Professional Documents

Culture Documents

Business Has The Following Information On 31 December 2015

Business Has The Following Information On 31 December 2015

Uploaded by

Abdul Shakoor Mohamed Irum0 ratings0% found this document useful (0 votes)

16 views4 pagesworksheet accounting

Original Title

Business Has the Following Information on 31 December 2015

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentworksheet accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views4 pagesBusiness Has The Following Information On 31 December 2015

Business Has The Following Information On 31 December 2015

Uploaded by

Abdul Shakoor Mohamed Irumworksheet accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

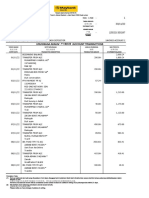

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

a) Journal entries to record bad debts written off

b) Bad debts account

c) Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

a) Journal entries to record bad debts written off

b) Bad debts account

c) Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

a) Journal entries to record bad debts written off

b) Bad debts account and Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

d) Journal entries to record bad debts written off

e) Bad debts account

f) Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

d) Journal entries to record bad debts written off

e) Bad debts account

f) Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts.

Prepare:

c) Journal entries to record bad debts written off

d) Bad debts account and Income statement extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts. Business

provide provision for doubtful debts of 5% on REMAINING trade receivables. On

1 January provision for doubtful debts amounted was $1000.

Prepare:

a) Journal entries to record bad debts written off and provision for doubtful

debts maintained

b) Bad debts account and Prov. for doubtful debts

c) Income statement extract and statement of financial position extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts. Business

provide provision for doubtful debts of 5% on REMAINING trade receivables. On

1 January provision for doubtful debts amounted was $1000.

Prepare:

a) Journal entries to record bad debts written off and provision for doubtful

debts maintained

b) Bad debts account and Prov. for doubtful debts

c) Income statement extract and statement of financial position extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts. Business

provide provision for doubtful debts of 5% on REMAINING trade receivables. On

1 January provision for doubtful debts amounted was $1000.

Prepare:

d) Journal entries to record bad debts written off and provision for doubtful

debts maintained

e) Bad debts account and Prov. for doubtful debts

f) Income statement extract and statement of financial position extract

Business has the following information on 31 December 2015.

$

Shiyam 20 000

Sunil 50 000

Nihal 30 000

On 31 December Nihal informed he is bankrupt. He agreed to pay $2 000, in full

settlement and remaining amount will be written off as bad debts. Business

provide provision for doubtful debts of 5% on REMAINING trade receivables. On

1 January provision for doubtful debts amounted was $1000.

Prepare:

d) Journal entries to record bad debts written off and provision for doubtful

debts maintained

e) Bad debts account and Prov. for doubtful debts

f) Income statement extract and statement of financial position extract

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Free Powerpoint Templates: Insert The Title of Your Presentation HereDocument59 pagesFree Powerpoint Templates: Insert The Title of Your Presentation HereAbdul Shakoor Mohamed Irum100% (1)

- Business Purchase - Worked Example: General JournalDocument2 pagesBusiness Purchase - Worked Example: General JournalAbdul Shakoor Mohamed IrumNo ratings yet

- Title Goes Here: This Is A Sample Text. You Can Replace This Text. Enter Text HereDocument25 pagesTitle Goes Here: This Is A Sample Text. You Can Replace This Text. Enter Text HereAbdul Shakoor Mohamed IrumNo ratings yet

- Corruption, Crime and Economic GrowthDocument283 pagesCorruption, Crime and Economic GrowthAbdul Shakoor Mohamed Irum100% (1)

- DPS ValuationDocument44 pagesDPS ValuationAlex ElliottNo ratings yet

- Chapter 29 The Business Cycle, Inflation, and DeflationDocument51 pagesChapter 29 The Business Cycle, Inflation, and DeflationkimkimberlyNo ratings yet

- ConclusionDocument13 pagesConclusionIndu TindwaniNo ratings yet

- Monetary Policy and Central Banking - Finance 7 SyllabusDocument9 pagesMonetary Policy and Central Banking - Finance 7 SyllabusMarjon DimafilisNo ratings yet

- Should We Use Cash or Credit Card When TravelingDocument2 pagesShould We Use Cash or Credit Card When TravelingNana SupriatnaNo ratings yet

- Tybms Sem5 RM Nov19Document2 pagesTybms Sem5 RM Nov19Kritika SinghNo ratings yet

- Module 4 - 7 - Different Ways of Calculating WACCDocument10 pagesModule 4 - 7 - Different Ways of Calculating WACCBaher WilliamNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Impacting Digital Payments in India KPMG ReportDocument32 pagesImpacting Digital Payments in India KPMG Reportsaty16No ratings yet

- ASTPS - Reading and Analyzing IRS TranscriptsDocument81 pagesASTPS - Reading and Analyzing IRS TranscriptsFeras ShreimNo ratings yet

- Rec LTD: 2. P/E 5.11 3. Book Value (RS) 209Document4 pagesRec LTD: 2. P/E 5.11 3. Book Value (RS) 209Srini VasanNo ratings yet

- Cryptocurrency Money Laundering Methods Free GuideDocument16 pagesCryptocurrency Money Laundering Methods Free GuideKarima AmiraNo ratings yet

- Inflation and Its CureDocument3 pagesInflation and Its CureSabyasachi SahuNo ratings yet

- Residual Appraisal and Gross Dvelopment Value For Commercial PropertiesDocument4 pagesResidual Appraisal and Gross Dvelopment Value For Commercial PropertiesAnonymous Th1S330% (1)

- Edu Vee GuidelinesDocument4 pagesEdu Vee GuidelinesCheikh NgomNo ratings yet

- StateDocument23 pagesStateFaces Forex Academy “Tshepobasson”No ratings yet

- Construction 09-2017-26 Sector HiddenDocument40 pagesConstruction 09-2017-26 Sector Hiddenajml39No ratings yet

- CH19 SguideDocument14 pagesCH19 Sguidezyra liam stylesNo ratings yet

- Easy Ways How To Get BitcoinDocument3 pagesEasy Ways How To Get Bitcoingo nikNo ratings yet

- Presentation 8-Project AppraisalDocument22 pagesPresentation 8-Project AppraisalafzalNo ratings yet

- Service Customer InvoiceDocument1 pageService Customer Invoicevadithyaprashanth357No ratings yet

- Ibs Bahau 1Document4 pagesIbs Bahau 1Khairul AzimNo ratings yet

- Iceland Foods RecommendationDocument2 pagesIceland Foods Recommendationccohen6410No ratings yet

- Cocu 1 - Theory AnswerDocument9 pagesCocu 1 - Theory AnswerVinetha KarunanithiNo ratings yet

- Franklin Mint Corporation, Franklin Mint Limited, and McGregor Swire Air Services Limited v. Trans World Airlines, Inc., 690 F.2d 303, 2d Cir. (1982)Document14 pagesFranklin Mint Corporation, Franklin Mint Limited, and McGregor Swire Air Services Limited v. Trans World Airlines, Inc., 690 F.2d 303, 2d Cir. (1982)Scribd Government DocsNo ratings yet

- The History of The Money Changers by Andrew HitchcockDocument10 pagesThe History of The Money Changers by Andrew HitchcockMuhammad AndalusiNo ratings yet

- Chapter 1 - International Financial Markets & MNCsDocument97 pagesChapter 1 - International Financial Markets & MNCsDung VươngNo ratings yet

- NandithaDocument15 pagesNandithasajijasmyNo ratings yet

- Risk Return AnalysisDocument1 pageRisk Return Analysissnehachandan91No ratings yet

- CH 6 Capital Gains TaxDocument6 pagesCH 6 Capital Gains TaxAaliyah Christine GuarinNo ratings yet