Professional Documents

Culture Documents

Global PC Market Declines As U.S. Sales Lag: Abstract (English)

Global PC Market Declines As U.S. Sales Lag: Abstract (English)

Uploaded by

jessica_liemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global PC Market Declines As U.S. Sales Lag: Abstract (English)

Global PC Market Declines As U.S. Sales Lag: Abstract (English)

Uploaded by

jessica_liemCopyright:

Available Formats

Global PC Market Declines As U.S.

Sales Lag

Laposky, John . TWICE : This Week in Consumer Electronics; New York Vol. 32, Iss. 17, (Oct 23, 2017):

18.

ProQuest document link

ABSTRACT (ENGLISH)

"While there were signs of stabilization in the PC industry in key regions, including EMEA, Japan and Latin America,

the relatively stable results were offset by the U.S. market, which saw a 10 percent year-over-year decline in part

because of a very weak back-to-school sales season," Kitagawa said. According to IDC, HP retained the top spot

and further lengthened its lead with a nearly 22.8 percent share of the global market, helped in part by major wins

in Asia/Pacific. Business PC demand is stable in the U.S., but demand could slow down among [small- and

medium-size businesses] due to PC price increases due to component shortages.

FULL TEXT

Headnote

IDC, Gartner see a continued slowdown going forward

Worldwide shipments of traditional PCs in the third quarter remained flat or were slightly down, according to the

two leading data-tracking companies.

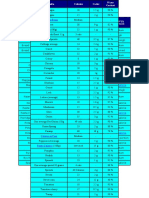

IDC's research showed shipments of desktop, notebook and workstation computers totaled 67.2 million units in

the third quarter of 2017, which translates into a slight year-over-year decline of 0.5 percent, though the research

firm said the results were better than projections of a 1.4 percent decline, and further demonstrate the trend of

market stabilization in recent quarters. Improvement in emerging markets as well as back-to-school promotions

helped boost results.

Gartner had worldwide PC shipments at 67 million units in the quarter, which compared with earlier Gartner

research, marked a 3.6 percent decline from the same period in 2016. Gartner said this was the 12th consecutive

quarter of declining PC shipments.

IDC said component shortages in recent quarters have continued to improve and thus did not factor as a

significant hindrance to production volumes. Nonetheless, higher component prices and inventory in some

markets meant limited shipments and validated IDC assumptions about a muted third quarter. Not surprisingly,

competitive pressures further cemented the dominance of the top five PC companies, which accounted for nearly

75 percent of the total traditional PC market.

Gartner disagreed with that finding. "There are ongoing component shortages, with DRAM shortages getting

particularly worse during the third quarter of the year compared with the first half of 2017. The component price

hike impacted the consumer PC market as most vendors generally pass the price hike on to consumers, rather

than absorbing the cost themselves," said Mika Kitagawa, principal analyst at Gartner. "We expect the DRAM

shortage to continue to the end of 2018, but it will not be reflected in the final PC prices immediately."

Gartner called out the relative weakness of the U.S. market for the worldwide decline. "While there were signs of

stabilization in the PC industry in key regions, including EMEA, Japan and Latin America, the relatively stable

results were offset by the U.S. market, which saw a 10 percent year-over-year decline in part because of a very

weak back-to-school sales season," Kitagawa said. "Business PC demand, led by Windows 10 upgrades, continued

to drive PC shipments across all regions, but its refresh schedule varies by region. The countries with stable

economies, such as the U.S., have created a positive sentiment among businesses, especially for small and

midsized businesses, which are more vulnerable to external events, such as economic or political."

PDF GENERATED BY SEARCH.PROQUEST.COM Page 1 of 3

According to IDC, HP retained the top spot and further lengthened its lead with a nearly 22.8 percent share of the

global market, helped in part by major wins in Asia/Pacific. HP was the only top vendor to manage a notable

shipment increase with growth of 6 percent on the year. Lenovo was second with 21.6 percent.

Gartner called Q3 a "virtual tie" for the top spot, with HP at 21.8 percent and Lenovo at 21.4 percent. However,

Gartner said, HP is in an upward trend, as it has experienced five consecutive quarters of global PC growth, while

Lenovo is in a downward trend with declining shipments in eight of the last 10 quarters.

"The traditional [global] PC market performed much as expected in the third quarter," said Loren Loverde, program

VP at IDC. "Emerging markets rebounded slightly more than anticipated, but overall results reflect the stabilization

we expected following component and inventory adjustments. The outlook for the fourth quarter remains cautious,

likely with a small decline in volume for the quarter and the year. The gains in emerging regions and potential for

more commercial replacements represent some upside potential, although we continue to expect incremental

declines in total shipments for the next few years."

As for the U.S. market, Gartner's Kitagawa said, "Weak back-to-school sales were further evidence that traditional

consumer PC demand drivers for PCs are no longer effective. Business PC demand is stable in the U.S., but

demand could slow down among [small- and medium-size businesses] due to PC price increases due to

component shortages."

Sidebar

"Weak back-to-school sales were further evidence that traditional consumer PC demand drivers for PCs are no

longer effective."

DETAILS

Subject: Emerging markets; Market strategy; Inventory; Shortages

Location: United States--US Latin America Japan

Ethnicity: Also

Publication title: TWICE: This Week in Consumer Electronics; New York

Volume: 32

Issue: 17

Pages: 18

Publication year: 2017

Publication date: Oct 23, 2017

Section: BY THE NUMBERS

Publisher: Future Publishing Ltd

Place of publication: New York

Country of publication: United Kingdom, New York

PDF GENERATED BY SEARCH.PROQUEST.COM Page 2 of 3

Publication subject: Engineering--Electrical Engineering, Computers--Software

ISSN: 08927278

Source type: Trade Journals

Language of publication: English

Document type: Feature

ProQuest document ID: 1963389368

Document URL: https://search.proquest.com/docview/1963389368?accountid=12763

Copyright: Copyright New Bay Media LLC Oct 23, 2017

Last updated: 2017-11-14

Database: SciTech Premium Collection,ProQuest Central

LINKS

Linking Service

Database copyright 2019 ProQuest LLC. All rights reserved.

Terms and Conditions Contact ProQuest

PDF GENERATED BY SEARCH.PROQUEST.COM Page 3 of 3

You might also like

- Carding SetupDocument16 pagesCarding SetupNaeem Islam100% (1)

- Low-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsFrom EverandLow-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsRating: 2.5 out of 5 stars2.5/5 (2)

- Berges Level 2 Book PDFDocument80 pagesBerges Level 2 Book PDFYulia Larin100% (1)

- Case Study of The Change Management of British Airways After The Economic Crisis of 2008Document5 pagesCase Study of The Change Management of British Airways After The Economic Crisis of 2008Mirela-Elena Popa0% (1)

- FT Article - The Quality of Quantity at NetflixDocument10 pagesFT Article - The Quality of Quantity at NetflixNiyati TiwariNo ratings yet

- HP Case AnalysisDocument16 pagesHP Case AnalysisReshma Jain80% (5)

- Cyber 09Document72 pagesCyber 09JohnNo ratings yet

- Study - Id10881 - Us PC Market Statista Dossier PDFDocument40 pagesStudy - Id10881 - Us PC Market Statista Dossier PDFjessica_liemNo ratings yet

- Mission Statement of BataDocument5 pagesMission Statement of BataArbab Usman Khan0% (1)

- The Future of LenovoDocument9 pagesThe Future of LenovoMihir ParsaniNo ratings yet

- Microsoft Beats Street Profit ViewDocument2 pagesMicrosoft Beats Street Profit ViewFitriAndriyaniNo ratings yet

- Written Analysis and Communication II: Case Analysis: Apple Inc. in 2010Document3 pagesWritten Analysis and Communication II: Case Analysis: Apple Inc. in 2010Angshuman DasNo ratings yet

- A Category Attractiveness AnalysisDocument12 pagesA Category Attractiveness AnalysisUrvashi Duggal100% (4)

- Laptop Industry Analysis Aditya AbhinavDocument13 pagesLaptop Industry Analysis Aditya AbhinavmallikatrivediNo ratings yet

- ProQuestDocuments 2019 10 10Document4 pagesProQuestDocuments 2019 10 10buddikalrNo ratings yet

- Assignment I ACBDocument9 pagesAssignment I ACBnetcrazymNo ratings yet

- PC 'Price Hike' Coming As Cost of Memory Soars - Analysts - The RegisterDocument1 pagePC 'Price Hike' Coming As Cost of Memory Soars - Analysts - The Registeran.tamilselvanNo ratings yet

- Common Printed Outlet Board Constrained.20121111.015735Document3 pagesCommon Printed Outlet Board Constrained.20121111.015735anon_505422600No ratings yet

- Cyber 02Document72 pagesCyber 02JohnNo ratings yet

- DELL Report EditedDocument26 pagesDELL Report EditedNimish DeshmukhNo ratings yet

- Demand-Supply Chip IndustryDocument4 pagesDemand-Supply Chip IndustryashulibraNo ratings yet

- Dell Computer's Tech and Strategies - ALTDocument77 pagesDell Computer's Tech and Strategies - ALTFiFi LapinNo ratings yet

- CY 2012 PC Sales To Touch 12Document3 pagesCY 2012 PC Sales To Touch 12Salman KhanNo ratings yet

- Fact Sheet Software Cybersecurity en DataDocument6 pagesFact Sheet Software Cybersecurity en DataMoneshia EltzNo ratings yet

- Research and Markets: Consumer Electronics Market Forecast To 2012Document15 pagesResearch and Markets: Consumer Electronics Market Forecast To 2012HackinchampNo ratings yet

- Europe IT Spending Set For 2011 GrowthDocument10 pagesEurope IT Spending Set For 2011 Growthvasudev63No ratings yet

- Netflix and MicrosoftDocument5 pagesNetflix and MicrosoftRegina RamirezNo ratings yet

- North West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Document11 pagesNorth West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Nam VoNo ratings yet

- Eye On InnovationDocument3 pagesEye On Innovationprezzo82No ratings yet

- ReportDocument16 pagesReportDivyaNo ratings yet

- Why Tech Will Bloom AgainDocument5 pagesWhy Tech Will Bloom AgainerejotaNo ratings yet

- EVGS WS10 Trends Summary Report FkE0f44b1xWuuekAf9bVXhhHBs 91894Document4 pagesEVGS WS10 Trends Summary Report FkE0f44b1xWuuekAf9bVXhhHBs 91894Karim AbousselhamNo ratings yet

- Flexible Printed Circuit Board (FPCB) Market - Top-Companies, Future-Growth, Regional Analysis Business-OpportunitiesDocument2 pagesFlexible Printed Circuit Board (FPCB) Market - Top-Companies, Future-Growth, Regional Analysis Business-Opportunitiessurendra choudharyNo ratings yet

- Case Study: Building Home Browsing PC SegmentDocument8 pagesCase Study: Building Home Browsing PC SegmentTariq Karim MughalNo ratings yet

- Industry Trends Report: Taressa SotoDocument5 pagesIndustry Trends Report: Taressa SotoTaressaNo ratings yet

- 10 Charts That Will Challenge Your Perspective of IoT's GrowthDocument12 pages10 Charts That Will Challenge Your Perspective of IoT's GrowthmgiordyNo ratings yet

- PC Industry Analysis in The USDocument29 pagesPC Industry Analysis in The USRefeerNo ratings yet

- Accenture High Performance Through More Profitable Business To Business ModelsDocument12 pagesAccenture High Performance Through More Profitable Business To Business ModelsDaniel TaylorNo ratings yet

- Gateway Incorporated AnalysisDocument10 pagesGateway Incorporated AnalysisPuneet KashyapNo ratings yet

- Laptop Industry Final ReportDocument7 pagesLaptop Industry Final Reportapi-700918564No ratings yet

- Software Spending 2011Document13 pagesSoftware Spending 2011Saket RajputNo ratings yet

- In Semiconductors, China Is in Commodity Hell (Part 4)Document9 pagesIn Semiconductors, China Is in Commodity Hell (Part 4)adrianrocchioNo ratings yet

- 07 25 08 NYC JMC UpdateDocument9 pages07 25 08 NYC JMC Updateapi-27426110No ratings yet

- Semi Conductors Shortage CaseDocument3 pagesSemi Conductors Shortage CasepyikyawlynnNo ratings yet

- BFM 721 BDocument17 pagesBFM 721 BRon KurtzbardNo ratings yet

- Microsoft Case AnalysisDocument7 pagesMicrosoft Case AnalysisAhmed Khawaja0% (1)

- Fair Use NoticeDocument6 pagesFair Use NoticeJames OrtegaNo ratings yet

- Informatics 3d PrintingDocument48 pagesInformatics 3d PrintingArun KumarNo ratings yet

- Earnings 21-25 NovemberDocument8 pagesEarnings 21-25 NovemberAlexeyNo ratings yet

- Economics of Gaming Consoles - A Study On XboxDocument22 pagesEconomics of Gaming Consoles - A Study On XboxKalyan Mukhopadhyay100% (1)

- PDF Robots - PagesDocument3 pagesPDF Robots - Pagesheiko.seemann2No ratings yet

- What As Per You Analysis Should Praxim Do? Why?Document2 pagesWhat As Per You Analysis Should Praxim Do? Why?Akhilesh KamalNo ratings yet

- Final Wireless Telecommunications Industry PaperDocument19 pagesFinal Wireless Telecommunications Industry Papervp_zarateNo ratings yet

- Global Microchip Shortage Boosts Niche Business - RNZDocument5 pagesGlobal Microchip Shortage Boosts Niche Business - RNZpyikyawlynnNo ratings yet

- Even Robots Are Having Trouble Finding WorkDocument2 pagesEven Robots Are Having Trouble Finding WorkSinuhe PaheNo ratings yet

- Sip ReportDocument58 pagesSip ReportAayushi NaagNo ratings yet

- Microsoft Results Show Tech Giant Is Living Up To The Legend Citi SaysDocument2 pagesMicrosoft Results Show Tech Giant Is Living Up To The Legend Citi SaysJames TackNo ratings yet

- Infosys StrategyDocument11 pagesInfosys StrategyRashmi SinghNo ratings yet

- U.S. Specialty Printing Consumables Market - Set To Record Exponential GrowthDocument2 pagesU.S. Specialty Printing Consumables Market - Set To Record Exponential Growthsurendra choudharyNo ratings yet

- Singapore It Sector: Amity Global Busines SchoolDocument9 pagesSingapore It Sector: Amity Global Busines SchoolVirag ShahNo ratings yet

- Commercial Printing Industry OverviewDocument12 pagesCommercial Printing Industry OverviewRaphael MamvuraNo ratings yet

- Building & Construction Plastics Products World Summary: Market Sector Values & Financials by CountryFrom EverandBuilding & Construction Plastics Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- The Smart Student's Guide to Smart Manufacturing and Industry 4.0From EverandThe Smart Student's Guide to Smart Manufacturing and Industry 4.0Rating: 4 out of 5 stars4/5 (1)

- Printing Presses, Lithographic World Summary: Market Sector Values & Financials by CountryFrom EverandPrinting Presses, Lithographic World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Graphic Design Service Revenues World Summary: Market Values & Financials by CountryFrom EverandGraphic Design Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Study - Id14489 - Hewlett Packard Statista Dossier PDFDocument56 pagesStudy - Id14489 - Hewlett Packard Statista Dossier PDFjessica_liemNo ratings yet

- Marketing Plan For HP PDFDocument14 pagesMarketing Plan For HP PDFjessica_liemNo ratings yet

- Study - Id10881 - Us PC Market Statista DossierDocument40 pagesStudy - Id10881 - Us PC Market Statista Dossierjessica_liemNo ratings yet

- Statistic - Id200032 - Ranking - Computer Brand Equity 2012 PDFDocument1 pageStatistic - Id200032 - Ranking - Computer Brand Equity 2012 PDFjessica_liemNo ratings yet

- Hewlett-Packard SWOT Analysis PDFDocument2 pagesHewlett-Packard SWOT Analysis PDFjessica_liemNo ratings yet

- Hewlett-Packard (HP) Business Strategy ReportDocument33 pagesHewlett-Packard (HP) Business Strategy Reportjessica_liemNo ratings yet

- Food CaloriesDocument1 pageFood Caloriesjessica_liemNo ratings yet

- Contoh ResumeDocument4 pagesContoh ResumennurulhassanNo ratings yet

- The Israel Lobby ControversyDocument2 pagesThe Israel Lobby ControversysisinjhaaNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- Law of Torts and Consumer Protection Act: NegligenceDocument30 pagesLaw of Torts and Consumer Protection Act: NegligenceSoumyadeep Mitra100% (6)

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- Babu Jagjeevana Ram Uttarandhra Sujala SravanthiDocument5 pagesBabu Jagjeevana Ram Uttarandhra Sujala SravanthiYuvaraju CherukuriNo ratings yet

- Weekly Report w34Document19 pagesWeekly Report w34Asep MAkmurNo ratings yet

- 2016 2as Exam JadaDocument3 pages2016 2as Exam JadaZima OkNo ratings yet

- Ancient History 12 - Daily Notes - (Sankalp (UPSC 2024) )Document16 pagesAncient History 12 - Daily Notes - (Sankalp (UPSC 2024) )nigamkumar2tbNo ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- Tata Aig Mediprime Insurance BrochureDocument2 pagesTata Aig Mediprime Insurance Brochurerehmy082No ratings yet

- Master Builder: PlusDocument31 pagesMaster Builder: PluswinataNo ratings yet

- NILE Initiating Coverage JSDocument11 pagesNILE Initiating Coverage JSBrian BolanNo ratings yet

- Online Writing SampleDocument2 pagesOnline Writing SampleSamson_Lam_9358No ratings yet

- Health and Physical Education ThesisDocument35 pagesHealth and Physical Education ThesisZia IslamNo ratings yet

- Malankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDocument26 pagesMalankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDr. Thomas Kuzhinapurath100% (6)

- Manajemen Dalam Pengambilan Keputusan Di GerejaDocument19 pagesManajemen Dalam Pengambilan Keputusan Di Gerejamelianuslokon0No ratings yet

- CH 3Document41 pagesCH 3Diana BaRobNo ratings yet

- Grupo Inditex Annual Report Inditex 09Document316 pagesGrupo Inditex Annual Report Inditex 09akansha02No ratings yet

- Money, Power Wall StreetDocument2 pagesMoney, Power Wall StreetAdyotNo ratings yet

- S R S M: Arah Owell and Cott AckenzieDocument7 pagesS R S M: Arah Owell and Cott AckenzieEduardo MBNo ratings yet

- Lesson 11.future Worth MethodDocument7 pagesLesson 11.future Worth MethodOwene Miles AguinaldoNo ratings yet

- Teaching The SchwaDocument5 pagesTeaching The SchwaStarr BlueNo ratings yet

- Topic 10 Diversity Management in Organisation PDFDocument12 pagesTopic 10 Diversity Management in Organisation PDFAlister AshleyNo ratings yet

- Tenses For Talking About The NewsDocument5 pagesTenses For Talking About The NewsThunder BurgerNo ratings yet