Professional Documents

Culture Documents

Worldcom - Executive Summary Company Background

Worldcom - Executive Summary Company Background

Uploaded by

Yosafat Hasvandro HadiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worldcom - Executive Summary Company Background

Worldcom - Executive Summary Company Background

Uploaded by

Yosafat Hasvandro HadiCopyright:

Available Formats

1

WorldCom – Executive summary

Company background

WorldCom was a provider of long distance phone services to businesses and residents.

It started as a small company known as Long Distance Discount Services (“LDDS”) during

1983 based in Jackson, Mississippi. In 1985, LDDS selected Bernie Ebbers to be its Chief

Executive Officer. The company become traded publicly as a corporation in 1989 as a

result of a merger with Advantage Companies Inc. The company name was changed to

LDDS WorldCom in 1995, and relocated to Clinton, Mississippi. The company grew

rapidly and become the third largest telecommunications company in the United States

The company acquires over half a dozen communication companies during the year

1988- 1994. In November 1997, WorldCom and Microwave Communication Inc. (MCI)

merged for US$37 billion and become MCI WorldCom, making it the largest corporate

merger in US history.

WorldCom Scandal

In 1999, WorldCom’s revenue growth slowed and stock price began to fall. WorldCom’s

expenses increased as its earnings growth rate dropped. This meant WorldCom’s

earnings might not meet Wall Street analyst’s expectations. In order to increase revenue,

the company reduced the amount of money it held in reserve by $2.8 billion to cover

liabilities for the acquired companies and moved this money into the revenue line of its

financial statements. In 2000, Ebbers began to classify operating expenses as long-term

capital investments for $3.85 billion. With the alliance of WorldCom’s Chief Financial

Officer, Accounting Department Director, Management Reporting Department Director,

Controller and Legal Entity Accounting Director, Ebbers made entries to falsify financial

reports with no documentation or justification. These changes turned WorldCom’s losses

into profits and made WorldCom’s assets appear more valuable.

How it was discovered

In 2002, the Securities Exchange Commission requested for more information as

accounting irregularities were spotted in WorldCom’s books. The SEC was suspicious

because WorldCom was making so much profit, while another huge communication

company, AT&T was having losses. Internal auditor, Cynthia Cooper had found the

improper accounting and questionable entries amounted $2 billion. The controller of

WorldCom, David Meyers admitted to internal auditors that they didn’t follows accounting

standards. WorldCom admitted to inflating their profits by $3.8 billion over the previous

five quarters. The company filed for bankruptcy on the same year. As a results, WorldCom

was renamed to MCI after it emerged from bankruptcy in 2004. Former CEO, Ebbers and

Former CFO, Sullivan were charged with fraud and violating securities laws. Ebbers found

guilty and sentenced to 25 years in prison while Sullivan pleaded guilty and requested for

lenient sentences.

2

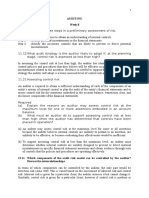

Case Study Answers

Q1- Describe the mechanisms that WorldCom’s management used to transfer profit from

other time periods to inflate the current period

WorldCom manipulated their profits using the infamous ‘cookie jar’ accounting technique

where the company build up reserves of expenses in one period and take advantage of

them in another period. The company created excess revenues for future expenses.

WorldCom falsely portrayed itself as a profitable business when it was not, and concealed

large losses suffered by improperly released certain reserves held against operating

expenses. The company also improperly classify operating expenses as capital

expenditures. WorldCom transferred the amounts in order to keep earnings in line with

the analyst’s projected earnings. This fraudulent accounting practices materially

understated the company’s expenses and materially overstated its earnings.

Q2 - Why did Arthur Anderson go along with each of these mechanisms?

We think that Arthur Anderson, external auditor for WorldCom had lost its independence

when conducting audit. Both Sullivan (CFO) and Myers (Controller) had worked for

Anderson before joining WorldCom. Also, Andersen’s close relationship with Ebbers,

resulted in lack of professional scepticism. They had conflict of interest whereby they felt

more responsible for their client rather than upholding their fiduciary responsibility.

Moreover, maybe Arthur wanted to maintain WorldCom as their client because of

WorldCom’s high reputation.

Q3 - How should WorldCom’s board of directors have prevented the manipulations that

management used?

Good managers make bad ethical choices because of the rationalization that the

manipulation is for company’s best interest and will never be found out. WorldCom’ board

of directors should have prevented the manipulations that management used by

establishing standard code of ethics. This could have been done by reviewing and

comparing the financial statements carefully and demanded for actions to be taken if there

were mistakes. Board members should question management when needed which

results in failure to protect the interest of shareholders of the company. Moreover, the

board of directors should have implemented better internal control procedure to prevent

fraud.

Q4 - Bernie Ebbers was not an accountant, so he needed that cooperation of accountants

to make his manipulations work. Why did WorldCom’s accountants go along?

WorldCom hired Sullivan and Myers which both had worked for Andersen. With knowing

this, WorldCom’s accountants were motivated to make sure that profits looked good

regardless if it was unethical or not. They were seeking to present a profit resulted

financial report to maintain the reputation of the company. Besides, they might get more

financial benefits if liaise in this unethical practices. Also, it might be that the accountants

were sacred to lose their jobs.

3

Q5 - Why would board of directors approve giving its Chair and CEO loans of over $408

million?

The board of directors approved giving its Chair and CEO loans of over $408 million

clearly because they felt the money was used for buying shares back into the company.

Also, it was described in company’s records as helping Ebbers to meet margin calls on

personal loans secured by his own WorldCom’s stock holdings. The mix of the Board and

close ties to Ebbers led to the Board’s lack of awareness on WorldCom’s issues. The

Board was inactive and met only about four times a year which was not enough for a

growing company at that time.

Q6 - How can a board ensure that whistleblowers will come forward to tell them about

questionable activities?

The board can ensure that whistleblowers will come forward to tell them about

questionable activities in order to help the company prevent financial losses caused by

fraud by creating ethical atmosphere. Board can encourage whistle blowers to come

forward by informing them that doing so will not hurt their employment or allow them to

be victimized. Board must ensure that whistle blower will be protected from revenge as a

result of good efforts to expose unethical activities. Moreover, they can be offered some

sort of incentives for whistle blowing in a company.

Discussion case

Tyco International Corporate Scandal 2002

Arthur J. Rosenberg, situated in Waltham, Massachusetts, founded Tyco Incorporated in

1960. The company produces electrical and electronic components, health-care, fire and

security services. In 1992, Leo Dennis Kozlowski became the CEO and used an

aggressive approach to gain acquisitions and mergers. In choosing Tyco Inc. board of

directors, Kozlowski only picked his own crony and composed the firm’s corporate

governance system. In 1999, after a stock split, rumors began to spread about Tyco’s

accounting habits. It was said that Tyco was producing irregular financial accounts, but it

was denied by Tyco’s leaders. Throughout the years of Kozlowski’s leadership, Tyco’s

profits grow beyond $30 billion.

Tyco’s scandal taken place in 2002 when board of directors launched an investigation

about their member’s incorrect behavior. Kozlowski and his few “friends" resigned and

have been dragged to the court. Kozlowski and Swartz, the Chief Finance Officer (CFO)

of Tyco Inc were alleged for stealing $170 million from the company and fraudulently

selling an additional $430 million in stock options. Kozlowski and few Tyco’s board of

directors also been accused in embezzling of Tyco fund for their private used. This

scandal has caused the shares value decreased drastically and made the workers

breathless. After the resignation of Kozlowski, Tyco was led by Edward Breen and the

firm have been saved.

4

Case Issue

The case of Tyco corporate scandal of 2002 was due to unethical business practices of

a number of its top-ranking officers, especially CEO Kozlowski. Kozlowski was involved

in numerous financial transactions that were not included in the financial reports of the

company. Kozlowski was also involved in unethical transactions with other Tyco officers

and lower ranking employees to cover up for his’s illegal financial transactions. He even

got outsiders involved in the problem when his second wife received money diverted from

the firm. Court proceedings proved that Kozlowski stole millions of dollars from Tyco, and

that his illegal financial transactions were extensive. Kozlowski and other officers from

Tyco were imprisoned. Tyco declined as investors lost confidence in the company. The

following are the issues that involved with conflict of interest that were in the discussion:

a) Conflict of interest Issues

The leaders in Tyco International were caught for involving in various unethical deeds.

While they were holding the position of trust as board of directors, they involved

themselves in issues that conflict with their positions. All the crimes they did showed

that they gave priority to self-interest rather than the interest of the shareholders of the

company. The following are the issues that involved with conflict of interest that were

in the case study. These issues are leader embezzlement of company fund, bribery

and accounting fraud.

b) Inappropriate discharge of employees

Dennis Kozlowski had discharged the employees without any notice when he found

out that some of the merged company did not perform well in producing the revenue.

Also, Jeanne Terrile, stock analyst of Tyco was fired because of giving adverse

opinion on Tyco rapid acquisitions and mergers. The CEO of Tyco International,

Kozlowski failed to follow two basic principles under discharge of employees. He fired

the employees without looking at their related job performances. Besides, he didn’t

refer to the fairness of procedures used to discharge the employees and also

contravene to the principle of due process. He failed to give the notice to the

employees and failed to make compensation and pension to the employees that have

been discharged by him. In this case, he does not treat his employees fairly and justly.

Conclusion

As a conclusion, both WorldCom and Tyco scandal was due to unethical practices. The

manipulation of accounts occurs because of lack in internal control and to show good

financial statement for the investors. A good way to avoid management oversights is to

have an environment where controls matter and business performed in accordance with

law and ethical practices. It is up to top management to send a pragmatic message to all

employees that good ethics is foundation of good business. Board of directors and

auditors need to have healthy level of scepticism to keep the controls working efficiently.

You might also like

- Accounting Fraud at WorldCom Case Study SolutionDocument8 pagesAccounting Fraud at WorldCom Case Study SolutionKuldip50% (2)

- Western Constitutionalism - Andrea BurattiDocument257 pagesWestern Constitutionalism - Andrea BurattiGulrukh SadullayevaNo ratings yet

- Test Bank For Walston Dunham Introduction To Law 7thDocument10 pagesTest Bank For Walston Dunham Introduction To Law 7thamberleemakegnwjbd100% (14)

- Tugas C12Document2 pagesTugas C12Yandra FebriyantiNo ratings yet

- Chapter 6 (Day 2) SolutionsDocument3 pagesChapter 6 (Day 2) SolutionsFredie LeeNo ratings yet

- Section - 5 Case-5.3Document21 pagesSection - 5 Case-5.3syafira0% (1)

- Chap 3 AISDocument14 pagesChap 3 AISChristine Joy Original100% (1)

- Chapter 19, Modern Advanced Accounting-Review Q & ExrDocument17 pagesChapter 19, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- 16.1 Chapter 5 Drury SolutionsDocument14 pages16.1 Chapter 5 Drury SolutionsNeacail Micallef75% (4)

- Worldcom - Executive Summary Company BackgroundDocument3 pagesWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNo ratings yet

- AF201 ExamDocument14 pagesAF201 ExamShikhaNo ratings yet

- AIS - Chapter 3 ReviewerDocument10 pagesAIS - Chapter 3 ReviewerEllaNo ratings yet

- Planning An Audit of Financial Statements8888888Document11 pagesPlanning An Audit of Financial Statements8888888sajedulNo ratings yet

- Music Source Inc. (Exp. Cycle 2)Document16 pagesMusic Source Inc. (Exp. Cycle 2)ClarizzaNo ratings yet

- Internal Control Over Financial Reporting (Chapter 3)Document82 pagesInternal Control Over Financial Reporting (Chapter 3)PeterSarmientoNo ratings yet

- Fraud Tutorial 3 Solution - ACL 9Document2 pagesFraud Tutorial 3 Solution - ACL 9ExequielCamisaCrusperoNo ratings yet

- Cis Chapter 11Document36 pagesCis Chapter 11Orio ArielNo ratings yet

- CC13 2 (Book/static) : Risk Assessment ProceduresDocument94 pagesCC13 2 (Book/static) : Risk Assessment Proceduresmonika1yustiawisdanaNo ratings yet

- EDP Auditing Week 13 - Business Ethics and FraudDocument23 pagesEDP Auditing Week 13 - Business Ethics and FraudSHYAILA ANISHA DE LAVANDANo ratings yet

- IT-Audit Team2Document1 pageIT-Audit Team2Von Andrei MedinaNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Chapter 01 - Business CombinationsDocument17 pagesChapter 01 - Business CombinationsTina LundstromNo ratings yet

- Week 8Document3 pagesWeek 8Anonymous J0pEMcy5vY100% (1)

- AUDITINGDocument20 pagesAUDITINGAngelieNo ratings yet

- Accounting Information System Chapter 7Document32 pagesAccounting Information System Chapter 7Cassie100% (1)

- Refer To The Accounting Change by Wertz Construction Company in PDFDocument1 pageRefer To The Accounting Change by Wertz Construction Company in PDFAnbu jaromiaNo ratings yet

- Bai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Document3 pagesBai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Ngọc MinhNo ratings yet

- 7103 - Notes Receivable and Loan ImpairmentDocument2 pages7103 - Notes Receivable and Loan ImpairmentGerardo YadawonNo ratings yet

- Computerised Accounting by M.raju 2019-20Document85 pagesComputerised Accounting by M.raju 2019-20PURNA CHANDRA RAONo ratings yet

- CH 01Document7 pagesCH 01Justin J-Five Anderson100% (3)

- ISRE 2400 2410 AmendedDocument8 pagesISRE 2400 2410 AmendedSerban VasiliuNo ratings yet

- Expenditure Cycle & Case StudyDocument7 pagesExpenditure Cycle & Case StudybernadetteNo ratings yet

- Accounting Information System - Chapter 2Document88 pagesAccounting Information System - Chapter 2Melisa May Ocampo AmpiloquioNo ratings yet

- BSA202 GR03 CH03 Ethics Fraud and Internal Control QuizDocument4 pagesBSA202 GR03 CH03 Ethics Fraud and Internal Control Quizohmyme sungjaeNo ratings yet

- Audit Strategy Memorandum Sample FormatDocument16 pagesAudit Strategy Memorandum Sample FormatHafid Rescue SerenadeNo ratings yet

- Royal AholdDocument5 pagesRoyal AholdRajaSaein0% (1)

- Audit of Non-Current AssetsDocument15 pagesAudit of Non-Current AssetsArlyn Pearl PradoNo ratings yet

- C3 Cost BehaviorDocument4 pagesC3 Cost BehaviorAngela PaduaNo ratings yet

- Quizlet Ais ch061 PDFDocument2 pagesQuizlet Ais ch061 PDFRaul Oreo JrNo ratings yet

- Impact of Accounting Information Systems On OrganizationalDocument5 pagesImpact of Accounting Information Systems On OrganizationalA2fahadNo ratings yet

- Aas 28 The Auditor S Report On Financial StatementsDocument13 pagesAas 28 The Auditor S Report On Financial StatementsRishabh GuptaNo ratings yet

- HO3 - Cost Concepts and Estimation PDFDocument9 pagesHO3 - Cost Concepts and Estimation PDFPATRICIA PEREZNo ratings yet

- Cost AccountingDocument14 pagesCost AccountingAdv Kamran Liaqat50% (2)

- Effectiveness of Accounting Information SystemDocument46 pagesEffectiveness of Accounting Information Systemphilip100% (1)

- CH 6 - Activity Based Costing UpdatedDocument16 pagesCH 6 - Activity Based Costing UpdatedAli OptimisticNo ratings yet

- ACC200 Tuturial Sem 3 2019 PDFDocument74 pagesACC200 Tuturial Sem 3 2019 PDFanon_255678422100% (1)

- RMK Audit 18Document14 pagesRMK Audit 18Amin MuhammadNo ratings yet

- Audit Case14 33 CompleteDocument9 pagesAudit Case14 33 CompleteIhsan NurhilmiNo ratings yet

- Accounting Information System - Chapter 5 - ReviewerDocument8 pagesAccounting Information System - Chapter 5 - ReviewerSecret LangNo ratings yet

- Chapter 9 - Budgeting1Document27 pagesChapter 9 - Budgeting1Martinus WarsitoNo ratings yet

- Ch19 Guan Hansen MowenDocument38 pagesCh19 Guan Hansen MowenratuhsNo ratings yet

- Fraud ReportDocument5 pagesFraud ReportGiang DuongNo ratings yet

- World Com ScandalDocument7 pagesWorld Com ScandalAddis FikruNo ratings yet

- Worldcom ScamDocument2 pagesWorldcom ScamSHASHANK MAHESHWARINo ratings yet

- Documentary On Worldcom Corporate Scandal 2Document6 pagesDocumentary On Worldcom Corporate Scandal 2tungeena waseemNo ratings yet

- WORLDCOM SCANDAL Audit PresentationDocument11 pagesWORLDCOM SCANDAL Audit PresentationDeepanshu 241 KhannaNo ratings yet

- Accounting Info - Updated partHDTASTF - RoldanDocument16 pagesAccounting Info - Updated partHDTASTF - RoldanRyan Joseph Agluba DimacaliNo ratings yet

- World ComDocument15 pagesWorld Commkg750No ratings yet

- Case On WORLDCOMDocument4 pagesCase On WORLDCOMjainender80No ratings yet

- World Com Case Solution: Team: Aziz PremjiDocument12 pagesWorld Com Case Solution: Team: Aziz PremjiKumara RajaNo ratings yet

- MCQ Midterms in Land Titles - 2020 - Answer KeyDocument21 pagesMCQ Midterms in Land Titles - 2020 - Answer KeyAr-Reb AquinoNo ratings yet

- Accounting Standards in The East Asia Region: By: M. Zubaidur RahmanDocument16 pagesAccounting Standards in The East Asia Region: By: M. Zubaidur Rahmanemerson deasisNo ratings yet

- Signs of Laylatul QadrDocument2 pagesSigns of Laylatul QadrMountainofknowledgeNo ratings yet

- Thomas BushellDocument1 pageThomas Bushellapi-361779682No ratings yet

- Property Law Notes PDFDocument25 pagesProperty Law Notes PDFJensen FlorenNo ratings yet

- 8 Ad-Art YayasanDocument13 pages8 Ad-Art YayasanBambang SulisNo ratings yet

- Application Format For Advance Payment For ImportDocument2 pagesApplication Format For Advance Payment For Importsrinivasan ragothaman50% (2)

- Constitution Notes: You Will Be Writing Questions at Home Tonight. There Are 14 Slides of Information To Take Notes OnDocument16 pagesConstitution Notes: You Will Be Writing Questions at Home Tonight. There Are 14 Slides of Information To Take Notes OnIuzi ValentinNo ratings yet

- Anti-Terrorism Act of 2020Document4 pagesAnti-Terrorism Act of 2020Kyla Ellen CalelaoNo ratings yet

- DR Cynthia Joseph Inquest (Article)Document2 pagesDR Cynthia Joseph Inquest (Article)jaludNo ratings yet

- JetDryer JetLite Instruction Manual PDFDocument6 pagesJetDryer JetLite Instruction Manual PDFDylan ParkNo ratings yet

- Azure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsDocument38 pagesAzure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsavaldirisNo ratings yet

- 5 Sanchez V Medicard PhilDocument2 pages5 Sanchez V Medicard Philk santosNo ratings yet

- TENPINBOWLINGDocument5 pagesTENPINBOWLING石原ユリカNo ratings yet

- Rosa Parks 100th Birthday QuestionsDocument5 pagesRosa Parks 100th Birthday Questionsapi-310709379No ratings yet

- AMLA DigestsDocument8 pagesAMLA DigestsIvy BernardoNo ratings yet

- Ballarpur Industries LTD.: Paper Industry OverviewDocument3 pagesBallarpur Industries LTD.: Paper Industry OverviewMadhukar ShyamNo ratings yet

- PDF High Performance Boards Improving and Energizing Your Governance 1St Edition Cossin Ebook Full ChapterDocument53 pagesPDF High Performance Boards Improving and Energizing Your Governance 1St Edition Cossin Ebook Full Chapterdebbie.mitchell437100% (2)

- Health Law: Consent in Health CareDocument14 pagesHealth Law: Consent in Health CareAvila VictoriaNo ratings yet

- ASJ Corporation and Antonio San Juan Vs Spouses Efren and MauraDocument2 pagesASJ Corporation and Antonio San Juan Vs Spouses Efren and MauraMa Lorely Liban-CanapiNo ratings yet

- Loan and AdvancesDocument72 pagesLoan and AdvancesAbdulqayum SattigeriNo ratings yet

- From: United States CorporationDocument5 pagesFrom: United States CorporationLeo M100% (2)

- Msa Newsletter 2014Q3Q4Document72 pagesMsa Newsletter 2014Q3Q4Tan Bak PingNo ratings yet

- B & I Law ProjectDocument18 pagesB & I Law ProjectVarad Arun YadavNo ratings yet

- Amberti v. CADocument6 pagesAmberti v. CAPatNo ratings yet

- (CRP Po - MT - Xi) AdmitcardDocument4 pages(CRP Po - MT - Xi) Admitcarduncle wizNo ratings yet

- Strachey - Contemporary Capitalism Joan RobinsonDocument3 pagesStrachey - Contemporary Capitalism Joan RobinsoneconstudentNo ratings yet

- SFC FranchiseDocument10 pagesSFC FranchisecorinacretuNo ratings yet