 2,445

10 Clarion Partners 7,439 10 JP Morgan Asset Management 155 10 Barings Real Estate Advisers 2,072

Hotels – Europe Hotels – Americas Hotels – Asia Pacific

Company €m Company €m Company €m

1 Brookfield 3,856 1 Starwood Capital Group 7,424 1 CapitaLand 10,493

2 AXA IM - Real Assets 3,018 2 PGIM 2,393 2 Gaw Capital Partners 1,252

3 Starwood Capital Group 2,986 3 Barings Real Estate Advisers 2,062 3 Brookfield 780

4 Patron Capital Advisors 2,912 4 Brookfield 1,959 4 Charter Hall 547

5 Union Investment 2,546 5 Clarion Partners 1,607 5 LaSalle Investment Management 221

6 DekaBank 2,377 6 UBS Asset Management 1,098 6 InfraRed Capital Partners 213

7 CapitaLand 1,249 7 Colony Capital 800 7 Colony Capital 100

8 Invesco Real Estate 742 8 Principal Real Estate Investors 790 8 AMP Capital 52

9 LaSalle Investment Management 632 9 Gaw Capital Partners 564 9 BlackRock 38

10 Internos Global Investors 571 10 Union Investment 447 10 Angelo, Gordon & Co. 21

Top 10 by strategy and geography

Core/core plus – Global Core/core plus – Europe Core/core plus – Americas

Company €m Company €m Company €m

1 PGIM 91,040 1 AXA IM - Real Assets 43,752 1 PGIM 78,093

2 TH Real Estate 76,624 2 CBRE Global Investors 39,900 2 TH Real Estate 57,090

3 CBRE Global Investors 67,200 3 DekaBank 31,512 3 Hines 39,455

4 UBS Asset Management 59,746 4 M&G 30,384 4 Clarion Partners 31,802

5 Hines 47,517 5 Union Investment 22,003 5 JP Morgan Asset Management 30,499

6 Deutsche Asset Management 46,324 6 UBS Asset Management 21,889 6 Bentall Kennedy Group 29,853

7 AXA IM - Real Assets 44,586 7 Legal & General Investment Mngt. 21,598 7 Brookfield 29,468

8 Credit Suisse 43,717 8 Standard Life Investments 20,452 8 Principal Real Estate Investors 26,258

9 Brookfield 36,471 9 Deutsche Asset Management 20,115 9 UBS Asset Management 25,641

10 M&G 34,497 10 TH Real Estate 18,824 10 Deutsche Asset Management 22,718

Core/core plus – Asia Pacific Value add – Global Value add – Europe

Company €m Company €m Company €m

1 CapitaLand 21,160 1 CapitaLand 14,111 1 Aberdeen Asset Management 7,742

2 The GPT Group 12,703 2 Tishman Speyer 12,193 2 Patrizia 7,000

3 Lendlease Investment Mngt. 12,532 3 TH Real Estate 8,954 3 TH Real Estate 5,499

4 Charter Hall 12,453 4 DRA Advisors 8,718 4 BNP Paribas Real Estate IM 5,200

5 AMP Capital 12,440 5 Hines 8,245 5 AXA IM - Real Assets 4,556

6 UBS Asset Management 12,216 6 Aberdeen Asset Management 8,006 6 Rockspring Property Inv. Managers 4,350

7 CBRE Global Investors 6,600 7 Heitman 7,889 7 Meyer Bergman 4,239

© IPE Research

8 Investa Property Group 5,587 8 PGIM 7,827 8 Heitman 3,792

9 PGIM 5,447 9 JP Morgan Asset Management 7,473 9 Cromwell Property Group 3,680

10 Invesco Real Estate 5,069 10 Patrizia 7,000 10 DTZ Investors 3,260

IPE REAL ESTATE november/december 2016

INVESTMENT 35

Value add – Americas Value add – Asia Pacific Opportunistic – Global

Company €m Company €m Company €m

1 DRA Advisors 8,718 1 CapitaLand 13,673 1 Brookfield 70,456

2 JP Morgan Asset Management 6,989 2 Mapletree Investments 1,299 2 Starwood Capital Group 32,413

3 CBRE Global Investors 5,800 3 LaSalle Investment Management 1,215 3 Hines 27,459

4 PGIM 5,722 4 GLP 1,129 4 CapitaLand 14,725

5 Hines 5,153 5 Lendlease Investment Mngt. 999 5 Patron Capital Advisors 11,854

6 Barings Real Estate Advisers 5,086 6 CBRE Global Investors 600 6 Tishman Speyer 11,133

7 Clarion Partners 4,257 7 Savills Investment Management 575 7 Morgan Stanley Investment Mngt. 9,906

8 Colony Capital 4,000 8 AEW Global 559 8 AEW Global 9,138

9 Heitman 3,887 9 PGIM 420 9 CBRE Global Investors 5,800

10 TH Real Estate 3,424 10 Pamfleet 415 10 Gaw Capital Partners 5,798

Opportunistic – Europe Opportunistic – Americas Opportunistic – Asia Pacific

Company €m Company €m Company €m

1 Patron Capital Advisors 11,854 1 Brookfield 62,424 1 CapitaLand 14,725

2 Starwood Capital Group 7,179 2 Starwood Capital Group 25,088 2 Gaw Capital Partners 5,798

3 Brookfield 5,670 3 Hines 21,445 3 BlackRock 4,526

4 Tristan Capital Partners 5,485 4 AEW Global 9,042 4 GLP 3,691

5 Morgan Stanley Investment Mngt. 4,787 5 CBRE Global Investors 5,700 5 Prologis 2,973

6 Hines 4,319 6 GTIS Partners 2,820 6 Brookfield 2,362

7 Colony Capital 2,800 7 Torchlight Investors 2,493 7 Morgan Stanley Investment Mngt. 1,813

8 Niam 2,308 8 Kohlberg Kravis Roberts & Co. 2,317 8 Hines 1,695

9 BMO Real Estate Partners 2,019 9 Colony Capital 1,800 9 LaSalle Investment Management 1,192

10 Aberdeen Asset Management 1,668 10 KBS 1,687 10 TH Real Estate 902

Top global multi-managers and listed managers

Fund-of-funds/multi-manager Listed real estate/REITs

Company €m Company €m Company €m

1 CBRE Global Investors 12,400 1 Cohen & Steers Capital Mngt. 37,302 16 Colony Capital 7,000

2 UBS Asset Management 9,447 2 Invesco Real Estate 26,862 17 Prologis 6,194

3 Aviva Investors 6,258 3 UBS Asset Management 23,698 18 AMP Capital 5,446

4 Schroder Real Estate Inv. Mngt. 4,272 4 APG Asset Management 23,267 19 M&G 5,076

5 Credit Suisse 2,337 5 Morgan Stanley Investment Mngt. 18,612 20 Brookfield 4,959

6 Franklin Real Asset Advisors 2,182 6 CBRE Global Investors 18,600 21 PGIM 4,513

7 Aberdeen Asset Management 2,166 7 CapitaLand 17,227 22 GLP 3,924

8 M&G 1,454 8 LaSalle Investment Management 13,109 23 Credit Suisse 3,745

9 LaSalle Investment Management 1,429 9 Mapletree Investments 12,351 24 MN 3,273

10 Syntrus Achmea RE & Finance 1,082 10 Principal Real Estate Investors 11,575 25 Heitman 3,257

11 DTZ Investors 385 11 JP Morgan Asset Management 10,199 26 AXA IM - Real Assets 2,915

12 DekaBank 359 12 Starwood Capital Group 9,402 27 Investa Property Group 2,414

13 KGAL Investment Management 300 13 TH Real Estate 9,284 28 BMO Real Estate Partners 2,034

14 TH Real Estate 193 14 Deutsche Asset Management 7,835 29 Barings Real Estate Advisers 1,959

15 GLL Real Estate Partners 149 15 AEW Global 7,332 30 BlackRock 1,740

A few words from the Circulation Department

Please help us to help you

We want to ensure that every issue of IPE that we deliver to you is correctly addressed, and so

reaches you promptly. Please help us by completing and returning the registration form when

we send one to you. Completed registrations last for three years, so we promise not to trouble

you too often. If you move location or job, remember to let us know so that your receipt of IPE

will not be interrupted.

Thank you for your co-operation.

For further information, please call or email Tony Pryce +44 (0) 20 3465 9311

or tony.pryce@ipe.com

2016 november/december IPE REAL ESTATE

You might also like

- Boscalt Hospitality Fund PitchbookDocument71 pagesBoscalt Hospitality Fund PitchbookrenatafornilloNo ratings yet

- Pittong HAFELEDocument2 pagesPittong HAFELETrần ThắngNo ratings yet

- REPE Case 02 45 Milk Street Investment RecommendationDocument20 pagesREPE Case 02 45 Milk Street Investment RecommendationziuziNo ratings yet

- Betaworks Shareholder Letter 2012Document32 pagesBetaworks Shareholder Letter 2012Erin GriffithNo ratings yet

- EY Landscaping UK Fintech PDFDocument20 pagesEY Landscaping UK Fintech PDFWilliamNo ratings yet

- CalculationsManual4.05 NA (S CURVE)Document38 pagesCalculationsManual4.05 NA (S CURVE)Teodoro Miguel Carlos IsraelNo ratings yet

- Konkrete Information Memorandum v2.5Document54 pagesKonkrete Information Memorandum v2.5Estate BaronNo ratings yet

- Realogy Lawsuit Against CompassDocument68 pagesRealogy Lawsuit Against CompassAnonymous 5HlSmcEutLNo ratings yet

- The PA I-78I-81 Logistics CorridorDocument20 pagesThe PA I-78I-81 Logistics CorridorAnonymous Feglbx5No ratings yet

- Facebook Initiating ReportDocument39 pagesFacebook Initiating Reportmiyuki urataNo ratings yet

- 7 8 20 Teaser Santo TomasDocument46 pages7 8 20 Teaser Santo TomasxavestNo ratings yet

- Membership List: Russell 3000® IndexDocument33 pagesMembership List: Russell 3000® IndexJordi Oller SánchezNo ratings yet

- Samples For Sushmitha-2Document9 pagesSamples For Sushmitha-2dpkrajaNo ratings yet

- Stephen Kern: The Culture of Time and Space 1880-1918Document14 pagesStephen Kern: The Culture of Time and Space 1880-1918Daniela KernNo ratings yet

- Leveraged Loan League TablesDocument31 pagesLeveraged Loan League TablescmoorefieldNo ratings yet

- Top 300 PEIDocument8 pagesTop 300 PEIJerome OngNo ratings yet

- Asset Listing 2021Document123 pagesAsset Listing 2021Meksen MahiedineNo ratings yet

- Real Estate Debt Due Diligence 2016Document17 pagesReal Estate Debt Due Diligence 2016Shahrani KassimNo ratings yet

- SCG - Example - Offering MemorandumDocument18 pagesSCG - Example - Offering MemorandumHammad KhanNo ratings yet

- Private Debt The Rise of An Asset ClassDocument4 pagesPrivate Debt The Rise of An Asset ClassCarlos VelasquezNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- REPE Case 03 Sao Paulo Opportunistic Pre Sold Condos SlidesDocument18 pagesREPE Case 03 Sao Paulo Opportunistic Pre Sold Condos SlidesBrado DelgadoNo ratings yet

- Citi Bank 2022 Family Office Survey ReportDocument50 pagesCiti Bank 2022 Family Office Survey ReportRoshan GaikwadNo ratings yet

- RE 01 12 Simple Multifamily Acquisition SolutionsDocument3 pagesRE 01 12 Simple Multifamily Acquisition SolutionsAnonymous bf1cFDuepPNo ratings yet

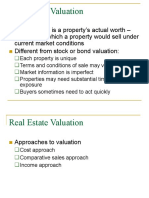

- InVEMA13 - Real Estate ValuationDocument9 pagesInVEMA13 - Real Estate ValuationDaniel ValerianoNo ratings yet

- Private Banking Welcomes YouDocument6 pagesPrivate Banking Welcomes YouSiddhesh ManeNo ratings yet

- 2024 F Prime Capital State of Fintech ReportDocument31 pages2024 F Prime Capital State of Fintech ReportprokonektNo ratings yet

- Owners Mag 9-2011Document60 pagesOwners Mag 9-2011casey1936No ratings yet

- Real Estate ForumDocument20 pagesReal Estate ForumfwbpNo ratings yet

- Basics of REITDocument9 pagesBasics of REITRoyce ZhanNo ratings yet

- Forney Offering Memorandum - NEW PDFDocument47 pagesForney Offering Memorandum - NEW PDFJose ThankachanNo ratings yet

- PB Asia 30 Equity Fund Prospectus SCDocument43 pagesPB Asia 30 Equity Fund Prospectus SCyanohuNo ratings yet

- REITs (Public + Private)Document81 pagesREITs (Public + Private)Chris CarmenNo ratings yet

- Hudson Webber Foundation's 2015 "7.2 SQ MI" ReportDocument99 pagesHudson Webber Foundation's 2015 "7.2 SQ MI" ReportRyan FeltonNo ratings yet

- AP Office 3Q 2011Document28 pagesAP Office 3Q 2011Colliers InternationalNo ratings yet

- Crowd Real Estate Site TrackingDocument56 pagesCrowd Real Estate Site TrackingahgonzalezpNo ratings yet

- Partnership PresentationDocument128 pagesPartnership Presentationparv dalalNo ratings yet

- Thomvest Real Estate Tech Review, September 2019Document32 pagesThomvest Real Estate Tech Review, September 2019Nima WedlakeNo ratings yet

- Monte Carlo Real EstateDocument32 pagesMonte Carlo Real EstateSangita SangamNo ratings yet

- Mapletree Commercial Trust Annual Report 2015-16Document160 pagesMapletree Commercial Trust Annual Report 2015-16Sassy TanNo ratings yet

- Manhattan Beach Real Estate Market Conditions - March 2015Document15 pagesManhattan Beach Real Estate Market Conditions - March 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Insurance As Related To Real Estate by Emile E. KahnDocument6 pagesInsurance As Related To Real Estate by Emile E. Kahnreal-estate-historyNo ratings yet

- Business Presentation / PitchDocument21 pagesBusiness Presentation / PitchDebbie HauserNo ratings yet

- Aviva UK: Goldman Sachs Conference, June 2008Document25 pagesAviva UK: Goldman Sachs Conference, June 2008Aviva GroupNo ratings yet

- HWVP Fund VII LP MemoDocument26 pagesHWVP Fund VII LP MemobytemealNo ratings yet

- Investment Opportunities in Australian Infrastructure Brochure PDFDocument24 pagesInvestment Opportunities in Australian Infrastructure Brochure PDFMaiko Lesmana DNo ratings yet

- Poland Investor GuideDocument32 pagesPoland Investor GuidearifnezamiNo ratings yet

- Pugilist Pitch Deck - InstitutionsDocument30 pagesPugilist Pitch Deck - Institutionsszu_han_changNo ratings yet

- Keck Seng Investments - Heller House Investment Memo - 4-7-16Document36 pagesKeck Seng Investments - Heller House Investment Memo - 4-7-16Marcelo P. LimaNo ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Hidden Treasures in The Nigerian Real Estate Sector by Dr. MKO BalogunDocument29 pagesHidden Treasures in The Nigerian Real Estate Sector by Dr. MKO BalogunVictor KingBuilderNo ratings yet

- Capitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalDocument54 pagesCapitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalMukarangaNo ratings yet

- The Journey Is The Reward: Changing Oakland'S Dynamic DistrictsDocument3 pagesThe Journey Is The Reward: Changing Oakland'S Dynamic DistrictsOaklandCBDs100% (1)

- Aztala Corporation Is The Real Estate Developer of BluHomesDocument46 pagesAztala Corporation Is The Real Estate Developer of BluHomesPaolo BellosilloNo ratings yet

- Investment MemoDocument37 pagesInvestment MemoAshish TripathiNo ratings yet

- Mckinsey Do It Urself Business PlansDocument10 pagesMckinsey Do It Urself Business Plansgodgod1982100% (1)

- Investment Proposal (Project) Application Form: C Ompany ProfileDocument3 pagesInvestment Proposal (Project) Application Form: C Ompany ProfilenabawiNo ratings yet

- Commercial Real Estate - Case Study Apr 2020Document2 pagesCommercial Real Estate - Case Study Apr 2020alim shaikhNo ratings yet

- UBS Future of The Tech EconomyDocument57 pagesUBS Future of The Tech EconomyaseptinNo ratings yet

- Birla Real Estate Investor PresentationDocument19 pagesBirla Real Estate Investor Presentationakumar4uNo ratings yet

- Investigacion Del Deutsche BankDocument14 pagesInvestigacion Del Deutsche BankJaumeNo ratings yet

- Q3 2023 Dubai Real Estate Market ReportDocument24 pagesQ3 2023 Dubai Real Estate Market ReportDaniyar KussainovNo ratings yet

- Lux Research-Improving The Front End of Innovatio (Client Confidential) PDFDocument10 pagesLux Research-Improving The Front End of Innovatio (Client Confidential) PDFNaveenNo ratings yet

- FINAL 5190 Commercial Real Estate OutlookDocument44 pagesFINAL 5190 Commercial Real Estate OutlookAnonymous Z7AgRR65f6No ratings yet

- Project Management – an Artificial Intelligent (Ai) ApproachFrom EverandProject Management – an Artificial Intelligent (Ai) ApproachNo ratings yet

- Da 15 132a3Document265 pagesDa 15 132a3LJ's infoDOCKETNo ratings yet

- Placement Report 2020-21Document14 pagesPlacement Report 2020-21Om JadhavNo ratings yet

- Modem Support TP-link MR3220Document7 pagesModem Support TP-link MR3220Timotius Ivan CaseyNo ratings yet

- Data IT Security ComapniesDocument17 pagesData IT Security ComapniesOmar FarooqNo ratings yet

- Bi-Annual RJIO TrackerDocument24 pagesBi-Annual RJIO TrackerArjun PNo ratings yet

- Our RecruriterDocument4 pagesOur RecruriterUkNo ratings yet

- 158877363Document606 pages158877363Skylark BLRNo ratings yet

- Fortinet Partners ListDocument40 pagesFortinet Partners ListneoaltNo ratings yet

- A Study of Unit Linked Insurance Plans of ICICI Prudential Life Insurance byDocument18 pagesA Study of Unit Linked Insurance Plans of ICICI Prudential Life Insurance byGeetanjali KumariNo ratings yet

- Company Name Contact Person Contact NumberDocument1 pageCompany Name Contact Person Contact NumberDr.N.G.P IT PlacementNo ratings yet

- Docket #0909 Date Filed: 11/26/2012Document88 pagesDocket #0909 Date Filed: 11/26/2012VivienneBarthaNo ratings yet

- فاتورة بوباDocument8 pagesفاتورة بوباEiflaRamosStaRitaNo ratings yet

- DapDocument50 pagesDapShreyaNo ratings yet

- List of Six Sigma CompaniesDocument16 pagesList of Six Sigma CompaniesDon bhauNo ratings yet

- TX 2017 PDFDocument265 pagesTX 2017 PDFSigit CahyoNo ratings yet

- Customer Calling DataDocument4 pagesCustomer Calling DataSamir GandhiNo ratings yet

- Self Directed Brokerage Option Mutual FundsxlsxDocument528 pagesSelf Directed Brokerage Option Mutual FundsxlsxGlenn-anthony Sending-State HortonNo ratings yet

- Acquisitions: SR - No. Acquiring Company Acquired Company HQ of Acquiring Company HQ of Acquired CompanyDocument4 pagesAcquisitions: SR - No. Acquiring Company Acquired Company HQ of Acquiring Company HQ of Acquired CompanyShashi Kumar BaranwalNo ratings yet

- NLLDocument415 pagesNLLDanmasterNo ratings yet

- SafeKey ACS MPIs On Amex Enabled July 2018Document1 pageSafeKey ACS MPIs On Amex Enabled July 2018Talent BeaNo ratings yet

- Givova Official Price ListDocument18 pagesGivova Official Price Listpremiersports1No ratings yet

- CIO - Database - NewDocument145 pagesCIO - Database - NewWilfred Dsouza67% (3)

- Agentes Autorizados ETF Site 05out21Document5 pagesAgentes Autorizados ETF Site 05out21Daniel EliasNo ratings yet

- CB Insights 2020 Fintech 250: Company Sector CategoryDocument3 pagesCB Insights 2020 Fintech 250: Company Sector CategoryBánh NgôNo ratings yet