Professional Documents

Culture Documents

Review of Related Literature

Review of Related Literature

Uploaded by

Rolly Baniqued0 ratings0% found this document useful (0 votes)

11 views3 pagesOriginal Title

1569940705793_Review of Related Literature.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views3 pagesReview of Related Literature

Review of Related Literature

Uploaded by

Rolly BaniquedCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Review of Related Literature

Our business landscape is continuously changing. Therefore, authorities and

governing bodies need to cope with the changes, and because of this the Government

Accounting Manual came into existence, it’s a milestone so far for the Philippine

Government insofar as public accounting sector is concerned. Government Accounting

Manual updated the standards, policies, guidelines and procedures in accounting for

government funds and property; coding structure and accounts; and accounting books,

registries, records, forms, reports and financial statements. According to the manual

with regards to the preparation of financial statements and other reports in conformity

with the requirements of the PPSAS and relevant accounting policies, it ensures

uniformity, accuracy, reliability and timeliness.

According to Dayag (2017), profit oriented entities and government entities are

not the same in reporting to the shareholders, but they should make sure that they

provide a report accounting the funds received and how they are spent. Perhaps most

importantly, taxpayers are entitled to see how the government is spending their money.

Pursuant to Section 109 of PD 1445, government accounting “encompasses the

process of analyzing, recording, classifying, summarizing and communicating all

transactions involving the receipt and disposition of government fund and property and

interpreting the result thereof.”

The status and wellness of a barangay’s accounting information system differs,

be it rural or urban. On a study by Bukar et al. (2013), it states that giving utmost

attention to the biggest challenges that the local government system today is

experiencing which are the lack of proper cash management and poor internal revenue

sourcing and collection is very necessary to ensure fund’s safety and proper application

of such funds to the required areas.

In relation to barangay’s accounting information system a study conducted by

Valle-Cruz et al. (2016) indicates that interactions between citizens and municipal

governments, supported by technologies, do affect citizens’ perception of transparency,

efficiency, and corruption and that the most impactful technologies identified were

websites, social media, and mobile technologies. The only demographic factor that had

a significant effect on citizens’ perception was employment status.

Also, a study by Nirwana et al. (2018) says that personal factors competence,

system or administration on factors regulation, and political factors will affect on the high

financial statements quality. On the other hand, they found out that personal factor

competence has no direct effect on the high or low performance.

According to Gillera et al. (2014) sources from other countries (trust fund), as

initiated by private companies, Foreign loans. Their study also indicated that

management of funds of government agencies differ, Ecosystem Research and

Development Bureau as the central office has a right to play the key facilitating role in

the implementations and operations, thus, broadening its scope in getting other sources

of funds, allocation, disbursement and monitoring.

In addition, Brule et al. (2015), article’s main contention is that the important

dimension of the state’s accountability to its citizens is the variation in individuals’

perceived ability to engage elected officials.

As regards to the LGU’s efficiency and quality of performance Sarmiento et al.

(2014) study revealed that in terms of economic dynamism the LGU’s overall quality of

performance is highly relevant but not excellent.

Transparency should always be observed in every information system and

financial reporting especially on the part of the government. Amir et al. (2017) finds that

business corruption is rampant on a wealthier country compared to the poor countries.

Falkowski (2013) which studied political accountability and governance in rural

areas finds that establishing leader-type public-private partnerships seems to be more

likely in municipalities where holding politicians to account is easier.

Meanwhile, a qualitative study by Gullberg et al. (2016) shows that timeliness is

also determined by organizational values and routines, management style and

managers’ previous experiences of technology not just accounting artefact.

Kim et al. (2012) study suggest that its likely to create a positive perception of

government transparency on e-participation applications focusing on user-friendly

design, it also finds that their development and their assessment of government

transparency is directly associated with e-participants’ satisfaction with e-participation

application.

A study conducted by Modlin (2012) indicate numerous reporting problems within

a majority of county governments ranging from internal control problems to

reconciliation issues that are required to be addressed for information users that

question the sustainability of the unit.

Fernandes et al. (2017) study shows that the higher implementation of open

government information, the stronger the influence of role of public leader on public

service performance.

Kapur (2019) The main areas that have been taken into account in this research

paper include, self-help: an issue in rural development, Ministry of Rural Development,

Department of Rural Development, principles of effective rural governance and

implementation of leadership functions.

Wiley (2015) stated that the answer to a question on “why were separate

accounting and financial reporting standards needed for governments?” depends on the

objectives and identities of the readers and the users as well as the overall objectives of

governmental financial reporting. In his book one primary characteristics of a

government’s structure and the services it provides is that, the relationship of taxpayers

to service receivers-In terms of impact on the objectives of financial reporting this

characteristic of governments may be the most significant. Following are some

interesting points that the Government Accounting Standards Board included in

Government Accounting Standards Board Concept Statement 1 (1987) that may affect

financial reporting objectives: Taxpayers are involuntary resource providers. They

cannot choose whether to pay their taxes, another is that it is difficult to measure

optimal quality or quantity for many of the services provided by governments. Those

receiving the services cannot decide the quantity or quality of a particular service of the

government.

Administrative Code (1987) Sec. 1, Chap. 1, Subtitle B of book V states that “all

resources of the government shall be managed, expended or utilized in accordance with

law and regulations and safeguarded against loss or wastages through illegal or

improper disposition to ensure efficiency, economy and effectiveness in the operations

of government. The responsibility to take care that such policy is faithfully adhered to

rests directly with the chief or head of the government agency concerned.”

United Nations Convention Against Corruption (2003), Art. 9 of Chap. II states

that “[e]ach State Party shall, in accordance with the fundamental principles of its legal

system, take appropriate measures to promote transparency and accountability in the

management of public finances. Such measures shall encompass, inter alia:

Procedures for the adoption of the national budget; Timely reporting on revenue and

expenditure; A system of accounting and auditing standards and related oversight;

Effective and efficient systems of risk management and internal control;

and Where appropriate, corrective action in the case of failure to comply with

the requirements established in this paragraph.”

Mancini et al. (2013) in his lecture notes in information system and organization,

mandatory compliance in transparency of public administration research paper shows

that a better level of transparency is achieved when it is required by law. s

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Stern Strategy EssentialsDocument121 pagesStern Strategy Essentialssatya324100% (3)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- Comprehensive Reviewer On Appraiser ExamjenDocument110 pagesComprehensive Reviewer On Appraiser ExamjenHarold Pelias87% (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Project On Cost AnalysisDocument80 pagesA Project On Cost Analysisnet635194% (16)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (Andrew Davidson & Co) An Implied Prepayment Model For MBSDocument13 pages(Andrew Davidson & Co) An Implied Prepayment Model For MBSgatzarNo ratings yet

- Group 1Document15 pagesGroup 1Rolly BaniquedNo ratings yet

- GG NaDocument10 pagesGG NaRolly BaniquedNo ratings yet

- MAS Reviewer Roque Chapter 1 PDFDocument18 pagesMAS Reviewer Roque Chapter 1 PDFRolly BaniquedNo ratings yet

- Case Study Written ReportDocument39 pagesCase Study Written ReportRolly BaniquedNo ratings yet

- LP - Acctg - 19 - 1stsem - 2019-2020Document16 pagesLP - Acctg - 19 - 1stsem - 2019-2020Rolly BaniquedNo ratings yet

- Net Operating Income Sales Sales Average Operating Assets Net Operating Income Average Operating AssetsDocument4 pagesNet Operating Income Sales Sales Average Operating Assets Net Operating Income Average Operating AssetsRolly BaniquedNo ratings yet

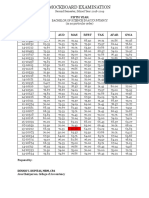

- Mockboard Examination: Id. NoDocument1 pageMockboard Examination: Id. NoRolly BaniquedNo ratings yet

- University of La Salette Inc. College of Accountancy College of Accountancy Student Council Dubinan East, Santiago City, PhilippinesDocument3 pagesUniversity of La Salette Inc. College of Accountancy College of Accountancy Student Council Dubinan East, Santiago City, PhilippinesRolly BaniquedNo ratings yet

- Gov SEC MeetingDocument1 pageGov SEC MeetingRolly BaniquedNo ratings yet

- Customer Privacy Policy 2019 V1Document2 pagesCustomer Privacy Policy 2019 V1Rolly BaniquedNo ratings yet

- Hamza Akbar: Investment/M&A Analyst InternDocument1 pageHamza Akbar: Investment/M&A Analyst Internapi-417045412No ratings yet

- Test Bank Chapter 3Document13 pagesTest Bank Chapter 3Caselyn Clyde UyNo ratings yet

- Milestone 2 Prompt 1Document9 pagesMilestone 2 Prompt 1NeelabhNo ratings yet

- Submissions: Score: 1 Out of 1Document77 pagesSubmissions: Score: 1 Out of 1Geli AceNo ratings yet

- Project On Ambuja CementDocument66 pagesProject On Ambuja CementMOHITKOLLINo ratings yet

- AFM Cash Budgeting Andria Ma'AmDocument9 pagesAFM Cash Budgeting Andria Ma'AmNavya KNo ratings yet

- NIBL Sahabhagita FundDocument5 pagesNIBL Sahabhagita FundyogendrasthaNo ratings yet

- Exim Bank MalaysiaDocument93 pagesExim Bank MalaysiaJohan Arief SoohaimiNo ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Aa1 3 2024Document39 pagesAa1 3 2024esratbithikaNo ratings yet

- Bayesian Methods For Measuring Operational Risks: ICBI Technical Risk Management ReportsDocument15 pagesBayesian Methods For Measuring Operational Risks: ICBI Technical Risk Management ReportsHejoolju Grubs100% (1)

- L & T Glass Installation QuoteDocument4 pagesL & T Glass Installation QuoteJessica Spears100% (1)

- Quizzer 5Document6 pagesQuizzer 5RarajNo ratings yet

- T4 - Past Paper CombinedDocument53 pagesT4 - Past Paper CombinedU Abdul Rehman100% (1)

- Set-Off and Counterclaim CJS HFRDocument4 pagesSet-Off and Counterclaim CJS HFRTitle IV-D Man with a plan100% (5)

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- The Rationale of New Economic Policy 1991Document3 pagesThe Rationale of New Economic Policy 1991Neeraj Agarwal50% (2)

- ) Under The Correct Heading To Show Whether The Item: For Examiner's UseDocument13 pages) Under The Correct Heading To Show Whether The Item: For Examiner's UseAung Zaw HtweNo ratings yet

- Bir Revenue Regulations No. 4-2007Document22 pagesBir Revenue Regulations No. 4-2007hirohonmaNo ratings yet

- 10000027146Document47 pages10000027146Chapter 11 DocketsNo ratings yet

- MC AnswerDocument24 pagesMC AnswerMiss MegzzNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Solomon WorkuDocument101 pagesSolomon WorkuchuchuNo ratings yet

- Finalising Basel III: in BriefDocument9 pagesFinalising Basel III: in BriefScribddNo ratings yet

- Complaint Management Policy-ISO Standards: Grievance Redressal IntroductionDocument9 pagesComplaint Management Policy-ISO Standards: Grievance Redressal IntroductionHitechSoft HitsoftNo ratings yet

- Banking and Finance Project-1Document37 pagesBanking and Finance Project-1ADITYA DHONENo ratings yet