Professional Documents

Culture Documents

Explanation Letter For NO ITR

Explanation Letter For NO ITR

Uploaded by

AARON GIBONGCopyright:

Available Formats

You might also like

- Affidavit of Support (Philippines)Document1 pageAffidavit of Support (Philippines)bertspamintuan85% (26)

- Affidavit of SupportDocument2 pagesAffidavit of SupportIvyGwynn21491% (11)

- Affidavit of SupportDocument2 pagesAffidavit of SupportJane CA90% (21)

- Affidavit of Loss - TIN ID. ResusDocument1 pageAffidavit of Loss - TIN ID. Resuspdalingay100% (5)

- Korean Visa Cover LetterDocument1 pageKorean Visa Cover LetterMaria Perez75% (8)

- Philhealth Request LetterDocument2 pagesPhilhealth Request LetterKilaine Montilla92% (13)

- Affidavit For The Cancellation of Business Name RegistrationDocument2 pagesAffidavit For The Cancellation of Business Name RegistrationJeshisha100% (1)

- Affidavit of Undertaking - HDMFDocument2 pagesAffidavit of Undertaking - HDMFbw_shop82% (17)

- Letter of Intent - NV To V PDFDocument1 pageLetter of Intent - NV To V PDFAlyssa Kaye Talledo67% (3)

- SupportDocument1 pageSupportAngie Douglas100% (1)

- Affidavit of Support and GuaranteeDocument1 pageAffidavit of Support and GuaranteeJoy Shock100% (4)

- Waiver For Non-Deductible FormDocument2 pagesWaiver For Non-Deductible FormQueenileen Arindaeng80% (5)

- Affidavit of Income Declaration (Philhealth)Document1 pageAffidavit of Income Declaration (Philhealth)Apple Joy ColladosNo ratings yet

- DTI Request LetterDocument1 pageDTI Request LetterChristine Joy Prestoza60% (5)

- Affidavit Factual Circumstances - SAMPLEDocument2 pagesAffidavit Factual Circumstances - SAMPLEJun Cadugo100% (2)

- Letter Complaint (DTI) Rubilyn Soderstorm.3-29Document1 pageLetter Complaint (DTI) Rubilyn Soderstorm.3-29JOHN VINCENT S FERRERNo ratings yet

- Affidavit of Change of Name After MarriageDocument2 pagesAffidavit of Change of Name After MarriageJohn Mark Paracad100% (2)

- Letter of Guarantee KoreaDocument1 pageLetter of Guarantee KoreaGabriel Sabariaga0% (1)

- Request For Number Coding ExemptionDocument1 pageRequest For Number Coding ExemptionArnold Rosario ManzanoNo ratings yet

- BIR Sample Letter of Intent For Efps (Individual)Document1 pageBIR Sample Letter of Intent For Efps (Individual)GraceKayCee50% (10)

- Affidavit of Change of Business NameDocument1 pageAffidavit of Change of Business Nameerap021767% (3)

- Letter of Explanation For The Late Compliance of Sanitary ClearanceDocument1 pageLetter of Explanation For The Late Compliance of Sanitary Clearancefranceheart67% (3)

- Bir Routing SlipDocument1 pageBir Routing SlipStephen Pinero Quismundo Jr.100% (3)

- Affidavit of Loss Pos ReyesDocument1 pageAffidavit of Loss Pos ReyesJeffrey Mojica100% (1)

- RE: Request For Manual PaymentDocument1 pageRE: Request For Manual PaymentJemrey Goles100% (7)

- Philhealth Request LetterDocument1 pagePhilhealth Request LetterKatherine88% (8)

- Affidavit of Support To TravelDocument2 pagesAffidavit of Support To TravelCarene Leanne Bernardo100% (3)

- Explanation For No ITR For Visa PurposeDocument1 pageExplanation For No ITR For Visa PurposeVishal DhimanNo ratings yet

- LetterDocument1 pageLetter姆士詹No ratings yet

- Authorization Letter DFADocument1 pageAuthorization Letter DFANorberto Sinsona Jr.100% (1)

- Letter of GuaranteeDocument2 pagesLetter of GuaranteeTrinca Diploma100% (1)

- Letter To Bir - Efps Manual PaymentDocument1 pageLetter To Bir - Efps Manual PaymentCarol Ledesma Yap-Pelaez70% (10)

- BIR Form 1906 - Application For ATPDocument1 pageBIR Form 1906 - Application For ATPMonica SorianoNo ratings yet

- Affidavit of SupportDocument1 pageAffidavit of SupportAngie DouglasNo ratings yet

- Authorization Letter-PhilhealthDocument1 pageAuthorization Letter-Philhealthfarizah joy bagundang67% (3)

- Affidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Document2 pagesAffidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Antonio J. David II80% (5)

- Philhealth Contribution Certificate FormatDocument1 pagePhilhealth Contribution Certificate FormatIzay Izay100% (1)

- Affidavit of loss-ACE FLORES ALAMIS Delivery ReceiptDocument1 pageAffidavit of loss-ACE FLORES ALAMIS Delivery ReceiptSandie Subida100% (1)

- Sample Authorization Letter - PAL CargoDocument1 pageSample Authorization Letter - PAL CargoBianca Adle100% (1)

- SPA PRCDocument2 pagesSPA PRCMaria Reylan Garcia100% (1)

- Request Letter For Certificate ResidencyDocument1 pageRequest Letter For Certificate Residencymohed ahmedNo ratings yet

- No Longer Connected LetterDocument1 pageNo Longer Connected Letterric rele100% (4)

- Globe Termination RequestDocument2 pagesGlobe Termination RequestJoby Jobzz SebellinoNo ratings yet

- Affidavit of Damage To VehicleDocument2 pagesAffidavit of Damage To VehiclePatrick Ramos100% (1)

- Request Letter For Reduction of PenaltyDocument1 pageRequest Letter For Reduction of PenaltyAljohn Sebuc100% (3)

- Request For DiscountDocument1 pageRequest For DiscountJenz PaulNo ratings yet

- Efps Letter of Intent - BiddingDocument1 pageEfps Letter of Intent - BiddingCarol Ledesma Yap-PelaezNo ratings yet

- Affidavit-Of-Transfer of Ownership MotorcycleDocument1 pageAffidavit-Of-Transfer of Ownership MotorcycleanaNo ratings yet

- Globe Authorization LetterDocument2 pagesGlobe Authorization Letterofelia guinitaran100% (1)

- Request Letter For Cor BirDocument1 pageRequest Letter For Cor BirFaizal Usop Patikaman100% (3)

- Sample of Affidavit of UndertakingDocument5 pagesSample of Affidavit of UndertakingLou Nonoi Tan100% (1)

- Request Letter For Change AddressDocument1 pageRequest Letter For Change AddressPinkwork Company100% (1)

- Sample Authorization LetterDocument3 pagesSample Authorization LetterElaine Iris Abasta0% (1)

- Request Letter To Lower Compromise Penalty ATP 1Document1 pageRequest Letter To Lower Compromise Penalty ATP 1Vher Christopher Ducay0% (2)

- 7.3 (A) - Letter of Redundancy For EmployeesDocument3 pages7.3 (A) - Letter of Redundancy For Employeesallen100% (1)

- City of Iloilo Office of The City Mayor City Disaster Risk Reduction Management OfficeDocument1 pageCity of Iloilo Office of The City Mayor City Disaster Risk Reduction Management Officefenan sollanoNo ratings yet

- Affidavit of No IncomeDocument2 pagesAffidavit of No IncomeGracelyn Enriquez Bellingan100% (6)

- Demand Letter MR, CarlosDocument3 pagesDemand Letter MR, CarlosAriel AlvaradoNo ratings yet

- Important RemindersDocument4 pagesImportant RemindersRizzaNo ratings yet

- Philrange Support Insurance Corporate: 4835-B Dayap St. Buendia Makati City Philippines Tel: (02) 583-7944Document1 pagePhilrange Support Insurance Corporate: 4835-B Dayap St. Buendia Makati City Philippines Tel: (02) 583-7944Nhez LacsamanaNo ratings yet

Explanation Letter For NO ITR

Explanation Letter For NO ITR

Uploaded by

AARON GIBONGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Explanation Letter For NO ITR

Explanation Letter For NO ITR

Uploaded by

AARON GIBONGCopyright:

Available Formats

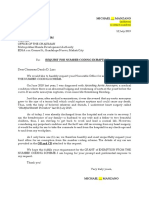

i CAN fly TRAVEL & TOURS CORP.

105-C Scout Castor cor. Tomas Morato Brgy. Laging Handa Quezon City

Email Address: inquiries@icanflytravel.com

Tel No.(02) 373-1801/998-7855

THE CONSUL GENERAL

EMBASSY OF THE REPUBLIC OF KOREA in the PHILIPPINES

McKinley Town Center, 122 Upper McKinley Rd.

Taguig City 1634, Philippines

September 16, 2019

LETTER OF EXPLANATION FOR NO ITR

Sir/Madame:

We are writing this letter to explain the absence of Income Tax Return

(ITR) of ARIADNE ARLENE S. DENZON, (the “Applicant”). The Applicant

is newly hired by the Company this year as Travel & Tour Coordinator

of I CAN FLY TRAVEL & TOURS CORP., “the Company”, and the Company is

yet to process the Applicant’s ITR after the taxable year of 2019.

Under the Philippine tax laws, the Applicant is not required to file

an ITR as Ms. DENZON will be under the substituted filing system since

she will only be earning purely from compensation. As the Applicant’s

employer, we are required to issue on an annual basis BIR Form 2316

as proof of any taxes withheld and thus will serve as the Applicant’s

ITR. However, it is not possible to issue BIR Form 2316 to the

Applicant for the current taxable year because it is not yet due for

filing with the BIR as of this date.

Very truly yours,

AARON P. GIBONG

FINANCE/ADMIN MANAGER

I CAN FLY TRAVEL & TOURS CORP.

(+632) 373-1801

You might also like

- Affidavit of Support (Philippines)Document1 pageAffidavit of Support (Philippines)bertspamintuan85% (26)

- Affidavit of SupportDocument2 pagesAffidavit of SupportIvyGwynn21491% (11)

- Affidavit of SupportDocument2 pagesAffidavit of SupportJane CA90% (21)

- Affidavit of Loss - TIN ID. ResusDocument1 pageAffidavit of Loss - TIN ID. Resuspdalingay100% (5)

- Korean Visa Cover LetterDocument1 pageKorean Visa Cover LetterMaria Perez75% (8)

- Philhealth Request LetterDocument2 pagesPhilhealth Request LetterKilaine Montilla92% (13)

- Affidavit For The Cancellation of Business Name RegistrationDocument2 pagesAffidavit For The Cancellation of Business Name RegistrationJeshisha100% (1)

- Affidavit of Undertaking - HDMFDocument2 pagesAffidavit of Undertaking - HDMFbw_shop82% (17)

- Letter of Intent - NV To V PDFDocument1 pageLetter of Intent - NV To V PDFAlyssa Kaye Talledo67% (3)

- SupportDocument1 pageSupportAngie Douglas100% (1)

- Affidavit of Support and GuaranteeDocument1 pageAffidavit of Support and GuaranteeJoy Shock100% (4)

- Waiver For Non-Deductible FormDocument2 pagesWaiver For Non-Deductible FormQueenileen Arindaeng80% (5)

- Affidavit of Income Declaration (Philhealth)Document1 pageAffidavit of Income Declaration (Philhealth)Apple Joy ColladosNo ratings yet

- DTI Request LetterDocument1 pageDTI Request LetterChristine Joy Prestoza60% (5)

- Affidavit Factual Circumstances - SAMPLEDocument2 pagesAffidavit Factual Circumstances - SAMPLEJun Cadugo100% (2)

- Letter Complaint (DTI) Rubilyn Soderstorm.3-29Document1 pageLetter Complaint (DTI) Rubilyn Soderstorm.3-29JOHN VINCENT S FERRERNo ratings yet

- Affidavit of Change of Name After MarriageDocument2 pagesAffidavit of Change of Name After MarriageJohn Mark Paracad100% (2)

- Letter of Guarantee KoreaDocument1 pageLetter of Guarantee KoreaGabriel Sabariaga0% (1)

- Request For Number Coding ExemptionDocument1 pageRequest For Number Coding ExemptionArnold Rosario ManzanoNo ratings yet

- BIR Sample Letter of Intent For Efps (Individual)Document1 pageBIR Sample Letter of Intent For Efps (Individual)GraceKayCee50% (10)

- Affidavit of Change of Business NameDocument1 pageAffidavit of Change of Business Nameerap021767% (3)

- Letter of Explanation For The Late Compliance of Sanitary ClearanceDocument1 pageLetter of Explanation For The Late Compliance of Sanitary Clearancefranceheart67% (3)

- Bir Routing SlipDocument1 pageBir Routing SlipStephen Pinero Quismundo Jr.100% (3)

- Affidavit of Loss Pos ReyesDocument1 pageAffidavit of Loss Pos ReyesJeffrey Mojica100% (1)

- RE: Request For Manual PaymentDocument1 pageRE: Request For Manual PaymentJemrey Goles100% (7)

- Philhealth Request LetterDocument1 pagePhilhealth Request LetterKatherine88% (8)

- Affidavit of Support To TravelDocument2 pagesAffidavit of Support To TravelCarene Leanne Bernardo100% (3)

- Explanation For No ITR For Visa PurposeDocument1 pageExplanation For No ITR For Visa PurposeVishal DhimanNo ratings yet

- LetterDocument1 pageLetter姆士詹No ratings yet

- Authorization Letter DFADocument1 pageAuthorization Letter DFANorberto Sinsona Jr.100% (1)

- Letter of GuaranteeDocument2 pagesLetter of GuaranteeTrinca Diploma100% (1)

- Letter To Bir - Efps Manual PaymentDocument1 pageLetter To Bir - Efps Manual PaymentCarol Ledesma Yap-Pelaez70% (10)

- BIR Form 1906 - Application For ATPDocument1 pageBIR Form 1906 - Application For ATPMonica SorianoNo ratings yet

- Affidavit of SupportDocument1 pageAffidavit of SupportAngie DouglasNo ratings yet

- Authorization Letter-PhilhealthDocument1 pageAuthorization Letter-Philhealthfarizah joy bagundang67% (3)

- Affidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Document2 pagesAffidavit and Affidavit of Loss - Andres (Cessation and Bir Documents)Antonio J. David II80% (5)

- Philhealth Contribution Certificate FormatDocument1 pagePhilhealth Contribution Certificate FormatIzay Izay100% (1)

- Affidavit of loss-ACE FLORES ALAMIS Delivery ReceiptDocument1 pageAffidavit of loss-ACE FLORES ALAMIS Delivery ReceiptSandie Subida100% (1)

- Sample Authorization Letter - PAL CargoDocument1 pageSample Authorization Letter - PAL CargoBianca Adle100% (1)

- SPA PRCDocument2 pagesSPA PRCMaria Reylan Garcia100% (1)

- Request Letter For Certificate ResidencyDocument1 pageRequest Letter For Certificate Residencymohed ahmedNo ratings yet

- No Longer Connected LetterDocument1 pageNo Longer Connected Letterric rele100% (4)

- Globe Termination RequestDocument2 pagesGlobe Termination RequestJoby Jobzz SebellinoNo ratings yet

- Affidavit of Damage To VehicleDocument2 pagesAffidavit of Damage To VehiclePatrick Ramos100% (1)

- Request Letter For Reduction of PenaltyDocument1 pageRequest Letter For Reduction of PenaltyAljohn Sebuc100% (3)

- Request For DiscountDocument1 pageRequest For DiscountJenz PaulNo ratings yet

- Efps Letter of Intent - BiddingDocument1 pageEfps Letter of Intent - BiddingCarol Ledesma Yap-PelaezNo ratings yet

- Affidavit-Of-Transfer of Ownership MotorcycleDocument1 pageAffidavit-Of-Transfer of Ownership MotorcycleanaNo ratings yet

- Globe Authorization LetterDocument2 pagesGlobe Authorization Letterofelia guinitaran100% (1)

- Request Letter For Cor BirDocument1 pageRequest Letter For Cor BirFaizal Usop Patikaman100% (3)

- Sample of Affidavit of UndertakingDocument5 pagesSample of Affidavit of UndertakingLou Nonoi Tan100% (1)

- Request Letter For Change AddressDocument1 pageRequest Letter For Change AddressPinkwork Company100% (1)

- Sample Authorization LetterDocument3 pagesSample Authorization LetterElaine Iris Abasta0% (1)

- Request Letter To Lower Compromise Penalty ATP 1Document1 pageRequest Letter To Lower Compromise Penalty ATP 1Vher Christopher Ducay0% (2)

- 7.3 (A) - Letter of Redundancy For EmployeesDocument3 pages7.3 (A) - Letter of Redundancy For Employeesallen100% (1)

- City of Iloilo Office of The City Mayor City Disaster Risk Reduction Management OfficeDocument1 pageCity of Iloilo Office of The City Mayor City Disaster Risk Reduction Management Officefenan sollanoNo ratings yet

- Affidavit of No IncomeDocument2 pagesAffidavit of No IncomeGracelyn Enriquez Bellingan100% (6)

- Demand Letter MR, CarlosDocument3 pagesDemand Letter MR, CarlosAriel AlvaradoNo ratings yet

- Important RemindersDocument4 pagesImportant RemindersRizzaNo ratings yet

- Philrange Support Insurance Corporate: 4835-B Dayap St. Buendia Makati City Philippines Tel: (02) 583-7944Document1 pagePhilrange Support Insurance Corporate: 4835-B Dayap St. Buendia Makati City Philippines Tel: (02) 583-7944Nhez LacsamanaNo ratings yet