Professional Documents

Culture Documents

Topic 5 - Spoilage, Defect, Scrap and Waste

Topic 5 - Spoilage, Defect, Scrap and Waste

Uploaded by

Krystyn MyrhyllCopyright:

Available Formats

You might also like

- Fallout PNP Character SheetDocument2 pagesFallout PNP Character SheetSteven Tran80% (5)

- 100 Questões Comentadas de PO PDFDocument31 pages100 Questões Comentadas de PO PDFMag NetoNo ratings yet

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Cost Accounting & Control Midterm ExaminationDocument7 pagesCost Accounting & Control Midterm ExaminationFerb CruzadaNo ratings yet

- CompTIA A+ Certification All-in-One Exam Questions Prep (220-701 & 220-702)From EverandCompTIA A+ Certification All-in-One Exam Questions Prep (220-701 & 220-702)Rating: 2.5 out of 5 stars2.5/5 (6)

- VNP SHEQ Consulting Proposal Audit Gambling BoardDocument3 pagesVNP SHEQ Consulting Proposal Audit Gambling BoardVictorNo ratings yet

- Retail ProjectDocument114 pagesRetail ProjectSowjanya KunareddyNo ratings yet

- ARS Webinar Handout 10292023Document3 pagesARS Webinar Handout 10292023johnafar998No ratings yet

- Materials in Cost AccountingDocument1 pageMaterials in Cost AccountingEi HmmmNo ratings yet

- 2 - Classroom ExercisesDocument4 pages2 - Classroom ExercisesHannah Jane ToribioNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingyurineo losisNo ratings yet

- Job OrderDocument2 pagesJob OrderGlen ValdezcoNo ratings yet

- Afar Job Order Costing Spoilage DefectiveDocument4 pagesAfar Job Order Costing Spoilage DefectiveKaye Angelie UsogNo ratings yet

- Job Order Costing Spoilage Defective - StudentDocument4 pagesJob Order Costing Spoilage Defective - StudentVince Christian PadernalNo ratings yet

- JOB ORDER COSTING Practice SetDocument5 pagesJOB ORDER COSTING Practice SetGoogle UserNo ratings yet

- 9011 - Job Order CostingDocument4 pages9011 - Job Order CostingVer LeeNo ratings yet

- Cost Accounting Cost Control FinalsDocument12 pagesCost Accounting Cost Control FinalsCindy Dela CruzNo ratings yet

- Job Order CostingDocument2 pagesJob Order Costingnelmamaeruz23No ratings yet

- Job Order CostingDocument4 pagesJob Order CostingVie ValeraNo ratings yet

- Please Write The Letter of Your Answer Beside Each NumberDocument8 pagesPlease Write The Letter of Your Answer Beside Each NumbershengNo ratings yet

- Try This - Cost ConceptsDocument6 pagesTry This - Cost ConceptsStefan John SomeraNo ratings yet

- LMSDocument4 pagesLMSJohn Carlo LorenzoNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Reviewer 3Document7 pagesReviewer 3Saeym SegoviaNo ratings yet

- Spoilage and Rework ProbsDocument3 pagesSpoilage and Rework ProbsShey INFTNo ratings yet

- Cost Accounting Final ExaminationDocument11 pagesCost Accounting Final ExaminationAndrew wigginNo ratings yet

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Document4 pagesSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Esheikell ChenNo ratings yet

- 10 Job Order CostingDocument5 pages10 Job Order CostingAllegria AlamoNo ratings yet

- Exercise Chap 18 (1,2,3)Document7 pagesExercise Chap 18 (1,2,3)Anh PhạmNo ratings yet

- Cost Accounting MidtermDocument4 pagesCost Accounting MidtermMieryle DioctonNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingulquira grimamajowNo ratings yet

- Week 9 - Job Order&process Costing ActivityDocument5 pagesWeek 9 - Job Order&process Costing ActivityMark IlanoNo ratings yet

- Quiz 2Document4 pagesQuiz 2Kathleen CusipagNo ratings yet

- Auditing Theory SummaryDocument53 pagesAuditing Theory SummaryguhilingprincejohnNo ratings yet

- Reviewer in AccountingDocument9 pagesReviewer in Accountingdunabels25% (4)

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- Epektos Part 1Document4 pagesEpektos Part 1Melvin MendozaNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- ANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireDocument5 pagesANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireKatrina PetracheNo ratings yet

- TOS Cost AssessmentDocument41 pagesTOS Cost AssessmentHNo ratings yet

- Cost Accounting OverheadDocument3 pagesCost Accounting OverheadNah HamzaNo ratings yet

- Theory Questions Job Order CostingDocument4 pagesTheory Questions Job Order CostingEl AgricheNo ratings yet

- Chapter 5 LABOR and FOHDocument22 pagesChapter 5 LABOR and FOHJenny AstroNo ratings yet

- CAC Quiz No. 3 PDFDocument14 pagesCAC Quiz No. 3 PDFEdi wow WowNo ratings yet

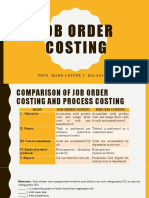

- Job Order Costing: Prof. Mark Lester T. Balasa, CpaDocument24 pagesJob Order Costing: Prof. Mark Lester T. Balasa, CpaNah HamzaNo ratings yet

- An Introduction To Cost Terms and PurposesDocument13 pagesAn Introduction To Cost Terms and PurposesHendriMaulanaNo ratings yet

- SpoilageDocument3 pagesSpoilageela kikayNo ratings yet

- Job Order Costing - Production LossesDocument1 pageJob Order Costing - Production LossesDerick FigueroaNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Accounting For Production Losses in A Job Order CostingDocument2 pagesAccounting For Production Losses in A Job Order CostingMARYGRACE FERRER100% (1)

- Far Eastern Univrsity Cost Accounting CanvassDocument8 pagesFar Eastern Univrsity Cost Accounting CanvassSharmaine FranciscoNo ratings yet

- Job Order Costing SeatworkDocument7 pagesJob Order Costing SeatworksarahbeeNo ratings yet

- Chapter 2Document3 pagesChapter 2subeyr963No ratings yet

- Cost Accounting Quiz 1Document4 pagesCost Accounting Quiz 1Mary Joanne Tapia33% (3)

- AFAR Quizzer 1 SolutionsDocument12 pagesAFAR Quizzer 1 SolutionsRic John Naquila CabilanNo ratings yet

- Part I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs DDocument9 pagesPart I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs Dsamuel debebe100% (1)

- Cost Accounting and Business Combinations PartialDocument3 pagesCost Accounting and Business Combinations Partialjemmaserrano1220No ratings yet

- Midterm ExamDocument4 pagesMidterm ExamJohn Rey Bantay RodriguezNo ratings yet

- ProcessDocument16 pagesProcessJoydip DasguptaNo ratings yet

- Chapter 2 SeatworkDocument7 pagesChapter 2 Seatworkrhiz cyrelle calanoNo ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- Question Capture GuidelinesDocument26 pagesQuestion Capture GuidelinesKrystyn MyrhyllNo ratings yet

- Topic 5 - Spoilage, Defect, Scrap and WasteDocument1 pageTopic 5 - Spoilage, Defect, Scrap and WasteKrystyn MyrhyllNo ratings yet

- Inventories Pratical ExercisesDocument6 pagesInventories Pratical ExercisesKrystyn Myrhyll50% (2)

- Also, e Indeed Romantic S (2017)Document2 pagesAlso, e Indeed Romantic S (2017)Krystyn MyrhyllNo ratings yet

- 00Document3 pages00Krystyn MyrhyllNo ratings yet

- Handout No. 16: Policitacion - Imperfect Promise / Merely An Unaccepted Offer and Represents TheDocument1 pageHandout No. 16: Policitacion - Imperfect Promise / Merely An Unaccepted Offer and Represents TheKrystyn MyrhyllNo ratings yet

- FRSCDocument8 pagesFRSCKrystyn MyrhyllNo ratings yet

- Handout No. 8PDocument1 pageHandout No. 8PKrystyn MyrhyllNo ratings yet

- Company / Project Title: Overview - The Quick PitchDocument3 pagesCompany / Project Title: Overview - The Quick PitchMauro Domingo'sNo ratings yet

- LIC Exp Date: AetnaDocument66 pagesLIC Exp Date: AetnaTrudyNo ratings yet

- GraffitiDocument6 pagesGraffitiaphex twinkNo ratings yet

- Mels Subtype DescriptionsDocument11 pagesMels Subtype DescriptionsclaraNo ratings yet

- EXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and YetDocument3 pagesEXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and Yet愛HAKIMZVNo ratings yet

- Affidavit of DesistanceDocument4 pagesAffidavit of DesistanceRaymond RainMan DizonNo ratings yet

- Turino Thomas Peircean Phenomenology and PDFDocument13 pagesTurino Thomas Peircean Phenomenology and PDFFelipe BarãoNo ratings yet

- Rose Water OintmentDocument1 pageRose Water OintmentThomas Niccolo Filamor ReyesNo ratings yet

- The Masterbuilder - February 2012 - Road Engineering SpecialDocument238 pagesThe Masterbuilder - February 2012 - Road Engineering SpecialChaitanya Raj GoyalNo ratings yet

- ECG-Based Biometric Schemes For Healthcare: A Systematic ReviewDocument23 pagesECG-Based Biometric Schemes For Healthcare: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- About EthiopianDocument7 pagesAbout EthiopianTiny GechNo ratings yet

- MatrixDocument30 pagesMatrixauras2065No ratings yet

- Ayamas Journal PDFDocument8 pagesAyamas Journal PDFRaajKumarNo ratings yet

- Circus Psychology An Applied Guide To Thriving Under The Big Top 2022018105 2022018106 9781032266343 9781032266435 9781003289227 - CompressDocument151 pagesCircus Psychology An Applied Guide To Thriving Under The Big Top 2022018105 2022018106 9781032266343 9781032266435 9781003289227 - CompressLaura GăvanNo ratings yet

- Jody Howard Director, Social Responsibility Caterpillar, IncDocument17 pagesJody Howard Director, Social Responsibility Caterpillar, IncJanak ValakiNo ratings yet

- Tech Report - Docx.hDocument8 pagesTech Report - Docx.hHuzaif samiNo ratings yet

- Intelligent Gesture Controlled Wireless Wheelchair For The Physically HandicappedDocument6 pagesIntelligent Gesture Controlled Wireless Wheelchair For The Physically HandicappedshivaramreddyNo ratings yet

- 1 PBDocument9 pages1 PBFriga FmNo ratings yet

- Causes For Tempdb Full - SQL ServerDocument4 pagesCauses For Tempdb Full - SQL Serverarunkumarco0% (1)

- MX 29 LV 160Document66 pagesMX 29 LV 160freitastsp9166No ratings yet

- Integrated Door Motor Controller User Manual: Shenyang Bluelight Automatic Technology Co., LTDDocument56 pagesIntegrated Door Motor Controller User Manual: Shenyang Bluelight Automatic Technology Co., LTDJulio Cesar GonzalezNo ratings yet

- Bad For Democracy How The Presidency Undermines The Power of The PeopleDocument272 pagesBad For Democracy How The Presidency Undermines The Power of The PeoplePaulNo ratings yet

- Design and Fabrication of Unmanned Arial Vehicle For Multi-Mission TasksDocument10 pagesDesign and Fabrication of Unmanned Arial Vehicle For Multi-Mission TasksTJPRC PublicationsNo ratings yet

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentVinothan VasavanNo ratings yet

- Upcat 2014 - Simulated Exam - Set A - Section 2 - Science Proficiency v.5.26Document14 pagesUpcat 2014 - Simulated Exam - Set A - Section 2 - Science Proficiency v.5.26Regina MercurioNo ratings yet

- 06 The Table of Shewbread Study 6Document4 pages06 The Table of Shewbread Study 6High Mountain StudioNo ratings yet

Topic 5 - Spoilage, Defect, Scrap and Waste

Topic 5 - Spoilage, Defect, Scrap and Waste

Uploaded by

Krystyn MyrhyllOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 5 - Spoilage, Defect, Scrap and Waste

Topic 5 - Spoilage, Defect, Scrap and Waste

Uploaded by

Krystyn MyrhyllCopyright:

Available Formats

TOPIC 5 – Accounting for Materials (SPOILAGE, DEFECT, SCRAP, WASTE)

Prepared by: Olivo, CPA, MBA

XXX Company made 8,500 units with the following costs:

Direct Materials P20.00

Direct Labor P16.00

Factory overhead P12.00

The Factory overhead unit cost is inclusive of allowance of P1.50 for units that would not meet production standards but will be able

to resell for at a salvage value.

After completion, the 440 rejected units, a number within the normal range of spoilage, were sold for P21.00 each.

Requirements:

1. Assuming the loss on the spoilage is charged to a specific job:

a. How much is the amount of the spoiled goods to be recognized?

b. How much is the cost per unit of finished goods?

c. How much is the increase from the original cost per unit to the cost per unit after spoilage?

d. How much is the Loss on Spoiled Goods?

e. How much is the increase in the FOHC as a result of the spoilage?

2. Assuming the loss on the spoilage is charged to all production:

a. How much is the amount of the spoiled goods to be recognized?

b. How much is the cost per unit of finished goods?

c. How much is the increase from the original cost per unit to the cost per unit after spoilage?

d. How much is the Loss on Spoiled Goods?

e. How much is the increase in the FOHC as a result of the spoilage?

3. Provide Journal entry for assumptions 1 and 2

XXX Company made 8,500 units with the following costs:

Direct Materials P20.00

Direct Labor P16.00

Factory overhead P12.00

The Factory overhead unit cost is inclusive of allowance of P1.50 for units that would not meet production standards and must be

processed further in order to be salable.

During production, the 440 units were found to be defective. The following costs were incurred in order to rework the defective

units:

Direct Materials P2,500

Direct Labor P6,000

Overhead P3,200

Requirements:

4. Assuming the additional cost is charged to a specific job:

a. How much is the total amount of work in process to be forwarded to Finished Goods?

b. How much is the cost per unit of finished goods?

c. How much is the increase from the original cost per unit to the cost per unit after rework?

d. How much cost of rework charged to Factory overhead control?

5. Assuming the additional cost is charged to all production:

a. How much is the total amount of work in process to be forwarded to Finished Goods?

b. How much is the cost per unit of finished goods?

c. How much is the increase from the original cost per unit to the cost per unit after rework?

d. How much cost of rework charged to Factory overhead control?

You might also like

- Fallout PNP Character SheetDocument2 pagesFallout PNP Character SheetSteven Tran80% (5)

- 100 Questões Comentadas de PO PDFDocument31 pages100 Questões Comentadas de PO PDFMag NetoNo ratings yet

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Cost Accounting & Control Midterm ExaminationDocument7 pagesCost Accounting & Control Midterm ExaminationFerb CruzadaNo ratings yet

- CompTIA A+ Certification All-in-One Exam Questions Prep (220-701 & 220-702)From EverandCompTIA A+ Certification All-in-One Exam Questions Prep (220-701 & 220-702)Rating: 2.5 out of 5 stars2.5/5 (6)

- VNP SHEQ Consulting Proposal Audit Gambling BoardDocument3 pagesVNP SHEQ Consulting Proposal Audit Gambling BoardVictorNo ratings yet

- Retail ProjectDocument114 pagesRetail ProjectSowjanya KunareddyNo ratings yet

- ARS Webinar Handout 10292023Document3 pagesARS Webinar Handout 10292023johnafar998No ratings yet

- Materials in Cost AccountingDocument1 pageMaterials in Cost AccountingEi HmmmNo ratings yet

- 2 - Classroom ExercisesDocument4 pages2 - Classroom ExercisesHannah Jane ToribioNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingyurineo losisNo ratings yet

- Job OrderDocument2 pagesJob OrderGlen ValdezcoNo ratings yet

- Afar Job Order Costing Spoilage DefectiveDocument4 pagesAfar Job Order Costing Spoilage DefectiveKaye Angelie UsogNo ratings yet

- Job Order Costing Spoilage Defective - StudentDocument4 pagesJob Order Costing Spoilage Defective - StudentVince Christian PadernalNo ratings yet

- JOB ORDER COSTING Practice SetDocument5 pagesJOB ORDER COSTING Practice SetGoogle UserNo ratings yet

- 9011 - Job Order CostingDocument4 pages9011 - Job Order CostingVer LeeNo ratings yet

- Cost Accounting Cost Control FinalsDocument12 pagesCost Accounting Cost Control FinalsCindy Dela CruzNo ratings yet

- Job Order CostingDocument2 pagesJob Order Costingnelmamaeruz23No ratings yet

- Job Order CostingDocument4 pagesJob Order CostingVie ValeraNo ratings yet

- Please Write The Letter of Your Answer Beside Each NumberDocument8 pagesPlease Write The Letter of Your Answer Beside Each NumbershengNo ratings yet

- Try This - Cost ConceptsDocument6 pagesTry This - Cost ConceptsStefan John SomeraNo ratings yet

- LMSDocument4 pagesLMSJohn Carlo LorenzoNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Reviewer 3Document7 pagesReviewer 3Saeym SegoviaNo ratings yet

- Spoilage and Rework ProbsDocument3 pagesSpoilage and Rework ProbsShey INFTNo ratings yet

- Cost Accounting Final ExaminationDocument11 pagesCost Accounting Final ExaminationAndrew wigginNo ratings yet

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Document4 pagesSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Esheikell ChenNo ratings yet

- 10 Job Order CostingDocument5 pages10 Job Order CostingAllegria AlamoNo ratings yet

- Exercise Chap 18 (1,2,3)Document7 pagesExercise Chap 18 (1,2,3)Anh PhạmNo ratings yet

- Cost Accounting MidtermDocument4 pagesCost Accounting MidtermMieryle DioctonNo ratings yet

- Cost AccountingDocument6 pagesCost Accountingulquira grimamajowNo ratings yet

- Week 9 - Job Order&process Costing ActivityDocument5 pagesWeek 9 - Job Order&process Costing ActivityMark IlanoNo ratings yet

- Quiz 2Document4 pagesQuiz 2Kathleen CusipagNo ratings yet

- Auditing Theory SummaryDocument53 pagesAuditing Theory SummaryguhilingprincejohnNo ratings yet

- Reviewer in AccountingDocument9 pagesReviewer in Accountingdunabels25% (4)

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- Epektos Part 1Document4 pagesEpektos Part 1Melvin MendozaNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- ANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireDocument5 pagesANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireKatrina PetracheNo ratings yet

- TOS Cost AssessmentDocument41 pagesTOS Cost AssessmentHNo ratings yet

- Cost Accounting OverheadDocument3 pagesCost Accounting OverheadNah HamzaNo ratings yet

- Theory Questions Job Order CostingDocument4 pagesTheory Questions Job Order CostingEl AgricheNo ratings yet

- Chapter 5 LABOR and FOHDocument22 pagesChapter 5 LABOR and FOHJenny AstroNo ratings yet

- CAC Quiz No. 3 PDFDocument14 pagesCAC Quiz No. 3 PDFEdi wow WowNo ratings yet

- Job Order Costing: Prof. Mark Lester T. Balasa, CpaDocument24 pagesJob Order Costing: Prof. Mark Lester T. Balasa, CpaNah HamzaNo ratings yet

- An Introduction To Cost Terms and PurposesDocument13 pagesAn Introduction To Cost Terms and PurposesHendriMaulanaNo ratings yet

- SpoilageDocument3 pagesSpoilageela kikayNo ratings yet

- Job Order Costing - Production LossesDocument1 pageJob Order Costing - Production LossesDerick FigueroaNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Accounting For Production Losses in A Job Order CostingDocument2 pagesAccounting For Production Losses in A Job Order CostingMARYGRACE FERRER100% (1)

- Far Eastern Univrsity Cost Accounting CanvassDocument8 pagesFar Eastern Univrsity Cost Accounting CanvassSharmaine FranciscoNo ratings yet

- Job Order Costing SeatworkDocument7 pagesJob Order Costing SeatworksarahbeeNo ratings yet

- Chapter 2Document3 pagesChapter 2subeyr963No ratings yet

- Cost Accounting Quiz 1Document4 pagesCost Accounting Quiz 1Mary Joanne Tapia33% (3)

- AFAR Quizzer 1 SolutionsDocument12 pagesAFAR Quizzer 1 SolutionsRic John Naquila CabilanNo ratings yet

- Part I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs DDocument9 pagesPart I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs Dsamuel debebe100% (1)

- Cost Accounting and Business Combinations PartialDocument3 pagesCost Accounting and Business Combinations Partialjemmaserrano1220No ratings yet

- Midterm ExamDocument4 pagesMidterm ExamJohn Rey Bantay RodriguezNo ratings yet

- ProcessDocument16 pagesProcessJoydip DasguptaNo ratings yet

- Chapter 2 SeatworkDocument7 pagesChapter 2 Seatworkrhiz cyrelle calanoNo ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- Question Capture GuidelinesDocument26 pagesQuestion Capture GuidelinesKrystyn MyrhyllNo ratings yet

- Topic 5 - Spoilage, Defect, Scrap and WasteDocument1 pageTopic 5 - Spoilage, Defect, Scrap and WasteKrystyn MyrhyllNo ratings yet

- Inventories Pratical ExercisesDocument6 pagesInventories Pratical ExercisesKrystyn Myrhyll50% (2)

- Also, e Indeed Romantic S (2017)Document2 pagesAlso, e Indeed Romantic S (2017)Krystyn MyrhyllNo ratings yet

- 00Document3 pages00Krystyn MyrhyllNo ratings yet

- Handout No. 16: Policitacion - Imperfect Promise / Merely An Unaccepted Offer and Represents TheDocument1 pageHandout No. 16: Policitacion - Imperfect Promise / Merely An Unaccepted Offer and Represents TheKrystyn MyrhyllNo ratings yet

- FRSCDocument8 pagesFRSCKrystyn MyrhyllNo ratings yet

- Handout No. 8PDocument1 pageHandout No. 8PKrystyn MyrhyllNo ratings yet

- Company / Project Title: Overview - The Quick PitchDocument3 pagesCompany / Project Title: Overview - The Quick PitchMauro Domingo'sNo ratings yet

- LIC Exp Date: AetnaDocument66 pagesLIC Exp Date: AetnaTrudyNo ratings yet

- GraffitiDocument6 pagesGraffitiaphex twinkNo ratings yet

- Mels Subtype DescriptionsDocument11 pagesMels Subtype DescriptionsclaraNo ratings yet

- EXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and YetDocument3 pagesEXPRESSING CONTRAST: However, But, Nevertheless, Still, Whereas and Yet愛HAKIMZVNo ratings yet

- Affidavit of DesistanceDocument4 pagesAffidavit of DesistanceRaymond RainMan DizonNo ratings yet

- Turino Thomas Peircean Phenomenology and PDFDocument13 pagesTurino Thomas Peircean Phenomenology and PDFFelipe BarãoNo ratings yet

- Rose Water OintmentDocument1 pageRose Water OintmentThomas Niccolo Filamor ReyesNo ratings yet

- The Masterbuilder - February 2012 - Road Engineering SpecialDocument238 pagesThe Masterbuilder - February 2012 - Road Engineering SpecialChaitanya Raj GoyalNo ratings yet

- ECG-Based Biometric Schemes For Healthcare: A Systematic ReviewDocument23 pagesECG-Based Biometric Schemes For Healthcare: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- About EthiopianDocument7 pagesAbout EthiopianTiny GechNo ratings yet

- MatrixDocument30 pagesMatrixauras2065No ratings yet

- Ayamas Journal PDFDocument8 pagesAyamas Journal PDFRaajKumarNo ratings yet

- Circus Psychology An Applied Guide To Thriving Under The Big Top 2022018105 2022018106 9781032266343 9781032266435 9781003289227 - CompressDocument151 pagesCircus Psychology An Applied Guide To Thriving Under The Big Top 2022018105 2022018106 9781032266343 9781032266435 9781003289227 - CompressLaura GăvanNo ratings yet

- Jody Howard Director, Social Responsibility Caterpillar, IncDocument17 pagesJody Howard Director, Social Responsibility Caterpillar, IncJanak ValakiNo ratings yet

- Tech Report - Docx.hDocument8 pagesTech Report - Docx.hHuzaif samiNo ratings yet

- Intelligent Gesture Controlled Wireless Wheelchair For The Physically HandicappedDocument6 pagesIntelligent Gesture Controlled Wireless Wheelchair For The Physically HandicappedshivaramreddyNo ratings yet

- 1 PBDocument9 pages1 PBFriga FmNo ratings yet

- Causes For Tempdb Full - SQL ServerDocument4 pagesCauses For Tempdb Full - SQL Serverarunkumarco0% (1)

- MX 29 LV 160Document66 pagesMX 29 LV 160freitastsp9166No ratings yet

- Integrated Door Motor Controller User Manual: Shenyang Bluelight Automatic Technology Co., LTDDocument56 pagesIntegrated Door Motor Controller User Manual: Shenyang Bluelight Automatic Technology Co., LTDJulio Cesar GonzalezNo ratings yet

- Bad For Democracy How The Presidency Undermines The Power of The PeopleDocument272 pagesBad For Democracy How The Presidency Undermines The Power of The PeoplePaulNo ratings yet

- Design and Fabrication of Unmanned Arial Vehicle For Multi-Mission TasksDocument10 pagesDesign and Fabrication of Unmanned Arial Vehicle For Multi-Mission TasksTJPRC PublicationsNo ratings yet

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentVinothan VasavanNo ratings yet

- Upcat 2014 - Simulated Exam - Set A - Section 2 - Science Proficiency v.5.26Document14 pagesUpcat 2014 - Simulated Exam - Set A - Section 2 - Science Proficiency v.5.26Regina MercurioNo ratings yet

- 06 The Table of Shewbread Study 6Document4 pages06 The Table of Shewbread Study 6High Mountain StudioNo ratings yet