Professional Documents

Culture Documents

Tax Set A

Tax Set A

Uploaded by

Marineth MonsantoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Set A

Tax Set A

Uploaded by

Marineth MonsantoCopyright:

Available Formats

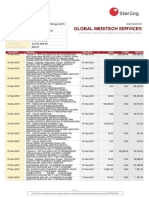

Since 1977

TAX E. D. TABAG

Quiz 3. SET A OCTOBER 2019

1. Statement 1: When the income tax due is in excess of 6. Fixed daily meal allowance not exceeding 25% of basic

P5,000, the individual taxpayer may elect to pay the minimum wage granted to professors and employees

tax in two equal installments. of an educational institution is

Statement 2: In case of installment payment of a. Exempt from basic income tax

income tax due, the first installment shall be paid at b. Subject to fringe benefit tax if the recipient is a

the time of filing the income tax return and the second rank and file employee

installment on or before October 15 following the close c. Subject to fringe benefit tax if the recipient is a

of the calendar year. managerial employee

a. true, true c. true, false d. Subject to basic income tax regardless of

b. false, false d. false, true employee’s rank

2. Statement 1: There is capital gain tax on shares of 7. A minimum wage earner is exempt from income tax

stock only if the shares are those of a domestic notwithstanding his receipt of the following, except:

corporation held as capital asset and not listed and a. holiday pay c. nightshift differential

traded in a local stock exchange. b. overtime pay d. commission

Statement 2: The capital gain tax on shares of stock is

paid within thirty days from the date of sale. 8. Pedro Masigasig is the Chief Finance Officer of Beta

a. Statements 1 & 2 are false Corporation. In 2018, he received a fringe benefit

b. Statement 1 is true but statement 2 is false amounting to P102,000. The total allowable expenses

c. Statement 1 is false but statement 2 is true incurred by the company for the said fringe benefit tax

d. Statements 1 and 2 are true expense is:

a. P120,000 c. P150,000

3. Which of the following statements is correct? b. P136,000 d. P156,923

I. The fringe benefit tax is a final withholding tax on

the grossed-up monetary value of the fringe 9. Interest income on bank deposit or investment with

benefit granted by the employer to an employee maturity period of at least five (5) years received by a

who holds a managerial or supervisory position. corporation is subject to:

II. Fringe benefit tax is effective regardless of whether Domestic Res. Foreign Non-resident

the employer is an individual, professional Corp. Foreign Corp.

partnership or a corporation (regardless of whether a. 20% 20% 30%

the corporation is taxable or not). b. Exempt Exempt Exempt

III. The fringe benefit tax regulations cover only those c. 20% 20% Exempt

fringe benefits given or furnished to managerial or d. 20% Exempt Exempt

supervisory employees. The regulations do not

cover those benefits which are part of 10. Interest income received from a depository bank under

compensation income, because these are subject expanded foreign currency deposit system prior to

to creditable withholding tax. 2018 shall be subject to:

a. I only c. I, II and III DC RFC NRFC

b. I and II only d. None of the above a. 20% 20% 20%

b. 7 ½% 7 ½% Exempt

4. Statement 1: The exemption of any fringe benefit c. 15% 15% Exempt

from the fringe benefit tax shall not be interpreted to d. 15% 7 ½% Exempt

mean exemption from any other income tax imposed

under the Tax Code except if the same is likewise 11. Interest income received from a depository bank under

expressly exempt from any other income tax imposed expanded foreign currency deposit system beginning

under the Tax Code or under any other existing law. January 1, 2018 or upon effectivity of the TRAIN Law

Statement 2: If the fringe benefit is exempted from shall be subject to:

the fringe benefit tax, the same may, however still DC RFC NRFC

form part of the employee’s gross compensation a. 20% 20% 20%

income which is subject to income tax, hence, likewise b. 7 ½% 7 ½% Exempt

subject to withholding tax on compensation income c. 15% 15% Exempt

payment. d. 15% 7 ½% Exempt

a. Statements 1 & 2 are false

b. Statement 1 is true but statement 2 is false 12. Royalty income received by a corporation prior to 2018

c. Statement 1 is false but statement 2 is true shall be subject to:

d. Statements 1 and 2 are true DC RFC NRFC

a. 20% 20% 30%

5. Statement 1: Fringe benefit tax is imposed on the b. 7 ½% 7 ½% Exempt

employee c. 15% 15% Exempt

Statement 2: The employer is the one liable for the d. 15% 7 ½% Exempt

payment of fringe benefit tax

a. Only statement 1 is correct 13. Royalty income received by a corporation beginning

b. Only statement 2 is correct January 1, 2018 or upon effectivity of the TRAIN Law

c. Both statements are correct shall be subject to:

d. Both statements are not correct

Page 1 of 2 www.prtc.com.ph TAX. SET A

EXCEL PROFESSIONAL SERVICES, INC.

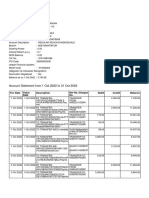

DC RFC NRFC Joint ABC Co. DEF Co.

a. 20% 20% 30% Venture

b. 7 ½% 7 ½% Exempt Gross P5,000,000 3,000,000 2,000,000

c. 15% 15% Exempt

Income

d. 15% 7 ½% Exempt

OPEX 3,000,000 2,000,000 1,500,000

14. Royalty income from books received by a corporation

prior to 2018 shall be subject to: 16. The income tax payable of the joint venture is

DC RFC NRFC a. P0 c. P300,000

a. 10% 10% 30% b. P150,000 d. P600,000

b. 20% 20% 30%

c. 15% 15% Exempt 17. The total income tax payable of ABC Co. is:

d. 15% 7 ½% Exempt a. P0 c. P300,000

b. P150,000 d. P600,000

15. Royalty income from books received by a corporation

beginning January 1, 2018 or upon effectivity of the 18. The total income tax expense of DEF Co. is:

TRAIN Law shall be subject to: a. P0 c. P570,000

DC RFC NRFC b. P150,000 d. P750,000

a. 10% 10% 30%

b. 20% 20% 30% 19. Assume the joint venture (JV) is a tax-exempt JV, its

c. 15% 15% Exempt income tax payable is

d. 15% 7 ½% Exempt a. P0 c. P300,000

b. P150,000 d. P600,000

Use the following data for the next five (5) questions:

ABC Company and DEF Company formed a joint venture. 20. Assume the joint venture is tax exempt, the total

They agreed to share profit or loss in the ratio of 70% and income tax expense of ABC Co. is:

30%, respectively. The results of operations of the joint a. P150,000 c. P300,000

venture as well as the co-venturers are as follows: b. P330,000 d. P720,000

***End of Quiz***

Goodluck!

Graduated Income Tax Rate effective 01 January 2018 until 31 December 2022

Not Over P250,000 – 0%

Over P250,000 but not over P400,000 - 20% of the excess over P250,000

Over P400,000 but not over P800,000 - P30,000 plus 25% of the excess over P400,000

Over P800,000 but not over P2,000,00 - P130,000 plus 30% of the excess over P800,000

Over P2,000,000 but not over P8,000,000 -P490,000 +32% of the excess over P2,000,000

Over P8,000,000 - P2,410,000 + 35% of the excess over P8,000,000

- end -

Page 2 of 2 www.prtc.com.ph TAX. SET A

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter-14-Solution - Part BDocument3 pagesChapter-14-Solution - Part BFaisal Naqvi100% (1)

- HyperbolaDocument38 pagesHyperbolaMarineth MonsantoNo ratings yet

- Name of The Study Author(s) Objectives Subject and Locale of The Study Significant Findings ReferenceDocument5 pagesName of The Study Author(s) Objectives Subject and Locale of The Study Significant Findings ReferenceMarineth MonsantoNo ratings yet

- International Standards For The Professional Practice of Internal AuditingDocument2 pagesInternational Standards For The Professional Practice of Internal AuditingMarineth MonsantoNo ratings yet

- Internal Audit and Budget Department - Cash ReceiptsDocument13 pagesInternal Audit and Budget Department - Cash ReceiptsMarineth Monsanto100% (1)

- Methods of Presentation of SubjectDocument40 pagesMethods of Presentation of SubjectMarineth MonsantoNo ratings yet

- Ch09 Layout Strategy - StudentDocument28 pagesCh09 Layout Strategy - StudentMarineth MonsantoNo ratings yet

- Accounting Information System - Chapter 1-3Document155 pagesAccounting Information System - Chapter 1-3Marineth Monsanto100% (2)

- Principles of Taxation For Business and Investment Planning 14Th Edition Jones Test Bank Full Chapter PDFDocument67 pagesPrinciples of Taxation For Business and Investment Planning 14Th Edition Jones Test Bank Full Chapter PDFlaeliavanfyyqz100% (12)

- Bill RPOSDocument3 pagesBill RPOSAditi KokaneNo ratings yet

- Email FormDocument2 pagesEmail Formajaynigam25No ratings yet

- Aviva Life Insurance Company India Limited Premium QuotationDocument4 pagesAviva Life Insurance Company India Limited Premium QuotationMohan BNNo ratings yet

- E Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Document1 pageE Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Abhishek KulkarniNo ratings yet

- LeasesDocument3 pagesLeasesBrian Christian VillaluzNo ratings yet

- Debit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedDocument1 pageDebit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedPrabhanjan BeheraNo ratings yet

- Petty Cash Bank ReconcilationDocument13 pagesPetty Cash Bank ReconcilationXS3 GamingNo ratings yet

- Public Entertainer - TaxDocument2 pagesPublic Entertainer - TaxChong Sin LingNo ratings yet

- Comfort Pack: Ms Maria Cardoso AguilarDocument5 pagesComfort Pack: Ms Maria Cardoso AguilarMariaJoseCardosoAguilarNo ratings yet

- City Assessor'S Office: Organizational ChartDocument2 pagesCity Assessor'S Office: Organizational ChartJohn Paulo RodriguezNo ratings yet

- Renewal Premium Acknowledgement: Policy DetailsDocument1 pageRenewal Premium Acknowledgement: Policy DetailsTejpal Singh ShekhawatNo ratings yet

- Promotion Study Material Clerk To OfficerDocument315 pagesPromotion Study Material Clerk To OfficerAbhishek KumarNo ratings yet

- COSTCON - Accounting For LaborDocument2 pagesCOSTCON - Accounting For LaborHoney MuliNo ratings yet

- Niruword 3Document11 pagesNiruword 3Raju BhaiNo ratings yet

- Book InvoiceDocument1 pageBook InvoiceKaushik DasNo ratings yet

- RMC 37-2012Document0 pagesRMC 37-2012Peggy SalazarNo ratings yet

- The Punjab Sales Tax On Services Act 2012Document77 pagesThe Punjab Sales Tax On Services Act 2012Muhammad imran LatifNo ratings yet

- Ksa Land Tax English 2015Document10 pagesKsa Land Tax English 2015Ty BorjaNo ratings yet

- 4 Laboratory Exercise 1: Introduction To Meetings Incentives, Conferences, and Events Management (MICE)Document4 pages4 Laboratory Exercise 1: Introduction To Meetings Incentives, Conferences, and Events Management (MICE)Kate Clarize AguilarNo ratings yet

- MEDITECH - MEDITECH Statement 20191128 PDFDocument49 pagesMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeNo ratings yet

- Payments Industry - Card ProcessingDocument5 pagesPayments Industry - Card ProcessingShriya Chandrakar100% (1)

- Dividend Income - Income TAXDocument36 pagesDividend Income - Income TAXDon TiansayNo ratings yet

- Real Property Located in The Philippines, Classified As Capital Assets, Including Pacto de Retro Sales andDocument2 pagesReal Property Located in The Philippines, Classified As Capital Assets, Including Pacto de Retro Sales andArki TorniNo ratings yet

- Vikas Jain: Account Statement - Account StatementDocument16 pagesVikas Jain: Account Statement - Account Statementvikas jainNo ratings yet

- MobileTransaction History 04052023104956Document2 pagesMobileTransaction History 04052023104956lipieNo ratings yet

- Form ST-4Document1 pageForm ST-4Suppy PNo ratings yet

- Internal Audit ManualDocument11 pagesInternal Audit ManualAnudeep ReddyNo ratings yet

- 2018 Florida Annual Resale Certiicate For Sales TaxDocument1 page2018 Florida Annual Resale Certiicate For Sales TaxStas BorkinNo ratings yet