Professional Documents

Culture Documents

Tax On Mobile Phone Import

Tax On Mobile Phone Import

Uploaded by

Hassan0 ratings0% found this document useful (0 votes)

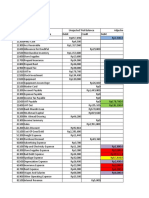

14 views2 pagesThis document outlines the various duties and taxes imposed on phone imports into Pakistan. It lists customs duty, regulatory duty, sales tax, additional sales tax, IT duty, mobile levy, and provincial tax as the different types of duties. It provides tables showing the amounts charged for mobile levy, regulatory duty, and the total taxation for various phone values ranging from $50 to $1,500. The total taxation includes fixed amounts for sales tax, customs duty, additional sales tax, and IT tax, along with percentages applied to the phone's value for regulatory duty, additional sales tax, and IT tax.

Original Description:

Tax On Mobile Phone Import

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the various duties and taxes imposed on phone imports into Pakistan. It lists customs duty, regulatory duty, sales tax, additional sales tax, IT duty, mobile levy, and provincial tax as the different types of duties. It provides tables showing the amounts charged for mobile levy, regulatory duty, and the total taxation for various phone values ranging from $50 to $1,500. The total taxation includes fixed amounts for sales tax, customs duty, additional sales tax, and IT tax, along with percentages applied to the phone's value for regulatory duty, additional sales tax, and IT tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesTax On Mobile Phone Import

Tax On Mobile Phone Import

Uploaded by

HassanThis document outlines the various duties and taxes imposed on phone imports into Pakistan. It lists customs duty, regulatory duty, sales tax, additional sales tax, IT duty, mobile levy, and provincial tax as the different types of duties. It provides tables showing the amounts charged for mobile levy, regulatory duty, and the total taxation for various phone values ranging from $50 to $1,500. The total taxation includes fixed amounts for sales tax, customs duty, additional sales tax, and IT tax, along with percentages applied to the phone's value for regulatory duty, additional sales tax, and IT tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Different Types of Duties and Taxes

First of all, let’s list down all the different types of duties and taxes you’ll have to pay

on phone imports.

Customs Duty

Regulatory Duty

Sales Tax

Additional Sales Tax

IT Duty

Mobile Levy

Provincial Tax

Value of Duties and Taxes

Mobile Levy

Value of phone in PKR Levy

10,000 to 40,000 Rs. 1000

40,000 to 80,000 Rs. 3000

Over 80,000 Rs. 5000

Regulatory Duty

Value of phone in US Dollars Taxation

$1 to $60 Rs. 250

$61 to $130 10% of value

Over $130 20% of value

Sales Tax

The amount for sales tax is fixed at Rs. 1500.

Customs Duty

The amount for customs duty is fixed at Rs. 250.

Additional Sales Tax

The additional sales tax is fixed at 3% of the phone’s value.

IT Tax

The IT tax is fixed at 9% of the phone’s value.

Provincial Tax

The provincial tax is applicable only for Punjab and it’s fixed at 0.9% of the phone’s value.

How Much Tax You’ll Pay Based on Phone Value

If you don’t want to swing out a calculator, we’ve compiled this list which will tell you exactly how much tax and

duties you’ll pay depending on the cost of the phone.

Please keep in mind that these charges are calculated by assuming the value of the US Dollar is equivalent to Rs. 140.

Value of Mobile Taxation in PKR

$50 Rs. 4641

$100 Rs. 6367

$150 Rs. 8083

$200 Rs. 13,116

$250 Rs. 15,666

$300 Rs. 20,216

$350 Rs. 22,767

$400 Rs. 25,317

$450 Rs. 27,867

$500 Rs. 30,417

$550 Rs. 34,967

Value of Mobile Taxation in PKR

$600 Rs. 37,517

$650 Rs. 40,067

$700 Rs. 42,618

$800 Rs. 47,718

$900 Rs. 52,818

$1,000 Rs. 57, 918

$1,200 Rs. 68,119

$1,400 Rs. 78,319

$1,500 Rs. 83, 420

You might also like

- Senyawa: Compound LyricismDocument51 pagesSenyawa: Compound LyricismMinor CompositionsNo ratings yet

- Trial Tribulation Triumph Before During and After AntichristDocument15 pagesTrial Tribulation Triumph Before During and After AntichristAngel Iulian Popescu0% (9)

- Laporan Keuangan Ud BuanaDocument20 pagesLaporan Keuangan Ud Buanafitrianura04No ratings yet

- Akuntansi (Haspisah KLS 11 Akl2)Document6 pagesAkuntansi (Haspisah KLS 11 Akl2)sansihkNo ratings yet

- Worksheet Akuntansi DahliaDocument4 pagesWorksheet Akuntansi DahliaDahliaNo ratings yet

- CV Maju WorksheetDocument6 pagesCV Maju WorksheetWijaya Mahathir AlbatawyNo ratings yet

- Profit & Loss For Kami's Clothing As at 2018Document3 pagesProfit & Loss For Kami's Clothing As at 2018Veer SinghNo ratings yet

- Analyse de Rentabilité: Cout vs. VenteDocument2 pagesAnalyse de Rentabilité: Cout vs. VenteFelix SerreNo ratings yet

- Siklus Akuntansi Pada PT Adi JayaDocument11 pagesSiklus Akuntansi Pada PT Adi Jayafitrianura04No ratings yet

- Acc No Account Name Trial Balance Adjustment Entries Debit Credit DebitDocument14 pagesAcc No Account Name Trial Balance Adjustment Entries Debit Credit Debitelza jiuniNo ratings yet

- PT - Zalia Nofi Nurlaila (23) Neraca LajurDocument6 pagesPT - Zalia Nofi Nurlaila (23) Neraca LajurNofi Nurlaila100% (1)

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- Hasna Aliya - Statement of Financial PositionDocument6 pagesHasna Aliya - Statement of Financial PositionFachri DKNo ratings yet

- English 12th ClassDocument7 pagesEnglish 12th ClassShahan ShafiqNo ratings yet

- CqwYCWOuzt2AH7W AAIqyfd7kFY312 PDFDocument7 pagesCqwYCWOuzt2AH7W AAIqyfd7kFY312 PDFShoaib ZaiNo ratings yet

- Budget For I Love Coffee Shop Pty LTD in 2022 (Financial Year)Document6 pagesBudget For I Love Coffee Shop Pty LTD in 2022 (Financial Year)Shefali GoyalNo ratings yet

- Neraca Lajur AfiDocument13 pagesNeraca Lajur AfiNabila AyuningtiasNo ratings yet

- FAQsDocument1 pageFAQsLance BeckhamNo ratings yet

- TimelyBills Sample Monthly ReportDocument10 pagesTimelyBills Sample Monthly Reportairlton nascimentoNo ratings yet

- Work Sheet Salon SansaDocument2 pagesWork Sheet Salon SansaSnowball GlxyNo ratings yet

- Analisis Finansial Kelompok 2Document11 pagesAnalisis Finansial Kelompok 2Nazli Wulantri BinabaNo ratings yet

- Planilha Gerenciamento IndDocument8 pagesPlanilha Gerenciamento Inddiego lopesNo ratings yet

- Kumala Wardani X.akDocument6 pagesKumala Wardani X.akDakun PonorogoNo ratings yet

- indahcahyaniEKONOMI KERTAS KERJADocument9 pagesindahcahyaniEKONOMI KERTAS KERJAPutra BagasNo ratings yet

- Dear Musthofa97.: Account Statement For One Month AgoDocument6 pagesDear Musthofa97.: Account Statement For One Month AgoMusthofa Asshidiqi YahyaNo ratings yet

- HITUNGHITUNGDocument10 pagesHITUNGHITUNGAndi MulhikmahNo ratings yet

- Commission ScheduleDocument2 pagesCommission ScheduleCristian SalazarNo ratings yet

- Business Financial PlanDocument2 pagesBusiness Financial Planakundropbox315No ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Draft Pembagian FinalDocument4 pagesDraft Pembagian FinalAniManiaNo ratings yet

- Cerel Aliyah RP (024032001077) Tugas Prak - AktDocument40 pagesCerel Aliyah RP (024032001077) Tugas Prak - Aktptraffasha rizky mandiriNo ratings yet

- Ulangan Laporan KeuanganDocument12 pagesUlangan Laporan KeuanganMaulidian AprilianiNo ratings yet

- Act. Eva 02.07.01 Christian Irene Gutierrez GarciaDocument42 pagesAct. Eva 02.07.01 Christian Irene Gutierrez GarciaIré GutierrezNo ratings yet

- 02-16 - Despesas MensaisDocument8 pages02-16 - Despesas Mensaiscarteiradeidoso3No ratings yet

- Jayatama ManualDocument14 pagesJayatama ManualSalsa nabila Raflani putriNo ratings yet

- Data Siswa Kursus Orat-Oret - IdDocument22 pagesData Siswa Kursus Orat-Oret - IdMuhammad RatmantoNo ratings yet

- Brosur Pulsa Elektrik Enter PulsaDocument1 pageBrosur Pulsa Elektrik Enter PulsaRhajuelJulhariAlbersaJaitunNo ratings yet

- Chedule of Harges: T M B LDocument7 pagesChedule of Harges: T M B LFarman AliNo ratings yet

- MWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization BelowDocument6 pagesMWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization Belowhung nguyenNo ratings yet

- Tugas Pert 15 PA IKelas BDocument12 pagesTugas Pert 15 PA IKelas BRinaldy SabilfinaNo ratings yet

- Projeto AIDocument4 pagesProjeto AILuciano GonçalvesNo ratings yet

- Worksheet Adi JayaDocument4 pagesWorksheet Adi JayaMarda LenaNo ratings yet

- Ekotek MariiniDocument5 pagesEkotek MariiniDHILA AYUNINGTYASNo ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- CAIXA JUNHODocument20 pagesCAIXA JUNHOElci frsnciscoNo ratings yet

- Laporan Bendahara Dadya Gede Pasek Kalang AnyarDocument18 pagesLaporan Bendahara Dadya Gede Pasek Kalang AnyarGede KarmayasaNo ratings yet

- Saham SheetDocument7 pagesSaham SheetDavidNo ratings yet

- Animated Key Data Dashboard TemplateDocument12 pagesAnimated Key Data Dashboard TemplatesundecaprioNo ratings yet

- Laporan Arus Kas PribadiDocument7 pagesLaporan Arus Kas PribadiN Dinar NurazizahNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- EKOTEKDocument6 pagesEKOTEKDHILA AYUNINGTYASNo ratings yet

- Chedule of Harges: T M B LDocument6 pagesChedule of Harges: T M B LAbdur RehmanNo ratings yet

- Vrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajDocument47 pagesVrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajAdi SPNo ratings yet

- Ekr Cash in FlowDocument5 pagesEkr Cash in FlowKhoirun NisaNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

- Tabela Bike PlanosDocument1 pageTabela Bike PlanosJoanderson CabralNo ratings yet

- Solution P6-2Document2 pagesSolution P6-2Frantino M Hutagaol100% (1)

- Rincian Penerimaan Dan Pengeluaran Dana Kapitasi JKN Puskesmas Tahun 2020Document6 pagesRincian Penerimaan Dan Pengeluaran Dana Kapitasi JKN Puskesmas Tahun 2020Incheng AssaNo ratings yet

- Expense Report: Date Travel Meals&Ent Other Rate TotalDocument2 pagesExpense Report: Date Travel Meals&Ent Other Rate TotalDaniel KleinerNo ratings yet

- Renbut Dan Lra Polsek Jereweh November 2019Document11 pagesRenbut Dan Lra Polsek Jereweh November 2019Bagoes'z Zubhiksa HeheyNo ratings yet

- Task 1 - Engineering EconomicsDocument2 pagesTask 1 - Engineering Economicsmahera wijaksaraNo ratings yet

- PPP Frame WorkDocument10 pagesPPP Frame WorkchelimilNo ratings yet

- Number 1 and 2 Crim DigestDocument4 pagesNumber 1 and 2 Crim DigestLovely LimNo ratings yet

- Hometask: Mi Ultimo Adios (My Last Farewell)Document3 pagesHometask: Mi Ultimo Adios (My Last Farewell)Jasmin BelarminoNo ratings yet

- Codex HarlequinsDocument10 pagesCodex HarlequinstommythekillerNo ratings yet

- Campbell GenealogyDocument28 pagesCampbell GenealogyJeff Martin100% (1)

- KUTO VPN For Android - Download The APK From UptodownDocument1 pageKUTO VPN For Android - Download The APK From Uptodownjeccampos9No ratings yet

- 20th Century British Lit. Upto 1940Document161 pages20th Century British Lit. Upto 1940Fa DreamsNo ratings yet

- Zuhair Kashmeri and Brian McAndrew Soft Target HowDocument4 pagesZuhair Kashmeri and Brian McAndrew Soft Target HowSandeep SharmaNo ratings yet

- Gul Khan Nasir Speech Against The Sardari SystemDocument5 pagesGul Khan Nasir Speech Against The Sardari SystemShahkoh Mengal100% (1)

- History of Ord SchoolDocument6 pagesHistory of Ord SchoolCOLONEL ZIKRIANo ratings yet

- People V MendozaDocument4 pagesPeople V MendozaKrys MartinezNo ratings yet

- Auditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsDocument6 pagesAuditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsHarutraNo ratings yet

- Bba - Guidelines For Project Work - MewarDocument5 pagesBba - Guidelines For Project Work - MewarRahul MinochaNo ratings yet

- Flight Ops - Cost Index Database PDFDocument15 pagesFlight Ops - Cost Index Database PDFDiego RangelNo ratings yet

- Fieldwork Tradition in Anthropology Prof. Subhdra ChannaDocument18 pagesFieldwork Tradition in Anthropology Prof. Subhdra ChannaFaith RiderNo ratings yet

- Basalom, Soror Jan19Document3 pagesBasalom, Soror Jan19Danica De GuzmanNo ratings yet

- Art HistoryDocument17 pagesArt HistorySteven UniverseNo ratings yet

- Principles of Asset AllocationDocument3 pagesPrinciples of Asset AllocationkypvikasNo ratings yet

- Daftar Siswa Melanjutkan (AL ISLAM & MANDALA)Document4 pagesDaftar Siswa Melanjutkan (AL ISLAM & MANDALA)Agus furnamaNo ratings yet

- Guy Wesley Reffitt - Detention MotionDocument19 pagesGuy Wesley Reffitt - Detention MotionLaw&CrimeNo ratings yet

- 013 Calculation of Trestle StructureDocument60 pages013 Calculation of Trestle StructureEbby Syabilal RasyadNo ratings yet

- Case Study Talent ManagementDocument2 pagesCase Study Talent ManagementaparnashastriNo ratings yet

- Lr. D Page - 87 Analyzing The Narrator's Character Development in "We The AnimalsDocument147 pagesLr. D Page - 87 Analyzing The Narrator's Character Development in "We The Animalsmuhammad zahirNo ratings yet

- The Right Thing To DoDocument4 pagesThe Right Thing To DoAyeen AbdullahNo ratings yet

- The Industrial Revolution Slideshow: Questions/Heading Answers/InformationDocument5 pagesThe Industrial Revolution Slideshow: Questions/Heading Answers/InformationMartin BotrosNo ratings yet

- Module - 3: Institutions Supporting EntrepreneursDocument47 pagesModule - 3: Institutions Supporting EntrepreneursChandan PNo ratings yet

- 13 Stat x-150Document179 pages13 Stat x-150ncwazzyNo ratings yet

- 61 Journal of Chinese Literature and CultureDocument15 pages61 Journal of Chinese Literature and CultureYvonne ChewNo ratings yet