Professional Documents

Culture Documents

Preference Shares - October 31 2019

Preference Shares - October 31 2019

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

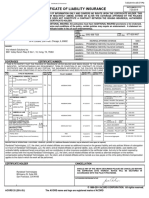

31 views1 pageThis document lists company names and their closing market figures for October 31, 2019, including closing price, day's price movement, high and low prices for the day and past 12 months, trading volume, percentage price change over 12 months, market capitalization, and other financial metrics. It provides performance data for a variety of South African and international exchange traded funds, stocks, and indices. Overall the document presents a snapshot of how various companies and funds performed on the stock market on October 31, 2019.

Original Description:

Preference Shares - October 31 2019

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists company names and their closing market figures for October 31, 2019, including closing price, day's price movement, high and low prices for the day and past 12 months, trading volume, percentage price change over 12 months, market capitalization, and other financial metrics. It provides performance data for a variety of South African and international exchange traded funds, stocks, and indices. Overall the document presents a snapshot of how various companies and funds performed on the stock market on October 31, 2019.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

31 views1 pagePreference Shares - October 31 2019

Preference Shares - October 31 2019

Uploaded by

Lisle Daverin BlythThis document lists company names and their closing market figures for October 31, 2019, including closing price, day's price movement, high and low prices for the day and past 12 months, trading volume, percentage price change over 12 months, market capitalization, and other financial metrics. It provides performance data for a variety of South African and international exchange traded funds, stocks, and indices. Overall the document presents a snapshot of how various companies and funds performed on the stock market on October 31, 2019.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Markets and Commodity figures

31 October 2019

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2420000 0 0 0 0 0 34.4 2510000 1740010 0 0 0 0

KRHALF 1105000 0 0 0 0 0 30 1105000 800000 0 0 0 0

KRQRTR 580000 0 0 0 0 0 39.8 600000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 0 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

1NVEST 4662 31 0.7 4713 4651 0 -6.8 6485 4529 0 0 0 7.3

1NVESTBOND 7106 -23 -0.3 7106 7106 0 2.9 7292 6887 7.1 0 0 2.4

1NVESTG7GOVT 8539 119 1.4 8599 8539 1 10.7 9000 7125 15.3 0 0 1.3

1NVESTGLOBAL 2181 39 1.8 2181 2181 0 20.1 2250 1658 73.5 0 0 2.9

1NVESTGOLDET 22496 408 1.8 22567 22095 0 26.7 23481 16487 154.6 0 0 0

1NVESTMSCI 4503 23 0.5 4503 4503 0 14.3 4545 3473 90.1 0 0 0

1NVESTPALLAD 26600 208 0.8 26902 26499 6 69 26902 12022 3871.7 0 0 0

1NVESTPLATIN 13805 299 2.2 13805 13634 40 12.9 16000 10620 2100.2 0 0 0

1NVESTRHODIU 76707 685 0.9 78000 76583 0 120.6 80544 22222 395.7 0 0 0

1NVESTS&P500 22775 89 0.4 23050 22775 0 15.6 23098 15318 21.5 0 0 0

1NVESTSWIX40 1060 13 1.2 1068 1058 0 6.6 1164 905 0 0 0 1.1

1NVESTTOP40 5040 67 1.3 5061 5029 0 9.2 5353 4305 0 0 0 2.1

2YRDOLLARCST 152030 875 0.6 152030 152030 0 2.7 156000 132510 69.5 0 0 0.8

AMIBIG50EX-S 1297 -120 -8.5 1395 1102 6 -6.7 3232 1102 24.8 0 0 0

AMIRLSTTEX-S 3454 -920 -21 4300 3454 0 -19.7 6900 1998 1.3 0 0 0

AMSSBP 24 -3 -11.1 24 24 0 -20 31 4 27 0 0 0

ANGSBW 5 -2 -28.6 5 5 0 0 29 5 7 0 0 0

ANGSBX 17 -5 -22.7 18 17 350 -41.4 36 17 22 0 0 0

ASHBURTONGBL 4944 27 0.5 4998 4908 6 12.3 4999 3754 582.6 0 0 1.6

ASHBURTONINF 2010 -24 -1.2 2030 2009 20 -0.6 2143 1918 326.2 0 0 3.2

ASHBURTONMID 736 8 1.1 742 706 30 7.6 759 636 378.6 0 0 2.2

ASHBURTONTOP 5046 73 1.5 5065 5035 15 9.1 5576 4367 1483.9 0 0 2.3

ASHBURTONWOR 773 13 1.7 777 770 13 8.7 801 603 122.6 0 0 0.8

BHPSBP 26 -1 -3.7 26 26 0 -16.1 34 4 27 0 0 0

CLSSBP 32 1 3.2 32 32 0 0 36 31 31 0 0 0

CORE DIVTRAX 2538 15 0.6 2562 2538 7 -1.5 2790 2309 311.8 0 0 1.2

CORE GLPROP 4208 105 2.6 4235 4101 78 18 4235 3330 483 0 0 2

CORE PREF 935 0 0 942 935 10 10.9 1010 830 347.3 0 0 6.2

CORE S&P500 4616 17 0.4 4647 4600 19 14.7 4647 3500 914 0 0 1.3

CORE SAPY 4784 0 0 0 0 0 -6.6 5460 4684 149.6 0 0 6.8

CORE TOP50 2272 28 1.2 2282 2260 12 5.3 2421 2041 1381.9 0 0 1.4

CORESHARESGL 1352 11 0.8 1369 1350 123 15.7 1369 1065 480.7 0 0 1.3

CORESHARESSA 1494 9 0.6 1505 1476 10 -8.6 1732 1449 0 0 0 7.8

CORESHARESSC 4547 46 1 4572 4520 1 3.6 4787 4208 126.3 0 0 2

DOLLARCSTDL 155050 2015 1.3 155370 153450 1 13.9 159000 125465 130.1 0 0 1.3

DSYSBP 32 -3 -8.6 32 32 0 0 35 28 35 0 0 0

ERAFI 0 0 0 0 0 0 0 0 0 28.2 0 0 0

ERAFIOVRLL 0 0 0 0 0 0 0 0 0 93.9 0 0 0

EXXSBP 23 2 9.5 23 23 0 0 28 21 21 0 0 0

FSRSBW 11 0 0 11 11 0 -64.5 43 9 11 0 0 0

FSRSBX 32 1 3.2 32 32 0 0 32 28 31 0 0 0

GFISBR 7 -3 -30 9 7 800 -78.1 35 7 10 0 0 0

GFISBS 22 -3 -12 22 22 0 0 32 22 25 0 0 0

HARSBV 21 -3 -12.5 21 21 200 -34.4 39 21 24 0 0 0

IMPSBT 6 0 0 6 6 0 -80.6 35 6 6 0 0 0

IMPSBU 10 0 0 10 10 0 -54.5 26 9 10 0 0 0

IMPSBV 29 -1 -3.3 29 29 0 0 35 29 30 0 0 0

KIOSBW 30 0 0 30 30 0 -6.3 48 16 30 0 0 0

KRCSTDLCRTFC 2362200 44200 1.9 2362200 2362200 0 25.5 2443450 1150398 771.1 0 0 0

MTNSBQ 20 0 0 20 20 0 -37.5 34 17 20 0 0 0

MTNSBX 0 0 0 0 0 0 0 0 0 0 0 0 0

NEWFUNDSEQUI 3672 28 0.8 3672 3672 0 29.8 3672 2500 203.7 0 0 2.9

NEWFUNDSGOVI 6577 -48 -0.7 6713 6549 30 11.4 6999 5790 932.5 0 0 8.8

NEWFUNDSILBI 6890 3 0 6925 6890 0 3 6988 6555 62 0 0 2.8

NEWFUNDSMAPP 2160 17 0.8 2160 2160 0 8.7 2294 1855 38.7 0 0 2.7

NEWFUNDSNEWS 4713 5 0.1 4713 4713 0 7.2 5318 4364 36.4 0 0 1.9

NEWFUNDSS&P 3040 -13 -0.4 3040 3040 0 -15.2 3767 2798 40.4 0 0 3.5

NEWFUNDSSHAR 326 -2 -0.6 326 322 2 6.9 350 270 51.1 0 0 1.8

NEWFUNDSSWIX 1709 18 1.1 1719 1706 103 9.2 1860 1542 22.8 0 0 1.2

NEWFUNDSTRAC 2602 1 0 2606 2602 0 7.5 2606 2416 216.3 0 0 6.3

NEWGOLD 13696 280 2.1 13876 13524 2536 12.8 14330 10536 14033.1 0 0 0

NEWGOLDISSUE 21550 420 2 21630 21150 714 26.6 22570 15765 14575 0 0 0

NEWGOLDPLLDM 26579 146 0.6 26831 26579 0 68.6 26831 15304 974 0 0 0

NFEQUITYVALU 925 6 0.7 925 925 0 -6 1038 876 110.4 0 0 1.9

NFLOWVLTLTY 1089 12 1.1 1097 1089 0 13 1097 907 125.5 0 0 1.8

NFVMDFNSV 962 6 0.6 962 962 0 0 997 939 49.6 0 0 2.1

NFVMHIGH 1095 22 2.1 1096 1091 0 15.3 1096 917 57.7 0 0 1.6

NFVMMDRT 997 16 1.6 997 997 0 0 997 879 54.6 0 0 1.4

NPNSBY 8 -4 -33.3 8 8 0 -75 44 7 12 0 0 0

NPNSBZ 45 -3 -6.3 45 45 0 28.6 50 34 48 0 0 0

PREFEXSCRTS 0 0 0 0 0 0 0 0 0 225.4 0 0 0

PRXSBP 38 -3 -7.3 38 38 0 2.7 45 32 41 0 0 0

RMBINFLTN 0 0 0 0 0 0 0 0 0 381.1 0 0 0

RMBMID 0 0 0 0 0 0 0 0 0 130.9 0 0 0

RMBTOP40 0 0 0 0 0 0 0 0 0 601.9 0 0 0

SATRIX40PRTF 5043 70 1.4 5060 4890 256 9.3 5375 4421 8543.2 0 0 1.8

SATRIXDIVIPL 241 2 0.8 244 239 892 2.6 267 224 1585.5 0 0 2.3

SATRIXFINI 1596 9 0.6 1617 1593 104 0.8 1811 1437 748.1 0 0 3.4

SATRIXILBI 582 -10 -1.7 591 582 9 3.2 601 552 100.7 0 0 2.9

SATRIXINDI 6812 105 1.6 6849 6521 20 8.1 7299 6090 1810.1 0 0 1.3

SATRIXMMNTM 1073 15 1.4 1073 1073 0 12.9 1095 906 24.4 0 0 1

SATRIXMSCI 4514 26 0.6 4555 4500 487 14.7 4555 3350 2431.2 0 0 0

SATRIXMSCIEM 4245 21 0.5 4294 4245 43 12.9 4294 3557 598.7 0 0 0

SATRIXNASDAQ 6843 42 0.6 6917 6804 19 18.7 6917 4896 586.3 0 0 0

SATRIXPRTFL 1493 14 0.9 1499 1480 13 -15.8 1900 1401 234.7 0 0 4.5

SATRIXQLTY 824 7 0.9 833 817 16 0.2 930 746 119.6 0 0 2.9

SATRIXRAFI40 1477 15 1 1477 1420 50 7.9 1554 1261 969 0 0 1.5

SATRIXRESI 4744 55 1.2 4744 4688 11 12.2 5002 3709 398 0 0 1

SATRIXS&P500 4546 20 0.4 4640 4546 20 15.6 4640 3406 732 0 0 0

SATRIXSWIXTO 1060 13 1.2 1067 1005 19 6.6 1180 956 365.6 0 0 1.4

SGLSBS 1 -3 -75 1 1 0 -96.3 29 1 4 0 0 0

SGLSBT 7 -2 -22.2 7 7 1810 -80 49 7 9 0 0 0

SOLSBS 50 7 16.3 50 50 0 78.6 76 24 43 0 0 0

SOLSBT 30 4 15.4 30 30 0 0 34 23 26 0 0 0

SYGNIAITRIX 2705 10 0.4 2732 2689 74 15.7 2800 1985 650.2 0 0 0.2

SYGNIAITRIXG 4352 71 1.7 4381 4310 15 17.2 4390 3400 314.8 0 0 1.1

SYGNIAITRIXS 4643 0 0 4699 4641 70 14 4822 3505 841 0 0 1.4

SYGNIAITRIXT 5123 65 1.3 5123 5123 0 9.4 5397 4218 212.5 0 0 2.8

TOPSBT 4 -2 -33.3 4 4 0 -82.6 46 4 6 0 0 0

TOPSBU 5 -2 -28.6 5 5 0 -79.2 24 5 7 0 0 0

TOPSBV 17 -3 -15 17 17 1075 -22.7 45 16 20 0 0 0

TOPSBW 23 -3 -11.5 23 23 730 0 31 23 26 0 0 0

TOPSKP 362 -115 -24.1 413 338 38 0 878 12 477 0 0 0

TOPSKR 883 -118 -11.8 883 883 0 40.8 1396 585 1001 0 0 0

TOPSKS 1070 -120 -10.1 1070 1070 0 32.1 1584 772 1190 0 0 0

TOPSKT 543 -117 -17.7 572 524 10 -29.4 1031 524 660 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1450 0 0 0 0 0 11.1 1450 1275 43.5 0 0 7

AFRICANOVER 1000 0 0 0 0 0 -4.9 1000 1000 2.8 0 0 1.2

BARWORLD6%PR 120 0 0 0 0 0 -0.8 123 120 0.5 0 0 15

CAPITEC-P 9700 0 0 9700 9700 0 7.8 10990 9000 79.9 0 0 8.7

CAXTON-P 15250 0 0 0 0 0 -19.7 19000 15250 7.6 0 0 3.2

DISC-B-P 9420 -30 -0.3 9480 9420 1 11.8 10000 8405 756 0 0 10.8

ELB-P 0 0 0 0 0 0 0 0 0 0 0 0 0

FIRSTRANDB-P 8500 0 0 8580 8500 42 7.6 9100 7800 3825 0 0 9

FOSCHINI 122 0 0 0 0 0 -1.6 126 122 0.2 0 0 10.7

GRINDRODPREF 7675 -125 -1.6 7825 7675 2 8.9 9000 6960 577.2 0 0 11.6

IBRDMBLPRF1 100485 0 0 0 0 0 0 101740 100271 343.4 0 0 5.6

INVESTEC 8660 160 1.9 8675 8650 2 16.4 9500 7252 1313 0 0 9.7

INVESTECPREF 8800 0 0 0 0 0 -20.7 10850 8500 242.4 0 0 3.5

INVICTA-P 8100 0 0 8100 8100 0 1.2 9450 7750 607.5 0 0 13.5

LIBERTY11C 107 0 0 0 0 0 -0.9 145 98 16.1 0 0 10.3

NAMPAK6%PREF 126 0 0 0 0 0 4.1 126 120 0.5 0 0 9.5

NAMPAK6,5%PR 131 0 0 0 0 0 18 131 121 0.1 0 0 9.9

NEDBANKPREF 943 -15 -1.6 943 943 6 9 1000 855 3432.3 0 0 9

NETCAREPREF 7980 0 0 7980 7980 4 9.3 8722 7113 518.7 0 0 10.5

PSGSERV 8250 -40 -0.5 8250 8250 46 14.6 9500 7140 1443.8 0 0 10.3

RECMANDCLBR 1478 0 0 0 0 0 -17.9 1825 1450 700.6 0 0 0

REUNERT55%PR 0 0 0 0 0 0 0 0 0 0.7 0 0 0

REXTRFRM 127 -3 -2.3 127 127 5 -36.5 130 121 0.2 0 0 9.4

SASFIN-P 7750 95 1.2 7750 7655 0 11.5 8500 7000 137.6 0 0 10.8

STANDARD-P 8635 -55 -0.6 8690 8630 14 7.5 9050 8000 4604.2 0 0 9.1

STD 85 -14 -14.1 85 85 121 6.3 308 68 7.9 0 0 7.6

STEINHOFF-P 4401 0 0 0 0 0 0 0 0 660.2 0 0 19

TDHPB 0 0 0 0 0 0 0 0 0 0 0 0 0

ZAMBEZIRF 7700 -200 -2.5 7894 7700 117 22.2 8025 6050 12632.5 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

ABLSIRESET 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 99794 13705 15.9 99794 99794 0 0 100534 80210 22.1 0 0 0

IBOMLC 0 0 0 0 0 0 0 0 0 583.3 0 0 0

INVLTD 1087000 8954 0.8 1087000 1087000 0 1.5 1150676 1021254 11.9 0 0 0

UBNPNF 68722 0 0 68722 68722 25 0 102278 36447 142.1 0 0 0

UBSELECA01NV 9351 0 0 9351 9351 0 -6.5 10361 8488 471.3 0 0 0

UBSELECB01NV 8929 0 0 8929 8929 0 -10.7 10428 8141 135.2 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBGLOBE 0 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 0 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11850 12 0.1 11850 11850 0 8.5 12203 10600 2367.6 0 0 0

DBMSCICHETN 7800 162 2.1 7800 7800 0 13.2 8400 6443 1527.6 0 0 0

DBMSCIEMETN 7013 163 2.4 7013 7013 0 13.3 7075 5850 1370 0 0 0

FRKBONDGOLD 2373900 44265 1.9 2373900 2373900 0 5.3 2458050 2246985 1030.8 0 0 0

FRSFRPT9JUN1 147650 3100 2.1 147650 147650 0 15.3 152700 111950 1063.4 0 0 0

GOLDCMMDTY-L 24528 477 2 24528 24528 0 24.2 25615 14588 240.5 0 0 0

IBETNT1CT46 0 0 0 0 0 0 0 0 0 48.6 0 0 0

IBLUSDZAROCT 151329 785 0.5 151329 151329 0 2 156989 133589 526.9 0 0 2.3

IBSWX40TR2ET 18185 149 0.8 18185 18185 0 10.1 19548 16210 901.8 0 0 0

IBTOP40CLIQU 124578 0 0 0 0 0 0 0 0 1.2 0 0 0

IBTOP40TR2ET 7584 101 1.3 7584 7562 0 13.1 7863 6476 954.1 0 0 0

IBVR2ETN 101208 19 0 101208 101208 0 0 101208 100019 1517.8 0 0 0

IBVR3ETN 101254 19 0 101254 101254 0 0 101254 100020 1518.5 0 0 0

NEWWAVEETN 13773 287 2.1 13773 13773 0 12.6 14445 10503 28.1 0 0 0

NEWWAVEEUROE 1686 13 0.8 1686 1686 0 0.4 1728 1474 37.8 0 0 0

NEWWAVEGBPET 1958 20 1 1960 1957 15 3.3 1960 1567 43.8 0 0 0.4

NEWWAVESLVET 264 4 1.5 264 259 1000 26.9 283 188 43 0 0 0

NEWWAVEUSDET 1518 9 0.6 1524 1507 73 1.9 1561 1340 382.3 0 0 2

PALADIUMCOMM 78021 571 0.7 78694 78021 0 75.7 78694 43348 387.3 0 0 0

PLATINUMCOMM 11476 248 2.2 11476 11476 0 13.3 11989 8707 224.6 0 0 0

SBACMMDTYIND 1424 -1 -0.1 1424 1424 0 -1.6 1458 1209 142.5 0 0 0

SBAFRICAEQUI 1158 7 0.6 1158 1158 0 10.5 1200 946 230.2 0 0 0

SBCOPPERETN 1473 -12 -0.8 1473 1473 0 1.9 1559 1311 148.5 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- PGMP Complete Reference SampleDocument45 pagesPGMP Complete Reference Samplemhamrawy100% (3)

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseDocument6 pagesA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftNo ratings yet

- Handbook Asset ManagementDocument232 pagesHandbook Asset ManagementGilmer PatricioNo ratings yet

- Burlington Northern Railroad CompanyDocument13 pagesBurlington Northern Railroad CompanysdNo ratings yet

- Baird - Euroland Foods CaseDocument5 pagesBaird - Euroland Foods CaseKyleNo ratings yet

- Visa EMV 3DS Compliant Vendor Product List - 22jan2020Document3 pagesVisa EMV 3DS Compliant Vendor Product List - 22jan2020klcekishoreNo ratings yet

- Preference Shares - July 30 2020Document1 pagePreference Shares - July 30 2020Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesMatshepo SeletswaneNo ratings yet

- Preference Shares - May 26 2020Document1 pagePreference Shares - May 26 2020Lisle Daverin BlythNo ratings yet

- Preference Shares - September 18 2019Document1 pagePreference Shares - September 18 2019Anonymous MPsxhBNo ratings yet

- Preference Shares - June 11 2018Document1 pagePreference Shares - June 11 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - November 6 2019Document1 pagePreference Shares - November 6 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - April 11 2018Document1 pagePreference Shares - April 11 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 25 2019Document1 pagePreference Shares - March 25 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 27 2018Document1 pagePreference Shares - July 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 19 2019Document1 pagePreference Shares - August 19 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - October 3 2019Document1 pagePreference Shares - October 3 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - September 26 2019Document1 pagePreference Shares - September 26 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - August 5 2019Document1 pagePreference Shares - August 5 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 25 2019Document1 pagePreference Shares - October 25 2019Anonymous MZp9gEGg6No ratings yet

- Preference Shares - November 5 2019Document1 pagePreference Shares - November 5 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - August 19 2019Document1 pagePreference Shares - August 19 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - August 28 2019Document1 pagePreference Shares - August 28 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - May 17 2018Document1 pagePreference Shares - May 17 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 2 2019Document1 pagePreference Shares - October 2 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - November 4 2019Document1 pagePreference Shares - November 4 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - August 7 2019Document1 pagePreference Shares - August 7 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 6 2019Document1 pagePreference Shares - September 6 2019Anonymous ZXo7Xf4No ratings yet

- Preference Shares - October 9 2019Document1 pagePreference Shares - October 9 2019Lisle Daverin BlythNo ratings yet

- PreferenceShares - June 27 2018Document1 pagePreferenceShares - June 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 2 2019Document1 pagePreference Shares - September 2 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 24 2019Document1 pagePreference Shares - March 24 2019Anonymous 7A1d7fjj3No ratings yet

- Preference Shares - September 11 2019Document1 pagePreference Shares - September 11 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 16 2019Document1 pagePreference Shares - September 16 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 31 2019Document1 pagePreference Shares - July 31 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 9 2019Document1 pagePreference Shares - September 9 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceShares - June 26 2017Document1 pagePreferenceShares - June 26 2017Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 19 2019Document1 pagePreference Shares - March 19 2019Tiso Blackstar GroupNo ratings yet

- PreferenceShares - June 23 2017Document1 pagePreferenceShares - June 23 2017Tiso Blackstar GroupNo ratings yet

- PreferenceShares PDFDocument1 pagePreferenceShares PDFTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - August 12 2019Document1 pagePreference Shares - August 12 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 19 2017Document1 pagePreference Shares - June 19 2017Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - July 29 2019Document1 pagePreference Shares - July 29 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - March 26 2019Document1 pagePreference Shares - March 26 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - February 27 2018Document1 pagePreference Shares - February 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 3 2019Document1 pagePreference Shares - June 3 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - August 14 2019Document1 pagePreference Shares - August 14 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 30 2018Document1 pagePreference Shares - July 30 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 17 2019Document1 pagePreference Shares - September 17 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - March 27 2019Document1 pagePreference Shares - March 27 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 18 2019Document1 pagePreference Shares - March 18 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - May 26 2019Document1 pagePreference Shares - May 26 2019Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 11 2022Document1 pageLiberty - December 11 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - December 5 2022Document2 pagesFairbairn - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 1 2022Document2 pagesSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 21 2022Document3 pagesBonds - November 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 1 2022Document3 pagesBonds - December 1 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 29 2022Document1 pageFuel Prices - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 30 2022Document3 pagesBonds - November 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 29 2022Document3 pagesBonds - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 23 2022Document3 pagesBonds - November 23 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 23 2022Document1 pageFuel Prices - November 23 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- Summer Training Project Report. ON "Customer Satisfaction of Existing Subscriber."Document84 pagesSummer Training Project Report. ON "Customer Satisfaction of Existing Subscriber."Rajveer Singh PariharNo ratings yet

- BP International Limited 2020Document99 pagesBP International Limited 2020anki jhaaNo ratings yet

- Apple ProjectDocument25 pagesApple ProjectNadia VirkNo ratings yet

- MKT420 Assignment - Business Analysis On 4P's Mini ReportDocument5 pagesMKT420 Assignment - Business Analysis On 4P's Mini ReportNurdini HusinNo ratings yet

- SWOT Analysis of Apparels Industry - Sakahawat Hossen (22281006)Document7 pagesSWOT Analysis of Apparels Industry - Sakahawat Hossen (22281006)sakhawat hossenNo ratings yet

- The Inbound Marketing Sales Playbookv5-1Document51 pagesThe Inbound Marketing Sales Playbookv5-1rahulartiNo ratings yet

- The Impact of Social Media Marketing On Purchase Decisions in The Tyre IndustryDocument130 pagesThe Impact of Social Media Marketing On Purchase Decisions in The Tyre IndustryCristopher MacaraegNo ratings yet

- NYU MKT Planning and Strategy SyllabusDocument8 pagesNYU MKT Planning and Strategy SyllabusTram AnhNo ratings yet

- AbsorptionDocument29 pagesAbsorptionRavi KatiyarNo ratings yet

- LexisNexis Concepts in Customer Due DiligenceDocument11 pagesLexisNexis Concepts in Customer Due DiligenceLexisNexis Risk Division100% (2)

- CertificateDocument1 pageCertificateganesh gaddeNo ratings yet

- TCSDocument4 pagesTCSSarithaNo ratings yet

- Exim Policy of IndiaDocument10 pagesExim Policy of IndiaYash BhatiaNo ratings yet

- SM - Distinctive CompetenciesDocument2 pagesSM - Distinctive CompetenciesVivek PimpleNo ratings yet

- Classification of Elements: Overheads - Accounting and ControlDocument11 pagesClassification of Elements: Overheads - Accounting and ControlAyushi GuptaNo ratings yet

- Web Design RFP SampleDocument9 pagesWeb Design RFP Samplebarneygurl0% (1)

- CompensationDocument36 pagesCompensationabdushababNo ratings yet

- 2.2.5 Using The Marketing MixDocument6 pages2.2.5 Using The Marketing MixryanNo ratings yet

- How To Design A Clothing Store: Interior Design and FunctionalityDocument5 pagesHow To Design A Clothing Store: Interior Design and FunctionalityNamit BaserNo ratings yet

- What Is Accounts Receivable (AR) ?Document2 pagesWhat Is Accounts Receivable (AR) ?Art B. EnriquezNo ratings yet

- METRO TRANSIT ORGANIZATION v. NLRCDocument2 pagesMETRO TRANSIT ORGANIZATION v. NLRCGabriel Literal100% (1)

- Cost ControlDocument3 pagesCost ControlAndry DepariNo ratings yet

- Employee MotivationDocument86 pagesEmployee MotivationKhaja PashaNo ratings yet

- FQP Informative PricingDocument8 pagesFQP Informative PricingkingxyzgNo ratings yet