Professional Documents

Culture Documents

Applicability of The Finance Act For December, 2019

Applicability of The Finance Act For December, 2019

Uploaded by

janardhan CA,CSCopyright:

Available Formats

You might also like

- Applicability of The Finance Act For June 2019Document1 pageApplicability of The Finance Act For June 2019Josef AnthonyNo ratings yet

- UntitledDocument1 pageUntitledKnow the FactsNo ratings yet

- Fifl' : Indira Gandhi National Garhi, Student EvaluationDocument5 pagesFifl' : Indira Gandhi National Garhi, Student EvaluationManoj VishwakarmaNo ratings yet

- Aphermc Guidelines 2020-23 PDFDocument9 pagesAphermc Guidelines 2020-23 PDFSantoshHsotnasNo ratings yet

- Indirect Tax Laws: Final Course Study MaterialDocument17 pagesIndirect Tax Laws: Final Course Study MaterialoverclockthesunNo ratings yet

- Assignment 2020-2021: For July 2020 and January 2021 Admission CycleDocument5 pagesAssignment 2020-2021: For July 2020 and January 2021 Admission CycleSukhetha polamNo ratings yet

- Exam Guidelines (R)Document4 pagesExam Guidelines (R)RishabhGupta 2k20umba32No ratings yet

- Notification - Methodology For Undertaking Summer Internship, Summer Training by Students PDFDocument2 pagesNotification - Methodology For Undertaking Summer Internship, Summer Training by Students PDFMudakir FaziliNo ratings yet

- Fees StructureDocument1 pageFees Structuredev_1989No ratings yet

- Circular No. SIU/EXAM/605/30 of 2019 Faculty of Management Symbiosis Institute of Business Management (Sibm-P)Document7 pagesCircular No. SIU/EXAM/605/30 of 2019 Faculty of Management Symbiosis Institute of Business Management (Sibm-P)Harsh JainNo ratings yet

- Programme RegulationsDocument115 pagesProgramme RegulationsPrince AdityaNo ratings yet

- Sharda University: Office of The RegistrarDocument3 pagesSharda University: Office of The RegistrarAhmed KhanNo ratings yet

- Closure of Semesters and Academic Year, 2019-20Document2 pagesClosure of Semesters and Academic Year, 2019-20Cosmk1ng Zero-1No ratings yet

- Academic Calendar 2019 - 20: RegistrationDocument4 pagesAcademic Calendar 2019 - 20: RegistrationPrakhar AgarwalNo ratings yet

- BDP Renewal NotificationDocument1 pageBDP Renewal NotificationSanjay ChowdhuryNo ratings yet

- Notification For Intermediate Year Students-4!6!2020Document4 pagesNotification For Intermediate Year Students-4!6!2020Mudit FauzdarNo ratings yet

- Schedule For External Examination - October 2018 and April 2019 Season - BA-BBA. LL.B. - Academic Year 2018-19Document4 pagesSchedule For External Examination - October 2018 and April 2019 Season - BA-BBA. LL.B. - Academic Year 2018-19Apurva SinghNo ratings yet

- TEE June 2021 Notification-09 - 07 - 2021Document2 pagesTEE June 2021 Notification-09 - 07 - 2021Garima SinghNo ratings yet

- Lovely Professional UniversityDocument3 pagesLovely Professional UniversitySam KNo ratings yet

- Applicability of The Finance Act For December 2017 PDFDocument1 pageApplicability of The Finance Act For December 2017 PDFSidharthNo ratings yet

- Attention Students: Applicability of The Finance Act For December 2017 ExaminationsDocument1 pageAttention Students: Applicability of The Finance Act For December 2017 ExaminationsSidharthNo ratings yet

- Extract From The MinutesDocument2 pagesExtract From The MinutesNoble MathewsNo ratings yet

- 67080bos54079 M1ipDocument17 pages67080bos54079 M1iprnathNo ratings yet

- NIRF Format For Teaching DepartmentsDocument4 pagesNIRF Format For Teaching DepartmentsSARIT SEKHAR MUKHERJEENo ratings yet

- Even Semester For Continuing Batch: Interim ACADEMIC CALENDAR 2019Document2 pagesEven Semester For Continuing Batch: Interim ACADEMIC CALENDAR 2019sajalgiriNo ratings yet

- Applicable Study Material For May, 2019 Exams - New Scheme Foundation, Intermediate and Final CourseDocument3 pagesApplicable Study Material For May, 2019 Exams - New Scheme Foundation, Intermediate and Final CourseGaneshaNo ratings yet

- Programmes Session Courses For Exemption: Instruction Under Exemption CategoryDocument1 pageProgrammes Session Courses For Exemption: Instruction Under Exemption CategoryAll India VideoNo ratings yet

- Circular On Fall Semester 2020 - 2021 Course RegistrationDocument1 pageCircular On Fall Semester 2020 - 2021 Course RegistrationPRANAV KUMAR 17BEC0473No ratings yet

- Guidelines On The Preparation of Pivot Idea Lesson ExemplarsDocument10 pagesGuidelines On The Preparation of Pivot Idea Lesson ExemplarsRaniel R BillonesNo ratings yet

- Integrated MBA Program (Accounting & Finance) School of Management, BBD UniversityDocument178 pagesIntegrated MBA Program (Accounting & Finance) School of Management, BBD UniversitySourav MishraNo ratings yet

- Human Resource ManagementDocument5 pagesHuman Resource ManagementSrijani DasNo ratings yet

- Notice CA PCA PDFDocument1 pageNotice CA PCA PDFbangs34No ratings yet

- Circular On Fall Sem 2020-21 RegistrationDocument1 pageCircular On Fall Sem 2020-21 RegistrationGame-changerNo ratings yet

- Faculty of Commerce and Management (Revised As On Dated 23/08/2019)Document5 pagesFaculty of Commerce and Management (Revised As On Dated 23/08/2019)TejasNo ratings yet

- BCom-Accounting-Finance (Integrated ACCA)Document3 pagesBCom-Accounting-Finance (Integrated ACCA)Abhishek RathodNo ratings yet

- Summer Internship-Law 2020Document22 pagesSummer Internship-Law 2020BIASED WORDS with Madhur RathaurNo ratings yet

- Academic Calendar of Events ODD Semester 2019Document2 pagesAcademic Calendar of Events ODD Semester 2019Darshan .MNo ratings yet

- RGNUL - Fee Relief RequestDocument22 pagesRGNUL - Fee Relief RequestVijay Srinivas KukkalaNo ratings yet

- Executive Programme (Old Syllabus) : Students Appearing in June 2019 Examination Shall Note The FollowingDocument3 pagesExecutive Programme (Old Syllabus) : Students Appearing in June 2019 Examination Shall Note The FollowingyashNo ratings yet

- GUCircular B.E PDFDocument2 pagesGUCircular B.E PDFLelan de SouzaNo ratings yet

- AcademicCalendar Full-Time Programmes AutumnTerm2019-20Document1 pageAcademicCalendar Full-Time Programmes AutumnTerm2019-20sandeep thodkarNo ratings yet

- Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsDocument1 pagePaper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsKarandeep Singh TuliNo ratings yet

- Academic Calendar (2019 2020) : Semester: July December 2019 Semester: January June 2020Document1 pageAcademic Calendar (2019 2020) : Semester: July December 2019 Semester: January June 2020Sp SinghNo ratings yet

- Two Year Mba Financial Markets Part 1 Syllabi and Course SchemeDocument36 pagesTwo Year Mba Financial Markets Part 1 Syllabi and Course SchemeOmesh JindalNo ratings yet

- Idt Vol-1 May Nov 2021 Exam PDFDocument616 pagesIdt Vol-1 May Nov 2021 Exam PDFSri Pavan100% (1)

- Schedule of Fees For The Academic Year 2020-21 First Degree (FD)Document4 pagesSchedule of Fees For The Academic Year 2020-21 First Degree (FD)Pranshu SaraswatNo ratings yet

- MAR ReclarificationsDocument5 pagesMAR ReclarificationsAritra BanerjeeNo ratings yet

- Project / Dissertation Activity: ND RD THDocument3 pagesProject / Dissertation Activity: ND RD THNishant ChaudharyNo ratings yet

- Bos 51896 NewDocument3 pagesBos 51896 NewSrinivasa GraphicsNo ratings yet

- Program Name Program Code Semester/ Year Total No. of Students Appeared 2020-2021Document8 pagesProgram Name Program Code Semester/ Year Total No. of Students Appeared 2020-2021Kal VenNo ratings yet

- Comm & MGMT 01 Summer 2022Document2 pagesComm & MGMT 01 Summer 2022Salil SarvagodNo ratings yet

- Adobe Scan 06 Sep 2021Document1 pageAdobe Scan 06 Sep 2021Sachin KandloorNo ratings yet

- PGP 2019 Offer Annexures - 08042019Document8 pagesPGP 2019 Offer Annexures - 08042019Saachi PrakashNo ratings yet

- Areas Status Actions Being Taken Expected Finish DateDocument3 pagesAreas Status Actions Being Taken Expected Finish DateRolly AbelonNo ratings yet

- Cpale-Syllabi-2018 - CPALE Syllabus Effective May 2019 - UE ..Document2 pagesCpale-Syllabi-2018 - CPALE Syllabus Effective May 2019 - UE ..Ian RelacionNo ratings yet

- Disposable Temporary EmailDocument1 pageDisposable Temporary Emailamit kumar singhNo ratings yet

- Notice Regarding Dates of University Exams 2019-20 Even Semester1589088098111Document1 pageNotice Regarding Dates of University Exams 2019-20 Even Semester1589088098111anil chaudharyNo ratings yet

- School of CommerceDocument10 pagesSchool of CommerceAkshay AgarwalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

Applicability of The Finance Act For December, 2019

Applicability of The Finance Act For December, 2019

Uploaded by

janardhan CA,CSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Applicability of The Finance Act For December, 2019

Applicability of The Finance Act For December, 2019

Uploaded by

janardhan CA,CSCopyright:

Available Formats

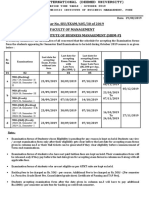

24th July, 2019

Attention Students

Applicability of the Finance Act, 2018 for December, 2019 Examinations

Students may note that the Finance Act, 2018 i.e. Assessment Year 2019-20 / Previous Year

2018-19 is applicable in December, 2019 examinations for the following papers:

Executive Programme (Old Syllabus)

(i) Tax Laws and Practice (Module-1, Paper-4)

Executive Programme (New Syllabus)

(ii) Tax Laws (Module-1, Paper-4)

Professional Programme (Old Syllabus)

(iii) Advanced Tax Laws and Practice (Module-3, Paper-7)

Professional Programme (New Syllabus)

(iv) Advanced Tax Laws (Module-1 Paper-2)

Professional Programme (New Syllabus)

(v) Direct Tax Law and Practice (Module-3, Elective Paper-9.5)

Students may also note that: For Indirect Taxes:

i. Goods and Services Tax (GST) is applicable for Executive Programme (Old Syllabus)

ii. Goods and Services Tax ‘GST’ & Customs Law is applicable for Executive Programme

(New Syllabus)

iii. Goods and Services Tax ‘GST’ & Customs Law is applicable for Professional

Programme (Old as well as New Syllabus).

Students are also required to update themselves on all the relevant Rules, Notifications,

Circulars, Clarifications, etc. issued by the CBDT, CBIC & Central Government, on or before six

months prior to the date of the December, 2019 Examination.

Note: The Finance Act 2019 (The Interim Budget 2019) will not be applicable for CS December,

2019 Exam in Taxation Paper at CS Executive and Professional Programme as the Amendments

related to Interim Budget (Finance Act, 2019) is applicable for the Assessment Year 2020-21 i.e.

Financial Year 2019-20. Therefore, the same is applicable for June, 2020 Exam.

Director

Dte. of Academics

You might also like

- Applicability of The Finance Act For June 2019Document1 pageApplicability of The Finance Act For June 2019Josef AnthonyNo ratings yet

- UntitledDocument1 pageUntitledKnow the FactsNo ratings yet

- Fifl' : Indira Gandhi National Garhi, Student EvaluationDocument5 pagesFifl' : Indira Gandhi National Garhi, Student EvaluationManoj VishwakarmaNo ratings yet

- Aphermc Guidelines 2020-23 PDFDocument9 pagesAphermc Guidelines 2020-23 PDFSantoshHsotnasNo ratings yet

- Indirect Tax Laws: Final Course Study MaterialDocument17 pagesIndirect Tax Laws: Final Course Study MaterialoverclockthesunNo ratings yet

- Assignment 2020-2021: For July 2020 and January 2021 Admission CycleDocument5 pagesAssignment 2020-2021: For July 2020 and January 2021 Admission CycleSukhetha polamNo ratings yet

- Exam Guidelines (R)Document4 pagesExam Guidelines (R)RishabhGupta 2k20umba32No ratings yet

- Notification - Methodology For Undertaking Summer Internship, Summer Training by Students PDFDocument2 pagesNotification - Methodology For Undertaking Summer Internship, Summer Training by Students PDFMudakir FaziliNo ratings yet

- Fees StructureDocument1 pageFees Structuredev_1989No ratings yet

- Circular No. SIU/EXAM/605/30 of 2019 Faculty of Management Symbiosis Institute of Business Management (Sibm-P)Document7 pagesCircular No. SIU/EXAM/605/30 of 2019 Faculty of Management Symbiosis Institute of Business Management (Sibm-P)Harsh JainNo ratings yet

- Programme RegulationsDocument115 pagesProgramme RegulationsPrince AdityaNo ratings yet

- Sharda University: Office of The RegistrarDocument3 pagesSharda University: Office of The RegistrarAhmed KhanNo ratings yet

- Closure of Semesters and Academic Year, 2019-20Document2 pagesClosure of Semesters and Academic Year, 2019-20Cosmk1ng Zero-1No ratings yet

- Academic Calendar 2019 - 20: RegistrationDocument4 pagesAcademic Calendar 2019 - 20: RegistrationPrakhar AgarwalNo ratings yet

- BDP Renewal NotificationDocument1 pageBDP Renewal NotificationSanjay ChowdhuryNo ratings yet

- Notification For Intermediate Year Students-4!6!2020Document4 pagesNotification For Intermediate Year Students-4!6!2020Mudit FauzdarNo ratings yet

- Schedule For External Examination - October 2018 and April 2019 Season - BA-BBA. LL.B. - Academic Year 2018-19Document4 pagesSchedule For External Examination - October 2018 and April 2019 Season - BA-BBA. LL.B. - Academic Year 2018-19Apurva SinghNo ratings yet

- TEE June 2021 Notification-09 - 07 - 2021Document2 pagesTEE June 2021 Notification-09 - 07 - 2021Garima SinghNo ratings yet

- Lovely Professional UniversityDocument3 pagesLovely Professional UniversitySam KNo ratings yet

- Applicability of The Finance Act For December 2017 PDFDocument1 pageApplicability of The Finance Act For December 2017 PDFSidharthNo ratings yet

- Attention Students: Applicability of The Finance Act For December 2017 ExaminationsDocument1 pageAttention Students: Applicability of The Finance Act For December 2017 ExaminationsSidharthNo ratings yet

- Extract From The MinutesDocument2 pagesExtract From The MinutesNoble MathewsNo ratings yet

- 67080bos54079 M1ipDocument17 pages67080bos54079 M1iprnathNo ratings yet

- NIRF Format For Teaching DepartmentsDocument4 pagesNIRF Format For Teaching DepartmentsSARIT SEKHAR MUKHERJEENo ratings yet

- Even Semester For Continuing Batch: Interim ACADEMIC CALENDAR 2019Document2 pagesEven Semester For Continuing Batch: Interim ACADEMIC CALENDAR 2019sajalgiriNo ratings yet

- Applicable Study Material For May, 2019 Exams - New Scheme Foundation, Intermediate and Final CourseDocument3 pagesApplicable Study Material For May, 2019 Exams - New Scheme Foundation, Intermediate and Final CourseGaneshaNo ratings yet

- Programmes Session Courses For Exemption: Instruction Under Exemption CategoryDocument1 pageProgrammes Session Courses For Exemption: Instruction Under Exemption CategoryAll India VideoNo ratings yet

- Circular On Fall Semester 2020 - 2021 Course RegistrationDocument1 pageCircular On Fall Semester 2020 - 2021 Course RegistrationPRANAV KUMAR 17BEC0473No ratings yet

- Guidelines On The Preparation of Pivot Idea Lesson ExemplarsDocument10 pagesGuidelines On The Preparation of Pivot Idea Lesson ExemplarsRaniel R BillonesNo ratings yet

- Integrated MBA Program (Accounting & Finance) School of Management, BBD UniversityDocument178 pagesIntegrated MBA Program (Accounting & Finance) School of Management, BBD UniversitySourav MishraNo ratings yet

- Human Resource ManagementDocument5 pagesHuman Resource ManagementSrijani DasNo ratings yet

- Notice CA PCA PDFDocument1 pageNotice CA PCA PDFbangs34No ratings yet

- Circular On Fall Sem 2020-21 RegistrationDocument1 pageCircular On Fall Sem 2020-21 RegistrationGame-changerNo ratings yet

- Faculty of Commerce and Management (Revised As On Dated 23/08/2019)Document5 pagesFaculty of Commerce and Management (Revised As On Dated 23/08/2019)TejasNo ratings yet

- BCom-Accounting-Finance (Integrated ACCA)Document3 pagesBCom-Accounting-Finance (Integrated ACCA)Abhishek RathodNo ratings yet

- Summer Internship-Law 2020Document22 pagesSummer Internship-Law 2020BIASED WORDS with Madhur RathaurNo ratings yet

- Academic Calendar of Events ODD Semester 2019Document2 pagesAcademic Calendar of Events ODD Semester 2019Darshan .MNo ratings yet

- RGNUL - Fee Relief RequestDocument22 pagesRGNUL - Fee Relief RequestVijay Srinivas KukkalaNo ratings yet

- Executive Programme (Old Syllabus) : Students Appearing in June 2019 Examination Shall Note The FollowingDocument3 pagesExecutive Programme (Old Syllabus) : Students Appearing in June 2019 Examination Shall Note The FollowingyashNo ratings yet

- GUCircular B.E PDFDocument2 pagesGUCircular B.E PDFLelan de SouzaNo ratings yet

- AcademicCalendar Full-Time Programmes AutumnTerm2019-20Document1 pageAcademicCalendar Full-Time Programmes AutumnTerm2019-20sandeep thodkarNo ratings yet

- Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsDocument1 pagePaper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsKarandeep Singh TuliNo ratings yet

- Academic Calendar (2019 2020) : Semester: July December 2019 Semester: January June 2020Document1 pageAcademic Calendar (2019 2020) : Semester: July December 2019 Semester: January June 2020Sp SinghNo ratings yet

- Two Year Mba Financial Markets Part 1 Syllabi and Course SchemeDocument36 pagesTwo Year Mba Financial Markets Part 1 Syllabi and Course SchemeOmesh JindalNo ratings yet

- Idt Vol-1 May Nov 2021 Exam PDFDocument616 pagesIdt Vol-1 May Nov 2021 Exam PDFSri Pavan100% (1)

- Schedule of Fees For The Academic Year 2020-21 First Degree (FD)Document4 pagesSchedule of Fees For The Academic Year 2020-21 First Degree (FD)Pranshu SaraswatNo ratings yet

- MAR ReclarificationsDocument5 pagesMAR ReclarificationsAritra BanerjeeNo ratings yet

- Project / Dissertation Activity: ND RD THDocument3 pagesProject / Dissertation Activity: ND RD THNishant ChaudharyNo ratings yet

- Bos 51896 NewDocument3 pagesBos 51896 NewSrinivasa GraphicsNo ratings yet

- Program Name Program Code Semester/ Year Total No. of Students Appeared 2020-2021Document8 pagesProgram Name Program Code Semester/ Year Total No. of Students Appeared 2020-2021Kal VenNo ratings yet

- Comm & MGMT 01 Summer 2022Document2 pagesComm & MGMT 01 Summer 2022Salil SarvagodNo ratings yet

- Adobe Scan 06 Sep 2021Document1 pageAdobe Scan 06 Sep 2021Sachin KandloorNo ratings yet

- PGP 2019 Offer Annexures - 08042019Document8 pagesPGP 2019 Offer Annexures - 08042019Saachi PrakashNo ratings yet

- Areas Status Actions Being Taken Expected Finish DateDocument3 pagesAreas Status Actions Being Taken Expected Finish DateRolly AbelonNo ratings yet

- Cpale-Syllabi-2018 - CPALE Syllabus Effective May 2019 - UE ..Document2 pagesCpale-Syllabi-2018 - CPALE Syllabus Effective May 2019 - UE ..Ian RelacionNo ratings yet

- Disposable Temporary EmailDocument1 pageDisposable Temporary Emailamit kumar singhNo ratings yet

- Notice Regarding Dates of University Exams 2019-20 Even Semester1589088098111Document1 pageNotice Regarding Dates of University Exams 2019-20 Even Semester1589088098111anil chaudharyNo ratings yet

- School of CommerceDocument10 pagesSchool of CommerceAkshay AgarwalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet