Professional Documents

Culture Documents

Financial Stability/Liquidity Ratios: Ratio Formula Indicate

Financial Stability/Liquidity Ratios: Ratio Formula Indicate

Uploaded by

William LattaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Stability/Liquidity Ratios: Ratio Formula Indicate

Financial Stability/Liquidity Ratios: Ratio Formula Indicate

Uploaded by

William LattaoCopyright:

Available Formats

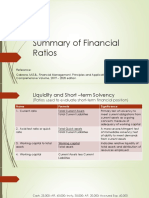

FINANCIAL STABILITY/LIQUIDITY RATIOS

Ratio Formula Indicate

Current ratio Current Assets Short-term debt paying ability

Current Liabilities

Acid-test ratio Quick Assets Immediate short-term liquidity

Current Liabilities

Debt-equity ratio Total Liabilities Level of borrowing relative to

Total Owners’ Equity funds used to finance the

company

Receivables turnover Net Credit Sales Liquidity of Receivables

Average Receivables

Inventory turnover Cost Sales Liquidity of Inventory

Average Merchandise Inventory

Payables turnover Net Credit Purchase Efficiency of payment to creditors

Average Trade Payables

Current Assets turnover Net Sales Effectiveness in the use of current

Average Current Assets assets

Fixed Assets turnover Net Sales Effectiveness in the use of fixed

Average Fixed Assets assets

Assets turnover Net Sales Efficiency in the use of assets to

Average Total Assets generate sales

PROFITABILITY RATIOS

Return on total assets Net income before interest & taxes Overall profitability of assets

Average Total assets

Operating expense ratio Operating Expenses Cost incurred to support each

Net Sales peso of sales

Gross profit ratio Gross Profit Margin between selling price and

Net Sales cost of goods sold

Net profit ratio Net Profit Net income generated by each

Net Sales peso of sales

INVESTMENT RATIOS

Earnings per share Net Income – Preferred dividends Net income earned on each

Weighted average no. of common ordinary share

shares

Return on owners’ equity Net Income Profitability of shareholders’

Average Owners’ Equity investments

Price-earnings ratio Price per Share How much an investor would pay

Earnings per Share for each peso of current earnings

Dividend yield Dividend per Share Return on stock investments

Price per Share based on the market value of the

shares

Dividend payout Common divided per share Portion of available profits

Earnings per share distributed to common

shareholders as dividend

You might also like

- Sample Free Comprehensive Stress Management 14eDocument26 pagesSample Free Comprehensive Stress Management 14eWilliam Lattao33% (3)

- ch06 HWDocument10 pagesch06 HWHạnh Nguyễn NguyễnNo ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)AsifMughalNo ratings yet

- Days 8&9 Ratio DefinitionsDocument1 pageDays 8&9 Ratio Definitionslai chenNo ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- ACC 1100 Day 08&09 Ratio DefinitionsDocument1 pageACC 1100 Day 08&09 Ratio DefinitionsMai Anh ĐàoNo ratings yet

- Common Ratios Used in Financial AnalysisDocument5 pagesCommon Ratios Used in Financial AnalysisSuperGuyNo ratings yet

- Current Assets Current Liabilities: 365 DaysDocument2 pagesCurrent Assets Current Liabilities: 365 DaysMadina MamasalievaNo ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Ratio Analysis GoodDocument13 pagesRatio Analysis GoodA.Rahman SalahNo ratings yet

- Ratios Formulas CommentsDocument5 pagesRatios Formulas CommentsMariano DumalaganNo ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- Summary of Financial RatiosDocument9 pagesSummary of Financial RatiosEdrian CabagueNo ratings yet

- Financial Ratios - Sheet1Document4 pagesFinancial Ratios - Sheet1Melanie SamsonaNo ratings yet

- Formulas Ratio AnalysisDocument4 pagesFormulas Ratio AnalysisMaxene GabuteraNo ratings yet

- ECN320 - FINAL - Formula SheetDocument2 pagesECN320 - FINAL - Formula Sheetclerry29No ratings yet

- LU 1 - Analysis and Interpretation of Financial Statements - NotesDocument4 pagesLU 1 - Analysis and Interpretation of Financial Statements - NotesSherly Zanele SamboNo ratings yet

- Important RatiosDocument2 pagesImportant RatiosSudha SinghNo ratings yet

- Ratios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDocument5 pagesRatios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDan Miguel SangcapNo ratings yet

- Financial Mix RatiosDocument7 pagesFinancial Mix RatiosansanandresNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisAgungNo ratings yet

- Days in Inventory: 365 Days / Times Every DaysDocument1 pageDays in Inventory: 365 Days / Times Every DaysV.Prasarnth Raaj Veera RaoNo ratings yet

- BA 569 Financial RatiosDocument7 pagesBA 569 Financial RatiosMariaNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisNur SyafiqahNo ratings yet

- List of formulas 公式表Document2 pagesList of formulas 公式表赵博No ratings yet

- Kpi 1713958219Document1 pageKpi 1713958219omji5177No ratings yet

- 50 Finance KPIsDocument1 page50 Finance KPIsDIPEN ASTIKNo ratings yet

- Topic 4. Stock MarketDocument7 pagesTopic 4. Stock MarketЕкатерина КидяшеваNo ratings yet

- Investment RatiosDocument2 pagesInvestment RatiosMisbah ZiyaNo ratings yet

- Formula CardDocument2 pagesFormula CardIan LicarosNo ratings yet

- Financial Ratios TableDocument2 pagesFinancial Ratios TableWiSeVirGoNo ratings yet

- Summary of Key FormulaeDocument1 pageSummary of Key FormulaeAlejandro ArbuluNo ratings yet

- Operating Ratios Ratio Method of Calculation SignificanceDocument4 pagesOperating Ratios Ratio Method of Calculation Significanceahi52001No ratings yet

- Day 4 SMC - by AHDocument78 pagesDay 4 SMC - by AHFidan StylesNo ratings yet

- Dupont Decomposition: Operating ProfitabilityDocument2 pagesDupont Decomposition: Operating ProfitabilitySatrujit MohapatraNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- Ratios - RN Book - Toclass - Tosec CDocument4 pagesRatios - RN Book - Toclass - Tosec CKulpreet KaurNo ratings yet

- Financial RatioDocument8 pagesFinancial RatioFabiano JoeyNo ratings yet

- 9960 FinancialratiosDocument2 pages9960 FinancialratiosGhelyn GimenezNo ratings yet

- Topic 13 Financial Statement AnalysisDocument32 pagesTopic 13 Financial Statement AnalysisAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Chapter 3Document61 pagesChapter 3Shrief MohiNo ratings yet

- Ratio Analysis FormulasDocument3 pagesRatio Analysis FormulasVinayaniv YanivNo ratings yet

- Glossary: (Ver Páginas Relacionadas)Document5 pagesGlossary: (Ver Páginas Relacionadas)SandyNo ratings yet

- ACCOUNTING FOR F&B AND HR FOR FOOD BUSINESS - by Thomas DavisDocument28 pagesACCOUNTING FOR F&B AND HR FOR FOOD BUSINESS - by Thomas DavisTesda CACSNo ratings yet

- Ratio Analysis - Easy To RememberDocument3 pagesRatio Analysis - Easy To RememberKhushbuJ100% (5)

- Accounting 2018Document32 pagesAccounting 2018zacrasheed2No ratings yet

- Days Sales in AR 360/ Sales/ AR End Days Seberapa Lama AR Ke Collect, Ga Boleh Lewat Credit Term (LBH CPT LBH Bagus)Document2 pagesDays Sales in AR 360/ Sales/ AR End Days Seberapa Lama AR Ke Collect, Ga Boleh Lewat Credit Term (LBH CPT LBH Bagus)Natasha WijayaNo ratings yet

- KPIS LaundryDocument10 pagesKPIS LaundryvvvasimmmNo ratings yet

- Ratio Used To Gauge Asset Management Efficiency and Liquidity Name Formula SignificanceDocument9 pagesRatio Used To Gauge Asset Management Efficiency and Liquidity Name Formula SignificanceAko Si JheszaNo ratings yet

- 2017 Accounting Examination PaperDocument30 pages2017 Accounting Examination PaperAccount NiceNo ratings yet

- Ratio FormulaeDocument3 pagesRatio FormulaeNandhaNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- Financial Statement Analysis Week 5bDocument34 pagesFinancial Statement Analysis Week 5bhezilgonzaga25No ratings yet

- Activity Ratios: AR TurnoverDocument10 pagesActivity Ratios: AR TurnoverGilynCarpesoAmoscoNo ratings yet

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Summary of Financial Ratios DiscussionDocument30 pagesSummary of Financial Ratios DiscussionJohn Mark CabrejasNo ratings yet

- Finance Formula BankDocument2 pagesFinance Formula BankMELISSA ANN COLOMANo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Iceland CaseDocument6 pagesIceland CaseWilliam Lattao0% (1)

- Guitar - RCMDocument1 pageGuitar - RCMWilliam LattaoNo ratings yet

- INTL 303 Syllabus - 2019 WinterDocument8 pagesINTL 303 Syllabus - 2019 WinterWilliam LattaoNo ratings yet

- International Trade Finance 36Document35 pagesInternational Trade Finance 36William LattaoNo ratings yet

- Panasia Indo Resources TBKDocument3 pagesPanasia Indo Resources TBKfranshalawaNo ratings yet

- Ledger and Balance SheetDocument4 pagesLedger and Balance SheetSyed ZamanNo ratings yet

- FijiTimes - June 22 2012 PDFDocument48 pagesFijiTimes - June 22 2012 PDFfijitimescanadaNo ratings yet

- Chap 6 Notes AFMDocument30 pagesChap 6 Notes AFMAngel RubiosNo ratings yet

- Raymond P&LDocument2 pagesRaymond P&LSJNo ratings yet

- Ch13 TifDocument53 pagesCh13 TifJerome James Foliente100% (1)

- ACC702 Course Material & Study GuideDocument78 pagesACC702 Course Material & Study Guidelaukkeas100% (4)

- Answer Jerry Rice and Grain StoresDocument2 pagesAnswer Jerry Rice and Grain StoresJken OrtizNo ratings yet

- 61089bos49694 Ipc Nov2019 gp1Document93 pages61089bos49694 Ipc Nov2019 gp1iswerya n.sNo ratings yet

- Review of Module 1: Fall 2017Document12 pagesReview of Module 1: Fall 2017Dimitra TaslimNo ratings yet

- The Effect of Non Financial Perspective Toward Financial Perspective of Balance Scorecard in Banking Companies Listed in Indonesia Stock ExchangeDocument8 pagesThe Effect of Non Financial Perspective Toward Financial Perspective of Balance Scorecard in Banking Companies Listed in Indonesia Stock ExchangeKim Elijah YamazakiNo ratings yet

- ICICI Financial AnalysisDocument13 pagesICICI Financial AnalysisAkhil MahajanNo ratings yet

- ACC106 - 2 - Material - Unit 5 - Updated 2Document37 pagesACC106 - 2 - Material - Unit 5 - Updated 2Ali EbNo ratings yet

- Ratio Analysis: 06/02/2020 1 Imlak Shaikh, PH.D, MDI GurgoanDocument43 pagesRatio Analysis: 06/02/2020 1 Imlak Shaikh, PH.D, MDI Gurgoanraghavendra_20835414No ratings yet

- ENSM - Comparative and Superlative - Pie Charts - Part 2Document30 pagesENSM - Comparative and Superlative - Pie Charts - Part 2med27919No ratings yet

- Ratio Analysis On BANK ASIA LIMITEDDocument9 pagesRatio Analysis On BANK ASIA LIMITEDMd. Sazzad Bin Azad 182-11-5934No ratings yet

- Chapter 08 DayagDocument24 pagesChapter 08 DayagEureka Fernandez67% (6)

- Project Report SbiDocument41 pagesProject Report SbiK R Î ZNo ratings yet

- Accounting Equation (Compatibility Mode)Document29 pagesAccounting Equation (Compatibility Mode)MahediNo ratings yet

- Matahari Department Store TBK.: August 2018Document4 pagesMatahari Department Store TBK.: August 2018Ana SafitriNo ratings yet

- NoidaDocument23 pagesNoidaAmmar Tambawala100% (1)

- CASH MANAGEMENT ANALYSIS RPP FINAL As of Dec 7 2021Document30 pagesCASH MANAGEMENT ANALYSIS RPP FINAL As of Dec 7 2021Amnie AliNo ratings yet

- Metals and Engineering Corporation: Feasibility Study ONDocument15 pagesMetals and Engineering Corporation: Feasibility Study ONkinfegetaNo ratings yet

- AP Municipal Budget ManualDocument65 pagesAP Municipal Budget ManualSAtya GAndhiNo ratings yet

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- 8e Ch3 Mini Case Client ContDocument10 pages8e Ch3 Mini Case Client Contaponic2825% (4)

- Stock AnalysisDocument13 pagesStock AnalysisRajesh PattanaikNo ratings yet

- Tamawood Case Study - Accounting Analysis - Suggested AnswerDocument3 pagesTamawood Case Study - Accounting Analysis - Suggested AnswerAnonymous 8ooQmMoNs1No ratings yet

- A Project Report On Ration Analysis of Hotel IndustryDocument20 pagesA Project Report On Ration Analysis of Hotel IndustrySuvayu ChakrabortyNo ratings yet