Professional Documents

Culture Documents

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

janardhan CA,CSOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

janardhan CA,CSCopyright:

Available Formats

Test Series: April 2019

MOCK TEST PAPER - 2

INTERMEDIATE (IPC): GROUP – I

PAPER – 1: ACCOUNTING

SUGGESTED ANSWERS/HINTS

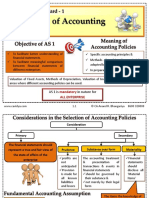

1. (a) (i) As per AS 1, any change in the accounting policies which has a material effect in the current

period or which is reasonably expected to have a material effect in later periods should be

disclosed. In the case of a change in accounting policies which has a material effect in the

current period, the amount by which any item in the financial statements is affected by such

change should also be disclosed to the extent ascertainable. Where such amount is not

ascertainable, wholly or in part, the fact should be indicated. Accordingly, the notes on

accounts should properly disclose the change and its effect.

Notes on Accounts: So far, the company has been providing 2% of sales for meeting “after

sales expenses during the warranty period. With the improved method of production, the

probability of defects occurring in the products has reduced considerably. Hence, the

company has decided not to make provision for such expenses but to account for the same

as and when expenses are incurred. Due to this change, the profit for the year is increased

by Rs. 12 crores than would have been the case if the old policy were to continue.

(b) As per AS 9 “Revenue Recognition”, in a transaction involving the sale of goods, performance

should be regarded as being achieved when the following conditions are fulfilled:

(i) the seller of goods has transferred to the buyer the property in the goods for a pri ce or all

significant risks and rewards of ownership have been transferred to the buyer and the seller

retains no effective control of the goods transferred to a degree usually associated with

ownership; and

(ii) no significant uncertainty exists regarding the amount of the consideration that will be derived

from the sale of the goods.

Case (i): 25% goods lying unsold with consignee should be treated as closing inventory and

sales should be recognized for Rs. 3,00,000 (75% of Rs. 4,00,000) for the year ended on

31.3.17. In case of consignment sale, revenue should not be recognized until the goods are

sold to a third party.

Case (ii): The sale is complete but delivery has been postponed at buyer’s request. Fashion

Ltd. should recognize the entire sale of Rs.1,95,000 for the year ended 31 st March, 2017.

Case (iii): In case of goods sold on approval basis, revenue should not be recognized until

the goods have been formally accepted by the buyer or the buyer has done an act accepting

the transaction or the time period for rejection has elapsed or where no time has been fixed,

a reasonable time has elapsed. Therefore, revenue should be recognized for the total sales

amounting Rs. 2,50,000 as the time period for rejecting the goods had expired.

Thus total revenue amounting Rs. 7,45,000 (3,00,000+1,95,000+2,50,000) will be recognized

for the year ended 31st March, 2017 in the books of Fashion Ltd.

(c) As per para AS 2 ‘Valuation of Inventories’, abnormal amounts of wasted materials, labour and

other production costs are excluded from cost of inventories and such costs are recognized as

expenses in the period in which they are incurred. The normal loss will be included in determining

the cost of inventories (finished goods) at the year end.

© The Institute of Chartered Accountants of India

Amount of Normal Loss and Abnormal Loss:

Material used 12,000 MT @ Rs. 150 = Rs. 18,00,000

Normal Loss (4% of 12,000 MT) 480 MT

Net quantity of material 11,520 MT

Abnormal Loss in quantity 150 MT (630 MT less 480 MT)

Abnormal Loss Rs. 23,437.50 [150 units @ Rs. 156.25

(Rs.18,00,000/11,520)]

Amount of Rs. 23,437.50 will be charged to the Profit and Loss statement.

(d) General Ledger Adjustment Account in Debtors Ledger

Date Particulars Rs. Date Particulars Rs.

01.04.2017 To Balance b/d 4,700 1.4.2017 By Balance b/d 1,79,100

01.04.2017 To Debtors ledger 01.04.2017 By Debtors ledger

to adjustment A/c: to adjustment A/c:

30.4.2017 Cash received 8,62,850 30.4.2017 Credit sales 9,97,700

Sales Returns 16,550 Cash paid for returns 3,000

Bills receivable BR dishonoured

received 47,500 3,750

Transfer to creditors 8,000 30.04.2017 By Balance c/d 4,900

ledger

30.04.2017 To Balance c/d

(bal.fig) 2,48,850

11,88,450 11,88,450

2. Partners’ Capital Accounts as on 1.4.2017

Anuj Ayush Piyush Anuj Ayush Piyush

To Anuj 22,950 68,850 By Balance 3,75,000 2,80,000 2,25,000

b/d

To Revaluation 37,400 37,400 18,700 By General 75,200 75,200 37,600

Loss Reserves

To Bank FD 2,34,000 By Ayush 91,800

To 8% Loan 2,70,600 and Piyush

To Balance c/d* 3,03,450 3,03,450 By Cash

(Bal. fig.) - 8,600 1,28,400

5,42,000 3,63,800 3,91,000 5,42,000 3,63,800 3,91,000

Balance Sheet as on 1.4.2017 after Anuj’s retirement

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Anuj’s Loan 2,70,600 Plant (90% of Rs. 7,87,000) 7,08,300

Creditors (2,16,000+10,000) 2,26,000 Stock (Rs. 1,03,000 less Rs. 6,000) 97,000

© The Institute of Chartered Accountants of India

Capital Accounts*: Debtors (95% of Rs. 1,56,000) 1,48,200

Ayush 3,03,450 Bank Balance 1,50,000

Piyush 3,03,450

11,03,500 11,03,500

*Total of capital balances should be Rs. 6,06,900 which is proportioned to individual partners in their

profit sharing ratio.

Working Notes:

1. Profit / Loss on revaluation

Revaluation Account

Amount Amount

(Rs.) (Rs.)

To Plant 78,700 By Interest on FD 9,000

To Creditors 10,000 By Loss on revaluation 93,500

To Inventory 6,000

To Provision for doubtful debts 7,800

1,02,500 1,02,500

2. Calculation of Goodwill

Goodwill Valuation

Profit of year ended Rs.

31.3.2017 (Rs. 3,30,000 less Rs. 93,500) 2,36,500

31.3.2016 2,32,000

31.3.2015 2,20,000

Total Profits 6,88,500

Average Profit = 6,88,500/3 = 2,29,500

Goodwill valued at 1 year purchase amounting Rs. 2,29,500.

3. Adjustment for goodwill among partners

Anuj’s share of goodwill (2,29,500 x 2/5) = 91,800

Gaining ratio of Ayush and Piyush

Ayush Piyush

1 2 1 1

2 5 2 5

54 1 52 3

10 10 10 10

Gaining Ratio = 1: 3

© The Institute of Chartered Accountants of India

Entry for adjustment of goodwill

Rs. Rs.

Ayush’s capital A/c Dr. 22,950

Piyush’s capital A/c Dr. 68,850

To Anuj’s capital A/c 91,800

(Being Anuj’s share of goodwill debited to remaining

partners in their gaining ratio)

3. (a) Investment Account of Gopal

For the year ended 31.3.2019

(Script: 15% Debentures in Ritu Industries Ltd.)

(Interest payable on 30 th June and 31st December)

Date Particulars Nominal Interes Cost Date Particulars Nominal Interest Cost

Value t Rs. Rs. Value Rs. Rs. Rs.

Rs.

1.04.18 To Balance 2,00,000 7,500 2,10,000 30.06.18 By Bank A/c - 22,500

A/c

1.05.18 To Bank A/c 1,00,000 5,000 1,02,000 1.11.18 By Bank A/c 1,20,000 6,000 1,14,600

30.11.18 To Bank A/c 80,000 5,000 76,800 1.11.18 By Profit & Loss - - 11,400

A/c

31.12.18 To Profit & 20,000 31.12.18 By Bank A/c 80,000 6,000 1,04,000

Loss A/c

31.03.19 To Profit & 37,250 31.12.18 By Bank A/c - 13,500 -

Loss A/c

(Bal. fig.) 31.12.18 By Bank A/c - 6,750 -

31.3.19 By Bal. c/d 1,80,000 - 1,78,800

3,80,000 54,750 4,08,800 3,80,000 54,750 4,08,800

Working Notes:

15 3

(i) Accrued Interest as on 1st April, 2018 = Rs. 2,00,000 x x ` 7,500

100 12

15 4

(ii) Accrued Interest as on 1.5.2018 = Rs. 1,00,000 x x ` 5,000

100 12

(iii) Cost of Investment for purchase on 1 st May = Rs. 1,07,000 – Rs. 5,000 = Rs. 1,02,000

15 6

(iv) Interest received as on 30.6.2018 = Rs. 3,00,000 x x ` 22,500

100 12

(v) Accrued Interest on debentures sold on 1.11.2018

15 4

= Rs. 1,20,000 x x ` 6,000

100 12

15 5

(vi) Accrued Interest = Rs. 80,000 x x ` 5,000

100 12

© The Institute of Chartered Accountants of India

15 6

(vii) Accrued Interest on sold debentures 31.12.2018 = Rs. 80,000 x x ` 6,000

100 12

(viii) Sale Price of Investment on 31 st Dec. = Rs. 1,10,000-Rs. 6,000 = Rs. 1,04,000

(ix) Loss on Sale of Debenture on 1.1.2018

Sale Price of debenture 1,14,600

Less: Cost Price of debenture

2,10,000

x ` 1,20,000 1,26,000

2,00,000

Loss on sale 11,400

15 6

(x) Accrued interest as on 31.12.2018 = Rs. 1,80,000 x x ` 13,500

100 12

15 3

(xi) Accrued Interest = Rs. 1,80,000 x x ` 6,750

100 12

(xii) Cost of investment as on 31 st March = Rs. 1,02,000 + Rs. 76,800 = Rs. 1,78,800

(xiii) Profit on debentures sold on 31 st December

= Rs. 1,04,000 –(Rs. 2,10,000x800/2,000) =Rs. 20,000

(b) Calculation of Interest and Cash Price

No. of Outstanding Amount Outstanding Interest Outstanding

installment balance at the end due at the balance at the balance at

s after the payment time of end before the the

of installment installme payment of beginning

nt installment

[1] [2] [3] [4] = 2 +3 [5] = 4 x [6] = 4-5

10/110

3rd - 5,50,000 5,50,000 50,000 5,00,000

2nd 5,00,000 4,90,000 9,90,000 90,000 9,00,000

1st 9,00,000 4,20,000 13,20,000 1,20,000 12,00,000

Total cash price = Rs. 12,00,000+ 6,00,000 (down payment) = Rs. 18,00,000.

Cars Account in the books of Krishan

Date Particulars Rs. Date Particulars Rs.

1.4.2015 To Fair Value 31.3.2016 By Depreciation A/c 4,50,000

Motors A/c 18,00,000 By Balance c/d 13,50,000

18,00,000 18,00,000

1.4.2016 To Balance b/d 13,50,000 31.3.2017 By Depreciation A/c 3,37,500

By Balance c/d 10,12,500

13,50,000 13,50,000

1.4.2017 To Balance b/d 10,12,500 31.3.2018 By Depreciation A/c 2,53,125

By Fair Value Motors A/c

(Value of 1 Car taken over

© The Institute of Chartered Accountants of India

after depreciation for 3

years @ 40%

p.a.) [9,00,000 - (3,60,000 1,94,400

+ 2,16,000 + 1,29,600)]

By Loss transferred to

Profit and Loss A/c on

surrender (Bal. fig.) 1,85,288

By Balance c/d

½ (10,12,500-2,53,125) 3,79,687

10,12,500 10,12,500

4. (a) Journal Entries related to internal reconstruction

in the books of Planet Ltd. (Rs. in lakh)

Particulars Debit Credit

Rs. Rs.

i 8% Preference share capital A/c (Rs. 100 each) Dr. 600

To 8% Preference share capital A/c 450

(Rs. 75 each)

To Capital reduction A/c 150

(Being the Preference shares of Rs. 100 each reduced to Rs.

75 each as per the approved scheme)

ii Equity share capital A/c (Rs. 10 each) Dr. 1,500

To Equity share capital A/c (Rs. 2 each) 300

To Capital reduction A/c 1,200

(Being the equity shares of Rs. 10 each reduced to Rs. 2 each)

iii Capital reduction A/c Dr. 48

To Equity share capital A/c (Rs. 2 each) 48

(Being 1/3rd of arrears of preference share dividend of three

years to be satisfied by issue of 24 lakh equity shares of Rs.

2 each)

iv 6% Debentures A/c Dr. 450

To Freehold property A/c 450

(Being claim settled in part by transfer of freehold property)

v Accrued debenture interest A/c Dr. 36

To Bank A/c 36

(Being accrued debenture interest paid)

vi Freehold property A/c Dr. 175

To Capital reduction A/c 175

(Being appreciation Rs. (550-375) in the value of freehold

property)

© The Institute of Chartered Accountants of India

vii Bank A/c Dr. 425

To Investment A/c 300

To Capital reduction A/c 125

(Being investment sold on profit)

viii Director’s loan A/c Dr. 450

To Equity share capital A/c (Rs. 2 each) 135

To Capital reduction A/c 315

(Being director’s loan waived by 70% and balance being

discharged by issue of 67.5 lakh equity shares of Rs. 2 each)

ix Capital reduction A/c Dr. 1,485

To Profit and loss A/c 783

To Trade receivables A/c (Rs. 675 x 40%) 270

To Inventories-in-trade A/c (450 x 80%) 360

To Bank A/c 72

(Being various assets, penalty on cancellation of contract,

profit and loss account debit balance written off through

capital reduction account)

x Capital reduction A/c Dr. 432

To Capital reserve A/c 432

(Being balance transferred to capital reserve account as per

the scheme)

(b) Capital Reduction Account (Rs. in lakh)

To Equity Share Capital 48 By 8% Pref. Share Capital 150

To P & L A/c 783 By Equity Share Capital 1,200

To Trade Receivables 270 By Freehold property 175

To Inventories 360 By Bank (profit on sale of 125

investment)

To Bank 72 By Director’s loan 315

To Capital Reserve 432

1,965 1,965

Bank Account (Rs. in lakh)

To Balance b/d 6 By Accrued debenture interest 36

To Investments 300 By Capital Reduction Account (Penalty on 72

cancellation of contract)

To Capital reduction 125 By Balance c/d 323

431 431

© The Institute of Chartered Accountants of India

(c) Note to Accounts on Share Capital and Tangible Assets

after implementation of internal reconstruction

Share Capital (Rs. in lakh)

Authorised:

300 lakh shares of Rs. 2 each 600

12 lakh, 8% Preference shares of Rs. 75 each 900

1,500

Issued, subscribed and paid up:

241.5 lakh Equity shares of Rs. 2 each 483

(out of which 91.5 lakh shares have been issued for consideration other than cash)

6 lakh, 8% Preference shares of Rs. 75 each fully paid up 450

Total 933

Tangible assets

Freehold property 825

Less: Utilized to pay Debenture holders (450)

Add: Appreciation 175 550

Plant and machinery 300

Total 850

Working Note:

Calculation of number of equity shares issued:

Equity shareholders 150 Lakh

Preference shareholders (in lieu of arrear of preference dividend) 24 Lakh

Directors 67.5 Lakh

5. (a) Surbhi Ltd. Cash Flow Statement for

the year ended 31 st March, 20X1

Cash Flow from Operating Activities

Rs. Rs.

Increase in balance of Profit and Loss Account (1,00,000 – 40,000

60,000)

Dividend payable 2,00,000

Provision for taxation (W.N.1) 80,000

Transfer to General Reserve (2,00,000 – 1,50,000) 50,000

Depreciation (W.N.2) 1,25,000

Profit on sale of Plant and Machinery (15,000)

Operating Profit before Working Capital changes 4,80,000

Increase in Inventories (2,00,000)

Decrease in Trade receivables 2,00,000

© The Institute of Chartered Accountants of India

Decrease in Trade payables (1,20,000)

Cash generated from operations 3,60,000

Income tax paid (50,000)

Net Cash from operating activities 3,10,000

Cash Flow from Investing Activities

Purchase of fixed assets (3,45,000)

Expenses on building (2,00,000)

(6,00,000 – 4,00,000)

Increase in investments (1,00,000)

Sale of old machine 35,000

Net Cash used in investing activities (6,10,000)

Cash Flow from Financing activities

Proceeds from issue of shares (10,00,000 – 8,00,000) 2,00,000

Proceeds from issue of debentures 2,00,000

Dividend paid (1,00,000)

Net cash used in financing activities 3,00,000

Net increase in cash or cash equivalents NIL

Cash and Cash equivalents at the beginning of the year 2,00,000

Cash and Cash equivalents at the end of the year 2,00,000

Working Notes:

1. Provision for taxation account

Rs. Rs.

To Cash (Paid) 50,000 By Balance b/d 70,000

To Balance c/d 1,00,000 By Profit and Loss A/c 80,000

(Balancing figure)

1,50,000 1,50,000

2. Plant and Machinery account

Rs. Rs.

To Balance b/d 5,00,000 By Depreciation 1,25,000

To Profit and Loss A/c 15,000

(profit on sale of

machine)

To Cash (Balancing figure) 3,45,000 By Cash 35,000

(sale of machine)

_______ By Balance c/d 7,00,000

8,60,000 8,60,000

© The Institute of Chartered Accountants of India

(b) Memorandum Trading Account for the period 1st April, 2016 to 29th August 2016

Rs. Rs.

To Opening Stock 3,95,050 By Sales 22,68,000

To Purchases 16,55,350 By Closing stock (Bal. 4,41,300

fig.)

Less: (20,500)

Advertisement

Drawings (1,000) 16,33,850

To Gross Profit

[30% of Sales] 6,80,400

[W N]

27,09,300 27,09,300

Statement of Insurance Claim

Rs.

Value of stock destroyed by fire 4,41,300

Less: Salvaged Stock (54,000)

Add: Fire Fighting Expenses 2,350

Insurance Claim 3,89,650

Note: Since policy amount is more than claim amount, average clause will not apply. Therefore,

claim amount of Rs. 3,89,650 will be admitted by the Insurance Company.

Working Note:

Trading Account for the year ended 31 st March, 2016

Rs. Rs.

To Opening Stock 3,55,250 By Sales 40,00,000

To Purchases 28,39,800 By Closing stock 3,95,050

To Gross Profit 12,00,000

43,95,050 43,95,050

Rate of Gross Profit in 2015-16

Gross Pr ofit

100 = 12,00,000/40,00,000 x 100 = 30%

Sales

6. (a) Mahaveer hospital

Income & Expenditure Account

for the year ended 31 December, 2016

Expenditure Rs. Income Rs.

To Salaries 24,000 By Subscriptions 24,500

To Diet expenses 15,600 By Govt. Grants (Maintenance) 20,000

To Rent & Rates 1,700 By Fees, Sundry Patients 4,800

To Printing & Stationery 2,400 By Donations 8,000

10

© The Institute of Chartered Accountants of India

To Electricity & Water- 2,400 By Benefit shows (net collections) 6,000

charges

To Office expenses 2,000 By Interest on Investments 800

To Excess of Income over

expenditure transferred to

Capital Fund 16,000

64,100 64,100

Balance Sheet as at 31 st Dec., 2016

Liabilities Rs. Rs. Assets Rs. Rs.

Capital Fund : Building :

Opening balance 49,300 Opening balance 90,000

Excess of Income Addition 50,000 1,40,000

Over Expenditure 16,000 65,300 Hospital Equipment :

Building Fund : Opening balance 34,000

Opening balance 80,000 Addition 17,000 51,000

Add : Govt. Grant 80,000 1,60,000 Furniture 6,000

Subscriptions Investments-

received in advance 2,400 8% Govt. Securities 20,000

Subscriptions receivable 1,400

Accrued interest 800

Prepaid expenses (Rent) 300

Cash at Bank 6,800

Cash in hand 1,400

2,27,700 2,27,700

Working Notes:

(1) Balance sheet as at 31st Dec., 2015

Liabilities Rs. Assets Rs.

Capital Fund Building 90,000

(Balancing Figure) 49,300 Equipment 34,000

Building Fund 80,000 Subscription Receivable 6,500

Creditors for Expenses: Cash at Bank 5,200

Salaries payable 7,200 Cash in hand 800

1,36,500 1,36,500

(2) Building Rs.

Balance on 31st Dec. 2016 1,40,000

Paid during the year (50,000)

Balance on 31st Dec. 2015 90,000

11

© The Institute of Chartered Accountants of India

(3) Equipment

Balance on 31st Dec. 2016 51,000

Paid during the year (17,000)

Balance on 31st Dec. 2015 34,000

(4) Subscription due for 2015

Receivable on 31st Dec. 2015 6,500

Received in 2016 (5,100)

Still Receivable for 2015 1,400

(b) Capital Redemption Reserve A/c Dr. 30,000

Securities Premium A/c Dr. 40,000

General Reserve A/c Dr. 30,000

To Bonus to Shareholders 1,00,000

(Being issue of bonus shares by utilization of various

Reserves, as per resolution dated …….)

Bonus to Shareholders A/c Dr. 1,00,000

To Equity Share Capital 1,00,000

(Being capitalization of Profit)

7. (a) (i) Current Liabilities/ Other Current Liabilities

(ii) Shareholders' Fund / Reserve & Surplus

(iii) Current liabilities/Other Current Liabilities

(iv) Contingent Liabilities and Commitments

(v) Shareholders' Fund / Share Capital

(vi) Fixed Assets

(vii) Shareholders' Fund / Money received against share warrants

(viii) Current Assets

(b) The entity has charged depreciation using the straight-line method at Rs. 1,00,000 per annum i.e

(5,00,000/5 years). On 1st January 2017, the asset's net book value is [5,00,000 – (1,00,000 x 4)]

Rs. 1,00,000. The remaining useful life is 4 years. The company should amend the annual provision

for depreciation to charge the unamortized cost over the revised remaining life of four years.

Consequently, it should charge depreciation for the next 4 years at Rs. 25,000 per annum i.e.

(1,00,000 / 4 years).

(c) (i) Operating Activities: c, e, f, g, j, m, o.

(ii) Investing Activities: a, h, k, l, p.

(iii) Financing Activities: b, d, i, n.

(d) Accounting Standards (ASs) are written policy documents issued by expert accounting body or

by government or other regulatory body covering the aspects of recognition, measurement,

presentation and disclosure of accounting transactions in the financial statements. Accounting

Standards reduce the accounting alternatives in the preparation of financial statements and ensure

12

© The Institute of Chartered Accountants of India

standardization of alternative accounting treatments and comparability of financial statements of

different enterprises.

Accounting Standards deal with the issues of

(i) Recognition of events and transactions in the financial statements,

(ii) Measurement of these transactions and events,

(iii) Presentation of these transactions and events in the financial statements in a manner that is

meaningful and understandable to the reader, and

(iv) Disclosure requirements which should be there to enable the public at large and the

stakeholders and the potential investors, in particular, to get an insight into what these

financial statements are trying to reflect and thereby facilitating them to take prudent and

informed business decisions.

(e) In modern time, computerized accounting systems are used in various areas. The significance of

the computerized accounting system is as follows:

(1) Increase speed, accuracy and security - In computerized accounting system, the speed with

which accounts can be maintained is several fold higher. Besides speed, level of accuracy is

also high in computerized accounting system.

(2) Reduce errors - In computerized accounting, the possibilities of errors are also very less

unless some mistake is made while recording the data.

(3) Immediate information - In this system, with an entry of a transaction, corresponding ledger

posting is done automatically. Hence, trial balance will also be automatically tallied and the

user will get the information immediately.

(4) Avoid duplication of work - Computerized accounting systems also remove the duplication of

the work.

13

© The Institute of Chartered Accountants of India

You might also like

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Solution Manual For Financial Accounting 6th Canadian Edition by LibbyDocument29 pagesSolution Manual For Financial Accounting 6th Canadian Edition by Libbya84964899475% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Module 8 - Bonds PayableDocument6 pagesModule 8 - Bonds PayableLui100% (2)

- FinancialPlan - 2013 Version - Prof DR IsmailDocument129 pagesFinancialPlan - 2013 Version - Prof DR IsmailSyukur Byte50% (2)

- CA Foundation MTP 2020 Paper 1 AnsDocument9 pagesCA Foundation MTP 2020 Paper 1 AnsSaurabh Kumar MauryaNo ratings yet

- IGNOU ms04 AnsDocument12 pagesIGNOU ms04 AnsmiestalinNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Test 5 Solutions AccountsDocument9 pagesTest 5 Solutions AccountsVijayasri KumaravelNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Revision Test Paper: Cap Ii (June 2017)Document12 pagesRevision Test Paper: Cap Ii (June 2017)binuNo ratings yet

- Acc q2 SANSDocument11 pagesAcc q2 SANSTanvir AnjumNo ratings yet

- MTP May20 ADocument9 pagesMTP May20 Aomkar sawantNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Goodwill 2004 - 3,43,700 (Printing Mistake)Document9 pagesGoodwill 2004 - 3,43,700 (Printing Mistake)vasanthgurusamynsNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Year Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)Document11 pagesYear Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)anon_573519739No ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Ty Sorn-T: (Time:Z%) Iours)Document4 pagesTy Sorn-T: (Time:Z%) Iours)shahisonal02No ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- MTP 4 28 Answers 1682339051Document9 pagesMTP 4 28 Answers 1682339051Suryanshi BaranwalNo ratings yet

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocument14 pagesMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Quiz 2 PrE3Document13 pagesQuiz 2 PrE3Lyca MaeNo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Financial Accounting - IVDocument6 pagesFinancial Accounting - IVMadhuram SharmaNo ratings yet

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Test 1 - Test On IND As 16, 38, 40 - Suggested AnsDocument11 pagesTest 1 - Test On IND As 16, 38, 40 - Suggested Ansbhallavishal.socialmediaNo ratings yet

- Crash MysoreDocument40 pagesCrash MysoreyashbhardwajNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument22 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of Indianaveen karhadkarNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Particulars Dr. Cr. Amount (RS.) Amount (RS.) : © The Institute of Chartered Accountants of IndiaDocument9 pagesParticulars Dr. Cr. Amount (RS.) Amount (RS.) : © The Institute of Chartered Accountants of Indiaomkar sawantNo ratings yet

- CA Inter p1 Accounts All Question Papers Answers @CA InterDocument297 pagesCA Inter p1 Accounts All Question Papers Answers @CA InterNagendra TNNo ratings yet

- 5th Sem Accounts Previous Year PapersDocument25 pages5th Sem Accounts Previous Year PapersViratNo ratings yet

- Unit 5 Banking Companies Special TransactionDocument14 pagesUnit 5 Banking Companies Special Transactiontimoni5707No ratings yet

- 94 Final PB FAR PDFDocument16 pages94 Final PB FAR PDFfanchasticommsNo ratings yet

- Assignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRDocument18 pagesAssignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRcyber kci100% (1)

- May 4519201 May 2019Document4 pagesMay 4519201 May 2019PILLO PATELNo ratings yet

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarDocument2 pagesOffice of The Principal Accountant General (A & E) Odisha, Bhubaneswarsohalsingh1No ratings yet

- Notes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dDocument10 pagesNotes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dar5769584No ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Tugas 1 Lab Auditing OkDocument9 pagesTugas 1 Lab Auditing OkIrmalia Anastasia SiagianNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesvenumadhavanNo ratings yet

- Accounting Standard Notes by Anand R. BhangariyaDocument96 pagesAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- SPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in EquityDocument8 pagesSPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in Equitylams.ronaldsunigaNo ratings yet

- Nikumbhe Bhushan Nanabhai PGP10158 HRM Re-Exam: AssetDocument8 pagesNikumbhe Bhushan Nanabhai PGP10158 HRM Re-Exam: AssetSOURABH TONDALENo ratings yet

- Company Profile 22Document32 pagesCompany Profile 22V. HarishNo ratings yet

- Lesson 2 (Basic Accounting Equation)Document47 pagesLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYNo ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- WIKADocument246 pagesWIKACuan 3No ratings yet

- Summaries of International Accounting StandardsDocument69 pagesSummaries of International Accounting Standardsmaryam rajputtNo ratings yet

- CBSE Class 12 Accountancy Ratio AnalysisDocument9 pagesCBSE Class 12 Accountancy Ratio AnalysisJyoti SinghNo ratings yet

- Lesson Title: Most Essential Learning Competencies (Melcs)Document9 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda TumbagaNo ratings yet

- Intel Financial Statement Analysis PaperDocument36 pagesIntel Financial Statement Analysis Paperapi-246945443100% (2)

- Quest MBA EnI Pragya Budhathoki Assignment IIDocument8 pagesQuest MBA EnI Pragya Budhathoki Assignment IIpragya budhathokiNo ratings yet

- Chap 14 Problem SolutionsDocument39 pagesChap 14 Problem SolutionsNAFEES NASRUDDIN PATELNo ratings yet

- Accounting Material For InterviewsDocument53 pagesAccounting Material For InterviewsMuhammad UmarNo ratings yet

- 19BBL110 Final Research Project LCFDocument19 pages19BBL110 Final Research Project LCFShubham TejasNo ratings yet

- Intellectual Capital Performance in The Financial Sector: Evidence From China, Hong Kong, and TaiwanDocument21 pagesIntellectual Capital Performance in The Financial Sector: Evidence From China, Hong Kong, and TaiwanIzaldi AnwarNo ratings yet

- Business Valuation in Mergers and Acquisitions UV6759-PDF-ENGDocument13 pagesBusiness Valuation in Mergers and Acquisitions UV6759-PDF-ENGSonalNo ratings yet

- Genpact Finance Interview QDocument5 pagesGenpact Finance Interview QJakir Hussain DargaNo ratings yet

- Company Accounts and IAS (Paper f3)Document7 pagesCompany Accounts and IAS (Paper f3)ASISHAHEENNo ratings yet

- 2018 AFR National Govt Volume IDocument493 pages2018 AFR National Govt Volume Imoshi kpop cartNo ratings yet

- AnnelieAsser FinalThesisDocument68 pagesAnnelieAsser FinalThesisAnnelie AsserNo ratings yet

- Cadila Health (Version 1)Document12 pagesCadila Health (Version 1)Sahitya sinhaNo ratings yet

- On The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountDocument3 pagesOn The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountRuthNo ratings yet

- Determinants of Profitability in Indian Automotive IndustryDocument4 pagesDeterminants of Profitability in Indian Automotive IndustrydjozinNo ratings yet

- Chapter 12 InvestmentsDocument12 pagesChapter 12 Investmentsaboodnawasrah777No ratings yet

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDocument42 pagesSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (48)

- Henri BoulangerieDocument7 pagesHenri BoulangerievietNo ratings yet

- MSBC 5060: Financial Statement Analysis and Financial ModelsDocument51 pagesMSBC 5060: Financial Statement Analysis and Financial ModelsLAMOUCHI RIMNo ratings yet