Professional Documents

Culture Documents

2007-12-12 155107 Javits

2007-12-12 155107 Javits

Uploaded by

Jaydeep Bairagi0 ratings0% found this document useful (0 votes)

6 views1 pageJavits & Sons common stock currently trades at $30 per share. It pays an annual dividend of $3 and is expected to grow dividends at a constant rate of 5% per year. Based on this information, the cost of equity for Javits & Sons is 15% if financed only through retained earnings, but would be 16.11% if new stock were issued due to a 10% flotation cost on the new shares.

Original Description:

Original Title

2007-12-12_155107_Javits.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJavits & Sons common stock currently trades at $30 per share. It pays an annual dividend of $3 and is expected to grow dividends at a constant rate of 5% per year. Based on this information, the cost of equity for Javits & Sons is 15% if financed only through retained earnings, but would be 16.11% if new stock were issued due to a 10% flotation cost on the new shares.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views1 page2007-12-12 155107 Javits

2007-12-12 155107 Javits

Uploaded by

Jaydeep BairagiJavits & Sons common stock currently trades at $30 per share. It pays an annual dividend of $3 and is expected to grow dividends at a constant rate of 5% per year. Based on this information, the cost of equity for Javits & Sons is 15% if financed only through retained earnings, but would be 16.11% if new stock were issued due to a 10% flotation cost on the new shares.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

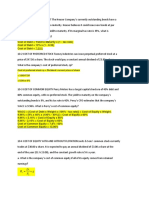

Javits & Sons common stock currently trades at $30 a share.

It is expected to pay an

annual dividend of $3.00 a share at the end of the year (D1= $3.00) and the constant

growth rate is 5% a year.

A) what is the company's cost of common equity if all of its equity comes from retained

earnings?

D1

Re = +g

P0

$3.0

Re = + 0.05

$30

= 0.15

= 15%

B) If the company were to issue new stock, it would incur a 10% flotation cost. What

would the cost of equity from new stock be?

Floatation Costs = $30 × 10% = $3

D1

Re = +g

P0- Floatation Costs

$3

Re = + 0.05

$30-$3

= 0.1611

= 16.11%

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Ch09 - Cost of Capital 12112020 125813pmDocument13 pagesCh09 - Cost of Capital 12112020 125813pmMuhammad Umar BashirNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- Chapter 7Document11 pagesChapter 7Muhammad WaqasNo ratings yet

- Solution 4Document5 pagesSolution 4askdgas50% (2)

- Sample Award Ceremony BudgetDocument1 pageSample Award Ceremony BudgetJaydeep BairagiNo ratings yet

- Common Stocks - WorksheetDocument7 pagesCommon Stocks - Worksheetvwfn8f7xmtNo ratings yet

- CF Tutorial 11Document12 pagesCF Tutorial 11stellaNo ratings yet

- FinMan AnswerDocument9 pagesFinMan AnswerJoel Orlanes Jr.No ratings yet

- Chapter 9Document2 pagesChapter 9mahnoor javaidNo ratings yet

- FM PFDocument12 pagesFM PFJenelle ReyesNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Easy Problem Chapter 11Document5 pagesEasy Problem Chapter 11Natally LangfeldtNo ratings yet

- Tutorial 6 - SolutionsDocument8 pagesTutorial 6 - SolutionsNguyễn Phương ThảoNo ratings yet

- Nadem A. Dolotallas AIS21: Preferred Dividend Pps (1 F) $ 9 $ 100 (0.95)Document3 pagesNadem A. Dolotallas AIS21: Preferred Dividend Pps (1 F) $ 9 $ 100 (0.95)Jasmin RabonNo ratings yet

- Sollutions To Cost of CapitalDocument5 pagesSollutions To Cost of CapitalBirat SharmaNo ratings yet

- FM COE FineDocument14 pagesFM COE FineBenzon Agojo OndovillaNo ratings yet

- Bonus Assignment 2Document4 pagesBonus Assignment 2Zain Zulfiqar67% (3)

- 4.chapter 8 - Stock ValuationDocument40 pages4.chapter 8 - Stock ValuationMohamed Sayed FadlNo ratings yet

- 5 - Cost of CapitalDocument6 pages5 - Cost of CapitaloryzanoviaNo ratings yet

- Chap 11 & 12Document4 pagesChap 11 & 12ElizabethNo ratings yet

- Chapter 9 Exercise QuestionsDocument3 pagesChapter 9 Exercise QuestionsLinda Castro OchoaNo ratings yet

- Week 3 TutorialDocument6 pagesWeek 3 TutorialRenee WongNo ratings yet

- Practice 4-Stock ValuationDocument3 pagesPractice 4-Stock Valuationelysepa7No ratings yet

- Dividend Payout Ratio 1 Retention Ratio: Abdullah Alnasser 436170093Document4 pagesDividend Payout Ratio 1 Retention Ratio: Abdullah Alnasser 436170093abdullahNo ratings yet

- ExtraExercices FinalFIN3301Document10 pagesExtraExercices FinalFIN3301Ghita100% (1)

- Business Finance Test Review Class - Questions AnswersDocument4 pagesBusiness Finance Test Review Class - Questions Answersbobhamilton3489No ratings yet

- Sample Question For Final Exam - Do Not Ask For SolutionDocument14 pagesSample Question For Final Exam - Do Not Ask For SolutionNguyễn NhungNo ratings yet

- FM19 Finals Q1 Stocks Bonds PortfolioDocument4 pagesFM19 Finals Q1 Stocks Bonds PortfolioJuren Demotor DublinNo ratings yet

- Assignment chp10Document10 pagesAssignment chp10Aalizae Anwar YazdaniNo ratings yet

- Tugas Accounting and Finance Bab 2 Setelah UtsDocument6 pagesTugas Accounting and Finance Bab 2 Setelah UtsbogitugasNo ratings yet

- Fitriyanto - Financial Management Asignment - CH 14 15Document6 pagesFitriyanto - Financial Management Asignment - CH 14 15iyanNo ratings yet

- Problems On Cost of CapitalDocument4 pagesProblems On Cost of CapitalAshutosh Biswal100% (1)

- Tugas CH 9 Manajemen KeuanganDocument5 pagesTugas CH 9 Manajemen KeuanganL RakkimanNo ratings yet

- Notes 220119 100928Document4 pagesNotes 220119 100928Elgun ElgunNo ratings yet

- Present ValueDocument38 pagesPresent Valuemarjannaseri77100% (1)

- Easy Problem Chapter 10Document4 pagesEasy Problem Chapter 10Natally LangfeldtNo ratings yet

- Individual Assignment: Subject: Human Resource Management Iemba Iei03Document9 pagesIndividual Assignment: Subject: Human Resource Management Iemba Iei03Thunder StormNo ratings yet

- Chapter 6 Interest Formulas - Equal Payment Series 3.13 If You Desire To Withdraw The Following Amounts Over The Next Five Years From ADocument4 pagesChapter 6 Interest Formulas - Equal Payment Series 3.13 If You Desire To Withdraw The Following Amounts Over The Next Five Years From ACHEANG HOR PHENGNo ratings yet

- Tugas 1 Ekotek - Andika Wahyu Kusuma - Muhammad Rafli RevansyahDocument1 pageTugas 1 Ekotek - Andika Wahyu Kusuma - Muhammad Rafli RevansyahChou ChouNo ratings yet

- Chapter 10 StocksDocument8 pagesChapter 10 Stocksbiserapatce2No ratings yet

- Mgt201 Solved SubjectiveDocument17 pagesMgt201 Solved Subjectivezahidwahla1No ratings yet

- Present Value of MoneyDocument29 pagesPresent Value of MoneySuryamanyu SharmaNo ratings yet

- Sample Quiz 2 (With Some Details)Document6 pagesSample Quiz 2 (With Some Details)时家欣No ratings yet

- Tugas 8 - C11 - Cost of CapitalDocument5 pagesTugas 8 - C11 - Cost of CapitalIqbal BaihaqiNo ratings yet

- Chapter 7 TutorialDocument4 pagesChapter 7 Tutorialararosli100% (1)

- Seminar 4 DCF Valuation, NPV, and Other Investment RulesDocument79 pagesSeminar 4 DCF Valuation, NPV, and Other Investment RulesPoun GerrNo ratings yet

- AFM Assignment 2Document11 pagesAFM Assignment 2Hira NazNo ratings yet

- FIN331 2010 Extra Credit 2 Problems 101209Document17 pagesFIN331 2010 Extra Credit 2 Problems 101209bradshawwNo ratings yet

- Tutorial 1 AnswersDocument7 pagesTutorial 1 AnswersFreya LiNo ratings yet

- Stock ValuationDocument5 pagesStock ValuationDiana SaidNo ratings yet

- Exercises Stocks ValuationDocument10 pagesExercises Stocks ValuationELISHA OCAMPONo ratings yet

- Example - Franchise PEDocument1 pageExample - Franchise PEShahrukhNo ratings yet

- Vn1001630 - Vo Thi Phuong Thuy - CFDocument9 pagesVn1001630 - Vo Thi Phuong Thuy - CFThunder StormNo ratings yet

- TCDNDocument6 pagesTCDNKhoa Hoang TrinhNo ratings yet

- The Good Life Company Has Just Paid A Dividend of $2.00 Per Common Stock. The Long-Run Growth Is Expected To Be 5.4%. If Investors' Required Rate of Return Is 11.4%, What Is The Stock Price?Document23 pagesThe Good Life Company Has Just Paid A Dividend of $2.00 Per Common Stock. The Long-Run Growth Is Expected To Be 5.4%. If Investors' Required Rate of Return Is 11.4%, What Is The Stock Price?Mary Justine PaquibotNo ratings yet

- Problem Solving 10Document6 pagesProblem Solving 10Ehab M. Abdel HadyNo ratings yet

- Tugas Cost of Capital QuestionsDocument7 pagesTugas Cost of Capital Questionssmoky 22No ratings yet

- Assigment VI (Retno Novia Mallisa - 484542)Document3 pagesAssigment VI (Retno Novia Mallisa - 484542)Vania OlivineNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Eic AnalysisDocument17 pagesEic AnalysisJaydeep Bairagi100% (1)

- S.No. Full APA Reference Citation: Journal of Managerial PsychologyDocument6 pagesS.No. Full APA Reference Citation: Journal of Managerial PsychologyJaydeep BairagiNo ratings yet

- Airtran Southwest Question: Delay in Minutes For Two Airlines Have Been Given. Does The Average Delay For Both The Airlines Differ?Document11 pagesAirtran Southwest Question: Delay in Minutes For Two Airlines Have Been Given. Does The Average Delay For Both The Airlines Differ?Jaydeep BairagiNo ratings yet