Professional Documents

Culture Documents

Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)

Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)

Uploaded by

Prachi NavghareOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)

Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)

Uploaded by

Prachi NavghareCopyright:

Available Formats

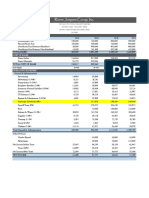

DCF Valuation (Amounts In Millions)

Calculation of Free Cashflow to the Firm

2017 2018 2019 2020 2021 2022

CA (excluding cash) 87,745 155,109 173,369 193,779 216,591 242,089

CL (excluding short term debt) 127,532 149,229 166,796 186,432 208,380 232,911

Working Capital (39,787) 5,881 6,573 7,347 8,212 9,178

EBIT 101,272 80,701 85,937 91,789 98,330 105,641

Changes in WC (33,906) 692 774 865 967

Deprecition and Amortization 26,039 34,829 38,929 43,512 48,635 54,360

Capex 32,524 47,280 52,846 59,067 66,020 73,793

Tax Rate

26%

FCFF ( EBIT-Tax-Changes in wc-

capex+depreciation) 13,496.17 49,127.60 51,748.02 54,676.93 57,950.64

PV OF FCFF INR 12,342.52 INR 49,127.60 INR 51,748.02 INR 54,676.93 INR 57,950.64

1 2 3 4 5

2014 2015 2016 2017

PBT 37,338 49,760 75,847 101,272

Tax Exp 9,022 11,854 20,875 26,162

Tax rate 24% 24% 28% 26%

CAPEX 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Purchase of Fixed asset 32,725 35,449 32,792 24,686 32,524 47,280 52,846 59,067 66,020 73,793

Revenue 432,159 432,718 492,950 570,615 669,247 748,033 836,093 934,521 1,044,535 1,167,501

% of Sale 8% 8% 7% 4% 5%

Average 6%

Long term growth rate 7%

CMP 6552.08 Beta Calculation

Diluted Shares 302.08 Regression Beta 1.0

Market Cap 1,979,252 Average D/E 0.00

Long term Liabilities+ short term 4,836 Unlevered Beta 1.0

Cash and Cash equivalents 227 Levered Beta 1.0

Net Debt 4,609

Enterprise Value 1,983,861

Weightage COD

Debt to Capital 0.2% Interest Rate 18.5%

Equtiy to Captial 99.8% After tax COD 13.7%

Debt to Equity 0.0023

Debt to Equity 0.0000 WACC 9.3%

COE Calculation Calculated Enterprise Value Amt in Rs

Beta of Stock 1.0 Sum of PV of FCFF INR 452,845

RFR 7% Terminal Value 2,642,036

Implied market return in india 9.3% PV of Terminal Value INR 1,690,073

Market Risk Premium of India 1.8% Enterprise Value INR 2,142,918

Cost of Equity 9.3% Less- Debt 4,609

Add-Cash 227

Intrinsic Value Equity Value 2,138,536

Equity Value 2,138,536 Terminal Value as % of TV 79%

Diluted Shares 302.08

Intrinsic Value 7,079

Valuation UNDERVALUED CMP is lower the intrinsic value

Discount / ( Premium ) 527

You might also like

- Final Solution - New Heritage Doll CompanyDocument6 pagesFinal Solution - New Heritage Doll CompanyRehan Tyagi100% (2)

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- Financial Performance of Interloop Limited (Ilp)Document2 pagesFinancial Performance of Interloop Limited (Ilp)Muhammad NadeemNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- DCF Analysis Coba2Document6 pagesDCF Analysis Coba2Main SahamNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDocument9 pagesNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNo ratings yet

- Annual Statistics 2018Document21 pagesAnnual Statistics 2018Shesha Nimna GamageNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- Lucky CementDocument45 pagesLucky Cementaleema anjumNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- 2024 AP SEC Form 20 Is Definitive Information StatementDocument356 pages2024 AP SEC Form 20 Is Definitive Information Statementtala alonzoNo ratings yet

- Valuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 AssumptionsDocument6 pagesValuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 Assumptionspriyal batraNo ratings yet

- Business Valuation Interactive Exercise Support (Template)Document34 pagesBusiness Valuation Interactive Exercise Support (Template)m.qunees99No ratings yet

- Exxon Mobil PDFDocument65 pagesExxon Mobil PDFivan.maldonadoNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Comcast Model ShareableDocument27 pagesComcast Model Shareablep44153No ratings yet

- MECWIN Investment ProposalDocument4 pagesMECWIN Investment ProposalVamsi PavuluriNo ratings yet

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal Mahajan100% (1)

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Report 2022Document338 pagesReport 2022Yerrolla MadhuravaniNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Financial Modeling CMDocument3 pagesFinancial Modeling CMAreeba Aslam100% (1)

- Vertical & Horizontal AnalysisDocument11 pagesVertical & Horizontal Analysisstd25732No ratings yet

- Financial Model EE ProjectDocument24 pagesFinancial Model EE ProjectRetno PamungkasNo ratings yet

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Document19 pagesForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyNo ratings yet

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Document19 pagesForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyNo ratings yet

- Transaction AssumptionsDocument21 pagesTransaction AssumptionsSuresh PandaNo ratings yet

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- RJC Fin ProjectionsDocument1 pageRJC Fin Projectionsapi-365066163No ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Short Form DCFDocument1 pageShort Form DCFjess236No ratings yet

- T V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreDocument4 pagesT V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreRahul DesaiNo ratings yet

- Nke Model Di VincompleteDocument10 pagesNke Model Di VincompletesalambakirNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Bcel 2019Document1 pageBcel 2019Dương NguyễnNo ratings yet

- Raymond AnalysisDocument31 pagesRaymond Analysissanket mehtaNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Bata India LTDDocument18 pagesBata India LTDAshish DupareNo ratings yet

- LBO Model DetailedDocument10 pagesLBO Model Detailedpre.meh21No ratings yet

- Ping An Insurance (Group) Company of China, LTDDocument27 pagesPing An Insurance (Group) Company of China, LTDVincent ChanNo ratings yet

- Wipro: Presented To: M SRIRAMDocument9 pagesWipro: Presented To: M SRIRAMashish sunnyNo ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Financial Statement: Statement of Cash FlowsDocument6 pagesFinancial Statement: Statement of Cash FlowsdanyalNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalNo ratings yet

- Intrinsic Value Calculator by MeDocument6 pagesIntrinsic Value Calculator by Menkw123No ratings yet

- SL2-Corporate Finance Ristk ManagementDocument17 pagesSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriNo ratings yet

- Cam Diploma in Digital MarketingDocument20 pagesCam Diploma in Digital MarketingfretgruNo ratings yet

- Peter England-Madhura GarmentsDocument17 pagesPeter England-Madhura Garmentswintoday01100% (2)

- 2023 Appropriation BillDocument14 pages2023 Appropriation BillIbrahim OlaideNo ratings yet

- What Ever Happened To The East Asian Developmental State The Unfolding DebateDocument23 pagesWhat Ever Happened To The East Asian Developmental State The Unfolding DebateCiCi GebreegziabherNo ratings yet

- Idemudia Henry & CED Part 1Document12 pagesIdemudia Henry & CED Part 1Adiri HenryNo ratings yet

- AmtekDocument13 pagesAmtekANKUR GARHWALNo ratings yet

- Standard Costing and Variance Analysis FormulasDocument2 pagesStandard Costing and Variance Analysis FormulasRashid HussainNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- Cost Volume Profit Analysis Problems PDFDocument3 pagesCost Volume Profit Analysis Problems PDFInah SalcedoNo ratings yet

- Regulatory Framework For Business TransactionsDocument11 pagesRegulatory Framework For Business TransactionsSteven Mark MananguNo ratings yet

- MSIN0045 Finance I 21-22 - Topic #4 SeminarDocument15 pagesMSIN0045 Finance I 21-22 - Topic #4 Seminarsedobi1512No ratings yet

- Relevant Costing Quiz 1Document4 pagesRelevant Costing Quiz 1Joe P PokaranNo ratings yet

- International BusinessDocument18 pagesInternational BusinessBilal MumtazNo ratings yet

- Re-Imagining The Iron Triangle - Embedding Sustainability Into Project ConstraintsDocument14 pagesRe-Imagining The Iron Triangle - Embedding Sustainability Into Project ConstraintsMonu KaratekaNo ratings yet

- Mba Syllabus Latest 050717 - Final - 2016-17ab1Document38 pagesMba Syllabus Latest 050717 - Final - 2016-17ab1siddhu243No ratings yet

- Vignesh New Finance ProjectDocument71 pagesVignesh New Finance Projectrakum81No ratings yet

- CLN 101Document12 pagesCLN 101akshdeep singhNo ratings yet

- Public Sector AccountingDocument415 pagesPublic Sector AccountingZebedy Victor ChikaNo ratings yet

- Zero Rated Sale (0% Vat)Document5 pagesZero Rated Sale (0% Vat)HazelClaveNo ratings yet

- FOB AssignmentDocument7 pagesFOB AssignmentOtoshi AhmedNo ratings yet

- Unit II Company Audit and VouchingDocument36 pagesUnit II Company Audit and VouchingMuskan TyagiNo ratings yet

- Brand Ambassadors 2021 by Ashish Gautam Ga Guru - OLD FORMATDocument65 pagesBrand Ambassadors 2021 by Ashish Gautam Ga Guru - OLD FORMATSushil 799 Pi 3No ratings yet

- 3.0 Cooperative Law (Notes and Activities) PDFDocument18 pages3.0 Cooperative Law (Notes and Activities) PDFmae camaganNo ratings yet

- Land and Agrarian Reform During Garcia & MacapagalDocument18 pagesLand and Agrarian Reform During Garcia & MacapagalMarianne Castor100% (1)

- There Are Three Main Factors That Lead Samsung To Be Cutting Edge Product LeaderDocument7 pagesThere Are Three Main Factors That Lead Samsung To Be Cutting Edge Product LeaderSakshi AgarwalNo ratings yet

- Sawhney Lampert Paper 2016Document33 pagesSawhney Lampert Paper 2016PURVA BORKARNo ratings yet

- Meaning of Responsibility CenterDocument18 pagesMeaning of Responsibility CenterSuman Preet KaurNo ratings yet

- Economic Dimension of EducationDocument45 pagesEconomic Dimension of EducationRizza De Mesa Pavia100% (1)

- Student Biryani Case StudyDocument6 pagesStudent Biryani Case StudyYousaf SaeedNo ratings yet

- Green Accounting: Cost Measures: Krishna Moorthy, Peter YacobDocument4 pagesGreen Accounting: Cost Measures: Krishna Moorthy, Peter YacobDiptesh SahaNo ratings yet