Professional Documents

Culture Documents

104 Review

104 Review

Uploaded by

alanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

104 Review

104 Review

Uploaded by

alanCopyright:

Available Formats

BFA104 – Accounting Context and Method

Week 13 – Revision

SOLUTIONS

Question 1

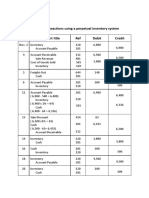

General Journal

Date Details Debit Credit

June 30 Rent Revenue 4 000

Unearned Revenue 4 000

Prepaid Expenses 600

Advertising Expense 600

Office Supplies Expense 5 955

Office Supplies 5 955

(7 200 – 1 245)

Depreciation Expense – Office Equipment 1 400

Accum Depreciation – Office Equip 1 400

(12 000 – 5 000 x 20%)

Accrued Revenue 1 500

Interest Revenue 1 500

Interest Expense 950

Accrued Expenses Payable 950

Salaries and Wages Expense 810

Accrued Expenses Payable 810

Question 2

General Journal

Date Details Debit Credit

2016

July 1 Accumulated Depreciation – Equipment 96 500

Equipment 96 500

To establish carrying amount of equipment before

improvements

Equipment 82 000

Cash at Bank 82 000

To record improvements to equipment

2017

Jan 1 Depreciation Expense - Motor Vehicles 15 900

Accumulated Depreciation - Motor Vehicles 15 900

Depreciation to date of disposal

(168 500 – 62 500) x 0.3 x 6/12) = $15 900

Either

Accumulated Depreciation – Motor Vehicles 78 400

Motor Vehicles 78 400

Netting off accumulated depreciation to the asset

Motor Vehicles – carrying amount now $90 100

Motor Vehicles (new) 82 000

Loss on Disposal of Motor Vehicles 8 100

Motor Vehicles (old) 90 100

Trade in of old Motor Vehicle for new Motor Vehicles

at a gain

Motor Vehicles (new) 110 000

Cash at Bank 110 000

Cash payment for new Motor Vehicles

OR Do all in one entry

Jan 1 Motor Vehicles (new) 192 000

Accumulated Depreciation - Motor Vehicles 78 400

Loss on Disposal of Motor Vehicles 8 100

Motor Vehicles (old) 168 500

Cash at Bank 110 000

Trade in of old Motor Vehicles for new Motor

Vehicles at a gain

Mar 1 Motor Vehicle Expense (or Maintenance Expense) 700

Cash at Bank 700

Paid for servicing of Motor Vehicles

June 30 Depreciation Expense – Motor Vehicles 38 400

Accumulated Depreciation – Motor Vehicles 38 400

Depreciation for six months to 30 June,

192 000 x 40% x 6/12

Depreciation Expense – Equipment 8 700

Accumulated Depreciation – Equipment 8 700

Depreciation of Equipment for year,

(160 500 – 30 000)/15

Question 3

General Journal

Date Details Debit Credit

Dec 31

a. Application 48 000

Share Capital 48 000

Shares allocated to successful applicants

Cash at Bank 48 000

Cash Trust 48 000

Cash from share issue transferred to bank account

Application 12 000

Cash Trust 12 000

Cash paid back to unsuccessful applicants

b. Final Dividend Declared 2 500

Final Dividend Payable 2 500

Final dividend declared at 50 000 shares x $0.05

c. Retained Profits 15 000

Share Capital 15 000

Issue of bonus shares to existing shareholders

d. Income Tax Expense 9 000

Income Tax Payable 9 000

Income tax expense for year

f. Allowance for Doubtful Debts 230

Accounts Receivable 230

Write off of bad debt

Bad Debts Expense 740

Allowance for Doubtful Debts 740

Adjust allowance for doubtful debts to 4% of

Accounts Receivable

Acc Rec 21 730 - 230 = 21 500

Allow required 21 500 x 0.0 4 = 860

Allow 350 - 230 = 120

Adjustment 860 - 120 = 740

Closing entries

Profit and Loss Summary 9 740

Bad Debts Expense 740

Income Tax Expense 9 000

Close additional expenses to P & L Summary

Profit and Loss Summary 5 260

Retained Profits 5 260

Transfer of profit for year to retained profits

Retained Profits 4 500

Interim Dividend Declared 2 000

Final Dividend Declared 2 500

Transfer of dividends declared from retained profits

Peanuts Ltd

Statement of Financial Position (extract)

As at 31 December 2016

Shareholders’ Equity:

Share Capital (102 500 Shares) 113 000

Retained Profits 37 540

150 540

You might also like

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Ic s01 Survey and Loss AssessmentDocument55 pagesIc s01 Survey and Loss AssessmentRanjith50% (4)

- Tugas Variable Costing and The Measurement of ESG and Quality CostsDocument5 pagesTugas Variable Costing and The Measurement of ESG and Quality Costsirga ayudiasNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- Far Quiz 2 Final W AnswersDocument6 pagesFar Quiz 2 Final W AnswersGia HipolitoNo ratings yet

- CH 4Document12 pagesCH 4Miftahudin Miftahudin0% (1)

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing The Financial StatementsDocument5 pagesChapter 4: Adjusting The Accounts and Preparing The Financial Statementschi_nguyen_100No ratings yet

- Accountancy I 2016 PDFDocument4 pagesAccountancy I 2016 PDFShahid RazwanNo ratings yet

- Accountancy and Auditing-2016 PDFDocument6 pagesAccountancy and Auditing-2016 PDFMian Abdullah YaseenNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- Book 2Document8 pagesBook 2May ManseNo ratings yet

- Name Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementDocument9 pagesName Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementHamza IqbalNo ratings yet

- Book 1Document14 pagesBook 1by ScribdNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Dissolution of Partnership - Question 1Document16 pagesDissolution of Partnership - Question 1anthony hoNo ratings yet

- Past Exam QuestionDocument3 pagesPast Exam QuestionYến Hoàng HảiNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- AfB1 Tutorial Questions For Week 3Document3 pagesAfB1 Tutorial Questions For Week 3zhaok0610No ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- Final ReviewDocument53 pagesFinal ReviewLalalaNo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Company Final Accounts: Debit Rs. Credit RsDocument5 pagesCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaNo ratings yet

- PGDM (2021-23) Exercise On Final AccountsDocument9 pagesPGDM (2021-23) Exercise On Final Accountspriyanshu guptaNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Accounting For Finance: Eric Cauvin Exercises 2Document6 pagesAccounting For Finance: Eric Cauvin Exercises 2ddd huangNo ratings yet

- Class Test Accountancy 11 JanDocument2 pagesClass Test Accountancy 11 Jansara VermaNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Corporate Final Accounts With AdjustmentsDocument6 pagesCorporate Final Accounts With AdjustmentsNeelu AggrawalNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Project Corporate AccountingDocument2 pagesProject Corporate AccountingARATFTAFTNo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (66)

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Finalterm Examination: Unfair Means in Completing ItDocument4 pagesFinalterm Examination: Unfair Means in Completing ItMuhammad Abdullah SaniNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- SS 2 Store MGT Third Term E-Learning NoteDocument38 pagesSS 2 Store MGT Third Term E-Learning Notepalmer okiemuteNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- A Project On Funds Flow Ststements 2016 in HeritageDocument61 pagesA Project On Funds Flow Ststements 2016 in Heritagevishnupriya100% (1)

- ch04Document76 pagesch04Margareta Jessica NathaniaNo ratings yet

- Intermediate Accounting Stice Stice SkousenDocument58 pagesIntermediate Accounting Stice Stice SkousenTornike Jashi100% (1)

- Group 1: A) Journalize The Transactions Using A Perpetual Inventory System Date Account Title Ref Debit CreditDocument6 pagesGroup 1: A) Journalize The Transactions Using A Perpetual Inventory System Date Account Title Ref Debit CreditQuỳnh'ss Đắc'ssNo ratings yet

- G.O. (MS) No.112 Dated: 22.06.2017 Naés à Tul, Må 08Document76 pagesG.O. (MS) No.112 Dated: 22.06.2017 Naés à Tul, Må 08Natchimuthu KannanNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Finance and Accounting Lecture 4Document47 pagesFinance and Accounting Lecture 4Mustafa MoatamedNo ratings yet

- Presentation1 ReshmaDocument26 pagesPresentation1 ReshmaJOE NOBLE 2020519No ratings yet

- ACCT1002 - Introduction To Financial Accounting Assignment # 2 Page - 1Document21 pagesACCT1002 - Introduction To Financial Accounting Assignment # 2 Page - 1MingxNo ratings yet

- Financial Ratio Analysis Case StudyDocument10 pagesFinancial Ratio Analysis Case StudyGracel Joy VicenteNo ratings yet

- Shalini Chaurasia, Voyage Accounting, M. Com. Sem.-Iii, Advance AccountingDocument5 pagesShalini Chaurasia, Voyage Accounting, M. Com. Sem.-Iii, Advance AccountingRitik SankarNo ratings yet

- Exercises of Accounting N PDocument34 pagesExercises of Accounting N PVan caothaiNo ratings yet

- Acc 223a CH 5 AnswersDocument13 pagesAcc 223a CH 5 Answersjr centenoNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 07 ChapterDocument18 pagesTest Bank Advanced Accounting 3e by Jeter 07 ChapterNicolas ErnestoNo ratings yet

- Prepare An Income Statements and A Balance Sheet: Senior High School DepartmentDocument10 pagesPrepare An Income Statements and A Balance Sheet: Senior High School DepartmentAira Mae PazNo ratings yet

- Final Accounts With Case Solution & Dindorf SolutionDocument39 pagesFinal Accounts With Case Solution & Dindorf SolutionAnkit kumarNo ratings yet

- Solution Performa - Mamta FashionsDocument3 pagesSolution Performa - Mamta FashionsGarimaBhandariNo ratings yet

- Ia3 - Chapter 1Document8 pagesIa3 - Chapter 1chesca marie penarandaNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Annexure II CP 14-13-14 PDFDocument381 pagesAnnexure II CP 14-13-14 PDFவேணிNo ratings yet

- Singapore GamingDocument12 pagesSingapore GamingJunyuanNo ratings yet

- AUVZSFDocument7 pagesAUVZSFnareeshkumar_koppalaNo ratings yet

- Income Statement and Related Information: Chapter Learning ObjectivesDocument52 pagesIncome Statement and Related Information: Chapter Learning ObjectivesIvern BautistaNo ratings yet

- SITXFIN004 Prepare and Monitorassessment 1 - Short Answer Questions v2.2Document7 pagesSITXFIN004 Prepare and Monitorassessment 1 - Short Answer Questions v2.2Tongshuo Liu0% (1)