Professional Documents

Culture Documents

Financial Accounting 2reviewer 2019 CPA

Financial Accounting 2reviewer 2019 CPA

Uploaded by

Ma. Liza Magat0 ratings0% found this document useful (0 votes)

491 views8 pagesCPA REVIEWER 2019

Original Title

Financial Accounting 2Reviewer 2019 CPA

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCPA REVIEWER 2019

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

491 views8 pagesFinancial Accounting 2reviewer 2019 CPA

Financial Accounting 2reviewer 2019 CPA

Uploaded by

Ma. Liza MagatCPA REVIEWER 2019

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

FINANCIAL ACCOUNTING AND REPORTING THEORY. VALIX SIY VALIX ESCALA

REVISED CONCEPTUAL FRAMEWORK

1. Which statement is true about the Conceptual Framework for Financial Reporting?

a. The Conceptual Framework isnot

by The Conceptual Framework describes the objective of financial reporting and the concept for

general purpose financial statements

ce Tnenses of gonfict the requirements ofthe relevant IFRS prevail over those of the Conceptual

Framework

4 Allo these statements are true about the Conceptual Framework

2 Which is a purpose ofthe Conceptual Framework?

To assist te IASB to develop IFRS based on consistent concepts

1 To asst preparers to develop consistent accounting policy when no standard applies to a

sarivulartansastion of when Standard allows. a chore of accounting policy.

To assistall parties to understand and interpret the Standards,

{3 Allof these can be considered a purpose ofthe Conceptual Framework

Which is not «purpose of having a Conceptual Framework?

4a Toenabe the profession to mare quickly solve emerging practical problems

bb. To provide a foundation fom which to build more useful standards

To enable the standard setting body to issue more useful and consistent pronouncements over

4, Tosssst regulatory agencies in issuing rules and regulations fora particular industry

4. The Conceptvel Framework provides the foundation for Standards that

Contribute to transparency by enhancing international comparability and quality of financial

information.

Sirengihen acourdabiy of the people entrusted with the entity

¢. Contihnte to economic efficiency by helping investors to identify opportunities and risks across

the world

44. Allof these are the result of Standards developed based on consistent concep

5. What provides “the why” or the gos! and purpose of accounting?

‘Measurement and resogntion concept

Qualitative characteristic of accounting informs

Element of financial statements

Objective of financial reporting

6,_ The objective of financial reporting in the Conceptual Framework

‘Is the foundation forthe Conceptual Framework,

“b Includes the qualitative characteristics that make accounting information use

‘¢. Isnot found i the Conceptual Framework.

4. All ofthe choices are correct regarding the objective of financial reporting,

Which statement is not an objective of financial reporting?

4a To provide information that is useful in investment and eredit decisions.

}. To provide information about entity resources, claims against those resources and changes in

those resources.

2, To provide information on te liquidation value ofan erity

‘Lo provide information that is useful in assessing cash flow prospects

{8 The assumption that an entity will not be sold or iguidaed in

1. Economic entity assumption dnplict? acre

pear future is known 3s

1. Monetary unit assumption 1¥0%*) errhgcnapt = #81) p sence x

«Time period assumption © By gchcn'y [Mee pevsectneee al .

& Going concer assumption; "47 7° —

Page 2

‘Which statement isan implication ofthe going concern assumption?

The histerical eos principle is credible.

+. Depreciaion and amortization polices are justifiable and approprite.

©. The curentsnoncurrent clasification of assets and liabilities is justitnble and significant.

4) All ofthese imply the going concem assumption

0. The economic entity assumption

4 sinapplicable to unincorporated businesses

Recognizes the legal aspects of business orgaizations

&. Requires periodic income measurement

4 Isappitcable to all forms of business organizations

1. Consolidated financial statements ae prepared shen a parent-subsiiary relationship exist.

Economic entity assumption er ons ONE

Legal entity assumption

‘Consolidation standard

Neutrality

2. During the lifetime of an entity, accountants produce financial statements at arbitrary or artificial

points in time in accordance with which basi accounting concept?

Objectivity coe cuaxitisl ,

%, Tine period assumption (by so

Material

4. Beonomic entity

13. Inflation is ignored in accounting de to

‘Economic entity assumption t a

Going concer assumption

© Monetary unit assumption 475, -

4. Periodicity assumption £00 san Meb

14. Inthe Conceptuel Framework, qualitative characteristics

4 Are considered ether fundamental or echancing

'b. Contribute to he decision-vsefulnes of financial vepertng information

Distinguish better informatio from interior information foe decision-making purposes.

4. Allof the chores ae comet. Eahenorg

35, Fundaments! qualitative characteristics of accountng information re 1 2

Relevance end comparabilicy

. Comparability and consistency eho

©. Faithful representation and relevance

4 Neutrality and verifability

16. Enhancing qualitative charaeristes of eccoutting information inhude

Relevance, faithful representation and materia

', Comparabilicy, understanésbility, melinss and reliability

© Paithtal representation ae timeliness

4. Materiahity and unerstandabity

17, When there is agreement beiween a measure or dsc:pton andthe phenomenon it purports to

epresent, the information possesses which characteristic?

Faithful representation

. Completeness

Neulrlicy

4. Pree from eror

6586

Page 3

18, The quality of fhithful eepresentation includes

Predictive value and confimmatory value

'. Completeness, tee from error and neutrality

& Comparability and understandabilty

4. Timeliness and verifabilty

19, The qualitative characteristic of relevance includes

1 Predictive value and confimmatory value

'. Completeness and neutrality

© Comparability and understandability

4. Vertiability and timeliness

20, Accounting information i considered relevant when it

8 Can be depended on to represent the economic conditions that it is imtended to represent

b. Iscapable of making a difference in a decision

¢. Is understandable by reasonably informed users of accountng information

4. Isverifiable and neutral

2

‘The underiying theme of the relevance is

a Decision usefulness

i, Understandability

©. Reliability

4. Comparability

22. Which of the following statements about materiality is mot correct?

‘2 Anitem must make a difference or it need not be disclosed.

b..Materaity is « matter of absolute size

© An item is material if the inclusion or omission would influence or change the judgment of 2

reasonable person

4. Materaity isa subguaity of elevane,

23, What is meant by comparability when discussing financial accounting information?

1. formation has predictive and feedback valve

', Information is reasonably free fom ero.

«Information is measured and reported ina similar fashion aeross entities

{Informations timely

‘24, What is meant by consistency when discussing financial aocountng information?

‘a Information is measured and reported ina similar fashion across points in time.

’. Informations timely,

‘Information is measured similarly across the industry.

4. Information is verifiable

25. Theenhancing quality of understandability means the information should be understood by

‘a Expersin the interpretation of financial statements

', Users with reasonable understanding of business and economic activities

Financial analysts

4 CPAs

26, For information tobe useful the linkage between the users and the deisions made is

Relevance

1b, Relibiity

, Understanabil

.- Materiaiy

27, According to Conceptual Framework, veriability implies

fa. Legal evidence

b. Logic

s, Consensus

Legal verdict

6586

Page 4

28. Proponents of historical cost ordinarily maintain that in comparison with all other valuation

altematives for financial reporting, statements prepared using historical cost are more

a. Verifiable

’. Relevant

«©. Indicative of the entity's purchasing power

& Conservative

29, When an entity has started placing its quarterly financial statements on its website thereby reducing

ample time to get information to uses, the qualitative concept involved is

a. Comparability

. Understandabibity

&, Verifability

4. Timeliness

530. The Concepeual Framework includes which constraint?

a Prudence

. Conservatism

© Cost

4 Allofthe choices are constraints in the conceptual framework

x

|. Which ofthe following best describes the cost-benefit constraint?

44 The benefit ofthe information must be greater than the cost of providing it.

'. Financial information should be fee from cost to users ofthe information.

©. Cost of providing financial information is not always evident or measurable but must be

considered. ama ae! Mie

4. All ofthe choices are correct.

Which statement is true about a reporting entity?

a. A reporting entity isan entity that is required or chooses to prepare financial statements

’. A reporting entity ean be a single entity or a portion ofthat entity or can comprise more than one

entity,

A reporting is not necessarily a legal entity.

4. All ofthese statements are true about a reporting entity

33, Which statement is true about financial statements of a reporting entity?

4. IP the reporting entity comprises both the parent and ts subsidiaries, the financial statements are

refered to as consolidated financial statements.

. If the reporting entity is the parent alone, the financial statements are referred to as

unconsolidated financial statements

Ifthe reporting entity comprises two or more entities that are not linked by a parentsubsidiary

relationship, the financial statements ae referred to as combined financial statements.

4, All ofthese statements are true about the financial statements of « reporting entity.

34, Which is within the definition of an asset under the Revised Conceptual Framework?

a. Anasset isa present economic resource,

'. The economic resource is aright that has the potential to produce economic benefits.

The economic resource is controlled by the entity as a result of past event

4. Allof these statements define an asset,

35. Under the Revised Conceptual Framework, which of the following criteria must be satisfied for a

liability to exis?

a. The entity has an obligation, ves

. ‘The obligation is to transfer an economic resource.

cc. The obligation isa present obligation that exists asa result of @ past event.

. Netassets or equity of an equity in tems of physical productive capacity

© Legal eapital

4. Share capital issued and outstanding

The physical cupitel concept requires that productive asets shall Ne measured at

a, Historical cst

, Current cost

© Lower of eurent cost and net realizable value

4. Netrealizable value

‘et income occurs when

Under the financial eapita! eo

yearend exceeds the nominal amount of net assets at

& When the nominal anrount of net assets

the beginning

b. Wher the physical productive capital at yea

beginning after excinding any distributions to and contsbut

& When the nominal amcunt of net assets at year-end exe

the beginning after excluding distributions to end sont

4. When the physical productive egpital at yearend exc

begianing,

end exceeds the physiesl productive capital atthe

from owners,

orninal amount of net assets at

tio from owners

isical productive capital atthe

a

END

6586

(CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

FINANCIAL ACCOUNTING AND REPORTING VALIX SIV VALIX FSCALA SANTOS

INVENTORY COST FLOW AND LCNRV

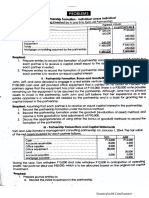

1. Anetiy provided the following information

Units Uniteost Tota cost

Jan ginning balance 10,000 150 1,300,000

S Purchase 30,000 180 15:00,000

1s Sale 15,000

16 Sale return 1,000

25 Purchase 4,00 200 00,000

26 Purcase tum 2,000 200 400,000

1. Under FIFO, what amouat should be reported as cost of gods sold?

a. 2220,000

». 2620,000

. 2,500,000

4 2,900,000

2. Under weighted average, what amount should be reported as ending inventory?

a. 1385480

1366640

© 1413360

& 1432,000

3. Under moving average, what amount shoul be reported as ending inventory?

a 1,690,000

». 1390,000

©. 1,790,000

4. 1,600,000

4. Under moving average, the next sale of inventory would be priced at what cost?

a 17378

b. 17900

© 200.00

4 190.00

2. On December 31, 2019, an entity reported inventory at P3,000,000 cost and P2,900,000 net

realizable value.’ On December 31, 2020, the inventory was P4,000,000 at cost and

3,700,000 at net realizable value, The entity made net purchases of P9,000,000 during 2020.

‘What amount should be reported as cost of goods sold for 2020?

a. 8,000,000

». 200,000

©. 81450,000

4. 8:300,000

3. On December 31, 2019, an entity experienced a decline inthe value of inventory resulting in

‘ waitedoum from P4,000,000 cost to P3,500,000 net realizable value. The entity used the

allowance method to record the necessary adjustment. In 2020, market conditions have

improved dramatically. On December 31, 2020, te inventory had a cost of P5,000,000 and

‘et realizable value of P4,800,000, The entity made purchases of P20,000,000 in 2020?

1. What amount should be recognized as gain on reversal of inventory writedowm in 2020?

1. 200,000

300,000

500,000

4 0

2, What amount should be reported as cat of goods sold in 2020?

19,000,000

19,300,000

18,700,000

24,000,000,

6596

ri Page 2

‘An enity reported the following information about ventory =

Cont NRY _LENRV

A 2,690,000 2,800,000 2,600,000

B 1,700,000 1,600,000 1,600,000,

2,000,000 1,600,000 1,600,000

900,000 1,800,000 1,800,000

|, What she inventory measurement under LCNRY individual approach?

7s. 000

8 Soa.o00

© 7000

73800000

2. Whats the inventory measurement under the LCNRY total approach?

2406000

8 700000

©. 7800000

4 77m000

5, Whatis he inventory measurement unde be LCNRY category approach?

a 7,800,000 oe ee

& 7700000

©. 200,000

4. 7100;000

5, On December 1, 2019, an entity entered into a commitment to purchase 100,000 barrels of

aviation fuel for PSS per barrel on March 31, 2020, The entity entered into this purchase

‘commitment to protect itself against the volatility in the aviation fucl market. By December

51, 2019, the purchase price of aviation fuel ad fallen 1 P50 per barrel. However, by March

31, 2020, when the entity took delivery ofthe 100,000 barrels the price of aviation fuel had

risen to P53 per barrel

1, What amount should be recognized as loss on purchase commitment in 2019?

a 500,000

, 200,000

300,000

4 0

2. What ammount should be recognized as gain on purchase commitment for 20

a $00,000

300,000,

800,000

a °

[3 What amount should be debited to purchases on March 31, 2020?

5,500,000

. $300,000

5,000,000

4. 4,700,000

6. During the current year, an entity purchased a tract of land for P12,000,000. The entity

incurred additional cost of 3,000,000 in preparing the land for sale. Of the tract of land,

70% was subdivided into residential lots ant! 30% was for road and a park. The tract of land

‘yas subdivided into residential lots as 100, Class A lots with sale price of F240,000 per lot.

00 Class B lots with sale price of P160,000 per lot, and 200 Class C lots with sale price of

'P100,000 per lot. What amount of the costs should be allocated to Class A lots?

207

1. 3,000,000

. 3,750,000

©. 6,000,000

4. 4,200,000

6596

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- RFBT (1) Cpa Reviewer 2019Document24 pagesRFBT (1) Cpa Reviewer 2019Ma. Liza Magat100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AE13 Financial Accounting and Reporting PDFDocument50 pagesAE13 Financial Accounting and Reporting PDFMa. Liza MagatNo ratings yet

- Production Operations SyllabusDocument5 pagesProduction Operations SyllabusMa. Liza MagatNo ratings yet

- 3 Acctg 327Document19 pages3 Acctg 327Ma. Liza MagatNo ratings yet

- Dr. Gloria D. Lacson Foundation Colleges, IncDocument5 pagesDr. Gloria D. Lacson Foundation Colleges, IncMa. Liza MagatNo ratings yet

- Production and Operation ManagementDocument4 pagesProduction and Operation ManagementMa. Liza MagatNo ratings yet

- HBO Handouts 1.2.3Document9 pagesHBO Handouts 1.2.3Ma. Liza MagatNo ratings yet

- reVIEW MATERIALS TAxDocument5 pagesreVIEW MATERIALS TAxMa. Liza MagatNo ratings yet

- Finac 4 REVIEWER 2019 CPADocument3 pagesFinac 4 REVIEWER 2019 CPAMa. Liza MagatNo ratings yet

- Financial Accounting 1Document4 pagesFinancial Accounting 1Ma. Liza MagatNo ratings yet