Professional Documents

Culture Documents

Proforma

Proforma

Uploaded by

WORLD STAR0 ratings0% found this document useful (0 votes)

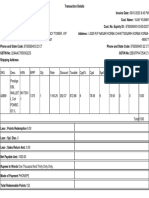

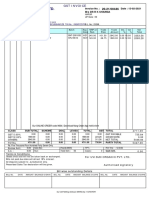

57 views2 pagesThis proforma invoice from World Star to Navkar Uniform provides pricing details for various notebooks, scrapbooks, and other school supplies. It lists 9 items being sold including jumbo notebooks, long books, scrapbooks, and three-ring binders. The total amount due is Rs. 19,69,090.35 with terms of 50% advance payment and the remaining on delivery within 15-20 days pending order confirmation, payment, and artwork approval. The invoice also includes the company's GSTIN and CST numbers as well as a declaration that all sales will be properly reported and taxes paid.

Original Description:

Procorma

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis proforma invoice from World Star to Navkar Uniform provides pricing details for various notebooks, scrapbooks, and other school supplies. It lists 9 items being sold including jumbo notebooks, long books, scrapbooks, and three-ring binders. The total amount due is Rs. 19,69,090.35 with terms of 50% advance payment and the remaining on delivery within 15-20 days pending order confirmation, payment, and artwork approval. The invoice also includes the company's GSTIN and CST numbers as well as a declaration that all sales will be properly reported and taxes paid.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

57 views2 pagesProforma

Proforma

Uploaded by

WORLD STARThis proforma invoice from World Star to Navkar Uniform provides pricing details for various notebooks, scrapbooks, and other school supplies. It lists 9 items being sold including jumbo notebooks, long books, scrapbooks, and three-ring binders. The total amount due is Rs. 19,69,090.35 with terms of 50% advance payment and the remaining on delivery within 15-20 days pending order confirmation, payment, and artwork approval. The invoice also includes the company's GSTIN and CST numbers as well as a declaration that all sales will be properly reported and taxes paid.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

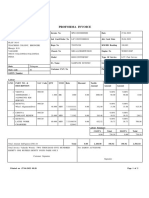

PROFORMA INVOICE

WORLD STAR Invoice No. 661

237, A.R.STREET,BARAR HOUSE. Date ; 9/6/2019

MUMBAI-400003 Delivery Note

TEL.NO.23451651 // FAX NO.23451652

E-MAIL:worldstar237@gmail.com Supplier's Ref.

Buyer NAVKAR UNIFORM Buyer's Order No.

Despatc Document No.

Despatched through

GST NO.:

Mob : 97736 73564

No. Description Qty Unit Rate Amount GST G Amt Total

1 Jumbo NB 100 Pg SL Hardbound with Pinning No Index 17506 Per Pc 8.7 152302.2 12% 18276.264 170578.464

2 Jumbo NB 200 Pg SL Hardbound with Pinning No Index 43252 Per Pc 13.4 579576.8 12% 69549.216 649126.016

3 Jumbo NB 200 Pg DL Hardbound with Pinning No Index 8648 Per Pc 13.4 115883.2 12% 13905.984 129789.184

4 Jumbo NB 200 Pg R/B Hardbound with Pinning No Index 8272 Per Pc 13.4 110844.8 12% 13301.376 124146.176

5 Jumbo NB 200 Pg Med Sq Hardbound with Pinning No Index 8916 Per Pc 13.4 119474.4 12% 14336.928 133811.328

6 Long Book 17 X 27cm 180 Pg Softbound No Index 25712 Per Pc 18.5 475672 12% 57080.64 532752.64

7 A5 Size 32Pg Scrap Book Ruled No Index 7093 Per Pc 19.0 134767 12% 16172.04 150939.04

8 3A TK red Size 36Pg Without Cover No Index 3622 Per Pc 10.5 38031 0% 0 38031

9 3A Jumbo Yellow Size 36Pg Without Cover No Index 3471 Per Pc 11.5 39916.5 0% 0 39916.5

Terms & Conditions:

1 Payment: 50% advance and rest against delivery.

2 Delivery: 15 to 20 days after confirmation of order, payment and approval of artwork.

3 Delivery charges Free at one Location

4 Unloading to be done by party, If not by party then extra Hamali Charges applicable

Total Amt. 1969090.35

Amount Chargeable (in words)

Rs. Nineteen lakhs Sixty Nine Thousand Ninety Only.

VAT Amount (in words)

Company's GSTIN : 27AAAFW0320K1ZE

Company's CST No. : 27180366897 C w.e.f. 1-4-06

Company's Service Tax No. :

Buyer's VAT TIN :

Company's PAN : AAAFW0320K

Declaration

"I/WE hereby certify that my/our registration certificate under the

Maharashtra Value Added Tax Act.2002 is in force on the date on which the

sale of the goods specified in this Tax Invoice is made by me/us and that the

transaction of sale covered by this Tax Invoice has been effected by me/us

and it shall be accounted for in the turnover of sales while filing of return

and the due tax, if any payable on the sale has been paid or shall be paid"

You might also like

- TETRA Engineered Solutions GuideDocument247 pagesTETRA Engineered Solutions GuideChandrasekar Srinivas MohanNo ratings yet

- The Cellular Level of Organization - AnaphyDocument12 pagesThe Cellular Level of Organization - AnaphyJean Rose SalahayNo ratings yet

- Millipore AcademicDocument93 pagesMillipore Academickron541No ratings yet

- Ajio FN4044406978 1705833538362Document1 pageAjio FN4044406978 1705833538362ShubhamNo ratings yet

- Sovachem & Co.: Tax InvoiceDocument1 pageSovachem & Co.: Tax InvoiceSohamNo ratings yet

- B398 Yog Assembled PCDocument2 pagesB398 Yog Assembled PCkannanunnichangalathNo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument2 pagesReliance Retail Limited Tax Invoice: Original For RecipientMainpal YadavNo ratings yet

- Frank 128 83900Document1 pageFrank 128 83900Aniket RoyNo ratings yet

- Tax Invoice: Kedia PolymerDocument1 pageTax Invoice: Kedia Polymerchotonpl95No ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument2 pagesReliance Retail Limited Tax Invoice: Original For RecipientMainpal YadavNo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument2 pagesReliance Retail Limited Tax Invoice: Original For RecipientMainpal YadavNo ratings yet

- IKEA billPrint23Mar20201018300605Document70 pagesIKEA billPrint23Mar20201018300605Ahsan DharNo ratings yet

- JJM BillDocument2 pagesJJM Billdas.abinash9777No ratings yet

- GoldenDocument1 pageGoldenGOLDEN MOTORSNo ratings yet

- Big Bazar BillDocument2 pagesBig Bazar Billvilge rogesonNo ratings yet

- Ajio 1706695309257Document1 pageAjio 1706695309257shaelkmr550No ratings yet

- Proforma Invoice and Purchase Agreement No.3011093Document3 pagesProforma Invoice and Purchase Agreement No.3011093dk3977891No ratings yet

- Ajio 1706695304396Document2 pagesAjio 1706695304396shaelkmr550No ratings yet

- FN0020505339Document2 pagesFN0020505339Viresh ImmannavarNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- Imtiaz SRG 18 07 2023Document1 pageImtiaz SRG 18 07 2023mycomputer5511No ratings yet

- No of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Document2 pagesNo of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Prashant Kumar SwarnakarNo ratings yet

- SSC SupplyOutward 2024-25-00022Document2 pagesSSC SupplyOutward 2024-25-00022sonalsales2012No ratings yet

- Sane Retail Private Limited,: Grand TotalDocument1 pageSane Retail Private Limited,: Grand TotalBhaskarNo ratings yet

- S7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDDocument1 pageS7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDRaj RishiNo ratings yet

- Ajio FN4044406978 1705833492543Document1 pageAjio FN4044406978 1705833492543ShubhamNo ratings yet

- 9517309706Document2 pages9517309706Doita Dutta ChoudhuryNo ratings yet

- KA01MF6346Document29 pagesKA01MF6346kamran.shahNo ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- TS30T4398 LabourDocument2 pagesTS30T4398 Labourphani kumarNo ratings yet

- SalesBill GT 1020Document1 pageSalesBill GT 1020pkNo ratings yet

- Sales Invoice 2221351033 Dated 09.09.2022Document2 pagesSales Invoice 2221351033 Dated 09.09.2022Jyoti PrakashNo ratings yet

- 158Document3 pages158Amit Kumar AgarwalNo ratings yet

- Tax Invoice Cum Challan: Sancheti AssociatesDocument2 pagesTax Invoice Cum Challan: Sancheti AssociatesRahul SahaNo ratings yet

- Veerco SLQT PI - 2537 121617Document2 pagesVeerco SLQT PI - 2537 121617designNo ratings yet

- 24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceDocument2 pages24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceSunil PatelNo ratings yet

- Bill 156623CS 12Document2 pagesBill 156623CS 12chakri0019No ratings yet

- SLKO993237803457382RPOSDocument1 pageSLKO993237803457382RPOSJayant kumarNo ratings yet

- Plain Sheet g28Document1 pagePlain Sheet g28Solomon kagimuNo ratings yet

- Work OrderDocument4 pagesWork Orderajaydas.itesNo ratings yet

- Ajio 1706694074008Document1 pageAjio 1706694074008shaelkmr550No ratings yet

- INDIA IWORLD 11 ProDocument3 pagesINDIA IWORLD 11 ProkalpanasinghkotmaNo ratings yet

- Report 55018Document2 pagesReport 55018gbataanaaNo ratings yet

- Maa Durga Industries: C-1 Chandpole Anaj MandiDocument1 pageMaa Durga Industries: C-1 Chandpole Anaj Mandiragavaga453No ratings yet

- InvoiceDocument2 pagesInvoiceIruleswar IrulesNo ratings yet

- CamScanner 980Document1 pageCamScanner 980desimunda.9804No ratings yet

- Ajio 1706695306292Document1 pageAjio 1706695306292shaelkmr550No ratings yet

- OD125609579198922000Document3 pagesOD125609579198922000sachin shawNo ratings yet

- Wa0012.Document1 pageWa0012.prashant.jamdar42No ratings yet

- Sales - GST - 12Document1 pageSales - GST - 12Madhur GuptaNo ratings yet

- Invoice OD508245269431558000Document1 pageInvoice OD508245269431558000JagadeeshSiriselaNo ratings yet

- 319 - TaxDocument2 pages319 - TaxDileep ShuklaNo ratings yet

- Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018Document1 pageTax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018RNo ratings yet

- Your BillDocument3 pagesYour Billsiddhmax21No ratings yet

- Ambika: Tax Invoice OriginalDocument3 pagesAmbika: Tax Invoice OriginalDare DevilNo ratings yet

- Bill5-882 - 5Document1 pageBill5-882 - 5harshoffice29No ratings yet

- InvoiceDocument2 pagesInvoiceShivaNo ratings yet

- Invoice 1605-23-S-726Document1 pageInvoice 1605-23-S-726Chintada Netaji PraneethNo ratings yet

- Ajio FN4440409996 1684686891319Document3 pagesAjio FN4440409996 1684686891319rama krishnaNo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Proforma Invoice and Purchase Agreement No.1813972Document6 pagesProforma Invoice and Purchase Agreement No.1813972MauroRajaNo ratings yet

- MBA Unemployment ReportDocument19 pagesMBA Unemployment ReportShiva NandNo ratings yet

- Datasheet (10) Fuente ConmutadaDocument11 pagesDatasheet (10) Fuente ConmutadaJose Antonio SeguraNo ratings yet

- Krauss-Maffei Disc and Drum Filters: Ssfe, TDF, TSFDocument16 pagesKrauss-Maffei Disc and Drum Filters: Ssfe, TDF, TSFetsimoNo ratings yet

- Sensation and Perception: Chapter FiveDocument44 pagesSensation and Perception: Chapter FiveGeneva SBENo ratings yet

- Antifoam Solutions: Antifoams As API & Process Aid Solid Dosage Forms With Liquid APIDocument6 pagesAntifoam Solutions: Antifoams As API & Process Aid Solid Dosage Forms With Liquid APIfelipe geymerNo ratings yet

- BHO CAMP 3 - Clash of The PrivateDocument522 pagesBHO CAMP 3 - Clash of The PrivateBabylyn SusulanNo ratings yet

- Theme Based ActivitiesDocument26 pagesTheme Based ActivitiesSanta Dela Cruz NaluzNo ratings yet

- CHEMISTRY (XI, XII & Medical) by VIJAY KUMAR (M.Sc. B.Ed.)Document8 pagesCHEMISTRY (XI, XII & Medical) by VIJAY KUMAR (M.Sc. B.Ed.)Vijay Kumar100% (1)

- Wa0008Document513 pagesWa0008miharnuti.uripNo ratings yet

- MLS Blocker Practical GuideDocument16 pagesMLS Blocker Practical Guideashutosh pandeyNo ratings yet

- Liz GreenDocument12 pagesLiz GreenPeter Sellmer100% (1)

- Funds Flow StatementDocument11 pagesFunds Flow Statementkulife50% (4)

- Micom BIU241-A02 SupplyDocument1 pageMicom BIU241-A02 SupplyYasser RagabNo ratings yet

- Nursing Care Plan Neonatal Intensive Care Unit: All India Institute of Medical Sciences, RishikeshDocument14 pagesNursing Care Plan Neonatal Intensive Care Unit: All India Institute of Medical Sciences, RishikeshArchna Yadav100% (1)

- Grelha Avaliação ITLSDocument2 pagesGrelha Avaliação ITLSMargarida ReisNo ratings yet

- In This Issue : Summer Photo ContestDocument4 pagesIn This Issue : Summer Photo ContestCarrie Aldrich MaliszewskiNo ratings yet

- ThyssenKrupp - Open Pit Mining Systems and EquipmentDocument28 pagesThyssenKrupp - Open Pit Mining Systems and EquipmentBoy Alfredo100% (1)

- Bài tập Anh 8 theo chuyên đề 1. NGỮ ÂM E 8 (UNIT 7-12) NDocument8 pagesBài tập Anh 8 theo chuyên đề 1. NGỮ ÂM E 8 (UNIT 7-12) NQuang Hưng NguyễnNo ratings yet

- Permintaan Pustu Burmeso Agustus 2023Document3 pagesPermintaan Pustu Burmeso Agustus 2023Black Bullet13No ratings yet

- Developmental Victimology - The Comprehensive Study of Childhood Victimizations PDFDocument26 pagesDevelopmental Victimology - The Comprehensive Study of Childhood Victimizations PDFatjoerossNo ratings yet

- National Population PolicyDocument28 pagesNational Population PolicyPinki BarmanNo ratings yet

- Ex 2 EnzymesDocument6 pagesEx 2 EnzymesCorinne TadeNo ratings yet

- PDEV2111 Lesson 5 Challengers of Middle and Late AdolescenceDocument5 pagesPDEV2111 Lesson 5 Challengers of Middle and Late AdolescenceJohn RoasaNo ratings yet

- United States v. David Christopher Schaefer, 11th Cir. (2016)Document7 pagesUnited States v. David Christopher Schaefer, 11th Cir. (2016)Scribd Government DocsNo ratings yet

- Romantic Dinner 2022 - PDR-1Document7 pagesRomantic Dinner 2022 - PDR-1Cornelius DavidNo ratings yet

- Mixers and Flowmakers: SMD, SMG and SFGDocument68 pagesMixers and Flowmakers: SMD, SMG and SFGDany Pilu0% (1)

- Chelsea HY25-2859-Part List PTODocument20 pagesChelsea HY25-2859-Part List PTOPrajna SatyaNo ratings yet