Professional Documents

Culture Documents

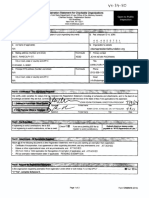

Investment Income and Expenses: (Including Capital Gains and Losses)

Investment Income and Expenses: (Including Capital Gains and Losses)

Uploaded by

Kenny SvatekOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Income and Expenses: (Including Capital Gains and Losses)

Investment Income and Expenses: (Including Capital Gains and Losses)

Uploaded by

Kenny SvatekCopyright:

Available Formats

Publication 550

Cat. No. 15093R Contents

Investment

Future Developments . . . . . . . . . . . . 1

Department

of the What's New .................. 2

Income and

Treasury

Internal Reminders . . . . . . . . . . . . . . . . . . . 2

Revenue

Expenses

Service Introduction . . . . . . . . . . . . . . . . . . 2

Chapter 1. Investment Income . . . . . . 2

General Information . . . . . . . . . . . 3

Interest Income . . . . . . . . . . . . . . 4

(Including Capital Discount on Debt Instruments . . . . 12

. . .

Gains and Losses) When To Report Interest Income

How To Report Interest Income . . . .

16

16

Dividends and Other

Distributions . . . . . . . . . . . . . 18

How To Report Dividend Income . . . 22

For use in preparing Stripped Preferred Stock . . . . . . . 24

REMICs, FASITs, and Other

2018 Returns CDOs . . . . . . . . . . . . .

S Corporations . . . . . . . . . .

Investment Clubs . . . . . . . . .

. . . 24

. . . 25

. . . 25

Chapter 2. Tax Shelters and Other

Reportable Transactions . . . . . . 26

Abusive Tax Shelters . . . . . . . . . 27

Chapter 3. Investment Expenses . . . . 30

Limits on Deductions . . . . . . . . . . 30

Interest Expenses . . . . . . . . . . . 30

Bond Premium Amortization . . . . . 32

Nondeductible Interest

Expenses . . . . . . . . . . . . . . 34

How To Report Investment

Interest Expenses . . . . . . . . . 34

When To Report Investment

Expenses . . . . . . . . . . . . . . 35

Chapter 4. Sales and Trades of

Investment Property . . . . . . . . . 35

What Is a Sale or Trade? . . . . . . . 35

Basis of Investment Property . . . . . 39

How To Figure Gain or Loss . . . . . 43

Nontaxable Trades . . . . . . . . . . . 45

Transfers Between Spouses . . . . . 47

Related Party Transactions . . . . . . 47

Capital Gains and Losses . . . . . . . 48

Reporting Capital Gains and

Losses . . . . . . . . . . . . . . . . 64

Special Rules for Traders in

Securities or Commodities . . . . 67

Chapter 5. How To Get Tax Help . . . . 68

Index . . . . . . . . . . . . . . . . . . . . . 73

Future Developments

For the latest information about developments

related to Pub. 550, such as legislation enacted

after it was published, go to IRS.gov/Pub550.

Get forms and other information faster and easier at:

• IRS.gov (English) • IRS.gov/Korean (한국어)

• IRS.gov/Spanish (Español) • IRS.gov/Russian (Pусский)

• IRS.gov/Chinese (中文) • IRS.gov/Vietnamese (TiếngViệt)

Mar 28, 2019

Children® (NCMEC). Photographs of missing Ordering forms and publications. Visit

What's New children selected by the Center may appear in

this publication on pages that would otherwise

IRS.gov/FormsPubs to download forms and

publications. Otherwise, you can go to IRS.gov/

Form 1040 redesigned. Form 1040 has been be blank. You can help bring these children OrderForms to order current and prior-year

redesigned for 2018. See Form 1040 and its in- home by looking at the photographs and calling forms and instructions. Your order should arrive

structions for more information. 800-THE-LOST (800-843-5678) if you recog- within 10 business days.

Forms 1040A and 1040EZ no longer availa- nize a child.

Tax questions. If you have a tax question

ble. Forms 1040A and 1040EZ are not availa- not answered by this publication, check

ble to file your 2018 taxes. See Form 1040 and Introduction IRS.gov and How To Get Tax Help at the end of

its instructions for more information. this publication.

This publication provides information on the tax

Capital gains invested in Qualified Opportu-

treatment of investment income and expenses.

nity Funds. You may be able to defer or ex-

It includes information on the tax treatment of

clude capital gains that you invest in Qualified

investment income and expenses for individual

Opportunity Funds. See section 1400Z-2, Form

shareholders of mutual funds or other regulated

8949 and its instructions, and IRS.gov/

investment companies, such as money market

Opportunity-Zones-Frequently-Asked-

Questions.

funds. It explains what investment income is

taxable and what investment expenses are de- 1.

Like-kind exchanges limited to real prop- ductible. It explains when and how to show

erty. Section 1031 allows you to defer recog- these items on your tax return. It also explains

nizing gain or loss when you exchange property

for like-kind property. Section 1031 was amen-

how to determine and report gains and losses

on the disposition of investment property and

Investment

ded to apply only to the exchange of real prop- provides information on property trades and tax

erty for real property of a like kind if both the

real property disposed of by you and the real

shelters. Income

property received by you are held for productive The glossary at the end of this publica-

use in a trade or business or for investment. TIP tion defines many of the terms used. Topics

The amendment does not apply if the property This chapter discusses:

was disposed of by you or received by you be-

fore 2018. See section 1031. Investment income. This generally includes

interest, dividends, capital gains, and other • Interest Income,

Exclusion of gain on rollover of empower- • Discount on Debt Instruments,

types of distributions including mutual fund dis-

ment zone assets. The election to rollover • When To Report Interest Income,

tributions.

gain on an empowerment zone asset has ex- • How To Report Interest Income,

pired for 2018. • Dividends and Other Distributions,

Investment expenses. These include interest

Rollovers into specialized small business paid or incurred to acquire investment property • How To Report Dividend Income,

investment companies (SSBICs). Tax-free and expenses to manage or collect income • Stripped Preferred Stock,

rollover of publicly traded securities gain into from investment property. • Real estate mortgage investment conduits

SSBICs is not available for sales after 2017. (REMICs), financial asset securitization

Miscellaneous itemized deductions sus- Qualified retirement plans and IRAs. The investment trusts (FASITs), and other

pended for tax years 2018 though 2025. rules in this publication do not apply to invest- collateralized debt obligations (CDOs),

Miscellaneous itemized deductions under sec- ments held in individual retirement arrange- • S Corporations, and

tion 67 are not allowed for tax years beginning ments (IRAs), section 401(k) plans, and other • Investment Clubs.

after 2017 and before 2026. See section 67(g). qualified retirement plans. The tax rules that ap-

Overall limitation on itemized deductions ply to retirement plan distributions are explained Useful Items

suspended for tax years 2018 though 2025. in the following publications. You may want to see:

The overall limitation on itemized deductions • Pub. 560, Retirement Plans for Small Busi-

under section 68 does not apply for tax years ness. Publication

beginning after 2017 and before 2026. See sec- • Pub. 571, Tax-Sheltered Annuity Plans.

• Pub. 575, Pension and Annuity Income. 525 Taxable and Nontaxable Income

tion 68(f).

525

• Pub. 590-A, Contributions to Individual Re- 537 Installment Sales

Disaster relief. Relief is available for those af- tirement Arrangements (IRAs).

537

fected by some disasters. See IRS.gov/ • Pub. 590-B, Distributions from Individual 590-B Distributions from Individual

DisasterTaxRelief.

590-B

Retirement Arrangements (IRAs). Retirement Arrangements (IRAs)

• Pub. 721, Tax Guide to U.S. Civil Service 925 Passive Activity and At-Risk Rules

Retirement Benefits.

925

1212 Guide to Original Issue Discount

Reminders

1212

(OID) Instruments

Comments and suggestions. We welcome

Foreign source income. If you are a U.S. citi- your comments about this publication and your Form (and Instructions)

zen with investment income from sources out- suggestions for future editions.

side the United States (foreign income), you You can send us comments through Schedule B (Form 1040) Interest and

must report that income on your tax return un-

Schedule B (Form 1040)

IRS.gov/FormComments. Or you can write to: Ordinary Dividends

less it is exempt by U.S. law. This is true

Schedule D (Form 1040) Capital Gains

whether you reside inside or outside the United Internal Revenue Service

Schedule D (Form 1040)

and Losses

States and whether or not you receive a Form Tax Forms and Publications

1099 from the foreign payer. 1111 Constitution Ave. NW, IR-6526 1040 U.S. Individual Income Tax Return

1040

Employee stock options. If you received an Washington, DC 20224 1099 General Instructions for Certain

option to buy or sell stock or other property as

1099

Information Returns

payment for your services, see Pub. 525, Taxa- Although we can’t respond individually to

ble and Nontaxable Income, for the special tax 2439 Notice to Shareholder of

each comment received, we do appreciate your

2439

rules that apply. Undistributed Long-Term Capital

feedback and will consider your comments as

Gains

Photographs of missing children. The Inter- we revise our tax forms, instructions, and publi-

nal Revenue Service is a proud partner with the cations. 3115 Application for Change in

3115

National Center for Missing & Exploited Accounting Method

Page 2 Chapter 1 Investment Income

6251 Alternative Minimum Tax —

6251 5. don’t file a joint return for the year. You will not be subject to this penalty if you

Individuals can show that your failure to provide the TIN

See Form 8615 and its instructions for details. was due to reasonable cause and not to willful

8582 Passive Activity Loss Limitations However, the parent can choose to include neglect.

8582

8615 Tax for Certain Children Who Have the child's interest and dividends on the pa- If you fail to supply an TIN, you also may be

rent's return if certain requirements are met.

8615

Unearned Income subject to backup withholding.

Use Form 8814, Parents’ Election To Report

8814 Parents' Election To Report Child's Child’s Interest and Dividends, for this purpose. Backup withholding. Your investment income

8814

Interest and Dividends

For more information about the tax on un- generally is not subject to regular withholding.

8815 Exclusion of Interest From Series

8815

earned income of children and the parents' However, it may be subject to backup withhold-

EE and I U.S. Savings Bonds Issued election, see Pub. 929, Tax Rules for Children ing to ensure that income tax is collected on the

After 1989 and Dependents. income. Under backup withholding, the bank,

8818 Optional Form To Record broker, or other payer of interest, original issue

Beneficiary of an estate or trust. Interest, discount (OID), dividends, cash patronage divi-

8818

Redemption of Series EE and I U.S.

Savings Bonds Issued After 1989 dividends, and other investment income you re- dends, or royalties must withhold, as income

ceive as a beneficiary of an estate or trust gen- tax, on the amount you are paid, applying the

8824 Like-Kind Exchanges

8824

erally is taxable income. You should receive a appropriate withholding rate.

8949 Sales and Other Dispositions of Schedule K-1 (Form 1041), Beneficiary's Share Backup withholding applies if:

of Income, Deductions, Credits, etc., from the fi-

8949

Capital Assets

duciary. Your copy of Schedule K-1 (Form 1. You do not give the payer your identifica-

8960 Net Investment Income

8960

1041) and its instructions will tell you where to tion number TIN in the required manner,

Tax—Individuals, Estates, and Trusts report the income on your Form 1040. 2. The IRS notifies the payer that you gave

See chapter 5, How To Get Tax Help, for infor- an incorrect TIN,

mation about getting these publications and Taxpayer Identification Number (TIN). You

must give your name and TIN (either a Social 3. The IRS notifies the payer that you are

forms.

Security Number (SSN), and employer identifi- subject to backup withholding on interest

cation number (EIN), or an individual tax identi- or dividends because you have underre-

General Information fication number (ITIN)) to any person required

by federal tax law to make a return, statement,

ported interest or dividends on your in-

come tax return, or

or other document that relates to you. This in- 4. You are required, but fail, to certify that

A few items of general interest are covered cludes payers of interest and dividends. If you

here. you are not subject to backup withholding

do not give your TIN to the payer of interest, you for the reason described in (3).

Recordkeeping. You should keep a may have to pay a penalty or be subject to

list of the sources and investment in- backup withholding. Certification. For new accounts paying in-

RECORDS come amounts you receive during the terest or dividends, you must certify under pen-

TIN for joint account. If the funds in a joint alties of perjury that your TIN is correct and that

year. Also keep the forms you receive showing

account belong to one person, list that person's you are not subject to backup withholding. Your

your investment income (Forms 1099-INT, In-

name first on the account and give that person's payer will give you a Form W-9, Request for

terest Income, and 1099-DIV, Dividends and

TIN to the payer. (For information on who owns Taxpayer Identification Number and Certifica-

Distributions, for example) as an important part

the funds in a joint account, see Joint accounts, tion, or similar form, to make this certification. If

of your records.

later.) If the joint account contains combined you fail to make this certification, backup with-

funds, give the TIN of the person whose name holding may begin immediately on your new ac-

Net investment income tax (NIIT). You may is listed first on the account. This is because count or investment.

be subject to the NIIT. The NIIT is a 3.8% tax on only one name and SSN can be shown on Form

the lesser of your net investment income or the 1099. Underreported interest and dividends.

amount of your modified adjusted gross income These rules apply both to joint ownership by You will be considered to have underreported

(MAGI) that is over a threshold amount based a married couple and to joint ownership by your interest and dividends if the IRS has deter-

on your filing status. other individuals. For example, if you open a mined for a tax year that:

joint savings account with your child using • You failed to include any part of a reporta-

Filing Status Threshold Amount funds belonging to the child, list the child's ble interest or dividend payment required

Married filing jointly $250,000

name first on the account and give the child's to be shown on your return, or

TIN. • You were required to file a return and to in-

Married filing separately $125,000 clude a reportable interest or dividend pay-

Single $200,000 Custodian account for your child. If your ment on that return, but you failed to file

child is the actual owner of an account that is the return.

Head of household (with $200,000

recorded in your name as custodian for the

qualifying person)

child, give the child's TIN to the payer. For ex- How to stop backup withholding due to

Qualifying Widow(er) with $250,000 ample, you must give your child's SSN to the underreporting. If you have been notified that

dependent child you underreported interest or dividends, you

payer of dividends on stock owned by your

child, even though the dividends are paid to you can request a determination from the IRS to

For more information, see Form 8960, Net

as custodian. prevent backup withholding from starting or to

Investment Income Tax—Individuals, Estates,

stop backup withholding once it has begun. You

and Trusts, and the Instructions for Form 8960. Penalty for failure to supply TIN. You will must show that at least one of the following sit-

be subject to a penalty if, when required, you uations applies.

Tax on unearned income of certain chil- fail to:

dren. Generally, you must file Form 8615 if

• No underreporting occurred.

• Include your TIN on any return, statement, • You have a bona fide dispute with the IRS

you: or other document; about whether underreporting occurred.

1. have more than $2,100 of unearned in- • Give your TIN to another person who must • Backup withholding will cause or is caus-

come; include it on any return, statement, or other ing an undue hardship, and it is unlikely

document; or that you will underreport interest and divi-

2. are required to file a tax return; • Include the TIN of another person on any dends in the future.

3. meet certain age/earned-income/ return, statement, or other document. • You have corrected the underreporting by

self-support threshold; The penalty is $50 for each failure up to a maxi- filing a return if you did not previously file

mum penalty of $100,000 for any calendar year. one and by paying all taxes, penalties, and

4. have at least one parent alive at the end of

the year; and

Chapter 1 Investment Income Page 3

Table 1-1. Where To Report Common Types of Investment Income separate returns, you each report half the in-

come.

(For detailed information about reporting investment income, see the

rest of this publication, especially How To Report Interest Income Income from property given to a child.

and How To Report Dividend Income in chapter 1.) Property you give as a parent to your child un-

Type of Income If you file Form 1040, report on ...

der the Model Gifts of Securities to Minors Act,

the Uniform Gifts to Minors Act, or any similar

Tax-exempt interest Line 2a. (See the instructions there.) law becomes the child's property.

Income from the property is taxable to the

Taxable interest Line 2b (See the instructions there.) child, except that any part used to satisfy a legal

obligation to support the child is taxable to the

Savings bond interest you will exclude because of higher Schedule B; also use Form 8815

parent or guardian having that legal obligation.

education expenses

Savings account with parent as trustee.

Ordinary dividends Line 3b (See the instructions there.) Interest income from a savings account opened

for a minor child, but placed in the name and

Qualified dividends Line 3a (See the instructions there.)

subject to the order of the parents as trustees,

Capital gain distributions Schedule 1, line 13, or, if required, Schedule D, is taxable to the child if, under the law of the

line 13. (See the instructions there.) state in which the child resides, both of the fol-

lowing are true.

Section 1250, 1202, or collectibles gain (Form 1099-DIV, Form 8949 and Schedule D • The savings account legally belongs to the

box 2b, 2c, or 2d) child.

• The parents are not legally permitted to

Nondividend distributions (Form 1099-DIV, box 3) Generally not reported* use any of the funds to support the child.

Undistributed capital gains (Form 2439, boxes 1a–1d) Schedule D

Accuracy-related penalty. An accuracy-rela-

Gain or loss from sales of stocks or bonds Schedule 1, line 13; also use Form 8949, ted penalty of 20% can be charged for under-

Schedule D, and the Qualified Dividends and payments of tax due to negligence or disregard

Capital Gain Tax Worksheet or the Schedule D Tax of rules or regulations or substantial understate-

Worksheet ment of tax. For information on the penalty and

any interest that applies, see Penalties in chap-

Gain or loss from exchanges of like-kind investment Schedule 1, line 13; also use Schedule D, Form

ter 2.

property 8824, and the Qualified Dividends and Capital Gain

Tax Worksheet or the Schedule D Tax Worksheet

*Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares Interest Income

more than 1 year. Use Part I if you held your mutual fund shares 1 year or less. For details on Form 8949, see Reporting

Capital Gains and Losses in chapter 4, and the Instructions for Form 8949.

Terms you may need to know

interest due for any underreported interest backup withholding. The civil penalty is $500. (see Glossary):

or dividend payments. The criminal penalty, upon conviction, is a fine

Accrual method

of up to $1,000, or imprisonment of up to 1 year,

If the IRS determines that backup withhold- Below-market loan

or both.

ing should stop, it will provide you with a certifi- Cash method

cation and will notify the payers who were sent Demand loan

Where to report investment income. Ta-

notices earlier. Forgone interest

ble 1-1 gives an overview of the forms and

Gift loan

How to stop backup withholding due to schedules to use to report some common types

Interest

an incorrect TIN. If you have been notified by of investment income. But see the rest of this

Mutual fund

a payer that you are subject to backup withhold- publication for detailed information about re-

Nominee

ing because you have provided an incorrect porting investment income.

Original issue discount

TIN, you can stop it by following the instructions

Joint accounts. If two or more persons hold Private activity bond

the payer gives you.

property (such as a savings account, bond, or Term loan

Reporting backup withholding. If backup stock) as joint tenants, tenants by the entirety,

withholding is deducted from your interest or or tenants in common, each person's share of

dividend income or other reportable payment, any interest or dividends from the property is This section discusses the tax treatment of dif-

the bank or other business must give you an in- determined by local law. ferent types of interest income.

formation return for the year (for example, a

Form 1099-INT) indicating the amount withheld. Community property states. If you are mar- In general, any interest that you receive or

The information return will show any backup ried and receive a distribution that is community that is credited to your account and can be with-

withholding as “Federal income tax withheld.” income, half of the distribution generally is con- drawn is taxable income. (It does not have to be

sidered to be received by each spouse. If you entered in your passbook.) Exceptions to this

Nonresident aliens. Generally, payments rule are discussed later.

file separate returns, you must each report

made to nonresident aliens are not subject to

one-half of any taxable distribution. See Pub.

backup withholding. You can use Form Form 1099-INT. Interest income is generally

555, Community Property, for more information

W-8BEN, Certificate of Foreign Status of Bene- reported to you on Form 1099-INT, or a similar

on community income.

ficial Owner for United States Tax Withholding statement, by banks, savings and loans, and

and Reporting (Individuals), to certify exempt If the distribution is not considered commun-

ity property and you and your spouse file sepa- other payers of interest. This form shows you

status. However, this does not exempt you from the interest you received during the year. Keep

the 30% (or lower treaty) withholding rate that rate returns, each of you must report your sepa-

rate taxable distributions. this form for your records. You do not have to

may apply to your investment income. For infor- attach it to your tax return.

mation on the 30%-rate, see Pub. 519, U.S. Tax

Example. You and your spouse have a Report on your tax return the total interest

Guide for Aliens.

joint money market account. Under state law, income you receive for the tax year. See the In-

Penalties. There are civil and criminal pen- half the income from the account belongs to structions for Form 1099-INT to see whether

alties for giving false information to avoid you, and half belongs to your spouse. If you file

Page 4 Chapter 1 Investment Income

you need to adjust any of the amounts reported • Domestic savings and loan associations, For deposits of less than $5,000, gifts or

to you. • Federal savings and loan associations, services valued at more than $10 must be re-

and ported as interest. For deposits of $5,000 or

Interest not reported on Form 1099-INT. • Mutual savings banks. more, gifts or services valued at more than $20

Even if you do not receive a Form 1099-INT, must be reported as interest. The value is deter-

you must still report all of your interest income. The “dividends” will be shown as interest in-

mined by the cost to the financial institution.

For example, you may receive distributive come on Form 1099-INT.

shares of interest from partnerships or S corpo- Example. You open a savings account at

rations. This interest is reported to you on Money market funds. Money market funds

your local bank and deposit $800. The account

Schedule K-1 (Form 1065), Partner's Share of are offered by nonbank financial institutions

earns $20 interest. You also receive a $15 cal-

Income, Deductions, Credits, etc., and Sched- such as mutual funds and stock brokerage

culator. If no other interest is credited to your

ule K-1 (Form 1120S), Shareholder's Share of houses, and pay dividends. Generally, amounts

account during the year, the Form 1099-INT

Income, Deductions, Credits, etc. you receive from money market funds should

you receive will show $35 interest for the year.

be reported as dividends, not as interest.

Nominees. Generally, if someone receives You must report $35 interest income on your tax

interest as a nominee for you, that person must Certificates of deposit and other deferred return.

give you a Form 1099-INT showing the interest interest accounts. If you buy a certificate of

received on your behalf. Interest on insurance dividends. Interest on

deposit or open a deferred interest account, in-

If you receive a Form 1099-INT that includes insurance dividends left on deposit with an in-

terest may be paid at fixed intervals of 1 year or

amounts belonging to another person, see the surance company that can be withdrawn annu-

less during the term of the account. You gener-

discussion on Nominee distributions, later. ally is taxable to you in the year it is credited to

ally must include this interest in your income

your account. However, if you can withdraw it

when you actually receive it or are entitled to re-

Incorrect amount. If you receive a Form only on the anniversary date of the policy (or

ceive it without paying a substantial penalty.

1099-INT that shows an incorrect amount (or The same is true for accounts that mature in 1 other specified date), the interest is taxable in

other incorrect information), you should ask the the year that date occurs.

year or less and pay interest in a single pay-

issuer for a corrected form. The new Form ment at maturity. If interest is deferred for more

1099-INT you receive will be marked “Correc- Prepaid insurance premiums. Any increase

than 1 year, see Original Issue Discount (OID),

ted.” in the value of prepaid insurance premiums, ad-

later.

vance premiums, or premium deposit funds is

Form 1099-OID. Reportable interest income Interest subject to penalty for early with- interest if it is applied to the payment of premi-

also may be shown on Form 1099-OID, Original drawal. If you withdraw funds from a deferred ums due on insurance policies or made availa-

Issue Discount. For more information about interest account before maturity, you may have ble for you to withdraw.

amounts shown on this form, see Original Issue to pay a penalty. You must report the total

Discount (OID), later in this chapter. amount of interest paid or credited to your ac- U.S. obligations. Interest on U.S. obligations,

count during the year, without subtracting the such as U.S. Treasury bills, notes, and bonds,

Exempt-interest dividends. Form 1099–DIV, penalty. See Penalty on early withdrawal of sav- issued by any agency or instrumentality of the

box 11, shows exempt-interest dividends from a ings, later, for more information on how to re- United States is taxable for federal income tax

mutual fund or other RIC paid to you during the port the interest and deduct the penalty. purposes.

calendar year. See the Instructions for Form

1040 for where to report. Money borrowed to invest in certificate Interest on tax refunds. Interest you receive

Form 1099–DIV, box 12, shows exempt-in- of deposit. The interest you pay on money on tax refunds is taxable income.

terest dividends subject to the alternative mini- borrowed from a bank or savings institution to

mum tax. This amount is included in box 11. meet the minimum deposit required for a certifi- Interest on condemnation award. If the con-

See the Instructions for Form 6251. cate of deposit from the institution and the inter- demning authority pays you interest to compen-

est you earn on the certificate are two separate sate you for a delay in payment of an award, the

Interest on VA dividends. Interest on insur- items. You must report the total interest you interest is taxable.

ance dividends left on deposit with the Depart- earn on the certificate in your income. If you

ment of Veterans Affairs (VA) is not taxable. itemize deductions, you can deduct the interest Installment sale payments. If a contract for

This includes interest paid on dividends on con- you pay as investment interest, up to the the sale or exchange of property provides for

verted United States Government Life Insur- amount of your net investment income. See In- deferred payments, it also usually provides for

ance policies and on National Service Life In- terest Expenses in chapter 3. interest payable with the deferred payments.

surance policies. Generally, that interest is taxable when you re-

Example. You deposited $5,000 with a ceive it. If little or no interest is provided for in a

Individual retirement arrangements (IRAs). bank and borrowed $5,000 from the bank to deferred payment contract, part of each pay-

Interest on a Roth IRA generally is not taxable. make up the $10,000 minimum deposit required ment may be treated as interest. See Unstated

Interest on a traditional IRA is tax deferred. You to buy a 6-month certificate of deposit. The cer- Interest and Original Issue Discount (OID) in

generally do not include it in your income until tificate earned $575 at maturity in 2018, but you Pub. 537.

you make withdrawals from the IRA. See Pub. received only $265, which represented the

590-B for more information. $575 you earned minus $310 interest charged Interest on annuity contract. Accumulated

on your $5,000 loan. The bank gives you a interest on an annuity contract you sell before

Form 1099-INT for 2018 showing the $575 in- its maturity date is taxable.

Taxable Interest—General terest you earned. The bank also gives you a

statement showing that you paid $310 interest Usurious interest. Usurious interest is interest

Taxable interest includes interest you receive for 2018. You must include the $575 in your in- charged at an illegal rate. This is taxable as in-

from bank accounts, loans you make to others, come. If you itemize your deductions on Sched- terest unless state law automatically changes it

and other sources. The following are some ule A (Form 1040), Itemized Deductions, you to a payment on the principal.

sources of taxable interest. can deduct $310, subject to the net investment

income limit. Interest income on frozen deposits. Ex-

Dividends that are actually interest. Certain clude from your gross income interest on frozen

distributions commonly called dividends are ac- Gift for opening account. If you receive non- deposits. A deposit is frozen if, at the end of the

tually interest. You must report as interest cash gifts or services for making deposits or for year, you cannot withdraw any part of the de-

so-called “dividends” on deposits or on share opening an account in a savings institution, you posit because:

accounts in: may have to report the value as interest. • The financial institution is bankrupt or in-

• Cooperative banks, solvent, or

• Credit unions,

• Domestic building and loan associations,

Chapter 1 Investment Income Page 5

• The state in which the institution is located A tax avoidance loan is any below-market An equal amount is treated as original issue dis-

has placed limits on withdrawals because loan where the avoidance of federal tax is one count (OID). The lender must report the annual

other financial institutions in the state are of the main purposes of the interest arrange- part of the OID as interest income. The bor-

bankrupt or insolvent. ment. rower may be able to deduct the OID as interest

expense. See Original Issue Discount (OID),

The amount of interest you must exclude is

Forgone interest. For any period, forgone in- later.

the interest that was credited on the frozen de-

terest is:

posits minus the sum of:

• The net amount you withdrew from these • The amount of interest that would be paya- Exceptions to the below-market loan rules.

ble for that period if interest accrued on the Exceptions to the below-market loan rules are

deposits during the year, and

loan at the applicable federal rate and was discussed here.

• The amount you could have withdrawn as payable annually on December 31, minus

of the end of the year (not reduced by any Exception for loans of $10,000 or less.

penalty for premature withdrawals of a time

• Any interest actually payable on the loan

for the period. The rules for below-market loans do not apply

deposit). to any day on which the total outstanding

If you receive a Form 1099-INT for interest in- Applicable federal rate. Applicable fed- amount of loans between the borrower and

come on deposits that were frozen at the end of eral rates are published by the IRS each month lender is $10,000 or less. This exception ap-

2018, see Frozen deposits, later, for information in the Internal Revenue Bulletin. The Internal plies only to:

about reporting this interest income exclusion Revenue Bulletin is available through IRS.gov/

1. Gift loans between individuals if the gift

on your tax return. IRB. You also can find applicable federal rates

loan is not directly used to buy or carry in-

The interest you exclude is treated as credi- in the Index of Applicable Federal Rates (AFR)

come-producing assets, and

ted to your account in the following year. You Rulings at IRS.gov/FederalRates.

must include it in income in the year you can See chapter 5, How To Get Tax Help, for 2. Pay-related loans or corporation-share-

withdraw it. other ways to get this information. holder loans if the avoidance of federal tax

is not a principal purpose of the interest ar-

Example. $100 of interest was credited on Rules for below-market loans. The rules that rangement.

your frozen deposit during the year. You with- apply to a below-market loan depend on

whether the loan is a gift loan, demand loan, or This exception does not apply to a term loan

drew $80 but could not withdraw any more as of described in (2) earlier that previously has been

the end of the year. You must include $80 in term loan.

subject to the below-market loan rules. Those

your income and exclude $20 from your income Gift and demand loans. A gift loan is any rules will continue to apply even if the outstand-

for the year. You must include the $20 in your below-market loan where the forgone interest is ing balance is reduced to $10,000 or less.

income for the year you can withdraw it. in the nature of a gift.

A demand loan is a loan payable in full at Exception for loans to continuing care

Bonds traded flat. If you buy a bond at a dis- any time upon demand by the lender. A de- facilities. Loans to qualified continuing care fa-

count when interest has been defaulted or mand loan is a below-market loan if no interest cilities under continuing care contracts are not

when the interest has accrued but has not been is charged or if interest is charged at a rate be- subject to the rules for below-market loans for

paid, the transaction is described as trading a low the applicable federal rate. the calendar year if the lender or the lender's

bond flat. The defaulted or unpaid interest is not A demand loan or gift loan that is a be- spouse is age 62 or older at the end of the year.

income and is not taxable as interest if paid low-market loan generally is treated as an For the definitions of qualified continuing care

later. When you receive a payment of that inter- arm's-length transaction in which the lender is facility and continuing care contract, see Inter-

est, it is a return of capital that reduces the re- treated as having made: nal Revenue Code section 7872(h).

maining cost basis of your bond. Interest that • A loan to the borrower in exchange for a

accrues after the date of purchase, however, is Exception for loans without significant

note that requires the payment of interest tax effect. Loans are excluded from the be-

taxable interest income for the year received or at the applicable federal rate, and

accrued. See Bonds Sold Between Interest low-market loan rules if their interest arrange-

• An additional payment to the borrower in ments do not have a significant effect on the

Dates, later in this chapter. an amount equal to the forgone interest. federal tax liability of the borrower or the lender.

The borrower generally is treated as transfer- These loans include:

Below-Market Loans ring the additional payment back to the lender 1. Loans made available by the lender to the

as interest. The lender must report that amount general public on the same terms and

If you make a below-market gift or demand as interest income.

loan, you must report as interest income any conditions that are consistent with the

The lender's additional payment to the bor- lender's customary business practice;

forgone interest (defined later) from that loan. rower is treated as a gift, dividend, contribution

The below-market loan rules and exceptions to capital, pay for services, or other payment, 2. Loans subsidized by a federal, state, or

are described in this section. For more informa- depending on the substance of the transaction. municipal government that are made avail-

tion, see section 7872 of the Internal Revenue The borrower may have to report this payment able under a program of general applica-

Code and its regulations. as taxable income, depending on its classifica- tion to the public;

If you receive a below-market loan, you may tion. 3. Certain employee-relocation loans;

be able to deduct the forgone interest as well as These transfers are considered to occur an- 4. Certain loans from a foreign person, un-

any interest you actually paid, but not if it is per- nually, generally on December 31. less the interest income would be effec-

sonal interest.

Term loans. A term loan is any loan that is tively connected with the conduct of a U.S.

Loans subject to the rules. The rules for be- not a demand loan. A term loan is a below-mar- trade or business and would not be ex-

low-market loans apply to: ket loan if the amount of the loan is more than empt from U.S. tax under an income tax

treaty;

• Gift loans, the present value of all payments due under the

• Pay-related loans, loan. 5. Gift loans to a charitable organization,

• Corporation-shareholder loans, A lender who makes a below-market term contributions to which are deductible, if

• Tax avoidance loans, and loan other than a gift loan is treated as transfer- the total outstanding amount of loans be-

• Certain loans made to qualified continuing ring an additional lump-sum cash payment to tween the organization and lender is

care facilities under a continuing care con- the borrower (as a dividend, contribution to cap- $250,000 or less at all times during the tax

tract. ital, etc.) on the date the loan is made. The year; and

amount of this payment is the amount of the

A pay-related loan is any below-market loan 6. Other loans on which the interest arrange-

loan minus the present value, at the applicable

between an employer and an employee or be- ment can be shown to have no significant

federal rate, of all payments due under the loan.

tween an independent contractor and a person effect on the federal tax liability of the

for whom the contractor provides services. lender or the borrower.

Page 6 Chapter 1 Investment Income

For a loan described in (6) above, all the crues. You cannot postpone reporting interest and matured in 2010. If you used method

facts and circumstances are used to determine until you receive it or until the bonds mature. 1, you generally should have reported the

if the interest arrangement has a significant ef- interest on these bonds on your 2010 re-

fect on the federal tax liability of the lender or Cash method taxpayers. If you use the cash turn.

borrower. Some factors to be considered are: method of accounting, as most individual tax-

2. Method 2. Choose to report the increase

• Whether items of income and deduction payers do, you generally report the interest on

in redemption value as interest each year.

generated by the loan offset each other; U.S. savings bonds when you receive it. But

• The amount of these items; see Reporting options for cash method taxpay- You must use the same method for all Series

• The cost to you of complying with the be- ers, later. EE, Series E, and Series I bonds you own. If

low-market loan rules, if they were to ap- you do not choose method 2 by reporting the in-

ply; and Series HH bonds. These bonds were issued crease in redemption value as interest each

• Any reasons other than taxes for structur- at face value. Interest is paid twice a year by di- year, you must use method 1.

ing the transaction as a below-market loan. rect deposit to your bank account. If you are a

cash method taxpayer, you must report interest If you plan to cash your bonds in the

If you structure a transaction to meet this ex- on these bonds as income in the year you re- TIP same year you will pay for higher edu-

ception and one of the principal purposes of ceive it. cation expenses, you may want to use

that structure is the avoidance of federal tax, method 1 because you may be able to exclude

Series HH bonds were first offered in 1980

the loan will be considered a tax-avoidance the interest from your income. To learn how,

and last offered in August 2004. Before 1980,

loan, and this exception will not apply. see Education Savings Bond Program, later.

Series H bonds were issued. Series H bonds

Limit on forgone interest for gift loans of are treated the same as Series HH bonds. If

you are a cash method taxpayer, you must re- Change from method 1. If you want to

$100,000 or less. For gift loans between indi-

port the interest when you receive it. change your method of reporting the interest

viduals, if the outstanding loans between the

Series H bonds have a maturity period of 30 from method 1 to method 2, you can do so with-

lender and borrower total $100,000 or less, the

years. Series HH bonds mature in 20 years. out permission from the IRS. In the year of

forgone interest to be included in income by the

The last Series H bonds matured in 2009. The change, you must report all interest accrued to

lender and deducted by the borrower is limited

last Series HH bonds will mature in 2024. date and not previously reported for all your

to the amount of the borrower's net investment

bonds.

income for the year. If the borrower's net invest-

Series EE and Series I bonds. Interest on Once you choose to report the interest each

ment income is $1,000 or less, it is treated as

these bonds is payable when you redeem the year, you must continue to do so for all Series

zero. This limit does not apply to a loan if the

bonds. The difference between the purchase EE, Series E, and Series I bonds you own and

avoidance of federal tax is one of the main pur-

price and the redemption value is taxable inter- for any you get later, unless you request per-

poses of the interest arrangement.

est. mission to change, as explained next.

U.S. Savings Bonds Series EE bonds. Series EE bonds were Change from method 2. To change from

first offered in January 1980 and have a matur- method 2 to method 1, you must request per-

This section provides tax information on U.S. ity period of 30 years. Before July 1980, Series mission from the IRS. Permission for the

savings bonds. It explains how to report the in- E bonds were issued. The original 10-year ma- change is automatically granted if you send the

terest income on these bonds and how to treat turity period of Series E bonds has been exten- IRS a statement that meets all the following re-

transfers of these bonds. ded to 40 years for bonds issued before De- quirements.

cember 1965 and 30 years for bonds issued 1. You have typed or printed the following

U.S. savings bonds currently offered to indi-

after November 1965. Paper Series EE bonds number at the top: “131.”

viduals include Series EE bonds and Series I

are issued at a discount. The face value is pay-

bonds. 2. It includes your name and social security

able to you at maturity. Electronic Series EE

For information about U.S. savings bonds are issued at their face value. The face number under “131.”

bonds, go to www.treasurydirect.gov/ value plus accrued interest is payable to you at 3. It includes the year of change (both the

indiv/indiv.htm. Also go to maturity. As of January 1, 2012, paper savings beginning and ending dates).

www.treasurydirect.gov/email.htm and click on bonds are no longer sold at financial institu-

a topic to find answers to your questions by tions. 4. It identifies the savings bonds for which

email. Owners of paper Series EE bonds can con- you are requesting this change.

vert them to electronic bonds. These converted 5. It includes your agreement to:

If you prefer, write to: bonds do not retain the denomination listed on

the paper certificate but are posted at their pur- a. Report all interest on any bonds ac-

chase price (with accrued interest). quired during or after the year of

change when the interest is realized

For Series EE and I Electronic Savings Series I bonds. Series I bonds were first upon disposition, redemption, or final

Bonds offered in 1998. These are inflation-indexed maturity, whichever is earliest; and

Treasury Retail Securities Services bonds issued at their face amount with a matur-

b. Report all interest on the bonds ac-

P.O. Box 7015 ity period of 30 years. The face value plus all

quired before the year of change

Minneapolis, MN 55480-7015 accrued interest is payable to you at maturity.

when the interest is realized upon dis-

Reporting options for cash method tax- position, redemption, or final maturity,

For Series EE and I Paper Savings Bonds payers. If you use the cash method of report- whichever is earliest, with the excep-

Treasury Retail Securities Services ing income, you can report the interest on Ser- tion of the interest reported in prior tax

P.O. Box 214 ies EE, Series E, and Series I bonds in either of years.

Minneapolis, MN 55480-0214 the following ways.

You must attach this statement to your tax

1. Method 1. Postpone reporting the interest return for the year of change, which you must

For Series HH and H Paper Savings until the earlier of the year you cash or dis- file by the due date (including extensions).

Bonds pose of the bonds or the year in which You can have an automatic extension of 6

Treasury Retail Securities Site they mature. (However, see Savings months from the due date of your return for the

P.O. Box 2186 bonds traded, later.) year of change (excluding extensions) to file the

Minneapolis, MN 55480-2186 Note. Series EE bonds issued in 1988 statement with an amended return. On the

matured in 2018. If you have used method statement, type or print “Filed pursuant to sec-

Accrual method taxpayers. If you use an ac- 1, you generally must report the interest tion 301.9100-2.” To get this extension, you

crual method of accounting, you must report in- on these bonds on your 2018 return. The must have filed your original return for the year

terest on U.S. savings bonds each year as it ac- last Series E bonds were issued in 1980

Chapter 1 Investment Income Page 7

Table 1-2. Who Pays the Tax on U.S. Savings Bond Interest the new co-owner will report only his or her

share of the interest earned after the transfer.

IF ... THEN the interest must be reported by ... If bonds that you and a co-owner bought

you buy a bond in your name and the name of another you. jointly are reissued to each of you separately in

person as co-owners, using only your own funds the same proportion as your contribution to the

you buy a bond in the name of another person, who is the the person for whom you bought the bond. purchase price, neither you nor your co-owner

sole owner of the bond has to report at that time the interest earned be-

fore the bonds were reissued.

you and another person buy a bond as co-owners, each both you and the other co-owner, in proportion to the

contributing part of the purchase price amount each paid for the bond.

Example 1. You and your spouse each

you and your spouse, who live in a community property you and your spouse. If you file separate returns, both you spent an equal amount to buy a $1,000 Series

state, buy a bond that is community property and your spouse generally report half of the interest. EE savings bond. The bond was issued to you

and your spouse as co-owners. You both post-

of the change by the due date (including exten- income tax return that shows all the interest pone reporting interest on the bond. You later

sions). See also Revenue Procedure 2015-13, earned to date, and by stating on the return that have the bond reissued as two $500 bonds,

Section 6.03(4). your child chooses to report the interest each one in your name and one in your spouse's

Instead of filing this statement, you can re- year. Either you or your child should keep a name. At that time neither you nor your spouse

quest permission to change from method 2 to copy of this return. has to report the interest earned to the date of

method 1 by filing Form 3115. In that case, fol- Unless your child is otherwise required to reissue.

low the form instructions for an automatic file a tax return for any year after making this

change. No user fee is required. choice, your child does not have to file a return Example 2. You bought a $1,000 Series

only to report the annual accrual of U.S. savings EE savings bond entirely with your own funds.

Co-owners. If a U.S. savings bond is issued in bond interest under this choice. However, see The bond was issued to you and your spouse

the names of co-owners, such as you and your Tax on unearned income of certain children, as co-owners. You both postponed reporting in-

child or you and your spouse, interest on the earlier, under General Information. Neither you terest on the bond. You later have the bond re-

bond generally is taxable to the co-owner who nor your child can change the way you report issued as two $500 bonds, one in your name

bought the bond. the interest unless you request permission from and one in your spouse's name. You must re-

the IRS, as discussed earlier under Change port half the interest earned to the date of reis-

One co-owner's funds used. If you used from method 2. sue.

your funds to buy the bond, you must pay the

tax on the interest. This is true even if you let Ownership transferred. If you bought Series Transfer to a trust. If you own Series E, Ser-

the other co-owner redeem the bond and keep E, Series EE, or Series I bonds entirely with ies EE, or Series I bonds and transfer them to a

all the proceeds. Under these circumstances, your own funds and had them reissued in your trust, giving up all rights of ownership, you must

the co-owner who redeemed the bond will re- co-owner's name or beneficiary's name alone, include in your income for that year the interest

ceive a Form 1099-INT at the time of redemp- you must include in your gross income for the earned to the date of transfer if you have not al-

tion and must provide you with another Form year of reissue all interest that you earned on ready reported it. However, if you are consid-

1099-INT showing the amount of interest from these bonds and have not previously reported. ered the owner of the trust and if the increase in

the bond taxable to you. The co-owner who re- But, if the bonds were reissued in your name value both before and after the transfer contin-

deemed the bond is a “nominee.” See Nominee alone, you do not have to report the interest ac- ues to be taxable to you, you can continue to

distributions, later, for more information about crued at that time. defer reporting the interest earned each year.

how a person who is a nominee reports interest

This same rule applies when bonds (other You must include the total interest in your in-

income belonging to another person.

than bonds held as community property) are come in the year you cash or dispose of the

Both co-owners' funds used. If you and transferred between spouses or incident to di- bonds or the year the bonds finally mature,

the other co-owner each contribute part of the vorce. whichever is earlier.

bond's purchase price, the interest generally is The same rules apply to previously unrepor-

taxable to each of you, in proportion to the Example. You bought Series EE bonds en- ted interest on Series EE or Series E bonds if

amount each of you paid. tirely with your own funds. You did not choose the transfer to a trust consisted of Series HH or

to report the accrued interest each year. Later, Series H bonds you acquired in a trade for the

Community property. If you and your you transfer the bonds to your former spouse Series EE or Series E bonds. See Savings

spouse live in a community property state and under a divorce agreement. You must include bonds traded, later.

hold bonds as community property, one-half of the deferred accrued interest, from the date of

the interest is considered received by each of the original issue of the bonds to the date of Decedents. The manner of reporting interest

you. If you file separate returns, each of you transfer, in your income in the year of transfer. income on Series E, Series EE, or Series I

generally must report one-half of the bond inter- Your former spouse includes in income the in- bonds, after the death of the owner (decedent),

est. For more information about community terest on the bonds from the date of transfer to depends on the accounting and income-report-

property, see Pub. 555. the date of redemption. ing methods previously used by the decedent.

Table 1-2. These rules are also shown in Purchased jointly. If you and a co-owner Decedent who reported interest each

Table 1-2. each contributed funds to buy Series E, Series year. If the bonds transferred because of death

EE, or Series I bonds jointly and later have the were owned by a person who used an accrual

Child as only owner. Interest on U.S. savings bonds reissued in the co-owner's name alone, method, or who used the cash method and had

bonds bought for and registered only in the you must include in your gross income for the chosen to report the interest each year, the in-

name of your child is income to your child, even year of reissue your share of all the interest terest earned in the year of death up to the date

if you paid for the bonds and are named as ben- earned on the bonds that you have not previ- of death must be reported on that person's final

eficiary. If the bonds are Series EE, Series E, or ously reported. The former co-owner does not return. The person who acquires the bonds in-

Series I bonds, the interest on the bonds is in- have to include in gross income at the time of cludes in income only interest earned after the

come to your child in the earlier of the year the reissue his or her share of the interest earned date of death.

bonds are cashed or disposed of or the year the that was not reported before the transfer. This

bonds mature, unless your child chooses to re- interest, however, as well as all interest earned Decedent who postponed reporting in-

port the interest income each year. after the reissue, is income to the former terest. If the transferred bonds were owned by

co-owner. a decedent who had used the cash method and

Choice to report interest each year. The had not chosen to report the interest each year,

This income-reporting rule also applies

choice to report the accrued interest each year and who had bought the bonds entirely with his

when the bonds are reissued in the name of

can be made either by your child or by you for or her own funds, all interest earned before

your former co-owner and a new co-owner. But

your child. This choice is made by filing an

Page 8 Chapter 1 Investment Income

death must be reported in one of the following accrued. Your aunt's executor chose not to in- this choice, it is treated as a change from

ways. clude any interest earned before your aunt's method 1. See Change from method 1, earlier.

death on her final return.

1. The surviving spouse or personal repre-

The income in respect of the decedent is the Form 1099-INT for U.S. savings bond inter-

sentative (executor, administrator, etc.)

sum of the unreported interest on the Series EE est. When you cash a bond, the bank or other

who files the final income tax return of the

bonds and the interest, if any, payable on the payer that redeems it must give you a Form

decedent can choose to include on that

Series HH bonds but not received as of the 1099-INT if the interest part of the payment you

return all interest earned on the bonds be-

date of your aunt's death. You must report any receive is $10 or more. Box 3 of your Form

fore the decedent's death. The person

interest received during the year as income on 1099-INT should show the interest as the differ-

who acquires the bonds then includes in

your return. The part of the interest payable but ence between the amount you received and the

income only interest earned after the date

not received before your aunt's death is income amount paid for the bond. However, your Form

of death.

in respect of the decedent and may qualify for 1099-INT may show more interest than you

2. If the choice in (1) is not made, the interest the estate tax deduction. For information on have to include on your income tax return. For

earned up to the date of death is income in when to report the interest on the Series EE example, this may happen if any of the following

respect of the decedent and should not be bonds traded, see Savings bonds traded, later. are true.

included in the decedent's final return. All • You chose to report the increase in the re-

interest earned both before and after the Savings bonds distributed from a retire- demption value of the bond each year. The

decedent's death (except any part repor- ment or profit-sharing plan. If you acquire a interest shown on your Form 1099-INT will

ted by the estate on its income tax return) U.S. savings bond in a taxable distribution from not be reduced by amounts previously in-

is income to the person who acquires the a retirement or profit-sharing plan, your income cluded in income.

bonds. If that person uses the cash for the year of distribution includes the bond's • You received the bond from a decedent.

method and does not choose to report the redemption value (its cost plus the interest ac- The interest shown on your Form 1099-INT

interest each year, he or she can postpone crued before the distribution). When you re- will not be reduced by any interest repor-

reporting it until the year the bonds are deem the bond (whether in the year of distribu- ted by the decedent before death, or on

cashed or disposed of or the year they tion or later), your interest income includes only the decedent's final return, or by the estate

mature, whichever is earlier. In the year the interest accrued after the bond was distrib- on the estate's income tax return.

that person reports the interest, he or she uted. To figure the interest reported as a taxa- • Ownership of the bond was transferred.

can claim a deduction for any federal es- ble distribution and your interest income when The interest shown on your Form 1099-INT

tate tax paid on the part of the interest in- you redeem the bond, see Worksheet for sav- will not be reduced by interest that accrued

cluded in the decedent's estate. ings bonds distributed from a retirement or before the transfer.

profit-sharing plan, later. • You were named as a co-owner, and the

For more information on income in respect of a other co-owner contributed funds to buy

decedent, see Pub. 559, Survivors, Executors, Savings bonds traded. If you postponed re- the bond. The interest shown on your Form

and Administrators. porting the interest on your Series EE or Series 1099-INT will not be reduced by the

E bonds, you did not recognize taxable income amount you received as nominee for the

Example 1. Your uncle, a cash method tax- when you traded the bonds for Series HH or other co-owner. (See Co-owners, earlier,

payer, died and left you a $1,000 Series EE Series H bonds, unless you received cash in for more information about the reporting re-

bond. He had bought the bond for $500 and the trade. (You cannot trade Series I bonds for quirements.)

had not chosen to report the interest each year. Series HH bonds. After August 31, 2004, you • You received the bond in a taxable distri-

At the date of death, interest of $200 had ac- cannot trade any other series of bonds for Ser- bution from a retirement or profit-sharing

crued on the bond, and its value of $700 was in- ies HH bonds.) Any cash you received is in- plan. The interest shown on your Form

cluded in your uncle's estate. Your uncle's ex- come up to the amount of the interest earned on 1099-INT will not be reduced by the inter-

ecutor chose not to include the $200 accrued the bonds traded. When your Series HH or Ser- est portion of the amount taxable as a dis-

interest in your uncle's final income tax return. ies H bonds mature, or if you dispose of them tribution from the plan and not taxable as

The $200 is income in respect of the decedent. before maturity, you report as interest the differ- interest. (This amount generally is shown

You are a cash method taxpayer and do not ence between their redemption value and your on Form 1099-R, Distributions From Pen-

choose to report the interest each year as it is cost. Your cost is the sum of the amount you sions, Annuities, Retirement or Profit-Shar-

earned. If you cash the bond when it reaches paid for the traded Series EE or Series E bonds ing Plans, IRAs, Insurance Contracts, etc.,

maturity value of $1,000, you report $500 inter- plus any amount you had to pay at the time of for the year of distribution.)

est income—the difference between maturity the trade.

value of $1,000 and the original cost of $500. For more information on including the cor-

rect amount of interest on your return, see U.S.

Example. You traded Series EE bonds (on

Example 2. If, in Example 1, the executor savings bond interest previously reported or

which you postponed reporting the interest) for

had chosen to include the $200 accrued inter- Nominee distributions, later.

$2,500 in Series HH bonds and $223 in cash.

est in your uncle's final return, you would report You reported the $223 as taxable income on Interest on U.S. savings bonds is ex-

only $300 as interest when you cashed the your tax return. At the time of the trade, the Ser- TIP empt from state and local taxes. The

bond at maturity. $300 is the interest earned af- ies EE bonds had accrued interest of $523 and Form 1099-INT you receive will indi-

ter your uncle's death. a redemption value of $2,723. You hold the Ser- cate the amount that is for U.S. savings bonds

ies HH bonds until maturity, when you receive interest in box 3. Do not include this income on

Example 3. If, in Example 1, you make or $2,500. You must report $300 as interest in- your state or local income tax return.

have made the choice to report the increase in come in the year of maturity. This is the differ-

redemption value as interest each year, you in- ence between their redemption value, $2,500,

clude in gross income for the year you acquire and your cost, $2,200 (the amount you paid for Education Savings Bond Program

the bond all of the unreported increase in value the Series EE bonds). (It also is the difference

of all Series E, Series EE, and Series I bonds between the accrued interest of $523 on the You may be able to exclude from income all or

you hold, including the $200 on the bond you in- Series EE bonds and the $223 cash received part of the interest you receive on the redemp-

herited from your uncle. on the trade.) tion of qualified U.S. savings bonds during the

year if you pay qualified higher education ex-

Example 4. When your aunt died, she Choice to report interest in year of trade. penses during the same year. This exclusion is

owned Series HH bonds that she had acquired You could have chosen to treat all of the previ- known as the Education Savings Bond Pro-

in a trade for Series EE bonds. You were the ously unreported accrued interest on Series EE gram.

beneficiary of these bonds. Your aunt used the or Series E bonds traded for Series HH bonds

cash method and did not choose to report the as income in the year of the trade. If you made You do not qualify for this exclusion if your

interest on the Series EE bonds each year as it filing status is married filing separately.

Chapter 1 Investment Income Page 9

Form 8815. Use Form 8815 to figure your ex- For information about these benefits, see Pub. (Form 1040, line 7) figured before the interest

clusion. Attach the form to your Form 1040. 970. exclusion, and modified by adding back any:

1. Foreign earned income exclusion,

Qualified U.S. savings bonds. A qualified Amount excludable. If the total proceeds (in-

U.S. savings bond is a Series EE bond issued terest and principal) from the qualified U.S. sav- 2. Foreign housing exclusion and deduction,

after 1989 or a Series I bond. The bond must be ings bonds you redeem during the year are not

3. Exclusion of income for bona fide resi-

issued either in your name (sole owner) or in more than your adjusted qualified higher educa-

dents of American Samoa,

your and your spouse's names (co-owners). tional expenses for the year, you may be able to

You must be at least 24 years old before the exclude all of the interest. If the proceeds are 4. Exclusion for income from Puerto Rico,

bond's issue date. For example, a bond bought more than the expenses, you may be able to

5. Exclusion for adoption benefits received

by a parent and issued in the name of his or her exclude only part of the interest.

under an employer's adoption assistance

child under age 24 does not qualify for the ex- To determine the excludable amount, multi-

program,

clusion by the parent or child. ply the interest part of the proceeds by a frac-

tion. The numerator (top part) of the fraction is 6. Deduction for tuition and fees,

The issue date of a bond may be ear-

lier than the date the bond is pur- the qualified higher educational expenses you

! 7. Deduction for student loan interest, and

CAUTION chased because the issue date as-

paid during the year. The denominator (bottom

part) of the fraction is the total proceeds you re- 8. Deduction for domestic production activi-

signed to a bond is the first day of the month in

ceived during the year. ties.

which it is purchased.

Example. In February 2018, Mark and Use the Line 9 Worksheet in the Form 8815

Beneficiary. You can designate any indi- instructions to figure your modified AGI. If you

Joan, a married couple, cashed qualified Series

vidual (including a child) as a beneficiary of the claim any of the exclusion or deduction items

EE U.S. savings bonds with a total denomina-

bond. listed above (except items 6, 7, and 8), add the

tion of $10,000 that they bought in April 2002

for $5,000. They received proceeds of $7,244, amount of the exclusion or deduction (except

Verification by IRS. If you claim the exclu-

representing principal of $5,000 and interest of items 6, 7, and 8) to the amount on line 5 of the

sion, the IRS will check it by using bond re-

$2,244. In 2018, they paid $4,000 of their worksheet, and enter the total on Form 8815,

demption information from the Department of

daughter's college tuition. They are not claiming line 9, as your modified AGI.

Treasury.

an education credit for that amount, and their Royalties included in modified AGI. Be-

Qualified expenses. Qualified higher educa- daughter does not have any tax-free educa- cause the deduction for interest expenses due

tional expenses are tuition and fees required for tional assistance. They can exclude $1,239 to royalties and other investments is limited to

you, your spouse, or your dependent to attend ($2,244 × ($4,000 ÷ $7,244)) of interest in your net investment income (see Investment In-

an eligible educational institution. 2018. They must pay tax on the remaining terest in chapter 3), you cannot figure the de-

Qualified expenses include any contribution $1,005 ($2,244 − $1,239) interest. duction for interest expenses until you have fig-

you make to a qualified tuition program or to a ured this exclusion of savings bond interest.

Figuring the interest part of the pro-

Coverdell education savings account. For infor- Therefore, if you had interest expenses due to

ceeds (Form 8815, line 6). To figure the inter-

mation about these programs, see Pub. 970, royalties deductible on Schedule E (Form

est to report on Form 8815, line 6, use the

Tax Benefits for Education. 1040), Supplemental Income and Loss, you

Line 6 Worksheet in the Form 8815 instructions.

Qualified expenses do not include expenses must make a special computation of your de-

for room and board or for courses involving If you previously reported any interest ductible interest to figure the net royalty income

sports, games, or hobbies that are not part of a from savings bonds cashed during included in your modified AGI. You must figure

degree or certificate granting program. 2018, use the Alternate Line 6 Work- deductible interest without regard to this exclu-

sheet below instead. sion of bond interest.

Eligible educational institutions. These You can use a “dummy” Form 4952, Invest-

institutions include most public, private, and ment Interest Expense Deduction, to make the

nonprofit universities, colleges, and vocational Alternate Line 6 Worksheet

special computation. On this form, include in

schools that are accredited and eligible to par- 1. Enter the amount from Form 8815, your net investment income your total interest

ticipate in student aid programs run by the De- line 5 . . . . . . . . . . . . . . . . . . . . . . . . . income for the year from Series EE and I U.S.

partment of Education. 2. Enter the face value of all post-1989 paper savings bonds. Use the deductible interest

Series EE bonds cashed in 2018 . . . . . . amount from this form only to figure the net roy-

Reduction for certain benefits. You must 3. Multiply line 2 by 50% (0.50) . . . . . . . . .

reduce your qualified higher educational expen- alty income included in your modified AGI. Do

4. Enter the face value of all electronic not attach this form to your tax return.

ses by all of the following tax-free benefits. Series EE bonds (including post-1989

After you figure this interest exclusion, use a

1. Tax-free part of scholarships and fellow- Series EE bonds converted from paper to

electronic format) and all Series I bonds separate Form 4952 to figure your actual de-

ships. duction for investment interest expenses and

cashed in 2018 . . . . . . . . . . . . . . . . . . .

2. Expenses used to figure the tax-free por- 5. Add lines 3 and 4 . . . . . . . . . . . . . . . . . attach that form to your return.

tion of distributions from a Coverdell ESA. 6. Subtract line 5 from line 1 . . . . . . . . . . .

Recordkeeping. If you claim the inter-

7. Enter the amount of interest reported as est exclusion, you must keep a written

3. Expenses used to figure the tax-free por- income in previous years . . . . . . . . . . . . RECORDS record of the qualified U.S. savings

tion of distributions from a qualified tuition 8. Subtract line 7 from line 6. Enter the result

program. here and on Form 8815, line 6 . . . . . . . .

bonds you redeem. Your record must include

the serial number, issue date, face value, and

4. Any tax-free payments (other than gifts or total redemption proceeds (principal and inter-

inheritances) received as educational as- Modified adjusted gross income limit.

est) of each bond. You can use Form 8818 to

sistance, such as: The interest exclusion is limited if your modified

record this information. You also should keep

adjusted gross income (modified AGI) is:

a. Veterans' educational assistance ben- bills, receipts, canceled checks, or other docu-

• $119,300 to $149,300 for married taxpay-

efits, mentation that shows you paid qualified higher

ers filing jointly, and

educational expenses during the year.

b. Qualified tuition reductions, or • $79,550 to $94,550 for all other taxpayers.

c. Employer-provided educational assis- You do not qualify for the interest exclusion if

tance. your modified AGI is equal to or more than the U.S. Treasury Bills,

5. Any expense used in figuring the Ameri-

upper limit for your filing status. Notes, and Bonds

can Opportunity and lifetime learning cred- Modified AGI. Modified AGI, for purposes

its. of this exclusion, is adjusted gross income Treasury bills, notes, and bonds are direct

debts (obligations) of the U.S. Government.

Page 10 Chapter 1 Investment Income

Taxation of interest. Interest income from Or, on the Internet, visit obligation. If you invested in the obligation

Treasury bills, notes, and bonds is subject to www.treasurydirect.gov/indiv/ through a trust, a fund, or other organization,

federal income tax but is exempt from all state indiv.htm. that organization should give you this informa-

and local income taxes. You should receive tion.

Form 1099-INT showing the interest (in box 3) Treasury inflation-protected securities Even if interest on the obligation is not

paid to you for the year. (TIPS). These securities pay interest twice a

! subject to income tax, you may have to