Professional Documents

Culture Documents

Calculate Taxable Amounts and Tax Payable For Prof - David?

Calculate Taxable Amounts and Tax Payable For Prof - David?

Uploaded by

Hashir AslamCopyright:

Available Formats

You might also like

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Ryanair Cadet Scheme FAQs-3Document4 pagesRyanair Cadet Scheme FAQs-3Devanshu JhaNo ratings yet

- Advanced TaxationDocument4 pagesAdvanced Taxationominopaul2No ratings yet

- Initial Plc-Jasons Employment Income For The Tax Year 22/23Document9 pagesInitial Plc-Jasons Employment Income For The Tax Year 22/23akramkiller0No ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- Ronald - Answer (TX UK)Document2 pagesRonald - Answer (TX UK)ysaneechar29No ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Chapter 2 - SolutionDocument12 pagesChapter 2 - SolutionAk AlNo ratings yet

- FormatsDocument15 pagesFormatsMohamed ShaminNo ratings yet

- December 2018Document8 pagesDecember 2018LelouchNo ratings yet

- Tax-week12 test bankDocument3 pagesTax-week12 test bankzeinab.iaems.researchNo ratings yet

- TK4 AccDocument5 pagesTK4 AccmeifangNo ratings yet

- Solutions To Income Tax ComputationDocument12 pagesSolutions To Income Tax Computationqmwdb2k27kNo ratings yet

- Day Rate 2021Document2 pagesDay Rate 2021api-513297911No ratings yet

- ACC 3013 Taxation Revision - TEST 2Document4 pagesACC 3013 Taxation Revision - TEST 2falnuaimi001No ratings yet

- Salary: Carol's Income Tax Liability - Continues To Be Employed For The Tax Year End 22/23Document4 pagesSalary: Carol's Income Tax Liability - Continues To Be Employed For The Tax Year End 22/23akramkiller0No ratings yet

- Chapter 5: Pensions Question 5.1-AnswerDocument3 pagesChapter 5: Pensions Question 5.1-AnswerAk AlNo ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Higher SkillsDocument14 pagesHigher SkillsArun ThomasNo ratings yet

- Chapter-01 Introduction Accounting Principles SDocument10 pagesChapter-01 Introduction Accounting Principles SShifatNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- Actual Expenditure 2008-2012 From 1st SeptemberDocument3 pagesActual Expenditure 2008-2012 From 1st SeptemberJordan ChambersNo ratings yet

- FABM Q3 M3 (Output No. 3 - The Accounting Equation)Document3 pagesFABM Q3 M3 (Output No. 3 - The Accounting Equation)Sophia MagdaraogNo ratings yet

- Answers (مبادئ مالية) Ch.2and3Document11 pagesAnswers (مبادئ مالية) Ch.2and3moon lightNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- CH 2 SolutionDocument4 pagesCH 2 SolutionHoang MinhNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Soal 1Document1 pageSoal 1j8zpmzcnjxNo ratings yet

- CHAPTER 1 EXE SolutionDocument5 pagesCHAPTER 1 EXE SolutionBhimsen ShresthaNo ratings yet

- Manage Money TemplateDocument1 pageManage Money TemplateRahman ZafNo ratings yet

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDocument5 pages9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRNo ratings yet

- Financial Accounting HomeworkDocument9 pagesFinancial Accounting HomeworkDương Nguyễn BìnhNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- f6 ANSDocument14 pagesf6 ANSSarad KharelNo ratings yet

- Hardhat Case - Rajesh Kumar NayakDocument12 pagesHardhat Case - Rajesh Kumar NayakSandeep RawatNo ratings yet

- AIB Final Written ExamDocument13 pagesAIB Final Written ExamNeeza GautamNo ratings yet

- Mock Test - Chapter 9.10.11 With ANSWERDocument2 pagesMock Test - Chapter 9.10.11 With ANSWERuthanh2209No ratings yet

- Income Tax: Syllabus Study GuideDocument34 pagesIncome Tax: Syllabus Study GuideSam NalliNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- FM II Assignment 12 SolutionDocument3 pagesFM II Assignment 12 SolutionSinpaoNo ratings yet

- ABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Document4 pagesABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Emmanuel Villeja LaysonNo ratings yet

- Individual Assignment Public Finance and TaxationDocument3 pagesIndividual Assignment Public Finance and TaxationSahal Cabdi AxmedNo ratings yet

- Hardhat LTD Projected Income Statement 2000/2001Document12 pagesHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNo ratings yet

- TrustsDocument9 pagesTrustskayzmm99No ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationDocument4 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationKyla Artuz Dela CruzNo ratings yet

- Devina Yulia 20221539 2EB09 AKM TM#3Document3 pagesDevina Yulia 20221539 2EB09 AKM TM#3rully movizarNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

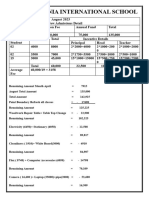

- Kidzania International SchoolDocument2 pagesKidzania International SchoolPrecious PearlNo ratings yet

- Accounting Quation Quiz ViladenoDocument1 pageAccounting Quation Quiz Viladenov1v1subrotoNo ratings yet

- Solutions Ch2Document3 pagesSolutions Ch2darkroyan426No ratings yet

- Balance PDFDocument2 pagesBalance PDFapi-436164332No ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- James AdvaccDocument5 pagesJames AdvaccJames De TorresNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Using The Average Costing LIFO and FIFO Method Compute The Cost?Document2 pagesUsing The Average Costing LIFO and FIFO Method Compute The Cost?Hashir AslamNo ratings yet

- Explain Regulatory Framework For Financial Reporting?: Task 1.5Document2 pagesExplain Regulatory Framework For Financial Reporting?: Task 1.5Hashir AslamNo ratings yet

- State The Limitations of Financial Statements?: Task 3.3Document1 pageState The Limitations of Financial Statements?: Task 3.3Hashir AslamNo ratings yet

- Define The Concept of Group As A Single Economic Unit and State Its Principles?Document1 pageDefine The Concept of Group As A Single Economic Unit and State Its Principles?Hashir AslamNo ratings yet

- Comment Why Reporting Financial Performance Is Important From The Company's Point of View?Document2 pagesComment Why Reporting Financial Performance Is Important From The Company's Point of View?Hashir AslamNo ratings yet

- Comment How Does Regulatory Framework Differs in Case of Public Entity, Specialized and Non-For-Profit Organisation?Document1 pageComment How Does Regulatory Framework Differs in Case of Public Entity, Specialized and Non-For-Profit Organisation?Hashir AslamNo ratings yet

- Comment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Document1 pageComment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Hashir AslamNo ratings yet

- Describe The Structure (Format) and Content of Financial Statements Under IFRS?Document5 pagesDescribe The Structure (Format) and Content of Financial Statements Under IFRS?Hashir AslamNo ratings yet

- State The Importance of Accounting Standards On Financial Instruments?Document2 pagesState The Importance of Accounting Standards On Financial Instruments?Hashir AslamNo ratings yet

- Define The Concept of Recognition and Measurement?: Task 1.3Document1 pageDefine The Concept of Recognition and Measurement?: Task 1.3Hashir AslamNo ratings yet

- Describe The Principles of Inventory Valuation and List Down The Methods of Computing The Cost of Inventory?Document1 pageDescribe The Principles of Inventory Valuation and List Down The Methods of Computing The Cost of Inventory?Hashir AslamNo ratings yet

- Task1.1 Explain Conceptual Framework?Document1 pageTask1.1 Explain Conceptual Framework?Hashir AslamNo ratings yet

- Explain Impairment Loss?: Task 2.7Document2 pagesExplain Impairment Loss?: Task 2.7Hashir AslamNo ratings yet

- Unit 7 - Strategic Human Marketing ManagementDocument10 pagesUnit 7 - Strategic Human Marketing ManagementHashir AslamNo ratings yet

- Comment On The True and Fair View'. As Being An Auditor Can You Guarantee That The Financial Statements Are True and Fair?Document2 pagesComment On The True and Fair View'. As Being An Auditor Can You Guarantee That The Financial Statements Are True and Fair?Hashir AslamNo ratings yet

Calculate Taxable Amounts and Tax Payable For Prof - David?

Calculate Taxable Amounts and Tax Payable For Prof - David?

Uploaded by

Hashir AslamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate Taxable Amounts and Tax Payable For Prof - David?

Calculate Taxable Amounts and Tax Payable For Prof - David?

Uploaded by

Hashir AslamCopyright:

Available Formats

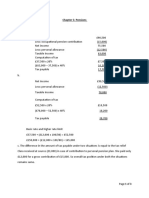

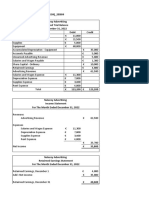

Task 2.

8

Calculate taxable amounts and tax payable for

Prof.David?

Salary Income:

Basic Salary = £3000 x 12 = £36,000

Bonus = £800

Total = £36,800

Property Income:

Property income = £2,400

Collection charges on property = (£240)

Total = £2,100

Other Income:

Income of non- professional writer = £350

Total = £350

TAXABLE INCOME:

Salary Income = £36,800

Property Income = £2,100

Other Income = £350

Total Income = £39,310

Person Allowance = (8,105)

Taxable Income = 31,205

TAX PAYABLE:

31205 @ 20% = £6,241

Tax deducted = (£880)

Tax Payable = £5,361

You might also like

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Ryanair Cadet Scheme FAQs-3Document4 pagesRyanair Cadet Scheme FAQs-3Devanshu JhaNo ratings yet

- Advanced TaxationDocument4 pagesAdvanced Taxationominopaul2No ratings yet

- Initial Plc-Jasons Employment Income For The Tax Year 22/23Document9 pagesInitial Plc-Jasons Employment Income For The Tax Year 22/23akramkiller0No ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- Ronald - Answer (TX UK)Document2 pagesRonald - Answer (TX UK)ysaneechar29No ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Chapter 2 - SolutionDocument12 pagesChapter 2 - SolutionAk AlNo ratings yet

- FormatsDocument15 pagesFormatsMohamed ShaminNo ratings yet

- December 2018Document8 pagesDecember 2018LelouchNo ratings yet

- Tax-week12 test bankDocument3 pagesTax-week12 test bankzeinab.iaems.researchNo ratings yet

- TK4 AccDocument5 pagesTK4 AccmeifangNo ratings yet

- Solutions To Income Tax ComputationDocument12 pagesSolutions To Income Tax Computationqmwdb2k27kNo ratings yet

- Day Rate 2021Document2 pagesDay Rate 2021api-513297911No ratings yet

- ACC 3013 Taxation Revision - TEST 2Document4 pagesACC 3013 Taxation Revision - TEST 2falnuaimi001No ratings yet

- Salary: Carol's Income Tax Liability - Continues To Be Employed For The Tax Year End 22/23Document4 pagesSalary: Carol's Income Tax Liability - Continues To Be Employed For The Tax Year End 22/23akramkiller0No ratings yet

- Chapter 5: Pensions Question 5.1-AnswerDocument3 pagesChapter 5: Pensions Question 5.1-AnswerAk AlNo ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Higher SkillsDocument14 pagesHigher SkillsArun ThomasNo ratings yet

- Chapter-01 Introduction Accounting Principles SDocument10 pagesChapter-01 Introduction Accounting Principles SShifatNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- Actual Expenditure 2008-2012 From 1st SeptemberDocument3 pagesActual Expenditure 2008-2012 From 1st SeptemberJordan ChambersNo ratings yet

- FABM Q3 M3 (Output No. 3 - The Accounting Equation)Document3 pagesFABM Q3 M3 (Output No. 3 - The Accounting Equation)Sophia MagdaraogNo ratings yet

- Answers (مبادئ مالية) Ch.2and3Document11 pagesAnswers (مبادئ مالية) Ch.2and3moon lightNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- CH 2 SolutionDocument4 pagesCH 2 SolutionHoang MinhNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Soal 1Document1 pageSoal 1j8zpmzcnjxNo ratings yet

- CHAPTER 1 EXE SolutionDocument5 pagesCHAPTER 1 EXE SolutionBhimsen ShresthaNo ratings yet

- Manage Money TemplateDocument1 pageManage Money TemplateRahman ZafNo ratings yet

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDocument5 pages9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRNo ratings yet

- Financial Accounting HomeworkDocument9 pagesFinancial Accounting HomeworkDương Nguyễn BìnhNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- f6 ANSDocument14 pagesf6 ANSSarad KharelNo ratings yet

- Hardhat Case - Rajesh Kumar NayakDocument12 pagesHardhat Case - Rajesh Kumar NayakSandeep RawatNo ratings yet

- AIB Final Written ExamDocument13 pagesAIB Final Written ExamNeeza GautamNo ratings yet

- Mock Test - Chapter 9.10.11 With ANSWERDocument2 pagesMock Test - Chapter 9.10.11 With ANSWERuthanh2209No ratings yet

- Income Tax: Syllabus Study GuideDocument34 pagesIncome Tax: Syllabus Study GuideSam NalliNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- FM II Assignment 12 SolutionDocument3 pagesFM II Assignment 12 SolutionSinpaoNo ratings yet

- ABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Document4 pagesABM11 BussMath Q2 Wk2 Gross-and-Net-Earnings-2Emmanuel Villeja LaysonNo ratings yet

- Individual Assignment Public Finance and TaxationDocument3 pagesIndividual Assignment Public Finance and TaxationSahal Cabdi AxmedNo ratings yet

- Hardhat LTD Projected Income Statement 2000/2001Document12 pagesHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNo ratings yet

- TrustsDocument9 pagesTrustskayzmm99No ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationDocument4 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationKyla Artuz Dela CruzNo ratings yet

- Devina Yulia 20221539 2EB09 AKM TM#3Document3 pagesDevina Yulia 20221539 2EB09 AKM TM#3rully movizarNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- Kidzania International SchoolDocument2 pagesKidzania International SchoolPrecious PearlNo ratings yet

- Accounting Quation Quiz ViladenoDocument1 pageAccounting Quation Quiz Viladenov1v1subrotoNo ratings yet

- Solutions Ch2Document3 pagesSolutions Ch2darkroyan426No ratings yet

- Balance PDFDocument2 pagesBalance PDFapi-436164332No ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- James AdvaccDocument5 pagesJames AdvaccJames De TorresNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Using The Average Costing LIFO and FIFO Method Compute The Cost?Document2 pagesUsing The Average Costing LIFO and FIFO Method Compute The Cost?Hashir AslamNo ratings yet

- Explain Regulatory Framework For Financial Reporting?: Task 1.5Document2 pagesExplain Regulatory Framework For Financial Reporting?: Task 1.5Hashir AslamNo ratings yet

- State The Limitations of Financial Statements?: Task 3.3Document1 pageState The Limitations of Financial Statements?: Task 3.3Hashir AslamNo ratings yet

- Define The Concept of Group As A Single Economic Unit and State Its Principles?Document1 pageDefine The Concept of Group As A Single Economic Unit and State Its Principles?Hashir AslamNo ratings yet

- Comment Why Reporting Financial Performance Is Important From The Company's Point of View?Document2 pagesComment Why Reporting Financial Performance Is Important From The Company's Point of View?Hashir AslamNo ratings yet

- Comment How Does Regulatory Framework Differs in Case of Public Entity, Specialized and Non-For-Profit Organisation?Document1 pageComment How Does Regulatory Framework Differs in Case of Public Entity, Specialized and Non-For-Profit Organisation?Hashir AslamNo ratings yet

- Comment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Document1 pageComment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Hashir AslamNo ratings yet

- Describe The Structure (Format) and Content of Financial Statements Under IFRS?Document5 pagesDescribe The Structure (Format) and Content of Financial Statements Under IFRS?Hashir AslamNo ratings yet

- State The Importance of Accounting Standards On Financial Instruments?Document2 pagesState The Importance of Accounting Standards On Financial Instruments?Hashir AslamNo ratings yet

- Define The Concept of Recognition and Measurement?: Task 1.3Document1 pageDefine The Concept of Recognition and Measurement?: Task 1.3Hashir AslamNo ratings yet

- Describe The Principles of Inventory Valuation and List Down The Methods of Computing The Cost of Inventory?Document1 pageDescribe The Principles of Inventory Valuation and List Down The Methods of Computing The Cost of Inventory?Hashir AslamNo ratings yet

- Task1.1 Explain Conceptual Framework?Document1 pageTask1.1 Explain Conceptual Framework?Hashir AslamNo ratings yet

- Explain Impairment Loss?: Task 2.7Document2 pagesExplain Impairment Loss?: Task 2.7Hashir AslamNo ratings yet

- Unit 7 - Strategic Human Marketing ManagementDocument10 pagesUnit 7 - Strategic Human Marketing ManagementHashir AslamNo ratings yet

- Comment On The True and Fair View'. As Being An Auditor Can You Guarantee That The Financial Statements Are True and Fair?Document2 pagesComment On The True and Fair View'. As Being An Auditor Can You Guarantee That The Financial Statements Are True and Fair?Hashir AslamNo ratings yet