Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

31 viewsCLN Company Comparative Statements of Financial Position As of December 31

CLN Company Comparative Statements of Financial Position As of December 31

Uploaded by

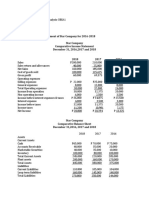

Vince Lloyd RaborCLN Company's total assets increased 2.98% from 2014 to 2015, however cash and short term investments decreased 19.5% over the same period. Total debt increased significantly by 76.19% due primarily to a 51.22% rise in long-term debt. Shareholders' equity declined 20.75% as retained earnings fell 187.4% between 2014 and 2015.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Fm-Answer-Key 2Document5 pagesFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- Joker Movie ReflectionDocument1 pageJoker Movie ReflectionVince Lloyd RaborNo ratings yet

- V2 Exam 3 Morning PDFDocument82 pagesV2 Exam 3 Morning PDFCatalinNo ratings yet

- Project Solution 1 - SampleDocument11 pagesProject Solution 1 - SampleNguyễn Diệu LinhNo ratings yet

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Illustration For Financial Analysis Using RatioDocument2 pagesIllustration For Financial Analysis Using RatioamahaktNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument24 pagesAnalysis and Interpretation of Financial StatementsMariel NatullaNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Horizontal AnalysisDocument1 pageHorizontal Analysiswill burrNo ratings yet

- Liquidity Ratios: Profitability RatiosDocument4 pagesLiquidity Ratios: Profitability RatioslobnadiaaNo ratings yet

- Morgan Stanley ProjectDocument24 pagesMorgan Stanley ProjectGoodangel Blessing0% (1)

- (Financial Analysis) MANALO, Frances M. LM2-1Document3 pages(Financial Analysis) MANALO, Frances M. LM2-11900118No ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Key Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceDocument15 pagesKey Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceRashan Jida ReshanNo ratings yet

- Revised Verti On SFP 2019Document2 pagesRevised Verti On SFP 2019cheesekuhNo ratings yet

- DARIA Assig2 Tren CorpDocument2 pagesDARIA Assig2 Tren CorpNina PaulaNo ratings yet

- Annual Income Statement (Values in 000's $) : Current AssetsDocument6 pagesAnnual Income Statement (Values in 000's $) : Current AssetsVikash ChauhanNo ratings yet

- Audit of CashDocument3 pagesAudit of CashKienthvxxNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementViejay CastilloNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- MBA104 - Almario - Parco - Case Study LGAOP02Document25 pagesMBA104 - Almario - Parco - Case Study LGAOP02Jesse Rielle CarasNo ratings yet

- FinMan (Common-Size Analysis)Document4 pagesFinMan (Common-Size Analysis)Lorren Graze RamiroNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- Financial Management #3Document4 pagesFinancial Management #3Roel AsduloNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- Elite, S.A. de C.V.: Balance GeneralDocument6 pagesElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- 108 Efe 94 F 05642 C 6 BcfeDocument11 pages108 Efe 94 F 05642 C 6 BcfeKryzha RemojoNo ratings yet

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- Red Chilli WorkingsDocument10 pagesRed Chilli WorkingsImran UmarNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- FINANCIAL ANALYSIS Practice 3Document15 pagesFINANCIAL ANALYSIS Practice 3Hallasgo, Elymar SorianoNo ratings yet

- Model Unit: 2016 Nissan Almera: Total Cost 630,000.00 Cash Discount If Cash 20,000.00 Total Cost (Cash Price)Document4 pagesModel Unit: 2016 Nissan Almera: Total Cost 630,000.00 Cash Discount If Cash 20,000.00 Total Cost (Cash Price)Yasser AureadaNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- Mandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Document4 pagesMandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Mohammad Raffe GuroNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- Financial Management Week 2 AssignmentDocument2 pagesFinancial Management Week 2 AssignmentAndrea Monique AlejagaNo ratings yet

- Apple Inc.Document14 pagesApple Inc.Orxan AliyevNo ratings yet

- Apple Inc Com in Dollar US in ThousandsDocument6 pagesApple Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Chap - Test - CH4 - Financial Ratio Analysis and Their Implications To ManagementDocument10 pagesChap - Test - CH4 - Financial Ratio Analysis and Their Implications To Managementroyette ladicaNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- Financial Ratio Horizontal and Vertical AnalysisDocument4 pagesFinancial Ratio Horizontal and Vertical AnalysisKyla SantosNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- FinancialsDocument6 pagesFinancialsharshithamandalapuNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Balance Sheet (Vertical & Horizontal Analysis)Document7 pagesBalance Sheet (Vertical & Horizontal Analysis)Nguyen Dac ThichNo ratings yet

- Common Size/Vertical Analysis: Lecture No. 9Document4 pagesCommon Size/Vertical Analysis: Lecture No. 9naziaNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- VCMMMM Final RequirementDocument8 pagesVCMMMM Final RequirementMaxine Lois PagaraganNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- JudaismDocument3 pagesJudaismVince Lloyd RaborNo ratings yet

- Document 6Document3 pagesDocument 6Vince Lloyd RaborNo ratings yet

- Black Swan ReflectionDocument1 pageBlack Swan ReflectionVince Lloyd RaborNo ratings yet

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- Accc372 Mod 2022 VCDocument26 pagesAccc372 Mod 2022 VCakeeraNo ratings yet

- BUSLYTCJDWILLIAMSCASEDocument20 pagesBUSLYTCJDWILLIAMSCASEchristinekehyengNo ratings yet

- CAPE Accounting 2006 U2 P1Document12 pagesCAPE Accounting 2006 U2 P1Pettal BartlettNo ratings yet

- Lesson 2 PDFDocument10 pagesLesson 2 PDFJet SagunNo ratings yet

- Solution - 1.: Calculation of NPV and IrrDocument5 pagesSolution - 1.: Calculation of NPV and IrrVishal DudejaNo ratings yet

- Corporate Goverance in IndiaDocument43 pagesCorporate Goverance in IndiaParandeep ChawlaNo ratings yet

- AFM习题带练讲义(一)Document127 pagesAFM习题带练讲义(一)周于No ratings yet

- Republic Act No. 2629 - Investment Company Act PDFDocument36 pagesRepublic Act No. 2629 - Investment Company Act PDFcool_peachNo ratings yet

- Value Creation Private EquityDocument6 pagesValue Creation Private EquityRobes BaimaNo ratings yet

- To Trinh HDQT Phuong An Phat HanhDocument4 pagesTo Trinh HDQT Phuong An Phat HanhLê Hưu NhânNo ratings yet

- M 202Document2 pagesM 202Rafael Capunpon VallejosNo ratings yet

- Partnership Operations - Sample ProblemsDocument2 pagesPartnership Operations - Sample ProblemsLyca Mae CubangbangNo ratings yet

- Efficiency RatiosDocument6 pagesEfficiency Ratiosabhi vermaNo ratings yet

- Steven JohnsonDocument4 pagesSteven JohnsonDan FreedNo ratings yet

- Cashflow FormatDocument4 pagesCashflow FormatRaja kumarNo ratings yet

- Introduction To Cost and Management AccountingDocument31 pagesIntroduction To Cost and Management AccountingTestNo ratings yet

- Emerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncDocument10 pagesEmerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncAlmaliyana BasyaibanNo ratings yet

- Midterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Document24 pagesMidterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Ian Ray PaglinawanNo ratings yet

- Initial Public OfferingDocument7 pagesInitial Public Offeringluv2skNo ratings yet

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- Chapter 2 - Lesson 4Document18 pagesChapter 2 - Lesson 4JajaNo ratings yet

- Return On Invested CapitalDocument3 pagesReturn On Invested CapitalZohairNo ratings yet

- Cash Oxley AssignmentDocument13 pagesCash Oxley AssignmentKaRl MariNo ratings yet

- Tutorial 1 QuestionsDocument4 pagesTutorial 1 QuestionshrfjbjrfrfNo ratings yet

- Financial Management (NOTES) Aug 2023Document289 pagesFinancial Management (NOTES) Aug 2023jhanvitiwari460No ratings yet

- Consolidated Financial Statements HY 2019 - Solutions 30Document41 pagesConsolidated Financial Statements HY 2019 - Solutions 30Musariri TalentNo ratings yet

- Journal: Illustration - 1 Journalise The Following Transactions in The Books of Shri .HerambhDocument10 pagesJournal: Illustration - 1 Journalise The Following Transactions in The Books of Shri .HerambhAyushi100% (1)

- FIN 072 - SAS - Day 17 - IN - Second Period ExamDocument12 pagesFIN 072 - SAS - Day 17 - IN - Second Period ExamEverly Mae ElondoNo ratings yet

CLN Company Comparative Statements of Financial Position As of December 31

CLN Company Comparative Statements of Financial Position As of December 31

Uploaded by

Vince Lloyd Rabor0 ratings0% found this document useful (0 votes)

31 views4 pagesCLN Company's total assets increased 2.98% from 2014 to 2015, however cash and short term investments decreased 19.5% over the same period. Total debt increased significantly by 76.19% due primarily to a 51.22% rise in long-term debt. Shareholders' equity declined 20.75% as retained earnings fell 187.4% between 2014 and 2015.

Original Description:

Original Title

Book1.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCLN Company's total assets increased 2.98% from 2014 to 2015, however cash and short term investments decreased 19.5% over the same period. Total debt increased significantly by 76.19% due primarily to a 51.22% rise in long-term debt. Shareholders' equity declined 20.75% as retained earnings fell 187.4% between 2014 and 2015.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

31 views4 pagesCLN Company Comparative Statements of Financial Position As of December 31

CLN Company Comparative Statements of Financial Position As of December 31

Uploaded by

Vince Lloyd RaborCLN Company's total assets increased 2.98% from 2014 to 2015, however cash and short term investments decreased 19.5% over the same period. Total debt increased significantly by 76.19% due primarily to a 51.22% rise in long-term debt. Shareholders' equity declined 20.75% as retained earnings fell 187.4% between 2014 and 2015.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

CLN COMPANY

COMPARATIVE STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31

Assets

Fiscal year is January-

PESO VALUE PERCENTAGE

December. All values 2014 2015

CHANGE VALUE

SGD millions.

Cash & Short Term Investments

19,380,000 15,600,000 -3,780,000 -19.50%

Cash Only 19,380,000 15,600,000 -3,780,000 -19.50%

Total Short-Term

- -

Investments

Short-Term Receivables 26,090,000 33,850,000 7,760,000 29.74%

Investment Securities - -

Securities in Custody - -

Other Investments 100,000 400,000 300,000 300.00%

Net Property, Plant &

1,080,000 2,140,000 1,060,000 98.15%

Equipment

Other Assets

(Including 103,530,000 103,190,000 -340,000 -0.33%

Intangibles)

Other Assets 347,170 939,850 592,680 170.72%

Intangible Assets 103,180,000 102,250,000 -930,000 -0.90%

Total Assets ### ### 4,470,000 2.98%

Liabilities & Shareholders' Equity

2014 2015

Total Debt 21,000,000 37,000,000 16,000,000 76.19%

ST

Debt &

Current 500,000 6,000,000 5,500,000 1100.00%

Portion

LT Debt

T

e

r 500,000 6,000,000 5,500,000 1100.00%

m

Long-

Term 20,500,000 31,000,000 10,500,000 51.22%

Debt

.

C

a

20,500,000 31,000,000 10,500,000 51.22%

p

it

al

Deferred Taxes 5,110,000 5,140,000 30,000 0.59%

Other Liabilities 44,570,000 49,520,000 4,950,000 11.11%

Liabiliti

es

(excl.

43,210,000 47,820,000 4,610,000 10.67%

Deferre

d

Income

Total Liabilities 70,680,000 91,650,000 20,970,000 29.67%

Common Equity (Total)

79,500,000 63,000,000 -16,500,000 -20.75%

Comm

on

Stock

70,700,000 70,700,000 0 0.00%

Par/Car

ry

Retaine

Value

d

8,810,000 -7,700,000 -16,510,000 -187.40%

Earning

ative

s

Transla

tion

Adjust

-12,684 -259 12,425 -97.96%

ment/U

nrealiz

ed For.

Exch.

Total Shareholders' Equity

79,500,000 63,000,000 -16,500,000 -20.75%

Total Equity 79,500,000 63,000,000 -16,500,000 -20.75%

Liabilities &

Shareholders' ### ### 4,470,000 2.98%

Equity

HORIZONTAL ANALYSIS:

CLN COMPANY

COMPARATIVE STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31

Assets

Fiscal year is January-

December. All values SGD 2014 2015

millions.

Cash & Short Term Investments 19,380,000 12.90% 15,600,000 10.09%

Cash Only 19,380,000 12.90% 15,600,000 10.09%

Total Short-Term Investments - -

Short-Term Receivables 26,090,000 17.37% 33,850,000 21.89%

Investment Securities - -

Securities in Custody - -

Other Investments 100,000 0.07% 400,000 0.26%

Net Property, Plant & 1,080,000 0.72% 2,140,000 1.38%

Equipment

Other Assets (Including 103,530,000 100.34% 103,190,000 66.72%

Intangibles)

Other Assets 347,170 0.34% 939,850 0.61%

Intangible Assets 103,180,000 68.70% 102,250,000 66.12%

Total Assets 150,180,000 100.00% ### 100.00%

Liabilities & Shareholders' Equity

2014 2015

Total Debt 21,000,000 13.98% 37,000,000 23.92%

Total Debt 500,000 0.33% 6,000,000 3.88%

Short Term Debt 500,000 0.33% 6,000,000 3.88%

Long-Term Debt 20,500,000 13.65% 31,000,000 20.05%

LT Debt excl. Capitalized 20,500,000 13.65% 31,000,000 20.05%

Leases

Deferred Taxes 5,110,000 3.40% 5,140,000 3.32%

Other Liabilities 44,570,000 29.68% 49,520,000 32.02%

Other Liabilities (excl. 28.77% 30.92%

43,210,000 47,820,000

Deferred Income)

Total Liabilities 70,680,000 47.06% 91,650,000 59.26%

Common Equity (Total) 79,500,000 52.94% 63,000,000 40.74%

Common Stock Par/Carry 70,700,000 47.08% 70,700,000 45.72%

Value

Retained Earnings 8,810,000 5.87% -7,700,000 -4.98%

Cumulative Translation

Adjustment/Unrealized For. -12,684 -0.01% -259 0.00%

Exch. Gain

Total Shareholders' Equity 79,500,000 52.94% 63,000,000 40.74%

Total Equity 79,500,000 52.94% 63,000,000 40.74%

Liabilities & Shareholders' 100.00% 100.00%

150,180,000 154,650,000

Equity

You might also like

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Fm-Answer-Key 2Document5 pagesFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- Joker Movie ReflectionDocument1 pageJoker Movie ReflectionVince Lloyd RaborNo ratings yet

- V2 Exam 3 Morning PDFDocument82 pagesV2 Exam 3 Morning PDFCatalinNo ratings yet

- Project Solution 1 - SampleDocument11 pagesProject Solution 1 - SampleNguyễn Diệu LinhNo ratings yet

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Illustration For Financial Analysis Using RatioDocument2 pagesIllustration For Financial Analysis Using RatioamahaktNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument24 pagesAnalysis and Interpretation of Financial StatementsMariel NatullaNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Horizontal AnalysisDocument1 pageHorizontal Analysiswill burrNo ratings yet

- Liquidity Ratios: Profitability RatiosDocument4 pagesLiquidity Ratios: Profitability RatioslobnadiaaNo ratings yet

- Morgan Stanley ProjectDocument24 pagesMorgan Stanley ProjectGoodangel Blessing0% (1)

- (Financial Analysis) MANALO, Frances M. LM2-1Document3 pages(Financial Analysis) MANALO, Frances M. LM2-11900118No ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Key Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceDocument15 pagesKey Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceRashan Jida ReshanNo ratings yet

- Revised Verti On SFP 2019Document2 pagesRevised Verti On SFP 2019cheesekuhNo ratings yet

- DARIA Assig2 Tren CorpDocument2 pagesDARIA Assig2 Tren CorpNina PaulaNo ratings yet

- Annual Income Statement (Values in 000's $) : Current AssetsDocument6 pagesAnnual Income Statement (Values in 000's $) : Current AssetsVikash ChauhanNo ratings yet

- Audit of CashDocument3 pagesAudit of CashKienthvxxNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementViejay CastilloNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- MBA104 - Almario - Parco - Case Study LGAOP02Document25 pagesMBA104 - Almario - Parco - Case Study LGAOP02Jesse Rielle CarasNo ratings yet

- FinMan (Common-Size Analysis)Document4 pagesFinMan (Common-Size Analysis)Lorren Graze RamiroNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- Financial Management #3Document4 pagesFinancial Management #3Roel AsduloNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- Elite, S.A. de C.V.: Balance GeneralDocument6 pagesElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- 108 Efe 94 F 05642 C 6 BcfeDocument11 pages108 Efe 94 F 05642 C 6 BcfeKryzha RemojoNo ratings yet

- Cortez Exam in Business FinanceDocument4 pagesCortez Exam in Business FinanceFranchesca CortezNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- Red Chilli WorkingsDocument10 pagesRed Chilli WorkingsImran UmarNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- FINANCIAL ANALYSIS Practice 3Document15 pagesFINANCIAL ANALYSIS Practice 3Hallasgo, Elymar SorianoNo ratings yet

- Model Unit: 2016 Nissan Almera: Total Cost 630,000.00 Cash Discount If Cash 20,000.00 Total Cost (Cash Price)Document4 pagesModel Unit: 2016 Nissan Almera: Total Cost 630,000.00 Cash Discount If Cash 20,000.00 Total Cost (Cash Price)Yasser AureadaNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- Mandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Document4 pagesMandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Mohammad Raffe GuroNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- Financial Management Week 2 AssignmentDocument2 pagesFinancial Management Week 2 AssignmentAndrea Monique AlejagaNo ratings yet

- Apple Inc.Document14 pagesApple Inc.Orxan AliyevNo ratings yet

- Apple Inc Com in Dollar US in ThousandsDocument6 pagesApple Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Chap - Test - CH4 - Financial Ratio Analysis and Their Implications To ManagementDocument10 pagesChap - Test - CH4 - Financial Ratio Analysis and Their Implications To Managementroyette ladicaNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- Financial Ratio Horizontal and Vertical AnalysisDocument4 pagesFinancial Ratio Horizontal and Vertical AnalysisKyla SantosNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- FinancialsDocument6 pagesFinancialsharshithamandalapuNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Balance Sheet (Vertical & Horizontal Analysis)Document7 pagesBalance Sheet (Vertical & Horizontal Analysis)Nguyen Dac ThichNo ratings yet

- Common Size/Vertical Analysis: Lecture No. 9Document4 pagesCommon Size/Vertical Analysis: Lecture No. 9naziaNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- VCMMMM Final RequirementDocument8 pagesVCMMMM Final RequirementMaxine Lois PagaraganNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- JudaismDocument3 pagesJudaismVince Lloyd RaborNo ratings yet

- Document 6Document3 pagesDocument 6Vince Lloyd RaborNo ratings yet

- Black Swan ReflectionDocument1 pageBlack Swan ReflectionVince Lloyd RaborNo ratings yet

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- Accc372 Mod 2022 VCDocument26 pagesAccc372 Mod 2022 VCakeeraNo ratings yet

- BUSLYTCJDWILLIAMSCASEDocument20 pagesBUSLYTCJDWILLIAMSCASEchristinekehyengNo ratings yet

- CAPE Accounting 2006 U2 P1Document12 pagesCAPE Accounting 2006 U2 P1Pettal BartlettNo ratings yet

- Lesson 2 PDFDocument10 pagesLesson 2 PDFJet SagunNo ratings yet

- Solution - 1.: Calculation of NPV and IrrDocument5 pagesSolution - 1.: Calculation of NPV and IrrVishal DudejaNo ratings yet

- Corporate Goverance in IndiaDocument43 pagesCorporate Goverance in IndiaParandeep ChawlaNo ratings yet

- AFM习题带练讲义(一)Document127 pagesAFM习题带练讲义(一)周于No ratings yet

- Republic Act No. 2629 - Investment Company Act PDFDocument36 pagesRepublic Act No. 2629 - Investment Company Act PDFcool_peachNo ratings yet

- Value Creation Private EquityDocument6 pagesValue Creation Private EquityRobes BaimaNo ratings yet

- To Trinh HDQT Phuong An Phat HanhDocument4 pagesTo Trinh HDQT Phuong An Phat HanhLê Hưu NhânNo ratings yet

- M 202Document2 pagesM 202Rafael Capunpon VallejosNo ratings yet

- Partnership Operations - Sample ProblemsDocument2 pagesPartnership Operations - Sample ProblemsLyca Mae CubangbangNo ratings yet

- Efficiency RatiosDocument6 pagesEfficiency Ratiosabhi vermaNo ratings yet

- Steven JohnsonDocument4 pagesSteven JohnsonDan FreedNo ratings yet

- Cashflow FormatDocument4 pagesCashflow FormatRaja kumarNo ratings yet

- Introduction To Cost and Management AccountingDocument31 pagesIntroduction To Cost and Management AccountingTestNo ratings yet

- Emerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncDocument10 pagesEmerging Market Corporate Bonds - A Scoring System: 'New York University, 2sa/omon Brothers IncAlmaliyana BasyaibanNo ratings yet

- Midterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Document24 pagesMidterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Ian Ray PaglinawanNo ratings yet

- Initial Public OfferingDocument7 pagesInitial Public Offeringluv2skNo ratings yet

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- Chapter 2 - Lesson 4Document18 pagesChapter 2 - Lesson 4JajaNo ratings yet

- Return On Invested CapitalDocument3 pagesReturn On Invested CapitalZohairNo ratings yet

- Cash Oxley AssignmentDocument13 pagesCash Oxley AssignmentKaRl MariNo ratings yet

- Tutorial 1 QuestionsDocument4 pagesTutorial 1 QuestionshrfjbjrfrfNo ratings yet

- Financial Management (NOTES) Aug 2023Document289 pagesFinancial Management (NOTES) Aug 2023jhanvitiwari460No ratings yet

- Consolidated Financial Statements HY 2019 - Solutions 30Document41 pagesConsolidated Financial Statements HY 2019 - Solutions 30Musariri TalentNo ratings yet

- Journal: Illustration - 1 Journalise The Following Transactions in The Books of Shri .HerambhDocument10 pagesJournal: Illustration - 1 Journalise The Following Transactions in The Books of Shri .HerambhAyushi100% (1)

- FIN 072 - SAS - Day 17 - IN - Second Period ExamDocument12 pagesFIN 072 - SAS - Day 17 - IN - Second Period ExamEverly Mae ElondoNo ratings yet