Professional Documents

Culture Documents

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Uploaded by

ANTO MATHICopyright:

Available Formats

You might also like

- Indian Ocean Trade Short Answer Question PracticeDocument2 pagesIndian Ocean Trade Short Answer Question Practiceapi-39087829863% (8)

- Smart CommunicationsDocument6 pagesSmart CommunicationsHaffiz AtingNo ratings yet

- Selections in The Present EconomyDocument3 pagesSelections in The Present EconomyNeil100% (3)

- Unknown HuhaahabaDocument11 pagesUnknown HuhaahabaAakash GuptaNo ratings yet

- Atupa8667q 2019 - 1 4Document6 pagesAtupa8667q 2019 - 1 4Dharamjot singhNo ratings yet

- Unknown 2Document14 pagesUnknown 2Aakash Gupta0% (1)

- Arupr6491f 2019 PDFDocument4 pagesArupr6491f 2019 PDFVeda PrakashNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Anoop JhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Santosh IyerNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Madhukar GuptaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Mayank GandhiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Abhirup MidyaNo ratings yet

- Aifpv8610a 2019Document4 pagesAifpv8610a 2019aniketNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document8 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Baliram KendreNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961pritam kumar DasNo ratings yet

- GGGG GGGG GGGGGDocument4 pagesGGGG GGGG GGGGGKothapalliGuruManiKantaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961DazzlingAnuragKingNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- 26as SampleDocument4 pages26as SampleSURABHI PATRANo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ahamed UmarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961nibuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tusharmohite0No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961praveen kNo ratings yet

- Aarpa5489j 2019Document5 pagesAarpa5489j 2019drali508482No ratings yet

- HGH NBDocument21 pagesHGH NBAakash GuptaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tarunNo ratings yet

- BCTPC0226N 2019 PDFDocument4 pagesBCTPC0226N 2019 PDFAnonymous wCIT17No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Daman SharmaNo ratings yet

- Aispa3631r 2020Document4 pagesAispa3631r 2020Rama Prasad PadhyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document6 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Joydip DattaNo ratings yet

- Atlpr9507m 2021Document4 pagesAtlpr9507m 2021chandra DiveshNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ATSI InstituteNo ratings yet

- Jyoti Bharat Gas 26 AsDocument4 pagesJyoti Bharat Gas 26 AsarjunNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Xen Operation DPHNo ratings yet

- Ekxps0001n 2019Document4 pagesEkxps0001n 2019SiddharthNo ratings yet

- 26 As Latest Both Cob Sob On 240719 PDFDocument4 pages26 As Latest Both Cob Sob On 240719 PDFAnish SamantaNo ratings yet

- Acope8800c 2020Document4 pagesAcope8800c 2020Asif EbrahimNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ghss chinniNo ratings yet

- TDS RM ShahiDocument4 pagesTDS RM Shahisachin rajNo ratings yet

- Ekxps0001n 2021Document4 pagesEkxps0001n 2021SiddharthNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document9 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961VVB MULTI VENTURE FINANCENo ratings yet

- Awzps7535d-2019 Sukhdev SinghDocument4 pagesAwzps7535d-2019 Sukhdev SinghAdv Gaurav MishraNo ratings yet

- Amkpp1500c 2018Document4 pagesAmkpp1500c 2018chinna rajaNo ratings yet

- PDFDocument4 pagesPDFsamaadhuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Firoz AminNo ratings yet

- Project ReportDocument5 pagesProject Reportsonali deotaleNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Amulya Kumar Verma 26asDocument4 pagesAmulya Kumar Verma 26asSatyendra SinghNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NN Sarfaesi Solutions AgencyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajniNo ratings yet

- AAACK7632B-2013-14 Form 26AASDocument7 pagesAAACK7632B-2013-14 Form 26AASRama Prasad PadhyNo ratings yet

- BQSPS0080B 2019 PDFDocument4 pagesBQSPS0080B 2019 PDFsaiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakesh BenganiNo ratings yet

- BYTPB9109B-Form 26AS-2021Document4 pagesBYTPB9109B-Form 26AS-2021bakeyanathanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961YashodhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961shilpiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961unknown_0303No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ashutosh SinhaNo ratings yet

- Aaack7632b 2011Document13 pagesAaack7632b 2011Rama Prasad PadhyNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- FypDocument12 pagesFypddalielaNo ratings yet

- Brazilian StagflationDocument1 pageBrazilian StagflationNadella HemanthNo ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- Business Partner in S4 HANA Customer Vendor IntegrationDocument17 pagesBusiness Partner in S4 HANA Customer Vendor IntegrationpipocaazulNo ratings yet

- Specification For Base PaperDocument3 pagesSpecification For Base PapervenkNo ratings yet

- Analysis of Financial Statement of HecDocument28 pagesAnalysis of Financial Statement of Hecsatyadarshi ravi singhNo ratings yet

- Call Money Market: What Do You Mean by Call Money Market?Document7 pagesCall Money Market: What Do You Mean by Call Money Market?NaveenNo ratings yet

- Culture As A Component of The Hospitality ProductDocument31 pagesCulture As A Component of The Hospitality ProductJasmine MalitNo ratings yet

- Chap 6 Regional PlanningDocument15 pagesChap 6 Regional PlanningShamsavina Sukumaran Shamsavina SukumaranNo ratings yet

- Anant Reasiong and Aptitude 187-237Document25 pagesAnant Reasiong and Aptitude 187-237ANANTNo ratings yet

- CorporCorporate Presentation Liugong Machinery Europe 2014ate Presentation Liugong Machinery Europe 2014Document43 pagesCorporCorporate Presentation Liugong Machinery Europe 2014ate Presentation Liugong Machinery Europe 2014Bagas Heryawan100% (2)

- Abellana v. Sps. PonceDocument3 pagesAbellana v. Sps. PoncejenizacallejaNo ratings yet

- Annual Report 2005Document132 pagesAnnual Report 2005zackypragmaNo ratings yet

- Ngo The Bach-Vietnamese Ceramics in Asian Maritime Trade Between 14th and 17th CenturiesDocument13 pagesNgo The Bach-Vietnamese Ceramics in Asian Maritime Trade Between 14th and 17th CenturiesmrohaizatNo ratings yet

- Do We Have To Wait For The Next Law Suit - Dracut MA FlyerDocument2 pagesDo We Have To Wait For The Next Law Suit - Dracut MA FlyerdracutcivicwatchNo ratings yet

- Research Paper Make in IndiaDocument6 pagesResearch Paper Make in IndiaAvik K DuttaNo ratings yet

- Handloom Industry in Kerala: A Study of The Problems and ChallengesDocument8 pagesHandloom Industry in Kerala: A Study of The Problems and ChallengesAmit ChatterjeeNo ratings yet

- Royal Mail Door To Door Rate Card July 2022Document8 pagesRoyal Mail Door To Door Rate Card July 2022self disciplineNo ratings yet

- India: Anheuser-Busch Inbev in India Key Facts & FiguresDocument2 pagesIndia: Anheuser-Busch Inbev in India Key Facts & FiguresTaylor BryantNo ratings yet

- NC165 05 Lorber PDFDocument20 pagesNC165 05 Lorber PDFمجدى محمود طلبهNo ratings yet

- Mathematical Models For Alkaline Pulp and Paper Properties of Oil Palm Empty Fruit Bunch Fibre (Efb)Document2 pagesMathematical Models For Alkaline Pulp and Paper Properties of Oil Palm Empty Fruit Bunch Fibre (Efb)Rushdan IbrahimNo ratings yet

- PLS 435 Wiseguy Book ReviewDocument7 pagesPLS 435 Wiseguy Book ReviewMack EverlyNo ratings yet

- JVA JuryDocument22 pagesJVA JuryYogesh SharmaNo ratings yet

- Tata 1Mg Healthcare Solutions Private LimitedDocument3 pagesTata 1Mg Healthcare Solutions Private LimitedSandeep BhargavaNo ratings yet

- Managerial Economics in A Global Economy: Cost Theory and EstimationDocument23 pagesManagerial Economics in A Global Economy: Cost Theory and EstimationArif DarmawanNo ratings yet

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDocument2 pagesBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramPaul WhalenNo ratings yet

- Damodaran Estimating Growth PDFDocument11 pagesDamodaran Estimating Growth PDFdeeps0705No ratings yet

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Uploaded by

ANTO MATHIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Uploaded by

ANTO MATHICopyright:

Available Formats

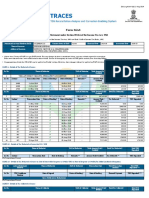

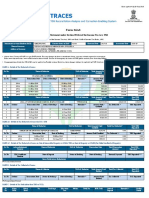

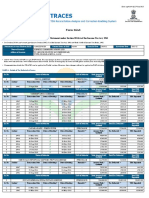

Data updated till 17-Oct-2019

Form 26AS

Annual Tax Statement under Section 203AA of the Income Tax Act, 1961

See Section 203AA and second provision to Section 206C (5) of the Income Tax Act, 1961 and Rule 31AB of Income Tax Rules, 1962

Permanent Account Number (PAN) ANVPM4452G Current Status of PAN Active Financial Year 2019-20 Assessment Year 2020-21

Name of Assessee DHASON ANTO MATHIAZHAGAN

Address of Assessee NO 2, MATHI NIVAS, NEW STREET, PARVATHIPURAM,

NAGERCOIL KANYAKUMARI, TAMIL NADU, 629003

Above data / Status of PAN is as per PAN details. For any changes in data as mentioned above, you may submit request for corrections

Refer www.tin-nsdl.com / www.utiitsl.com for more details. In case of discrepancy in status of PAN please contact your Assessing Officer

Communication details for TRACES can be updated in 'Profile' section. However, these changes will not be updated in PAN database as mentioned above

(All amount values are in INR)

PART A - Details of Tax Deducted at Source

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid/ Total Tax Deducted # Total TDS

Credited Deposited

1 GOVT HOSPITAL KUZHITHURAI MRIG01603A 252690.00 6552.00 6552.00

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid / Tax Deducted ## TDS Deposited

Credited

1 192 30-Jun-2019 F 26-Sep-2019 - 85716.00 312.00 312.00

2 192 30-Jun-2019 U 07-Aug-2019 B -85716.00 -312.00 -312.00

3 192 30-Jun-2019 U 07-Aug-2019 - 85716.00 312.00 312.00

4 192 31-May-2019 F 07-Aug-2019 - 83487.00 3120.00 3120.00

5 192 30-Apr-2019 F 07-Aug-2019 - 83487.00 3120.00 3120.00

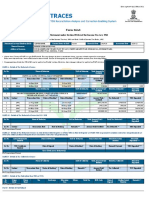

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid/ Total Tax Deducted # Total TDS

Credited Deposited

2 S P MULTI SPECIALITY HOSPITAL PRIVATE LIMITED TVDS02260G 150000.00 15000.00 15000.00

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid / Tax Deducted ## TDS Deposited

Credited

1 194J 30-Jun-2019 F 06-Aug-2019 - 50000.00 5000.00 5000.00

2 194J 31-May-2019 F 06-Aug-2019 - 50000.00 5000.00 5000.00

3 194J 30-Apr-2019 F 06-Aug-2019 - 50000.00 5000.00 5000.00

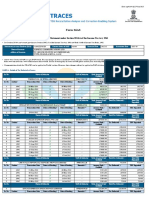

PART A1 - Details of Tax Deducted at Source for 15G / 15H

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid / Total Tax Deducted # Total TDS

Credited Deposited

Sr. No. Section 1 Transaction Date Date of Booking Remarks** Amount Paid/Credited Tax Deducted ## TDS Deposited

No Transactions Present

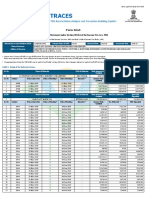

PART A2 - Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA/ TDS on Rent of Property u/s 194IB (For Seller/Landlord of Property)

Sr. No. Acknowledgement Name of Deductor PAN of Deductor Transaction Date Total Transaction Total TDS

Number Amount Deposited***

Sr. No. TDS Certificate Date of Deposit Status of Booking* Date of Booking Demand Payment TDS Deposited***

Number

Gross Total Across Deductor(s)

No Transactions Present

PART B - Details of Tax Collected at Source

Sr. No. Name of Collector TAN of Collector Total Amount Paid/ Total Tax Collected + Total TCS

Debited Deposited

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid/ Tax Collected ++ TCS Deposited

Debited

No Transactions Present

PART C - Details of Tax Paid (other than TDS or TCS)

Sr. Major 3 Minor 2 Tax Surcharge Education Others Total Tax BSR Code Date of Challan Serial Remarks**

No. Head Head Cess Deposit Number

No Transactions Present

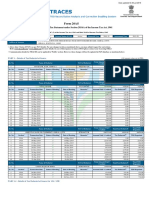

Part D - Details of Paid Refund

You might also like

- Indian Ocean Trade Short Answer Question PracticeDocument2 pagesIndian Ocean Trade Short Answer Question Practiceapi-39087829863% (8)

- Smart CommunicationsDocument6 pagesSmart CommunicationsHaffiz AtingNo ratings yet

- Selections in The Present EconomyDocument3 pagesSelections in The Present EconomyNeil100% (3)

- Unknown HuhaahabaDocument11 pagesUnknown HuhaahabaAakash GuptaNo ratings yet

- Atupa8667q 2019 - 1 4Document6 pagesAtupa8667q 2019 - 1 4Dharamjot singhNo ratings yet

- Unknown 2Document14 pagesUnknown 2Aakash Gupta0% (1)

- Arupr6491f 2019 PDFDocument4 pagesArupr6491f 2019 PDFVeda PrakashNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Anoop JhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Santosh IyerNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Madhukar GuptaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Mayank GandhiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Abhirup MidyaNo ratings yet

- Aifpv8610a 2019Document4 pagesAifpv8610a 2019aniketNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document8 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Baliram KendreNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961pritam kumar DasNo ratings yet

- GGGG GGGG GGGGGDocument4 pagesGGGG GGGG GGGGGKothapalliGuruManiKantaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961DazzlingAnuragKingNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- 26as SampleDocument4 pages26as SampleSURABHI PATRANo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ahamed UmarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961nibuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tusharmohite0No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961praveen kNo ratings yet

- Aarpa5489j 2019Document5 pagesAarpa5489j 2019drali508482No ratings yet

- HGH NBDocument21 pagesHGH NBAakash GuptaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tarunNo ratings yet

- BCTPC0226N 2019 PDFDocument4 pagesBCTPC0226N 2019 PDFAnonymous wCIT17No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Daman SharmaNo ratings yet

- Aispa3631r 2020Document4 pagesAispa3631r 2020Rama Prasad PadhyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document6 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Joydip DattaNo ratings yet

- Atlpr9507m 2021Document4 pagesAtlpr9507m 2021chandra DiveshNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ATSI InstituteNo ratings yet

- Jyoti Bharat Gas 26 AsDocument4 pagesJyoti Bharat Gas 26 AsarjunNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Xen Operation DPHNo ratings yet

- Ekxps0001n 2019Document4 pagesEkxps0001n 2019SiddharthNo ratings yet

- 26 As Latest Both Cob Sob On 240719 PDFDocument4 pages26 As Latest Both Cob Sob On 240719 PDFAnish SamantaNo ratings yet

- Acope8800c 2020Document4 pagesAcope8800c 2020Asif EbrahimNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ghss chinniNo ratings yet

- TDS RM ShahiDocument4 pagesTDS RM Shahisachin rajNo ratings yet

- Ekxps0001n 2021Document4 pagesEkxps0001n 2021SiddharthNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document9 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961VVB MULTI VENTURE FINANCENo ratings yet

- Awzps7535d-2019 Sukhdev SinghDocument4 pagesAwzps7535d-2019 Sukhdev SinghAdv Gaurav MishraNo ratings yet

- Amkpp1500c 2018Document4 pagesAmkpp1500c 2018chinna rajaNo ratings yet

- PDFDocument4 pagesPDFsamaadhuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Firoz AminNo ratings yet

- Project ReportDocument5 pagesProject Reportsonali deotaleNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Amulya Kumar Verma 26asDocument4 pagesAmulya Kumar Verma 26asSatyendra SinghNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NN Sarfaesi Solutions AgencyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajniNo ratings yet

- AAACK7632B-2013-14 Form 26AASDocument7 pagesAAACK7632B-2013-14 Form 26AASRama Prasad PadhyNo ratings yet

- BQSPS0080B 2019 PDFDocument4 pagesBQSPS0080B 2019 PDFsaiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakesh BenganiNo ratings yet

- BYTPB9109B-Form 26AS-2021Document4 pagesBYTPB9109B-Form 26AS-2021bakeyanathanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961YashodhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961shilpiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961unknown_0303No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ashutosh SinhaNo ratings yet

- Aaack7632b 2011Document13 pagesAaack7632b 2011Rama Prasad PadhyNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- FypDocument12 pagesFypddalielaNo ratings yet

- Brazilian StagflationDocument1 pageBrazilian StagflationNadella HemanthNo ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- Business Partner in S4 HANA Customer Vendor IntegrationDocument17 pagesBusiness Partner in S4 HANA Customer Vendor IntegrationpipocaazulNo ratings yet

- Specification For Base PaperDocument3 pagesSpecification For Base PapervenkNo ratings yet

- Analysis of Financial Statement of HecDocument28 pagesAnalysis of Financial Statement of Hecsatyadarshi ravi singhNo ratings yet

- Call Money Market: What Do You Mean by Call Money Market?Document7 pagesCall Money Market: What Do You Mean by Call Money Market?NaveenNo ratings yet

- Culture As A Component of The Hospitality ProductDocument31 pagesCulture As A Component of The Hospitality ProductJasmine MalitNo ratings yet

- Chap 6 Regional PlanningDocument15 pagesChap 6 Regional PlanningShamsavina Sukumaran Shamsavina SukumaranNo ratings yet

- Anant Reasiong and Aptitude 187-237Document25 pagesAnant Reasiong and Aptitude 187-237ANANTNo ratings yet

- CorporCorporate Presentation Liugong Machinery Europe 2014ate Presentation Liugong Machinery Europe 2014Document43 pagesCorporCorporate Presentation Liugong Machinery Europe 2014ate Presentation Liugong Machinery Europe 2014Bagas Heryawan100% (2)

- Abellana v. Sps. PonceDocument3 pagesAbellana v. Sps. PoncejenizacallejaNo ratings yet

- Annual Report 2005Document132 pagesAnnual Report 2005zackypragmaNo ratings yet

- Ngo The Bach-Vietnamese Ceramics in Asian Maritime Trade Between 14th and 17th CenturiesDocument13 pagesNgo The Bach-Vietnamese Ceramics in Asian Maritime Trade Between 14th and 17th CenturiesmrohaizatNo ratings yet

- Do We Have To Wait For The Next Law Suit - Dracut MA FlyerDocument2 pagesDo We Have To Wait For The Next Law Suit - Dracut MA FlyerdracutcivicwatchNo ratings yet

- Research Paper Make in IndiaDocument6 pagesResearch Paper Make in IndiaAvik K DuttaNo ratings yet

- Handloom Industry in Kerala: A Study of The Problems and ChallengesDocument8 pagesHandloom Industry in Kerala: A Study of The Problems and ChallengesAmit ChatterjeeNo ratings yet

- Royal Mail Door To Door Rate Card July 2022Document8 pagesRoyal Mail Door To Door Rate Card July 2022self disciplineNo ratings yet

- India: Anheuser-Busch Inbev in India Key Facts & FiguresDocument2 pagesIndia: Anheuser-Busch Inbev in India Key Facts & FiguresTaylor BryantNo ratings yet

- NC165 05 Lorber PDFDocument20 pagesNC165 05 Lorber PDFمجدى محمود طلبهNo ratings yet

- Mathematical Models For Alkaline Pulp and Paper Properties of Oil Palm Empty Fruit Bunch Fibre (Efb)Document2 pagesMathematical Models For Alkaline Pulp and Paper Properties of Oil Palm Empty Fruit Bunch Fibre (Efb)Rushdan IbrahimNo ratings yet

- PLS 435 Wiseguy Book ReviewDocument7 pagesPLS 435 Wiseguy Book ReviewMack EverlyNo ratings yet

- JVA JuryDocument22 pagesJVA JuryYogesh SharmaNo ratings yet

- Tata 1Mg Healthcare Solutions Private LimitedDocument3 pagesTata 1Mg Healthcare Solutions Private LimitedSandeep BhargavaNo ratings yet

- Managerial Economics in A Global Economy: Cost Theory and EstimationDocument23 pagesManagerial Economics in A Global Economy: Cost Theory and EstimationArif DarmawanNo ratings yet

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDocument2 pagesBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramPaul WhalenNo ratings yet

- Damodaran Estimating Growth PDFDocument11 pagesDamodaran Estimating Growth PDFdeeps0705No ratings yet