Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

27 viewsUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Uploaded by

grace1. The document provides financial ratio analysis for Woolworths Limited and Metcash Limited based on their 2012 annual reports.

2. It includes income statements, statements of financial position, cash flow statements, and common financial ratios such as gross profit margin, operating expense ratio, return on assets, current ratio, and debt to equity ratio.

3. The ratios show Woolworths' gross profit margin was 26.0% in 2012, its current ratio was 0.86, and its debt to equity ratio was 155.5%, while Metcash's gross profit margin was 9.5%, current ratio was 0.79, and debt to equity ratio was 165.5%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Insurance Agency Business PlanDocument43 pagesInsurance Agency Business PlanJoin Riot100% (5)

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Microsoft Dynamics 365 For Operations Support For If RsDocument40 pagesMicrosoft Dynamics 365 For Operations Support For If RsAlfian Noor RahmanNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Sample QCD With Life EstateDocument2 pagesSample QCD With Life Estatemarioma12No ratings yet

- Marketing Analysis Toolkit - Market Size and MarketDocument14 pagesMarketing Analysis Toolkit - Market Size and MarketMathewNo ratings yet

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Aml CFT NBI Training MaterialDocument52 pagesAml CFT NBI Training Materialdeep100% (2)

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- RelianceDocument2 pagesRelianceAADHYA KHANNANo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- FM205 CaseDocument33 pagesFM205 CaseAastik RockzzNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Name of The Company Last Financial Year First Projected Year CurrencyDocument15 pagesName of The Company Last Financial Year First Projected Year CurrencygabegwNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Daniel John Gabriel FarDocument9 pagesDaniel John Gabriel FarJohn Gabriel DanielNo ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- Increase (Decrease) 2019 2018 Amount Percent Sales RevenueDocument6 pagesIncrease (Decrease) 2019 2018 Amount Percent Sales RevenuewennylynNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- Financial Performance SpreadsheetDocument4 pagesFinancial Performance SpreadsheetAngel Mae PalasNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Horizontal and Vertical Analysis of ProfitDocument3 pagesHorizontal and Vertical Analysis of ProfitIfzal AhmadNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- Ratio Analysis TemplateDocument6 pagesRatio Analysis TemplateGapar FitriNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Venture Capital NotesDocument7 pagesVenture Capital NotesRaj VidalNo ratings yet

- Chapter 13Document12 pagesChapter 13Mike PermataNo ratings yet

- Bab2 Act Development & ClassificationDocument26 pagesBab2 Act Development & ClassificationagustadivNo ratings yet

- Chapter 13 AnswersDocument5 pagesChapter 13 Answersvandung19No ratings yet

- Lawrep 036 CSLJ JL 0245Document17 pagesLawrep 036 CSLJ JL 0245Jeckl100% (1)

- Huaneng Shandong Ruyi (Pakistan) Energy PVTDocument13 pagesHuaneng Shandong Ruyi (Pakistan) Energy PVTHumaira AtharNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- ShiiiDocument59 pagesShiiiShiva Prasad KasturiNo ratings yet

- Final FMDocument17 pagesFinal FMNikita MaskaraNo ratings yet

- CH 08 - Financial OptionsDocument59 pagesCH 08 - Financial OptionsSyed Mohib HassanNo ratings yet

- A Guide To Venture Capital Term SheetsDocument54 pagesA Guide To Venture Capital Term SheetsSandeep Dhawan100% (2)

- AEB15 SM C10 v4Document28 pagesAEB15 SM C10 v4Victor LuiNo ratings yet

- Sources of Financing For New Technology Firms: A Comparison by GenderDocument20 pagesSources of Financing For New Technology Firms: A Comparison by GenderThe Ewing Marion Kauffman FoundationNo ratings yet

- Truthofthe Stock Tape PDFDocument36 pagesTruthofthe Stock Tape PDFCardoso PenhaNo ratings yet

- PTWC IssueDocument4 pagesPTWC IssueSajjad AfzalNo ratings yet

- Keycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmDocument3 pagesKeycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmekaarinathaNo ratings yet

- Income Tax Calculation 2010ver 10 3Document31 pagesIncome Tax Calculation 2010ver 10 3Vidya SajitNo ratings yet

- Policies ManualDocument23 pagesPolicies Manualpateljayamin100% (1)

- Casey Research Crisis & Opportunity Summit: AgendaDocument3 pagesCasey Research Crisis & Opportunity Summit: AgendaPatrick Simon-UnNo ratings yet

- Investment Analysis and Portfolio ManagementDocument33 pagesInvestment Analysis and Portfolio ManagementUqaila Mirza0% (1)

- First Learn - Then Earn (Indian Stock Market)Document31 pagesFirst Learn - Then Earn (Indian Stock Market)stardennisNo ratings yet

- Summer Training Project REPORT: "Perception of Investors Towards Investing in Uti Mutual Fund"Document30 pagesSummer Training Project REPORT: "Perception of Investors Towards Investing in Uti Mutual Fund"Pihu SharmaNo ratings yet

- A Few Thoughts On The Parag Parikh Flexicap Fund Completing 10 Years Since LaunchDocument2 pagesA Few Thoughts On The Parag Parikh Flexicap Fund Completing 10 Years Since Launchsathiya J100% (1)

- Dissolution of PartnershipDocument42 pagesDissolution of PartnershipRahul Singh67% (3)

- Britannia Industry AnalysisDocument10 pagesBritannia Industry AnalysisTomthin Ahanthem100% (1)

Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Uploaded by

grace0 ratings0% found this document useful (0 votes)

27 views3 pages1. The document provides financial ratio analysis for Woolworths Limited and Metcash Limited based on their 2012 annual reports.

2. It includes income statements, statements of financial position, cash flow statements, and common financial ratios such as gross profit margin, operating expense ratio, return on assets, current ratio, and debt to equity ratio.

3. The ratios show Woolworths' gross profit margin was 26.0% in 2012, its current ratio was 0.86, and its debt to equity ratio was 155.5%, while Metcash's gross profit margin was 9.5%, current ratio was 0.79, and debt to equity ratio was 165.5%.

Original Description:

calculation

Original Title

Note

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides financial ratio analysis for Woolworths Limited and Metcash Limited based on their 2012 annual reports.

2. It includes income statements, statements of financial position, cash flow statements, and common financial ratios such as gross profit margin, operating expense ratio, return on assets, current ratio, and debt to equity ratio.

3. The ratios show Woolworths' gross profit margin was 26.0% in 2012, its current ratio was 0.86, and its debt to equity ratio was 155.5%, while Metcash's gross profit margin was 9.5%, current ratio was 0.79, and debt to equity ratio was 165.5%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial Statements

Uploaded by

grace1. The document provides financial ratio analysis for Woolworths Limited and Metcash Limited based on their 2012 annual reports.

2. It includes income statements, statements of financial position, cash flow statements, and common financial ratios such as gross profit margin, operating expense ratio, return on assets, current ratio, and debt to equity ratio.

3. The ratios show Woolworths' gross profit margin was 26.0% in 2012, its current ratio was 0.86, and its debt to equity ratio was 155.5%, while Metcash's gross profit margin was 9.5%, current ratio was 0.79, and debt to equity ratio was 165.5%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

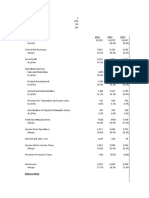

ACCT5001

Individual Assignment - Part B: Ratios

NB: Do not change the format of this worksheet

Woolworths Limited Metcash Limited

Use 2012 annual reports

Horizontal Vertical Horizontal Vertical

Pro forma Financial Statements 2012 2011 2011-12 2012

2012 2011 2011-12 2012

Income Statement (Ignore other comprehensive income) AUD$'m AUD$m % % AUD$m AUD$m % %

Sales Revenue (sale of goods only) 55,129.8 52,609.1 4.8% 100.0% 12,255.1 12,364.0 -0.9% 100.0%

Cost of sales -40,792.4 -39,050.0 4.5% 74.0% -11,086.1 -11,186.9 -0.9% 90.5%

Gross profit from continuing operations 14,337.4 13,559.1 5.7% 26.0% 1,169.0 1,177.1 -0.7% 9.5%

All other rev/income (incl financial income & share of associate profit/( 397.0 400.5 -0.9% 0.7% 111.7 96.2 16.1% 0.9%

Operating Expenses (excl. financing/interest costs) -11,347.7 -10,666.7 6.4% 20.6% -826.3 -831.7 -0.6% 6.7%

Significant items 0.0 0.0 N/A 0.0% -176.7 -6.9 2460.9% 1.4%

Earnings from continuing operations before interest and tax (EBIT) 3,386.7 3,292.9 2.8% 6.1% 277.7 434.7 -36.1% 2.3%

financing cost/expense -318.3 -300.1 6.1% 0.6% -80.3 -77.5 3.6% 0.7%

Net Profit from continuing operations before income tax 3,068.4 2,992.8 2.5% 5.6% 197.4 357.2 -44.7% 1.6%

Income tax expense -885.0 -869.2 1.8% 1.6% -71.8 -106.1 -32.3% 0.6%

Profit/Loss from continuing operations after tax 2,183.4 2,123.6 2.8% 4.0% 125.6 251.1 -50.0% 1.0%

Net profit/(loss) from discontinued operations -366.3 16.7 -2293.4% -0.7% -27.2 0.0 N/A -0.2%

Profit for the period 1,817.1 2,140.3 -15.1% 3.3% 98.4 251.1 -60.8% 0.8%

Statement of Financial Position

Assets

Cash and cash equivalents 833.4 1,519.6 -45.2% 3.9% 51.5 152.9 -66.3% 1.3%

Trade receivables (excl. Impairment allowance, other & prepayments) 231.3 211.5 9.4% 1.1% 883.6 876.1 0.9% 21.9%

Inventories 3,698.3 3,736.5 -1.0% 17.1% 833.6 954.9 -12.7% 20.6%

All other current asset items 1,039.1 859.3 20.9% 4.8% 249.9 147.8 69.1% 6.2%

Total current assets 5,802.1 6,326.9 -8.3% 26.9% 2,018.6 2,131.7 -5.3% 50.0%

Property, plant and equipment 9,589.0 8,620.3 11.2% 44.4% 224.4 197.6 13.6% 5.6%

Intangible assets 5,282.0 5,236.6 0.9% 24.5% 1,551.9 1,291.1 20.2% 38.4%

All other non-current asset items 908.0 644.6 40.9% 4.2% 243.1 179.5 35.4% 6.0%

Total non-current assets 15,779.0 14,501.5 8.8% 73.1% 2,019.4 1,668.2 21.1% 50.0%

Total assets 21,581.1 20,828.4 3.6% 100.0% 4,038.0 3,799.9 6.3% 100.0%

Libilities

Trade payables 4,013.4 4,132.0 -2.9% 18.6% 1,112.2 1,205.4 -7.7% 27.5%

Borrowings ( interest bearing current liabilities) 54.4 1,471.1 -96.3% 0.3% 17.8 8.6 107.0% 0.4%

Current provisions 939.8 861.0 9.2% 4.4% 155.1 73.4 111.3% 3.8%

All other current liability items 1,758.6 1,558.1 12.9% 8.1% 291.0 187.0 55.6% 7.2%

Total current liabilities 6,766.2 8,022.2 -15.7% 31.4% 1,576.1 1,474.4 6.9% 39.0%

Borrowings (non-current interest-bearing loans/debt) 4,695.3 3,373.8 39.2% 21.8% 974.0 826.7 17.8% 24.1%

Non-current provisions 527.3 465.2 13.3% 2.4% 151.4 54.2 179.3% 3.7%

All other non-current liability items 1,146.0 1,121.4 2.2% 5.3% 1.4 1.8 -22.2% 0.0%

Total non-current liabilities 6,368.6 4,960.4 28.4% 29.5% 1,126.8 882.7 27.7% 27.9%

Total liabilities 13,134.8 12,982.6 1.2% 60.9% 2,702.9 2,357.1 14.7% 66.9%

Equity

Contributed equity and shares held in trust 4,275.9 3,932.5 8.7% 19.8% 1,148.8 1,139.0 0.9% 28.4%

Retained earnings / (Accumulated losses) 4,163.4 3,897.5 6.8% 19.3% 86.3 208.0 -58.5% 2.1%

Reserves -243.9 -236.8 3.0% -1.1% 26.0 28.2 -7.8% 0.6%

Other -7.2 0.0 N/A 0.0% 0.0 0.0 N/A 0.0%

Total Parent Equity interest 8,188.2 7,593.2 7.8% 37.9% 1,261.1 1,375.2 -8.3% 31.2%

Non-conrolling interests in the equity 258.1 252.6 2.2% 1.2% 74.0 67.6 9.5% 1.8%

Total equity 8,446.3 7,845.8 7.7% 39.1% 1,335.1 1,442.8 -7.5% 33.1%

Total liabilities and equity 21,581.1 20,828.4 3.6% 100.0% 4,038.0 3,799.9 6.3% 100.0%

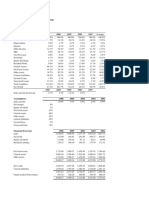

Cash Flow Statement

Net cash (used in)/provided by operating activities 2,873.8 2,991.1 -3.9% 284.3 142.5 99.5%

Net cash (used in)/provided by investing activities -2,080.3 -2,177.4 4.5% -270.6 -82.3 -228.8%

Net cash (used in)/provided by financing activities -1,469.2 -0.7 -209785.7% -115.5 -117.8 2.0%

Net increase / decrease in cash and cash equivalents -675.7 813.0 -183.1% -101.8 -57.6 -76.7%

Cash and cash equivalents at the beginning of the year 1,519.6 713.4 113.0% 152.9 210.6 -27.4%

Net foreign exchange difference 1.3 -6.8 119.1% 0.4 -0.1 500.0%

Cash and cash equivalents at the end of the year 845.2 1,519.6 -44.4% 51.5 152.9 -66.3%

Financial ratio analysis:

Gross profit margin 26.0% 25.8%

Profit margin

Operating expense ratio -20.6% -20.3%

Cash flow to sales ratio 5.2% 5.7%

Return on assets

Return on equity 26.8%

Asset turnover 2.60

Inventory turnover

Receivables turnover

Payables turnover

Days Inventory 25

Days Receivables 1

Days Payables

Cash to cash cycle / operating cycle

Current ratio 0.86 0.79

Acid (Quick) ratio 0.31 0.32

Current cash debt coverage

Debt to Equity ratio 155.5% 165.5%

Financial Leverage 255.5% 265.5%

Times interest earned

Cash debt coverage 0.22

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Insurance Agency Business PlanDocument43 pagesInsurance Agency Business PlanJoin Riot100% (5)

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Microsoft Dynamics 365 For Operations Support For If RsDocument40 pagesMicrosoft Dynamics 365 For Operations Support For If RsAlfian Noor RahmanNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Sample QCD With Life EstateDocument2 pagesSample QCD With Life Estatemarioma12No ratings yet

- Marketing Analysis Toolkit - Market Size and MarketDocument14 pagesMarketing Analysis Toolkit - Market Size and MarketMathewNo ratings yet

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Aml CFT NBI Training MaterialDocument52 pagesAml CFT NBI Training Materialdeep100% (2)

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- RelianceDocument2 pagesRelianceAADHYA KHANNANo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- FM205 CaseDocument33 pagesFM205 CaseAastik RockzzNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Name of The Company Last Financial Year First Projected Year CurrencyDocument15 pagesName of The Company Last Financial Year First Projected Year CurrencygabegwNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Finance Detective - Ratio AnalysisDocument2 pagesFinance Detective - Ratio AnalysisAndhitiawarman NugrahaNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Daniel John Gabriel FarDocument9 pagesDaniel John Gabriel FarJohn Gabriel DanielNo ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- Increase (Decrease) 2019 2018 Amount Percent Sales RevenueDocument6 pagesIncrease (Decrease) 2019 2018 Amount Percent Sales RevenuewennylynNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- Financial Performance SpreadsheetDocument4 pagesFinancial Performance SpreadsheetAngel Mae PalasNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Horizontal and Vertical Analysis of ProfitDocument3 pagesHorizontal and Vertical Analysis of ProfitIfzal AhmadNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- Ratio Analysis TemplateDocument6 pagesRatio Analysis TemplateGapar FitriNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Venture Capital NotesDocument7 pagesVenture Capital NotesRaj VidalNo ratings yet

- Chapter 13Document12 pagesChapter 13Mike PermataNo ratings yet

- Bab2 Act Development & ClassificationDocument26 pagesBab2 Act Development & ClassificationagustadivNo ratings yet

- Chapter 13 AnswersDocument5 pagesChapter 13 Answersvandung19No ratings yet

- Lawrep 036 CSLJ JL 0245Document17 pagesLawrep 036 CSLJ JL 0245Jeckl100% (1)

- Huaneng Shandong Ruyi (Pakistan) Energy PVTDocument13 pagesHuaneng Shandong Ruyi (Pakistan) Energy PVTHumaira AtharNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- ShiiiDocument59 pagesShiiiShiva Prasad KasturiNo ratings yet

- Final FMDocument17 pagesFinal FMNikita MaskaraNo ratings yet

- CH 08 - Financial OptionsDocument59 pagesCH 08 - Financial OptionsSyed Mohib HassanNo ratings yet

- A Guide To Venture Capital Term SheetsDocument54 pagesA Guide To Venture Capital Term SheetsSandeep Dhawan100% (2)

- AEB15 SM C10 v4Document28 pagesAEB15 SM C10 v4Victor LuiNo ratings yet

- Sources of Financing For New Technology Firms: A Comparison by GenderDocument20 pagesSources of Financing For New Technology Firms: A Comparison by GenderThe Ewing Marion Kauffman FoundationNo ratings yet

- Truthofthe Stock Tape PDFDocument36 pagesTruthofthe Stock Tape PDFCardoso PenhaNo ratings yet

- PTWC IssueDocument4 pagesPTWC IssueSajjad AfzalNo ratings yet

- Keycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmDocument3 pagesKeycare: Example - Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC) CapmekaarinathaNo ratings yet

- Income Tax Calculation 2010ver 10 3Document31 pagesIncome Tax Calculation 2010ver 10 3Vidya SajitNo ratings yet

- Policies ManualDocument23 pagesPolicies Manualpateljayamin100% (1)

- Casey Research Crisis & Opportunity Summit: AgendaDocument3 pagesCasey Research Crisis & Opportunity Summit: AgendaPatrick Simon-UnNo ratings yet

- Investment Analysis and Portfolio ManagementDocument33 pagesInvestment Analysis and Portfolio ManagementUqaila Mirza0% (1)

- First Learn - Then Earn (Indian Stock Market)Document31 pagesFirst Learn - Then Earn (Indian Stock Market)stardennisNo ratings yet

- Summer Training Project REPORT: "Perception of Investors Towards Investing in Uti Mutual Fund"Document30 pagesSummer Training Project REPORT: "Perception of Investors Towards Investing in Uti Mutual Fund"Pihu SharmaNo ratings yet

- A Few Thoughts On The Parag Parikh Flexicap Fund Completing 10 Years Since LaunchDocument2 pagesA Few Thoughts On The Parag Parikh Flexicap Fund Completing 10 Years Since Launchsathiya J100% (1)

- Dissolution of PartnershipDocument42 pagesDissolution of PartnershipRahul Singh67% (3)

- Britannia Industry AnalysisDocument10 pagesBritannia Industry AnalysisTomthin Ahanthem100% (1)