Professional Documents

Culture Documents

GATT Declaration Form

GATT Declaration Form

Uploaded by

Amandeep WaliaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GATT Declaration Form

GATT Declaration Form

Uploaded by

Amandeep WaliaCopyright:

Available Formats

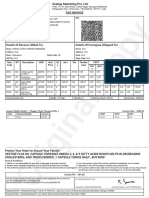

Annexure-1

CUSTOM DECLRATION FORM ORIGINAL

(See Rule 10 of Customs Valuation Rules, 1988)

Note: This declaration shall not be required for goods imported as passengers’ Baggage, goods imported for personal

use upto value of Rs. 1000/-, Samples of no commercial value, or where the goods are subject to specific rateof duty.

1. Importers Name and Address :

2. Supplier’s Name and Address :

3. Name and address of the agent, if any:

4. Description of goods :

5. Country of Origin :

6. Port of shipment :

7. AWB / BL Number and Date :

8. IGM Number and Date :

9. Contract Number and Date :

10. Nature of Transaction :

(Sale, Consignment, Hire, Gift etc.)

11. Invoice Number ad Date :

12. Invoice value :

13. Terms of payment :

14. Currency of payment :

15. Exchange rate :

16. Terms of Delivery :

17. Relationship between buyer and seller [Rule 2(2)]:

18. If related, what is the basis of declared value :

19. Conditions or Restrictions attached with the sale [Rule 4(2)] :

20. Valuation Method Application : (See Rule 4 to 8) :

21. Cost of services note included in the invoice value (Rule 9) :

(a) Brokerage and commissions :

(b) Cost of containers :

(c) Packing cost :

(d) Cost of goods and services supplied by the buyer :

(e) Royalties and licence fees :

(f) Value of proceeds with accure to seller :

(g) Fright :

(h) Insurance :

(i) Loading, unloading, handling charges :

(j) Landing charges :

(k) Other payments, if any :

22. Assessable Value in Rs. :

23. Previous imports of identical / similar goods, if any :

(a) Bill of Entry Number and Date :

(b) IGM Number and Date :

24. Any other relevant information : (Attach separate sheet, if necessary)

DECLARATION

1. I/We hereby declare that the information furnished above are true, complete and correct in every respect.

2. I/We also undertake to bring to the notice of proper officer any particulars which subsequently come to my/our

knowledge which will have a bearing on valuation.

Place

Date Signature of Importer

FOR CUSTOMS HOUSE USE

1. Bill on Entry Number and Date :

2. Valuation Method Applied (See Rules 4 to 8) :

3. If declared value not accepted, brief reasons :

4. Reference number and Date of any previous decisions/ruling :

5. Value Assessed,

A.O. Assistant Collector

DECLARATION

DECLARATION TO BE SIGNED BY AN IMPORTER CLEARING GOODS

WITH THE HELP OF A CUSTOM HOUSE AGENT

1. I/We declare to the best of my knowledge and belief that the contents of invoice No.(s)……………..

Dated ………… and other documents relating to the goods covered by the said invoice(s) and

presented here with are true and correct in every respect.

2. I/We declare that I/We have not received and do not know of any other documents and information

showing a different price value (including local payments whether as commission or otherwise)

quantity or description of the said goods and that if at any time hereafter. I/We discovered any

information showing different state of facts. I/We will immediately make the same know to the

Collector of Customs.

3. I/We declare that the goods covered by this bill of entry have been imported on an outright purchase

consignment account.

4. I/We am/are/not connected with the suppliers as:

(a) Agents distributors indenter branch subsidiary concession are and

(b) Collector entitled to the use of trade mark patent and Design

(c) Otherwise than as ordinary imports of buyers

5. I/We declare that method of invoicing has not changed since the date on which my/our books or

accounts or accounts and agreements with the suppliers were examined previously by Custom House.

N.B. : Strike out whichever is not applicable.

Signature of Importer

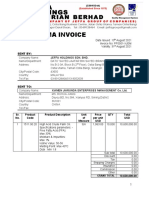

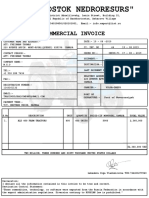

You might also like

- Trust Deed KenyaDocument11 pagesTrust Deed Kenyasam gold100% (2)

- Certificate of Origin Form - Germany FactoryDocument1 pageCertificate of Origin Form - Germany FactoryJiwoo A-Tech100% (1)

- Test 3Document2 pagesTest 3rafaelNo ratings yet

- Proforma Invoice: 10T Hydraulic Decoiler With Tracking Car 8m Automatic Pickup Ink-Jet PrinterDocument1 pageProforma Invoice: 10T Hydraulic Decoiler With Tracking Car 8m Automatic Pickup Ink-Jet PrinterKarima ALARDANo ratings yet

- Air India Web Booking Eticket (YH575) - SharmaDocument2 pagesAir India Web Booking Eticket (YH575) - SharmasachinNo ratings yet

- Comercial InvoiceDocument1 pageComercial Invoicepatel vimalNo ratings yet

- Gul275AWB - 1055604Document1 pageGul275AWB - 1055604Karan AggarwalNo ratings yet

- InvoiceDocument1 pageInvoiceAmruth Charan KNo ratings yet

- PDFDocument1 pagePDFAnonymous aOIgRVXx57No ratings yet

- UniglobeDocument2 pagesUniglobeGurdev SinghNo ratings yet

- Quotation Format ALIGARH KAR 1Document2 pagesQuotation Format ALIGARH KAR 1Ashish PandeyNo ratings yet

- Decleration LetterDocument1 pageDecleration LetterRT WorkNo ratings yet

- SPIC Proforma Invoice Trial Charges RevisedDocument1 pageSPIC Proforma Invoice Trial Charges RevisedsiddharthnayakNo ratings yet

- Proforma Invoice: Craig WeinbergerDocument8 pagesProforma Invoice: Craig WeinbergerayşeNo ratings yet

- XIR BEARING-Vicky-IN15072201-1 PDFDocument1 pageXIR BEARING-Vicky-IN15072201-1 PDFstojanovalidijaNo ratings yet

- Zemen - 12 12 2021Document1 pageZemen - 12 12 2021christina tetemkeNo ratings yet

- Ningbo Fangli Group Marketing Co. LTDDocument1 pageNingbo Fangli Group Marketing Co. LTDEsteban Ibarra RuizNo ratings yet

- E-Ticket Passenger and 1 MoreDocument7 pagesE-Ticket Passenger and 1 MoreArmaNo ratings yet

- Dec CanDocument3 pagesDec CanamernitwNo ratings yet

- Payment Receipt PALASHDocument1 pagePayment Receipt PALASHarpitNo ratings yet

- ReceiptDocument1 pageReceiptdgmisctyNo ratings yet

- Tradres Loan 2016 BCC - BR - 108 - 432Document45 pagesTradres Loan 2016 BCC - BR - 108 - 432RAJANo ratings yet

- 000BI6W9Document1 page000BI6W9rajuranjansNo ratings yet

- Invoice INV 184Document1 pageInvoice INV 184Igede YadnyaNo ratings yet

- RTA FormDocument14 pagesRTA Formsayed69No ratings yet

- ColgateDocument1 pageColgatekokila infraltdNo ratings yet

- Debit Note/Invoice: Remarks: N/ADocument1 pageDebit Note/Invoice: Remarks: N/AMd.Rafiqul IslamNo ratings yet

- Takraf Export InvoiceDocument1 pageTakraf Export Invoicemanoj983@gmail.comNo ratings yet

- I RRZ+ F) Invn Ix, - (S:: Ievn N . I Rns I Rez+Document3 pagesI RRZ+ F) Invn Ix, - (S:: Ievn N . I Rns I Rez+Lycv Montederamos Asis100% (1)

- Commercial InvoiceDocument4 pagesCommercial InvoiceHimanshu KushwahaNo ratings yet

- Hyacinth ProductsDocument2 pagesHyacinth ProductsnrcagroNo ratings yet

- Proforma InvoiceDocument2 pagesProforma InvoiceADEL SHAWKYNo ratings yet

- Hotel Invoice: Bill To: Address Line 1: Address Line 2: City, State ZIP TelDocument1 pageHotel Invoice: Bill To: Address Line 1: Address Line 2: City, State ZIP TelAmit PanditNo ratings yet

- Proforma Invoice (DeltaSalesApp) - Himgiri Soap Chemical Industries PDFDocument1 pageProforma Invoice (DeltaSalesApp) - Himgiri Soap Chemical Industries PDFRupesh GhimireNo ratings yet

- Inv P List 118 PDFDocument3 pagesInv P List 118 PDFTariqul SowrovNo ratings yet

- Pro Forma Invoice - 0001Document4 pagesPro Forma Invoice - 0001noreenNo ratings yet

- Dell Quotation INDDocument5 pagesDell Quotation INDManisha AgrawalNo ratings yet

- 328-2 - Export Packing ListDocument1 page328-2 - Export Packing ListHaziqueNo ratings yet

- MODELO. - ICPO - YesDocument6 pagesMODELO. - ICPO - YesEliel KleinNo ratings yet

- Warehouse Tentative Agreement With AwsDocument2 pagesWarehouse Tentative Agreement With Awsgrandsupreme.myNo ratings yet

- PackslipAndInvoice PuneDocument4 pagesPackslipAndInvoice PunevinaykumarjainNo ratings yet

- Proforma InvoiceDocument8 pagesProforma Invoicelokesh_mkNo ratings yet

- ConfirmationDocument2 pagesConfirmationsunny singhNo ratings yet

- BOC File 4Document2 pagesBOC File 4NORHAYATI BINTI ABDULLAH MoeNo ratings yet

- Modelo Proforma Invoice PIDocument1 pageModelo Proforma Invoice PIferdinand jhnatanNo ratings yet

- Ald 400 Farm Tractor Commercial Invoice PDFDocument2 pagesAld 400 Farm Tractor Commercial Invoice PDFAlexanderNo ratings yet

- Cameroun: Insurance Company Air Insurance NoticeDocument1 pageCameroun: Insurance Company Air Insurance NoticeENKI INGENIERIA & GEODESIANo ratings yet

- Requested To Supply Following Material (S) As Per Given Terms & ConditionsDocument2 pagesRequested To Supply Following Material (S) As Per Given Terms & ConditionsAsis SahooNo ratings yet

- Invoice Philips Trimmer PDFDocument1 pageInvoice Philips Trimmer PDFRahulNo ratings yet

- JJJHJHDocument1 pageJJJHJHDrAbhishek SarafNo ratings yet

- Format SIsDocument2 pagesFormat SIsSalim MalickNo ratings yet

- Admit CardDocument4 pagesAdmit Cardsaran kumar satsangiNo ratings yet

- Purchase OrderDocument3 pagesPurchase Orderchalla gundla NagarajuNo ratings yet

- Quotation - Golden HopeDocument3 pagesQuotation - Golden HopeAnifa OthmanNo ratings yet

- Bill For Hotel Sagar InternationalDocument2 pagesBill For Hotel Sagar InternationalgopihcNo ratings yet

- 100115619v2 PDFDocument5 pages100115619v2 PDFMartin Estrada CaceresNo ratings yet

- Muhammad AsgharDocument1 pageMuhammad AsgharayazNo ratings yet

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Document1 pageDetails of Receiver (Billed To) Details of Consignee (Shipped To)VESTIGE JVRATNAMNo ratings yet

- Research PaperDocument2 pagesResearch PaperSUHAIL BABANo ratings yet

- Form A With DeclarationDocument3 pagesForm A With DeclarationRohish MehtaNo ratings yet

- Gatt DeclarationDocument2 pagesGatt Declarationrupeshkumar084No ratings yet

- Test-5 - RevisedDocument8 pagesTest-5 - Revisedmangla.harsh77No ratings yet

- Harley Davidson Strategic Management Changed NewDocument33 pagesHarley Davidson Strategic Management Changed NewDevina GuptaNo ratings yet

- Investasi Sementara Pada ObligasiDocument34 pagesInvestasi Sementara Pada ObligasiAli-ImronNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- CIB Derivative WhitePaper 293301Document4 pagesCIB Derivative WhitePaper 293301shih_kaichihNo ratings yet

- Eligible Securities - RBA RepoDocument43 pagesEligible Securities - RBA RepoNDNo ratings yet

- 0.0 Concept NoteDocument2 pages0.0 Concept NoteAnurag SharmaNo ratings yet

- Company Screening - 2022 10 22 - 18 46 33Document25 pagesCompany Screening - 2022 10 22 - 18 46 33Shuchita AgarwalNo ratings yet

- Bs-Delhi 6 - 10 PDFDocument15 pagesBs-Delhi 6 - 10 PDFRavi JosephNo ratings yet

- Cutting Edge Pre-Int Unit 14Document10 pagesCutting Edge Pre-Int Unit 14AngelaNo ratings yet

- Barangay Budget FormsDocument31 pagesBarangay Budget FormsNonielyn Sabornido100% (1)

- Projected Cash Flow Statement in ExcelDocument19 pagesProjected Cash Flow Statement in ExcelfarshidianNo ratings yet

- HOMEWORKDocument3 pagesHOMEWORKFranklin FiencoNo ratings yet

- Acctg 311 Prelim ExamDocument8 pagesAcctg 311 Prelim ExamJaycie EscuadroNo ratings yet

- FINS 3616 Tutorial Questions-Week 2 - AnswersDocument5 pagesFINS 3616 Tutorial Questions-Week 2 - AnswersJethro Eros Perez100% (1)

- Islamic Finance System PDFDocument4 pagesIslamic Finance System PDFXahid YousafNo ratings yet

- LGUScoreCard BLGFDocument32 pagesLGUScoreCard BLGFKristel ClaudineNo ratings yet

- (Economy) Calculating Income Tax, Tax Exemption Vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal PDFDocument15 pages(Economy) Calculating Income Tax, Tax Exemption Vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal PDFRavikanth ReddyNo ratings yet

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- Before The Ld. Sole Arbitraor Dr. Abhishek Atrey Advocate Supreme Court of IndiaDocument7 pagesBefore The Ld. Sole Arbitraor Dr. Abhishek Atrey Advocate Supreme Court of IndiaSulabh Gupta100% (1)

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Applied Value Investing (Williams, Quinn JR) FA2016Document4 pagesApplied Value Investing (Williams, Quinn JR) FA2016darwin12No ratings yet

- 2019 760 Instructions PDFDocument52 pages2019 760 Instructions PDFLelosPinelos123No ratings yet

- SICHOTS240114220Document1 pageSICHOTS240114220Sandu MonicaNo ratings yet

- Sarvagya Institute of CommerceDocument44 pagesSarvagya Institute of CommerceadhishcaNo ratings yet

- Comparative Study Between Public and Private BankDocument40 pagesComparative Study Between Public and Private BankRashmi ShuklaNo ratings yet

- New Cascadia (WA Statute - CL Majority Rule) Old Olympia (CL - Modern Trend)Document19 pagesNew Cascadia (WA Statute - CL Majority Rule) Old Olympia (CL - Modern Trend)Sam AdamsNo ratings yet

- General Quiz: Chiranjeevi and SharmilaDocument68 pagesGeneral Quiz: Chiranjeevi and SharmilaRavi TejaNo ratings yet