Professional Documents

Culture Documents

AUD Review To BSA Quali 2019

AUD Review To BSA Quali 2019

Uploaded by

Princess BanquilCopyright:

Available Formats

You might also like

- Standard Operating Procedures: SOP For Fixed Assets ManagementDocument26 pagesStandard Operating Procedures: SOP For Fixed Assets ManagementShrasti Varshney67% (3)

- Internal Audit ProgramDocument8 pagesInternal Audit ProgramKrishna Khandelwal100% (3)

- 5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andDocument2 pages5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andAngeloNo ratings yet

- TOA - 01-CASH AND CASH EQUIVALENTS W - SOLDocument5 pagesTOA - 01-CASH AND CASH EQUIVALENTS W - SOLPachi100% (1)

- PTI Organisation of International Chapters (OIC) by LawsDocument15 pagesPTI Organisation of International Chapters (OIC) by LawsInsaf.PK67% (3)

- Pressure Vessel CertificationDocument4 pagesPressure Vessel CertificationalokbdasNo ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- Quiz Bowlers' Society Auditing TheoryDocument8 pagesQuiz Bowlers' Society Auditing TheorysarahbeeNo ratings yet

- Aaconapps2 00-C92pb2aDocument17 pagesAaconapps2 00-C92pb2aJane DizonNo ratings yet

- Test Bank Auditing and Assurance Services 13e by Arens Chapter 14 PDF FreeDocument16 pagesTest Bank Auditing and Assurance Services 13e by Arens Chapter 14 PDF FreeNora AlghanemNo ratings yet

- DocxDocument86 pagesDocxMubarrach MatabalaoNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Applied Auditing Review Course Pre-Board - Answer KeyDocument13 pagesApplied Auditing Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- Wiley Problems and Solutions - AUD Modules 1 To 3Document34 pagesWiley Problems and Solutions - AUD Modules 1 To 3ABCNo ratings yet

- AUDITINGDocument20 pagesAUDITINGAngelieNo ratings yet

- Auditing TheoryDocument13 pagesAuditing TheoryRaven GarciaNo ratings yet

- Final Examination Government AccountingDocument6 pagesFinal Examination Government AccountingCristel TannaganNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Chap 015Document19 pagesChap 015RechelleNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Ch04-Audit Evidence and Audit ProgramsDocument24 pagesCh04-Audit Evidence and Audit ProgramsJames PeraterNo ratings yet

- AUDITING THEORY Reviewer MCDocument5 pagesAUDITING THEORY Reviewer MCSheena OroNo ratings yet

- Auditing Theory Test BankDocument26 pagesAuditing Theory Test Bankdfgmlk dsdwNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankDAN NGUYEN THE100% (1)

- 05GeneralInternalControl NotesDocument5 pages05GeneralInternalControl Notesjhaeus enajNo ratings yet

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Materials Comprehensive AUd TheoryDocument15 pagesMaterials Comprehensive AUd TheoryAnonymous EgTu8E6O100% (1)

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Multiple Choic1Document4 pagesMultiple Choic1stillwinmsNo ratings yet

- QUIZ RESULTS For Eilifsen - Auditing & Assurance Services - Chapter 13 - Auditing The Inventory Management Process - Multiple Choice Quiz - Jerichopedragosa@GmailDocument6 pagesQUIZ RESULTS For Eilifsen - Auditing & Assurance Services - Chapter 13 - Auditing The Inventory Management Process - Multiple Choice Quiz - Jerichopedragosa@GmailJericho PedragosaNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- TBCH01Document6 pagesTBCH01Arnyl ReyesNo ratings yet

- QUizzer 4 - Overall With AnswerDocument20 pagesQUizzer 4 - Overall With AnswerJan Elaine CalderonNo ratings yet

- At MCQ Salogsacol Auditing Theory Multiple ChoiceDocument32 pagesAt MCQ Salogsacol Auditing Theory Multiple ChoiceJannaviel MirandillaNo ratings yet

- Chapter 18Document30 pagesChapter 18homer_639399297No ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocument29 pagesModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneNo ratings yet

- A. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientDocument7 pagesA. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientRenNo ratings yet

- AP 5906q ReceivablesDocument3 pagesAP 5906q ReceivablesJulia MirhanNo ratings yet

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- AUD Final Preboard QuestionsDocument12 pagesAUD Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Quiz - Understanding The Entity and Its EnvironmentDocument4 pagesQuiz - Understanding The Entity and Its EnvironmentKathleenNo ratings yet

- Phil. Cpa Licensure Examination AuditingDocument9 pagesPhil. Cpa Licensure Examination AuditingbasmalabassyNo ratings yet

- Practice Questions For Audit TheoryDocument4 pagesPractice Questions For Audit TheoryHanna Lyn BaliscoNo ratings yet

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Whittington 22e Solutions Manual Ch15Document10 pagesWhittington 22e Solutions Manual Ch15潘妍伶No ratings yet

- Auditing Chapter 2 ReviewDocument21 pagesAuditing Chapter 2 ReviewYomna AttiaNo ratings yet

- Chapter 1 - Aud TheoDocument8 pagesChapter 1 - Aud TheoCamille MagdaraogNo ratings yet

- SW - Code of EthicsDocument1 pageSW - Code of EthicsJudy Ann ImusNo ratings yet

- Audit CH 6 and 7Document30 pagesAudit CH 6 and 7Nanon WiwatwongthornNo ratings yet

- Pre EngagementDocument3 pagesPre EngagementJanica BerbaNo ratings yet

- Auditing Theory Solution Manual by SalosagcolDocument4 pagesAuditing Theory Solution Manual by Salosagcolglcpa0% (1)

- Chapter 9 Audit SamplingDocument47 pagesChapter 9 Audit SamplingYenelyn Apistar CambarijanNo ratings yet

- Auditing, Attestation, and AssuranceDocument3 pagesAuditing, Attestation, and AssuranceChryzbryth LorenzoNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Ap 03 Purchase To Pay and Hire To Retire Processes Audit of Trade PayablesDocument8 pagesAp 03 Purchase To Pay and Hire To Retire Processes Audit of Trade PayablesYoung MetroNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument7 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Unit VIII Completing The AuditDocument16 pagesUnit VIII Completing The AuditMark GerwinNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument6 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Second Preboards in Auditing - FinalDocument9 pagesSecond Preboards in Auditing - FinalROMAR A. PIGANo ratings yet

- John Bo HandoutDocument9 pagesJohn Bo HandoutPachiNo ratings yet

- Cis Audit Test BankDocument3 pagesCis Audit Test BankPachiNo ratings yet

- Ap - 01 Cash and Cash EquivalentsDocument11 pagesAp - 01 Cash and Cash EquivalentsPachi0% (2)

- Tutor Notes PPE Revaluation and ImpairmentDocument2 pagesTutor Notes PPE Revaluation and ImpairmentPachiNo ratings yet

- Ahmedmohamedjama: Curriculum Vitae: October 15 Ahmed Mohamed JamaDocument5 pagesAhmedmohamedjama: Curriculum Vitae: October 15 Ahmed Mohamed JamaFred OchiengNo ratings yet

- Universal Data Privacy Consent Form DEPEDDocument2 pagesUniversal Data Privacy Consent Form DEPEDGladys Angela Valdemoro50% (2)

- Corporate Governance of Unilever and MicDocument22 pagesCorporate Governance of Unilever and MicAnushk ShuklaNo ratings yet

- FM - 12 Corrective Action RequestDocument1 pageFM - 12 Corrective Action RequestBleep NewsNo ratings yet

- Acco Nov 2009 Eng MemoDocument19 pagesAcco Nov 2009 Eng Memosadya98No ratings yet

- Corporate Finance ProjectDocument31 pagesCorporate Finance ProjectKrishnendu SahaNo ratings yet

- Question - Analysis Audit and Assurance Application LevelDocument28 pagesQuestion - Analysis Audit and Assurance Application LevelIQBAL MAHMUDNo ratings yet

- Absorption and Marginal CostingDocument3 pagesAbsorption and Marginal CostingZaira AneesNo ratings yet

- Adjectives With PrepositionsDocument4 pagesAdjectives With PrepositionsThompsonBWNo ratings yet

- CH 01 PARAMDocument14 pagesCH 01 PARAMpankajgopalsharmaNo ratings yet

- Company Law ObjectivesDocument26 pagesCompany Law Objectivessathyan_avinashNo ratings yet

- 10thPayCommissionReport Kerala StateDocument120 pages10thPayCommissionReport Kerala StateJacob MathewNo ratings yet

- Targeted Testing: Engagement Test Objective Audit UnitDocument12 pagesTargeted Testing: Engagement Test Objective Audit UnitFanli KayoriNo ratings yet

- FDA-ISO QMS Audit Checklist GreenlightDocument3 pagesFDA-ISO QMS Audit Checklist Greenlightada wangNo ratings yet

- No. 2014-10 June 2014: Development Stage Entities (Topic 915)Document38 pagesNo. 2014-10 June 2014: Development Stage Entities (Topic 915)viviNo ratings yet

- Criteria For Contractor SelectionDocument21 pagesCriteria For Contractor Selectioner.kb.karkiNo ratings yet

- Detailed Tender Notice: UIDSSMT Tender (Vol. I) KMC - KolhapurDocument10 pagesDetailed Tender Notice: UIDSSMT Tender (Vol. I) KMC - Kolhapurjkedar_78No ratings yet

- WRD 27e - SE PPT - Ch03 - ADADocument19 pagesWRD 27e - SE PPT - Ch03 - ADANovrissa DianiNo ratings yet

- Chapter 25Document33 pagesChapter 25Elie Bou GhariosNo ratings yet

- PWCDocument39 pagesPWCsmile xiii100% (1)

- International Auditing and Assurance Standards Board: 2020 EditionDocument102 pagesInternational Auditing and Assurance Standards Board: 2020 EditionSanket BaraiNo ratings yet

- Csa ArtikelDocument13 pagesCsa ArtikelSilvi Eka PutriNo ratings yet

- Supplier Appraisal - What To CheckDocument6 pagesSupplier Appraisal - What To CheckCosmos AfagachieNo ratings yet

- Group 2 Internal Control in Cis EnvironmentDocument13 pagesGroup 2 Internal Control in Cis EnvironmentKathlaine Mae ObaNo ratings yet

- Annual Report of PROTON 2006Document195 pagesAnnual Report of PROTON 2006IzzahAzizNo ratings yet

- Auditing and AccountingDocument38 pagesAuditing and Accountingberihun admassuNo ratings yet

AUD Review To BSA Quali 2019

AUD Review To BSA Quali 2019

Uploaded by

Princess BanquilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUD Review To BSA Quali 2019

AUD Review To BSA Quali 2019

Uploaded by

Princess BanquilCopyright:

Available Formats

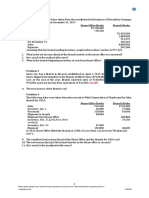

FAR EASTERN UNIVERSITY

INSTITUTE OF ACCOUNTS, BUSINESS, AND FINANCE

AUDITING THEORY REVIEW

1. Which of the following best describes “high level of assurance”?

A. It refers to the professional accountant having obtained evidence based on procedures agreed upon

between the practitioner and the intended users to be satisfied that findings be reported to the intended

users.

B. It refers to the professional accountant having obtained sufficient external and internal appropriate

evidence to be satisfied that the subject matter is plausible in the circumstances.

C. It refers to the professional accountant having obtained sufficient appropriate evidence to conclude that

the subject matter conforms in all material respects with identified suitable criteria.

D. It refers to the professional accountant having obtained sufficient evidence to conclude that he has no

knowledge of any required modifications to be made in the financial statements in order for them to

conform of prescribed criteria.

2. Assurance services least likely involve

A. Implementing a system that improves the processing of information.

B. Improving the quality of information for decision purposes.

C. Improving the quality of the decision model used.

D. Improving the relevance of information.

3. In making a decision to accept or continue with a client, the auditor should consider:

A. B. C. D.

Its own independence Yes No Yes No

Its ability to service a client properly Yes Yes Yes No

The integrity of the client’s management Yes Yes No Yes

4. Arrangements concerning which of the following are least likely to be included in engagement letter? A

A. A predecessor auditor.

B. Fees and billing.

C. CPA investment in client securities.

D. Other services to be provided in addition to the audit.

5. In designing written audit programs, an auditor should establish specific audit objectives that related primarily

to the

A. Timing of audit procedures.

B. Cost-benefit of gathering evidence.

C. Selected audit techniques.

D. Financial statement assertions.

6. Which of the following nonfinancial information would an auditor most likely consider in performing analytical

procedures during the planning phase of an audit?

A. Square footage of selling space.

B. Turnover of personnel in the accounting department.

C. Objectivity of audit committee members.

D. Management’s plans to repurchase stock.

7. Which of the following procedures would an auditor most likely include in the planning phase of a financial

statement audit?

A. Obtain an understanding of the entity’s risk assessment process.

B. Identify specific internal control activities designed to prevent fraud.

C. Evaluate the reasonableness of the entity’s accounting estimates.

D. Perform cutoff tests of the entity’s sales and purchases.

8. The element of the audit planning process most likely to be agreed upon with the client before implementation

of the audit strategy is the determination of the

A. Evidence to be gathered to provide a sufficient basis for the auditor’s opinion.

B. Procedures to be undertaken to discover litigation, claims, and assessments.

C. Pending legal matters to be included in the inquiry of the client’s attorney.

D. Timing of inventory observation procedures to be performed.

9. The management’s assessment of the entity’s ability to continue as a going concern covers a period of:

A. Not longer than 12 months from balance date.

B. Not longer than 12 months from the date of audit report.

C. At least 12 months from the balance sheet date.

D. At least 12 months from the date of audit report.

10. Adequate audit planning helps ensure that appropriate attention is devoted:

A. B. C. D.

To important areas of the audit Yes Yes Yes Yes

So that potential problems are promptly identified Yes Yes No No

So that the work is completed expeditiously No Yes No Yes

11. An auditor obtains knowledge about a new client’s business and its industry to

A. Make constructive suggestions concerning improvements to the client’s internal control.

B. Develop an attitude of professional skepticism concerning management’s financial statement

assertions.

C. Evaluate whether the aggregation of known misstatements causes the financial statements takes as a

whole to be materially misstated.

D. Understand the events and transactions that may have an effect on the client’s financial statements.

12. Which item would not be contained in an audit program?

A. Staff assigned to the audit.

B. List of specific tasks to be performed.

C. Documentation of system being reviewed.

D. Estimated time required to perform each task.

13. When planning an examination, an auditor should

A. Consider whether the extent of substantive tests may be reduced based on the results of the internal

control questionnaire.

B. Make preliminary judgments about materiality levels for audit purposes.

C. Conclude whether changes in compliance with prescribed control procedures justifies reliance on them

D. Prepare a preliminary draft of the management representation letter.

14. Which of the following is most likely a fraud risk factor?

A. A. Management has a practice of conveying forecast information to analysts, creditors, and other third

parties.

B. Turnover of management has been low throughout the preceding five-year period.

C. Several claims against the senior management are outstanding alleging a violation of the securities law.

D. The company has shown the ability to generate a positive cash flow from operations, while reporting

earnings and earnings growth.

15. A Company showed a large restructuring charge on its income statement in 2019 and has experienced a

constantly rising earnings trend since that time. This would most nearly represent an example of

A. Using immaterial transactions to increase reported earnings to meet analysts' expectations

B. Big bath accounting.

C. Cookie jar reserves.

D. Creative acquisition accounting.

16. Which of the following should the auditor likely to do when the application of planned audit procedures indicates

the possible existence of fraud or error?

A. The auditor should resign in order to avoid legal responsibility.

B. He should discuss the matter with the person whom he believes is involved with the irregularities.

C. He should consider the potential effect on the financial statements.

D. He should refer the suspected fraud or error to the internal auditor.

17. Generally, the decision to notify parties outside the client's organization regarding an illegal act is the

responsibility of the

A. Independent auditor.

B. Management.

C. Outside legal counsel.

D. Internal auditors.

18. Margaret Manufacturing, Inc. sought a P2,000,000 loan from Bank of P.I. Bank of P.I insisted that audited financial

statements be submitted before granting credit. Margaret agreed. An audit was performed by an independent

auditor who submitted an audit report to Margaret that was to be used solely for the purpose of negotiating a

loan from the bank. Bank of P.I., upon reading the audited financial statements, decided in good faith not to

extend the credit desired. Certain ratios, used routinely by Bank of P.I. in reaching credit decisions, were judged

insufficient. Margaret used copies of the audited financial statements to obtain credit elsewhere. Despite

complying with Philippine Standards on Auditing, the independent auditor failed to discover a sophisticated

embezzlement scheme perpetrated by Margaret's chief financial officer. The auditor is liable to

A. Third parties who relied on the audited financial statements to extend credit.

B. Margaret to repay the audit fee because Bank of P.I. did not extend credit.

C. Margaret for any losses Margaret suffered as a result of failing to discover the embezzlement.

D. None of the parties.

19. Which of the following is appropriate about risk assessment?

A. Detection risk is eliminated if an auditor were to examine 100 percent of the account balance or class of

transactions

B. There is an inverse relationship between detection risk and the combined level of inherent and control

risk.

C. The assessed level of inherent and control risk can be sufficiently low, thus resulting to eliminating the

need for substantive tests.

D. Audit risk may be more appropriately determined by assessing inherent and control risk separately.

20. The auditor should perform which of the following as risk assessment procedure?

A. Analytical procedures

B. Confirmation

C. Recalculation

D. Reperformance

21. Which of the following situations will normally result to decrease in the extent of audit procedures?

A. Increase in the risk of material misstatement.

B. Increase in the degree of assurance the auditor plans to obtain.

C. Increase in materiality level.

D. None of the above.

22. While performing an audit, Sebastian decides to restrict the risk of misstatement to 3%.What must the acceptable

level of detection risk be if inherent risk is 25% and control risk is 40%?

A. 0.3%

B. 30%

C. 12%

D.33.3%

23. Detection risk is

A. The risk that the auditor gives an inappropriate audit opinion when the financial statements are

materially misstated.

B. The risk that a misstatement, that could occur in an account balance or class of transactions and that

could be material individually or when aggregated with misstatements in other balances or classes, will

not be prevented or detected and corrected on a timely basis by the accounting and internal control

systems.

C. The risk that an auditor's substantive procedures will not detect a misstatement that exists in an

account balance or class of transactions that could be material, individually or when aggregated with

misstatements in other balances or classes.

D. The susceptibility of an account balance or class of transactions to misstatement that could be material,

individually or when aggregated with misstatements in other balances of classes, assuming that there

were no related internal controls.

24. In considering materiality for planning purposes, an auditor believes that misstatements aggregating P100,000

would have a material effect on an entity’s income statement, but the misstatements would have to aggregate

P200,000 to materially affect the balance sheet. Ordinarily, it would be appropriate to design auditing procedures

that would be expected to detect misstatements that aggregate

A. P100,000

B. P200,000

C. P150,000

D. P300,000

25. In considering materiality for planning purposes, an auditor believes that misstatements aggregating P100,000

would have a material effect on an entity’s income statement, but the misstatements would have to aggregate

P200,000 to materially affect the balance sheet. Ordinarily, it would be appropriate to design auditing procedures

that would be expected to detect misstatements that aggregate

E. P100,000

F. P200,000

G. P150,000

H. P300,000

26. When control risk is assessed at the maximum level for all financial statement assertions, an auditor should

document the auditor’s

a. b. c. d.

Understanding of the entity’s internal control Yes Yes No Yes

structure elements

Conclusion that control risk is at the maximum No Yes Yes Yes

level

Basis for concluding that control risk is at the No No Yes Yes

maximum level

27. Which statement is correct regarding the audit evidence?

A. The greater the risk, the less audit evidence is likely to be required.

B. The higher the quality, the more may be required

C. Merely obtaining more audit evidence may not compensate for its poor quality.

D. Obtaining audit evidence relating to a particular assertion is a substitute for obtaining audit evidence

regarding another assertion.

28. The auditor considers the status of legal matters up to

A. The date of the audit report

B. The balance sheet date.

C. The issuance of financial statements.

D. Up to the date of receipt of letter from lawyers.

29. Which of the following is not a procedure used by an auditor in the examination of accounts receivable?

A. Confirmation

B. Reconciliation

C. Inquiry

D. Physical count and inspection

30. Which of the following relates to rights and obligations assertion?

A. The entity holds or controls the rights to assets, and liabilities are the obligations of the entity.

B. All assets, liabilities and equity interests that should have been recorded have been recorded.

C. Transactions and events that have been recorded have occurred and pertain to the entity.

D. Assets, liabilities, and equity interests are included in the financial statements at appropriate amounts

31. The measure of the quality of audit evidence and its relevance to a particular assertion and its reliability.

A. Sufficiency

B. Significance

C. Appropriateness

D. Assurance

32. Control environment

A. Consists of the policies and procedures that help ensure that management directives are carried out.

B. Includes the governance and management functions and the attitudes, awareness, and actions of those

charged with governance and management concerning the entity’s internal control and its importance in

the entity.

C. Is the entity’s process for identifying business risks relevant to financial reporting objectives and deciding

about actions to address those risks, and the results thereof.

D. Consists of the procedures and records established to initiate, record, process, and report entity

transactions (as well as events and conditions) and to maintain accountability for the related assets,

liabilities, and equity.

33. An auditor for a large service company is performing an audit of the company's cash balance. The auditor is

considering the most appropriate audit procedure to use to ensure that the amount of cash is accurately

recorded on the company's financial statements. The most appropriate audit procedures for the objective are

A. Review collection procedures and perform an analytical review of accounts receivable; confirm balances

of accounts receivable; and verify the existence of appropriate procedures and facilities.

B. Compare cash receipt lists with the receipts journal and bank deposit slips; review the segregation of

duties, observe, and test cash receipts.

C. Review the organizational structure and functional responsibilities; verify the existence and describe

protection procedures for unused checks, including security measures.

D. Examine bank reconciliations, confirm bank balances, and verify cut off of receipts and disbursements;

foot totals of reconciliations and compare to cash account balances.

34. The inability of the client to prepare certain audit requirements may most likely lead the auditor to

A. Withdraw from the engagement.

B. Express qualified opinion or a disclaimer.

C. Express qualified or adverse opinion.

D. Express unqualified opinion with explanatory paragraph.

35. A CPA engaged to examine financial statements observes that the accounting for a certain material item is not in

conformity with generally accepted accounting principles, and that this fact is prominently disclosed in a footnote

to the financial statements. The CPA does not agree with this departure from GAAP and should

A. Not allow the accounting treatment for this item to affect the type of opinion because the deviation from

generally accepted accounting principles was disclosed.

B. Express an unqualified opinion and add an explanatory paragraph emphasizing the matter by reference

to the footnote.

C. Qualify the opinion because of the deviation from generally accepted accounting principles.

D. Disclaim an opinion.

END OF DISCUSSION

You might also like

- Standard Operating Procedures: SOP For Fixed Assets ManagementDocument26 pagesStandard Operating Procedures: SOP For Fixed Assets ManagementShrasti Varshney67% (3)

- Internal Audit ProgramDocument8 pagesInternal Audit ProgramKrishna Khandelwal100% (3)

- 5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andDocument2 pages5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andAngeloNo ratings yet

- TOA - 01-CASH AND CASH EQUIVALENTS W - SOLDocument5 pagesTOA - 01-CASH AND CASH EQUIVALENTS W - SOLPachi100% (1)

- PTI Organisation of International Chapters (OIC) by LawsDocument15 pagesPTI Organisation of International Chapters (OIC) by LawsInsaf.PK67% (3)

- Pressure Vessel CertificationDocument4 pagesPressure Vessel CertificationalokbdasNo ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- Quiz Bowlers' Society Auditing TheoryDocument8 pagesQuiz Bowlers' Society Auditing TheorysarahbeeNo ratings yet

- Aaconapps2 00-C92pb2aDocument17 pagesAaconapps2 00-C92pb2aJane DizonNo ratings yet

- Test Bank Auditing and Assurance Services 13e by Arens Chapter 14 PDF FreeDocument16 pagesTest Bank Auditing and Assurance Services 13e by Arens Chapter 14 PDF FreeNora AlghanemNo ratings yet

- DocxDocument86 pagesDocxMubarrach MatabalaoNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Applied Auditing Review Course Pre-Board - Answer KeyDocument13 pagesApplied Auditing Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- Wiley Problems and Solutions - AUD Modules 1 To 3Document34 pagesWiley Problems and Solutions - AUD Modules 1 To 3ABCNo ratings yet

- AUDITINGDocument20 pagesAUDITINGAngelieNo ratings yet

- Auditing TheoryDocument13 pagesAuditing TheoryRaven GarciaNo ratings yet

- Final Examination Government AccountingDocument6 pagesFinal Examination Government AccountingCristel TannaganNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Chap 015Document19 pagesChap 015RechelleNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Ch04-Audit Evidence and Audit ProgramsDocument24 pagesCh04-Audit Evidence and Audit ProgramsJames PeraterNo ratings yet

- AUDITING THEORY Reviewer MCDocument5 pagesAUDITING THEORY Reviewer MCSheena OroNo ratings yet

- Auditing Theory Test BankDocument26 pagesAuditing Theory Test Bankdfgmlk dsdwNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankDAN NGUYEN THE100% (1)

- 05GeneralInternalControl NotesDocument5 pages05GeneralInternalControl Notesjhaeus enajNo ratings yet

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Materials Comprehensive AUd TheoryDocument15 pagesMaterials Comprehensive AUd TheoryAnonymous EgTu8E6O100% (1)

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Multiple Choic1Document4 pagesMultiple Choic1stillwinmsNo ratings yet

- QUIZ RESULTS For Eilifsen - Auditing & Assurance Services - Chapter 13 - Auditing The Inventory Management Process - Multiple Choice Quiz - Jerichopedragosa@GmailDocument6 pagesQUIZ RESULTS For Eilifsen - Auditing & Assurance Services - Chapter 13 - Auditing The Inventory Management Process - Multiple Choice Quiz - Jerichopedragosa@GmailJericho PedragosaNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- TBCH01Document6 pagesTBCH01Arnyl ReyesNo ratings yet

- QUizzer 4 - Overall With AnswerDocument20 pagesQUizzer 4 - Overall With AnswerJan Elaine CalderonNo ratings yet

- At MCQ Salogsacol Auditing Theory Multiple ChoiceDocument32 pagesAt MCQ Salogsacol Auditing Theory Multiple ChoiceJannaviel MirandillaNo ratings yet

- Chapter 18Document30 pagesChapter 18homer_639399297No ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocument29 pagesModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneNo ratings yet

- A. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientDocument7 pagesA. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientRenNo ratings yet

- AP 5906q ReceivablesDocument3 pagesAP 5906q ReceivablesJulia MirhanNo ratings yet

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- AUD Final Preboard QuestionsDocument12 pagesAUD Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Quiz - Understanding The Entity and Its EnvironmentDocument4 pagesQuiz - Understanding The Entity and Its EnvironmentKathleenNo ratings yet

- Phil. Cpa Licensure Examination AuditingDocument9 pagesPhil. Cpa Licensure Examination AuditingbasmalabassyNo ratings yet

- Practice Questions For Audit TheoryDocument4 pagesPractice Questions For Audit TheoryHanna Lyn BaliscoNo ratings yet

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Whittington 22e Solutions Manual Ch15Document10 pagesWhittington 22e Solutions Manual Ch15潘妍伶No ratings yet

- Auditing Chapter 2 ReviewDocument21 pagesAuditing Chapter 2 ReviewYomna AttiaNo ratings yet

- Chapter 1 - Aud TheoDocument8 pagesChapter 1 - Aud TheoCamille MagdaraogNo ratings yet

- SW - Code of EthicsDocument1 pageSW - Code of EthicsJudy Ann ImusNo ratings yet

- Audit CH 6 and 7Document30 pagesAudit CH 6 and 7Nanon WiwatwongthornNo ratings yet

- Pre EngagementDocument3 pagesPre EngagementJanica BerbaNo ratings yet

- Auditing Theory Solution Manual by SalosagcolDocument4 pagesAuditing Theory Solution Manual by Salosagcolglcpa0% (1)

- Chapter 9 Audit SamplingDocument47 pagesChapter 9 Audit SamplingYenelyn Apistar CambarijanNo ratings yet

- Auditing, Attestation, and AssuranceDocument3 pagesAuditing, Attestation, and AssuranceChryzbryth LorenzoNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Ap 03 Purchase To Pay and Hire To Retire Processes Audit of Trade PayablesDocument8 pagesAp 03 Purchase To Pay and Hire To Retire Processes Audit of Trade PayablesYoung MetroNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument7 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Unit VIII Completing The AuditDocument16 pagesUnit VIII Completing The AuditMark GerwinNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument6 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Second Preboards in Auditing - FinalDocument9 pagesSecond Preboards in Auditing - FinalROMAR A. PIGANo ratings yet

- John Bo HandoutDocument9 pagesJohn Bo HandoutPachiNo ratings yet

- Cis Audit Test BankDocument3 pagesCis Audit Test BankPachiNo ratings yet

- Ap - 01 Cash and Cash EquivalentsDocument11 pagesAp - 01 Cash and Cash EquivalentsPachi0% (2)

- Tutor Notes PPE Revaluation and ImpairmentDocument2 pagesTutor Notes PPE Revaluation and ImpairmentPachiNo ratings yet

- Ahmedmohamedjama: Curriculum Vitae: October 15 Ahmed Mohamed JamaDocument5 pagesAhmedmohamedjama: Curriculum Vitae: October 15 Ahmed Mohamed JamaFred OchiengNo ratings yet

- Universal Data Privacy Consent Form DEPEDDocument2 pagesUniversal Data Privacy Consent Form DEPEDGladys Angela Valdemoro50% (2)

- Corporate Governance of Unilever and MicDocument22 pagesCorporate Governance of Unilever and MicAnushk ShuklaNo ratings yet

- FM - 12 Corrective Action RequestDocument1 pageFM - 12 Corrective Action RequestBleep NewsNo ratings yet

- Acco Nov 2009 Eng MemoDocument19 pagesAcco Nov 2009 Eng Memosadya98No ratings yet

- Corporate Finance ProjectDocument31 pagesCorporate Finance ProjectKrishnendu SahaNo ratings yet

- Question - Analysis Audit and Assurance Application LevelDocument28 pagesQuestion - Analysis Audit and Assurance Application LevelIQBAL MAHMUDNo ratings yet

- Absorption and Marginal CostingDocument3 pagesAbsorption and Marginal CostingZaira AneesNo ratings yet

- Adjectives With PrepositionsDocument4 pagesAdjectives With PrepositionsThompsonBWNo ratings yet

- CH 01 PARAMDocument14 pagesCH 01 PARAMpankajgopalsharmaNo ratings yet

- Company Law ObjectivesDocument26 pagesCompany Law Objectivessathyan_avinashNo ratings yet

- 10thPayCommissionReport Kerala StateDocument120 pages10thPayCommissionReport Kerala StateJacob MathewNo ratings yet

- Targeted Testing: Engagement Test Objective Audit UnitDocument12 pagesTargeted Testing: Engagement Test Objective Audit UnitFanli KayoriNo ratings yet

- FDA-ISO QMS Audit Checklist GreenlightDocument3 pagesFDA-ISO QMS Audit Checklist Greenlightada wangNo ratings yet

- No. 2014-10 June 2014: Development Stage Entities (Topic 915)Document38 pagesNo. 2014-10 June 2014: Development Stage Entities (Topic 915)viviNo ratings yet

- Criteria For Contractor SelectionDocument21 pagesCriteria For Contractor Selectioner.kb.karkiNo ratings yet

- Detailed Tender Notice: UIDSSMT Tender (Vol. I) KMC - KolhapurDocument10 pagesDetailed Tender Notice: UIDSSMT Tender (Vol. I) KMC - Kolhapurjkedar_78No ratings yet

- WRD 27e - SE PPT - Ch03 - ADADocument19 pagesWRD 27e - SE PPT - Ch03 - ADANovrissa DianiNo ratings yet

- Chapter 25Document33 pagesChapter 25Elie Bou GhariosNo ratings yet

- PWCDocument39 pagesPWCsmile xiii100% (1)

- International Auditing and Assurance Standards Board: 2020 EditionDocument102 pagesInternational Auditing and Assurance Standards Board: 2020 EditionSanket BaraiNo ratings yet

- Csa ArtikelDocument13 pagesCsa ArtikelSilvi Eka PutriNo ratings yet

- Supplier Appraisal - What To CheckDocument6 pagesSupplier Appraisal - What To CheckCosmos AfagachieNo ratings yet

- Group 2 Internal Control in Cis EnvironmentDocument13 pagesGroup 2 Internal Control in Cis EnvironmentKathlaine Mae ObaNo ratings yet

- Annual Report of PROTON 2006Document195 pagesAnnual Report of PROTON 2006IzzahAzizNo ratings yet

- Auditing and AccountingDocument38 pagesAuditing and Accountingberihun admassuNo ratings yet