Professional Documents

Culture Documents

Book Value Cash Realized Loss

Book Value Cash Realized Loss

Uploaded by

BonDocEldRic0 ratings0% found this document useful (0 votes)

28 views1 pageThe partnership of Xenia, Yolly, and Zerna decided to liquidate. Prior to liquidation, their statement of financial position showed assets of P160,000 consisting of cash and other assets, and liabilities and equity of P160,000. Other assets were realized over 3 months, resulting in a total loss of P54,000. The question asks to prepare a statement of liquidation by installment wherein each partner has sufficient interest to absorb the possible loss.

Original Description:

Parcor

Original Title

Parcor Acc lec 6

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe partnership of Xenia, Yolly, and Zerna decided to liquidate. Prior to liquidation, their statement of financial position showed assets of P160,000 consisting of cash and other assets, and liabilities and equity of P160,000. Other assets were realized over 3 months, resulting in a total loss of P54,000. The question asks to prepare a statement of liquidation by installment wherein each partner has sufficient interest to absorb the possible loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views1 pageBook Value Cash Realized Loss

Book Value Cash Realized Loss

Uploaded by

BonDocEldRicThe partnership of Xenia, Yolly, and Zerna decided to liquidate. Prior to liquidation, their statement of financial position showed assets of P160,000 consisting of cash and other assets, and liabilities and equity of P160,000. Other assets were realized over 3 months, resulting in a total loss of P54,000. The question asks to prepare a statement of liquidation by installment wherein each partner has sufficient interest to absorb the possible loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

LA CONSOLACION UNIVERSITY PHILIPPINES A.F.

ISIP

PARTNERSHIP AND CORPORATION ACCOUNTING LECTURE 06 – LIQUIDATION BY INSTALLMENT

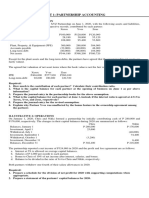

Xenia, Yolly and Zerna are business partners sharing profits and losses equally. They decide to liquidate their partnership.

Prior to the liquidation, the partnership statement of financial position on June 30, 2019 is presented below:

Assets Liabilities & Equity

Cash P5,000 Liabilities P40,000

Other assets 155,000 Xenia capital 30,000

Yolly capital 40,000

Zerna capital 50,000

Total P160,000 Total P160,000

The following data relate to the realization of other assets:

Book Value Cash Realized Loss

July P80,000 P65,000 P15,000

August 42,000 24,000 18,000

September 33,000 12,000 21,000

Total P155,000 P101,000 P54,000

Prepare statement of liquidation by installment wherein each partner has sufficient interest to absorb possible loss.

You might also like

- ACC 110 - CFE - 21 22 With ANSWERSDocument25 pagesACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Pre Midterm AFAR PDFDocument12 pagesPre Midterm AFAR PDFDanielle Nicole Marquez100% (1)

- Quiz Liquidation and DissolutionDocument30 pagesQuiz Liquidation and DissolutionIan RanilopaNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Name: Date: Subject: Section and Time:: Problem 1Document16 pagesName: Date: Subject: Section and Time:: Problem 1Marie GarpiaNo ratings yet

- Paulo (Fair Value) Jolina (Fair Value)Document2 pagesPaulo (Fair Value) Jolina (Fair Value)Patricia Camille Dela CruzNo ratings yet

- Unit 4.2 Partnership LiquidationDocument2 pagesUnit 4.2 Partnership LiquidationBenjamine EscañoNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Toaz - Info Partnership Qs PRDocument8 pagesToaz - Info Partnership Qs PRToni Rose Hernandez LualhatiNo ratings yet

- JOINT ARRANGEMENTS ProblemsDocument8 pagesJOINT ARRANGEMENTS ProblemsRichard LamagnaNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Liquidation Sample ProblemsDocument1 pageLiquidation Sample ProblemsMarian B TersonaNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Quiz in PartnershipDocument12 pagesQuiz in Partnershiplouise carino50% (2)

- 02Document3 pages02Jodel Castro100% (1)

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Liquidation Assignment PrintingDocument2 pagesLiquidation Assignment Printingranilyn.dacocoNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Accounting For Partnership FARDocument31 pagesAccounting For Partnership FARlousevero10No ratings yet

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuarteNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- General Instruction: Write Your Final Answer On The Answer Sheet. Read The Problems Carefully Before AnsweringDocument4 pagesGeneral Instruction: Write Your Final Answer On The Answer Sheet. Read The Problems Carefully Before AnsweringJeane Mae BooNo ratings yet

- CH 018Document2 pagesCH 018Joana TrinidadNo ratings yet

- Business Combination: Straight ProblemsDocument1 pageBusiness Combination: Straight ProblemsCilNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20John Carlos Doringo100% (1)

- Practical Accounting 2Document12 pagesPractical Accounting 2jaysonNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- ParCor SampleDocument1 pageParCor SampleMiscaCruzNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Partnership Dissolution: QuizDocument5 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Set A - Prelim Exam in COGM6Document5 pagesSet A - Prelim Exam in COGM6kaii 1234No ratings yet

- Partnersip TutorialsDocument4 pagesPartnersip Tutorialsjames VillanuevaNo ratings yet

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- Blue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Document7 pagesBlue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Mark Edgar De Guzman100% (1)

- Assets Liabilities and CapitalDocument1 pageAssets Liabilities and CapitalBonDocEldRicNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- AFARDocument41 pagesAFARAlican, JerhamelNo ratings yet

- 0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFDocument9 pages0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFIan RanilopaNo ratings yet

- A 4. LiquidationDocument3 pagesA 4. LiquidationAngela DucusinNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Lesson 7 Joint VenturesDocument9 pagesLesson 7 Joint VenturesheyheyNo ratings yet

- Marian CompanyDocument2 pagesMarian CompanySigmund TagguegNo ratings yet

- 1 - PDFsam - 01 Partnership - RetirementxxDocument9 pages1 - PDFsam - 01 Partnership - RetirementxxnashNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Assets Liabilities and CapitalDocument1 pageAssets Liabilities and CapitalBonDocEldRicNo ratings yet

- The Exercise of The Pardoning Power in The PhilippinesDocument14 pagesThe Exercise of The Pardoning Power in The PhilippinesBonDocEldRicNo ratings yet

- GI Inclusions, Exclusions and DeductionsDocument16 pagesGI Inclusions, Exclusions and DeductionsBonDocEldRic100% (1)

- Executive Summary: 1.1 ObjectivesDocument16 pagesExecutive Summary: 1.1 ObjectivesBonDocEldRicNo ratings yet

- 2019 Cpa ExamDocument14 pages2019 Cpa ExamBonDocEldRicNo ratings yet

- PRTC Tax Final Preboard May 2018Document13 pagesPRTC Tax Final Preboard May 2018BonDocEldRicNo ratings yet

- Financial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureDocument11 pagesFinancial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureBonDocEldRicNo ratings yet

- Research PaperDocument26 pagesResearch PaperBonDocEldRicNo ratings yet

- Research Proposal DawDocument2 pagesResearch Proposal DawBonDocEldRicNo ratings yet

- Research ProposalDocument15 pagesResearch ProposalBonDocEldRicNo ratings yet